Vol. 40 (Number 18) Year 2019. Page 3

KRAINER, Christiane W. M. 1; KRAINER, Jefferson A. 2; VIDOLIN, Ana C. 3; MATOSKI, Adalberto 4; ROMANO, Cezar A. 5; TEIXEIRA, Marcelo C. 6 & SILVA, Rogério B. 7

Received: 20/12/2018 • Approved: 18/05/2019 • Published 03/06/2019

ABSTRACT: The objective of this article is to characterize the relationship between construction companies and their suppliers of construction materials, in order to subsidize strategies for the formation of partnerships. An applied, descriptive and quantitative research was carried out in construction companies in the Metropolitan Region of Curitiba. The results show that there is no partnership formation in the contractor-supplier relationship, there is only a good commercial relationship between the organizations involved. |

RESUMO: O presente artigo tem como objetivo caracterizar o relacionamento das empresas construtoras com seus fornecedores de materiais de construção, com a finalidade de subsidiar estratégias para a formação de parcerias. Foi realizada uma pesquisa aplicada, descritiva e quantitativa em empresas construtoras da Região Metropolitana de Curitiba. Os resultados revelam que não há formação de parceria no relacionamento construtora-fornecedor, há tão somente um bom relacionamento comercial entre as organizações envolvidas. |

The civil construction supply chain is characterized by fragmentation, instability, unique designs, high labor dependence, and by disregarding levels of uncertainty (Azambuja & O'Brien, 2009; Isatto, Azambuja, & Formoso, 2015). The productive chain of the sector is complex, heterogeneous, formed by a set of activities with different degrees of difficulty, interconnected by diverse products and various technological processes (Neves & Guerrini, 2010; Aitken & Paton, 2016). Isatto et al. (2015) adds that it is a system composed of multiple companies connected through commercial links in order to carry out the enterprise.

The multiple companies system becomes part of the supply chain in the sector, which generates efficiency problems, such as the lack of coordination and integration, due to the separation between the project and the construction of the enterprise (Xue, Li, Shen, & Wang, 2005; Meng, 2012). Thus, the processes of acquisition and integration of suppliers are directly associated with obtaining positive results, increasing productivity and reducing unit costs (Vrijhoef & Koskela, 2000; Christopher, 2016).

In this way, supply management plays a key role in the management of the supply chain of civil construction, as it operates with many suppliers, so that interorganizational relationships are a reality and impact on the performance of the chain companies (Isatto et al., 2015). Among the strategies of supply, the formation of partnerships stands out. Bandeira, Mello and Maçada (2009) and Ju, Ding, and Skibniewski (2017) emphasize that lasting partnerships avoid interrupting supply of materials, reducing the risk of delays and contractual fines, and making the company reliable and of high quality. The joint operation of the agents involved in the supply chain guarantees the full and correct execution of the activities within the construction site (Azambuja & O'Brien, 2009; Aitken & Paton, 2016).

In this context, the objective of this work is to characterize the relationship between the construction companies and their suppliers of construction materials, in order to subsidize strategies for the formation of partnerships.

The supply chain of a construction company has peculiarities that differ from that of other manufacturing industries. After all, the productive process in the construction sector takes into account the immobile end product, which is generally unique, with a long cycle of existence and inconstancy of resource utilization (Azambuja & O'Brien, 2009; Meng, 2012; Aitken & Paton, 2016 ), which makes it difficult to reproduce in the future the same arrangement of companies, making its supply chain unique (Isatto et al., 2015).

Vrijhoef and Koskela (2000) add that the civil construction supply chain is:

a) Convergent: the supplies converge to the construction site;

b) Temporary: organizations that are formed to carry out a single enterprise usually do not last for the next enterprise and may assume a configuration different from the previous one; and

c) Made-to-order: each project creates a unique product with little repetition.

Civil construction involves the participation, usually simultaneous, of many suppliers. Considering that a company, in general, participates in more than one type of operation., From the adaptation of the model of Sharpe (1963) , Fusco and Sacomano (2009), classify the suppliers of a certain organization in three levels:

a) Partner: value involved high, with high risk;

b) Preferential: amount involved and average risk;

c) Commercial: value involved and low risk.

One of the strategies for managing the supply chain is the formation of an alliance (partnership) to reach an objective through the interaction of the players (Neves & Guerrini, 2010; Ju et al., 2017). Santos and Jungles (2008), Isatto et al. (2015) reinforce the importance of the search for partnerships in civil construction, emphasize this action must be constant within the companies and should focus on the most representative suppliers (those with the highest percentage of purchases and expenses). The main reason is that the creation of partnerships, which has therefore a representative positive impact on competitiveness for both agents, involved (Isatto et al., 2015).

Different researchers classified the types of existing partnerships according to the degree of commitment between organizations (suppliers and companies). The types of partnerships between clients and suppliers are described in Fig. 1.

Figure 1

Types of customer / supplier partnerships

Authors |

Feature |

Types of Partneship |

Merli (1994) |

Three levels of operational relationship due to the degree of development of what he calls comakership or partnership relationship, in which actions are taken together.

|

Class III (common supplier): negotiations based on minimum quality specifications; security issues; prices; individual short-term lots; and systematic inspections of supplies. Class II ("integrated" supplier or "operational" comakership): quality guaranteed and self-certified based on pre-established criteria; systematic improvement of the quality and prices of the products supplied; automatic replenishment and without this-that intermediary; price adjustment based on agreed criteria; frequent supplies in small lots for "open" orders; long-term relationship and periodic reviews; overall responsibility for the products supplied; absence of receipt inspection; and supplier consulting and training. Class I (comaker supplier or partner): global com-kership with partnership characteristics; class II operational activities; cooperation in the design of new products / technologies; common investments in planning and development and in technological achievements; and continuous exchange of information on processes and products. |

Lambert, Emmelhainz and Gardner (1996) |

Three types of partnership defined according to the degree of involvement of the supplier with the company |

Type I: Companies position themselves as partners and, with limitations, manage activities and planning. The partnership has a short-term focus and covers only one area or sector of the organization. Type II: companies move beyond the management of activities, starting for integration. The partnership is long term. It covers various areas and areas of organizations. Type III: companies have a significant level of operational integration. Each company perceives the other as an extension of its own company. There is no deadline for the partnership to end. |

Li, Cheng, Love, and Irani (2001) |

Four stages of partnership

|

Stage 1 (competitive): partner companies are in contact with each other in a single point, there is no search for commitment, there is a high degree of confrontation. The partnership exists only to meet contract requirements. This is the most common case in civil construction partnerships. Stage 2 (oriented towards cooperation): there is greater communication and interaction between the parties due to the change in the format of the organizations to adapt to the enterprise. Stage 3 (integrated): communications and interactions are intensified even further, sharing of knowledge and resources between partners; Stage 4 (strategic cooperation): a strategic alliance is formed that promotes effective communication, exchange of knowledge, access to technology and resources. A partnership based on confidence and commitment is created.. |

Santos and Jungles (2008) point out three key elements to form partnerships: trust and cooperation, long-term relationship and information sharing. When these elements are present, the authors reinforce the probability of a positive result, such as the increase of the level of value added and the reduction of waste is greater. For Christopher (2016), supply chain management with a focus on relationships, trust, recognition and cooperation is essential for the pursuit of positive results, increased productivity, efficiency and reduced unit costs. According to Li et al. (2012) a better buyer-supplier relationship affects improving the competitiveness of organizations and is influenced by effective communication, trust and supplier development, factors that require long-term commitment and top management support.

Trust is based on the belief that the parties will not act in opposition to common interests. Trust allows suppliers to engage and cooperate in the development of their buyer's endeavors, further increasing the degree of commitment in the alliance (Purdy & Safayeni, 2000; Meng, 2012; Emuze, Kadangwe, & Smallwood, 2015). Trust becomes a strategic value when there are conditions for mutual gains (Cheng, Heng, Love, & Irani, 2004, Meng, 2012). Finally, there must be confidence that the partnership will be maintained (Neves & Guerrini, 2010; Vensellar, Gruis, & Verhoeven, 2015).

In the management of the relationship with suppliers, commitment and trust promote greater cooperation, reduce conflicts and improve decision-making (Cheng et al., 2004; Venselaar et al., 2015). Cooperation, which requires an information structure with methods of creation, administration and communication, is essential in the processes of innovation, acquisition of technology and openness to differentiated markets, as it provides access to resources and products, reduces risk and drives the development of competitive advantage (Neves & Guerrini, 2010, Isatto et al., 2015, Christopher, 2016).

Long-term relationships, usually established through contracts, can also result in increased trust. Contracts, in addition to consolidating trust, allow for a shared strategic vision and greater collaboration between companies, since a good buyer will work with their supplier and vice versa, so that both remain financially strong (Purdy & Safayeni, 2000; Venselaar et al., 2015). Santos and Jungles (2008) and Papadopoulos, Zamer, Gayialis, and Tatsiopoulos (2016) argue that long-term relationships allow for the elaboration of a shared strategic vision and are established by contract settlement in the distant future, with automatic renewal, according to the achievement of the expected results. The short-term relationships between builders and suppliers can provide productivity gains in the industry (Akintoye, Mcintosh, & Fitzgerald, 2000; Venselaar et al., 2015; Papadopoulos et al., 2016).

Sharing information, ranging from product and project specifications, planning and purchasing schedules to full access to a customer and / or supplier database, also boosts interorganizational integration, as can facilitate the transfer of know-how and the joint realization of trainings and meetings between buyers and suppliers (Purdy & Safayeni, 2000; Meng, 2012; Isatto et al., 2015). In addition, communication between organizations develops suppliers and promotes their commitment to strategic relationships in the search for continuous improvement, allowing suppliers' problems to be treated as problems of the construction companies and vice versa (Krause, 1999; Meng, 2012, Papadopoulos et al., 2016).

In order to achieve the objective of this work, we took into account the perceptions of one of the agents of the civil construction supply chain: the construction company. Data were collected from 35 construction companies in the metropolitan region of the city of Curitiba, located in the state of Paraná, Brazil.

We chose a non-probabilistic sampling for convenience, selecting accessible members of the population (companies that returned to the research appeal). The present research can not be considered as representative of the population, extrapolations and generalizations are not possible.

As a data collection instrument, a questionnaire was divided into two parts: profile of the organization and the interviewee (9 multiple choice closed questions); and identification of the elements that constitute the supplier-builder relationship (27 closed-ended multiple choice questions). The questionnaire was developed based on the theoretical framework researched, having as a directive source the works of Merli (1994), Lambert et al. (1996), Purdy and Safayeni (2000), Li et al. (2001), Santos and Jungles (2009) and Bandeira et al. (2009).

To transform qualitative variables into quantitative ones we use a semantic differential scale that comprises a pair of adjectives or antonym sentences. Respondents distributed responses on a scale of 1 to 7 points.

Results analysis was performed in two stages: descriptive and inferential analysis (Spearman's correction).

The descriptive analysis made possible some initial findings from the evaluation of the set of responses. In this analysis were applied measures that summarize the obtained data even more, presenting representative values of the whole series. Two types of measures were used: those of central position (average, median and arithmetic mean) and dispersion (standard deviation). For a standard deviation <1, the responses were considered to be consistent and for a deviation> 3, it was understood that there was a high variability in the responses (HAIR JR et al., 2005).

In the other step, inferential analysis, the data were entered into the software R and Statistical Package for Social Sciences (SPSS) to verify the correlation of Spearman (ρ), which is an associative measure (sharing of variance) between two variables with force or (increasing or decreasing a variable X generates the same impact on Y).

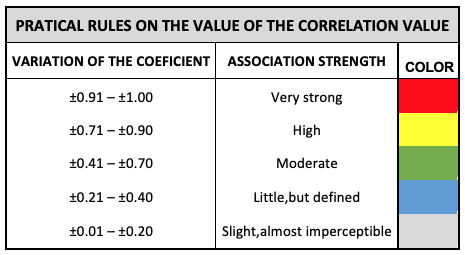

In the interpretation of the results, the Spearman correlation coefficient varies from -1 to 1. The positive or negative direction of the relationship between the variables is generated by the signal that suggests the strength of the relationship between the variables. The degree of correlation between the variables in each analysis was highlighted by the variation of the coefficient (ρ) defined by Hair Jr, Babin, Money, & Samouel (2005), with inclusion of colors for each association (Fig. 2).

Figure 2

Representation of Correlation Coefficient

Source: Adapted from Hair Jr. et al. (2005)

A perfect correlation (-1 or 1) shows that the score of one variable can be determined by knowing the score of the other. On the other hand, a zero value correlation reveals that there is no linear relationship between the variables.

First, the sample was identified (companies surveyed and respondents). The sample consisted of 35 construction companies. Table 1 summarizes the characteristics of the organizations surveyed, depicting their respective occurrences (in percentages).

Table 1

Profile of companies surveyed

Company Profile |

|||

Characteristics |

% |

Characteristics |

% |

Foundation |

Until 5 years – 12% |

Administration |

Family business – 40% |

Between 5 and 10 years – 14% |

Profissional Management – 34% |

||

Between 10 e 20 years – 37% |

Mixed Management – 23% |

||

More than 20 years – 37% |

Others – 3% |

||

Constitution |

Private Limited Company – 89% |

Certification |

No one– 60% |

Mixed Capital entity – 9% |

|

PBPQ-H – 20% |

|

Publicly Traded Company – 2% |

|

ISO 9001 – 26% |

|

|

|

Other – 3% |

|

Numbers of employees

|

Until 19 employees – 51% |

|

|

Between 20 and 99 employeess – 29% |

|

||

Between 100 and 499 employees – 9% |

|

||

More than 500 employees – 3% |

|

||

Not answer – 9% |

|

||

------

Table 2

Profile of companies respondents

Respondent profile |

Respondent profile |

||

Position/Function |

% |

Position/Function |

% |

Direction |

43% |

Engineer |

31% |

Coordination |

6% |

Production Supervisor |

3% |

Manager |

14% |

Technician |

3% |

It is extracted from this first approximation that the majority of the suppliers surveyed are located in Curitiba; have more than 5 years of foundation (88%); they are limited companies (89%); are managed by family members (40%) and professionals (34%); employ, in the majority (62%), between 20 and 99 100 employees; and hold ISO 9001 (26%) or no certification (60%).

With respect to respondents, as shown in table 2, the majority belongs to the sales department (58.40%). It should be clarified that the sellers of the supplier companies are specialized workers, generally engineers or business managers.

Subsequently, the descriptive analysis itself began. Table 3 shows the results obtained in relation to the localization and dispersion measurements.

Table 3

Profile of the researched companies

V |

Construction Company |

Mean |

Mode |

Median |

Standard Deviation |

1 |

What is the degree of commitment of the supplier in the participation and contribution in the cycle of development of your own products? |

4.77 |

5.00 |

5.00 |

1.26 |

2 |

Is there an operational relationship with your suppliers? |

3.66 |

3.00 |

4.00 |

1.63 |

3 |

What is the level of trust of the company regarding the suppliers? |

5.83 |

6.00 |

6.00 |

0.82 |

4 |

What are your expectations that the suppliers will fulfill the agreement? |

5.80 |

6.00 |

6.00 |

0.96 |

5 |

Is the relationship between the company and the suppliers a longstanding one? |

5.74 |

7.00 |

6.00 |

1.17 |

6 |

Is the contract renewed automatically when the desired performance and objective are met? |

4.43 |

6.00 |

5.00 |

2.17 |

7 |

Are there expectations of new contracts with your current suppliers? |

5.69 |

6.00 |

6.00 |

1.11 |

8 |

Do your suppliers encourage and invest in the development of new technologies? |

4.89 |

5.00 |

5.00 |

1.30 |

9 |

Do the suppliers have access to the composition of costs of your products (ventures)? |

2.77 |

1.00 |

2.00 |

1.73 |

10 |

Does the company pressure the suppliers so there is a rise in quality? |

5.57 |

7.00 |

6.00 |

1.22 |

11 |

How does the company perceive itself regarding its bargaining power towards its suppliers? |

4.83 |

4.00 |

5.00 |

1.22 |

12 |

Does the supplier offer its differentiated pricing policy to your company? |

5.06 |

6.00 |

5.00 |

1.24 |

13 |

Do your suppliers interfere in the production programs? |

3.31 |

2.00 |

3.00 |

1.76 |

14 |

Does the company have exclusive supply deals on your ventures? |

2.80 |

1.00 |

2.00 |

2.06 |

15 |

Does the company have suppliers that represent 50% or more of the costs of supply to the company? |

3.23 |

1.00 |

2.00 |

2.31 |

16 |

Does the company demand certificates of quality on its products and/or processes? |

4.91 |

5.00 |

5.00 |

1.48 |

17 |

Do the suppliers have autonomy to deliver materials without orders? |

1.37 |

1.00 |

1.00 |

0.97 |

18 |

Does the supplier participate in the meetings with the technical staff and the supply sector of the company? |

3.31 |

5.00 |

3.00 |

1.79 |

19 |

Does the company carry out recruitment processes for choosing its suppliers? |

4.29 |

5.00 |

5.00 |

1.54 |

20 |

Does the company carry out an evaluation process to measure the performance of its suppliers (inputs)? |

4.66 |

6.00 |

5.00 |

1.68 |

When observing (Table 3) the respondents pointed out: median commitment (5.00) with the development of their enterprises (median 5 - V1); operational relationship below average (average 3.66 - V2); and high level of confidence in its suppliers (mode 6 - V3). Most builders claim to have long-lasting relationships (over 5 years) with their suppliers (mode 7, median 6 and standard deviation 1.17 - V5). Long-term relationships, as well as trust, are key elements for the formation of partnerships (Santos & Jungles, 2008; Li et al., 2012; Papadopoulos et al., 2016).

Suppliers have high expectations that their customers comply with the combined (V4), which shows the presence of the element trust. In contrast, in relation to the automatic renewal of contracts (V6), these do not occur intensely (mean 4.43, median 5, with disparate responses high standard deviation: 2.17). The builders, in general, keep the same suppliers when entering into new contracts (mode and median 6 - V7).

There is moderate incentive and investment of suppliers in the development of new technologies (mode and median 5 - V8). From what is perceived, there is a high level of involvement and trust on the part of the supplier, who even believes in the existence of the benefits of the partnership. According to Santos and Jungles (2008), the formation of partnerships guarantees a more stable workforce and production for suppliers, which can be pointed out as one of the benefits of the partnership between suppliers and construction contractors.

The construction companies, in turn, pressure suppliers to increase quality (mode 7 and median 6 - V10), requiring the supply of certified inputs (mode and median 5 - V16). nother. As for access to cost formation of enterprises, most suppliers do not have full access (average 2.77, mode 1 and median 2 -V9). This result shows that there is no full confidence of the builders, which, consequently, does not fit the formation of true partnerships. Moreover, the construction companies have a medium bargaining power (mode 4 - V11); and there are no suppliers that represent more than 50% of the cost of supply (mode 1, median 2 - V15). On the other hand, they have ensured a differentiated price policy by the suppliers (median 5 - V12). The results indicate that there is an essentially commercial relationship.

Another two aspects identified in this research that are contrary to the consolidation of trust, cooperation and strategic partnerships are little or no autonomy for delivery of materials without a request (mode and median 1 - V17) and the non-predominance of exclusivity agreements in the supply of materials (mode 1, median 2 - V14).

Meetings with the technical staff and supplies sector (V18) occur with low frequency (median 3). The results also show that the contractors perform some selection process (average 4.29) and performance evaluation (average 4.66). The selective process, however, is medium in rigor (mode 5 - V19), while the supplier performance evaluation process is slightly more developed (mode 6 - V20). It should be noted, therefore, that there is still conditions for implementation and improvements in the selection and performance evaluation processes.

It is observed therefore, that suppliers tend to adapt to the requirements of the clients for the formation of the partnership, but this adaptation, in general, does not provide them with significant gains, which evidences the existence of an asymmetrical relationship between the agents, constructors with greater bargaining power.

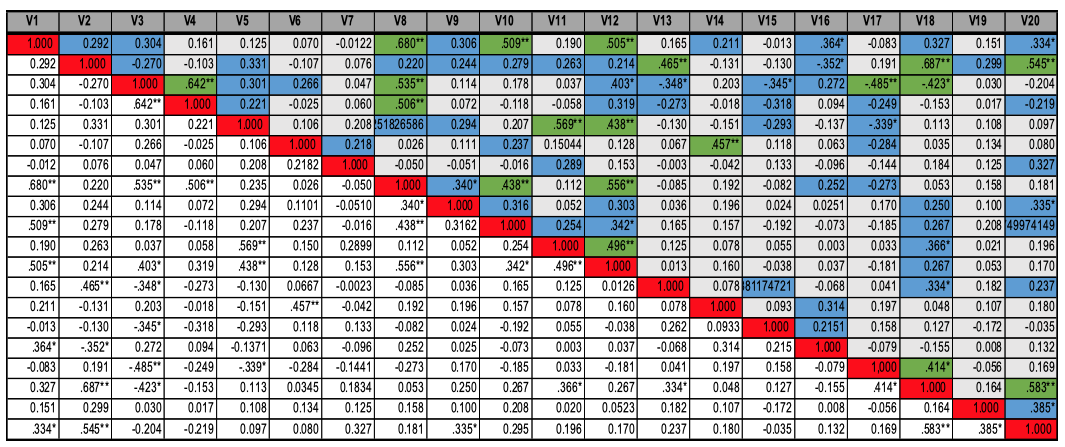

Finally, we set out to analyze Spearman's correlations. The results of the analysis are illustrated in Annexe. Note that of the 190 interactions among the variables, 117 (61.58%) represent slight, almost imperceptible associations; 55 (28.95%) small associations, however defined; and, 18 (9.47%) moderate associations.

The variables with the greatest strength of association are: V1, V2, V3, V4, V5, V6, V8, V11, V13, V17 and V18 (Table 4).

Table 4

Variables and their correlations

Variable |

Moderate Correlations |

Association |

V1 |

V8 |

0.680 |

V10 |

0.509 |

|

V12 |

0.505 |

|

V2 |

V13 |

0.465 |

V18 |

0.687 |

|

V20 |

0.545 |

|

V3 |

V4 |

0.642 |

V8 |

0.535 |

|

V17 |

0.485 |

|

V18 |

0.423 |

|

V4 |

V8 |

0.506 |

V5 |

V11 |

0.569 |

V12 |

0.438 |

|

V14 |

0.457 |

|

V8 |

V10 |

0.438 |

V12 |

0.556 |

|

V11 |

V12 |

0.496 |

V17 |

V18 |

0.414 |

V18 |

V20 |

0.583 |

The moderate correlation between the variables identifies which characteristics are most affecting in the relationship between the constructors and their suppliers and how they relate, providing indicatives that guide the formation of partnerships. The most important correlations are shown in table 5.

Table 5

Higher Variables and Correlations

Variable |

Moderate Correlations |

Association |

V2 - Is there an operational relationship with your suppliers? |

V18 - Does the supplier participate in meetings with the company's technical staff and supply sector? |

0.687 |

V1 - What degree of commitment of the supplier in the participation and contribution in the development cycle of its own products? |

V8 - Do your suppliers encourage and invest in the development of new technologies? |

0.680 |

V3 - What is the level of confidence of the company in relation to its suppliers? |

V4 - What is the expectation that your suppliers will comply with what has been agreed? |

0.642 |

V18 - Does the supplier participate in meetings with the company's technical staff and supply sector? |

V20 - Does the company conduct a process to evaluate the performance of its suppliers (inputs)? |

0.583 |

V5 - Is the relationship between the company and the suppliers lasting? |

V11 - How does the company perceive itself with regard to bargaining power over its suppliers? |

0.569 |

V8 - Do your suppliers encourage and invest in the development of new technologies? |

V12 - Does the supplier offer a differentiated price policy for the company? |

0.556 |

It is noted (Table 5) that the highest degree of correlation is between variables V2 and V18. In the perception of the respondents the greater the volume of meetings between supplier and builder the better the operational relationship with its suppliers. The participation of the supplier with the technical staff of the construction company (V18) also has a strong correlation with the performance evaluation process of the supplier companies (V20). Vendor performance evaluation processes encourage information sharing and, consequently, more meetings. The meetings bring companies closer together by promoting information sharing, transfer of knowledge, consulting, training, integration events and more.

The variable V8 (incentive and investment in the development of new technologies) also has a strong association (0.680 and 0.556, respectively) with variable V1 (degree of supplier commitment) and variable V12 (differentiated price policy for the construction company). These correlations suggest that the greater the incentive and investment in the development of new technologies, the greater the degree of commitment of the supplier in the development cycle of the products of the constructors and the better commercial conditions for both the builders and suppliers.

The performance of selective processes and performance evaluation of the suppliers are variables with emphasis of correlation, revealing the importance of the two processes. These processes promote the holding of meetings and the exchange of information between builders and suppliers.

Another association worth mentioning is the correlation between the level of confidence (V3) and the expectation of its suppliers to comply with the agreement (V4). Trust in the relationship increases, as long as the agreement in negotiation is fulfilled.

Finally, an association of relevance is the correlation between durable relationship between builders and suppliers (V5) and bargaining power (V11). These correlations point out that the more balanced the relationship the more lasting the relationship between organizations.

High level of trust and commitment, long-term relationship, differentiated price policy and operational cooperation are the main characteristics of the relationship between the contractor and the supplier. However, construction companies do not provide the costs of their products, there is little exclusivity in supplies, they pressure suppliers to increase quality and reduce costs.

The results show that the contractor-supplier relationship is in the primary stage both in the classification of Fusco and Sacomano (2009) and in the authors consulted as Merli (1994), Lambert et al (1996) and Li et al (2001) (Fig. 1). For the present sample, therefore, there is no partnership formation, there is only a good commercial relationship between the organizations involved.

The studies show that, for the formation of partnership, from the perspective of the construction company, a high frequency of meetings with the technical staff and the supplying sector of the client constructor is necessary. The builders believe that more meetings, the level of operational relationship will be better. Another important highlight in the formation of the partnerships is the degree of commitment and the level of incentive and investment in new technologies of the suppliers.

It is worth emphasizing the importance of selective processes and performance evaluation, which promote a larger number of meetings, and, consequently, increase trust and extend the duration of relations, which may also result in the formation of partnerships. After all, sharing information, trust, and long-term relationships are key elements in partnership.

In summary, a sustainable relationship, a high level of trust, supplier selection and evaluation, a greater volume of meetings with the supply and technical staff of the clients and negotiated bargain on mutual gains.

Aitken, A., & Paton, R. A. (2016). The ‘transaction X-ray’: understanding construction procurement. Proceedings of the Institution of Civil Engineers: Management, Procurement and Law, 169(3), 115-123.

Akintoye, A., McIntosh, G., & Fitzgerald, E. (2000). A survey of supply chain collaboration and management in the UK construction industry. European Journal of purchasing & Supply Management, 6(3-4), 159-168.

Azabuja, M., O'Brien, W. J. (2009). Construction supply chain modeling: issues and perspectives. In O’ Brien WJ, Formoso CT, Vrijhoef R and London KA (ed.). Construction supply chain management: handbook (pp. 2-31). CRC Press.

Bandeira, R. A. D. M., Mello, L. C. B. D. B., & Macada, A. C. G. (2009). Relacionamento interorganizacional na cadeia de suprimentos: um estudo de caso na indústria da construção civil [The interorganization relationship in the supply chain: a case study in the civil construction industry]. Produção, 19(2), 376-387.

Cheng, E. W., Li, H., Love, P. E., & Irani, Z. (2004). Strategic alliances: a model for establishing long-term commitment to inter-organizational relations in construction. Building and Environment, 39(4), 459-468.

Christopher, M. (2016). Logistics & supply chain management. UK: Pearson.

Emuze, F., Kadangwe, S., & Smallwood, J. (2015, February). Supply chain structures in construction: views from Malawi. In Proceedings of the Institution of Civil Engineers-Municipal Engineer (Vol. 168, No. 3, pp. 199-205). Thomas Telford Ltd.

Fusco, J. P. A.; Sarcomano, J. B. (2009). Alianças em redes de empresas [Alliances in business networks]. São Paulo: Arte & Ciência, 2009.

Hair, J., Babin, B., Money, A., & Samouel, P. (2005). Fundamentos de métodos de pesquisa em administração [Essential of business research methods]. Porto Alegre: Bookman Companhia Ed.

Isatto, E. L., Azambuja, M., & Formoso, C. T. (2013). The role of commitments in the management of construction make-to-order supply chains. Journal of management in engineering, 31(4), 04014053.

Ju, Q., Ding, L., & Skibniewski, M. J. (2017). Optimization strategies to eliminate interface conflicts in complex supply chains of construction projects. Journal of Civil Engineering and Management, 23(6), 712-726.

Krause, D. R. (1999). The antecedents of buying firms' efforts to improve suppliers. Journal of operations management, 17(2), 205-224.

Lambert, D. M., Emmelhainz, M. A., & Gardner, J. T. (1996). Developing and implementing supply chain partnerships. The international Journal of Logistics management, 7(2), 1-18.

Li, H., Cheng, E. W., Love, P. E., & Irani, Z. (2001). Co-operative benchmarking: a tool for partnering excellence in construction. International Journal of Project Management, 19(3), 171-179.

Meng, X. (2012). The effect of relationship management on project performance in construction. International Journal of Project Management, 30(2), 188-198.

MerliI, G. (1994). Comakership: a nova estratégia para os suprimentos [Comakership: the new strategy for supplies]. Rio de Janeiro: Qualitymark.

Neve, F., & Guerrini, F. M. (2010). Modelo de requisitos e componentes técnicos para a formação e gerência de redes de cooperação entre empresas da construção civil [Technician components and requirements model for the formation and management of cooperation networks among civil construction companies]. Gestão & Produção, 17(1), 195-206.

Papadopoulos, G. A., Zamer, N., Gayialis, S. P., & Tatsiopoulos, I. P. (2016). Supply Chain Improvement in Construction Industry. Universal Journal of Management, 4(10), 528-534.

Purdy, L., & Safayeni, F. (2000). Strategies for supplier evaluation: a framework for potential advantages and limitations. IEEE Transactions on Engineering Management, 47(4), 435-443.

Santos, A. P. L., & Jungles, A. E. (2008). Como gerenciar as compras de materiais de construção civil [How to manage materials purchases in construction]. São Paulo: Pini Ed.

SHARPE, W. F. (1963). Portifolio theory and capital markets. New York: Mac GrawHill.

Venselaar, M., Gruis, V., & Verhoeven, F. (2015). Implementing supply chain partnering in the construction industry: Work floor experiences within a Dutch housing association. Journal of Purchasing and Supply Management, 21(1), 1-8.

Vrijhoef, R., & Koskela, L. (2000). The four roles of supply chain management in construction. European journal of purchasing & supply management, 6(3-4), 169-178.

Xue, X., Li, X., Shen, Q., & Wang, Y. (2005). An agent-based framework for supply chain coordination in construction. Automation in construction, 14(3), 413-430.

Pearson correlation result

1. PhD. student, Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: chriswmk70@gmail.com

2. PhD. student, Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: profjeffersonkra@gmail.com

3. Msc. student, Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: ana.vidolin@uol.com.br

4. PhD., Prof. Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: romano.utfpr@gmail.com

5. PhD., Prof. Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: adalberto@utfpr.edu.br

6. Msc. student, Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: marcelo@trional.com.br

7. PhD. student, Postgraduate Program in Civil Engineering. Civil Engineering Academic Department. Federal Technological University of Paraná. Curitiba. Brazil. E-mail: rogerio.ufmt@outlook.com