Vol. 39 (Number 50) Year 2018. Page 5

Elnur T. MEKHDIEV 1; Igor I. LITVINYUK 2; Irina V. BURENINA 3; Natalia V. SPASSKAYA 4; Elvira A. PIRVERDIEVA 5

Received: 21/06/2018 • Approved: 25/08/2018 • Published 15/12/2018

ABSTRACT: This article highlights the advantages of integrating oil refining and petrochemical industries in a single industrial complex. The authors probe different points of view taken by the owners on this process, and study the issue concerning the optimal degree of such integration, given common operational technological scheme. The article specifically emphasizes such tendencies, taking place currently on the European markets. |

RESUMEN: Este artículo muestra las ventajas de integrar industrias petroquímicas y de refinación de petróleo en un solo complejo industrial. Los autores exploran diferentes puntos de vista de este proceso dado por los propietarios, y estudiar la cuestión relativa al grado óptimo de dicha integración, dada esquema tecnológico operativo común. El artículo enfatiza específicamente tales tendencias, que tienen lugar actualmente en los mercados europeos. |

Over the recent years, with financial crisis being the main factor, oil refining and petrochemical business has incurred losses because of low profitability, excess of production in several regions (mainly in Europe), and high competition of local and foreign market actors. This has brought up to the necessity of reviewing different approaches in terms of consolidating exploitation, management and development of the potential of these industries, stepping back from earlier common practice of a separate existence of entities representing them.

Economical crisis has resulted in a globally decreased demand for petrochemical products, and the producers’ main task has become to sustain their profitability. Vertical integration between OR and petrochemical complexes is the most efficient way to cut cost and maintaining profitability.

Petrochemical industry does not have leverage over the raw materials that chiefly come from oil refineries (OR). However, as the review of bibliography reveals, an integrated oil refining and petrochemical complex (IORPC) does. It comes as reliable supplies, and ensures that the producer has the opportunity to choose the best raw material. IORPC can vary the quality of initial raw material to diversify the production of main chemicals. IORPC, for instance, can use the raw material of different quality (light or heavy oil).

Meanwhile, according to the polls, conducted within the companies of the industries, the biggest obstacle to complete the integration projects is managing such interflows in the plant-to-plant connection knots (Figure 1) (Popovic y otros, 2014).

Figure 1

Rating of the obstacles, arisen from the realization of integrating OR and petrochemical industries

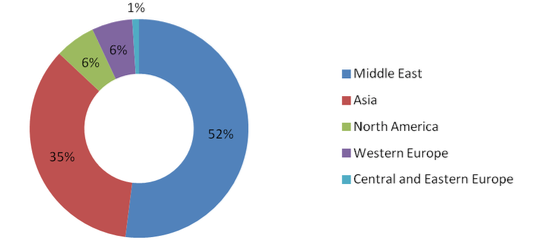

To greatest extent integration has been specific to European refineries that benefited from the nearness of raw material sources and financial advantages, provided by the shared infrastructure. However, the demand and the production shifted to Asian-Pacific region (APR) and the majority of projects are being elaborated there (Guliev y otros, 2016). Many of the complexes, which are going to become operational are integrated projects. That will help to Asian producers to obtain competitive advantage on a long-term horizon. The Middle East is a one more region where the integration of OR and petrochemical complexes has already started, with the tendency towards the increasing of their number remaining. Figure 2 shows global investment in the integration processes (Soucek y otros, 2012).

Figure 2

The most considerable investments into integrating OR and petrochemical complexes

The flexibility in raw material use gives the advantage for petrochemical producers via the opportunity of changing the volumes of main petroleum products. Integrating oil refining into petrochemical complex provides one more advantage: it could provide supply of hydrogen, which is a byproduct of petrochemical production.

The current state of world industry is partially explained by changing standards concerning aromatics and benzene content in petrol. Benzene, toluene or dimethyl benzene extraction from OR reformate is most often economically unjustified. Nonetheless the existing equipment or the one with minor upgrades allows some companies to run production based on reformate of aromatics of medium fraction. Then fractions are moved in order to mix with the materials from other units for more large-scaled extraction of fraction benzene toluene xylene (BTX). This scheme is economically justified, facilitates to overcome limits in the process of mixing petrol and to achieve higher profitability through raw material production for petrochemical industry.

Economical standing of the integrated complexes will look even better, if the opportunity of shared use of technical resources, fixed assets and common factory infrastructure is considered. Compared with the independent approach shared use of technical means decreases capital expenditures, because of such objects’ capital building costs may account up to 40% and more. Integration operation also optimizes power consumption of the object, and thus increases the overall efficiency. The cooperation existing in the integrated infrastructure maximizes the integrated advantages. IORPC guarantee the strategic advantage to producers by ensuring uninterrupted supplies and having leverage over its quality. On top of that, the decreased transportation costs along with the quicker delivery and the distribution of petrochemical products increase operational efficiency.

Successful integration will demand for centralization of support functions and, for instance, safety, storage, logistics and service. An OR company can optimize its profit through recycling petrochemical byproducts. Decreasing capital expenses, operational and overhead expenditures and turnaround cash will result in overall cost cutting. Moreover, the integration of OR and petrochemical complex will further entail significant cost cutting in petrochemical industry as ecological standards are expected to continue toughening in the future. Growing ecological problems contribute to the creation of new integrated oil petrochemical complexes. Mutually beneficial coordination can be achieved via synchronization the objects of OR and petrochemical units as well as through using technologies of recycling byproducts of IORPC. The main integration tendency is reusing of petrochemical byproducts in the unit but the operational efficiency of more than a half of OR will increase (under the existed technological framework) due to production of fuel mixes based on the byproducts.

Many OR are taking the advantage of integration with petrochemical complexes, thus increasing the efficiency of operational activity. At the same the extent of integration between OR and petrochemical complexes differs from region to region.

The choice of right operational model and the necessary extent of integration for the costing chain (for each object and region) will be decisive for increasing the profitability at volatile market. The achievement of necessary integration extent requires holistic approach to define market, technological opportunities as well as to manage the core assets.

Integrated complexes can be virtually divided into three categories:

A common complex configuration considerably depends on the type of oil, required product assortment and the application flexibility. Petrochemical refineries may be at greatest interest to cracking companies, in particular to those working with very light or extremely heavy oil.

The ability to solve difficult problems containing many variables in real time and to manage growing data amount also requires advanced informational technologies (IT). Integration may be achieved only in case of accurate dynamic modeling and matching of all important factors to actual inputs. The following are IT for managing integration:

The combined use of IT and upgraded technological process continue to increase the efficiency of more and more gradually integrated complexes.

Key technologies connecting OR and petrochemical industry are made of:

Since in many cases technological approaches have reached practically the theoretical limits, new strategies to increase the profit of integrated producers are being looked for. Improving the raw material for increasing the production volume of petrochemicals is one of the first example. This approach resulted from the understanding of kinetic efficiency through optimized oil feed. The second example is changing oil refinery process to maximize recycling oil fractions into petrochemicals. Some companies apply the amended process of catalytic cracking to shift the assortment towards petrochemical products.

The specific character of petrochemical industry is the cyclic recurrence of its profitability due to joint effect of cycling demand and supply.

Forecasted cycles of capacity utilization lead to corresponding profitability cycles.

Profitability has cyclic character with stages of prosperity and recession. That can be explained by three traditional reasons:

In general, all over the world petrochemical companies are doing restructuring, uniting, fulfilling internal and global strategies on increasing profitability and dealing with forecasted economical changes, in particular in Europe experiencing growth rate reduction (Guliyev, Litvinuyk, 2016). In nearest future surviving of petrochemical sector will require a serious decision making process. One of the way to avoid the cycle of insufficient profitability in petrochemical business is the integration with OR.

In general, integration may have positive effects on raw material availability, possibilities of processing and reprocessing flows from OR and petrochemicals units, as well as decrease of cost per unit indicator.

Based on research results on IORPC it's necessary to underline the integration's advantages according to following categories:

1. Complex management

Integration means the management of activity using one and the same administration, aiming at assets optimization in developed regions and at project elaborating in developing regions (Guliyev y Mekhdiev, 2017). Beyond that the merger of technical service and financial/HR groups will have cost-cutting effect at all levels. Synergy effects arisen due to such organization ensure a considerable economy.

2. Efficiency increase at the subdivision level

Integration means beneficial cooperation at the organization (the number of central functions decrease by 15%), influence leverages on suppliers and partners. Moreover, integration of capacities (including storage of raw material) optimizes capital use, at once decreasing storage costs.

IORPC has also the advantage of decreasing the need for inventories and supplies (consequently the need for working capital and investments in oil storage), cutting transportation cost as well as segregation of costs of definite products and capital investments in infrastructure.

Cutting logistical costs is considerably important issue. Analysis shows that decreasing these costs by 10% in the chain of raw material supply at chemical production increases the profitability by 6-8%, meanwhile for instance decreasing administrative expenses by 10% stimulates the profitability to grow only by 2-4% (Shell Global Solutions, 2014).

IORPC has also the following advantages:

Considering the scenarios of integration, the use of natural gas remains relevant issue. Using natural gas as the fuel for OR, that grants wealth of opportunities for improving the efficiency of OR and petrochemical industries. IORPC may benefit from these opportunities the following advantages (Taraphadar y Yadav, 2012):

Over the long time OR have seen market pressure because of law profitability indicators, thus made unattractive the building of OR. Exploring and drilling costs as well as oil prices play an important role in building OR or not. Some countries have their reserves and savings that is why they can afford to develop OR sector despite current law profitability.

Meantime, on the one hand, OR are the sources of products which have a great impact on world economy. In order to balance the population, increase the exploitation of more OR in large scale is considered obligatory. The only remedy is proceeding to integration and to make the whole complex more attractive in comparison with the building of stand-alone OR.

This integration will grant many advantages: high competitiveness given decreasing benefits from oil refineries, risks allocation, reduction of gas consumption and carbon dioxide emissions, increase in flexibility and efficiency of recycling process with sophisticated technologies, as well as the creation of new vacancies at the integrated complex.

However, it’s necessary to take into account some difficulties: calculation accuracy of capex and economic evaluation, area limitation etc.

On the other hand, OR products are considered by companies as the subject of probable benefits. In such a way, benzene, diesel and jet fuel are profitable products while Ethan, olefins, petroleum feedstock, petcock etc. decrease the average profitability of OR. In its turn petrochemical factories produce the range of byproducts (naphtha, aromatics, BTX etc.) which as a rule result in decreasing the profitability of a petrochemical company. Applying low-cost byproducts of OR, it’s possible to “upgrade” them up to profitable petrochemical products. The opposite situation for low-cost petrochemicals should work for improving OR profitability. Hence the income of integrated company may beat the figures of separate summing up both OR and petrochemical factory.

Other important aspect particularly for a petrochemical company is the availability and the cost of raw material, since transportation expenses of raw material have a negative impact on the economics of petrochemical factory.

It is logical to assume, that the biggest income may be obtained by the integration according to the scenario where the majority of products contribute to the fullest extent possible and the selling of semi-finished goods is limited. But here the organization of integration process is extremely important, because a new petrochemical company usually integrates with existing OR and the use define technologies depends on the OR configuration and its location. However, the unlock synergies, surpassing simple summing up the incomes of OR and petrochemical company, requires the highest extent of integration coordination.

In the future, a considerable amount of planned petrochemical projects in APR and Middle East will be integrated. That will contribute to maintain competitiveness in the long-term, i.e. ensure sustainable business process (Guliyev y Litvinuyk, 2017).

Guliev, I. A. y Litvinyuk I. I. (2017). Issues for Long-Range Projection of International Energy Markets through the Prism of Sustainable Development. International Journal of Energy Economics and Policy, 7 (2), 296-303.

Guliev, I. A. y Mekhdiev, E. T. (2017). The role of fuel and energy sector in the Eurasian economic community integration process. International Journal of Energy Economics and Policy, 7 (2), 72-75.

Guliyev, I. A. y Litvinyuk, I. I. (2016). Oil Products' Markets of the European Countries: Production Capacity and Transport Infrastructure. Problems of Economics and Management in Oil and Gas Complex, 10, 46-53.

Guliev, I. A., Litvinyuk I. I. y Mekhdiev E. T. (2016). The newest tendencies of the world market condensed natural gas: Preconditions expansions of export potential Australia, Canada, Russia and the USA. SOCAR Proceedings, (2), 56-66.

Popovic, Z., Soucek, I., Ocic, O. y Adzic, S. (2014). Refining and Petrochemical Interface. Case Study: HIP Petrohemija – NIS, Energetika. Zlatibor.

Ratan, S. y van Uffelen, R. (2008). Curtailing refinery CO2 through H2 plant. PTQ Gas, 13, 19-23. Retrieved from: https://www.researchgate.net/publication/293038288_Curtailing_refinery_CO2_through_H2_plant

Shell Global Solutions. (2014). Exploiting refinery and petrochemical integration. Co-create. Integrate. Innovate. Special Supplement to Hydrocarbon Processing, P. 8. Retrieved from: http://s05.static-shell.com/content/dam/shell-new/global/downloads/pdf/hcp-supplement-v30-screen.pdf

Soucek, I., Popovic, Z. y Ocic, O. (2012). Refinery and Petrochemical Interface. Refining and Petrochemical Round Table. Bucharest.

Taraphadar, T. y Yadav, P. (2012). Natural Gas Fuels: The Integration of Refining and Petrochemicals. PTQ, 3. Retrieved from: http://www.digitalrefining.com/article/1000557

1. Ph.D., leading researcher. Institute of International Finance and International Financial Security. Financial University under the Government of the Russian Federation. Contact e-mail: e.mehdiev@gmail.com

2. Centre for Strategic Research and Geopolitics in Energy. International Institute of Energy Policy and Diplomacy. Moscow State Institute of International Relations (University) of the Ministry of Foreign Affairs of the Russian Federation.

3. Doctor of Economics, professor. Department of Economics and Management of Oil and Gas Industry. Ufa State Petroleum Technological University.

4. Ph.D., associate professor. Department of innovation and applied Economics. Orel State University named after I. S. Turgenev.

5. Assistant. Department of Foreign Languages. Institute of Service and Sectoral Management. Tyumen Industrial University.