Vol. 40 (Number 13) Year 2019. Page 29

SEMENOVA, Nadezhda N. 1; IVANOVA, Irina A. 2 & GRIBANOV, Alexey V. 3

Received: 25/02/2018 • Approved: 30/03/2019 • Published 22/04/2019

ABSTRACT: The purpose is to assess external factors influence on the commercial bank deposit policy formation. The empirical results proved the fact that deposit policy of the commercial banks registered in the Republic of Mordovia is influenced by such external environment factors as gross domestic product and average accrued wage growth rate. Thus, an individual commercial bank, as a rule, has no ability to manage these factors, but should take them into account while developing its deposit policy. |

RESUMEN: El propósito es evaluar la influencia de factores externos en la formación de la política de depósitos de bancos comerciales. Los resultados empíricos demostraron el hecho de que la política de depósitos de los bancos comerciales registrados en la República de Mordovia está influenciada por factores ambientales externos, como el producto interno bruto y la tasa de crecimiento promedio de los salarios acumulados. Por lo tanto, un banco comercial individual, por regla general, no tiene capacidad para manejar estos factores, pero debe tenerlos en cuenta al desarrollar su política de depósitos. |

One of the most important features of the banking system is commercial entities’ resource mobilization for their transformation into the investment resources, which eventually provides for the sustainable growth rate in the country (Ahmad and Malik, 2009; Alkhazaleh, 2017; Balago, 2014; Benhabib and Spiegel, 2000).

The authors point out that the Russian banking system was influenced significantly by the world financial and economic crisis of 2008-2009, which caused the financial stability deterioration and bankruptcy of some credit organizations. The latter, alongside with the low bank institutions trust level, influenced the national commercial banks’ deposit policy (Vasilyeva and Nikulina, 2011; Vasilyeva and Vysotskaya, 2018; Gavrilin and Tychkova, 2016).

The current banking sector development stage in Russia is characterized by the following negative tendencies in the resources mobilization sphere: (1) banking sector undercapitalization; (2) short-term deposits; early withdrawal and holding money in the foreign currency; (3) commercial banks’ revocation licenses increase, caused by their ineffective resource mobilization policy; (4) the liabilities concentration in the biggest Russian banks, showing deterioration in the interbank competition; (5) the possible resource mobilization reduction while mainstreaming the individuals and companies’ deposits (as increased influence of alternative bank sources of funds placement complicates the internal resources mobilization for the credit organizations, and the consequent sanctions policy narrows down the potentialities of the external resources mobilization); (6) high proportion of the on-demand deposits, the so-called “hot money” (Bespalova et al., 2017; Vasilyeva and Vysotskaya, 2018; Isakov and Nikonets, 2018; Maslova and Martynenko, 2017).

The aforementioned allows for the conclusion that the Russian banking qualitative development, the specific bank institutions financial improvement is impossible without the competent deposit policy for the commercial banks, providing the funding base stability and private savings into the investment resources transformation improvement. This necessitates the assessment of the external factors influence on its development. The main difficulty of the assessment is the inability of a particular commercial bank to manage them (especially in short term period), but has to take them into account in the deposit policy development.

In current economics and business practice the problem of the commercial banks deposit policy development as an element of its general policy is regarded as a debatable one. Firstly, it is caused by lack of common approach to the definition of the term “deposit policy”. The scientific works in banking analysis distinguished the following approaches to the economic content of the term: 1) the entity aspect regards the deposit policy as the banks’ strategy and tactics in the sphere of the necessary resources mobilization (Molchanova et al., 2016; Lavrushina, 2016; Panova, 1997); 2) in the functional aspect it is regarded as a set of measures providing the credit organization with the stable funding base in accordance with its requirements and characteristics (Nikulina and Abalkin, 2015); 3) in applied aspect it is a formal document, which regulates the process of the economic entities’ temporarily redundant funds to deposits mobilization. (Beloglazova and Krolivetskaya, 2008; Korobova, 2006; Rykov, 2015).

P.S. Rose declares that the bank’s deposit policy is closely connected to the credit one and is regarded as an element of its common credit organization funds system management strategy (Rose, 1998). He considers the asset-liability management as a complicated process of the coordinated bank balance management providing a set of measures for the ultimate banking effectiveness, the credit organization’s correspondent liquidity rate support and bank risks minimizing.

Swiss economist E. Baltensperger distinguishes “partial” and “full” credit organizations’ asset-liability management patterns (Baltensperger, 1980). He considers the partial pattern as being the portfolio-theoretical one describing either the liability management policy or the asset management policy of a commercial bank. Correspondingly, the full patterns are regarded as the ones, describing the asset-liability management structure and mechanisms in their correlation. Herewith, the researcher recognizes the both types’ rightness, as in their correlation they present the evolution stages of theoretical approaches to a credit organization asset-liability structural components management.

It is obvious that every commercial bank takes into account not only political, economic and social situation in the country as a whole and in the correspondent region in particular, but its internal abilities, the selected development strategy, approaches to its realization at banking market. That requires more detailed study of the factors influencing the commercial banks deposit policy.

In their works, the economists divide the factors influencing the commercial banks funding base development into two groups, namely: the external environment factors (reveal the influence of the economic, political and social stability in the country) and intrabank factors (are defined by the banking system general condition and the specific bank particular condition) (Gevorkyan, 2015; Bondarenko et al., 2016).

The current economic literature presents the surveys, analyzing a correlation between the bank deposit rate and such factors as: the financial crisis (Ritz, 2015); the population income level (Gevorkyan, 2015); oil and gas prices instability (Saif-Alyousf et al., 2018); interest rate (Maslova and Martynenko, 2017; Ojeaga, 2014); the quantity of the services (Maharana et al., 2015); the technological innovation implementation (Yao et al., 2018); deposit insurance mechanism (Jusairi et al., 2018; Nys et al., 2014); the regulation and control providing by the Central Bank (Al-Badran, 2018).

It should be noted that in the works, devoted to the studying of the external and internal banking environment influence on the deposit policy, the researchers present only the influence significance expert assessment for each factor (Bitkina, 2018; Vorobyova, 2018; Gerasimenko et al., 2011; Prokusheva, 2015). The given assessment is sometimes not objective and gives the opportunity for the initial data ambiguous interpretation. Besides, although the authors point out that the factors influencing the commercial banks deposit policy are correlated and present the mixed influence on their work, they analyze them separately. Each factor in particular does not define the complete object of the survey, but their correlated combination can provide the comprehensive idea of the phenomenon nature.

In our research the authors focused exclusively on the external environment factors influence on the commercial bank deposit policy studying. This decision was caused by the following ideas:

- Commercial bank is an open system. Its stability in the specific moment, as well as in definite time interval, depends mainly on how promptly the analyzed system reacts exactly on the external irritant, mobilizing its inner forces and resources;

- The external environment factors are of the objective nature and are not influenced by the credit organization management. Thus, when the negative inner factors can be eliminated by the competent management (for example weak client orientation of the stuff is removed easily with the training), the external environment factors’ negative influence can only be leveled.

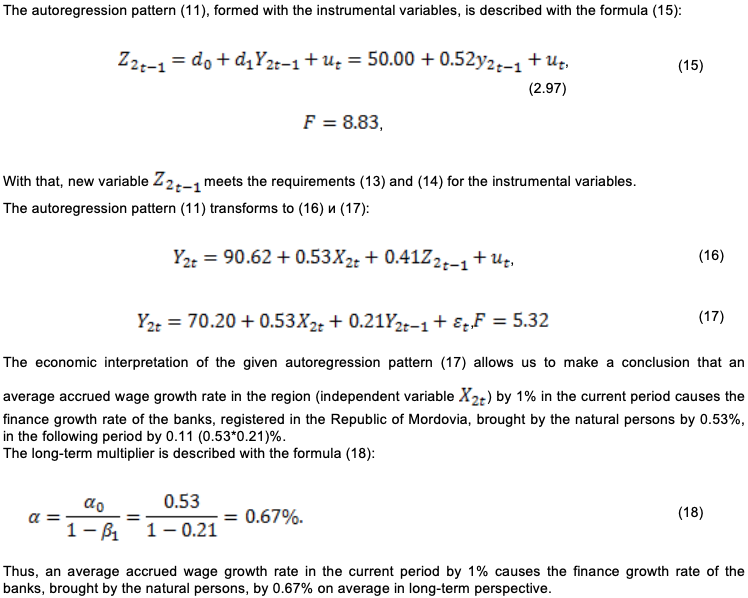

We have analyzed with the mathematical modeling tools the external factors’ influence on the deposit policy of the regional commercial banks registered in the Republic of Mordovia, one of the subjects of the Russian Federation. In the given study, the authors focus on the dynamic econometric patterns formation, as the effective indicators variables’ response on the external factors influence is delayed due to some economic, including financial, system rigidity. The regression equations with the polynomial structure distributed lag formation and autoregression pattern with the instrumental variable are presented as the dynamic pattern.

The dynamic economic patterns themselves make it possible to estimate the effective variable in some moment of time t with the variables included, which corresponds to the current and the previous moments of time.

The authors also used correlation, component, dispersion, and least-square methods for the regression parameters estimation, statistic hypothesis testing by Fisher and Student’s criteria, method of instrumental variables development to analyze, verify, and indicate the economic patterns.

We use two effective variables to study the external environment factors influence on the regional commercial banks’ policy, namely: finance growth rate of the banks, registered in the Republic of Mordovia, brought by the companies (the effective variable Y1) and by the natural persons (the effective variable Y2). The dynamic rate is presented by the empiric data for 2006-2017. The interval between the dynamic timing levels is a quarter. Such significant quantified external environment factors, correlated to the effective variables with the cause-and-effect link and application content, as: gross domestic product, retail turnover, inflation, average accrued wage rate, business confidence index, ease of deposits for the population index, are included into the pattern formation as the independent variables.

With the distributed lag economic patterns and autoregression patterns construction the authors point out that the deposit policy of the commercial banks, registered in the Republic of Mordovia, are influenced by the following external environment factors as gross domestic product and an average accrued wage growth rates. Thus, in particularly, it is defined that the gross domestic product growth rate by 1% in the current period will cause: (a) the finance growth rate of the regional banks, brought by the companies, by 0.76% in a year, by 0.98% in two years; (b) the finance growth rate of the regional banks, brought by the natural persons by 0.55% in a year, by 0.52% in two years, by 0.40% in three years. Also, it is concluded that the average accrued wage growth rate in the current period by 1% causes the finance growth rate of the regional commercial banks, brought by the natural persons, by 0.53%, in the following period by 0.11% and by 0.67% on average in long-term perspective.

Thus, the given analysis proves the hypothesis of the external environment factors’ significant influence on the commercial banks’ deposit policy. The further investigations should be devoted to the reasoning of the effective methods and tools of the deposit policy realization in accordance with the external factors that will provide the commercial banks’ funding base stability and private savings into the investment resources transformation improvement.

AHMAD, E., MALIK, A. Financial sector development and economic growth: An empirical analysis of developing countries. Journal of Economic Cooperation and Development. Vol 30, year 2009, issue 1, page 17-40.

AL-BADRAN, O.R.A. The interaction between possessed capital and deposits with credit control of the bank. Opcion. Vol 34, year 2018, issue 17, page 906-915.

ALKHAZALEH, A.M.K. Does banking sector performance promote economic growth? Case study of Jordanian commercial banks. Problems and Perspectives in Management. Vol 15, year 2017, issue 2, page 55-64.

BALAGO, G.S. Financial sector development and economic growth in Nigeria: An empirical investigation. International Journal of Finance and Accounting. Vol 3, year 2014, issue 4, page 253-265.

BALTENSPERGER, E. Alternative Approaches the Theory of the Banking Firm. Journal of Monetary Economics. Vol January, year 1980, page 1–37.

BELOGLAZOVA, G.N., KROLIVETSKAYA, L.N. (2008). Banking. Spb: Piter.

BENHABIB, J., SPIEGEL, M. The role of financial development in growth and Investment. Journal of Economic Growth. Vol 5, year 2000, issue 4, page 341-360.

BESPALOVA, O.V., FARADZHOVA, A.S., SHIBANOV, I.A. The commercial bank deposit policy in new stage of the Russian banking system development. Economics and business. Vol 2, year 2017, issue 79, page 484-488.

BITKINA, I.K. Macroeconomic factors influence on the commercial banks deposit operations. The bulletin of Moscow University of Humanities and Economics. Vol 1, year 2018, page 33-39.

BONDARENKO, T.G., ISAEVA, E.A., ZHDANOVA, O.A., PASHKOVSKAYA, M.V. Model of formation of the bank deposit base as an active method of control over the bank deposit policy. Journal of Applied Economic Sciences. Vol 11, year 2016, issue 7, page 1477-1489.

GAVRILIN, A.V., TYCHKOVA, T.Yu. The problem of the commercial banks funding base development in the current period. The current tendencies of the current science and technology development. Vol 10-9, year 2016, page 21-24.

GERASIMENKO, R.A., KHOROSHEVA, E.I., GERASIMENKO, V.V. The banks deposit policy and factors, influencing its development. Finance, accounting, baking. Vol 1, year 2011, page 141–150.

GEVORKYAN, A.A. The analysis and assessment of the factors, influencing the Russian commercial banks funding base development. Economic systems management: digital scientific journal. Vol 1, year 2015, issue 73. Retrieved from: https://cyberleninka.ru/article/n/analiz-i-otsenka-faktorov-vliyayuschih-na-deyatelnost-rossiyskih-kommercheskih-bankov-po-formirovaniyu-resursnoy-bazy

GRIFFITHS, W.E., HILL, R.C., JUDGE, G.G. (1993). Learning and practicing econometrics. New-York: Wiley.

ISAKOV, N.G., NIKONETS, O. E. Current commercial banks deposit policy, its problems, instruments, perspectives. Scientific and methodological digital journal “Concept”. Vol 7, year 2018, page 202–210.

KOROBOVA, G.G. (2006). Banking. Moscow: Economist.

KUSAIRI, S., SANUSI, N.A., ISMAIL, A.G. Dilemma of deposit insurance policy in ASEAN countries: Does it promote banking industry stability or moral hazard? Borsa Istanbul Review. Vol 18, year 2018, issue 1, page 33-40.

LAVRUSHINA, O.I. (2016). Russian banking system optimization: the monograph. Moscow: Financial University under the Government of the Russian Federation.

MAHARANA, N., CHOUDHURY, S.K., PANIGRAHI, A.K. Deposit Mobilization of Commercial Banks: A Comparative Study of BOB and Axis Bank in Bhubaneswar City. Journal of Management Research and Analysis. Vol 2, year 2015, issue 3, page 195-203.

MASLOVA, A.A., MARTYNENKO, N.N. The commercial bank deposit policy and stereotypes of its development in terms of unstable economy. Contemporary science: the actual theory and practice problems. Series: Economics and Law. Vol 7, year 2017, page 55-57.

MOLCHANOVA, L.A., SHANINA, A.N., KOVAL, N.V. The commercial bank deposit policy and instruments for its realization. Belgorod University of cooperation, economics and law bulletin. Vol 3, year 2016, issue 59, page 206-213.

NIKULINA, A.N., ABALKIN, A.A. The commercial banks deposit policy: instruments, problems, perspectives. Economic and management problems. Vol 4, year 2015, page 62–66.

NYS, E., TARAZI, A., TRINUGROHO, I. Political connections, bank deposits, and formal deposit insurance. Journal of Financial Stability. Vol 19, year 2014, page 83-104.

OJEAGA, P., ODEJIMI, O. The impact of interest rate on bank deposit: Evidence from the Nigerian banking sector. Mediterranean Journal of Social Sciences. Vol 5, year 2014, issue 16, page 232-238.

PANOVA, G.S. (1997). The commercial bank credit policy. Moscow: IKC “DiS”.

PROKUSHEVA, K.P. Endopathic causes’ influence on the commercial bank deposit policy development. Magistracy Bulletin. Vol 10, year 2015, issue 49, page 93-96.

RITZ, R.A., WALTHER, A. How do banks respond to increased funding uncertainty? Journal of Financial Intermediation. Vol 24, year 2015, issue 3, page 386-410.

ROSE, P.S. (1998). Commercial Bank Management. Boston, Mass: Irwin/McGraw-Hill.

RYKOV, S.V. The organization aspects’ influencing the commercial banks deposit policy analysis. University Bulletin (State University of Management). Vol 11, year 2015, page 220-225.

SAIF-ALYOUSFI, A.Y.H., SAHA, A., MD-RUS, R. Impact of oil and gas prices shocks on banks’ deposits in an oil and gas-rich economy: Evidence from Qatar. International Journal of Emerging Markets. Vol 13, year 2018, issue 5, page 875-901.

VASILYEVA, A.S., NIKULINA, N.V. The commercial bank deposit policy peculiarities in modern conditions. Banking and Finance. Vol 40, year 2011, issue 472, page 42-52.

VASILYEVA, A.S., VYSOTSKAYA, T.R. The current stage of the commercial banks deposit market. International scientific research magazine. Vol 7-1, year 2017, issue 61, page 6-9.

VOROBYOVA, E.I. Russian national commercial bank deposit policy. (PC) in Crimea. The scientific bulletin: finance, banks, investments. Vol 1, year 2018, issue 42, page 99-110.

YAO, M., DI, H., ZHENG, X., XU, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technological Forecasting and Social Change. Vol 135, year 2018, page 199-207.

1. Economic Department, Ogarev Mordovia State University, Russian Federation, nadezhda_semenova_1980@bk.ru

2. Economic Department, Ogarev Mordovia State University, Russian Federation

3. Economic Department, Saransk Cooperative Institute (branch) of Russian University of Cooperation, Russian Federation