Vol. 40 (Number 6) Year 2019. Page 15

ROGOVA, Tatjana M. 1

Received: 09/10/2018 • Approved: 27/01/2019 • Published 18/02/2019

ABSTRACT: Purpose: to examine the experience of venture financing of innovation activities and identify areas for development of Russian economy. The author considers reveals the features and shortcomings of the used mechanism along with its institutional basis, and examines the practical and functional features of the innovation-financing infrastructure. The study identifies prospective directions for the modernization of Russian venture financing schemes: leasing and factoring, analyzes the effectiveness and feasibility of the venture financing innovation mechanisms. |

RESUMEN: El autor estudia los fundamentos conceptuales de la organización del financiamiento de las actividades de innovación en Rusia, identifica las características y limitaciones del mecanismo utilizado, sus fundamentos institucionales, estudia la práctica y las características específicas del funcionamiento de la infraestructura de financiación de la innovación. Se determinan las direcciones prometedores de modernización de los esquemas rusos del financiamiento de riesgo: leasing y factoring. Sse analiza la efectividad y la conveniencia de aplicar mecanismos del financiamiento de riesgo de a la actividad de innovación en condiciones rusos, cuyos resultados proporcionan la base para tomar decisiones gerenciales sobre los métodos de financiación de la innovación. |

Scientific and technical progress, which has been universally recognized as the most important factor in economic development, is most often associated with innovative development. This is the only process that unites science, technology, economics, entrepreneurship, and management. It involves generation of an innovation and extends from the birth of a concept to its commercial realization, thus covering the entire complex of relations: production, exchange, and consumption.

The development and implementation of innovations is a crucial factor of social and economic development, the guarantee of economic security. The economies based on critical, basic and high technologies continue to grow steadily (Gabdullin, & Mironova, 2017). According to experts, the annual turnover of high technologies and science-intensive products in the world market is several times higher than the turnover of the raw materials market, including oil and oil products (Goncharenko, & Fatyanova, 2013).

Only timely financing combined with efficient management and competent technical advice provides opportunities for implementation of promising innovative projects and high technology developments that require hard work for commercialization. Financing of innovation activities has a huge resource potential, though suffers from several shortcomings related to the large inertia caused by numerous organizations involved in the projects. A sound system of financing innovative activities allows for the accumulation of financial resources, the possibility of their concentration in the key areas of innovation processes (Madatova, 2012).

A balanced system of financing innovative activities contributes to the creation of conditions for the rapid and effective implementation of innovations, the development of the company's innovative potential, and allows for maintaining the human resources of the innovation company (Milkina, 2016).

For this reason, the general tendency for financing a significant part of sectoral and intra-firm innovations of a limited nature at the expense of the own capital of the company ready to take a conscious risk in order to obtain excess profit becomes as relevant as the financing of large-scale innovative projects.

Background

The formation of the innovation climate in enterprises is impossible without a system of innovative financing. This system implies the provision of resources, which include not only cash but also other investments expressed in monetary terms, including fixed and working capital, property rights and intangible assets, credits, loans and mortgages, rights of use, etc. All methods of financing are divided into direct and indirect (Kalashnikov, 2013). The latter include methods that provide innovative projects with the necessary material, technical, labor and information resources. An example is the installment purchase or a leasing (rent) of equipment required for the project; purchase of the license for the technology used in the project implemented in the form of a "royalty" (percentage of sales of the final product); placement of securities with payment in the form of supplies or leasing the necessary resources; attraction of the required labor resources, and contributions of knowledge, skills and know-how resources to the project.

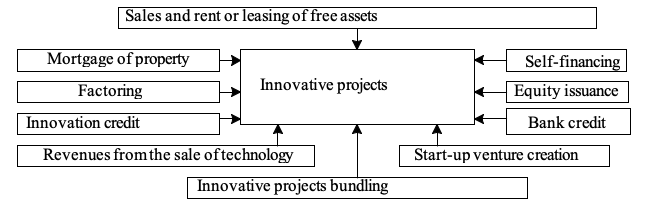

In general, the system of financing innovative activities includes typical sources and organizational forms of financing (Figure 1).

Figure 1

Sources and forms of innovation financing

Compiled by the author based on the data from Venture investment as a

form of financing the innovation process, by Topsokhalov, 2016

The world experience shows that a 10 times increase in capital in 5-7 years is a normal expected result for a European or an American venture fund. According to experts, such results can be achieved in 1-2 years. However, as the experience of the United States and Europe has shown, to achieve these indicators, i.e. to turn venture capital into an effective tool for financing innovative projects, a number of specific prerequisites are required:

– a developed technological environment capable of generating and distributing innovations;

– an active competitive environment that encourages innovation in production and in the market;

– favorable legal and tax conditions to guarantee the safety and profitability of venture capital investments (Topsokhalov, 2016).

The dominant role in financing innovative programs is given to loans from banks and other financial institutions, equity issuance and internal sources (retained earnings and depreciation charges). Credit sources of innovative projects financing are very diverse (Table 1), with the priority given to bank credits.

Table 1

Classification of loans for innovation financing

Classification criteria |

Basic types of loans |

By the type of creditor |

Foreign, state, bank, commercial (in the form of leasing) |

By the form of provision |

Commodity, financial |

By the purpose |

Investment, mortgage (mortgaged property) |

By duration of the credit |

Long-term (from 5 years), short-term (up to 1 year) |

Compiled by the author based on ‘Venture financing – the way

to develop an innovative economy’ by Aleshina, 2017.

In general, the sources of innovation financing are the internal funds of the subjects of innovation activity. The magnitude of investments in the innovation sphere varies in different cycle phases. The development of basic investments, which requires massive long-term investments, takes place in the periods of crisis recovery and reactivation. Since the propensity for accumulation and innovation is weakening during the crisis, the government directly (based on budgetary investments) and indirectly (through the provision of economic benefits) supports innovative activity, contributing to the revival of the economy and enhancing its competitiveness. The extent of state support in the phases of recovery and sustainable development declines, while the innovation process is carried out on a competitive basis. During this period, the improving innovations prevail, since they require less investment and do not involve any significant risks, compared to the basic innovations. This allows reducing the extent of state support for innovation activities. The level of innovation-investment activity is minimal in the crisis phase, characterized by the development of pseudo-innovations, which do not require significant improvements.

The financing of innovation activities is a set of principles, methods and forms of innovation management.

Innovative activity should be associated with the projected result, leading to the changes both within the commodity producer and in the external environment. Thus, the growth of solvent demand follows by an increase in the requirements for consumer properties of the manufactured products. This forces the enterprises to expand and update their nomenclature, make the appropriate changes in the construction and design of goods, restructure marketing networks, and diversify the range of services in the consumer market. The expansion of the service sector needs provides for the transformation of the manufacturing process and the information systems. The development of the service sector creates a new competitive environment and new demands for goods and services.

The activation of innovation activities is possible only based on a developed financing system. The success of innovation is largely determined by the forms of organization and the methods of financial support. Developed countries obtain the financial resources for innovation from both public and private sources. The system of financing innovation is a complex interlacing of forms and sources of financing. The procedure for financing innovative projects and the structure of investment resources in each specific case has its own specifics and is directly related to the nature of the ongoing innovations.

Innovation activity is closely associated with the predicted result, which results in changes both within the enterprise and in the external environment. Thus, the growth in solvent demand is accompanied by an increase in requirements for manufactured products. This forces the manufacturers to expand and update their product range, make the appropriate changes in the construction and design of goods, restructure marketing networks, and diversify the range of services in the consumer market. Expansion of requirements in the sphere of innovative services results in a transformation of the production process and the information systems. The development of innovative services creates a new competitive environment and new demands for goods and services.

Small business investment companies are created with state participation; they have tax and financial incentives and state guarantees for the loans granted to small firms. These companies provide small innovative firms with state-subsidized venture capital. Since their foundation till the end of the 1990s, small business investment companies have paid $8.5 billion to 55 thousand small businesses, including 2.6 billion (Kulebyakin, 2011) in the form of state loans. They have contributed to the development of several young innovative firms that have now become world famous companies – Intel, Apple, etc.

The problem of raising funds in the current context of financial turbulence remains critical for many innovative companies. Thus, the acquisition of innovative equipment and technology might be difficult or simply impossible. The attraction of additional financial resources in the form of a loan can also be problematic due to equity requirements (as a rule, at least 20% of the cost of equipment will have to be paid out of own funds), whilst the loan terms are often limited to 1-2 years.

The way out of this situation could be a broad application of the new financial instruments for industrial investment, one of which is leasing.

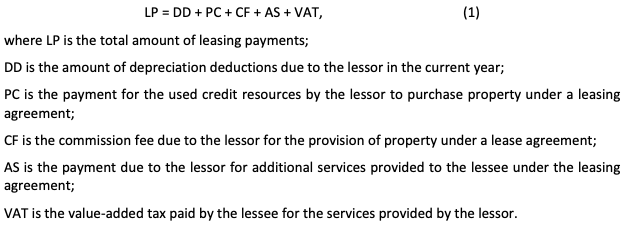

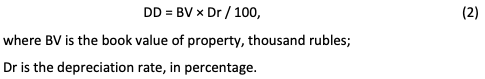

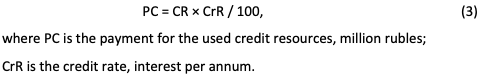

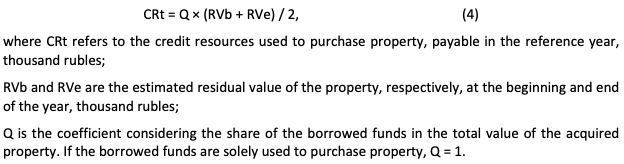

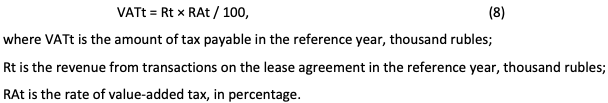

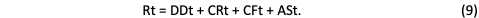

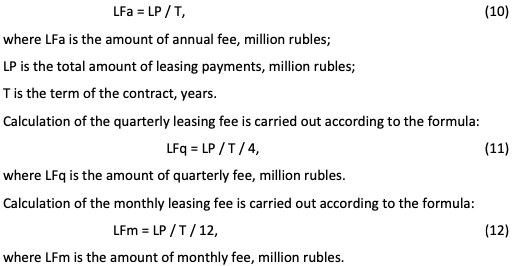

To make the right decisions on debt financing in the form of a lease, it is necessary to calculate the amount of payment for leasing services, to determine the actual annual interest rate and compare it with the rates of bank loans or other borrowings. In practice, the discounting methods or simple calculations are used for these purposes. The second calculation method is simpler, but at the same time accurate; therefore, it can be recommended for use. The essence of the method is that based on the initial cost of the facility, the annual installments of its value repayment, along with the interest rate, the capital of the lessor invested in these values is calculated as the average amount of debt and all costs for the purchased leasing services.

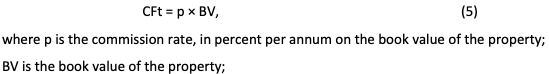

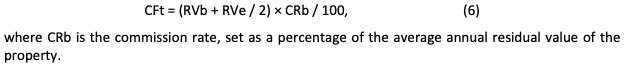

With a decrease in the loan debt received by the lessor for the acquisition of property – the subject matter of the leasing agreement, the amount of payment for the loans decreases, along with the amount of commission to the lessor. If the parties agreed that the interest rate is a percentage of the unpaid value of the property, it is advisable to calculate the leasing payments in the following sequence:

a) of the book value of the property by the formula (3.5)

b) of the average annual residual value of the property according to the formula

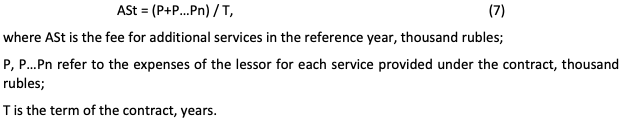

9. Calculation of leasing fees when paid in equal parts with the periodicity stipulated in the contract is carried out according to the formula

In accordance with the concluded leasing agreement, the organization receives production equipment worth 120,000 rubles for four years, at 25%; additional expenses are accepted for payment of 4,000 rubles annually. Repayment of the total value of fixed assets is established in equal parts once a year.

When calculating the total amount of annual payments for the leasing services, it is necessary to determine the initial cost of the purchased equipment, which is reduced by the amount of annual contributions. In this case, it will amount to 120 thousand rubles for the first year;

for the second year: 90 thousand rubles = 120 – (120 × 25/ 100);

for the third year: 60 thousand rubles = 90 – (120 × 25/ 100);

for the fourth year: 30 thousand rubles = 60 – (120 × 25/ 100).

The average annual debt can be calculated as half of the cost of funds, divided by the number of years: (120 / 2) / 4 = 15.

The average debt will amount to:

for the first year: 105 thousand rubles = 120 – 15;

for the second year: 75 thousand rubles = 90 – 15;

for the third year: 45 thousand rubles = 60 – 15;

for the fourth year: 15 thousand rubles = 30 – 15.

Definition of the average debt is the basis for calculating the amount of interest for the capital invested by the lessor. With a rate of 25%, these amounts will be:

for the first year: 26.25 thousand rubles = 105 × 0.25;

for the second year: 18.75 thousand rubles = 75 × 0.25;

for the third year: 11.25 thousand rubles = 45 × 0.25;

for the fourth year: 3.75 thousand rubles = 10 × 0.25.

As can be seen, the amount of interest decreases annually due to a decrease in average debt, i.e. repayment of annual payments.

Based on their total, one can acquire the total debt or the amount of leasing payments for each year and for the entire leasing period.

In this case, the total amount of leasing payments is 196,000 rubles. The financial parameters of the leasing contract are presented in Table 2.

Table 2

Lease payment calculation, thousand rubles

Year |

Cost of the object |

Average debt |

Annual fee |

Cost of the capital |

Additional expenses |

Total debt |

1 |

120 |

105 |

30 |

26.25 |

4 |

60.25 |

2 |

90 |

75 |

30 |

18.75 |

4 |

52.75 |

3 |

60 |

45 |

30 |

11.25 |

4 |

45.25 |

4 |

30 |

15 |

30 |

3.75 |

4 |

37.75 |

Total |

0 |

60 |

120 |

60 |

16 |

196.0 |

Compiled by the author based on ‘Venture financing – the way

to develop an innovative economy’ by Aleshina, 2017.

In determining the lease repayment solvency, it is advisable to compare these with the forecasted profit data for the relevant period. During the first year of equipment use, the profit is projected at 40.25 thousand rubles, in the second – 46.0 thousand rubles, in the third – 55.0 thousand rubles, and in the fourth year – 58.6 thousand rubles. The calculation results are presented in Table 3.

Table 3

Calculation of lease repayment solvency, thousand rubles

Year |

Lease payment |

Profit |

Deviation |

1 |

60.25 |

40.25 |

- 20.0 |

2 |

52.75 |

46.0 |

- 6.75 |

3 |

45.25 |

55.0 |

- 4.75 |

4 |

37.75 |

58.75 |

+ 21.0 |

Total |

196.0 |

200.0 |

+ 4.0 |

Compiled by the author

The profit received for the first three years is not sufficient to cover the lease payments. In the last year, the lessee will receive a real opportunity not only to cover the leasing services for the current year but also to repay the entire debt, as well as the right to acquire the ownership of the corresponding object.

Therefore, leasing is considered one of the most effective forms of financing the expansion of the production base, its improvement, modernization, and technical development of production.

A financial manager must carefully analyze the use of such form of financing as leasing. It is advisable to compare it with a bank loan. For these purposes, a comparison of the two cost-effective calculations is performed (credit and leasing).

As a basis for comparison, the author suggests conducting an analysis of the possibilities of acquiring an integrated innovative production line, worth 500,000 rubles for a five-year period of use:

1) to acquire the property through a bank loan with interest (28% per annum); repayment of the loan is provided in equal parts at the end of each year, together with interest;

2) to lease the property with an annual rent of 200 thousand rubles and the right to acquire it in ownership with an additional payment of 50 thousand rubles.

Calculations of costs related to the acquisition of equipment through credit and lease are presented in Tables 4 and 5, respectively.

Table 4

Calculation of costs for a loan, thousand rubles

Years |

1 |

2 |

3 |

4 |

5 |

Loan repayments |

100 |

100 |

100 |

100 |

100 |

Cost of capital |

175 |

140 |

105 |

70 |

35 |

Total debt |

275 |

240 |

205 |

170 |

135 |

Depreciation |

40 |

40 |

40 |

40 |

40 |

Reduction of taxable profit |

235 |

200 |

165 |

130 |

95 |

Tax reduction |

90 |

80 |

66 |

52 |

38 |

Effective costs |

141 |

120 |

99 |

78 |

57 |

Compiled by the author

-----

Table 5

Calculation of costs for a lease, thousand rubles

Years |

1 |

2 |

3 |

4 |

5 |

Payment for leasing |

200 |

200 |

200 |

200 |

200 |

Reduction of tax amount |

80 |

80 |

80 |

80 |

80 |

Effective costs |

120 |

120 |

120 |

120 |

120 |

Payment for leasing |

200 |

200 |

200 |

200 |

200 |

Reduction of tax amount |

80 |

80 |

80 |

80 |

80 |

Compiled by the author

When choosing a leasing scheme for financing the modernization of fixed assets, the costs (instead of 495 thousand rubles from bank loans) will increase to 650 thousand rubles: the effective costs will amount to 600 thousand rubles and 50 thousand rubles as additional payment for expenses.

Such a simple comparison of costs is not accurate since it does not consider the distribution of these costs over time, i.e. the real possibilities of their payment and use of free cash. Therefore, in practice, the discount method is used to determine the present value of the difference between the effective expenditure on credit and leasing for each year of financing these values.

Thus, none of the activities will find wide application if it does not bring benefits to all the participants in contractual relations and, first of all, to the potential user. What are the advantages of leasing to a lessee?

1. The decrease in the need for own starting capital. As a rule, leasing involves full financing by the lessor and does not require immediate commencement of payments.

2. It is often easier to acquire a leased property than a loan for the property acquisition since the leased property serves as collateral.

3. A leasing agreement is considered more flexible than a loan agreement; it provides an opportunity for both parties to work out a convenient payment scheme.

4. A leasing agreement can be concluded for a longer period than a loan agreement.

5. For the lessee, the risk of moral and physical depreciation and obsolescence of the property is reduced, since he does not acquire the property into ownership, but for temporary use.

6. The leased property is not listed on the balance sheet of the lessee, which does not increase his assets and exempts him from property tax.

7. Lease payments are fully included in expenses (costs) and actually reduce the taxable profit.

8. Leasing allows for the use of accelerated depreciation.

9. Small businesses are exempt from the payment of VAT.

Although leasing as a form of financing innovation has a number of disadvantages, however, positive aspects inherent in the lease exceed the negative ones, while the international historical experience confirms the important role of leasing in the development of innovation and the expansion of production of innovative eco-friendly products.

Among the main advantages of leasing forms of financing innovative activities, there are:

The possibility of innovative reproduction and modernization of fixed assets even in the absence of appropriate resources.

Creating conditions for the effective use of cash, increasing the speed of its turnover, increasing financial liquidity and expanding the possibility of developing innovative activities, increasing its profitability.

Empowering timely updates of innovative production equipment by leasing the most modern, high-performance types.

All the transaction participants are interested in leasing: the producer receives new sales channels, the user acquires an opportunity to purchase equipment without initial financial costs, and the leasing company becomes a financial link between the producer and the recipient at a certain fee. The state also benefits from this transaction –national production is developing, tax revenues to the budget are increasing, while social stress is reduced through the establishment of new jobs.

In the modern conditions, leasing is particularly relevant for the development of entrepreneurship, which can accelerate the formation of the production base and strengthen the role of the middle class in the formation of the market and the development of market infrastructure. In this case, the starting capital decreases, since the leasing company takes over the primary capital costs for the acquisition of equipment.

The author expresses her gratitude to the administration and the scientific community of the Southern Federal University for the support given to the scientific project and valuable comments on the materials of the publication.

Aleshina, D.V. (2017). Venture financing – the way to develop an innovative economy, in Topical Issues of Finance and Insurance in Modern Russia. Materials of the IV Regional Scientific and Practical Conference (pp. 164–167). Minin University.

Gabdullin, N.M. and Mironova, M.D. (2017). Venture financing management as a factor of innovation growth in the Russian economy, Science Review, 3, pp. 66–70.

Goncharenko, L.P. and Fatyanova, I.R. (2013). Features of venture capital and the practice of venture capital investment in Russia and abroad, Innovations and Investments, 3, pp. 33–37.

Kalashnikov, A.A. (2013). Features of the venture financing as a form of providing the investment process and the directions of its support, Science Journal of Volgograd State University. Global Economic System, 1, pp. 210–215.

Kulebyakin, K.A. (2011). Private mutual funds of venture investments in the system of investment of innovation activity in Russia, Bulletin of P.G. Demidov Yaroslavl State University. Humanities, 2, pp. 198–201.

Madatova, O.V. (2012). Key directions of the venture capital development in the modern society, Bulletin of International Nobel Economic Forum, 1-2(5), pp. 196–201.

Milkina, I.V. (2016). Analysis of development institutions in the system of supporting innovation activities in the regions and municipalities of Russia, Science. Innovations. Education, 2(20), pp. 61–84.

Topsokhalov, A.I. (2016). Venture investment as a form of financing the innovation process, in From Theory to Practice. Collection of Articles of the All-Russian Student Scientific-Practical Conference, pp. 339–344.

1. Department of Innovation and International Management, Faculty of Management, South Federal University, Rostov-on-Don, Russia, a laureate of the competition of scientific papers in 2015, in recognition of her research work in the field of export of educational services. The author studies the problems of managing international financial flows. Her other research interests include risk management, the global economy, and the international management. In her recent studies, she examines the credit and finance risks; e-mail: rogovatata@rambler.ru