Vol. 39 (Number 47) Year 2018. Page 27

Yuri M. TSYGALO 1V; Alexey V. DOROZHKIN 2; Ekaterina E. DOROZHKINA 3

Received: 29/06/2018 • Approved: 15/08/2018

ABSTRACT: The subject of the article is the mechanism for assessing outsourcing risk management efficiency. The purpose of the article is to develop a mechanism for assessing outsourcing risk management efficiency, taking into account the interests of all participants in the restructuring of the company at all stages of the project. Outsourcing efficiency for a company that accepts transferred functions is always assessed positively through guaranteed order and sales of products. The main task of commercial activity is to increase the company’s value in the mechanisms for assessing restructuring efficiency. Suggestions are made to form a mechanism for assessing outsourcing risk management efficiency, based on the indicator @ Risk – “at risk”. This indicator can be determined for any financial performance of the company, both before the transition to outsourcing, and after. A pure cash flow “at risk” FCF @ Risk is the main for assessing efficiency. The outsourcing project is considered effective if ΔFCF @ Risk as a result of the transition to outsourcing is positive. |

RESUMEN: El tema del artículo es el mecanismo para evaluar la eficiencia de la gestión de riesgos de la subcontratación. El propósito del artículo es desarrollar un mecanismo para evaluar la eficiencia de la gestión de riesgos de la subcontratación, teniendo en cuenta los intereses de todos los participantes en la reestructuración de la empresa en todas las etapas del proyecto. La eficiencia de la subcontratación para una empresa que acepta funciones transferidas siempre se evalúa positivamente a través de pedidos y ventas garantizadas de productos. La principal tarea de la actividad comercial es aumentar el valor de la compañía en los mecanismos para evaluar la eficiencia de la reestructuración. Se hacen sugerencias para formar un mecanismo para evaluar la eficiencia de la gestión de riesgos de la subcontratación, basado en el indicador Riesgo @ "en riesgo". Este indicador puede determinarse para cualquier desempeño financiero de la compañía, tanto antes de la transición a la subcontratación como después. Un flujo de efectivo puro "en riesgo" FCF @ Risk es el principal para evaluar la eficiencia. El proyecto de externalización se considera efectivo si ΔFCF @ Risk como resultado de la transición a la externalización es positivo. |

Outsourcing is a flexible and effective mechanism for restructuring companies. Traditionally, outsourcing is understood as the transfer of non-core functions of the organization to a third-party executor who has necessary resources and competencies. In a direct translation from the English language, the term outsourcing means “on the side”, i.e. “outside”, which opens up wide opportunities for improving the company’s activity. Such actions can be (Zhdanov, 2008; Fedorenko, 2007; Kurbanov & Plotnikov, 2016; Moiseeva, Malyutina & Moskvina, 2010):

- Attraction of external resources (personnel, development of projects, unique equipment and skills of employees, etc.) to solve their own problems;

- Transfer of the function / process to the execution of a third-party organization that has necessary resources and competencies;

- Transfer of production to the region with less expensive labor from the region with more expensive labor to reduce costs;

- Collection and processing of data from external sources;

- Use of temporary staff (outstaffing) without a conclusion of the employment contract with employees;

- Repair and maintenance of equipment by a third-party organization;

- Any other services of the third-party organization to perform its own tasks.

Currently, the horizon of outsourcing application has no boundaries: it is applied in any sphere of the company’s activity, and the main functions of the company were added to the list of transferred functions. However, there is no consensus how to assess outsourcing efficiency. Known approaches are focused on branch features of the company - the outsourcing customer, which determines objectives and criteria for assessing outsourcing.

The research methodology includes literature analysis, mathematical and economic modeling, statistical, correlation, abstract-logical and other methods.

It has been revealed that methods to assess outsourcing have a sectoral focus, which influences the choice of assessment criteria. Criteria are taken as technical indicators of companies’ performance (reduction of production areas, optimization of personnel) and economic (reduction of customer costs, reduction of related working capital), depending on the industry of the company in question. The efficiency of the transfer of functions to an external executor is considered for the customer of services. Outsourcer benefits are established a priori, like increasing capacity utilization, obtaining a stable order, etc. Known mechanisms for assessing outsourcing efficiency do not take into account risks and uncertainties of the project. It is proposed to assess outsourcing risk management efficiency in terms of changing financial indicators of all participants in the process, achieved after the the transfer of functions. It is recommended to use the approach that takes into account indicators “at risk” - @Risk. As a criterion, any financial or economic indicator can be adopted, but the most efficient is the amount of FCF (free cash flow). The efficiency of the proposal is shown by calculations.

Despite the recognition and dissemination of outsourcing, the attitude towards it remains ambiguous. Outsourcing researchers focus mainly on benefits that the outsourcing organization – outsourcing customer receives, outsourcing certain functions to the outsider. It means that the host organization, the outsourcer, always benefits from a stable order and is guaranteed to be sold. The simultaneous influence of outsourcing on all participants has not been investigated yet. Meanwhile, A.Yu. Zhdanov (2008) warns that the transfer of certain functions to the third-party executor can lead to the market monopolization to perform transferred functions, to a decrease in the quality and growth of the cost of goods and services delivered to the customer (Zhdanov, 2008). The possible negative consequences of outsourcing, leading to a failure to achieve the set goals and objectives for restructuring the company, as well as outsourcing risks in the scientific literature are not considered deeply enough.

The ambiguous view of outsourcing is due to differences in approaches to research and assessment of benefits of the restructuring mechanism under consideration. So, A. M. Vyzhitovich (2015) believes that the main benefits of transferring functions is the ability to fully focus on the core business, get rid of many tasks that arise during the course of work. The outsourcer is individuals and organizations that are assigned to a task for a long time (Vyzhitovich, 2015). The transfer of certain functions is suitable for those companies that specialize in a specific field, have knowledge, experience and necessary technical equipment.

According to R.V. Fedorenko (2014), the main result of outsourcing is the cost reduction, which entails the activation of business processes efficiency (Fedorenko, 2014; 2007). The company-customer has the opportunity to strengthen the company’s activity in new business areas, or to increase its own weak positions. A serious reason for turning to outsourcing is the reluctance to waste time on questions that can be solved by professionals. Fedorenko R.V. notes that in Russia outsourcing is most often outsourced to accounting records, providing clearing services, arranging meals for company employees, translating important documents and contracts, providing hardware and equipment, advertising and PR services, office security, IT services and other non-core functions (Fedorenko, 2007).

A similar opinion is held by O.V. Lobanov (2005), he notes that the necessary component of the company’s activity is costs for conducting commercial activities, and also for managing non-core assets (Lobanov, 2005).

Non-core assets do not bring profit, but are absolutely necessary for the normal functioning of the company. In addition, some activities require a long training of employees, the presence of certain tangible and intangible assets: motivation, a special corporate culture, a high level of trust of buyers and suppliers, etc. Such resources are complex for copying by competitors, they are being developed over many years through high costs and targeted efforts. The implementation of such activities by own means can be very unprofitable or inefficient for the company.

B.D. Heywood (2004) notes that it is very important to understand the reasons for the growing popularity of outsourcing. The growth of world economies entails an increase in volumes of production and turnover of national companies. There is a growing need for time and resources for core activities, as well as external assistance to perform support but equally important functions (Heywood, 2004).

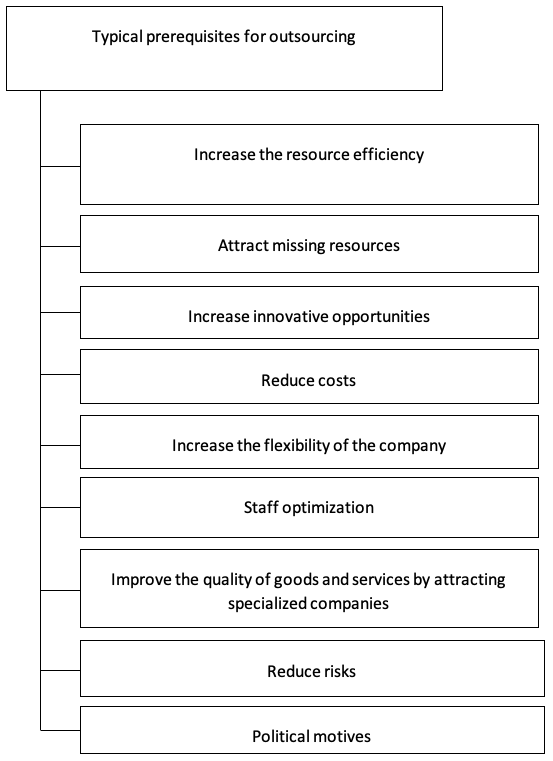

Thus, there are many reasons for outsourcing and the main ones are shown in Figure 1.

Fig. 1

Prerequisites for outsourcing

Source: author’s development

Outsourcing is firmly presented in the practice of Russian companies, but the cautious attitude of top-managers, shareholders and the public to it remains. The transfer of functions to the third party frightens managers with the alleged loss of control over production processes and a weak scientific and methodological justification for technology. The implementation of the effective project for the transfer of certain functions to the outside contractor may result in the loss of jobs in the region or even in the country (when certain functions are transferred to foreign companies), which will cause opposition of the public and authorities. Nevertheless, in practice, Russian companies have accumulated quite a lot of experience in outsourcing and assessing the application of such technology. Known approaches to assess outsourcing efficiency are quite unambiguous: the assessment is based on clear benefits (usually the customer) of outsourcing functions, - optimization of the company structure, concentrating on core activities, reducing production costs, improvement of product quality, reduction in the number of company personnel, and a number of others. Benefits of the receiving party - the outsourcer, are practically not considered.

Thus, I.V. Petrova (2014) determines the reduction of costs of the company-customer for the production of products outsourced, for production areas, for basic and support means of production, for personnel, including seasonal as criteria for outsourcing efficiency. As a general criterion for outsourcing efficiency, we propose a ratio of costs for own production of products or services and costs for purchasing the same products from the outsourcer. If the ratio is greater than one, then outsourcing is profitable (Petrova, 2014). I.V. Petrova used indicators that are fairly simple and with great certainty can be determined at the design stage of restructuring the company. The proposed assessment mechanism is effective at the project stage of outsourcing. The methodology, proposed by I.V. Petrova, for determining outsourcing efficiency has a clearly pronounced sectoral character: enterprises of the garment industry are selected for the base, which determines the criteria chosen for assessment.

A. Kh. Kurbanov & V.A. Plotnikov (2016) offer a more general methodology that is not tied to a particular industry. They proposed to assess outsourcing relationships according to the reached potential level of the customer service system; timeliness of rendering services under the outsourcing contract; conformity of volumes of given services and consumer experience; efficiency of provided services. The multiplication of four criteria gives “a comprehensive criterion for customer service efficiency” (Kurbanov & Plotnikov, 2016). The analysis of the proposed criteria and the author’s approach shows that the methodology allows assessing outsourcing efficiency as a whole. The proposed mechanism at the final stages of the project is effective: “introduction of outsourcing” and “assessment of outsourcing efficiency”. These authors offer a different approach to assess outsourcing, treating it as a mechanism for disintegration of processes. According to the method assessing the effect of disintegration, we compare the additional effect obtained from the implementation of the project (transition to outsourcing), with the costs of its implementation. The project is considered successful if the difference in the additional effect and costs is positive.

N.R. Moiseeva et al. (Moiseeva, Malyutina & Moskvina, 2010) believe that the effect of outsourcing will be composed of direct and indirect components. The direct effect is attributed to a decrease in the cost of production, a reduction in the amount of related working capital, a reduction in logistics costs, an increase in liquidity, and a number of others. The indirect effect is ensured by focusing attention on core business, faster response to changes in the external environment, reduction of the company’s staff, guarantee of professional responsibility, etc. (Moiseeva, Malyutina & Moskvina, 2010). The proposed methodology for assessing outsourcing efficiency is focused on the transport company, which is reflected in the selection of efficiency criteria, in particular, accounting for changes in logistics costs.

M.Yu. Savelieva & Yu.V. Savelieva (2015) suggest assessing outsourcing efficiency on financial indicators achieved when transferring functions to the external executor. The “Comparative effect of outsourcing” (CEO), which takes into account the change in the company’s value, is proposed as an integral indicator of efficiency.

Meanwhile, the transfer of the company’s functions to the outside contractor is a restructuring of the organization. According to paragraph 48 of Federal Law No. 208 “On Joint Stock Companies”, decisions on reorganization of the company are the powers of the general meeting of shareholders. Therefore, the importance of justifying outsourcing efficiency increases significantly. The owners of the company may have considerable financial resources, but they cannot be guided by the features of the industry or peculiarities of society transformation. The proposed criteria for assessing efficiency should be clear and interesting to the shareholder, such as cost parameters of the restructuring project and their impact on the amount of dividends.

Many authors in publications confine themselves only to a list of criteria on the basis of which one can directly assess economic efficiency of outsourcing without leading to the assessment mechanism. As a rule, the improvement of product quality, cost reduction, optimization of the company’s personnel, increasing the rhythm of supplies, etc. are taken into account. Known mechanisms for determining outsourcing efficiency are focused on the industrial specificity of companies and reflect the results of the company’s operational activity in the short term. They provide for the assessment of outsourcing on technical and economic indicators, which primarily characterize the quality of design and transfer of functions to the external executor. The choice of efficiency criteria in such methods is determined by tasks that have to solve outsourcing, but the main task of the commercial structure is to increase the company’s value, it is almost not taken into account. The methods take little account of risks and consequences of their implementation for all outsourcing participants. The presence of risks and uncertainties, characteristic of any project, means that the process may deviate from the original plan, and the achieved results will be far from planned.

Dividends attributable to shareholders will depend on financial indicators, which include operational and non-operational profit before interest and taxes (EBIT); weighted average cost of capital (WACC) and its dynamics; dynamics of EBIT; the dynamics of the company’s value; free cash flow (FCF). For all these indicators, the transition to outsourcing can have both a positive and a negative impact.

The EBIT indicator is widely used in the foreign practice of companies and corresponds to a similar indicator in financial statements compiled according to Russian standards. Changes in profit before interest and taxes are due to changes in income and expenses (M.Y. Savelieva & Yu.V. Savelieva, 2015). The increase in revenues will result in the increase in the quality of final products achieved by delivering quality services and components to the outsourcer, reducing the company’s costs for materials, energy, labor, social contributions, and overhead (including administrative costs). Improving the quality of products may lead to the increase in sales or justify the increase in prices, which will also increase the revenue. It is possible to increase the income from investment and financial activities by renting vacant premises, selling the released equipment, etc.

In case of errors in the design of outsourcing, it is possible to reduce revenues, and accordingly EBIT, due to the increase in the cost of acquiring components and services from the outside, as well as additional costs associated with the choice of the outsourcer, the loss of some suppliers and consumers, possibly the loss of part of proceeds from the sale of products.

The weighted average cost of capital (WACC) in the application of outsourcing can also significantly change, as the structure of capital changes by reducing the share of borrowed funds and increasing the share of own funds. Minimizing the WACC indicator will allow achieving the increase in the company’s value, and expanding its investment opportunities.

The effective indicator of using outsourcing is the change in the company’s value. This indicator is one of the main in the group of criteria for financial and economic assessment of outsourcing and is, as a rule, complex. The indicator of the company’s value change represents the full information about many characteristics of its development (the size of the company’s capital, its structure, profit value, etc.) and can be determined by the revenue method as the sum of FCF (free cash flow).

Known mechanisms for assessing outsourcing efficiency cannot be considered complete, as they do not take into account risks and uncertainties, the implementation of which can fundamentally distort the estimate. A full definition of outsourcing risks and financial consequences of their implementation is a long, voluminous and rather complicated process, and results are difficult for the owners to perceive. Therefore, we propose an approach that takes into account the indicators “at risk” - @Risk. This criterion allows determining in financial terms any indicator of the company’s activity: profit @ Risk, profitability @ Risk, FCF @ Risk, earnings @ Risk, etc., before restructuring and after transformation and carrying out activities that reduce the impact of risks.

FCF @ Risk is the generalizing indicator, but it has a small degree of accuracy and a probabilistic nature. At its core, it assesses the “volatility” of benefits or alternative incomes. Obviously, the maximum increase in the company’s value is achieved with the maximum reduction in outsourcing risks. Moreover, the more risks are reduced, the greater the positive effect of the growth in value is achieved. Indeed, one of the consequences of transferring inefficient functions to outsourcing is the liquidation of significant expense items with simultaneous inflows from the sale of released assets. This leads to a more rational use of working capital, as well as to a refusal of loans in favor of using its own funds for the implementation of projects to modernize production. The criterion for deciding whether to transfer a function or process to production outsourcing is the positive value of the ΔFCF @ Risk indicator, which, based on its content, means the expected increase in the company’s value in the long term.

Thus, the proposed approach to calculate the comparative effect of outsourcing makes it possible to assess its feasibility in terms of impact on the company’s value (total FCF) through a discount rate indicator calculated by the CAPM (capital asset pricing model). This indicator is calculated on the basis of assessing risks arising from the actions of outsourcing participants. The authors proposed to assess the impact of these risks on the company’s value by increasing the reward for risks associated with activities of outsourcing participants when calculating the discount rate. As the discount rate for assessing the company’s value, it is proposed to use the WACC (weighted average cost of capital) model, which is presented in formula (1).

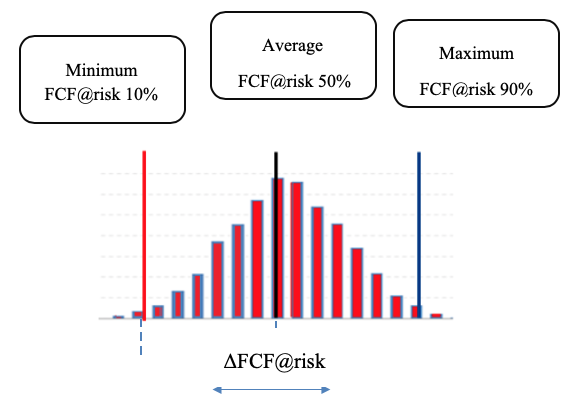

The proposed reward for outsourcing risks in CAPM are presented in Table 3. Accounting the reward for risks in determining the discount rate allows you to comprehensively assess the impact of outsourcing risks on the actions of participants in the process and calculate the company’s value at risk, namely FCF @ Risk (Free Cash Flow @ Risk – the total net cash flow of the company at risk) - Figure 2. We get the maximum loss (the amount of the cash flow reduction) of cash, below which the flow will not decrease over a certain period of time (for example, a year) probability (for example, 95% of cases). In the remaining 5% of cases, the cash flow will decline more than it was planned. In this case, the amount of discounted FCF, taking into account the terminal value, is a measure of the company’s value.

Table 3

Reward for specific risks arising from the actions of participants in the outsourcing process

Risk factor |

Degree of risk |

||

Low |

Average |

High |

|

Dependence of the outsourcing project on shareholders / board of directors (possible intervention in the outsourcing process) |

1 |

2 |

3 |

Dependence of the outsourcing project on management (incorrect substantiation of the project efficiency, incomplete risk accounting) |

1 |

2 |

3 |

Dependence of the outsourcing project on counterparties (refusal to obtain the results of the processes outsourced) |

1 |

2 |

3 |

Dependence of the outsourcing project on competitors (impeding the transfer of functions to outsourcing, reducing the project efficiency from the actions of competitors) |

1 |

2 |

3 |

Total (amount) |

|

||

Weighted average risk value (risk reward) |

|

||

Source: author’s development.

To determine risk management efficiency of outsourcing activities, the authors propose a method based on the calculation of the difference between the inherent and residual outsourcing project based on the assessment of @risk - formula 3.

ΔЭr= FCF@Risk (i) – FCF@Risk (r), (3)

where ΔЭr – is the effect of managing outsourcing risks; FCF @ Risk (i) - estimation of the company’s value taking into account the inherent risk; FCF @ Risk (r) - estimation of the company’s value taking into account the residual risk.

The outsourcing risks at each stage of the project have their own profile, but the FCF @ Risk indicator allows you to take into account all risks of outsourcing at all stages of the project.

The proposed approach also allows quantitative assessing the effect of risk management activities by estimating the inherent and residual risks that continue to affect the company after the implementation of the outsourcing project. The methodology of @Risk arose as a result of the evolution of various methods of financial analysis of the subject of the economy, primarily the banking institution. It allows estimating the maximum losses in the value of a particular asset for a certain time, provided that the actual losses do not exceed the assumed upper limit in the event of unfavorable market conditions.

When calculating the value of @Risk, 95%, 97.5%, and 99% confidence intervals (the degree of probability) on the Gaussian curve are used (Figure 2). This means that if, for example, the company indicates that the 99% value of a one-day @Risk equals $ 10 million, then the next day there is only 1 chance out of 100 (1%), that under the previous market conditions, the amount of losses will exceed indicated $ 10 million (that is, the company can state with 99% confidence that the amount of unforeseen losses will not exceed 10 million dollars). In this case, the calculation of the value of @Risk can be performed both on the basis of a two-sided test (calculation of any deviation) and on the basis of a one-sided test (calculation of the magnitude of possible losses).

Figure 2

Example calculation of ΔFCF @ risk

Source: author’s development

The advantage of the @Risk methodology is that the assessment includes accounting for the impact of all major risks affecting the company’s value when outsourcing (formula 4).

Efficiency = Changes {Return; Risk} (4)

The assessment of FCF @ risk allows assessing the effect of the outsourcing project taking into account project risks and profitability and consciously make decisions to implement or refuse to implement the project:

Table 4

Risk classes of integration projects

Risk level |

∆ Эr |

Low risk |

More than 3% of the company’s value |

Average risk |

from 3-5% of the company’s value |

High risk |

from 5-10% of the company’s value |

Critical risk |

More than 10% of the value of the company’s value |

Source: author’s development

For projects with a high or critical level of risk, a review or closure of such an outsourcing project is required.

Thus, the assessment of the comparative effect of outsourcing allows estimating its feasibility in terms of impact on the company’s financial result and, in general, on the company’s value.

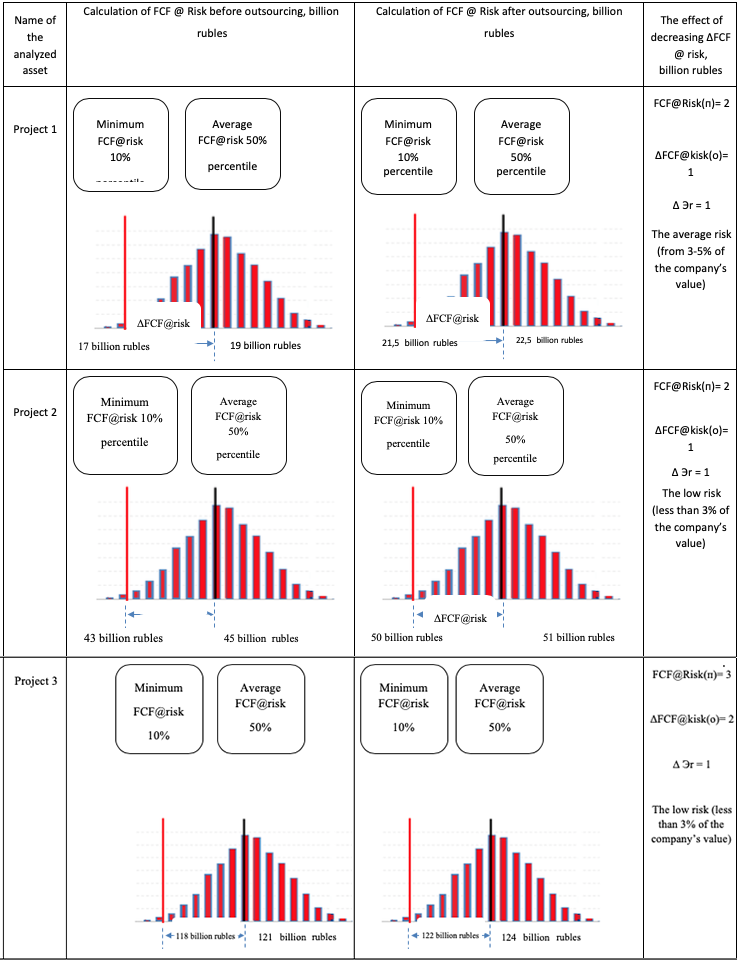

To test the methodology, the effects of outsourcing projects for coal assets of individual Russian metallurgical companies were analyzed, the results of which are presented in Table 5. In accordance with the calculation, ΔEr corresponds to a low or average risks, which, in accordance with the proposed approach, suggests positive recommendations for launching the outsourcing project. The quantitative analysis shows a decrease in the value at @Risk, i.e. fluctuations in the company’s value under the influence of risks after the procedure for outsourcing functions are reduced.

Table 5

The effect of decreasing in the FCF @ Risk indicator when outsourcing

Source: author’s development.

Outsourcing allows two (and possibly more) companies participate in the process. A priori it is assumed that outsourcing is beneficial to all participants, which is difficult to achieve. Determining outsourcing efficiency in terms of @ Risk we can get opposite results for different participants. Therefore, it is advisable to assess outsourcing efficiency taking into account the indicators of all participants. In the case where processes are outsourced, a company in the group or a company owned by the same owner, the @ risk indicators are added to determine the total impact on the companies’ consolidated value, with the potential for a differently directed effect from the implementation of outsourcing risks.

Efficiency @ Risk = efficiency @ Risk Company1 + efficiency @ Risk Company2 + ... + efficiency @ Risk Companyn

where n - is the number of outsourcing participants.

Possible negative consequences of outsourcing will be covered by positive results of other participants. If the overall efficiency of @ Risk is positive, then such a project is advisable to take. The interests of individual participants can be met by organizational and managerial actions, for example, partial compensation of losses to the “losing party”.

The existing methods of economic assessment of outsourcing efficiency are imperfect. They are based on technical and economic indicators, reflecting the specifics of organizations - customers of outsourcing and industry, and they take into account the interests of only one side of the process. A universal mechanism is to assess the project efficiency based on changes in the companies’ value - all outsourcing participants. The assessment of efficiency is recommended to be carried out according to the indicator @ Risk (at risk). To assess outsourcing project efficiency, a single indicator for all participants @ Risk is determined. The project should be considered economically viable if the sum of the @ Risk indicators of all participants is positive.

Fedorenko, R.V. (2007). Assessment of prospects for the development of outsourcing in the customs sphere. Vestnik of the Samara State Economic University, Vol. 4, pp. 170 - 172.

Fedorenko, R.V. (2014). Risks of logistic outsourcing. Bulletin of the Volga State University of Service. Series: The Economy, Vol. 4(36), pp. 127 - 131.

Heywood, B.D. (2004). Outsourcing. In search of competitive advantages. M.: Williams, 176 p.

Horne, J.K.Van & Vahovich, Jr.J.M. (2008). Fundamentals of financial management. Williams, pp. 669-676.

Kurbanov, A.Kh. & Plotnikov, V.A. (2016). Outsourcing: History, methodology, practice: monograph. Moscow: INFRA-M, pp. 100-106.

Lobanov, O.V. (2005). Outsourcing alignment. Company management, Vol. 1, pp. 46-49.

Moiseeva, N.K., Malyutina, O.N. & Moskvina, I.A. (2010). Outsourcing in the development of business partnership. Moscow: Finance and Statistics: INFRA-M, 240 p.

Petrova, I.V. (2014). Effective outsourcing: The decision making mechanism: Monograph. M.: RIOR: INFRA-M, pp. 55-60.

Savelieva, M.Yu. & Savelieva, Yu.V. (2015). Estimation of the financial feasibility of production outsourcing taking into account the company's value growth. Journal of Russian Entrepreneurship, Vol.16, No. 1.

Vyzhitovich, A.M. (2015). Actual tasks in the risk management system of outsourcing strategies in the process of enterprise restructuring. Vestnik NSUEU, № 2.

Zhdanov, A.Yu. (2008). Outsourcing in the practice of Russian companies: Textbook. Moscow: FSEI HPE "Financial Academy under the Government of the Russian Federation.

1. Doctor of Economics, Head of the Department “General Management and Project Management” Department of Corporate Finance and Corporate Governance of the Financial University under the Government of the Russian Federation, Moscow, Russia. E-mail: tsigalov_@mail.ru

2. Candidate of Economic Sciences, Associate Professor of the Department of Management of the Financial University under the Government of the Russian Federation, Moscow, Russia dorozhkinav@gmail.com

3. Chief accountant of LLC "Mobile advertising", Moscow Russian dekevg@gmail.com