Vol. 40 (Number 13) Year 2019. Page 17

ZIABLITCKAIA, Natalia V. 1; MANINA, Ekaterina A. 2 & BORSHCHENYUK Vera N. 3

Received: 26/12/2018 • Approved: 22/03/2019 • Published 22/04/2019

ABSTRACT: This paper presents a synthesis of the main tasks and principles of quality inspections of state funds. The article also contains the monitoring of the effectiveness of one of the controllers - the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug-Ugra, which indicators of violations in the public sector are increasing from year to year. The authors made a number of positive and negative conclusions about the work of state regulatory authorities. The authors proved that the directions for improving state financial control today are: the transition to a centralized system of financial control; minimization of corruption risks in the management of state (municipal) finances; toughening the responsibility of officials for wasteful and inefficient spending of budget funds, for embezzlement and fraudulent schemes; introduction of mechanisms to improve the effectiveness of control measures in the legal system; priority of preliminary and current control; development of a separate federal law on state financial control in Russia. |

RESUMEN: Este documento presenta una síntesis de las principales tareas y principios de las inspecciones de calidad de los fondos estatales. El artículo también contiene el monitoreo de la efectividad de uno de los controladores, la Cámara de Cuentas de la Autónoma Okrug-Ugra de Khanty-Mansiysk, cuyos indicadores de violaciones en el sector público están aumentando de año en año. Se hace una serie de conclusiones, positivas y negativas, sobre el trabajo de las autoridades reguladoras estatales. Los autores demuestran que las instrucciones para mejorar el control financiero estatal en la actualidad son: la transición a un sistema centralizado de control financiero; minimización de los riesgos de corrupción en la gestión de las finanzas estatales (municipales); endurecer la responsabilidad de los funcionarios por el gasto inútil y derrochador de los fondos del presupuesto, por malversación y esquemas fraudulentos; introducción de mecanismos para mejorar la efectividad de las medidas de control en el sistema legal; Prioridad de control preliminar y actual; desarrollo de una ley federal separada sobre el control financiero estatal en Rusia. |

In the context of a difficult financial and economic situation, the main focus of the activities of financial controllers is the control over the reasonableness, efficiency and effectiveness of budget expenditures. Therefore, great importance is attached to the effectiveness of state financial control, which is crucially dependent on a number of internal and external factors.

In a broad sense, the concept of financial control is the control over the legality and expediency of actions in the field of education, distribution and use of monetary funds in order to effectively use them. The main purpose of state financial control in the Russian Federation is to ensure compliance with the principles of legality, expediency and effectiveness of the actions of the authorities in managing state financial resources, their preservation and enhancement to perform the functions of the state.

The annual Message of the President of the Russian Federation to the Federal Assembly points out the need for substantial tightening of control over the movement of public funds, which will help to ensure the balance and the sustainability of the budget system, and, therefore, affect the quality of life of all citizens. Huge resources are concentrated in the hands of the state, their distribution and rational use is impossible without proper organization of financial control in the budget sphere.

Different Russian scientists were engaged in problems of the theory and practice of state financial activity: Babich A.M., Burtsev V.V., Grigoriev E.K., Kozlov A.A., Melnik M.V., Pavlova L.N., Polyak G.B., Stepashin S.V., Cherkashina I.B., Shokhin S.O. and Yalbulganov A.A. All of them prove the need for an established system of state and municipal financial control. Currently, there are a number of problems and tensions in this sphere, which will be partially resolved by the draft Federal Law “On Amendments to the Budget Code of the Russian Federation to improve state (municipal) financial control, internal financial control and internal financial audit” which was prepared for adoption.

In the 20th century the financial control was turned into an instrument of class struggle, a means of economic suppression, and was punitive in our country. A special place was given to the preliminary control, which taught to comply with all the rules, principles and was carried out before committing a financial error, as well as actual control.

In his messages to the Federal Assembly of the Russian Federation the President of the Russian Federation, V. Putin, regularly speaks about the need for reform the system of state control bodies. The task of developing a draft of a specific federal law on control was given by the President of Russia in 2015, but the document has not yet been approved.

In our work, we tended to show serious problems, which were caused by the absence of a new law, or at least a delay in amending existing legislation. On the example of one of the Accounts Chambers - the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug - Ugra, whose performance was evaluated for the period 2012-2017 based on official reporting data, the issues of legality and effectiveness of the use of regional budget funds are not always positive. From the position of the regional dimension, the territory of the Khanty-Mansiysk Autonomous Okrug - Ugra (hereinafter KHMAO – Ugra) is the leaders among the regions of the Russian Federation in a number of indicators: the scale of the economy, oil and gas production, area. As of today, only 35 employees work in the structure of the Accounts Chamber of the District, including the chairman of the chamber, 3 auditors and the staff of the Accounts Chamber itself. According to the Law of the Khanty-Mansiysk Autonomous Okrug-Ugra, the Accounts Chamber of the Autonomous Okrug carries out control and auditing, expert-analytical, informational and other activities, ensuring the implementation of external financial control in accordance with the Budget Code of the Russian Federation. All the stages of the budget process are under control: from the formation of the budget to the report approval on its execution. Using the methods of systematic, economic and statistical analysis of practical material, we conducted an assessment of violations and shortcomings in the work of this monitoring body.

Chapter 3 text In accordance with the Budget Code of the Russian Federation, the functions of implementing external state financial control are performed by the Accounts Chamber of the Russian Federation. In this paper, we will focus on the results of the performance of the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug - Ugra. Being the state authority of the district, the main monitoring body of the Khanty-Mansiysk Autonomous Okrug-Ugra has organizational and functional independence, but its activities are financed by the budget of the autonomous region.

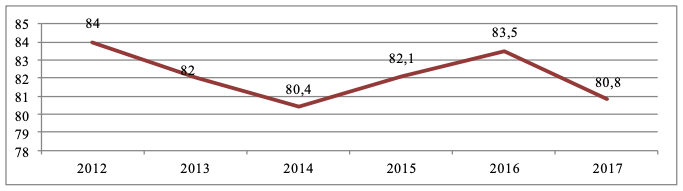

Figure 1

Dynamics of changes in the amount of financing of the Accounts Chamber of

the Khanty-Mansiysk Autonomous Okrug-Ugra for 2012-2017, mln. of Rub.

The figure shows that the costs of maintaining the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug-Ugra have been almost at the same level in recent years and even decreased in 2017 by 3.2 million rubles in comparison with 2012. The costs include not only the salaries of the staff of the Chamber, but also the material and technical equipment for the normal functioning of its activities. The control over the use of budget funds of the Accounts Chamber and its property is carried out on the basis of resolutions of the legislative (representative) authority of the Khanty-Mansiysk Autonomous Okrug-Ugra.

External state financial control is exercised by the Accounts Chamber in the form of monitoring and (or) expert-analytical measures.

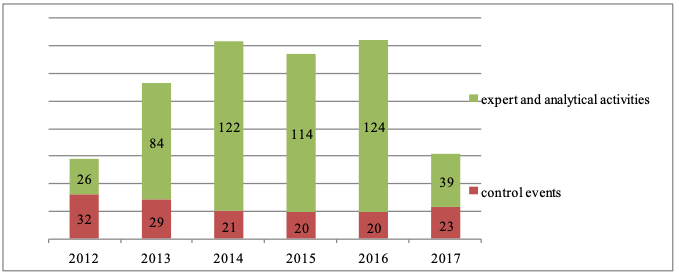

Figure 2

Changes in the number of events held by the Accounts Chamber

of the Khanty-Mansiysk Autonomous Okrug-Ugra for 2012-2017

As we can see from Figure 2, the number of control measures taken during the analyzed period decreased. However, in 2017 compared to 2016, their number increased by 15%. At the same time, the number of expert and analytical events increased from 26 in 2012 to 124 in 2016. It can be mentioned that in recent years, the Accounts Chamber has focused namely on organization of expert and analytical events, but in 2017 their number significantly reduced to 39, that is, 3.2 times. At the same time, from the reports on the activities of the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug-Yugra, it can be seen that during the analyzed period, the number of bodies and organizations that were audited decreased systematically from 107 in 2012 to 50 in 2016, and increased again to 99 in 2017. This indicates that the District Accounts Chamber pays great attention to the quality of control measures, rather than to the quantitative indicator. This is evidenced by the control measures using the principles of performance audit. But the negative moment is a fivefold decrease in the number of such events by 2016 compared to 2013 and the lack of data about them in 2017 (fig.3).

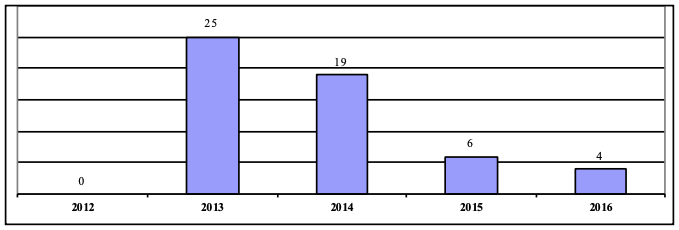

Figure 3

The number of control measures carried out using

the principles of performance audit for 2012-2016

Performance audit, being a product of international practice of the activities of financial control bodies, allows revealing the facts of unproductive use of state and municipal resources. The use of this external control mechanism is widely used in the work of the District Accounts Chamber, but the general decrease in the scope of verification activities had an impact on this issue.

Let us consider the types and volumes of violations identified by the Accounts Chamber of the district for the period 2012-2017 (Table I). It can be seen from the table that the number of violations detected in the financial and budgetary sphere increased 2.15 times in the analyzed period. The main violations and shortcomings identified by the Accounts Chamber of the Autonomous Okrug are:

- adoption of budget commitments by the municipal authorities of the Okrug in the amount exceeding the reported budget obligation limits;

- overstating the initial (maximum) cost of contracts during the procurement procedures;

- acceptance for payment of work actually not performed by the contractor;

- failure to take measures to reclaim the penalty for failure to perform or improper execution of contracts;

- the adoption of unlawful decisions issued by the order of the administration of the municipality, on the provision of public budget loans to a legal entity;

- implementation by the institution of services not provided for by its Charter.

- violation of the accounting procedure, etc.

Table I

Dynamics of the volume of violations identified by the Accounts Chamber

of the Khanty-Mansiysk Autonomous Okrug - Ugra for 2012-2017

|

Value |

Year 2012 |

Year 2013 |

Year 2014 |

Year 2015 |

Year 2016 |

Year 2017 |

1. |

Violations of legislation in the financial and budgetary spheres, mln. rub. |

5 421,6 |

8 132,7 |

8 737,3 |

12 003,8 |

8 135,2 |

11 642,0 |

1.1 |

including inappropriate use of funds, mln. rub. |

6,1 |

0,8 |

1,4 |

1,2 |

94,0 |

7,6 |

2. |

Inefficient use of public funds, mln. rub. |

1 345,8 |

190,7 |

275,0 |

973,6 |

266,4 |

1 004,0 |

3. |

Violations remedied mln. rub. |

28,8 |

1 009,0 |

2 501,0 |

670,7 |

993,4 |

1 036,4 |

3.1 |

including the return of funds to the budgets, mln. rub. |

28,8 |

4,6 |

37,8 |

7,4 |

100,3 |

26,3 |

Thus, nowadays the Accounts Chamber is an external Financial Control Body that plays a key role in the district budget process. The positive aspect of the activity of the Accounts Chamber of the Khanty-Mansiysk Autonomous Okrug-Ugra is the increase in the number of administrative cases initiated by the employees of the Accounts Chamber. This was made possible by vesting with appropriate powers at the legislative level. But violations in the public sector are only increasing, which adversely affects the performance indicators of budget funds spending. According to the authors, tighter control is needed from the main managers and managers of public funds, which can be achieved only by endowing them with additional powers in this area. An important step towards solving the problem will be the development of the necessary regulations to improve the efficiency of budget spending.

The negative aspects include the lack of indicators characterizing the preliminary control, for example, “prevented due to the audit”. It is also necessary to focus on the increase in the number of control measures carried out using the performance audit, whose performance is only decreasing, compared to previous years.

It should be added that the activities of the municipal financial control bodies are not directly subordinated to the state authorities; there are no unified methods and standards for control over state financial resources. This leads to the implementation of financial control by municipal authorities to a greater extent in the form of follow-up control, after committing violations. Another unfavorable factor is the increase in the cost of maintaining the Accounts Chamber with a constant structure and staff rate.

The basis of international financial control rules is a system of the following principles, which are the basic rules for the control activity as a whole: independence, publicity, preventiveness, objectivity, legality, regularity and all-encompassing nature.

1. Independence means the freedom of verification work from those persons which should be verified by the financial control authorities.

2. Publicity means that the results of financial control activities should be publicly accessible and open.

3. Preventiveness means that financial control should be preventive in nature in order to exclude the possibility of a financial error.

4. Objectivity means that the findings of controllers and the process of inspections should exclude bias or predisposition, as well as other motives.

5. Legality means that the activities of the financial control authorities must strictly comply with the laws and other regulatory acts of the country.

6. Regularity (systematicity) means that the control is carried out at regular intervals, which brings discipline not only for the objects of inspection, but also for the work of the controllers themselves.

7. Inclusive character means that financial control is in effect throughout the country [1].

State financial control in Russia can successfully integrate its unique inspection experience with international practices of the effectiveness of control bodies. For example, it can be by developing specific performance indicators. This will be a kind of independent examination of the activities of state authorities of the constituent entities of the Russian Federation, which will improve the quality of public finance and property management.

Evaluating the performance of state and municipal financial control bodies, it is necessary to focus mainly on the “prevented losses” indicator, which by definition characterizes the work of the financial control bodies, and not on indicators of inefficiency and misuse of funds. The formation of a mechanism for improving state financial control is built on the duality of the concept of "efficiency". On the one hand, the effectiveness of state financial control as the effectiveness of the implementation of budget programs, on the other, the efficiency of the bodies that exercise this control. It is necessary to combine both of these criteria, to conduct planned control measures and audit at the same time as the introduction of control monitoring.

In order to accelerate the transition to the audit of the effectiveness of public spending, the Government of the Russian Federation Order No. 2593-p of December 30, 2013 adopted the program to improve the efficiency of public finance management for the period up to 2018. In accordance with this program, there is a transformation of the tasks of the bodies of external state (municipal) financial control. When organizing their activities, the emphasis should be shifted from control over financial flows to control over the results their use brings. At the same time, one of the main tools in the activities of bodies of external state (municipal) control becomes an efficiency audit. Performance audit is intended to assess the effectiveness of the activities of state authorities in terms of the effectiveness of measures, as well as the achievement of the ultimate goals and objectives of state programs in social, economic or another spheres of social activities [2].

The transition to an audit of the effectiveness of public expenditures is a new activity of control bodies, which involves an analysis of the effectiveness and thrift of using public funds as such, an assessment of possible reserves for the growth of public revenues and an assessment of the reasonableness of public spending.

The transition to audit of efficiency in Russia was discussed at the end of 2003, before major restructuring of state financial control bodies, but until now the audit of efficiency requires the improvement not only at the federal level, but especially at the regional level.

We also see the need for further abolition of the structure of state and municipal financial control bodies. Today, the tasks and functions of state financial control bodies are not specific enough, the boundaries of responsibility are somewhat fluid, and their activities are coordinated rather weakly. In recent years, a significant number of decrees and other legal acts were adopted to abolish certain control bodies and distribute their functions to other control structures. Thus, by Decree of the President of the Russian Federation of 02.02.2016 No. 41 “On some issues of state control and supervision in the financial and budgetary sphere”, some bodies of state financial control were abolished, and their functions were previously transferred to other services. This decree should be perceived not just as a document that implies the optimization of the number of government bodies, but as another step towards improving state financial control.

We propose to discuss one more event to improve financial control in Russia, namely, the elimination of duplicate functions in relation to the same objects of inspection. A good example is the procurement sphere, where a huge number of bodies is authorized for the same inspection. These include the Accounts Chamber of the Russian Federation, departments for placing orders at the municipal level, the Federal Treasury of Russia, the Federal Antimonopoly Service, and law enforcement agencies and prosecutors, etc. But, despite the large number of financial controllers, the number of detected violations of the law on the contract system does not decrease, and, consequently, a significant part of actions in relation to the state (municipal) customer is directed not so much at warning as at identifying violations and shortcomings. This is fully consistent with the functions of regulatory bodies. But at the same time, the work of external control must be complemented by the activity of internal control, which is precisely intended to prevent violations, that is, to identify and eliminate the causes of violations and to make shortcomings [3].

We propose to toughen penalties for inappropriate and inefficient use of budgetary funds. In particular, the increase in measures of criminal and administrative responsibility, as today there are no adequate measures to violators of budget legislation. The responsibility for violations in the field of budget legislation is provided for by Chapter 29 of the Budget Code of the Russian Federation “General provisions on budget violations and the application of budgetary coercive measures”, as well as the Code on Administrative Offenses of the Russian Federation, which provides for only two elements of budget legislation violations:

A) For misuse of budget funds a fine is imposed on officials in the amount between 20,000 and 50,000 rubles or disqualification for a period from 1 year to 3 years; for legal entities - from 5 to 25% of the amount of funds received from the budget of the budget system of the Russian Federation, used not for the intended purpose;

B) Credit default or late payment of the budget loan, which entails the imposition of an administrative fine on officials in the amount between 20,000 and 50,000 rubles.

In accordance with Article 285.1 of the Criminal Code of the Russian Federation for large-scale inappropriate spending of budget funds, an official is punished with a fine in the amount of 100,000 to 300,000 rubles, or in the amount of wages for a period of 1 to 2 years, or forced labor for up to 2 years with deprivation of the right to hold certain positions for up to 3 years or without it, or arrest for up to 6 months, or imprisonment for up to 2 years with deprivation of the right to hold certain posts. In practice, criminal cases against those who ineffectively spent budget funds are not initiated. In addition, practice shows that the control bodies, having revealed the facts of misuse of budget funds, for the most part cannot count on the administrative persecution of the guilty parties due to the expired statute of limitations [4].

Recently, there have been a lot of discussions on the practice of introducing internal audit at all levels of government and administration. Its formal existence, and sometimes the complete absence, is, in the opinion of the authors, the most important problem of modern financial control. At the beginning of 2014, the Government of Russia, at the initiative of the Ministry of Finance, adopted a resolution on the creation of internal control and internal audit bodies for federal government bodies. However, this system started its work only two years later. Unfortunately, the system of internal control and internal audit does not function properly. This is evidenced by a significant amount of violations in the field of procurement, accounting and budget reporting. How can it be eliminated? To solve this problem, it is necessary to give the main managers and managers of budget funds responsibility for the implementation and internal audit, as well as the responsibility to develop standards and rules for the use of budget funds [5].

High-quality internal audit will allow the state (and municipal) financial control bodies to be exempted from audits of the targeted nature of budget spending and focus on the performance audit [6].

We see a big problem in the absence of a unified information area all around the Russian Federation. Its creation will allow combining the results of the activities of control bodies, to automate the accounting of control measures and to ensure the exchange of relevant information between control bodies. It is necessary to create a unified information system of control bodies, regardless of their departmental affiliation, to improve the scientific and methodological support of control in order to increase objectivity, quality, efficiency and comprehensiveness of control through the use of various control methods. How to do this is a problem that some economists cannot solve [7].

Our idea, which needs further refinement, is to define budget accounting as the final stage of the budget process. We believe that it is necessary to lead budgetary relations in terms of planning, using and controlling use out from the influence of accounting, since namely violations in the field of budget accounting take the largest share in the structure of violations, especially at the municipal level. Bookkeeping should not overshadow the planning and use of budgetary funds, as is happening today [8].

In order to increase the effectiveness and efficiency of state financial control, to increase the adequacy of the positive results achieved in the process of its implementation, while at the same time taking into account the costs incurred, it is necessary to carry out the proposed directions for improving financial control in Russia.

We think that it is necessary to take measures to improve the effectiveness of control measures aimed at clarifying the responsibility of officials for violations of the requirements of the law on the implementation of budget legislation; to increase the responsibility of officials for non-compliance with the regulations of the control bodies; on the establishment of mechanisms for the return of budgetary funds [9].

We decided to propose another direction of improvement - the decentralization of the financial control system. Separately existing regional counting chambers, which are not subordinate to the highest financial and controlling body of the state, are one of the reasons hindering effective management in the field of public finances. The process of centralization of financial control bodies began in Russia, but time is needed and the development of a regulatory base for its completion.

Centralized control over public finances also implies the optimization of budget activities and the integration of information systems used in a unified information area. The centralized information technology platform will ensure optimal remote interaction of all participants in the budget process in a unified area, and this will allow to formulate uniform requirements for information systems based on a centralized approach to managing public finances. Due to the use of technologies for organizing the centralized storage and processing of information, the time required to obtain reliable operational information on budget planning will be reduced, which in turn will improve the efficiency of budget expenditures [10].

The authors of almost every scientific article on state financial control in Russia, Ukraine and other countries of the former Soviet Union propose the adoption of a separate federal law “On State (Municipal) Financial Control” [11]. The presence of a large number of laws, decrees, resolutions and other legal acts regulating the relevant relations does not provide coordination and interaction between control and financial bodies, but shows more differences and discrepancies. There are no uniform principles and a unified methodological base of state financial control [12]. Therefore, in January 2015, Russian President Putin V.V. instructed the Government of the Russian Federation to develop a draft federal law on control and submit it for consideration to the State Duma before September 1, 2015. However, this draft federal law “On the Basics of State and Municipal Control in the Russian Federation” continues to be under consideration. The draft law has an important goal - a comprehensive legal regulation of the sphere of state and municipal control (supervision). It should increase the effectiveness and efficiency of control and supervisory activities, while excessive intervention in the activities of citizens is planned to be reduced. The provisions of the draft law are aimed at maximizing the legal regulation of the sphere of control and supervisory activities. However, the draft law does not say anything about state and municipal financial control, as many economists had expected, with the exception of annexes, which define the powers of the bodies responsible for it [13].

We think that the development of a specific federal law on state and municipal financial control will lay the legal foundation for the development of domestic state control. The theoretical framework will create the foundation for the functioning of all elements of the state financial control system. Without a proper theoretical framework, there will not be a unified and coherent system of financial control. At the same time, the main goal of the proposed Federal Law is to establish a regulatory framework for the functioning, development and improvement of the state financial control system throughout Russia, ensuring the preservation and effective use of national property and the growth of citizens' well-being. We suppose that in one law not only goals, tasks, objects of financial control will be defined, but also financial violations and responsibility for their violations, a system of financial control procedures will be indicated [14].

Also in the law the definition of the types, forms and methods of state and municipal control, the timing and frequency of their implementation should be given. The definitions should be given to the terms “control” and “supervision” and their distinction, as well as other terms, for example, “inefficient use of funds”, which everyone interprets individually.

An important issue is also the definition of a body with the status of the highest control body. It is proposed to define these mechanisms of interaction between the executive and legislative authorities in this law and determine the status of the highest control body in it. The adoption of the law on state (municipal) financial control will initiate a new stage in the improvement of state and municipal financial control in the Russian Federation.

The results we obtained and the proposed ways to improve the state financial control should proceed in stages. Which of the directions has to be implemented first, which - the second? What events should be hold together? How will it be possible to systematize these areas? Here are our tasks and ideas for future research.

And one more question remains unanswered. Will the federal law about it all solve the problems of financial control? So should it be seen as a panacea, or will the law serve as only a starting point for the rapid development of high-quality financial work?

Thus, the process of reforming the state and municipal financial control in Russia is far from complete, one can only say at the beginning of building a competent and organized financial control mechanism that will help to turn it into a real tool of government in the interests of citizens of the Russian Federation.

[1] Khimichev N. I. Financial law: a textbook. M .: INFRA, 2012, pp.153-155.

[2] Turbina E.P., Simonyan M.A. Historical aspects of the formation and development of financial control in Russia [Electronic resource] // Electronic catalog of the SPG library. http://shgpi.edu.ru/files/nauka/vestnik/2015/2015-2-31.pdf.

[3] Ziablitckaia N.V. Peculiarities of structural adjustment in Russia // Russian business (2011), No.1, Issue 2, pp.10-15.

[4] Shekhina A.V. Theory and practice of internal audit // State financial control (2015), No.9, pp.31-44.

[5] Kozko Ye.V. Essential characteristics and criteria of the state financial control system // Young Scientist (2015), No.11, pp.873-876.

[6] Dikan L., Deineko Y., Kalinkin D., Public internal financial control reforming in Ukraine: Conceptual foundations and practices (2017), Vol. 165, Issue 5-6, pp.60-65.

[7] Mukanova G.K., Mukanov O.N., Abdykhadyrova A.M., Vasiyeva S.M. Barriers to effective public sector financial budgeting as compared between developed countries, Russian Federation and countries of Central Asia such as Kazakhstan and Kyrgyz Republic // Social Science and Humanity (2016), No.3, pp.95-102.

[8] Shokhin S. Fundamentals of state and municipal financial control. (Article-by scientific and practical commentary to Chapter 26 of the Budget Code of the Russian Federation). M.: Izd. FGU "Editorial Office of the Rossiyskaya Gazeta", 2008.

[9] Danchikov E.A. Financial control for financial controllers // State financial control (2015), No.10, pp.2-6.

[10] Baber W.R., Gore A.K., Rich K.T., Zhang J.X., Accounting restatements, governance and municipal debt financing, Journal of Accounting and Economics (2013), Vol. 56, Issue 2-3, pp. 212-227.

[11] Gusev A.V. On reforming the state (municipal) financial control // State financial control (2015), No.10, pp.7-17.

[12] Penchuk A.V. State financial control in the Russian Federation and directions for its improvement // Economics and management of innovative technologies. 2014. No.6. URL: http://ekonomika.snauka.ru/2014/06/550.

[13] Meiss, Karl-Michael; Naumik-Gladka Kateryna; Krivtsova Tetiana; with co-authors. Improvement of public financial control in the context of ensuring financial security of the state. ECONOMIC ANNALS-XXI, vol. 168, Issue: 11-12, pp. 63-68.

[14] Hay D., Cordery C., The value of public sector audit: Literature and history, Journal of Accounting Literature (2018), Vol.40, pp. 1-15.

1. Department of Economics, management and law. South Ural state University. Doctor of Economics, Associate Professor, Head of the Department of Economics, management and law. Contact e-mail: econ10@rambler.ru

2. Department of Economics, management and law. South Ural state University. Candidate of Economic Sciences, Associate Professor of the Department of Economics, management and law. Contact e-mail: eamanina@ya.ru

3. Department of Economics, management and law. South Ural state University. Candidate of Pedagogical Sciences, Associate Professor of the Department of Economics, management and law. Contact e-mail comm-nv@susu.ru