Vol. 40 (Number 14) Year 2019. Page 20

VYAKINA, Irina V. 1

Received: 17/01/2019 • Approved: 14/04/2019 • Published 29/04/2019

ABSTRACT: The security of doing business has been a topic of active debate all over the world. However, in addition to the natural factors ensuring entrepreneurs’ security in a competitive market environment, specific risks connected with periodic property redistribution and the competition for the control over assets characterize the transformation processes in Russia. The research focuses on the protection mechanisms of business rights and interests within a transformation economy. The article includes the analysis of the current state of entrepreneurship and the assessment of the existing protection of entrepreneurs’ rights and interests in Russia. |

RESUMEN: La seguridad de hacer negocios ha sido un tema de debate activo en todo el mundo. Sin embargo, además de los factores naturales que garantizan la seguridad de los empresarios en un entorno de mercado competitivo, los riesgos específicos relacionados con la redistribución periódica de la propiedad y la competencia por el control de los activos caracterizan los procesos de transformación en Rusia. La investigación se centra en los mecanismos de protección de los derechos e intereses comerciales dentro de una economía en transformación. El artículo incluye el análisis del estado actual del espíritu empresarial y la evaluación de la protección existente de los derechos e intereses de los empresarios en Rusia. |

The absence of trust between the state, and business and entrepreneurs’ confidence in the economic security of their business has been a substantial reason of the entrepreneurial activity slowdown recently.

The level of confidence between the state and business is still extremely low. It can be related to both the parties’ reputation and the lack of successful long-term cooperation as well as the changeability of regulatory legal acts, the business environment, and frequent changes of government decision-makers.

In spite of the fixed economic improvements, the national economy is still in recession, which began in 2014 and resulted in sales resistance, real income reduction, poverty level rise, fixed capital investment reduction. Taken together that has led to the entrepreneurial activity slowdown and pessimistic expectations of the Russian business community.

Uncertainty connected with geopolitical tension and sanctions contributed to the further degradation of the confidence level. A weaker rouble gave price advantage to some non-raw material sectors, which could grow their export supplies and attract investments. However, the Russian entrepreneurial activity continues to decline in the environment of tense geopolitics and sanctions in view of the growth of capital costs and sales resistance. A sales slowdown caused by a sharp decline of real wages and incomes resulted in the poverty level rise. The national economic growth prospects depend on not only external factors but also internal possibilities of business to adapt to the worsening situation.

The study provides a formal analysis of legal acts and federal laws adopted in the Russian Federation in the field of business protection and economic and statistical evaluation of judicial statistics data provided by the Judicial Department of the Supreme Court of the Russian Federation. Table and graphical methods used to visualize the data. The data was systematized and processed with traditional methods of scientific analysis, mathematical statistics, historical and logical analysis, graphic and mathematical modeling.

Economic relations develop through the interests of interdependent economic entities managing economic benefits, material, financial and human resources. Interests underlie the motivation of individuals or social groups and the decisions taken by all the parties of economic activities.

Russian academician Leonid Abalkin stated, “The insufficient research of economic law mechanisms is largely connected with the underestimation of the problem of interests by economics. Our knowledge does not go far ordinary ideas and notions, we are aware of neither their structure nor their hierarchy to the full” (Abalkin, 1970).

The modern economic theory connects the notion of ‘economic interest’ to the notions of ‘benefit’ or ‘profit’. ‘Interest’ in political economics gives rise to motivation being the base for decision-making. In social sciences ‘interest’ is a real cause of social actions, the basis of direct motives and ideas of individuals or social groups.

Economy, in general, involves agents and their groups with opposite interests. Therefore, the satisfaction of demands and interests of some groups of economic entities falls into a distributive conflict with those of others. The economic stability means considerable diversification and the presence of a wide layer of dynamic small and middle businesses that runs counter to the interests of big business. Sustainable high incomes of citizens constrains, in short-term period, the business opportunities to invest, etc.

James Buchanan stated fairly, “The consent of economic interests of individuals, groups, and the society in general can only be possible ideally” (Buchanan, 1997).

It is evident that to reach absolute consent of economic interests is impossible since the satisfaction of one entrepreneur’s interests can infringe the interests of others, providing that each entity strive to maximize their utility and minimize their costs when having relationship with other market actors or the state.

The object of protection in business considered entrepreneurs’ disputed or violated rights and interests. The regulatory environment involving the regimes of respect for proprietary rights, the norms regulating land acquisition and land use rules, economic activities, tax and finance regulations is a crucial factor determining the level of the economic security of entrepreneurship.

entrepreneurial activity assumed the factor of launching a trajectory of stable development and providing the economic security of business and the nation in general. stimulation of economic growth, unemployment reduction, and growth in prosperity linked to fostering entrepreneurial activity (Castaño, Méndez, Galindo, 2016). The improvement of confidence and joint enterprises of the state and business do not only increase the level of joint project profitability but also make it possible to spread risks and ensure additional benefits for every party. (Autio, Rannikko, 2016). At the same time, the national economic policy including the tax and monetary ones, influences entrepreneurial activity strongly (Salman, 2016).

Natasha Hamilton-Hart states that there are three types of regulatory environment determining the ways of business right and interest protection (Hamilton-Hart, 2017):

- Legality lawfulness (legal ways of business right protection with a judicial system)

- Legal pluralism (simultaneous coexistence of informal political and legal juridical mechanisms of business right protection)

- Lawlessness or routine illegality (the use of political resources or legitimate cover for protecting business and redistributing property).

Besides researchers evaluate the regulatory environment and the entrepreneurs’ interest observance as regards the mechanisms of incorporeal right protection (Laplume, Pathak, Xavier-Oliveira, 2014), the absence of unofficial payment practice, the variety of repayment forms or extortions which reduce return on equity and increase costs on doing business (Ranasinghe, 2017), and entrepreneurs’ propensity for corruption (Dickel, Graeff, 2018). Petra Dickel and Peter Graeff state that higher expected economic profit is more likely for corruption. The practice of entrepreneurs’ disregard for regulations and their propensity for corruption determined by expected economic gains and the high probability of corruption being successful.

As for the national economic interests, they, according to official definition, are ‘objectively significant economic needs of the country which satisfaction provides the strategic national priorities’ (Decree of the President of the Russian Federation No. 208 dated May 13, 2017 “On the strategy of economic safety of the Russian Federation for the period up to 2030”, Section I). Besides, according to the normative interpretation economic security ensured with the measures to counter its challenges and threats and to provide the protection of national interests in economic sphere.

The issue of the consent of economic interests, as the basis for development in view of individuals and businesses’ right protection, is widely discussed by researchers. Entrepreneurs’ different interests presuppose the contradictions and tension between them as well as the huge amount of divergent interests.

A class approach of the theory of economic interests can be traced in the early works of Ralf Gustav Dahrendorf, the author of a class conflict theory (Dahrendorf, 1959). The methodology of modeling economic interests in the USSR developed by I. M. Syroyezhkin (Syroyezhkin, 1983). At the beginning of the Russian reform economic interest was considered by Russian scholars as an incentive and a motive inducing to economic activities.

The author of the stakeholder theory of organizational management Robert Edward Freeman (Freeman, 1984) and his followers explain the strategy of a business development due regard to the interests of stakeholders.

It is commonly thought that the role of the State in regulating the conditions of business activities and creating an entrepreneurial climate involves the establishment of rules of licensing, registering business and taxpaying. an entrepreneurial climate and institutional environment determine entrepreneurship self-perception and its status in the society, new business opportunities, perceived possibilities, fear of failure and entrepreneurs’ intentions (Beynon, Jones, Pickernell, 2018).

Various empirical studies try to evaluate the relationship between entrepreneurial activity and economic growth, which is not unambiguous for the countries of different stages of economic development. This uncertain relationship attracts researchers to the idea of revealing direct and indirect factors influencing a business economic security. They try to identify the main reasons of the differences taking into account national mental, political, judicial, economic and social factors. National business systems were evaluated and measured in (Acs, Autio, Szerb, 2014) where these systems studied as fundamental resource distribution systems managed by individuals or institutions regulating entrepreneurs’ actions and their outcomes.

In addition to the stage of the country development and its well-being, the economic security of business greatly influenced by national mentality, culture, business aims and purposes, and risk behavior. Entrepreneurs’ assessment of their economic efficiency, their perception of risk as well as their combination determine the logics of making decisions in a business environment (Stroe, Parida, Wincent, 2018).

However, David L. Poole (Poole, 2018) states that, using as a pretext the development of measures to facilitate emerging SME sector promoted as the new development prescription for low-income countries, politicians are based on unproven claims and are therefore exposed influence of broad array of vested interests, be they vendors of microcredit, management consultants or economists of various persuasions.

Due to institutional voids and deficient formal institutions in transitioning economies, entrepreneurs believe in their business reinvestment if they have political connections (Ge, Stanley, Eddleston, Kellermanns, 2017). political connections can encourage entrepreneurs to see opportunities for growth and, in contrast, entrepreneurs lacking political connections mainly see threats in a deteriorating institutional environment and, thus, limit their business reinvestment.

(Rajan, Zingales, 2003) examines the development of a financial sector in different countries in the twentieth century (the level of 1913 compared with that of 1999). The authors try to find some common patterns in the influence of individual groups’ interests on economic development of various countries. They mention that the politics of interest groups is a crucial factor of financial and economic development of different countries. The authors conclude that the development of some emerging economies hindered by their incumbents’ opposition. Due to their privileged access to financing in underdeveloped financial systems incumbents have a positional rent. The disclosure systems and law enforcement diminish the relative importance of incumbents’ reputation and reduce barriers to an entrance into business.

Many researchers, e.g. (de Soto, 1989), claim that the countries with a weak institutional system have informal economic sectors (shadow economy) playing a prominent role and trying to establish an exchange structure. Insufficient protection of property rights immobilizes the exchange process ensuring contract relationship. It is a question of not only high transaction costs but also an institutional system, which determines the basic structure of production and contributes to a conservation of the low level of development.

Manсur Olson, studying the shifts in relative positions of different countries and regions in the period after World War II, advances a thesis that the longer the society lives in a political stability, the more likely powerful lobbies with special interests emerge which, in turn, depresses the efficiency of economy (Olson, 1982).

There is a widespread belief that the reasons of property concentrations in different countries connected to the quality of institutional environment and the level of confidence between market actors. With a low confidence level, weak contract discipline, a paucity and non-transparency of economic information, the lack of independent judiciary, unreliable enforcement mechanisms, a high level of corruption only rather strong and stable informal and kinship relations assist in forming a business environment where complex long-term transactions and deals are possible.

When participants in economic interaction belong to the same family or group, the level of trust increases, the risk of opportunistic behavior diminishes, and transaction costs decrease. Sustainable economic ties within business groups are complementing or replacing dysfunctional commodity, labor, and capital markets. In addition, due to the lack of developed business skills and corporate governance, the management concentration allows a single person enjoying the general confidence to control a large array of resources. It should be noted that business integration processes affect not only Russia; they increased worldwide in the second part of the twentieth century. Key economic entities integrated in the global economy include

- transnational corporations, long-term strategic alliances, transnational banks and investment companies, financial and industrial groups,

- self-regulating organizations of professional participants in financial and securities markets, business unions and associations, private entrepreneur’s associations facilitating trade and marketing,

- world economic and financial institutions (the International Monetary Fund, the groups of a World Bank, the World Trade Organization (WTO),

- regional integration associations (the European Union, the North American Free Trade Association (NAFTA), the Association of Southeast Asian Nations (ASEAN), etc.);

- sectorial organizations of commodity-producing countries (OPEC of petroleum exporters, the alliance of cocoa producing countries, the intergovernmental council of copper exporting countries, the association of rubber producing countries, etc.).

Thus, an international superstructure regulating and controlling more than half of all world resources and operating according to the principles that differ from traditional ones for national economies has emerged.

At the micro level, an inter-company cooperation and integration lead to the fact that in real economic life competition takes place not so much at the level of individual firms, as at the level of all sorts of alliances, unions, and associations. In other words, competition takes the form of rivalry between teams and associations consisting of groups of companies.

Entrepreneurs’ individual interests and their associations’ collective interests interact in entrepreneurial activity and use network forms of business organization. The collective interests of joint network activities convert into the firm’s benefits. Inter-company network initiatives supported by the state base on the idea that benefits increase as more participants communicate with each other (Munksgaard, Medlin, 2014).

However, strengthening integration processes force to pay more attention to the problems of ensuring the protection of individual association members’ economic and strategic interests and economic security. This happens both at the macro level and at lower levels of economic activity. In particular, the strategic interests of individual members of associations and alliances include not only the access to resources and sources of raw materials, preservation and consolidation of trade flows and markets, but also the protection of their own economic interests, the preservation of the ability to make decisions and a certain independence.

On balance, it seems that major conditions of entrepreneurs’ interest protection determining the level of business economic security are as follows:

- respect for property rights and the rule of law,

- transparency of the accounting and disclosure system,

- legal system determining the level of transaction costs,

- regulatory infrastructure protecting entrepreneurs, promoting competition and reducing risks.

Entrepreneurial activity is a result indicator depending on the prevailing external conditions of economic activity including the conditions for setting up and running a business and the barriers to doing business. At the same time, entrepreneurial activity is an indicator of the level of business’s economic security.

With the decline in the population’s purchasing power, the fall in real incomes and the unavailability of borrowed funding sources, business activity slows down noticeably; entrepreneurs abandon long-term projects and invest primarily in liquid assets.

The largest decline in entrepreneurial activity is observed in wholesale and retail trade; agriculture, forestry, hunting, fishing and fish farming; financial and insurance activities. At the same time, the number of enterprises registered only in the field of health and social services increases. Similar trends observe in almost all regions of the country.

Thus, the Russian Federation in the regional and sectorial profiles is experiencing a decline in entrepreneurial activity. Ensuring economic security base, on the one hand, on the availability of resources and material means sufficient to guarantee protection and development and, on the other hand, manifests itself in people’s meaningful and organized actions aimed at achieving the goals set and taking preventive measures. Consequently, business representatives do not consider the current business environment to be safe and are more likely to reduce their business activity.

Over the past years, the Russian economy has undergone major political and institutional changes having an impact on private entrepreneurial activity. We are talking about strengthening the state’s influence on economic life, and its control and supervisory functions, measures to strengthen tax administration at both the federal and regional levels, the growing influence of law enforcement agencies and the legislative expansion of their rights (for example, in the investigation of tax offenses), the control over the economic agents’ behavior. In addition, the concentration of centrally distributed resources among state-owned corporations, companies and banks with state participation is increasing.

Business processes provide through the interaction of government agencies shaping the conditions and priorities of economic policy and business structures operating directly in different sectors of the economy.

Recently, the degree of political influence on the economy has increased which is connected both with the foreign policy aggravation and is the result of Western sanctions and Russian counter-sanctions. Among the most obvious trends are the establishment of trade barriers, both explicit and in the form of sanitary restrictions, restriction of budget purchases of imported goods and access to external borrowing, de-offshorization. Political regulation of economic activity often replaces the legal one.

There has also been an increase in the amount of fines imposed on business by the regulatory authorities (the Federal Service for Supervision of Communications, Information Technology and Mass Media, the Federal Service for the Oversight of Consumer Protection and Welfare, the Federal Service for Veterinary Surveillance, the Federal Service for State Registration, Cadaster and Cartography, The Federal Tax Service and the Pension Fund of the Russian Federation). Moreover, rather high fines impose for administrative offenses. This is largely due to the fact that the amount of a fine is included in the planning activities and the performance data of control and supervisory authorities. It should be noted that, logically, the mechanism for motivating officials of the supervisory authorities should include an assessment of the audited persons’ compliance with the current legislation and not revealed violations.

The state can coordinate laws and enforce non-monetary penalties, including prison sentences. Since administrative regulation forms within a certain legal field, its nature is predetermined by various kinds of legislative acts and regulatory documents, it seems appropriate to consider not just the state’s regulatory functions but the legislative and legal acts on which people make management decisions.

Differences in legal systems also historically determine the actions of the judiciary, the degree of its independence from the executive authority, the long-term consequences of decisions taken by the courts and their influence on the behavior of economic relation parties in future. The level of entrepreneurs’ protection in different countries closely relates to the historical affiliation of various national systems of law and their disposition for one or another legal tradition.

The fundamental differences of national law systems are due to historical, ideological, political, and mental features. In the Anglo-Saxon countries (in particular, the British and American legal systems), a common law system has historically formed and operates, whereas most countries of continental Europe has a civil law system (a special legal tradition formed in the Scandinavian countries). At the same time, the priority is not given to specific norms contained in the legislation of this or that country but to the historical origin of the legal system itself. R. I. Kapelyushnikov, in particular, describes the historical differences of legal systems as follows, “If the British common law courts initially served as a tool in the struggle of the Parliament against the Crown’s claims, on the Continent, on the contrary, they acted as obedient guides of its will” (Kapelyushnikov, 2006).

Paul Mahoney, who studied the interrelationship of the factors of economic growth and the characteristics of different legal systems, proved that, in addition to the widespread view that countries with common law legal systems have more developed financial markets than civil law countries, historical features of the formation and origin of legal systems motivate entrepreneurial activity and economic growth. The author also states that, in addition to the legal system, the position of the state determining administrative barriers and the authorities’ actions is of great importance. Anglo-Saxon countries applying the common law system ensure their economic growth through not only a particular legal system but also greater security of property and contract rights secured by the authorities’ actions (Mahoney, 2001).

The current legislation provides for preventive pre-trial and judicial protection of entrepreneurs’ rights. This includes the measures of pre-trial conflict resolution and preventive protection. They are negotiation procedures, signing dispute protocols, filing applications and complaints with government supervisors, notarization of documents, etc. One of the options for pre-trial protection of the interests of entrepreneurs is mediation, when a third party, a mediator, is invited to resolve the conflict, helping the parties to identify points of interaction and thereby resolve the conflict.

The Federal Institute of Mediation was enshrined in legislation with the Federal Law No. 193-FZ dated July 27, 2010 “On the alternative procedure for the settlement of disputes with the participation of a mediator (a mediation procedure)”. The reform was to have solved the main problem of the Russian courts – a high load. However, the reform has not justified the hopes. According to official statistics, the parties seek the help of a mediator only in few cases. The reason is the fact that there are no effective mechanisms for enforcing the mediation agreement in case one of the parties violates it. For example, if state courts issue an order to enforce the decision of the intermediate court, the mediation agreement cannot be enforced only if it has not already been approved as a settlement agreement in the judicial proceedings. The mediation is also not popular due to the relative cheapness and quickness of the Russian justice.

The judicial protection of entrepreneurs’ rights guaranteed by the Constitution of the Russian Federation may be exercised in regular courts, arbitration courts, and intermediate courts established under various associations of entrepreneurs. In case of the right violation, the entrepreneur has the right to file a claim with the court of the relevant authority. During the court session, they are entitled to assert their rights as stipulated by the Civil and Arbitration Procedure Codes of the Russian Federation as a plaintiff or a defendant depending on the quality of participation in the process.

Table 3 presents the court statistics data provided by the Judicial Department at the Supreme Court of the Russian Federation.

Table 3 shows that the Russian Federation has been going through the active process of the construction and development of its judiciary. Therefore, the number of proceedings increased nearly fourfold between 1995 and 2017.

Table 3

Number of completed cases heard by regular courts (according to court statistics)

Years |

Criminal cases |

Civil cases |

Administrative violation cases |

Total |

Criminal cases |

Civil cases |

Administrative violation cases |

|

|

in thnd |

% |

||||||

1995 |

1 064.4 |

2 805.4 |

1 927.3 |

5 797.1 |

18.4% |

48.4% |

33.2% |

|

1996 |

1 188.7 |

3 056.5 |

1 923.0 |

6 168.2 |

19.3% |

49.6% |

31.2% |

|

1997 |

1 045.5 |

3 878.5 |

1 879.5 |

6 803.5 |

15.4% |

57.0% |

27.6% |

|

1998 |

1 126.7 |

4 746.7 |

1 813.4 |

7 686.8 |

14.7% |

61.8% |

23.6% |

|

1999 |

1 260.6 |

5 002.9 |

1 824.8 |

8 088.3 |

15.6% |

61.9% |

22.6% |

|

2000 |

1 309.4 |

4 953.8 |

1 462.9 |

7 726.1 |

16.9% |

64.1% |

18.9% |

|

2001 |

1 202.8 |

3 678.2 |

1 462.9 |

6 343.9 |

19.0% |

58.0% |

23.1% |

|

2002 |

804.6 |

2 672.4 |

989.6 |

4 466.6 |

18.0% |

59.8% |

22.2% |

|

2003 |

675.7 |

2 188.8 |

623.2 |

3 487.7 |

19.4% |

62.8% |

17.9% |

|

2004 |

718.9 |

2 048.3 |

989.6 |

3 756.8 |

19.1% |

54.5% |

26.3% |

|

2005 |

722.1 |

1 907.0 |

378.4 |

3 007.5 |

24.0% |

63.4% |

12.6% |

|

2006 |

736.9 |

2 021.5 |

324.3 |

3 082.7 |

23.9% |

65.6% |

10.5% |

|

2007 |

1 188.7 |

9 010.2 |

5 553.5 |

15 752.4 |

7.5% |

57.2% |

35.3% |

|

2008 |

1 166.2 |

10 720.6 |

5 414.8 |

17 301.6 |

6.7% |

62.0% |

31.3% |

|

2009 |

1 113.4 |

13 314.3 |

5 650.8 |

20 078.5 |

5.5% |

66.3% |

28.1% |

|

2010 |

1 073.5 |

14 102.3 |

5 326.9 |

20 502.7 |

5.2% |

68.8% |

26.0% |

|

2011 |

997.3 |

12 668.2 |

5 296.0 |

18 961.5 |

5.3% |

66.8% |

27.9% |

|

2012 |

942.0 |

10 259.0 |

5 731.5 |

16 932.5 |

5.6% |

60.6% |

33.8% |

|

2013 |

943.9 |

12 831.9 |

5 809.0 |

19 584.9 |

4.8% |

65.5% |

29.7% |

|

2014 |

936.6 |

13 872.7 |

6 461.5 |

21 270.8 |

4.4% |

65.2% |

30.4% |

|

2015 |

962.6 |

15 820.0 |

6 620.0 |

23 402.6 |

4.1% |

67.6% |

28.3% |

|

2016 |

963.9 |

17 029.2 |

6 423.1 |

24 416.2 |

3.9% |

69.7% |

26.3% |

|

2017 |

914.9 |

14 511.7 |

6 512.1 |

21 938.7 |

4.2% |

66.1% |

29.7% |

|

Source: the Judicial Division of the Russian Federation Supreme Court

http://www.cdep.ru/index.php?id=79

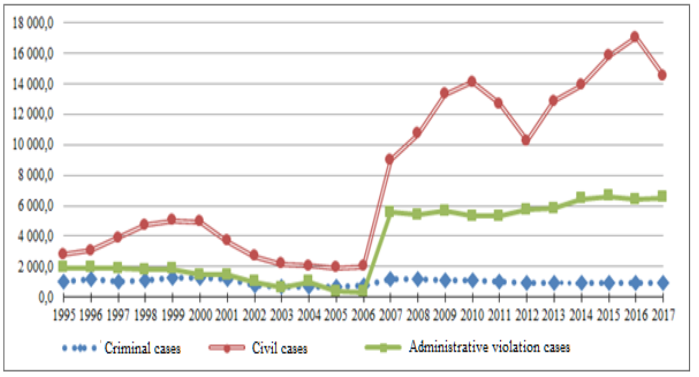

Fig. 1 shows the dynamics of court proceeding by different law branches. According to it, since 2007 there has been a sharp increase in court hearings examined by regular courts in civil cases involving administrative offenses.

This is due to the following reasons.

Firstly, due to the significant changes in legislation and the expansion of powers of regular courts there has been an increase in the staff number of federal judges of regular courts, an increase in staff number of assistant judges of federal regular courts, the extension of the staff of assistant judges and administrators of arbitration courts.

At the same time, the load of justices of the peace has increased several times, especially in civil and administrative cases.

Secondly, the financing of courts and judges’ material security has increased; the wages fund for court personnel and the Judicial Department at the Supreme Court of the Russian Federation has increased; the procedure of its formation has changed; the paying conditions of the judiciary employees have been brought into line with those of other federal government employees.

Thirdly, the automation and informatization of the judicial system have been completed. AIS area network has been introduced. The network is to provide information and analytical support for the functions of regular courts, various judicial bodies, the staff of the Judicial Department and its departments (divisions) in the Russian Federation regions.

Figure 1

Number of completed cases (with the last year

remains taken into account) heard by regular courts

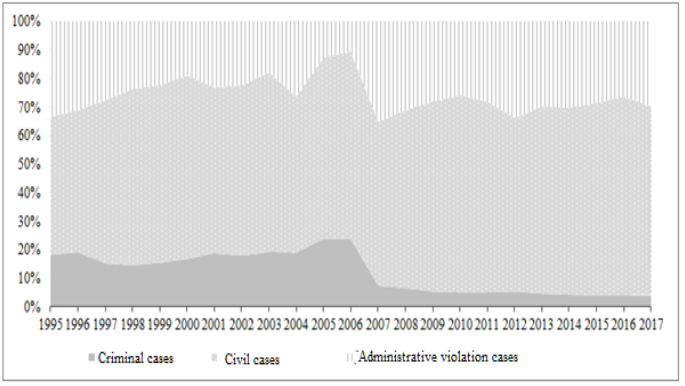

Figure 2 shows that the increase in the total number of court proceedings has decreased the proportion of criminal cases, but has increased the proportion of civil and administrative violation cases.

Figure 2

Structure of completed cases by law branches heard by regular courts

Despite the many options for protecting the entrepreneurs’ rights entrepreneurs do not feel protected. The reasons mentioned are the following: not always perfect legislation, unproductive activities of the judiciary in the field of an entrepreneurial law, entrepreneurs’ weak legal literacy especially among small businesses.

According to the results of surveys, entrepreneurs offer

- to hold regular meetings and debates with public officials,

- to create collegial councils at government bodies with the participation of entrepreneurs,

- to develop some mechanisms for pre-trial settlement of disputes with the assistance of professional mediators,

- to strengthen the information and consulting support for businesses,

- to assist in the organization and running of businesses.

Business representatives advocate for promoting the mechanisms of public-private partnership and strive to act as participants in promising and important projects.

For example, Vubiao Zhou states that the hybrid entrepreneurship forms with China’s public and private sectors help both to protect private property rights and to gain access to key resources and opportunities. Public-private hybrid forms act as a substitute for deficient market and legal institutions, which is one of the ways to protect the interests of entrepreneurship (Zhou, 2017).

At the same time, entrepreneurs insist on increasing the transparency of government activities, propose to develop an officials’ motivation system based on the economic growth assessment and real conditions of doing business, and introduce indicators for assessing the state and municipal government employees’ performance efficiency.

The entrepreneurs offer

- reduction in the number and duration of administrative procedures,

- decrease in the number of inspections by regulatory authorities,

- differentiation depending on the number of employees and the size of a business,

- access to municipal property, redemption and long-term lease of real property assets and land; smaller licensing requirements, etc.

However, the majority of entrepreneurs talk about the need to reduce tax burden on business, tariffs, rates, and mandatory payments. Taxation is known to lead to a conflict of private and public interests. Taxation restricts the property right guaranteed by the Constitution of the Russian Federation.

Tax relations in the view of state interests aim at systematizing tax revenues to the budgets of all levels and stimulating economic entities’ business activities. On the other hand, a tax system bases on the principle of the state’s dependence on taxpayers.

Further tasks to increase business confidence and economic security will require specific measures to create favorable conditions for improving a business climate, developing entrepreneurship, raising the business representatives’ awareness and knowledge of digital technologies, strengthening the ties between the scientific community, private and public sectors. At the same time, improving a regulatory legal framework, creating a favorable tax environment, encouraging investment in innovations, and encouraging entrepreneurship should become high-level political priorities.

The tragic events and accidents show that much more needs to be done to increase the responsibility of the founders of enterprises for the results of their activities. It is not only tax regulation, but also the need to streamline the processes of promoting and closing down of enterprises. Irresponsibility leads to the establishment of tens of thousands of one-day enterprises created to carry out specific transactions after which they cease to exist. As for the situations where accidents occur, it is difficult to find those responsible from both business and officials. There is a frequent change of incumbents and the company rotations.

1. Economic security ensures by meaningful and organized people’s actions aimed at achieving the goals set and taking preventive measures. Due to the low purchasing power of the population, the fall in real incomes and the lack of borrowed sources of finance the Russian Federation is going through a decline in entrepreneurial activity in both a service sector and a sphere of material production. The number of liquidated organizations exceeds the number of established one in virtually all the regions of the country with rare exceptions. Consequently, entrepreneurs do not consider the current business environment to be safe and are more likely to reduce their activities. This has mostly affected enterprises and organizations working in financial and insurance sectors, wholesale and retail trade, and agriculture. At the same time, the number of enterprises registered in healthcare and social service sectors is increasing.

2. The level of entrepreneurs’ right protection determined by the existing institutional and legal conditions including some administrative barriers to doing business on a particular territory as well as the level of a supporting infrastructure development and accessibility. Despite the many options for protecting the entrepreneurs’ rights business representatives do not feel protected. Not perfect legislation, unproductive activities of the judiciary in the field of an entrepreneurial law, entrepreneurs’ weak legal literacy especially among small businesses are reasons of the problem.

3. It seems that in this regard it is necessary to talk not about strengthening the control over participants in economic activities, but strengthening their responsibility subject to the application of law and the increase of relation openness and transparency among all interested parties. Such opportunities provide by the digital economy and IT in all areas of economic relations.

4. Trust and confidence in business based on the parties’ reputation and their interaction experience. The level of entrepreneurs’ confidence in the state remains extremely low. This can be attributed to both the lack of successful long-term cooperation and the variability of legal acts, conditions for doing business and the frequent change of incumbents making decisions on behalf of the state. Distrust and corruption appear in an environment where laws, rules, and regulations are formal in the absence of the rule of law and the selective practice of its application. In addition, the mechanisms of real public control inherent in a civil society are not yet sufficiently developed. The establishment of a civil society means the development of its judicial system being independent from executive authorities, easier access to the information on law interpretations and enforcement practice descriptions, and higher responsibility of all the parties involved in economic relations.

The paper is based on the research carried out with the financial support by RFBR according to the research project № 19-010-00032 А

Decree of the President of the Russian Federation of May 13, 2017 No. 208 “On the strategy of economic safety of the Russian Federation for the period up to 2030” (Section 1).

Abalkin L.I. (1970). Political Economy and Economic Policy. Moscow: Thought Publishing (p. 192).

Acs Z.J., Autio E. and Szerb L. (2014). National Systems of Entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476-494.

Autio E., Rannikko H. (2016). Retaining winners: Can policy boost high-growth entrepreneurship? Research Policy, 45(1), 42-55.

Beynon M.J., Jones P. and Pickernell D. (2018). Entrepreneurial climate and self-perceptions about entrepreneurship: a country comparison using fsQCA with dual outcomes. Journal of Business Research, 89, 418-428.

Buchanan J. (1997). Works: The Constitution of Economic Policy. Calculation of consent. The boundaries of freedom. Moscow: Taurus Alpha (p. 24).

Castaño M.S., Mendez M.T. and Galindo M.A. (2016). The effect of public policies on entrepreneurial activity and economic growth. Journal of Business Research, 69(11), 5280-5285.

Dahrendorf R. (1959). Class and class conflict in industrial society. Stanford, CA: Stanford University Press.

de Soto H. (1989). The Other Path: The Invisible Revolution in the Third World. New York: Harper and Row.

Dickel P., Graeff P. (2018). Entrepreneurs' propensity for corruption: A vignette-based factorial survey. Journal of Business Research, 89, 77-86.

Freeman R. (1984). Edward strategic management: a stakeholder approach. Boston: Pitman.

Ge J., Stanley L.J., Eddleston K. and Kellermanns F.W. (2017). Institutional deterioration and entrepreneurial investment: The role of political connections. Journal of Business Venturing, 32(4), 405-419.

Hamilton-Hart N. (2017). The legal environment and incentives for change in property rights institutions. World Development, 92, 167-176.

Kapelyushnikov R.I. (2006). The concentration of ownership in the system of corporate governance: the evolution of ideas. Russian Journal of Management, 4(1), 3–28.

Laplume А.О., Pathak S. and Xavier-Oliveira E. (2014). The politics of intellectual property rights regimes: An empirical study of new technology use in entrepreneurship. Technovation, 34(12), 807-816.

Mahoney P.G. (2001). The common law and economic growth: Hayek might be right. The Journal of Legal Studies, 30(2), 503-525.

Munksgaard K.B., Medlin C.J. (2014). Self- and collective-interests: Using formal network activities for developing firms’ business. Industrial Marketing Management, 43(4), 613-621.

Olson M. (1982). The rise and decline of nations: economic growth, stagflation, and social rigidities. New Haven. CT: Yale University Press.

Poole D.L. (2018). Entrepreneurs, entrepreneurship and SMEs in developing economies: How subverting terminology sustains flawed policy. World Development Perspectives, 9, 35-42.

Rajan G. R., Zingales L. (2003) The great reversals: The politics of financial development in the twentieth century. Journal of Financial Economics, 69(1), 5-50.

Ranasinghe A. (2017) Property rights, extortion and the misallocation of talent. European Economic Review, 98, 86-110.

Salman D.M. (2016). What is the role of public policies to robust international entrepreneurial activities on economic growth? Evidence from cross-countries study. Future Business Journal, 2(1), 1-14.

Sanchez de Pablo J.D., Peña Garcia Pardo I. and Hernandez P.F. (2014) Influence factors of trust building in cooperation agreements. Journal of Business Research, 67(5), 710-714.

Stroe S., Parida V. and Wincent, J. (2018). Effectuation or causation: An fsQCA analysis of entrepreneurial passion, risk perception, and self-efficacy. Journal of Business Research, 89, 265-272.

Syroyezhkin I.M. (1983) Methodological aspects of modeling economic interests. Leningrad: LFEI.

1. PhD in Economics, Associate Professor of the Department of Economics and Production Management of Tver State Technical University, Russia, e-mail: ivyakina@yahoo.com