Vol. 39 (Number 47) Year 2018. Page 32

Anna SHKILEVA 1

Received: 09/07/2018 • Approved: 20/08/2018

ABSTRACT: The article presents an assessment of the creditworthiness of a construction company with the help of three methods: the classical method of rating the enterprise, the methodology of R.S. Sayfullin and G.G. Kadykov, the methodology of the PJSC "Savings Bank of Russia". A comparison of these methods was carried out using the example of "Mostostroy-11". |

RESUMEN: El artículo presenta una evaluación de la solvencia de una empresa de construcción con la ayuda de tres métodos: el método clásico de calificación de la empresa, la metodología de R.S. Sayfullin y G.G. Kadykov, la metodología de la Caja de Ahorros de Rusia. Una comparación de estos métodos se llevó a cabo utilizando el ejemplo de "Mostostroy-11". |

Many construction organizations cannot carry out their core business in full without additional funds. The procedure for assessing the creditworthiness of the borrower is to determine the ability to timely and fully repay debt obligations. Currently, there is no single standardized credit rating system in the world. Therefore, banks use different methods of analyzing the borrower's creditworthiness.

The creditworthiness of "Mostostroy-11" was determined using three methods:

In accordance with the classical methodology of the rating of the enterprise, first of all, it is necessary to group assets and liabilities (Table 1), analyze the liquidity of the balance sheet (Table 2).

Table 1

Grouping of assets and liabilities of "Mostostroy-11".

Indicators |

2015 |

2016 |

2017 |

Assets |

|||

A1 - most liquid assets |

105946.00 |

66284.00 |

177472.00 |

A2 - quick assets |

2192002.00 |

2722723.00 |

3692953.00 |

A3 - slow-moving assets |

2825006.00 |

4058423.00 |

6168611.00 |

A4 - hard-to-sell assets |

2223460.00 |

2724675.00 |

4181615.00 |

BALANCE |

7346414.00 |

9572105.00 |

14220651.00 |

Liabilities |

|||

P1 - most urgent obligations |

2126576.00 |

3019954.00 |

4442109.00 |

P2 - short-term liabilities |

1289643.00 |

307910.00 |

407726.00 |

PЗ - long-term liabilities |

184046.00 |

1831794.00 |

3892324.00 |

P4 - standing liabilities |

3746149.00 |

4412447.00 |

5478492.00 |

BALANCE |

7346414.00 |

9572105.00 |

14220651.00 |

-----

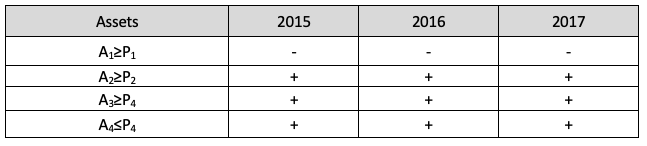

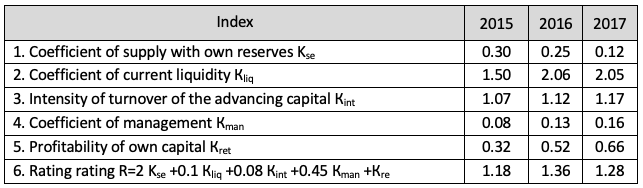

Table 2

Compliance with the liquidity conditions of the balance sheet

The received liquidity ratios of "Mostostroy-11" balance sheet indicate the insufficiency of the most liquid assets (A1) to cover its current liabilities. This is possible only by 73% in 2015, 71% in 2016 and by 67% in 2017. Although in the implementation of fast-track assets (A2), funds to repay the most urgent obligations are sufficient.

The calculation of creditworthiness ratios is presented in Table 3, the borrower's classification by credit quality is shown in Table 4.

Table 3

Calculation of credit ratios

Index |

2015 |

2016 |

2017 |

Balance sheet liquidity ratio |

0.73 |

0.71 |

0.67 |

Absolute liquidity ratio |

1.50 |

2.06 |

2.07 |

Coefficient of quick liquidity |

0.67 |

0.84 |

0.80 |

Coefficient of current liquidity |

0.03 |

0.02 |

0.04 |

Coefficient of autonomy |

0.51 |

0.46 |

0.39 |

------

Table 4

Credit rating by borrower

Index |

First class |

Second class |

Third class |

Share, % |

Coefficient of current liquidity (Coefficient of coverage) |

2 and higher |

1.0-2.0 |

Less than 1.0 |

30 |

Coefficient of quick liquidity |

1.0 and higher |

0.5-1.0 |

Less than 0.5 |

20 |

Absolute liquidity ratio |

0.2 and higher |

0.15-0.2 |

Less than 0.15 |

30 |

Coefficient of autonomy |

0.7 and higher |

0.5-0.7 |

Less than 0.5 |

20 |

Based on the calculated coefficients, taking into account the borrower's classification by the level of creditworthiness, the rating of "Mostostroy-11" was carried out (table 5).

Table 5

Calculation of the rating of "Mostostoroy-11"

Index |

Indicator weight |

2015 |

2016 |

2017 |

|||

Value |

Class |

Value |

Class |

Value |

Class |

||

Coefficient of current liquidity |

30% |

1.5 |

2 |

2.06 |

1 |

2.07 |

1 |

Coefficient of quick liquidity |

20% |

0.7 |

2 |

0.87 |

2 |

0.82 |

2 |

Absolute liquidity ratio |

30% |

0.03 |

3 |

0.02 |

3 |

0.04 |

3 |

Coefficient of autonomy |

20% |

0.51 |

2 |

0.46 |

3 |

0.39 |

3 |

Sum of points: |

650 |

|

230 |

|

220 |

|

220 |

The results of the calculations showed that throughout the whole period of the study the enterprise can be attributed to the second class of borrowers, therefore, the bank can issue a loan to it in the usual way, provided that there are corresponding obligations (guarantees, pledge, etc.).

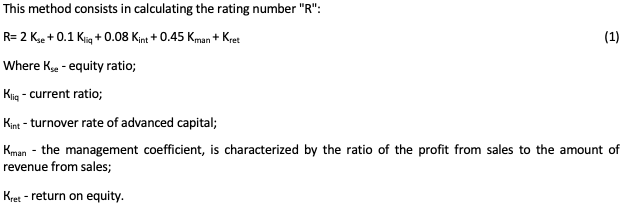

Methodology R.S. Sayfullin and G.G. Kadykov is an attempt to adapt the "Z-score" model of E. Altman to Russian conditions. The normative values of the coefficients used do not take into account the sectoral features of the organization, the model can be applied to enterprises of various scales. This method of diagnosis was built taking into account the specifics of Russian business, so it seems most optimal for use. In this methodology, 5 indicators are used, most often used and fully characterize the financial condition of the enterprise.

Table 6

Results of calculation of the rating number for "Mostostroy-11"

Substituting the values of the calculated coefficients in the general form of the model, we obtained the rating numbers equal to 1.18; 1.36 and 1.28 respectively for 2015, 2016 and 2017. The financial condition of an enterprise with a rating of 1 or more is characterized as satisfactory, therefore, for "Mostostroy-11", this condition is met.

According to the methodology of the PJSC "Savings Bank of Russia", in order to determine the creditworthiness of the borrower, a quantitative risk analysis was carried out using three groups of estimated indicators (Table 7,8):

- liquidity ratios;

- ratio of equity to borrowed funds;

- indicators of turnover and profitability.

Table 7

The main evaluation indicators of the methodology of the PJSC "Savings Bank of Russia"

# |

Indicator name |

Explanation |

1. |

K 1 - Absolute liquidity ratio |

Shows how much of the short-term debt can be repaid, if necessary, from available funds, funds on deposit accounts and highly liquid short-term securities. |

2. |

K 2 - Intermediate coverage ratio (quick liquidity ratio) |

It characterizes the enterprise's ability to promptly release money from the economic circulation and pay off debt obligations. |

3. |

K 3 - Coefficient of current liquidity (total coverage ratio) |

Gives an overall assessment of the liquidity of the enterprise, in the calculation of which the numerator includes all current assets |

4. |

K 4 - Equity ratio |

Shows the share of the enterprise's own funds in the total amount of the enterprise's funds. |

5. |

K 5 - Profitability of sales |

Shows the share of sales profit from sales revenue |

-----

Table 8

The differentiation of indicators by category

Coefficients |

First class |

Second class |

Third class |

K 1 |

0.2 and higher |

0.1 - 0.2 |

Less than 0.15 |

K 2 |

0.8 and higher |

0.5 - 0.8 |

Less than 0.5 |

K 3 |

2.0 and higher |

1.0 - 2.0 |

Less than 1.0 |

K 4 |

1.0 and higher |

0.7 - 1.0 |

Less than 0.7 |

K 5 |

0.15 and higher |

Less than 0.15 |

Unprofitable |

Evaluation of the calculation results of the five main assessment coefficients (the first and second groups) consisted in assigning to the Borrower a category for each of these indicators, based on a comparison of the values obtained with the established ones. Next, the sum of scores for these indicators was determined in accordance with their scales. The results of the calculations are presented in Tables 9-11.

Table 9

Calculation of scores (2015)

Index |

Actual value |

Category |

Indicator weight |

Calculation of the score |

K 1 |

0.02 |

3 |

0.11 |

0.33 |

K 2 |

0.69 |

2 |

0.05 |

0.1 |

K 3 |

1.36 |

2 |

0.42 |

0.84 |

K 4 |

0.23 |

3 |

0.21 |

0.63 |

K 5 |

0.07 |

2 |

0.21 |

0.42 |

S |

х |

х |

1 |

2.32 |

-----

Table 10

Calculation of scores (2016)

Index |

Actual value |

Category |

Indicator weight |

Calculation of the score |

K 1 |

0.03 |

3 |

0.11 |

0.33 |

K 2 |

0.7 |

2 |

0.05 |

0.1 |

K 3 |

1.5 |

2 |

0.42 |

0.84 |

K 4 |

0.3 |

3 |

0.21 |

0.63 |

K 5 |

0.12 |

2 |

0.21 |

0.42 |

S |

х |

х |

1 |

2.32 |

------

Table 11

Calculation of scores (2017)

Index |

Actual value |

Category |

Indicator weight |

Calculation of the score |

K 1 |

0.02 |

3 |

0.11 |

0.33 |

K 2 |

0.87 |

1 |

0.05 |

0.05 |

K 3 |

2.06 |

1 |

0.42 |

0.42 |

K 4 |

0.25 |

3 |

0.21 |

0.63 |

K 5 |

0.16 |

1 |

0.21 |

0.21 |

S |

х |

х |

1 |

1.64 |

Other indicators of turnover and profitability (Table 12,13) (the third group) were used for general characteristics and considered as additional to the first five indicators.

Table 12

Dynamics of indicators of turnover of "Mostostroy-11"

Index |

2015 |

2016 |

2017 |

Coefficient of turnover of liquid assets, in turnover |

74.43 |

161.05 |

93.87 |

Duration of turnover of liquid assets, in days |

4.84 |

2.24 |

3.84 |

Coefficient of turnover of inventory, in revolutions |

2.66 |

2.34 |

2.34 |

Duration of turnover of inventory in days |

135.48 |

153.53 |

153.82 |

Coefficient of turnover of circulating assets, in revolutions |

1.54 |

1.56 |

1.67 |

Duration of turnover of working capital, in days |

233.87 |

230.92 |

215.30 |

Asset turnover ratio, in turnover |

1.07 |

1.12 |

1.17 |

Duration of assets turnover, in days |

335.37 |

322.80 |

307.30 |

Factor of turnover of own capital, in revolutions |

2.11 |

2.42 |

3.04 |

Duration of turnover of own capital, in days |

171.02 |

148.80 |

118.39 |

Coefficient of turnover of accounts receivable, in revolutions |

3.65 |

3.98 |

4.77 |

Repayment period of receivables, in days |

98.75 |

90.53 |

75.51 |

-----

Table 13

Dynamics of Profitability Indicators of "Mostostroy-11"

Index |

2015 |

2016 |

2017 |

Profitability of ROS operations,% |

7.5 |

12.8 |

16.2 |

Net profit margin,% |

4 |

6 |

7 |

Profitability of ROM products,% |

4.2 |

7.3 |

8.5 |

Return on assets ROA |

0.04 |

0.07 |

0.08 |

Return on equity ratio ROE |

0.08 |

0.15 |

0.22 |

Based on the results of the assessment of the creditworthiness of "Mostostroy-11" with the help of PJSC "Savings Bank of Russia" methodology, it can be concluded that this enterprise belongs to the second class of creditworthiness, the lending of which requires a balanced approach. Improvement of profitability indicators, as well as indicators of turnover over the period under review, can only positively influence the determination of the rating of "Mostostroy-11" when assessing its creditworthiness.

Thus, by analyzing the creditworthiness of "Mostostroy-11" with the help of three methods, it can be said that this organization retains the ability to repay its liabilities at the expense of production stocks, finished goods, receivables and other current assets. There are also opportunities to raise additional borrowed funds without the risk of losing financial stability.

SAVITSKAYA, G.V. (2009) Analysis of the economic activity of the enterprise (5th ed) Moscow: Infra-M (in Russ.).

SHEREMET, A.D. (2004) Methods of financial analysis. Moscow: Infra-M (in Russ.).

PJSC "SAVINGS BANK OF RUSSIA" (2015) The credit rating of the borrower by the method of Sberbank. Retrieved from http://afdanalyse.ru/publ/finansovyj_analiz/

ocenka_kreditosposobnosti/metodika_sb/29-1-0-43 (in Russ.)

1. Industrial University of Tyumen, 625000, Tyumen, Volodarskogo str. 38, Russian Federation, Email: anna170280@yandex.ru