Vol. 40 (Number 10) Year 2019. Page 23

MUSAEVA Khaibat 1; MIRZABALAEVA Farida 2; MIRGOROD Ekatеrina 3; ALIEVA Patimat 4 & KERIMOVA Zaira 5

Received: 19/02/2019 • Approved: 15/03/2019 • Published 31/03/2019

ABSTRACT: The key objective of the study was to analyze the implementation issues related to the fiscal and regulatory potentials for regional taxes in the context of the development of taxation in federalism in the constituent entities of the Russian Federation (RF). During the research process, the methods of historical, logical and economic and statistical analysis, systematic, multifaceted and modular approaches were used. A set of recommendations is proposed, aimed at improving the mechanism for administering regional taxes in the RF. |

RESUMEN: El objetivo clave del estudio fue analizar los problemas de implementación relacionados con el potencial fiscal y regulatorio de los impuestos regionales en el contexto del desarrollo de la tributación en el federalismo en las entidades constituyentes de la Federación Rusa (RF). Durante el proceso de investigación, se utilizaron los métodos de análisis histórico, lógico y económico y estadístico, sistemático, multifacético y modular. Se propone un conjunto de recomendaciones, destinadas a mejorar el mecanismo para administrar los impuestos regionales en la RF. |

In the RF, with its federative framework, high differentiation of sub-federal entities in terms of the amount and quality of production resources, where preserving the unity of the country’s economic space and stimulating regional development should be carried out in parallel, the problem of tax authority of various governmental levels is a priority for tax policy. At the current stage of development of the theoretical knowledge of tax federalism in the RF there is no comprehensive approach to the study of its problems, while the scientific literature has covered issues of interaction between fiscal federalism and regional tax policy rather fragmentarily.

Foreign scientists are more focused on the general issues of the relationship between the national and subnational components of tax policy (Ebel and Taliercio, 2005). At the same time, the issues of the impact of the tax structure both on the companies’ entrepreneurial activity and on the behavior of households are studied in detail. So, for instance, in his scientific publications, Professor John Freebairn emphasizes that “estimating the effects of taxes on market outcomes, efficiency and redistribution is an important area of economic analysis and policy evaluation» (Freebairn, 2017). Problems of increasing the regional tax competitiveness, as well as the regulation of taxation of non-renewable natural resources in different jurisdictions are considered in the works by P. Maniloff and D.T. Manning (2018). In some works by foreign authors, various options for estimating tax expenditures at regional level are studied (Sheikh, 2014). In research, the focus is, to a greater extent, on quantitative assessments of the degree to which instruments of the regional element of tax policy affect economic growth. (Srithongrung and Kriz, 2014).

According to the well-known Russian professor L.N. Lykova, whose opinions we share, in modern domestic publications, the formation of the regional element of tax policy is mainly viewed in terms of “descriptions of specific measures and activities conducted by a particular subject of the Russian Federation, the order of granting tax exemptions and their results for certain regions of the RF, as well as problems and tools of interregional tax competition” (Lykova, 2018).

Regional taxes are an important part of the tax system in the RF. In the process of establishing market relations and implementing large-scale tax reforms in Russia, regional taxes were substantially transformed. In particular, some regional taxes have been abolished, others have been combined, in addition, the method of their calculation and collection has undergone significant changes. Despite its constant transformation, the tax system has many shortcomings that negatively affect the process of implementing the fiscal and regulatory potential of regional taxes, which determines the need to deepen research in this area, to develop a constructive settlement in order to improve their efficiency, adapted to the modern realities.

Under the current Russian legislation, regional taxes are recognized as established by the Tax Code of the Russian Federation (TC of the RF), brought into force by the RF constituent entities’ laws and obligatory for payment in the territory of the respective subject. At the present stage in the Russian Federation, the composition of regional taxes is limited to such three taxes as: transport tax (Chapter 28, TC of the RF), corporate property tax (Chapter 30, TC of the RF) and gambling tax (Chapter 29, TC of the RF).

The corporate property tax is decisive in the system of regional taxes, in the collection of which both fiscal and economic functions must be implemented. In the RF, originally, the property tax was enacted in 1992 and was governed by the law of the Russian Federation of December 13, 1991 No. 2030-1 “On Corporate Property Tax”. Since 1.01.2004 the method of calculating and collecting the corporate property tax has been governed by Chapter 30 of TC of the RF. The introduction of the corporate property tax pursued fiscal goals. At the same time, the established corporate property tax was to become an economic incentive to enhance the efficiency of fixed assets (Bazhenov, 2018). However, the corporate property tax, being the most important tax in the system of property taxation, does not play a fundamental role in the formation of the revenue base of the budgets of the RF constituent entities, the potential of this tax has not been fully realized until now.

The structure of the corporate property tax, as well as any other tax, is characterized by the elements (tax base, tax rate, tax benefits, etc.), which are the basis of the methodology for its calculation and collection. In accordance with the RF legislation (Article 375 of TC of the RF), the tax base is established on the basis of the average annual net assets that is subject to taxation. In most developed countries in the world, the market value of property is taken as the basis for calculating a real estate tax or corporate property tax, and not the net asset value.

Since 2015, in the RF regions, in the context of reforming property taxation, the issue of transition to real estate taxation has been partially resolved on the basis of the cadastral value (which is close to market value) for certain types of tax units. Thus, since January 1, 2015, the tax base for corporate property tax has been defined as the cadastral value in relation to the following types of property: administrative and business centers, shopping centers, office and other non-residential premises, real estate objects of foreign non-residents, residential buildings that are not recognized on the balance sheet (Tax Code of the Russian Federation 2018). According to Article 380 Chapter 30 of Tax Code of the RF, tax rates are established by the laws of the constituent entities of the Federation and may not exceed 2.2%. At the same time, subjects of the RF may have the opportunity to differentiate tax rates depending on the categories of taxpayers and (or) property.

In the setting of the RF, the main regulatory burden in the system of taxes levied on organizations in territorial budgets is the profit tax. This tax is applied to federal taxes, but most of it is credited to the territorial budgets (the basic tax rate is 20%, of which 17% is credited to the budgets of the subjects of the Federation, and 3% to the federal budget). The regulatory role of the corporate property tax and transport tax related to the regional ones, is expressed much less in comparison with the tax on profit of organizations. However, the subjects of the RF still have a number of powers to regulate the elements and influence the method of calculating the regional taxes under study.

Subjects of the RF have certain powers in terms of establishing differentiated tax rates depending on the categories of taxpayers. In a number of subjects of the RF (the Republic of Dagestan, Ingushetia, Tuva, the Altai Krai, the Kaliningrad Region), differentiated tax rates for corporate property tax have not been introduced. Differentiated tax rates depending on the categories of taxpayers and (or) property recognized as a tax unit, as well as tax benefits in many RF subjects are applied to: corporate investors, businesses involved in innovation activities, organizations established for the implementation of investment projects, housing facilities and engineering infrastructure, as well as religious organizations.

An essential element of the methodology for calculating and levying taxes is tax benefits, which, on the one hand, can act as tools for economic incentives or to prevent bankruptcy of companies, and on the other hand, represent significant fiscal losses (Kireyeva, 2014). “The successful application of tax benefits contributes to additional investments in sectors, regions or countries that would not have been realized without these benefits. At the same time, inefficient tax benefits can lead to an uneven distribution of resources, when some types of activities receive an excess of investment, and others – its non-availability. Determining the impact of tax incentives on the development of industrialized countries is a challenging task. However, it is even more difficult to find out whether using tax benefits for developing countries will help make their markets more competitive” (Klemm, 2009). In fact, it can be argued that there are problems in applying benefits in different countries, different effect of their introduction, and in some cases, the total absence. It is not by chance that some scientists completely deny the need to apply tax benefits for the economies of certain countries. For example, Professor J. Lang at the University of Cologne declared in the Draft Code of Tax Laws for Central and Eastern European States that it is not permissible to introduce benefits in countries with developing economies (Lang, 1993).

In the context of insufficient budgetary funds and the deficiency of most regional budgets of the RF in modern conditions, the urgency of solving the issues of increasing the efficiency of tax benefits and their optimization, including regional taxes, is increasing (Proskura, 2013). As the undertaken study showed, many of the benefits introduced by the subjects of the RF, including the establishment of a reduced tax rate, reflect the specifics of the relevant subject of taxation. For instance, in the Republic of Karelia, the tax rate on corporate property in the amount of 0.5% is established for the organizations engaged in timber stockpiling, wood processing and production of wooden items, as well as the organizations engaged in the production of machinery and equipment for paper making, and cardboard. In the Murmansk region and Kamchatka Krai, the tax rate on corporate property has been reduced from 2.2 to 1% for organizations whose main activities are fishing and seafood processing (Vasilyeva, 2018). In the Republic of Dagestan, a reduced property tax rate is applied to organizations implementing priority investment projects in economy.

Analysis of the Russian legislation in terms of the methodology for calculating and charging regional taxes and fees suggests that there are two options for granting benefits: tax exemptions provided at the federal level and implying full exemption from payment of this type of tax, as well as benefits that are established and introduced by RF subjects independently. In 2017, budget losses due to the use of tax concessions destined for the revenues of the constituent entities of the RF accounted for more than 14% of their total tax revenues. At the same time, as can be seen from the data in Table 1, most of the budget losses are caused by the benefits provided by federal law. In 2017 compared to 2015, despite the reduction in losses related to benefits provided at the regional level from 2.6 to 2.3%, the total amount of budget losses in connection with the provision of tax benefits increased from 8.3 to 14.3%, also in respect to the increase in benefits provided for federal taxes from 5.7% to 11.8%. A significant part of budget losses because of benefits accounts for the companies’ profit, which is referred to federal taxes, but most of it, as noted above, is credited to the budgets of the constituent entities of the RF.

Table 1

Tax Revenue Shortfalls in Consolidated Budgets of the Constituent Entities of the

Russian Federation in Connection with the Provision of Tax Benefits in 2013-2017

|

Parameter name |

2013 |

2014 |

2015 |

2016 |

2017 |

1 |

Total fiscal loss (in % from tax yield of budgets in subjects of the RF), including, due to: |

7.4 |

7.2 |

8.3 |

14.2 |

14.3 |

1.1. |

- Granting benefits at the federal level |

5.0 |

4.6 |

5.7 |

11.8 |

12.0 |

1.2. |

- Benefits granted at the regional level |

2.4 |

2.6 |

2.6 |

2.4 |

2.3 |

Source: Statistical tax reports of the Federal Tax Service of Russia for the

period 2013-2017 (№5 Research Progress Report, 5 National Bank).

Taking into consideration the significant impact on the stability of regional budgets of decisions in relation to the introduction of tax benefits for taxes, the revenues of which go to these budgets, an estimate of the effectiveness of introducing benefits should be mandatory (Malis, 2018). Currently, particular subjects of the RF apply the method of assessing the efficiency of tax benefits, which considers, along with revenue shortfalls in the budgets of the budget system, the creation of favorable conditions for investment, as well as the results of the implementation of the benefits received by taxpayers.

However, the application of methods for assessing the efficiency of tax benefits is not widespread. It should also be noted that in order to estimate the efficiency of tax benefits, the executive authorities need a large array of information obtained from the regional departments of the Federal Tax Service of Russia, Rosstat (Federal Service of State Statistics), financial departments, as well as taxpayers themselves on the basis of regulatory documents. In addition, there is no obligation to provide any information on tax benefits and the efficiency of their use in Russian tax legislation. To ensure the stability of the tax system, it is necessary to stipulate the obligation of taxpayers to provide information on the results of the use of benefits (of non-social nature) to tax authorities in tax legislation (Lipatova, 2017).

To assess the efficiency of tax benefits in full, it is necessary to take into account the “increment (reduction) in all tax revenues, i.e., by their type, and not only in keeping to which benefits are provided. In the case of granting benefits under federal law, the calculation of changes in tax revenues for all taxes is expedient. This calculation is necessary for monitoring and future analysis, since the skillful granting of advantages at one tax makes possible achievement of an effect related to other tax payments” (Musaeva et al., 2015).

Summarizing the results of the undertaken analysis, it should be noted that the powers of the subjects of the RF, as compared to the powers at the federal level, are very limited in the legislative regulation of regional taxation. The key elements of taxation are established by federal legislation, and regional tax regulations are only entitled to specify the tax rate within the limits established by federal legislation, supplement the list of benefits and determine the deadlines for payment of the appropriate tax. Providing the constituent entities of the RF with the rights to regulate other elements (taxable entity, tax rate, etc.) referring to regional taxes will provide constitutional rights and a real opportunity for the regions to pursue independent tax policy. In Russia, there remains the problem of real estate appraisal associated with the insufficient development of markets and institutions for assessing such real estate as industrial facilities. Within the conditions of the Russian Federation, the low fiscal role of regional taxes, along with the high level of depreciation of fixed assets, the significant extent of tax avoidance, and not fully yet resolved issues of a full-scale transition to the market value of property tax, is due to the presence of numerous tax benefits (in some cases ineffective), herewith the benefits provided for by federal legislation are dominated, which contradicts the principles of building real tax federalism. Regional taxes, although not received by the federal budget, but a substantial part of tax benefits for them are provided for by federal tax legislation. Under current conditions, a mechanism is needed to compensate for the shortfall in incomes of regional and local budgets, or to abolish the corresponding federal benefits and transfer powers to the regional level. An important area to improve the mechanism of regional taxation is the elimination of benefits that are not justified from the point of view of socio-economic efficiency, but at the same time allow taxpayers to evade paying taxes.

One of the main possible negative consequences of large-scale and unreasonable use of benefits is the scale of tax avoidance. In Russia, the legislative field for counteracting tax evasion is at an early stage of development, so the experience of developed countries in this area, including the United States, is currently of interest for further tax policy reform (Vylkova, 2015).

In the United States, the economic substance doctrine is applied to disallow the tax benefits that go beyond the anticipated scope of the relevant provisions of the Tax Code. In order that the doctrine will not be applied to the taxpayer, he must demonstrate that the transaction changed his economic position meaningfully and that he has substantial non-tax purpose for entering this transaction. If the transaction does not satisfy the economic substance doctrine, then a penalty can be imposed from the reduced tax amount (40%). In addition, a number of judicial doctrines have been developed in the United States in order to prohibit tax benefits related to transactions that are carried out for tax evasion: the doctrine of predominance of substance over form, the step transaction doctrine and the sham transaction doctrine. The US law includes restrictions on benefits in all bilateral tax agreements (Accountability and Transparency: A Guide for State Ownership 2010).

In the RF, certain areas of property tax reform are partially based on the use of foreign experience. In most industrialized countries of the world, production equipment is not subject to property tax. In the RF, measures to remove equipment from property taxation have only been implemented since 2013, and at the same time, only for newly acquired movable property.

As the analysis of statistical data reveals, since 2009 in Russia there has been a tendency of redistribution of income in favor of the federal budget at the expense of the consolidated budgets of the subjects of the RF. Thus, if the share of taxes received by the budgets of the subjects of the Federation in 2009 was 54.5%, then in 2017 only 46.6%. Since “the share of own tax revenues in the structure of revenues of regional and local budgets is low, there is a dependence of regional and local budgets on interbudgetary transfers. The share of gratuitous receipts in regional incomes is on average about 20%. At the same time, this share varies in different regions. So, if in 2016 it amounted to 83.7% in the Chechen Republic, 88.0% in the Republic of Ingushetia, 80.9% in the Republic of Dagestan, then 1.5% in the Yamalo-Nenets Autonomous Okrug, in the Khanty-Mansi Autonomous Okrug – to 3.7%” (Consolidated budgets of the constituent entities of the Russian Federation and the budgets of territorial state extra-budgetary funds 2017). It seems that the solution to the problems of interregional socio-economic inequality lies in different planes, demanding a systematic approach (Malis, 2018). Possible ways to solve the existing problem in the field of tax policy are seen in expanding the composition of regional taxes at the expense of a corresponding reduction in federal taxes, or the establishment of increased standards for deductions to regional budgets from federal regulatory taxes, for instance, from excise taxes (excise taxes are included in federal taxes under the current Russian tax law). Currently, excise taxes are distributed between the federal and regional budgets in equal proportions. The transfer of excise taxes to regional budget revenues will simplify the mechanism for the tax distribution and will strengthen the financial base of the budgets of the constituent entities of the RF.

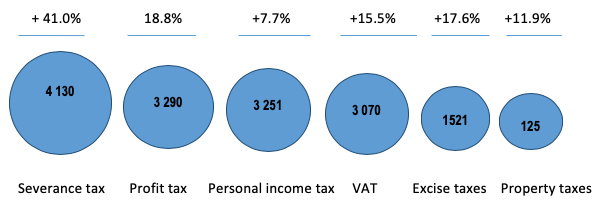

Figure 1

The amount of revenues from the main taxes to the consolidated

budget of the RF in 2017 compared to 2016 (bln, in %)

According to official data from the Federal Tax Service of Russia, in 2017 compared to 2016, tax revenues administered by this service increased by 20% and amounted to RUB 17,343.3 bn. The volume and growth rates of revenues collected from main taxes to the consolidated budget of the RF in 2017 compared to 2016, are shown in Figure 1. The growth of tax revenues is a result of the cumulative effect of the tendency of GDP growth in the RF, legislative initiatives and tax administration.

The growth rate of regional tax revenues in 2017 compared to 2016, outpaced the overall growth of tax revenues (total tax growth – 20%, regional tax growth – 22%). Despite this, the fiscal role of regional taxes continues to be of minor importance. As our calculations showed, the arithmetic mean values of this indicator in 2013-2017 related to the revenues of the consolidated budgets of the constituent entities of the RF ranged from 10.9 to 13.5%. At the same time, there is the dominance of regions (44 out of 85 regions) with the value of the indicator of regional tax revenues below the national average, i.e. less than 10.9% (Table 2). As the data in Table 2 demonstrate, the average rates of regional tax revenues in the period 2013-2017 ranged from 10.9 to 13.5% in 27 regions of the RF, and in 44 regions they were below average. This is due to the uneven social and economic development of the territories of the RF, the presence of a large number of regions-outsiders and a considerably smaller number of regions-leaders.

The socio-economic conditions in the regions largely depend on the geographical location of the territories, the availability of resources, and the sectoral structure of production. Regions such as Moscow, St. Petersburg, the Tyumen Region and the Murmansk Region are the territories where the share of regional taxes is maximum. The low production potential of many constituent entities of the RF causes the insufficiency of their own tax revenues. A number of regions have virtually no own tax base at all and are funded entirely from the federal budget. Insignificant amounts of revenues from regional taxes cannot fully cover the budget needs of the constituent entities of the RF; therefore, they are striving in every way to increase the tax base with regard to federal taxes. This leads to a number of problems, one of which manifests itself in the competitive “struggle” with the federal center for the base of one or another tax, which in turn is a negative manifestation of fiscal centralization. However, the study of this issue is beyond the scope of this research.

Table 2

Comparative characteristics of region grouping, depending on regional tax

revenues to the consolidated budgets of constituent entities of the RF in 2013-2017

Group |

RF subjects |

Mean value of share in 2013-2017, in % of the total |

Number of regions |

Mean value, in % |

For all subjects of the Russian Federation |

10.9-13.5% |

85 |

Group 1 |

The city of Moscow, the city of St. Petersburg, Moscow Region, Tyumen Region, Murmansk Region, Samara Region, Nizhny Novgorod Region, Sverdlovsk Region, Tatarstan, Bashkortostan, Irkutsk Region, Chelyabinsk Region, Krasnoyarsk Krai |

Above the mean |

14 |

Group 2 |

Rostov Region, Republic of Yakutia, Perm Krai, Novosibirsk Region, Leningrad Region, Krasnodar Krai, Kemerovo Region, Voronezh Region, Volgograd Region, Primorsky Krai, Stavropol Krai, Orenburg Region, Saratov Region, Sakhalin Region, Belgorod Region, Arkhangelsk Region, Khabarovsk Krai, Altai Krai, Omsk Region, the Republic of Crimea, Tula Region, Volgograd Region, Komi Republic, Udmurtia, Lipetsk Region, Tomsk Region, Yaroslavl Region, the Republic of Dagestan |

Within the mean |

27 |

Group 3 |

Vladimir Region, Tver Region, Kaliningrad Region, Murmansk Region, the Chechen Republic, Penza Region, Tambov Region, Kaluga Region, Amur Region, Kursk Region, Ulyanovsk Region, Kirov Region, Zabaikalsky Krai, Bryansk Region, Astrakhan Region, Ryazan Region, the Chuvash Republic, Kamchatka Krai, Smolensk Region, the Republic of Buryatia, the Republic of Mordovia, Novgorod Region, the Republic of Karelia, Kurgan Region, Oryol Region, Ivanovo Region, the Republic of Kabardino-Balkaria, the Republic of Khakassia, Pskov Region, Mari El, North Ossetia, Kostroma Region, Magadan Region, Ingushetia, Karachay-Cherkessia, the Republic of Adygea, Chukotka Autonomous Okrug, the city of Sevastopol, Tuva, the Republic of Kalmykia, the Altai Republic, the Jewish Autonomous Region. |

Below the mean |

44 |

Source: Calculated according to: Consolidated budgets of the constituent entities of the

Russian Federation and the budgets of territorial state extra-budgetary funds for the period 2013-2017.

As noted earlier, in Russia, the potential of property taxes, relating both to regional taxes (corporate property tax) and local taxes (personal property tax), has not been adequately realized. According to the data of the Federal Tax Service (FTS) of Russia, the receipt of property taxes by the consolidated budget of the RF in 2017 amounted to RUB 1,250.3 bn, which is by RUB 133.3 bn, or by 11.9% more than in 2016. As can be seen from the data presented in Table 3, in 2017, compared to 2016, revenues from property tax of individuals increased the most among the property taxes of the consolidated budget.

Observed in 2017 compared to 2016, “the growth of receipt from individual property tax was due to the following main factors: the transition to the procedure for calculating tax based on the cadastral value involving new objects in the tax turnover for which the tax base has not been previously determined since 2016 in 21 subjects of the RF. In 2017 the cumulative increase in property tax revenues in these regions amounted to 5.2%; the use of a higher tax rate for tax calculation in 28 regions of the RF – 0.4 % (in 2015 – 0.2%); and an increase in the number of taxpayers of this tax – 2% and a change in the elements of taxation (tax rates and (or) benefits) by decisions of municipal authorities” (Background information on the results of the activities of the Federal Tax Service of Russia 2017).

Table 3

Comparative data on changes in regional tax revenues to the

consolidated budgets of constituent entities of the RF in 2013-2017

|

Indicators |

Tax revenues (RUB bn) |

Changes in 2017 compared to 2016 (+, -) |

|||||

2013 |

2014 |

2015 |

2016 |

2017 |

RUB bn |

in % |

||

1. |

Regional taxes, total |

721.7 |

752.6 |

853.0 |

902.9 |

1024.9 |

122.0 |

13.5 |

1.1. |

Corporate property tax |

615.1 |

634.6 |

712.4 |

751.0 |

853.4 |

102.4 |

15.6 |

1.2. |

Transport tax |

106.1 |

117.5 |

139.9 |

151.1 |

170.5 |

19.4 |

11.4 |

1.3. |

Gambling tax |

0.5 |

0.5 |

0.7 |

0.8 |

1.0 |

0.2 |

20.9 |

2 |

Local taxes, total |

172.7 |

187.9 |

224.6 |

260.8 |

339.0 |

78.2 |

29.9 |

2.1. |

Personal income tax |

48.9 |

55.5 |

68.3 |

84.2 |

152.3 |

68.1 |

44.7 |

2.2 |

Land tax |

123.8 |

132.4 |

156.3 |

176.6 |

186.7 |

10.1 |

5.4 |

Source: Statistical tax reports of the Federal Tax Service of Russia for the period 2013-2017.

In 2017 compared to 2016, the corporate property tax in the constituent entities of the RF increased by 15.6% and amounted to RUB 853.4 bln (Table 3). The growth of the revenues of the main regional tax in most of the constituent entities of the RF was influenced mainly by such factors as: the use of property taxation in 61 constituent entities of the RF based on the cadastral value of real estate in accordance with Article 378 of the Tax Code of the Russian Federation, as well as the commissioning of new objects of taxation.

Despite a slight increase, in general, the share of corporate property tax in budget revenues from the constituent entities of the RF, compared with the role of similar taxes in developed foreign countries, continues to be low. The insignificant fiscal role of the corporate property tax in Russia is explained by such factors as: first, the high level of depreciation of fixed assets and the fact that the issues of transition to the cadastral or market value of property for tax purposes are not fully resolved; secondly, the “amount of the shortfall” in budget revenues is significant because of the established benefits at the federal level; thirdly, various regions actively apply benefits and preferences with regard to corporate property tax as an instrument of horizontal tax competition. Annually, the country’s budget system loses about 0.22% of GDP due to the established property tax benefits and reduced rates. Sometimes a complete exemption from the payment of property tax becomes a condition for the implementation of an investment project to create large-scale production on the territory of a particular region of the RF” (Vasilyeva, 2018). The solution of the defined problem may consist in changing the principles of providing benefits at the regional level, enlarging their budgetary returns.

Budget revenues from transport tax in 2017 compared to 2016 in the constituent entities of the RF increased in whole by 11.4% and amounted to RUB 170.5 bln (Table 3). It should be noted that in the revenues of the consolidated budgets of the constituent entities of the RF the fiscal role of the transport tax continues to be very insignificant, despite the emerging uptrend.

In the system of regional taxes in certain regions of the RF, a tax is also levied on gambling. Note that in the RF since 1.07.2009 tax on gambling, in relation to gaming, is allowed only in four special economic zones (Altai Krai, Krasnodar Krai, Primorsky Krai, and Kaliningrad Region). From this time, a significant part of the gambling business in Russia went into hiding. Herewith, more than 30 regions of the country (including the Arkhangelsk, Belgorod, Kurgan, Omsk, Chelyabinsk Regions, the Krasnoyarsk Krai, Tatarstan, the Republic of Dagestan, the Chechen Republic, and others) banned gambling establishments on their territory. As shown by the data in Table 3, although tax revenues from the gambling tax increased by 20.9% in general in all RF regions in 2017 compared to 2016, revenues from it are very small.

According to the Administration of the FTS of Russia in relation to the Republic of Dagestan, in 2017 tax payments were collected in the amount of RUB 33,016 mln in the region, which is 4.2% more than in 2016 (Table 4). The data in Table 4 demonstrate that the share of regional taxes in the Republic of Dagestan accounts for less than 12% of the total tax revenues (if compared with other subjects of the RF – the threshold average value), and 3 times less for local taxes. Along with the low production potential of the region, the present situation is also explained by the fact that, under current Russian tax legislation, the largest budget generating taxes are included in federal taxes (personal income tax, VAT, corporate income tax, excise taxes, etc.), although some of them are credited to regional budgets for their balancing, and taxes with a low tax base – to the regional and local budgets.

Table 4

Place and role of regional taxes in total tax revenues

in the Republic of Dagestan in 2014-2017 (RUB, mln)

Indicators |

2014 |

2015 |

2016 |

2017 |

Growth rate, 2017/2016, in % |

||||

Types of taxes and payments |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

|

Overall tax payments, of these: |

26,662 |

100 |

27,512 |

100 |

31,764 |

100.0 |

33016 |

100 |

104.2 |

Regional taxes |

3,228 |

12.0 |

3,247 |

11.8 |

3,550 |

11.2 |

3,838 |

11.7 |

108.1 |

Source: Compiled by the authors according to: Statistical tax reports of the Federal

Tax Service of Russia related to the Republic of Dagestan for the period 2014-2017.

In 2017, in Dagestan, as in many subjects of the RF, there was a generally positive trend in the area of regional tax administration. The main reasons that influenced the growth of corporate property tax receipts are: improvement in the results of tax authorities’ activity monitoring, debt redemption of past years, inflation, and an increase in the tax base due to property revaluation. An important reason for the growth in corporate property tax revenues is the transition to the cadastral valuation of certain objects of property and the abolition of a number of benefits. However, the reserves of the growth of tax revenues related to the consolidated budget of the Republic of Dagestan consist in upgrading interdepartmental cooperation, increasing the efficiency of tax control, expanding the tax base both by updating fixed assets, improving their technical equipment, and by involving unaccounted tax objects into circulation.

Table 5

The composition and structure of regional tax revenues to the

budget in the Republic of Dagestan in 2014-2017 (RUB, mln)

Indicators |

2014 |

2015 |

2016 |

2017 |

Growth rate, 2017/2016, in % |

||||

Types of taxes and payments |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

Amount, RUB, mln |

Share, in % |

|

Regional taxes, including: |

3,228 |

100.0 |

3,247 |

100 |

3,550 |

100 |

3,838 |

100 |

108.1 |

Corporate property tax |

2,811 |

87.1 |

2,825 |

87.0 |

3,099 |

87.3 |

3,225 |

84.0 |

104.0 |

Transport tax |

417 |

12.9 |

422 |

13.0 |

451 |

12.7 |

613 |

16.0 |

136.0 |

Source: Compiled by authors according to: Statistical tax reports of the Federal Tax

Service of Russia related to the Republic of Dagestan for the period 2014-2017.

As can be seen from the data in Table 5, the most significant increase in regional taxes in Dagestan was observed in terms of transport tax. Thus, in 2017, the budget system received a tax of RUB 613 mln from the transport system (by 36% more than in 2016). The increase in revenue from transport tax was mainly due to a growth in the number of taxable items, as well as a raise in tax rates for cars worth more than RUB 3 mln.

Despite the simplicity of calculating the transport tax, there are flaws that prevent the most complete collection in the process of its administration. These gaps are mainly related to the exchange of information about the availability of vehicles as far as taxable persons are concerned, about the tax base related to vehicles in the authorities involved in this tax administration. The transport tax administration is largely hampered by the existing criteria for differentiation of rates. In developed industrial countries, the gradation of transport tax rates stimulates citizens to purchase a new powerful car, but in our case, it is vice versa. In some developed countries (for instance, in the United States, excise tax on gasoline is collected as compared to the Russian transport tax). Taking into account a thorough analysis of the foreign countries’ advanced experience in terms of levying a transport tax, we consider it necessary to change the criteria for differentiating tax rates, and move from a purely fiscal approach to a fiscal and incentive one. It is also necessary to eliminate the elements of double taxation in the legislation when charging a transport tax. For the corporate tax property and transport tax, there should be one object of taxation – a vehicle, and two tax bases – one in value terms, and the other in the physical indicator of the vehicle. Both of these taxes are real, related to property, direct and regional.

Thus, as this study showed, in order to improve the system of regional taxation, the most complete realization of the fiscal and regulatory potential of regional taxes in the conditions of the RF it is appropriate:

Accountability and Transparency: a Guide for State Ownership. 2010. Organization for Economic Cooperation and Development. Retrieved from: http://www.oecd.org/daf/ca/accountabilityandtransparencyaguideforstateownership.htm.

Background information on the results of the activities of the Federal Tax Service of Russia. 2017. Federal Tax Service of Russia. Retrieved from: https://www.nalog.ru.

BAZHENOV, A.A. (2018). Regional Taxes in Charts. Vladimir: Transit-IKS.

Consolidated budgets of the constituent entities of the Russian Federation and the budgets of territorial state extra-budgetary funds. 2017. The Federal Treasury. Retrieved from: http://www.roskazna.ru/ispolnenie-byudzhetov/konsolidirovannye-byudzhety-subektov/.

EBEL, R.D., and TALIERCIO, R. (2005). Subnational Tax Policy and Administration in Developing Economies. Tax Policy Center. Retrieved from: https://www.taxpolicycenter.org/publications/subnational-tax-policy-and-administration-developing-economies.

FREEBAIRN, J. Opportunities and challenges for CGE models in analysing taxation. Economic Papers. Vol37, year 2017, issue 1, page 17–29. DOI: https://doi.org/10.1111/1759-3441.12202.

KIREYEVA, A. The financing of innovation and the application of tax benefits: Current status in the Republic of Belarus. Contemporary Economics Issues. Vol1, year 2014. DOI: https://doi.org/10.24194/11409.

KLEMM, A. (2009). Causes, Benefits, and Risks of Business Tax Incentives. Washington: International Monetary Fund.

LANG, J. (1993). Draft Code of Tax Laws for Central and Eastern European States. Bonn: Federal Ministry of Finance.

LIPATOVA, I.V. The system of regional taxation: Legal and economic analysis. Accounting, Analysis and Audit. Vol 1, year 2017, page 71–74.

LYKOVA, L.N. Regional component of tax policy: Ways to support economic growth. Problems of Territory’s Development. Vol 2, year 2018, page 71–86. DOI: 10.15838/ptd/2018.2.94.5.

MALIS, N.I. Improving tax policy at the regional level: The main directions. Financial Journal. Vol 1, year 2018, issue 41, page 51–60. DOI: 10.31107/2075-1990-2018-1-51-60.

MANILOFF, P., and MANNING, D.T. Jurisdictional tax competition and the division of nonrenewable resource rents. Environmental & Resource Economics. Vol 71, year 2018, issue 1, page 179–204. DOI: 10.1007/s10640-017-0143.

MUSAEVA, К., ALIEV, B., SULEYMANOV, M., and DYUKINA, T. Tax relieves: Costs of their application in taxation and issues of the efficiency evaluation. Asian Social Science. Vol 11, year 2015, issue 7, page 333–343. DOI: 10.5539/ass.v11n5p333.

PROSKURA, E. Features of organization of the tax administration in conditions of post-crisis development. Contemporary Economics Issues. Vol 2, year 2013. DOI: https://doi.org/10.24194/21319.

SHEIKH, M. (2014). Estimating the True Size of Government: Adjusting for Tax Expenditures. Ottawa: Macdonald-Laurier Institute.

SRITHONGRUNG, A., and KRIZ, K. The impact of subnational fiscal policies on economic growth: A dynamic analysis approach. Journal of Policy Analysis and Management. Vol 33, year 2014, issue 4, page 912–928. DOI: 10.1002/pam.21784.

Statistical tax reports of the Federal Tax Service of Russia for the period 2013-2017. Federal Tax Service of Russia. Retrieved from: https://www.nalog.ru.

Statistical tax reports of the Federal Tax Service of Russia related to the Republic of Dagestan for the period 2014-2017. Retrieved from: http://www.nalog.ru.

Tax Code of the Russian Federation. 2018. Retrieved from: http://www.nalogovyykodeks.ru/.

VASILYEVA, A.Yu. Improving the mechanism for granting benefits as regards the corporate property tax. The Development of Modern Science: Theoretical and Applied Aspects. Year 2018, page 24: 33.

VYLKOVA, E.S. Counteraction to tax evasion: the US experience. Bulletin of the Irkutsk State Economic Academy. Vol 25, year 2015, issue 4, page 651–656. DOI: 10.17150/1993-3541.2015.25(4).651-656.

1. Dagestan State University, 43a Gadjieva St., Makhachkala, 367000, Republic of Dagestan, Russian Federation. khaibat.musaeva@yandex.ru

2. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russian Federation

3. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russian Federation

4. Dagestan State University, 43a Gadjieva St., Makhachkala, 367000, Republic of Dagestan, Russian Federation

5. North-Caucasian Institute (branch) of the All-Russian State University of Justice (RLA of the Ministry of Justice of Russia) 87 Agasieva St., 7 Akushinskogo St., Makhachkala, Republic of Dagestan, Russian Federation