Vol. 40 (Number 3) Year 2019. Page 5

Yaneth Patricia ROMERO Alvarez 1; Mario Frank PEREZ Perez 2; William Alejandro NIEBLES Nuñez 3

Received: 08/08/2018 • Approved: 30/11/2018 • Published: 28/01/2019

ABSTRACT: The sector of SME plays an important role in emerging economies and their internationalization allows them to generate competitiveness; however, this involves exposing their balance sheets to the risks inherent in the variations of exchange rates. A solution to this is to isolate the company by using either operational or financial hedges. The objective of this research is to establish the current state of the management of foreign exchange risk in several SME in the municipality of Sincelejo in Colombia. In general, a lack of knowledge was found in SME entrepreneurs about risk management alternatives. |

RESUMEN: El sector de las Pymes juega un rol importante en las economías emergentes y su internacionalización les permite generar competitividad; sin embargo, esto acarrea exponer sus balances a los riesgos inherentes a las variaciones de los tipos de cambio. Una solución a ello, es aislar la empresa mediante el uso de coberturas ya sean operativas o financieras. El objetivo de la presente investigación es la de establecer el estado actual de la gestión del riesgo cambiario en varias Pymes del Municipio de Sincelejo en Colombia. En general se encontró un desconocimiento en los empresarios de Pymes acerca de las alternativas de gestión del riesgo cambiario. |

SME represent more than 90% of companies in Colombia and, in large part, the country's economic growth is promoted by the financial stability of these enterprises which, to achieve greater competitiveness, venture into external markets exposing their balances to the risks inherent in currency exchange rate variations called "Exchange Risk". This, added to the limited negotiating power of SME can influence their profitability or even lead to failure. A solution to reduce exposure to this type of risk is to isolate it from the effects of exchange movements by using either operational or financial hedges. In the operative ones, for example, a company got into debt in foreign currency also might be a net exporter; in that case, a devaluation might have no significant effect in its general performance (Arbeláez, Steiner, and Salamanca, 2010).

On the other hand, an example of foreign exchange risk hedges, is the financial derivatives. They are common strategies nowadays in the markets as they allow to ensure future prices of purchase or sale of products or raw materials but especially for the exchange rate in monetary system where the currency floats freely as is the case of Colombia, where the exchange rate band was eliminated since 1999 (Villar, 1999) and where the dollar-peso currency needed to close the business in exports and imports is among the most revalued currencies of the emerging economies in Latin America.

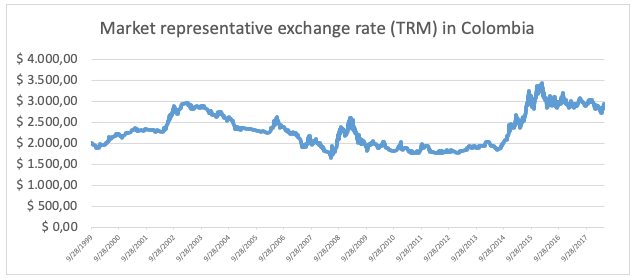

Figure 1

Historical Daily Exchange rate representative of the market (TRM)

Source: Bank of Republic (2018).

Figure 1 indicates the high daily variability of the representative rate of the market (official exchange rate (USD/COP)) with a standard deviation of 418% that gives account of the inherent risk to the transactions of international trade that are made in dollars and for this it is necessary to have the coverage to exchange rate risk.

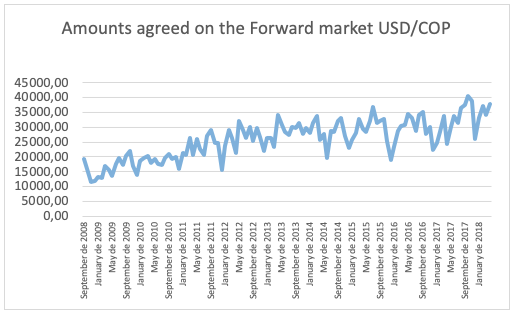

In particular, Colombia began its operation with financial derivatives in the Stock Exchange (BVC,) in September of the year 2008, being the third country in Latin America to enter this market after Brazil and Mexico; in this market, futures are negotiated on interest rates, exchange rate, indices and stocks (ASOBANCARIA, 2018). All the operations that are performed in this market have the intermediation of the camera of Central Risk of counterpart of Colombia (CRCC), making it possible to eliminate risks to defaults in the operations and make more effective the process of complementarity of business (BVC, 2018). Taking into account the information of the Bank of the Republic about the futures on the exchange rate that has been made in Colombia, these have been increasing significantly, in fact, according to Figure 2, only in the last quarter of the year 2018 were negotiated Over USD 23.91 billion.

Figure 2

Amounts agreed on the Forward Market USD/COP. Amounts are in millions of dollars. T

he amounts include flows forward of peso-dollar swap operations and correspond to what has been agreed by the IMC.

Source: Bank of the Republic (first quarter of 2018).

This significant increase in the amounts traded in forward operations, is explained by the dynamism of foreign direct investment toward both inside and out, inherent to globalization, as well as the growth of investment portfolios by hedge funds abroad and the coverage needs of real-sector companies that are more involved in the dynamics and operations of international trade. Despite the foregoing, exchange-rate risk coverage remains uncommon; As a result, companies, banks, and government are, in principle, subject to a significant risk due to exchange rate volatility (Arbelaez, Steiner, & Salamanca, 2010).

The methodology to carry out risk coverage in SME that manage international operations, begins with knowing how to distinguish the types of risks that the company faces, among them the exchange risk, then calculate the amount exposed to that risk and search for information with specialized firms or banks of your confidence about financial instruments to mitigate risks. According to the foregoing, the objective of this research is to establish for SME in the municipality of Sincelejo in Sucre – Colombia, the knowledge and use of exchange risk hedges, as well as the management of information and professional guidance associated with the topic.

The literature found at the international level on the effects of exchange rate movements -on the performance of the company is extensive (Arbeláez , Steiner, & Salamanca, 2010; Bae, Ho, & Soo, 2018; Bishev & Boshkov, 2016; Caglayan & Demir, 2014. Most authors point out that devaluation can improve the competitiveness of the exporting and importing local companies and contribute to the internationalization. But, it would negatively affect the performance of Companies that have liabilities denominated in foreign currency (balance effect). In fact, the study of Dhasmana (2015) relates that the impact can depend on the degree of market power, trade orientation, foreign ownership, access to national finance and the concentration of the industry.

At the level of Colombia, however, the literature found in studies on the vulnerability to the volatility of exchange rates especially in SME in Colombia is scarce. It was found for example the study of Berggrun, España & López (2011) who proposed a methodology for the analysis of exchange rate risk to an exporting company in order to determine the probable impact of this risk and also to model and analyze the different alternatives you can use to mitigate it.

In addition, despite having a different objective than this research, it was found that in the study of Cardona (2010) on financial planning in the exporting SME of Antioquia, with regard to the knowledge of the instruments of financial risk coverage: 74% of the SME surveyed knew about this fact. However, only 56% had used contracts for exchange rate futures and only about 13% of the companies studied had used the subsidies for the payment of the premiums of exchange-rate hedging contracts created by Bancoldex in order to mitigate the effects of the revaluation.

To generate dynamism in the economy, companies must be competitive and expand beyond their local environment, venturing into other markets that can bring with it multiple benefits, but also multiple risks such as exchange risk. According to Adler and Dumas (1984) cited by Lizarzaburu & Berggrun (2013), the exchange risk is a concept related to the deviation to what is envisaged in the exchange rate of a currency. It corresponds to the variations in the exchange rates of the local currency against a foreign currency that can cause considerable profit losses (Rodriguez, 2012).

Now then, on having spoken about exchange risk, it is necessary to define concepts such as exchange rate exposure and volatility of the instrument; The first refers to the amount in foreign currency that runs a company through different financial instruments, and can be transactions, economic and accounting (Vivel-Búa & Lado-Sestayo, 2016). Whereas the concept of exchange rate volatility consists in the tendency of appreciation or depreciation of the value of the currencies and which depends to a great extent on the type of exchange and the frequency of the same one (Lizarzaburu & Berggrun, 2013). The materialization of exchange risk for transactional exposure can bring with it millions of losses for exporting or importing companies, especially SME that are more vulnerable in an economy because it affects future cash flows in the national currency. In fact, according to Vivel-Búa and Lado-Sestayo (2016), in developed countries such as Spain fluctuations in the exchange rate were identified as the third biggest threat in the international management of companies in a survey carried out by the consultant Pricewaterhouse and the Wall Street Journal in the year 2004.

However, there is evidence from different countries where, despite the existence of foreign exchange risk, companies do not use hedges for different reasons such as the belief that they have no exchange exposure. They use of other methods to manage exchange risk (such as supplier and client financing) and the perception of an implicit free insurance offered by the official intervention in the changing market (Buscio, Gandelman, & Kamil, 2012). In the study of Bartram et al. (2010) cited by Hansen & Hyde (2013), three ways are established through which companies mitigate exchange risk: by transmitting costs to customers, changing the locations of operations, or through exchange risk hedges. The authors Berggrun, España, & López (2011) established in their research a complete methodology for the management of exchange risk based on the financial statements. The methodology proposed by the authors includes the following activities:

1. Identify the type of exchange risk to which the company is exposed, which is determined by the type of operating structure or business of each company.

2. Measure the impact that the risk generates.

3. Apply and analyze the different operational and financial alternatives to minimize the risk.

4. Make decisions to minimize exchange risk taking into account the deadline and the level of risk you are willing to assume.

Assuming the previous methodology, this research adds to the selection of the type of exchange risk coverage. There are different mechanisms through which companies act to cover the risks to the variability of the exchange rate, that is to say, they are not necessarily only financial cover, they can also be operational as indicated by the different alternatives in Table 1.

Table 1

Alternatives for exchange risk hedges in SMEs

Position |

Operational alternatives

|

Financial alternatives |

Importers or companies with short dollar positions |

The possibility of exporting, looking for sourcing options with local vendors. The decrease in exchange risk is obtained because the exports would provide currencies to cover the payments and the supply with local suppliers would decrease the payments to be made in foreign currency. |

|

Exporters or companies with long positions in dollars |

The possibility of importing as a source of supply, to increase the base of local clients. The decrease in exchange risk is obtained because surplus currencies would be used for the payment of imports and because by increasing the local customer base the company's sensitivity to export risk is reduced. |

|

Source: Taken and adapted from (Berggrun, España, & López, 2011)

The mechanism of selection of the type of coverage will depend on the benefits and costs that the companies can obtain through each one of them and the administrator must decide in a cost-benefit relation and the type of exchange exposure. Other factors that also affect this decision, according to Giraldo-Prieto, González, Vesga and Ferreira (2017) and Bathi (2002) are the exposure to the exchange rate that the company has and the costs in the management of coverage such as the cost of information.

Not all operational alternatives are recommended for all companies: while companies with expected positive exposure should reduce their exposure through currency derivatives, internal transactions with foreign subsidiaries and Foreign currency debt financing, companies with expected negative exposure should do so through exchange rate coverage activities ( Bae, Ho & Soo, 2018).

On the other hand, financial alternatives include the use of financial derivatives, which in turn have their advantages and disadvantages. The derivative instruments are financial innovations with characteristics of continuous change and adaptation to the requirements of the environment (Ibañez, Romero-Meza, Coronado-Ramirez, & Venegas-Martinez, 2015). They are financial instruments designed on an underlying and whose price depends on the price of the same. According to BVC (2018) a derivative is "an agreement of purchase or sale of a certain asset, at a specific future date and at a defined price. The underlying assets, on which the derivative is created, can be stocks, fixed-income securities, currencies, interest rates, stock indices, raw materials and energy, among others. "

Several authors have established the multiple benefits and risks that may result from the use of financial derivatives. Among them, Allayanis, Lel, & Miller (2012) established a direct and strong relationship between the use of financial derivatives and the value of the company in the market. Because the use of exchange-rate hedging instruments decreases the volatility of the cash flows and therefore the risk faced by the owners, reduce the company's bankruptcy costs and eliminate agency problems that lead the company to underinvestment. This means that by leaving out attractive investment projects, asymmetries of information are reduced and companies can access higher levels of indebtedness (Castillo & Moreno, 2008).

Likewise, Geczy (1997) cited by Giraldo-Prieto, González, Vesga & Ferreira (2017) found that companies with high growth and limited financing are more likely to make hedges with coin derivatives, improving their costs related to financial constraints, allowing to present a cash flow that is better suited to investment and growth opportunities, as well as reducing the risk of bankruptcy. One of the unfavorable aspects for SME in the management of exchange risk is the limited access to the derivatives market, either because of ignorance or lack of public policies to encourage a higher level of banking of business activities (Buscio, Gandelman, & Kamil, 2012). Also, the different methodologies involved in the management of exchange risk demand the permanent management of updated information (Bathi, 2002).

Finally, the decision of the type of coverage to use will depend on this type of knowledge which may be inaccessible or may have transactional costs affecting the operation and which ultimately affect the expected outcome of the coverage. Considering the foregoing, an inquiry can be made on the knowledge and use of foreign exchange hedging operations in SME and their valuation in relation to the subject.

The present research is exploratory and transversal. It allowed from the information of 15 companies of the city of Sincelejo in Sucre-Colombia, to carry out an approach of the use and knowledge on the hedges of risk in the SME of the city that perform some kind of international trade operation such as imports or exports or business in foreign currency. It is hoped, therefore, that this approach to the subject can be used as a source for further research.

The instrument used was based on an open questionnaire made to the people responsible for making financial decisions for companies in the city supported by an interview under a qualitative approach that would account for a reality closer to the SME to international trade operations, to the risks they are exposed to and to the knowledge and importance of risk hedges. The quantitative data were processed in the free statistical software INFOSTAT.

Of the total number of companies analyzed in this research, 60% have less than 20 employees, 33% between 21 and 50 employees, and 7% between 51 and 120 employees. As for the level of assets, 93% have less than 501 S.M.M.L.V. (Spanish acronym for currency legal monthly minimum salary) and the remainder between 501 and 5000 S.M.M.L.V. data that, according to the Law 590 of 2000, classify them as SME.

In order to be able to establish hedging operations, it was necessary for the companies to carry out international trade operations such as: imports of raw materials, product on process or finished product for marketing, export or sale in external markets, especially of the finished product, or foreign exchange transactions or currency as is the case of remittances from abroad or from the exchange houses.

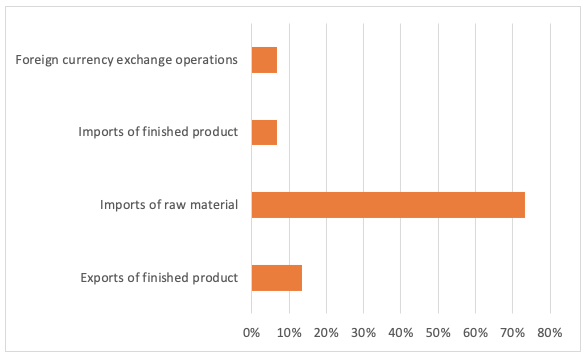

According to Figure 3, as regards the type of international trade business carried out by SME in the study, the majority of them (73%) make imports specifically of raw materials that are used in their production processes, 7% of them import finished products for marketing, the 13% export finished products and 7% carries out foreign currency exchange operations. Although the others that carry out import and export operations also indicated that they use the exchange operations to be able to make the payments or to nationalize the sales.

Figure 3

International trade operations of the 15 companies studied

Source: Authors

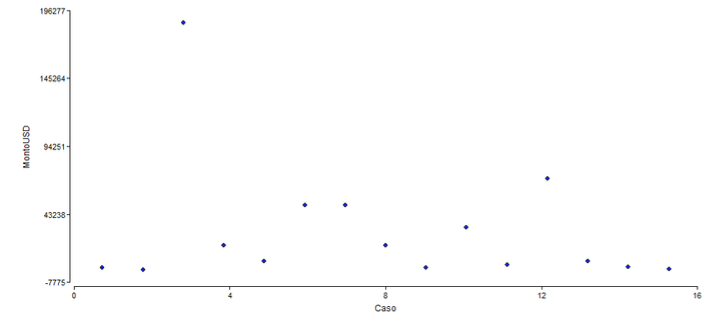

The volume of money from these operations varies from USD 1500 to USD 187,000 per month (Figure 4), although some companies opt not to give this type of information as they consider it confidential information.

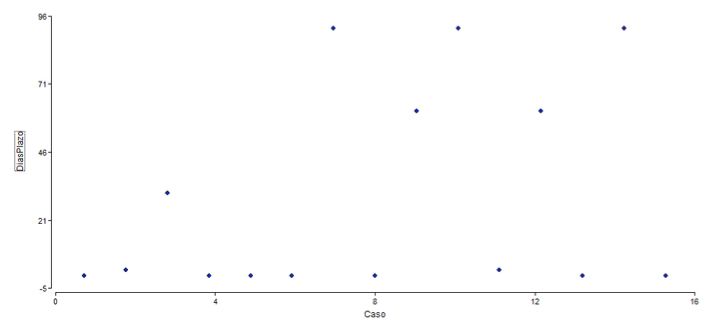

Figure 4

Monthly amount negotiated by SMEs.

Source: Own elaboration in INFOSTAT

Regarding the terms of operations, 47% of SMEs perform cash and 13% to 2 days, that is, this group of companies do not make coverages. Of the remaining, 7% do operations at 30 days, 13% at 60 days and the remaining 20% at 90 days, as shown in Figure 5.

Figure 5

International Trade Operations Deadlines

Source: Own elaboration in INFOSTAT

Although this period shown in Figure 5, it is not decisive to establish whether it is covered or not, since the most relevant variable of this research is the one that determines whether the SME carry out foreign exchange risk hedges against export operations. Import or foreign exchange operations. In this, it is found that for the most part, 87% of the companies analyzed do not cover, despite the fact that their financial institutions in this type of operations advise 67% of them. In this regard, is commented by one of the managers interviewed: "Through these trainings teach us the good handling of this type of operations, so that the company implements them for better performance; But unfortunately we live in a culture where this kind of knowledge is not put into practice that favors companies".

Other comments on the international trade operations of some of the entrepreneurs were:

"Foreign operations generate a great impact for the country".

"For us this type of operation is very easy, besides this brings us many competitive advantages in the market where we are at the moment that is the commercialization of steel and its derivatives".

An important aspect in the decision making of the currency exchange operations is the access to specialized information of the exchange rates and their projections, for example, for the purchase of raw material every month end. In this sense, when consulting the companies their source of consultation for the exchange rate, it is found that the majority consults it on the Web page Dataifx which shows official information on the daily TRM from the Stock exchange of Colombia (BVC).

As for the distinction between the types of operational or financial coverage, at the level of interviews conducted no domain was found in front of the subject. However, it was found that the total of companies that import raw materials for their production processes, 60% carries out operational coverages because they also have local suppliers that allow them to supply the inventory deficits in cases in which the demand requires it.

In the case of financial hedges, it was found that none of the entrepreneurs interviewed know the operation of financial coverage, but are advised by their financial institution, so the questions allusive to the structuring and decision of the Forwards were not answered by respondents. This makes clear the panorama as to the knowledge of these financial products and the clear need to generate more educational strategies and of public policies that result in the management of the risk of exchange in the small and medium enterprises of the country..

With this exploratory study it is possible to determine that the majority of the companies selected for the study, despite the fact that they carry out international trade operations (especially imports of raw materials) that are exposed to the variability of the dollar exchange rate, prefer cash operations to hedge foreign exchange risk.

Multiple authors at national and international level have established the uses and benefits of exchange risk management, including:

• Improve the performance of companies, generating value.

• Achieve greater competitiveness.

• Contribute to the internationalization of companies

• Diversify the market

• Limit operating costs and profit losses against exchange rate fluctuations.

Taking into account the above, it is important that SME that carry out international trade operations, whether import or export, know about this type of operations and become aware of the importance of hedging against currency changes to protect against the volatility and dynamism of money markets, this, in turn, contributes to the soundness of the financial system and stimulates the development of other markets, such as capital markets.

Allayanis , G., Lel, U., & Miller, D. P. (2012). The use of foreign currency derivatives, corporate governance, and firm valur around the world. Journal of International Economics, 65-79.

Arbeláez , M. A., Steiner, R., & Salamanca, A. (2010). INVESTMENT AND EXPOSURE TO EXCHANGE RATE CHANGES IN COLOMBIA. Fedesarrollo.

ASOBANCARIA. (25 de 05 de 2018). ASOBANCARIA. Obtenido de Conozca como funciona el Mercado de Derivados: http://www.asobancaria.com/sabermassermas/conozca-el-mercado-derivados-como-funciona/

Bae, S. C., Ho Kwon, T., & Soo Park, R. (2018). Managing exchange rate exposure with hedging activities: New approach and evidence. International Review of Economics and Finance, 53, 133-150.

Bathi, S. S. (2002). Analysis of Information Cost Incurred in Foreign Exchange Risk Management by SMEs. Sustaining SME Innovation, Competitiveness and Development in the Global Economy, 1-13.

Berggrun Preciado, L., España Calderón, L. F., & López Casella, J. A. (2011). Gestión del riesgo cambiario en una empresa exportadora. Estudios Gerenciales, 219-238.

Bishev, G., & Boshkov, T. (2016). ARE EXCHANGE RATE EXPOSURE AND HEDGING IMPORTANT FOR FIRM PERFORMANCES? EVIDENCE FOR MACEDONIAN SMES. International Journal of Information, Business and Management, 34-46.

Buscio, V., Gandelman, N., & Kamil, H. (2012). Exposición Cambiaria y Uso de Instrumentos Derivados en Economías Dolarizadas: Evidencia Microeconómica para Uruguay. REVISTA DE ECONOMÍA, 41-89.

BVC. (31 de 05 de 2018). Bolsa de Valores de Colombia. Obtenido de Traders BVC: http://www.tradersbvc.com.co/derivados

BVC. (25 de 05 de 2018). BVC. Obtenido de Mercado de Derivados: https://www.bvc.com.co/pps/tibco/portalbvc/Home/AcercaBVC/Comunicados_Prensa?com.tibco.ps.pagesvc.action=updateRenderState&rp.currentDocumentID=b338283_14be0709146_-5dad0a0a600b&rp.revisionNumber=1&rp.attachmentPropertyName=Attachment&com.tibco.ps.pagesvc

Caglayan, M., & Demir, F. (2014). Firm Productivity, Exchange Rate Movements, Sources of Finance, and Export Orientation. World Development, 204-219.

Cardona Montoya, R. A. (2010). Planificación financiera en las pyme exportadoras. Caso de Antioquia, Colombia. AD-minister, 50-74.

Castillo R., A., & Moreno S., D. (2008). Uso de derivados cambiarios y su impacto en el valor de empresas: el caso de empresas chilenas no financieras. Estudios de Administración, 1-30.

Dhasmana, A. (2015). Transmission of real exchange rate changes to the manufacturing sector: The role of financial access. Intenational Economics, 48-69.

Giraldo-Prieto, C. A., González Uribe, G. J., Vesga Bermejo, C., & Ferreira Herrera, D. C. (2017). Financial hedging with derivatives and its impact on the Colombian market value for listed companies. Contaduría y Administración, 1572-1590.

Hansen S., E., & Hyde, S. (2013). DETERMINANTES DE LA EXPOSICIÓN CAMBIARIA DE LAS EMPRESAS CHILENAS. Economía Chilena, 70-88.

Ibáñez, F., Romero-Meza, R., Coronado-Ramirez, S., & Venegas-Martinez, F. (2015). Financial Innovations in Latin America: Derivatives markets and Determinants of Risk Management. Santiago de Chile: MPRA.

Lizarzaburu, E., & Berggrun, L. (2013). Gestión del riesgo cambiario: aplicación una empresa exportadora peruana. Estudios Gerenciales, 379 - 384.

Rodriguez, N. D. (2012). El riesgo país en la inversión extranjera directa: concepto y. Papeles de Europa, 109 - 129.

Villar Gómez, L. (1999). Política Cambiaria en un proceso de ajuste ordenado. Bogotá: Banrep.

Vivel-Búa, M., & Lado-Sestayo, R. (2016). Análisis de la Exposición económica al Riesgo cambiario en el Mercado Español. Globalización, Competitividad y Gobernalidad, 20-55.

1. Industrial Engineer. Master in Finance. Research professor in the Finance area of the University of Sucre in Sincelejo - Colombia. ORCID: 0000-0002-1723-5717. Email: yaneth.romero@unisucre.edu.co

2. Agroindustrial Engineer. Master in Industrial Engineering. Research professor in the University Corporation of the Caribbean CECAR in Sincelejo - Colombia. ORCID: 0000-0002-1723-5717. Email: mario.perez@cecar.edu.co

3. Business Administrator. PhD. in Management sciences. Master in strategic management. Research professor in the estrategic area of the University of Sucre. ORCID: 0000-0001-9411-4583 Email: william.niebles@unisucre.edu.co