Vol. 40 (Number 14) Year 2019. Page 26

TOLMACHEVA, Olga V. 1; LVOVA, Maya I. 2; CHERNYSHEVA, Natalya A. 3 y YEMELYANOVA, Alisa A. 4

Received: 05/02/2019 • Approved: 09/04/2019 • Published 29/04/2019

ABSTRACT: The basic subject of research is the process of the bail-out (financial recovery) of individual banks and the Russian banking system in crisis. The relevance of this topic depends on the importance of the sustainability of the Russian banking system and the Russian Federation Central Bank’s policies to recover this banking system. A new model of the bail-out with the Banking Sector Consolidation Fund (BSCF) had been created and implemented in mid-2017. The main changes are based upon the transition from credit scheme to the direct involvement of a regulator in the capital of banks during the financial bail-out. |

RESUMEN: El tema básico de la investigación es el proceso de rescate (recuperación financiera) de bancos individuales y del sistema bancario ruso en crisis. La relevancia de este tema depende de la importancia de la sostenibilidad del sistema bancario ruso y de las políticas del Banco Central de la Federación Rusa para recuperar este sistema bancario. A mediados de 2017, se creó e implementó un nuevo modelo de rescate con el Fondo de Consolidación del Sector Bancario (BSCF). Los cambios principales se basan en la transición del esquema de crédito a la participación directa de un regulador en el capital de los bancos durante el rescate financiero. |

There is a number of problems of the banking system because of economic crisis of 2008 and 2014-2015 in the Russian Federation. The banks were limited to receive borrowed funds in foreign countries because of the sanctions imposed. There was the lack of resources in the banking system as a result of the impossibility to borrow ‘cheap’ funds abroad. The mass revocation of banking licenses caused a lack of public trust in banks and banking system. There was the maximum quantity of the deposit contracts that were terminated. People preferred to keep the money at home.

Moreover, the weakening of the ruble had resulted in the debt of the commercial banks to the central bank that increased as a result of a reassessment of extended credits and reserves. That debt had reached the historical high of 6,5 trillion rubles in 2014. [8]

The State Duma of the Russian Federation had passed a decision on the bail-out to support the banking system.

Bail-out (financial recovery) is a process that intended to regain financial sustainability of bank, other market participants and banking system through measures taken by authorized bodies. Financial recovery is an alternative to bankruptcy.

The implementation of the concept for recovery of the banking system involving the government had started with the Central Bank of Russia and Deposit Insurance Agency of Russia (DIA) in 2005 and crisis of 1998 was the main reason of it.

The Federal Act dated 28 October 2008 № 175-FZ ‘On additional measures to strengthen the sustainability of the banking system in the period up to 31 December 2011’ [1] came into force. It determined operating conditions and parameters of State support for the troubled banks in Russia in order to prevent bankruptcy [9].

The Deposit Insurance Agency of Russia served as the insurer of contribution and as the bankruptcy commissioner and also had become an active participant in implementation of measures to recover banks in order to prevent bankruptcy from the date of adoption that Federal Act.

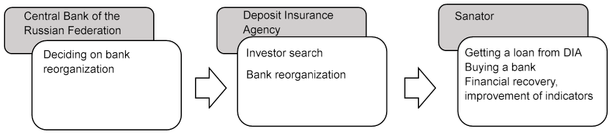

The procedures for implementing the banking bail-out had not changed for 10 years (figure 1). If a bank loses its financial sustainability, the Central Bank of Russia is able to offer the Deposit Insurance Agency of Russia to take part in the bail-out of this credit organization. The staff of the Central Bank and Deposit Insurance Agency of Russia assesses the financial situation of a bank and then the Deposit Insurance Agency either decides to take part in the bail-out or to refuse. The DIA searches for the investor and begins to conduct the procedure of financial recovery. This bank is sent low-interest loan and is launching the financial recovery.

Figure 1

The model of the banking bail-out until the mid-2017.

The Federal Act dated 26 October 2012 №127-ФЗ ‘On insolvency (bankruptcy)’ indicates some reasons. After discovery one of them a director of a bank has to be asked the Central Bank of Russia to conduct the procedure of the bail-out. A list of reasons:

There are two types of the implementation of the banking bail-out [3]. The first one is the full bail-out involving a private investor or with the purchase of its shares by the DIA (if there is not a private investor at an early stage). The second one is the so-called partial bail-out which entails delegation of the part of responsibility and assets (equivalent amount) from a troubled bank to a bank with financial sustainability and the further elimination of a troubled bank.

There are three situations in the banking system related to commercial banks without financial sustainability

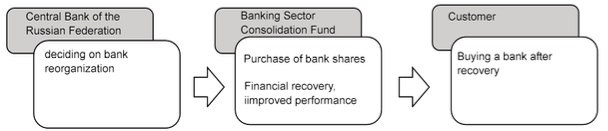

The credit type of the implementation of the banking bail-out was valid until the mid-2017. After the adoption of the amendment of the Federal Act dated 10 July 2002 № 86-FZ ‘On the Central Bank of the Russian Federation (Bank of Russia)’ (was adopted by the State Duma on 27 June 2002, the most recent version) [4] the Banking Sector Consolidation Fund, which funds are administered through the company (under the Central Bank of Russia), was created. From now on, the bail-out is conducted with the financial resources of the Fund [10]. Thus, the modifications consist mainly of the transition from credit scheme to the direct involvement of a regulator in the capital of banks during the bail-out.

There are the exact procedures for implementing the banking bail-out since the mid-2017 (the Figure 2). When a bank loses its financial sustainability, the Central Bank of Russia makes a decision on participation in the bail-out of this credit organization. The Banking Sector Consolidation Fund buys shares of this bank and begins to conduct the procedure of financial recovery. After this procedure the Banking Sector Consolidation Fund searches for a purchaser of the bank.

Fig. 2

The model of the banking bail-out after 2017

There is the acceleration of slower main economic indicators in the Russian Federation economy at the end of 2014-2015. The following table 1 shows the dynamics of the main Russian economic indicators such as gross domestic product (GDP), inflation, external debt, refinancing rate and etc. from 2012 to 2016.

Table 1

The dynamics of the main economic indicators

in the Russian Federation from 2012 to 2016

Indicator |

2016 |

2015 |

2014 |

2013 |

2012 |

GDP, bln rbl. |

86,044 |

83,232 |

79,199 |

73,133 |

68,164 |

Inflation, % |

5.4 |

12.9 |

11.36 |

6.45 |

6.58 |

Externak debt, bln $ |

|

515.3 |

597.3 |

|

|

Refinancing rate, % |

- |

8,25 |

8,25 |

8,25 |

8,25 |

Key rate, % |

10 |

11 |

17 |

5,5 |

- |

Fixed investment, bln rbl. |

14,639 |

13,897 |

13,902 |

13,450 |

12,586 |

The dynamics of economic indicators (high inflation, decrease of the income of the inhabitants and etc.) complied with a decline in retail segment credit for banks and a lack of new creditworthy borrowers. Eventually the indicators of cost-effectiveness and capital adequacy of commercial banks fell, arrears increased.

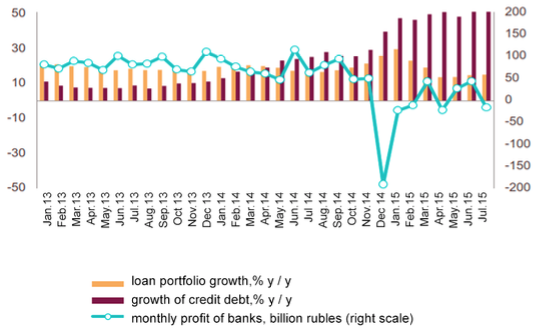

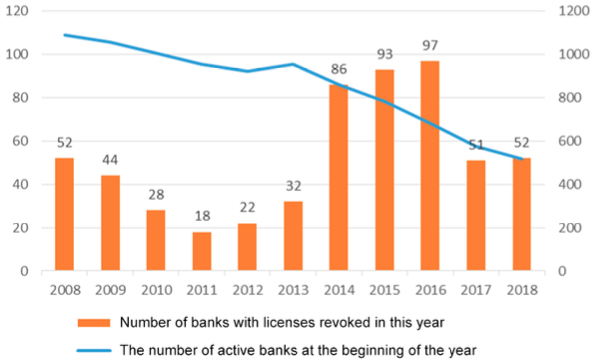

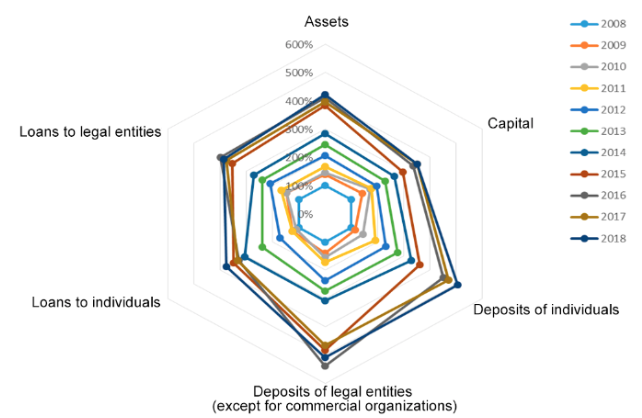

The figure 3 shows the main indicators of the banking system (in % of the same month of a previous year, bln rbl.) according to the Central Bank of Russia.

Figure 3

The main indicators of the banking system, bln. rbl.

There is increase in arrears as a result of the difficult financial situation of borrowers. Banks bear the additional costs of the establishment of reserves for possible loss.

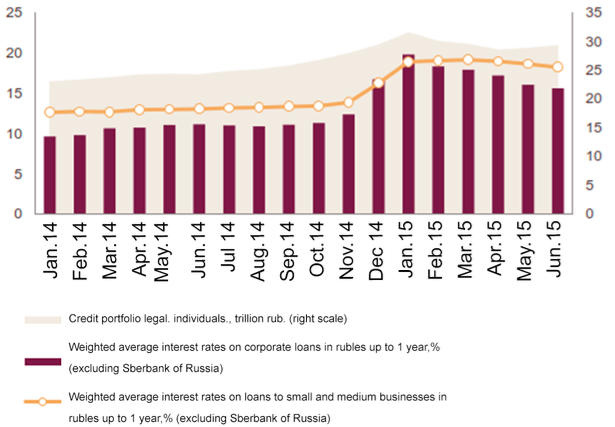

Commercial banks adopt a conservative policy during crisis, thus increasing interest rates on credit funds needed for replenishment of turnover means.

Figure 4

Weighted average interest rates in rubles (excluding PJSC ‘Savings Bank of

Russia’), per cent per annum (%), data from the Central Bank of Russia.

Commercial banks are in a closed circle. The increase in interest rates caused the decline in credit, which, in turn, affected the lack of working capital for development, decrease of net interest margin and increase in loss. As a result, commercial banks need financial support of the government.

Figure 5

The dynamics of the number of the banks

with revoked license for 2008-2018 [7].

According to the statistical data from the Central Bank of Russia (the figure 5), the decrease of the number of current credit organizations in Russia is due to revocation of credit license. 575 licenses were withdrawn over the past 10 years.

About 2 per cent of the current credit organizations are not participants of the System of deposit insurance

Figure 6

Change of the main indicators of the banking

system in Russia (2009-2018 relative to 2008)

Let us consider the dynamics of the main indicators of the banking system in Russia (Fig. 6).

Recourse framework of credit organizations continues to grow with funds provided by customer accounts.

The volume of individual’s deposits increased by 7,0 % for 2017 (25 trillion rubles). Legal entities’ deposits increased by 9 trillion rubles for 2017.

Russia has stagnated in times of the economic recession of the banking system.

The bank's assets of the Russian Federation increased by just 1,1% since 2015. Eventually the profitability of assets and capital is respectively 1% and 8%. The amount of own means increased, with the result that their adequacy has increased to 12%. However, it is important that the main factor of the growth of capital was the Government programme aimed at obtaining capital.

There are a lot of attempts to conduct the procedures of the bail-out of even not large credit organizations in Russia. The link between the country's financial situation and bail-out of banks has been revealed. For example, the Central Bank of Russia decided to conduct the procedures of financial recovery of 14 credit organizations during crisis of 2008-2008. The bail-out of 2 banks was declared during the relatively stable period from 2010 to 2013 [11].

The bail-out of 12 and 15 banks was conducted after the imposition of sanctions and serious deterioration in the country's economy in respectively 2014 and 2015. The situation did not change in 2016. The bail-out of PJS Company ‘Bank Otkritie Financial Corporation’ and PJS Company ‘B&N Bank’, which were in the top-15 the largest credit organizations, was conducted in the third quarter of 2017 [11]. This was due to the main national feature of financial recovery, namely a relatively small percentage of the successful bail-out.

Let us consider the advantages and disadvantages of the model of the bail-out until 2017 (the table 2).

Table 2

The advantages and disadvantages of

the older model of the bail-out until 2017

Advantages |

Disadvantages |

increase in the regions of United Bank presence |

low efficiency of the bail-out |

significant increase in client base |

low percentage of return of budget funds for saving |

cost reduction related to the current activities |

lack of an open mechanism for the Central Bank of Russia to determine banks in need of financial recovery |

|

selection process for investors who are responsible for the bail-out and assessment of funds |

|

possibility for banks to change financial situation through asset distribution on the account of troubled bank |

The new model of the bail-out solves the problems of the previous one but also there are some new disadvantages (the table 3).

Table 3

The advantages and disadvantages of the new model of the bail-out.

Advantages |

Disadvantages |

cost reduction related to the bail-out |

opacity of financial decisions |

increase in restoration of financial sustainability |

increase in the state share on the market

|

real, rather than spurious recovery |

possibility of appearance of conflict of interest |

increase in control over expense |

danger of appearance of conflict of interest |

deletion of dependence of the bail-out on a financial position of a bank-investor |

violation of the principles of competition |

|

bail-out of large banks for which will be difficult to find a buyer |

|

high cost for the bail-out |

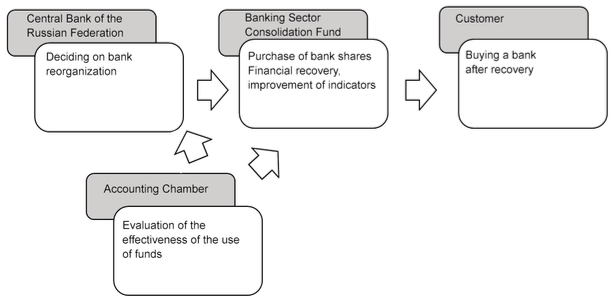

Several options of a change of the current banking bail-out can be suggested.

To involve an external body, for example, the Court of Auditors, in assessment of funds which the Central Bank of Russia gives for the bail-out (the figure 7).

Figure 7

The model №1 of the bail-out.

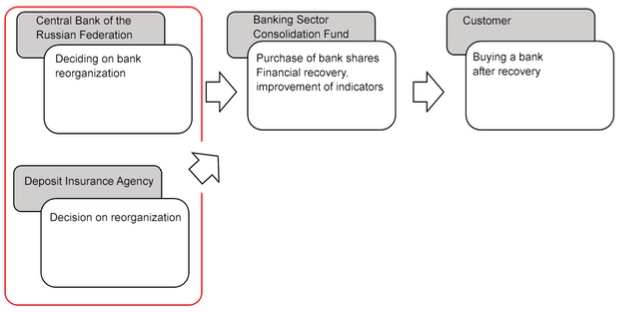

To share the authority between the Central Bank of Russia and Deposit Insurance Agency of Russia within the bail-out. That means that there are people or organizations that are responsible for the bail-out and it solves staffing problem because the Deposit Insurance Agency of Russia has gained considerable experience in the bail-out and has a staff of experts (the figure 8).

Figure 8

The model №2 of the bail-out.

The new model of the banking financial recovery was introduced about a year ago and it is too soon to say about its effectiveness.

There are some problems of the new model of the banking bail-out. Firstly, it may not be enough money given by the Central bank of Russia for the banking bail-out. And these banks can pose a threat to financial and economic stability of the government. Thus, the same disadvantages that new mechanism has tried to struggle with will appear because of the necessity of funds. Secondly, there is not management that’s able to recover a large credit organization in the short term without additional measures such as spinning off ‘toxic’ assets and their transfer to a specially created bank. Moreover, that bank is also in need of funding. Thirdly, the termination of the obligation to subordinated creditors has been a problem. Also this situation should be settled by the law. In addition, the establishment of a large financial institution which belongs to a regulator can lead to negative trends on the market of banking services, including an area of competition [6].

The economic crisis determined some problems of the banking sector in Russia. The most effective measure towards the increase in the financial sustainability of banks is support from the State to recover the banking system. The recent reform of the banking bail-out resulted in the following changes: the transition from credit scheme to the direct involvement of a regulator in the capital of banks during the bail-out. It is still early to predict the outcome of the results related to the new model of the banking bail-out. The Banking Sector Consolidation Fund has been conducting the bail-out of the banks during the year and none of them were sold on the open market. The Central Bank of Russia hopes that the banking bail-out will be able to help credit organizations to become more attractive to investors. However, the problem is that there are not many investors, who are ready to invest in the bank assets.

Some issues of the new model of the banking bail-out could be resolved by the introduction of the new supervisory authority and sharing of the authority between the Central Bank of Russia and, for example, Deposit Insurance Agency of Russia. But also there are other matters related to a search for investors, the Banking Sector Consolidation Fund, its possibilities to recover a lot of banks at the same time.

The banking sector of Russia which was in crisis three times over the past 10 years was analyzed. Three groups of banks can be therefore identified. The first group is banks that need to be recovered. The second one is banks with the license revoked and others.

Two models of the bail-out were analyzed. The first model had been operating since 2008 and was reformed just in the mid-2017.

It is considered that the banking bail-out has been gaining the popularity and this requires creating the model in accordance with the economic conditions of the country.

Abernathy, J. L., Herrmann, D., Kang, T., & Krishnan, G. V. (2013). Audit committee financial expertise and properties of analyst earnings forecasts. Advances in Accounting, 29, 1–11.

Abbott, L. J., Parker, S.,&Peters, G. F. (2004). Audit Committee Characteristics and Restatements, 23, 6987.

Albring, S., Robinson, D., & Robinson, M. (2013). Audit committee financial expertise, corporate governance, and the voluntary switch from auditor-provided to non-auditor-provided tax services. Advances in Accounting, Incorporating Advances in International Accounting, 1–14.

Baron, R.M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–82.

Bremser, W. G., & Chung, Q. B. (2005).A framework for performance measurement in the e-business environment. Electronic Commerce Research and Applications, 4(4), 395–412.

Grafton, J., Lillis, A. M., & Widener, S. K. (2010). The role of Performance Measurement and Evaluation in building organizational capabilities and performance. Accounting, Organizations and Society, 35(7), 689–706.

Henri, J.-F. (2006). Management control systems and strategy: A resource-based perspective. Accounting, Organizations and Society, 31(6), 529–558.

Jamil, C. Z. M., & Mohamed, R. (2011). Performance Measurement System (PMS) in Small Medium Enterprises (SMEs): A Practical Modified Framework Jamil & Mohamed. World Journal of Social Sciences, 1(3), 200–212.

Jamil, C. Z. M., & Mohamed, R. (2013). The Effect of Management Control System on Performance Measurement System at Small Medium Hotel in Malaysia. International Journal of Trade, Economics and Finance, 4(4), 202–208.

Kaplan, R.S., Norton, D.P., (1996). The Balanced Scorecard: Translating Strategy into Action. Harvard Business School Press, Boston, MA.

Kuye, O. L., Ogundele, O. J. K., & Otike-Obaro, A. (2013). Government Bailout of Financially Distressed Banks in Nigeria : A Justifiable Strategy Department of Business Administration University of Lagos International Journal of Business and Social Science, 4(8), 174–180.

Langfield-Smith, K. (1997). Management control systems and strategy: A critical review. Accounting Organizations and Society, 22(2), 207–232.

Terjesen, S., & Singh, V. (2008). Female Presence on Corporate Boards: A Multi-Country Study of Environmental Context. Journal of Business Ethics, 83(1), 55–63.

Vo, D., &Phan, T. (2013). Corporate governance and firm performance: empirical evidence from Vietnam

Zahra, S., & Pearce, J. (1989). Boards of Directors and Corporate Financial Performance: A Review and Integrative Model, 15(2), 291–334.

1. Ural Federal University, 620002, Russia, Ekaterinburg, Mira str., 19

2. Ural State University of Economics, 620144, Russia, Ekaterinburg, 8 marta str., 62

3. Ural Federal University, 620002, Russia, Ekaterinburg, Mira str., 19

4. Ural Federal University, 620002, Russia, Ekaterinburg, Mira str., 19

Contact Email: ctig.usue@mail.ru