Vol. 40 (Number 18) Year 2019. Page 30

KHEYFETS, B. 1 & CHERNOVA, V. 2

Received: 11/03/2019 • Approved: 12/05/2019 • Published 03/06/2019

ABSTRACT: The article examines the experience of developed and developing countries in structural and technological modernization of the economy through innovative means of strategic management and specialized programs – "Nouvelle France Industrielle" in France, "Industrie 4.0" in Germany, "Made in China 2025" in China, and "Make in India" in India. These programs focus on implementing fundamental structural changes and achieving concrete results in the medium and long term. It is indicative that the share of high-tech exports is growing rapidly in countries under consideration. The tasks set in such smart re-industrialization programs are highly relevant to the Russian economy and deserve careful consideration and adaptation. |

RESUMEN: El artículo describe la experiencia de las países desarrollados y en desarrollo en cuanto a la implementación de la modernización tecnológica de la economía por vía de los medios de la gestión estratégica utilizando los programas especiales tales como “Nouvelle France Industrielle” en Francia, “Industrie 4.0” en Alemania, “Made in China 2025” en China, “Make in India” en India. Estos programas tienen como objetivo la implementación de los cambios estructurales fundamentales y están orientados hacia el logro de los resultados específicos a medio y largo plazo. Cabe notar que la parte proporcional de las exportaciones de alta tecnología de los países de interés crece a un ritmo elevado. Las tareas de tales programas de reindustrialización inteligente son extremadamente relevantes para la economía de Rusia y merecen la consideración atenta y la adaptación. |

The global financial and economic crisis has shown an urgent need to accelerate structural and technological modernization based on new technologies which have caused the fourth industrial revolution (Shvab, 2016; Prause, & Atari, 2017; Gerlitz, 2016; Shatrevich, & Strautmane, 2015). These technologies would qualitatively change the sphere of material production, affect the entire society, and result in serious changes in the international division of labor. The introduction of additive technologies substantially reduces transportation and helps to localize diverse industries in countries with small markets where traditional technologies would not be effective. Additive technologies, in fact, shorten the global production chain and, accordingly, the volume of cross-border trade.

To respond to the new challenges of technological progress more effectively, most countries have developed strategic programs to create the appropriate material conditions for such transformations. This is not just about developed countries (which have implemented such programs as "Nouvelle France Industrielle" in France, "Industrie 4.0" in Germany, "High Value Manufacturing Catapult" in the UK, "Industrial Value Chain Initiative" in Japan, "Fabbrica del Futuro" in Italy, "Smart Factory" in the Netherlands, "Industria Conectada 4.0" in Spain, "Prumysl 4.0" in the Czech Republic), but also several countries with transitional economies (with the programs like "Manufacturing Innovation 3.0" in the Republic of Korea, "Made in China 2025" in China, "Make in India" in India, "Smart Nation Programme" in Singapore, "National Industry 4.0 Policy" in Malaysia, "National Technology Initiative" in Kazakhstan, etc.). Although most of these programs affect all sectors of the economy, they have their own priorities. Some of them mainly focus on the accelerated introduction of technologies of the fourth industrial revolution. In this regard, these programs can be called an instrument for selective structural policy. The majority of structural and technological transformations envisaged by such programs refer to the industry and related service sectors. Therefore, these programs can reasonably be called re-industrialization programs, and, given their selective and innovative character, smart re-industrialization programs.

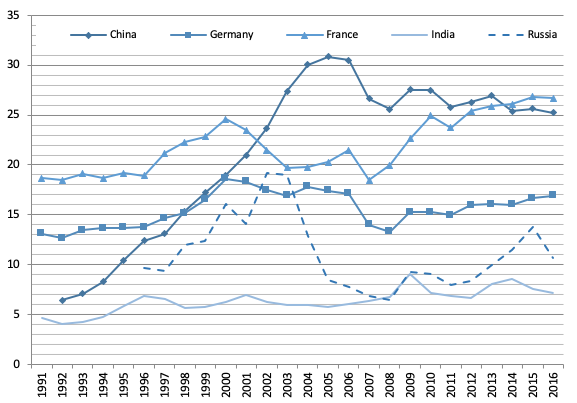

It is worth noticing that the share of high-tech exports in the entire volume of export-oriented manufacturing industry is growing rapidly in countries that have adopted smart re-industrialization programs. In Russia, this indicator is significantly lower than in the developed European countries and China (Fig. 1). The problems of development of small and medium-sized enterprises in the context of their information function (by the example of Russian companies) are discussed in detail in the works by Litau (2018a, 2018b).

Fig. 1

High-tech countries' exports in % of the total manufacturing export

Source: (World Bank, 2018)

Notably, according to "The Readiness for the Future of Production Report 2018" released by the World Economic Forum (WEF) experts, countries that have adopted these programs outpace Russia (Table 1).

Table 1

Russia and foreign countries on key readiness

criteria for future production (score)

Rank indicator |

Russia |

China |

India |

Republic |

France |

Germany |

Production structure |

||||||

Overall score |

35 |

5 |

30 |

2 |

18 |

3 |

Complexity |

44 |

27 |

48 |

4 |

15 |

2 |

Scope |

25 |

1 |

9 |

2 |

28 |

12 |

Production drivers |

||||||

Overall score |

43 |

25 |

44 |

21 |

10 |

6 |

Technology and innovation |

39 |

25 |

34 |

17 |

14 |

8 |

Human capital |

25 |

40 |

63 |

30 |

23 |

7 |

Global trade and investment |

49 |

9 |

55 |

17 |

14 |

8 |

Institutions |

87 |

61 |

54 |

25 |

21 |

14 |

Stable resources |

35 |

66 |

96 |

46 |

10 |

13 |

Overall demand |

20 |

2 |

5 |

13 |

10 |

4 |

Source: (World Economic Forum, 2018)

All this suggests that the tasks set in smart re-industrialization programs are extremely relevant for the Russian economy. Let us consider some of them in detail.

The tendency for smart re-industrialization of Germany has become apparent after the global financial crisis of 2008-2009. A high percentage of industrial production in GDP has always been one of the benefits of the German economy, compared with other developed countries, where the service sector plays a major role. The increasing global competition, investment in new technologies and developments implemented by other countries affect Germany’s competitiveness. The idea of "Industry 4.0" and its key element – "smart enterprises" – was first presented in 2011 at the Hanover Fair by German scientists and politicians H. Kagerman, V.-D. Lucas and V. Walster (Belov, 2016). In 2012, the German government adopted the innovative program "Industrie 4.0" under the "high-tech Strategy 2020" (Federal Ministry of Education and Research, 2010).

To date, unlike other countries that have started developing and implementing programs of the fourth industrial revolution in varying degrees, Germany faces the challenge of maintaining its leading position (Federal Ministry for Economic Affairs and Energy, 2018). The list of essential measures to stimulate innovation includes the creation of a highly efficient system of economic agents, preservation, and enhancement of potential through increasing the share of highly skilled labor. To increase the attractiveness of Germany as a business location for new production and relocation for foreign enterprises the strategy focuses on modern technology. It is estimated that due to the use of these technologies, by 2025, six branches of the German economy can get additional 78 billion euros: mechanical engineering – 23.04 billion euros, automotive industry – 14.80 billion euros, electrical engineering – 12.08 billion euros, chemical industry – 12.02 billion euros, ICT industry – 14.05 billion euros, and agriculture – 2.78 billion euros. The potential of the expected growth (1.7% per year) lies in new innovative products, new services and business models, as well as more efficient operational processes across the value chain (BITCOM, & Fraunhofer IAO, 2014, pp. 6-7).

The "Industry 4.0" strategy involves the entire range of training activities (European Commission, 2017), tax depreciation benefits, as well as measures to promote the German brand "Industry 4.0" (Germany Trade & Invest, 2018) in the world market, etc.

The position of France in the global manufacturing sector has declined significantly in recent decades due to the proliferation of global value chains. As a result, the added value generated by France (as a percentage of GDP) has decreased from 17.7% in 1990 to 11.3% in 2016 (PwC, & Global Manufacturing and Industrialisation Summit, 2018, p. 11). In 2013, the French government developed the "Nouvelle France Industrielle strategy" (NFI) to revitalize and boost the development of the manufacturing sector. NFI was implemented as a strategy for the innovation and technological modernization of the manufacturing sector, covering 34 industrial sectors. In 2015, the second phase of the NFI program was launched named "Industrie du Futur" (IdF) (New Industrial France, 2016).

The initiative "Industrie du Futur" identifies 9 key priority areas: medicine of the future, eco-mobility, new resources, sustainable urban development, transport of tomorrow, data economy, smart objects, digital trust, and clever food production. The IdF also provides a detailed plan for implementation of Industry 4.0 – "Usine du Futur". The cross-cutting nature of the "Industrie du Futur" initiative is supported by the definition of its key technologies (currently – "Key Technologies 2020"). The choice of strategic technologies is based on the analysis of global markets and their medium-term development forecasts (Business France, 2016).

Preparing future generations to the new challenges is considered the cornerstone of the "Industrie du Futur" success in France. Considerable attention is also given to the formation of strategic partnerships at the European and international levels. France also faces the challenge of restoring its industrial base by relocating the enterprises from abroad through the introduction of Industry 4.0 technologies.

Increased attention to the Industry 4.0 programs (in 2015, about 64% of investment flows went to research and development, software and databases) and insufficient – to the manufacturing sector (about 27% of investment flows went to machinery and equipment, while in Germany investments in machinery and equipment amounted to 45%, in Italy – 67%), have contributed to the fact that machines and equipment in France are on average ten years older than in Germany (PwC, & Global Manufacturing and Industrialisation Summit, 2018).

Furthermore, small French enterprises are experiencing great difficulties in internationalization and export, and, unlike small German enterprises, cannot participate in the non-price competition.

Therefore, French economy faces the challenge of placing a renewed emphasis on the manufacturing sector, reallocating its highly skilled labor resources, a strong foundation in research universities, access to capital, and significant innovative potential to this sector.

The "Make in India" program focuses on pursuing an active policy of technological modernization, diversifying the structure of the economy by accelerating the development of high-tech industries and thus improving its international competitiveness.

The program involves an increase in the share of the manufacturing industry from 15% to 25% by 2022 and provides for the creation of almost 100 million new jobs. The goal is to create a powerful industrial hub in India that would satisfy both domestic needs and export expansion. In this regard, the program can be considered as an import substitution program. Already in 2017, the ratio of imports to GDP was 22%, while in 2005 the corresponding figure was 30%.

The "Make in India" program is aimed at attracting investment in industry and infrastructure and includes, among other things, the abolition of permitting procedures and restrictions on foreign participation in several sectors (including strategic ones), simplification of business procedures, and modernization of infrastructure (construction of large-scale "industrial corridors") (India Brand Equity Foundation, n.d.). For this purpose, the program provides for a serious legal reform, which should enable India to make a jump in the Doing Business rating, while in 2013 it ranked 142nd out of 190 countries (in 2018, India has moved to 100th place).

Implementation of this program should result in the creation of 100 "smart cities". Furthermore, India seeks to increase research and development costs and create a second "Silicon Valley" in its territory. The "Make in India" program is based on the principles of selectivity and priority in economic policy. It identifies 25 key areas. However, these are quite broad spheres covering most of the economy. Therefore, this policy can be attributed to selective with a certain degree of conventionality.

At the same time, already at the first stage of implementation, the "Make in India" program faced certain difficulties. In 2016, the contribution of the manufacturing sector to GDP was only 16%, no noticeable progress was made in improving the quality of roads, railway lines, and ports, while the growth rate of new jobs declined. In 2015-2016, only 641 thousand jobs were created, although each year the working-age population increases by about 1 million people every month (Dutt D'Cunha, 2017).

In March 2015, China announced a 10-year program called "Made in China 2025", which stimulates revitalization of the industry through the development of intelligent manufacturing. In line with this goal, the program involves the stimulation of economic transformation, the modernization of China’s manufacturing industry, the development of advanced production and the integration of traditional and new industries. It provides state support for 10 major industrial sectors, the products of which should account for 80% of the Chinese domestic market. It is planned that $300 billion will be invested in the program (Bradsher, & Mozur, 2017).

China has already occupied high positions in several high-tech sectors of the economy. Production and use of robots have become one of them. In 2017, almost one-third of all installed robots in the world accounted for China. By 2020, the number of industrial robots should amount to 950.3 thousand units. This will exceed their number in Europe by 1.5 times (611.7 thousand units) (International Federation of Robotics, 2018). Other sectors also show accelerated growth, for example, the production of lithium batteries (Eurasia Development Ltd., 2017). What is particularly important is that the "Made in China 2025" program provides 70% of self-sufficiency for the main components and materials in such industries as aerospace and telecommunications equipment (Segal, 2018). It is planned that 40% of the chips used in smartphones will be produced by domestic producers, which will significantly reduce import dependence. By 2025, domestic production should cover up to 60% of the demand for ICT equipment.

Moreover, according to the program, the development of high-tech industries will contribute to expansion into new global markets (Reuters, 2018). The "Made in China 2025" program was the first step of a larger three-phase project, planned until 2050. Its implementation will contribute to the development of domestic technological innovation, the creation of local brands and their recognition in global markets. By 2050, China should become the leading innovation economy in the world – 70% of the Chinese industry products should work in super innovation areas (Mikheev, 2018).

The rapid development of convergence of nano-, bio- and information technology, and cognitive technologies will largely determine the main vector of global innovation dynamics. The use of new technologies will not only become the basis for the formation of new markets but also significantly affect the appearance of traditional industries (energy, transport, industrial production, etc.). These trends are reflected in the priority system of the world centers for scientific and technological development (Table 2).

Table 2

Priorities of the world centers for scientific and technological development

Medicine and biotechnology |

USA |

Germany |

Japan |

France |

China |

Medicine and biotechnology |

Medicine |

Innovations for life |

Medicine and biotechnology |

Medicine |

|

Agricultural production system with high value added |

|||||

ICT |

ICT |

Communication technology |

ICT |

The system of pervasive information network |

|

New materials |

Composite materials |

|

Composite materials |

|

Composite materials |

Green technologies |

Clean Energy |

Ecology / Energy sectors |

Waste recycling, use of alternative energy |

Waste recycling, clean water, use of alternative energy |

Sustainable resources, nuclear power |

Production technologies |

Management of complex systems |

|

Robotics, metal processing |

|

Smart manufacturing technologies |

Other |

Space and aviation technologies |

Mobility |

Earth sciences, high-speed rail technologies |

Atomic and thermonuclear technologies, high-speed rail traffic technologies |

Use of space and the ocean potential |

Defense technologies |

Security |

Security and defense system |

Source: (National Economic Council, 2011; Technology Strategy Board, 2009; Council

for Science and Technology Policy, 2010; Ministry for Higher Education and Research, 2010;

Federal Ministry for Education and Research, 2009)

The analysis of the new government tools for smart re-industrialization in developed and developing countries justifies the need to develop a Russian version of structural and technological modernization – "Make in Russia". Russia needs effective and well-proven management tools that can ensure its competitiveness in the new global economy.

Over the past decades, the Russian government has implemented several policy documents on the economic development of the country as a whole and its individual areas. However, specific conditions of structural and technological modernization established in the mid-2010s require slightly different approaches to solving this problem. At the same time, it would be appropriate to use the existing developments, primarily the Strategy of the Scientific and Technological Development of the Russian Federation and related program documents, such as the Forecast of the Scientific and Technological Development of Russia for the Period until 2030, the "Digital Economy of the Russian Federation" program, the National Technology Initiative, etc. The existing contradictions of the long-term development of Russia's traditional industry result in the projected stage forks (Akberdina et al., 2017). Those include optimization of the industrial, trade and service sectors of the economy, the ratio of inertial and innovative development vectors, the variability of migration flows and the choice of the regional agglomeration model.

Therefore, the "Make in Russia" program should differ from the previously prepared strategic documents. First, it should be specific and designed for a medium-term perspective of 10 years. Considering the time required for the development of the program, it should cover the period of 2020-2030. For this purpose, along with the common areas, it is necessary to set the specific parameters, including the interim targets (for 2025). Thus, the "Make in Russia 2030" program would become the most important document of strategic planning.

The innovative and accelerated scenarios of Russia's strategic development suggest a far more complex management model for both the government and business. In this, the balance between market and state management methods can achieve sustainable growth in terms of resources, which is confirmed by the assessment of empirical investment capacity the economy (Berdyugina et al., 2017). Prospective solutions to innovative and accelerated scenarios are associated with investing in high technology and human capital development projects with payback parameters exceeding the medium-term limits on the market. The main barriers are due to the lack of globally competitive professional staff – both at the level of corporations and public administration and the ineffectiveness of coordination mechanisms. It is expected that active technological modernization can improve the socio-economic development parameters (Table 3).

Table 3

The key indicators of socio-economic development forecast of the

Russian Federation for 2010-2030 (average annual growth rates, %)

Indicators |

Options |

2016-2020 |

2021-2025 |

2026-2030 |

Gross domestic product |

1 2 3 |

3.6 4.4 6.8 |

3.0 4.0 5.3 |

2.5 3.7 4.2 |

Production industry |

1 2 3 |

2.7 3.4 5.2 |

2.3 3.0 4.1 |

2.3 2.9 3.3 |

Investments in fixed assets |

1 2 3 |

5.1 6.6 12.6 |

4.3 5.5 7.1 |

3.6 4.8 4.0 |

Real wages |

1 2 3 |

4.7 5.4 11.1 |

3.6 4.6 8.2 |

3.1 4.1 4.6 |

Retail trade turnover |

1 2 3 |

4.5 4.7 7.3 |

3.3 4.4 6.1 |

2.3 4.2 4.5 |

Exports – in total (by the end of period), billion US dollars |

1 2 3 |

668 705 732 |

868 989 1051 |

1176 1438 1615 |

Imports – in total (by the end of period), billion US dollars |

1 2 3 |

563 574 695 |

703 765 975 |

909 1067 1244 |

Source: (Ministry of Economic Development of the Russian Federation, 2013).

The forecast of long-term socio-economic development of the Russian Federation for the period up to 2030

In this regard, it is important to orient the program towards a complex of industries that provide real structural and technological modernization of the Russian economy. The proposed program should clearly define the development priorities. These include, above all, the drivers of the fourth industrial revolution. However, it is necessary to define the most important ones. In India, for example, there are 25 challenges designated as priorities, in China – 10, in France – 9, and in Germany – 4. In Russia, the primary areas of scientific and technological progress are reflected in the list of priority directions for development of civilian science, technology, and engineering, which generally correspond to world scientific and technological priorities. Those include information and telecommunication systems; life sciences; nanosystems industry; transport and space systems; environmental management; energy efficiency, energy saving, and nuclear power.

As for traditional technologies, the "Make in Russia 2030" program should focus on their technological modernization, considering the emerging trends in consumption of the relevant products in the global economy (Kheyfets, & Chernova, 2018). Today, global trends actualize the development of production and technology in the field of the industrial Internet of things (Vlasov et al., 2018a, 2018b). At the same time, E.B. Lenchuk rightly notes that focusing exclusively on the development of knowledge-intensive sectors cannot ensure the systemic sustainability of the national economy, especially in large diversified systems (Lenchuk, 2018).

Considering the modern trends in the development of material production and peculiarities of Russia's geopolitical strategy, the "Make in Russia 2030" program should, to a certain extent, be import-substituting. The imposition of sanctions has revealed new opportunities for Russian manufacturers. The new import substitution policy announced by the Russian government restricted the access of leading foreign countries to the market and expanded the potential for internal development. Sustainable marketing communication strategies can serve as an interesting form of promotion (Chernova et al., 2017). Overall, the implementation of the "Make in Russia 2030" program will allow refusing from the import of certain types of finished products, assemblies, and parts, as well as start exporting and entering new global value-added production chains (Kheyfets, 2019; Kheyfets et al., 2018).

The analysis of the new government tools for smart re-industrialization in developed and developing countries justifies the need to develop a Russian version of structural and technological modernization. In this regard, the "Make in Russia 2030" program could become the main strategic tool that should transform the conservative structure of the economy. In general, the implementation of modernization strategies should result in the increased competitiveness of the Russian economy and its individual sectors due to improving the efficiency of production processes against the reduced costs and greater flexibility of production; increasing the speed of production processes and further improvements in the quality of products; changing the place of national enterprises and industrial sectors in global value chains, increasing the efficiency of global chains based on vertical and horizontal associations; developing new products and business processes using the Internet technologies, which should give impetus to economic growth.

Akberdina, V.V, Tretyakova, O.V, & Vlasov, A.I. (2017). A Methodological Approach to Forecasting the Spatial Distribution of Workplaces in an Industrial Metropolis. Problems and Perspectives in Management, 15(4), 50-61. Retrieved March 9, 2019, from http://doi.org/10.21511/ppm.15(4).2017.05

Belov, V.B. (2016). A New Paradigm of the Industrial Development of Germany – the Strategy "Industrie 4.0". Modern Europe, 5, 11-22.

Berdyugina, O.N., Vlasov, A.I., & Kuzmin, E.A. (2017). Investment Capacity of the Economy during the Implementation of Projects of Public-Private Partnership. Investment Management and Financial Innovations, 14(3), 189-198. Retrieved March 9, 2019, from http://doi.org/10.21511/imfi.14(3-1).2017.03

BITCOM, & Fraunhofer IAO. (2014). Industrie 4.0 – Volkswirtschaftliches Potenzial für Deutschland Studie (pp. 6-7). Retrieved October 10, 2018, from https://www.ipa.fraunhofer.de/content/dam/ipa/de/documents/UeberUns/Leitthemen/Industrie40/Studie_Vokswirtschaftliches_Potenzial.pdf

Bradsher, K., & Mozur, P. (2017). China’s Plan to Build Its Own High-Tech Industries Worries Western Businesses. Retrieved September 15, 2018, from https://www.nytimes.com/2017/03/07/business/china-trade-manufacturing-europe.html

Business France. (2016). Créative Industry 2016. Retrieved September 25, 2018, from http://proxy-pubminefi.diffusion.finances.gouv.fr/pub/document/18/20849.pdf

Chernova, V.Y., Zobov, A.M.; Starostin, V.S., & Butkovskaya, G.V. (2017). Sustainable Marketing Communication Strategies of Russian Companies under the Import Substitution Policy. Entrepreneurship and Sustainability Issues, 5(2), 223-230. Retrieved March 9, 2019, from https://doi.org/10.9770/jesi.2017.5.2(5)

Council for Science and Technology Policy. (2010). Japan’s Science and Technology Basic Policy Report.

Dutt D'Cunha, S. (2017). PM Modi Calls the World To "Make in India", but the Initiative Fails to Take off. Retrieved September 15, 2018, from

Eurasia Development Ltd. (2017). Made in China 2025. Retrieved September 15, 2018, from http://chinanew.tech/made_in_china_2025_news

European Commission. (2017, January). Germany: Industrie 4.0. Retrieved October 17, 2018, from https://ec.europa.eu/growth/tools-databases/dem/monitor/sites/default/files/DTM_Industrie%204.0.pdf

Federal Ministry for Economic Affairs and Energy. (2018). Annual Economic Report 2018. A Strengthened Economy Ready to Embrace the Future. Retrieved October 5, 2018, from https://www.bmwi.de/Redaktion/EN/Publikationen/jahreswirtschaftsbericht-2018.pdf?__blob=publicationFile&v=2

Federal Ministry for Education and Research. (2009). Research and Innovation for Germany. Results and Outlook. Berlin.

Federal Ministry of Education and Research. (2010). Ideas. Innovation. Prosperity. High-Tech Strategy 2020 for Germany. Retrieved October 13, 2018, from https://www.manufacturing-policy.eng.cam.ac.uk/documents-folder/policies/germany-ideas-innovation-prosperity-high-tech-strategy-2020-for-germany-bmbf/view

Gerlitz, L. (2016). Design Management as a Domain of Smart and Sustainable Enterprise: Business Modelling for Innovation and Smart Growth in Industry 4.0. Entrepreneurship and Sustainability Issues, 3(3), 244-268. Retrieved March 9, 2019, from https://doi.org/10.9770/jesi.2016.3.3(3)

Germany Trade & Invest. (2018). Industrie 4.0 – Germany Market Report and Outlook. Retrieved October 3, 2018, from

https://www.gtai.de/GTAI/Content/EN/Invest/_SharedDocs/Downloads/GTAI/Industry-overviews/industrie4.0-germany-market-outlook-progress-report-en.pdf?v=12

India Brand Equity Foundation. (n.d.). Make in India. New Initiatives. Retrieved September 3, 2018, from https://www.ibef.org/economy/make-in-india

International Federation of Robotics. (2018). IFR Forecast: 1.7 Million New Robots to Transform the World’s Factories by 2020. Retrieved March 9, 2019, from https://ifr.org/ifr-press-releases/news/ifr-forecast-1.7-million-new-robots-to-transform-the-worlds-factories-by-20

Kheyfets, B.A. (2019). New Economic Megapartnerships and Russia. St. Petersburg: Aletheia. (p. 288).

Kheyfets, B.A., & Chernova, V.Y. (2018). Tools for Estimating the Effectiveness of Import-Substituting Modernization: Case in the Agriculture of Russia. European Research Studies Journal, 3(21), 179-191.

Kheyfets, B.A., Chernova, V.Y., & Degtereva, E.A. (2018). Prospects and Threats of Implementing the Export-Oriented Import Substitution Policy in the EEU Territory. WSEAS Transactions on Business and Economics, 15, 404-412.

Lenchuk, E.B. (2018). Formation of an Innovative Development Model for Russia: Work on Errors. Bulletin of the Institute of Economics of the Russian Academy of Sciences, 1, 36.

Litau, E. (2018a). Entrepreneurship and Economic Growth: A Look from the Perspective of Cognitive Economics. In ACM International Conference Proceeding Series (pp. 143-147). Retrieved March 9, 2019, from http://doi.org/10.1145/3271972.3271978

Litau, E. (2018b). Information Flows Management as a Way to Overcome “Puberty Challenges” of a Small Enterprise. In ACM International Conference Proceeding Series (pp. 34-38). Retrieved March 9, 2019, from http://doi.org/10.1145/3278252.3278259

Mikheev, V. (2018). Cautious but Persistent Dragon. Retrieved September 15, 2018, from https://stimul.online/articles/interview/ostorozhnyy-no-nastoychivyy-drakon/?sphrase_id=1951

Ministry for Higher Education and Research. (2010). National Research and Innovation Strategy.

Ministry of Economic Development of the Russian Federation. (2013). The Forecast of Long-Term Socio-Economic Development of the Russian Federation for the Period up to 2030.

National Economic Council, Council of Economic Advisers, & Office of Science and Technology Policy. (2011). A Strategy for American Innovation. Securing Our Economic Growth.

New Industrial France. Building France’s Industrial Future. (2016). Retrieved October 3, 2018, from https://www.economie.gouv.fr/files/files/PDF/web-dp-indus-ang.pdf

Prause, G., & Atari, S. (2017). On Sustainable Production Networks for Industry 4.0. Entrepreneurship and Sustainability Issues, 4(4), 421-431. Retrieved March 9, 2019, from https://doi.org/10.9770/jesi.2017.4.4(2)

PwC, & Global Manufacturing and Industrialisation Summit. (2018). The Future of Manufacturing – France (p. 11). Retrieved October 17, 2018, from https://gmisummit.com/wp-content/uploads/2018/06/20180627_GMIS-France_vF.pdf

Reuters. (2018). Factbox: Made in China 2025: Beijing's Big Ambitions from Robots to Chips. Retrieved September 15, 2018, from https://www.reuters.com/article/us-usa-trade-china-policy-factbox/factbox-made-in-china-2025-beijings-big-ambitions-from-robots-to-chips-idUSKBN1HR1DK

Segal, A. (2018). Why Does Everyone Hate Made in China 2025? Retrieved September 15, 2018, from https://www.cfr.org/blog/why-does-everyone-hate-made-china-2025

Shatrevich, V., & Strautmane, V. (2015). Industrialisation Factors in Post-Industrial Society. Entrepreneurship and Sustainability Issues, 3(2), 157-172. Retrieved March 9, 2019, from https://doi.org/10.9770/jesi.2015.3.2(4)

Shvab, K. (2016). The Fourth Industrial Revolution. Moscow: Eksmo. (p. 139).

Technology Strategy Board. (2009). Creative Industries. Strategy 2009-2012. Swindon.

Vlasov, A.I., Echeistov, V.V, Krivoshein, A.I., Shakhnov, V.A., Filin, S.S., & Migalin, V.S. (2018a). An Information System of Predictive Maintenance Analytical Support of Industrial Equipment. Journal of Applied Engineering Science, 16(4), 515-522. Retrieved March 9, 2019, from http://doi.org/10.5937/jaes16-18405

Vlasov, A.I., Grigoriev, P.V, Krivoshein, A.I., Shakhnov, V.A., Filin, S.S., & Migalin, V.S. (2018b). Smart Management of Technologies: Predictive Maintenance of Industrial Equipment Using Wireless Sensor Networks. Entrepreneurship and Sustainability Issues, 6(2), 489-502. Retrieved March 9, 2019, from

http://doi.org/10.9770/jesi.2018.6.2(2)

World Bank. (2018). High-Technology Exports (% of Manufactured Exports). Retrieved September 25, 2018, from

https://data.worldbank.org/indicator/TX.VAL.TECH.MF.ZS?locations=CN-FR-DE-IN-RU&view=chart

World Economic Forum. (2018, January). The Readiness for the Future of Production. Report 2018. Insight Report (pp. 12, 38-39). Retrieved September 7, 2018, from http://www3.weforum.org/docs/FOP_Readiness_Report_2018.pdf

1. Institute of Economics of the Russian Academy of Science, Russian Federation; Financial University under the Government of the Russian Federation, Russian Federation. Email: bah4l2@rambler.ru

2. Department of Marketing, Peoples' Friendship University of Russia (RUDN University), Russian Federation; Department of Advertising and Public Relations, State University of Management, Russian Federation. Email: veronika.urievna@mail.ru