Vol. 39 (Number 50) Year 2018. Page 8

Alexey Alexeevich KUZUBOV 1; Nina Vladimirovna SHASHLO; 2 Alexey Vladimirovich RODIONOV 3

Received: 22/06/2018 • Approved: 02/09/2018 • Published 15/12/2018

ABSTRACT: The article traces the history of the origin and formation of Bitcoin Cryptocurrency and discusses some features of the "Blockchain". The positive and negative aspects of operation with cryptocurrencies are analyzed. The Ethereum cryptocurrency, which is closest to Bitcoin by capitalization, is considered, and the main differences between them are analyzed. On the basis of the conducted research, the forecast on the most probable direction of the cryptocurrency market development for the near future and the possibility of their integration into the world financial system is grounded. This research and its results contribute new ideas to the solution of the global scientific problem – the formation of a scientifically based opinion of academic science to a new phenomenon in the economy- cryptocurrencies and their role in the global financial system. The work is one of the few devoted to a new phenomenon in the economy – cryptocurrencies; the author's forecasts about the possible directions of further development of the cryptocurrency market are presented. This work opens the possibility of further research in the field of cryptocurrency market, its further development and integration into the global financial system. |

RESUMEN: El artículo rastrea la historia del origen y la formación de la criptomoneda de Bitcoin y analiza algunas características de la "cadena de bloques". Se analizan los aspectos positivos y negativos de la operación con criptomonedas. Se considera la criptomoneda Ethereum, que está más cerca de Bitcoin por capitalización, y se analizan las principales diferencias entre ellos. Sobre la base de la investigación realizada, el pronóstico sobre la dirección más probable del desarrollo del mercado de la criptomoneda para el futuro próximo y la posibilidad de su integración en el sistema financiero mundial se fundamenta. Esta investigación y sus resultados aportan nuevas ideas a la solución del problema científico mundial: la formación de una opinión científica de la ciencia académica sobre un nuevo fenómeno en la economía: las criptomonedas y su papel en el sistema financiero global. El trabajo es uno de los pocos dedicados a un nuevo fenómeno en la economía: las criptomonedas; Se presentan las previsiones del autor acerca de las posibles direcciones de un mayor desarrollo del mercado de criptomonedas. Este trabajo abre la posibilidad de una mayor investigación en el campo del mercado de la criptomoneda, su posterior desarrollo e integración en el sistema financiero global. |

During the past few years, problematics of cryptocurrencies, a relatively new concept in the financial world, has attracted the attention of financiers, investors and representatives of academic science. The entire global financial community today observe the unprecedented growth of Bitcoin and Ethereum rates, which in the period of 2016-2017 showed an increase of their value of more than 2000%. Along with the growing popularity appeared natural doubts about the feasibility of investing in cryptocurrencies. Their quotes show high volatility. The cost of crypto-financial assets in the short term varies with an amplitude of 30-40%, but the growth peakes (20 040 USD per Bitcoin on 17.12.2017) determine a high attractiveness for financial investors.

The uniqueness of the code and the principle of operation of cryptocurrencies were considered by many experts. E. Sixt (2017) analyzed in detail the software environment and the technological platform in the framework of which the trading of this asset is operated. In the same work the regularities of cryptosystems appearance in the financial market were revealed. N. Popper in his research (Popper, 2017a; Popper, 2017b) studied the phenomenon of avalanche-like growth of the cryptocurrencies’ value and identified factors that, in his opinion, have a significant impact on the correction of the Bitcoin’s value. In turn, E. Grinberg raised the issue of anonymity within the blockchain technology and presented examples of the use of Bitcoin in the criminal world, which puts this advantage in doubt (Grinberg, 2013). Within the framework of academic science, there is no consensus on the role played in the financial market by cryptocurrencies. A. Kuts insists on the prospective collapse of the Bitcoin’s exchange rate, as he believes in the cryptocurrency pyramid scheme and argues his opinion by the fact that virtual money does not have material support (Kuts, 2017). However, according to other experts, it is doubtless that the Blockchain technology is unique and can be used outside the financial market. Thus, K. Kleinberg and D. Helbing studied ways of introducing Blockchain technology in social spheres of human life (Kleinberg, &Helping, 2016), S. Wiefling and colleagues suggested using technologies in virtual sports or in other non-financial areas (Wiefling, LoIacono, &Sandbrink, 2017).

All researchers suggest significant prospects that the Blockchain carries. A. Knyazev (2017) described and analyzed them in detail in his works. Like any modern technology, Blockchain, and, accordingly, Bitcoin, as a tool derived from this technology, carries certain risks, and it is very important to understand the mechanics of this market and to strive to predict the fluctuations of its indicators.

At the present stage, there are no clear trends and directions in the development of crypto technologies. As a result, public policy in this area hasn’t acquired a clear outline yet. In different countries, there are diametrically opposed approaches of state regulators in the field of administration of private agents’ operations with cryptoassets. Venezuela’s government has determined the blockchain as one of the areas of economic growth. Was launched the trade of Venezuelan state cryptocurrency Petro. At the same time, China has banned all primary placements of cryptocurrencies and is trying to limit their distribution on its financial market. Note that most countries have not decided with their policy in the field of the research yet. Prospects for the development of cryptocurrencies are also not sufficiently defined. In this regard, the analysis of the development of the leading digital currencies, the forecast of demand on them and the prospects for further growth are presented as a rather urgent task.

The purpose of the work is to analyze the current trends and the state of the international market of leading cryptocurrencies, as well as to assess the possible prospects for their further development and integration into the global financial system.

To obtain the results of the research the following research methods were used: theoretical generalization for systematization of the current state of the international cryptocurrency market; induction and deduction for the formation of analytical tools for assessing the further development of the world monetary system. The work also used graphic and monographic methods.

The methodologically the work is based on the ideas of the neo-Keynesian theory and new neoclassical synthesis. On this basis was supposed to justify the model of the studied financial market and to carry out the forecast of the dynamics of its indicators.

Money, as a financial instrument, can be observed as payment instrument, that is used to pay for goods and services or to make savings. Money carry out three main functions: instrument of exchange, instrument of payment, saving. Cryptocurrency is a special instrument of payment, as it is digital information, the unit of which is "bit". As well as paper money, it has no intrinsic value. Accordingly, society will be ready to fully use it only when there is a sufficient number of goods and services on the market that can be bought for cryptocurrency. When a certain level of trust to asset is gained, it can become a full-fledged instrument of payment. One of the main advantages of the cryptocurrency is that it can not be forged, which is connected both with the fact that it is a computer code, and with the fact that decentralized services of storage and reconciliation of information about transactions are used for its circulation. In fact, each market participant is a carrier of information about all transactions, which excludes the falsification of records on individual accounts. But perhaps the main difference from the ordinary electronic money is the absence of an intermediary in transactions with cryptocurrency (Hanl, &Michaelis 2017,).

Today, the identity of the Bitcoin creator remains unknown. A conditional founder is a certain Satoshi Nakamoto (is supposedly a pseudonym of a person or group of people who developed the Bitcoin protocol and created the first version of the software in which this protocol was implemented). It is known that in 2010 Satoshi Nakamoto suspended his participation in the project and transferred the cases to his colleagues. Communication with them, he still maintains through the P2P Foundation website. There is also personal information about the age and place of residence: Japan, 37 years. However, the users ' correctness of personal data is questionable, as the technical instructions are made in English of a very high level. His fortune is estimated at 1 million Bitcoins (as of December 17, 2017, it was slightly more than 20 bln USD). This fortune could be mined using only a common network of computers (Notheisen, Holev, & Shanmugam, 2017). It should be noted that the process of Bitcoins’ mining consist in the computer tasks solving, in which the user receives a "coin" for a certain result. For this purpose, a computer with high performance and appropriate software is required.

In order to understand the mechanism of Bitcoin, you should understand the essence of the term "Blockchain". Thus, the term "Blockchain" means the program code that was developed by Satoshi Nakamoto in 2009 for storing and transmitting information via the Internet. "Blockchain" consists of a chain of blocks and makes it possible to conduct transactions and Bitcoin’s mining within the network. The user receives coins for the calculation of his computer certain mathematical algorithms specified by the block.

The peculiarity of "Blockchain" is to record all the operations on the blocks without the right to change or delete the already entered information. It should be noted that all data is transmitted according to the peer-to-peer mechanism (from one user to another or P2P), which means that there is no intermediary between the sender and the recipient of the coin (Koblitz, & Menezes, 2015).

Initially, the Creator of the system found that it is possible to issue a currency that is limited to 21 million Bitcoins (21 mln BTC). Emissions are calculated by the algorithm, starting with the initial release of 1 block containing 50 BTC. Every hour the system generates the issue of 6 blocks (1 block in 10 minutes), but every 4 years the number of Bitcoins in 1 block decreases by 50%. Thus, in 2017, 1 block contains 12.5 BTC, and by 2140 the number of bitcoins will reach its maximum of 21 million (Cap, 2012; Kethineni, CAO, & Dodge, 2017).

To make transactions, the user needs to have a wallet that will represent the code without personalization. Having a wallet number and access code, you can perform anonymous operations. The reliability of operations provides a mechanism for the safety of all transactions on the Blockchain platform (Sixt, 2017) [8].

The mechanism of confirmation of the transaction works in the following way. After a transaction of certain amount of money to another user's wallet, the system must confirm the operation and save it. This means that information about this operation should be included in the code of the new generated block. To be fully confirmed by the system, the transaction information must be included in all the next 6 blocks. This ensures the safety of users and significantly complicates the possibility of theft of money, but since the amount of information in the blocks is limited to 1 megabyte, the operation can take 5-7 hours (Sixt, 2017, 25).

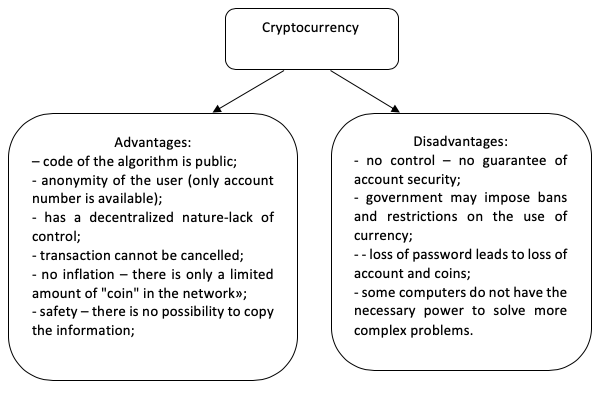

Both positive and negative sides of working with cryptocurrencies are highlighted in the literature (Pic. 1) (Sorge, & Krohn-Grimberghe, 2013; Knyazev, 2017, 87).

Picture 1

Positive and negative aspects of operations with cryptocurrencies

The information, presented in the figure require some explanation, because some positive aspects of cryptocurrencies look like negative. For example, anonymity. Complete anonymity opens up the opportunity to carry out illegal operations: buying or selling drugs and weapons, and if there is no access to the user's wallet, it is almost impossible to track the flow of funds.

However, such feature as anonymity of the user is also rather conditional. Indeed, the user does not specify his personal data, but has a wallet with a certain number. With this number it is possible to track all the operations done by the user, and if at any stage of the operation user at least once will link the wallet number with his identity, then all information about the transactions will be available.

Similarly, any person in the transaction chain can be used, and the frequency of payments can indirectly identify the person involved in the transaction chain. Accordingly, the more individuals are known, the easier it is to identify other users of the network. Such a system is used by Bitcoin, but there is a number of other, more secure cryptocurrencies. They use the mechanism of mixing transactions in the Blockchain. Such mechanisms provide a complete data protection, but their liquidity and capitalization are still minor. Alternative cryptocurrencies aren’t widespread, and they haven’t receive popularity yet, in contrast to Bitcoin (Sixt, 2017, R. 32).

Cryptocurrencies as a financial asset did a long way from complete uncertainty to avalanche-like growth of demand on them and citation in the top news feeds of leading news agencies. For that, starting in 2010, this subject began

In order to be mentioned in academic and business circles, it took approximately 20 years of technological development for digital payment instruments. In 1991 Phill Zimmerman developed the first ever software to encrypt e-mail "Pretty Good Privacy (PGP)" (Sixt, 2017, p. 5). In 1989, David Shuman founded the company "DigiCash". He developed the concept of operating with the digital currency "Cybercoin". The company used a voucher system in which each coin was a digital code stored on a hard drive. Encryption was performed using algorithms that were publicly available. To prevent double payments, the transaction had to confirm through a Central server (Sixt, 2017, p. 4).

In 1997, British cryptographer Adam Beck developed the Hashcash system, which was based on the Proof-of-Work-System program. This software was protecting email users from spam and viruses, blocking computers (Sixt, 2017, p. 7).

The idea of creating a common database, which could store the history of all transactions, was invented in 1990 by Harper and Stornet. The concept assumed that the user will be able to obtain a document on the transactions from the Central server in the shortest possible time, and which will contain a link to previous operations.

This gave the opportunity to fully display a pattern of made payments and transfers (Sixt, 2017, p 6). In 1998, Wai Dai has developed "b-money" concept, allowing use of scriptblock as code of network "Peer-to-Peer-Netzwerk". In the period between 1998-2008 Nick Szabo developed a monetary system "Bit-Gold". His invention was based on the approach of Adam Beck, with the difference that the Sabo code suggested the possibility of using digital values of the cryptocurrency repeatedly (Sixt, 2017, p. 7).

In 2005, Hal Finney combined the concepts of Wai Dai and Adam Beck to create a database of modern cryptocurrency. The concepts had a significant drawback, which was a double bill of digital coins. Accordingly, it could not be trusted by users and could not be applied in the market of goods and services. The problem was solved on 31.10.2008 by Satoshi Nakamoto, who developed the modern Bitcoin system. His idea had the following features in contrast to the previously proposed. Within the outsourcing and creation of a decentralized network to request confirmation of the transaction in the form of "mining" – a reward for the creation of subsequent coins, using the algorithm proposed by Wai Dai.

The combination of the use of the Wai-Dai code and the reproduction of all possible transactions (the Harper and Stornet concept) led to the solution of the problem of double counting of coins and the development of a decentralized system without the appearance of intermediaries between operations. The system also provided the full confidence of users in reliability of the transactions and was given the opportunity to track every action in the network (Sixt, 2017, p. 7).

In 2008, the bitcoin.org domain and address were officially registered. Up to 2009 was started the work on the creation and release of the first Bitcoin client. The reward was 50 Bitcoins. In the same year, the currency began to gain popularity, and users started actively create new coins. The concept assumed the release of a certain amount of money, so the mining was controlled by increasing the complexity of the algorithms. In the beginning, it was enough to have one personal computer, but now requires special equipment with high power processor(s). In 2009 financial community had no idea about the possibilities of a new financial asset, so the rate of Bitcoin to the dollar was very low – 700 Bitcoins per 1 USD. The current level of development of Bitcoin began to acquire with the assistance of the first company "New Liberty Standard", which began to publish the rate of the coin.

The time of emergence and development of cryptocurrencies and, in particular, Bitcoin corresponds to the period of financial crisis of 2008-2009, and this fact can hardly be considered as accident. In our opinion, the appearance of cryptocurrencies in the market at that time was a reaction to the financial crisis, when the governments of many countries began to put pressure on their financial systems to "whitewash" their black and gray areas. This, accordingly, created a demand for alternative, uncontrolled payment systems for various segments of the shadow business. In addition, the first transaction of Bitcoin, which was carried out in 2009 by the Creator of the currency – Satoshi Nakamoto, belongs to the same period. Then the recipient of the coins became a programmer Hal Finney – the Creator of "algorithm proof of work done" (Sixt, 2017,p. 7).

Up to 2010, the first cryptocurrency exchange service was created and the first purchase/sale operation was carried out. US citizen Laszlo Chanics paid for 2 pizzas 10 000 Bitcoins (approximately USD 50 in 2010). A few months later Bitcoin exchange rate has increased significantly and the same 10 000 Bitcoins costed 600 USD (on the 17.12.2017 the cost of the pizza would be slightly more than 200 000,00 USD).

Such a sharp rise of cryptocurrency, apparently, caused the publication about Bitcoin on the website "Slashdot". Soon the first Bitcoin burse – "MtGox" – was created. This meant that Bitcoin already had sufficient liquidity in the market and the exchange created profits on the price rate fluctuations. The founder of the Bitcoin burse was Jed McCaleb (later, in 2011, it was sold to the Japanese company "Tibanne Co"). In 2011, the volume of transactions on purchase and sale of Bitcoins has reached 1 USD mln (Informatsionnyy sayt Bitcoin, 2017).

The first problem faced by Bitcoin – the lack of material security. The exchange rate, both then and now, is governed exclusively by supply and demand. The next obstacle was the interest of hackers who were interested in users’ wallets. As a result of constant attacks and hacking of the burse "MtGox" they managed to lower the rate of of Bitcoin to 0,01 USD. At such a low price, Bitcoins were bought or stolen from users ' wallets. Then it led to the closure of the "MtGox" for a week and provoked the interest of the mas media: the first conferences and startups in the direction of cryptocurrencies started their work (Knyazev, 2017; Sorge, & Krohn-Grimberghe, 2013).

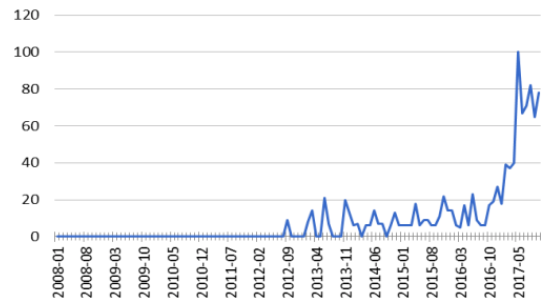

Since the second half of 2012, a sharp increase in Bitcoin transactions began (Pic. 2). The new financial instrument gained recognition in the financial world during this period. The peak was in 2013, when the Bitcoin exchange rate reached its historic high of that period on the level of 300 USD. In the same year, the owner of an anonymous trading platform "Silk Road", which could be accessed through the anonymous browser Tor (Grinberg, 2013; Popper, 2017) was arrested. A large proportion of the goods on the site were weapons, drugs, Bank card details and personal data. In the media, this story received great publicity with reference to the fact that payments were made in Bitcoins and the Bitcoin rate fell sharply. Also, the decline was affected by an article published in the magazine Forbes, which informed about the site through which funds were collected for the murder of politicians. In this case the payment was Also made by Bitcoin. All negative sides were reflected in the fall of the rate, but at the end of the same year the situation stabilized and the rate reached its new maximum of 1200 USD (InformatsionnyysaytBitcoin, 2017).

Picture 2

Dynamics of the number of Bitcoin transactions, thousand units

Thus, in 2013, Bitcoin was in the focus of attention of the entire financial world, which raised concerns for the stability of traditional currencies and led to the desire of countries to control the flow of cryptocurrency. Increasingly, there were cases of buying and selling drugs or weapons with the help of Bitcoins. In some countries, this currency has been banned or put forward proposals for the introduction of coin taxation (Notheisen, Cholewa, & Shanmugam, 2017; Bennhold, 2017).

In 2014, there was a collapse of the Bitcoin exchange, which led to a sharp fall in the exchange rate. In addition, the theft of Bitcoins from network users resumed. In early January, the first secure cryptocurrency vault "Elliptic Vault" was opened.

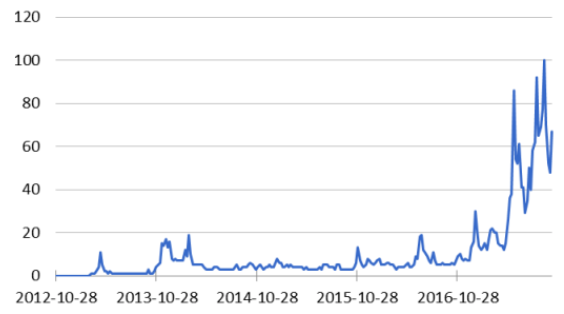

The change of public interest to Bitcoin over the past 5 years can be tracked by the chart of such indicator as "requests on the Internet". Pic. 3 predents the graph of the number of user requests for the keyword "Bitcoin" in the Google search system in the period from the end of October 2012 to November 2017.

Picture 3

Number of requests for the keyword "Bitcoin" by users in the Google search

system from November 2012 to November 2017, thousand units.

In 2011, the popularity of Bitcoin for the first time crossed the mark of "0" and at the end of 2012 for the first time was the first recorded abnormal surge of interest to Bitcoin. In 2013, the popularity of Bitcoin was kept on a high level, but due to the crisis in 2014 decreased slightly and remained at a low level until mid-2015. From 2015 to 2016, the number of requests to Google has steadily increased, and by the end of 2016 there was already a sharp increase in the popularity of the currency. In 2017 interest to Bitcoin continued to increase and at the same time appeared first companies and countries that announced their intention to work with Bitcoins. As of the second half of 2017, according to Google Trends analysis, the greatest interest to Bitcoin was shown by African countries, in particular Nigeria, Ghana and South Africa; among Eastern European countries – Estonia, Slovenia and the Czech Republic; in the Americas – Canada and the United States (Google Trends, 2017).

Another example of the growing popularity of cryptocurrencies was the country of Vanuatu, which offered to buy its citizenship for Bitcoins. The cost was 41.5 Bitcoins. Upon receipt of citizenship was supposed to pass a number of mandatory checks under the laws of the country, and all transactions were carried out through a partner state – the burse of Australia. This decision was made taking into account the fact that many Bitcoin investors are looking for ways to invest their savings with the payment of low taxes. In Vanuatu, it is possible to acquire tangible assets without paying high taxes, which was supposed to trigger the popularity of the new citizenship program. Citizens of Vanuatu also have the opportunity to travel visa-free in more than 100 countries, including some European countries (Haig, 2017).

The airline "StarJetsInternationalLLC", engaged in providing business jets for private flights, announced the possibility of paying for its services by Bitcoins. This was done to improve its competitiveness in the air transport market, as well as to improve the comfort and attractiveness of its services (Sterlin, 2017).

Relatively recently, online Megamarket "Amazon.com" declared readiness to make payments in Bitcoins, but at the time of the announcement "Amazon.com" had no direct opportunity to receive payments for goods in Bitcoins. For this there are several services and one such service is the platform "Purse.io" (Demartino, 2016). The site allows the buyer to chooses the product on the site "Purchase.io " and to places it in the cart, then this product is seen by another user who wants to buy Bitcoins. After he pays for the goods by ordinary money, the goods are sent to the buyer, and Bitcoins come to the account of the user who wanted to buy Bitcoins and paid for the goods in traditional money (Demartino, 2016).

It should also be noted the policy of the Corporation "Google" in the direction of the introduction of Bitcoin, which has upgraded its API to work with payment systems and added the ability to pay with Bitcoins. This means that everyone who uses the API can now pay in cryptocurrency (Bitcoin Merchants can Use Google's Android Pay to Make Payments Easier, 2015).

Starting from 01.04.2017, Japan has adopted a bill granting Bitcoin and other cryptocurrencies status of payment instuments (V Yaponii bitkoiny priznali platezhnym sredstvom, 2017). This led to an increase of investors’ interest and a jump in the rate. Japan has one of the most developed economies in the world, so the official recognition of Bitcoin as a payment instrument was the reason for active investment operations and an increase in the rate to a record peak at that time. However, by July, the rate was adjusted, falling by 15% due to rumors about the possible division of the currency into two separate assets, which caused a short panic among users.

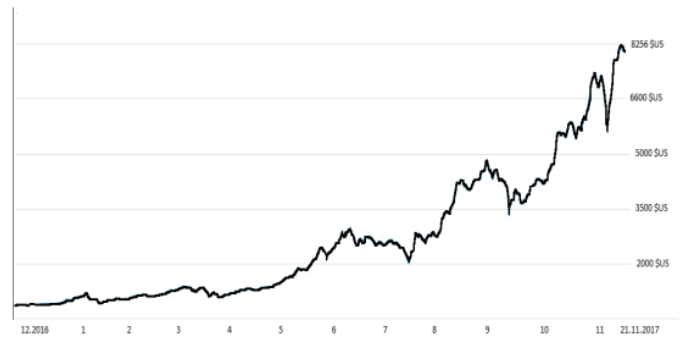

Pic. 4 shows the dynamics of the Bitcoin exchange rate to the USD for the period from 20.11.2016 to 22.11.2017 All described events are well traced on this picture. We intentionally present a chart that ends with this date, as in the next four weeks Bitcoin exchange rate more than doubled, reaching to 17.12.2017 mark of 20 040 USD per Bitcoin. Therefore, if we presented a graph that includes this period, it would smooth out most of the decreases and growths. So it could be rather hard to visually track the events described above.

Picture 4

Bitcoin to USD exchange rate for the period from 20.11.2016 to 21.11.2017

In may 2017, the pension Fund in the US "BitcoinIRA", which accepts deposits in Bitcoins, announced the growth of investments in cryptocurrencies. However, the Fund itself warned users against deposits only in such currency because of its instability. According to analytics’ estimates, Bitcoin volatility is such that under unfavorable circumstances, the loss of investment capital in Bitcoin can be very significant (Arkhangelskiy, 2017).

On August 1, 2017, another currency unit "Bitcoin Cash" was created on the basis of Bitcoin. This decision was made on the basis of the inability of Bitcoin to perform a large number of transactions. When it was created, the possibility of high popularity in the market was not taken into account, so now Bitcoin requires modernization. With the advent of the new unit, the amount on the users’ wallets doubled. So if the account consisted 5 Bitcoins, after 01.08.2017 they were joined by another 5 units of Bitcoin Cash (Knyazev, 2017).

It should be noted that in a number of countries restrictions and prohibitions on the use of cryptocurrencies are introduced, and this can affect its popularity and cost. Therefore, it is possible that for some time the Bitcoin exchange rate can be adjusted. Nevertheless, popularity among users, availability of algorithms for mining, publications in the media that form the interest of both existing investors and attract new ones are likely to support it on a high level.

The main competitor of Bitcoin today is Ethereum (the value of the coin on 17.12.17 was 718 USD, the market capitalization is 69.3 USD bln), which is a platform for application developers, based on a decentralized Blockchain system.

Ethereum appeared in 2011 and was developed by Russian programmer Vitaly Buterin. Unlike Bitcoin, Ethereum is widely used by application developers to pay fees and services. Ethereum creation rectified some of the shortcomings of Bitcoin. So, in this network it is possible to decentralize earlier centralized systems. You can make changes to the Blockchain only with the permission of all network members. This eliminates fraud and the possibility of corruption, but does not help to modernize the network. The Ethereum network operates on the basis of so-called" Smart contracts", which work on the principle of achieving a certain value and execution after a given action. More simply, the user can add a new algorithm to the Blockchain, and to fulfill a special condition, the system will perform the previously prescribed action in the code (Sillaber, & Waltl, 2017). It should be noted that after the creation of a smart contract, it is possible to make changes to it only with the consent of all members, which means full transparency of the operation and eliminates possible fraud on both sides. This approach is applicable in many areas of everyday life, and therefore has become popular (Koblitz, & Menezes, 2015).

The Ethereum network has convenient functionality with the help of the Ethereum Virtual machine (EVM), which allows you to add and change functions in the application. Another advantage is the ability to write programs in any of the known programming languages (Popper, 2017a).

Every year, more and more companies speak in favor of cryptocurrencies and offer cooperation. Thus, the transnational company "Oracle" presented at the conference "OpenWorld 2017" a new cloud space, due to which customers can create blockchain applications. A full launch is planned for 2018 So the company joins other corporations based on the concept of Baas (the Blockchain-as-a-service). The same concept is already used by such corporations as IBM and Microsoft. Thanks to the launch of such a platform, Oracle Corporation plans to expand its cloud technologies and attract more customers. This direction is called "Blockchain Cloud Service" and will have advantages for Start-up companies. They will be able to test their applications through the Oracle space offered for a relatively low price (Condon, 2017).

Today, the sphere of cryptocurrencies is at the stage of formation and development. Quite interesting are the statements of some top managers of the IMF. Thus, managing Director Christine Lagarde turned the side of digital money and expressed her desire to participate in the development of a new financial direction. Also, Christine Lagarde considers the possible development of cryptocurrency based on special drawing rights project (SDR), which has all the possibilities to apply the functions of the Blockchain. In contrast, Jamie Dimon, the CEO of the IMF, considers Bitcoins to be a "cheat" and does not see a continued positive outcome for cryptocurrency (Sterlin, 2017). But the only fact of such discussion on such a high level suggests that the popularity of digital money is likely to grow, and their rate, respectively, increase.

Most recently, the Bitcoin exchange rate reached its new historical maximum of 20 042 USD (17.12.17). In our opinion, Bitcoin, on the one hand, is very similar to the "Giffen product", i.e. such a type of product, which demand increases with the increase in its price. But on the other hand, if economic theory determines the group of Gifen goods, as, in most cases, inexpensive, but without which it is extremely difficult for the population to do, then Bitcoin does not really fit into this definition. Most likely, the answer is that nothing like the phenomenon of Bitcoin classical economic theory hasn’t describe yet, and therefore this question still requires detailed study. At this point, for many researchers, including us, it has become absolutely obvious that most of the holders of cryptocurrencies have opened their positions not to carry out calculations. Cryptocurrency investors were exclusively motivated by the desire to receive super profits from the growth of capitalization of this market.

It was natural to create a digital currency that could simplify payments and make anonymity in the network. Its popularization in 2009-2010 and further development is most likely related to the pressure of governments of a number of countries on business entities of the financial sector in order to identify and eliminate black and gray zones in the financial systems.

Current Bitcoin exchange rate looks highly overrated. However, even with the onset of both deep and not very significant correction, further growth of the Bitcoin rate is quite possible. Such a hypothesis can be put forward, based on the growing popularity of the cryptocurrency and the demand on it. We can assume that every year more and more companies will offer payments in cryptocurrency, trying not to lose both existing and potential customers.

Cryptocurrencies are an almost ideal way to conduct financial transactions in the shadow sector. Despite the ambiguous interpretation of this situation, this state of affairs will also contribute to the further increase of the Bitcoin’s rate. The emergence of a qualitatively new tool in the global financial system – cryptocurrencies, which are able to simplify payment transactions, reducing their cost by eliminating intermediaries and at the same time give anonymity to operations, was expected and natural. Which of the existing cryptocurrencies will become prevalent in the financial system, at this moment is not possible to predict, but the fact is that this new type of currency is confidently included in the daily life of business and the population, and this may mean that the world economy is currently stand on the verge of unpredictable revolutionary changes.

Bennhold, K. (2017). How to Catch Hackers? Old-School Sleuthing, With a Digital Twist The New York Times. 14.05.2017 Web. 12.10.2017 Retrieved from: https://www.nytimes.com/2017/05/14/world/europe/ransomware-cyberattack-wannacry-hacking.html?rref=collection%2Ftimestopic%2FBitcoin&action=click&contentCollection=timestopics®ion=stream&module=stream_unit&version=latest&contentPlacement=10&pgtype=collection.

Bitcoin Merchants Can Use Google’s Android Pay to Make Payments Easier (2015). NewsBTC. 02.06.2015 Web. 12.10.2017 Retrieved from: http://www.newsbtc.com/2015/06/02/bitcoin-merchants-can-use-googles-android-pay-to-make-payments-easier/.

Cai, Y., & Zhu, D. (2016). Fraud detections for online businesses: a perspective from blockchain technology. Financial Innovation, 2(1), 1-10. doi:10.1186/s40854-016-0039-4.

Cap, C. H. (2012). Bitcoin — das Open-Source-Geld. HMD Praxis Der Wirtschaftsinformatik, 49(1), 84–93. doi:10.1007/bf03340666.

Condon, S. (2017). Oracle rolls out Blockchain Cloud Service. ZDNET. 02.10.2017 Web. 12.10.2017 Retrieved from: http://www.zdnet.com/article/oracle-rolls-out-blockchain-cloud-service/.

Demartino, I. (2016). Purse.io Review: Incredibly Useful. coinjournal.net. 5.4.2016 Web. 4.11.2017 Retrieved from: https://coinjournal.net/purse-io-review/.

Dierksmeier, C., & Seele, P. (2016). Cryptocurrencies and Business Ethics. Journal of Business Ethics, 1-14. doi:10.1007/s10551-016-3298-0.

Gomber, P., Koch, J.-A., & Siering, M. (2017). Digital Finance and FinTech: current research and future research directions. Journal of Business Economics, 87(5), 537–580. doi:10.1007/s11573-017-0852-x.

Google Trends: kolichestvo zaprosov «bitkoin» prevzoshlo rekord 2013 goda [Google Trends: the number of requests "bitcoin" surpassed the record of 2013] (2017) forexsystemsru.com. 30.05.2017 Web. 12.10.2017 Retrieved from: https://forexsystemsru.com/bitkoin-segodnya-novosti-i-prognozy/83091-bitkoin-segodnya-novosti-kriptovalyut-98.html (in Russian).

Grinberg, E. (2013). Tsifrovaya anarkhiya: kto ustroil okhotu za golovami politikov v internete [Digital anarchy: who arranged a hunt for politicians on the Internet]. Forbes. 25.11.2013 Web. 12.10.2017 Retrieved from: http://www.forbes.ru/tekhnologii/internet-i-svyaz/247738-tsifrovaya-anarkhiya-kto-ustroil-okhotu-za-golovami-politikov-v (in Russian).

Haig, S. (2017). Vanuatu Becomes First Nation to Accept Bitcoin in Exchange for Citizenship NewsBTC. 10.10.2017 Web. 12.10.2017 Retrieved from: https://news.bitcoin.com/vanuatu-becomes-first-nation-to-accept-bitcoin-as-citizenship-payment/.

Hanl, A., & Michaelis, J. (2017). Kryptowährungen — ein Problem für die Geldpolitik? Wirtschaftsdienst, 97(5), 363–370. doi:10.1007/s10273-017-2145-y.

Informatsionnyy sayt Bitcoin [Bitcoin Information Site] (2017). bitcoin.com. Retrieved from: bitcoin.com.

Kethineni, S., Cao, Y., & Dodge, C. (2017). Use of Bitcoin in Darknet Markets: Examining Facilitative Factors on Bitcoin-Related Crimes. American Journal of Criminal Justice. doi:10.1007/s12103-017-9394-6.

Kleineberg, K.-K., & Helbing, D. (2016). A “Social Bitcoin” could sustain a democratic digital world. The European Physical Journal Special Topics, 225(17-18), 3231–3241. doi:10.1140/epjst/e2016-60156-7.

Knyazev, A. (2017). Monetnyy dvor. Samyye perspektivnyye kriptovalyuty dlya investitsiy [The Mint. The most promising crypto currency for investments]. Forbes. 10.10.2017 Web.12.10.2017 Retrieved from: http://www.forbes.ru/finansy-i-investicii/351245-monetnyy-dvor-samye-perspektivnye-kriptovalyuty-dlya-investiciy (in Russian).

Koblitz, N., & Menezes, A. J. (2015). Cryptocash, cryptocurrencies, and cryptocontracts. Designs, Codes and Cryptography, 78(1), 87–102. doi:10.1007/s10623-015-0148-5.

Kuts, A. (2017). Puzyr' ili novoye zoloto: chto proiskhodit s bitkoinom i drugimi kriptovalyutami? [Bubble or new gold: what happens to bitcoin and other crypto-currencies?]. forbes.ru. Retrieved from http://www.forbes.ru/finansy-i-investicii/347851-puzyr-ili-novoe-zoloto-chto-proishodit-s-bitcoin-i-drugimi (in Russian).

Notheisen, B., Cholewa, J. B., & Shanmugam, A. P. (2017). Trading Real-World Assets on Blockchain. Business & Information Systems Engineering, 59(6), 425–440. doi:10.1007/s12599-017-0499-8.

Popper N. (2017). Business Giants to Announce Creation of a Computing System Based on Ethereum The New York Times. 27.02.2017 Web. 2.11.2017 Retrieved from: https://www.nytimes.com /2017/02/27/business/dealbook/ethereum-alliance-business-banking-security. html?rref=collection%2Ftimestopic%2FBitcoin&action=click&contentCollection=timestopics®ion=stream&module=stream_unit&version=latest&contentPlacement=15&pgtype=collection.

Popper, N. (2017). AlphaBay, Biggest Online Drug Bazaar, Goes Dark, and Questions Swirl The New York Times. 07.06.2017 Web. 12.10.2017 Retrieved from: https://www.nytimes.com/2017/07/06/business/dealbook/alphabay-online-drug-bazaar-goes-dark.html?rref=collection%2Ftimest opic%2FBitcoin&action=click&contentCollection=timestopics®ion=stream&module=stream_unit&version=latest&contentPlacement=4&pgtype=collection.

Popper, N. (2017). Understanding Ethereum, Bitcoin’s Virtual Cousin. The New York Times. 1.11.2017 Web. 2.11.2017 Retrieved from: www.nytimes.com/2017/10/01/technology/what-is-ethereum.

Sillaber, C., & Waltl, B. (2017). Life Cycle of Smart Contracts in Blockchain Ecosystems. Datenschutz Und Datensicherheit - DuD, 41(8), 497–500. doi:10.1007/s11623-017-0819-7.

Sixt, E. (2017). Bitcoins und andere dezentrale Transaktionssysteme. doi:10.1007/978-3-658-02844-2.

Sorge, C., & Krohn-Grimberghe, A. (2013). Bitcoin — das Zahlungsmittel der Zukunft? Wirtschaftsdienst, 93(10), 720–722. doi:10.1007/s10273-013-1589-y.

Sterlin, L. (2017). IMF Chief Lagarde Tells Central Bankers: «Not Wise to Dismiss Virtual Currencies». NewsBTC. 30.09.2017 Web. 12.10.2017 Retrieved from: https://news.bitcoin.com/imf-chief-lagarde-tells-central-bankers-not-wise-to-dismiss-virtual-currencies/.

Sterlin, L. (2017). Star Jets International Now Accepts Bitcoin Payments Econotimes. 19.10.2017 Web. 12.10.2017 Retrieved from: https://news.bitcoin.com/star-jets-international-now-accepts-bitcoin-payments/.

V Yaponii bitkoiny priznali platezhnym sredstvom [In Japan, bitcoins were recognized as a means of payment]. (2017). lenta.ru. 01.04.2017 Web. 12.10.2017 Retrieved from: https://lenta.ru/news/2017/04/01/japan/ (in Russian).

Weber, M. (2017). Plattform-Entrepreneurship: Technologien und Gründungschancen. Crowd Entrepreneurship, 41–58. doi:10.1007/978-3-658-17031-8_3.

Wiefling, S., Lo Iacono, L., & Sandbrink, F. (2017). Anwendung der Blockchain außerhalb von Geldwährungen. Datenschutz Und Datensicherheit – DuD, 41(8), 482–486 (in German).

doi:10.1007/s11623-017-0816-x.

1. Federal State-Funded Educational Institution of Higher Education “Vladivostok State University of Economics and Service”, 690014,Russia, Vladivostok, Gogolya str., 41. Candidate of Economic Sciences. Contact email address: E-mail: alexceyk@gmail.com

2. Federal State-Funded Educational Institution of Higher Education “Vladivostok State University of Economics and Service”, 690014, Russia, Vladivostok, Gogolya str., 41. Candidate of Economic Sciences. Contact email address: ninelllsss@gmail.com

3. Academy of Federal Penitentiary service of Russia, 390000, Russia, Ryazan, str. Sennya,1. Doctor of Economic Sciences. Contact email address: a.v.rodionov@list.ru