Vol. 40 (Number 20) Year 2019. Page 20

ROMERO, Hector 1; FAJARDO, Eddy J. 2 & LUZARDO, Marianela 3

Received: 19/03/2019 • Approved: 30/05/2019 • Published 17/06/2019

ABSTRACT: The present investigation, studies the process of boom and fall of the gold mining companies in Venezuela late nineteenth and early twentieth century. The methodology used is that of survival analysis . The contribution of this work focuses on understanding the impact that international links had about this sector in the period analyzed. Each element of the industry is discussed from the type of capital (foreign or national). It is found that in the measure that the gold companies in Venezuela had financial resources (mainly from outside) they could last longer in time. |

RESUMEN: La presente investigación, estudia el proceso de auge y caída de las empresas mineras auríferas de Venezuela de finales del siglo XIX y principios del siglo XX. La metodología empleada es la del análisis de sobrevivencia. El aporte de este trabajo se centra en comprender el impacto que los vínculos internacionales tuvieron sobre este sector en el periodo analizado. Se discute cada elemento de la industria a partir del tipo de capital (foráneo o nacional). Se encuentra que en la medida que las empresas auríferas en Venezuela contaban con recursos financieros (principalmente provenientes del exterior) podían perdurar más en el tiempo. |

In this research the cycle of rise and decline of gold mining companies in Venezuela in the late nineteenth and early twentieth century is studied, taking into account elements of the global economy in the period under study. Most of the academic works, which have focused on understanding the economic sector in the Venezuelan south-east, have focused on analyzing internal events from an economic, political and legal point of view.

In this regard, González (2001) raises the interference of President Guzmán Blanco in the granting of concessions, as well as the business that he carried out during part of the period under study and that had a negative impact on the national gold mining activity. The work of Murguey (1989), meanwhile, details the legal elements in relation to the procedure for granting concessions and operation of gold mining companies, both domestic and foreign, in the Guayana region between 1870-1900 and its effects on the national gold production. On the other hand, the contributions of Rodríguez's research (2014) on national elements such as the plague of locusts, the fall in coffee prices, the decline of sugarcane production, which resulted in stagnation, stand out, of which the gold sector was not exempt. Also, by reducing the sources of work and income, the author mentions how bands were formed that ravaged the villages in search of food, given the forced paralyzation of the labor force in the mines.

The emergence of the gold standard, as an international monetary arrangement, and an increasing demand for currency due to the boom of the world economy towards the year 1870, coincides with the increase in gold mining activity in Venezuela. In the same way, the period under study has been identified by the academic literature as a time marked by the economic growth of the Latin American and Caribbean region with an "outward" vision. This growth was characterized by the volatility of the price of exports of raw materials, including agricultural products and metals associated with mining.

In this way, gold became the main export item in this region of the country. From its boom period, which spanned nearly thirty years, it began to slide into a considerable recession. The reasons for this stagnation can be found, in addition to the internal problems related to the dismantling of the domestic market and the sensitive depletion of the gold seams, to the discovery of rich deposits with higher yields than the dwindling mines of the Guayana region, in a region controlled by the British Empire: South Africa. In order to decompose the reality of the Venezuelan gold mining activity of the late nineteenth and early twentieth centuries, the present investigation is subdivided as follows: In this section, the approach to the problem and the review of the academic literature are advanced. Section II discusses the methodology used, that is, the survival analysis. In section III, the results and main findings are presented, while section IV offers the final comments.

The study of survival processes plays an important role in different fields of knowledge. Although its origin is based on the field of engineering, its current applications overflow into the field of finance, the economy, history, medicine and business administration. So, for example, the comparison between survival observed in two groups of patients can lead to validation a certain treatment or, alternatively, to identify a factor of important risk. In the same way, it can be used to understand the determinants of the durability over time of a business organization. The data from time to event have special characteristics that make the regular statistical analysis techniques not adequate. These characteristics that are related to the way in which the data is collected and usually they refer to the total or partial loss of the information of interest:

• Variable follow-up duration (individuals are incorporated at different times of the study)

• Incomplete information (time of origin, loss of follow-up, closure of the study, among others )

• Lack of information (subjects or individuals not included in the sample)

According to Borges (2005) the Kaplan and Meier estimator is the most used survival function and is defined for the case in that the data may present censure on the right. In this estimator, it is necessary to work with periods of time, but the same times of observation are contributing to the estimation of the survival function. On the other hand, the Cox regression model studies the association between the survival experience and a set of explanatory variables (also known as co-variables), measures for each of the individuals or objects in the sample. In the case of survival data, the analysis is focuses on the risk that the event occurs, so it is directly modeled the risk function. This means that, if you have two (2) groups of individuals, the risk at a particular time for an individual in a group is proportional to the risk at the same time for a similar individual in another group.

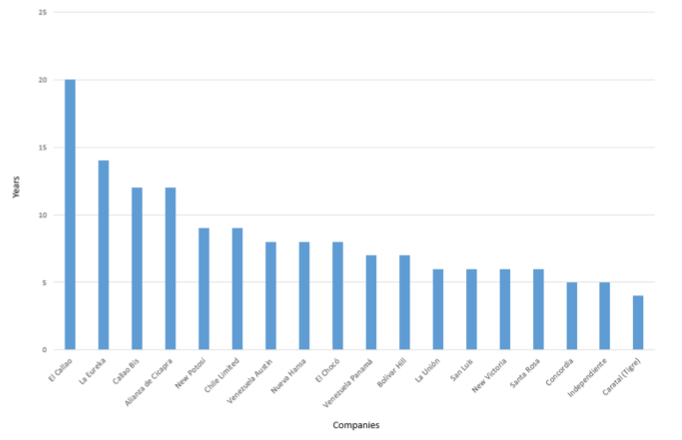

As for the duration, Figure 1 shows the durability (operating time) of some of the gold mining companies that were formed towards the end of the 19th century in Venezuela. Not all are taken into account, due to lack of statistical information. This methodology assigns a role to the time elapsed from the installation of the company until the moment it disappears or is absorbed by another organization (Tamgac, 2013). By doing this, time is assumed as a variable that allows capturing the effects that have not been understood, measured or in a certain way are unknown about the nature of a phenomenon. In this case, the event under study lies in the probabilities of durability of the gold mining companies established in Venezuela at the end of the 19th century.

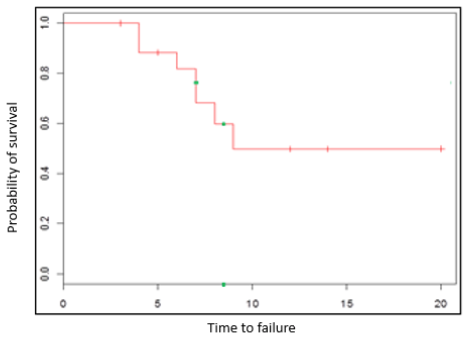

In this way, it is possible to decompose which are the most significant elements that affect survival and which are the variables or determinants that affect the duration of the companies. In total, 18 gold companies installed in the period under study are considered. Figure 2 presents the survival function of these organizations, observing that on average these organizations remain operative (without breaking or being absorbed by other companies) for 8 years.

Figure 1

Duration of the gold mining companies from its formation until its liquidation

or sale in the boom period of the gold mining activity (1860-1890)

Source: Murguey (1989), Rodríguez (2014) and González (2001)

-----

Figure 2

Survival function for 18 companies of the boom

period of the gold mining activity in Venezuela

Source: self-made

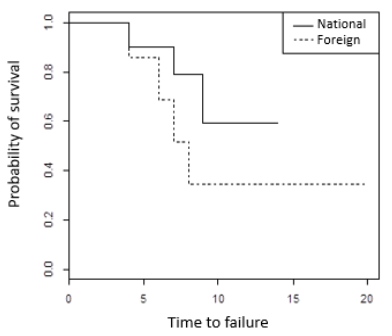

In a next level of analysis, differentiated survival curves are constructed for the group considered if the companies were of national or foreign capital. It is visually perceived in Figure 3 , that in the first 4 years there is no difference between national and foreign companies, after this time it seems that foreign companies have longer survival time. However, when observing the results of the Log Rank Test , it can be concluded that there is not enough statistical evidence to affirm that Nationality is a factor that influences the survival time of companies in the boom period of gold mining activity . However, it can be speculated, in the case of foreign companies , that they could count a greater source of capital.

Figure 3

Survival function for 18 companies of the boom period of the gold

mining activity in Venezuela according to national or foreign capital

Source: self made

Next, an analysis is developed to choose the best model adjusted to the survival of gold companies for the period of boom under study in relation to a series of own variables: origin of capital (national or foreign), area of exploitation granted (hectares), number of pylons (unit), strokes per minute and depth of operation (in meters)(see table 2).

Table 2

Variables of the gold mining companies from its formation until its liquidation

or sale in the boom period of the gold mining activity (1860-1890)

Company |

Origin of capital |

Area of exploitation |

Pylons |

Strokes per minute |

Depth |

El Callao |

1 |

2.253 |

60 |

97 |

320,44 |

New Potosí |

0 |

2.126 |

20 |

82 |

82 |

Venezuela Panamá |

0 |

1.279 |

50 |

87 |

91,84 |

Callao Bis |

0 |

279 |

20 |

89 |

121,9 |

Bolívar Hill |

0 |

442 |

5 |

64 |

24 |

Alianza de Cicapra |

1 |

1.029 |

20 |

81 |

65 |

Chile Limited |

0 |

575 |

60 |

90 |

177 |

Venezuela Austin |

0 |

341 |

0 |

95 |

114 |

La Unión |

1 |

519 |

20 |

92 |

62 |

San Luis |

1 |

192 |

20 |

75 |

23 |

Nueva Hansa |

1 |

215 |

20 |

79 |

32 |

La Eureka |

0 |

162 |

20 |

75 |

29 |

Concordia |

1 |

160 |

20 |

75 |

26 |

El Chocó |

0 |

618 |

20 |

80 |

26 |

Independiente |

0 |

8 |

5 |

79 |

33 |

New Victoria |

0 |

600 |

20 |

82 |

66 |

Caratal (Tigre) |

0 |

575 |

20 |

85 |

37 |

Santa Rosa |

1 |

519 |

20 |

80 |

16 |

Note: National (1) and foreign (0 ).

Source: Murguey (1989).

The variable nationality implies the origin of the owners and control of the organization. In this sense, a value of one (1) represents that the owners are from the country; while a value of zero (0) means that the gold company had foreign ownership and control. The variable surface, on the other hand, implies the extension of the concession that each company owned (measured in square hectares). The number of pylons is related to the pylons, which were activated by hydraulic power. These mills in particular, were under the technology employed by the California miners in the United States. The greater the number of pylons, the greater the processing of the gold sands. On the other hand, the strokes per minute imply the speed at which the crushing process was carried out. The greater the number of strokes, the greater the amount of gold material that was processed. Finally, there is the depth variable. This indicator presents the degree of depth of the mines from which the gold ore was extracted. Only companies with sufficient financial resources were able to develop deep mining.

Table 3 shows the model with all variables used in the study sample. It can be affirmed that the variables shock and depth are significant at 10%, because the p-value obtained is less than 0.10. In other words, this implies that these two variables can explain the success or failure of the gold companies for the period under study. Both elements are associated with technological capabilities and availability of financial resources to undertake mining extraction in depth in the mines.

Table 3

Model for the gold industry at the end of the

19th century (failure is an event of interest)

Variables |

Coefficient |

Exp(coefficient) |

p - value |

Lower 95% |

Upper 95% |

Origin of capital |

0,8497 |

2.3389 |

0,4001 |

0,3232 |

16,92 |

Area of Exploitation |

0,0016 |

1,0016 |

0,2389 |

0,9989 |

1,0044 |

Pylons |

-0.1723 |

0,8416 |

0,2083 |

0,6435 |

1,1009 |

Strokes per minute |

0,2563 |

1,2921 |

0,0532 |

0,9964 |

1,6757 |

Depth |

-0,0995 |

0,9052 |

0,0383 |

0,8238 |

0,9946 |

|

|

df |

p - value |

Likelihood ratio test |

12,2400 |

5 |

0,0315 |

Note: This model is significant by the criterion of likelihood ratio test

for 5% significance level , because the p-value is less than 0 05.

Source: self made.

The interpretation of the coefficients of the explanatory variables differs for continuous and discrete. This interpretation is made by estimating the exponential function evaluated on the estimated coefficients for each one of them. In this sense, the exponential of the estimated coefficient for the strokes is of 1.29, which means that, when increasing the number of strokes in the gold material, the risk of failure is 1.29 times lower compared to the realization of a hit less to crush the gold material. This result shows that the strokes could be a factor in favor, instead of a risk factor, that is, the greater the proportion of strokes in the material, the lower the probability that the company will fail.

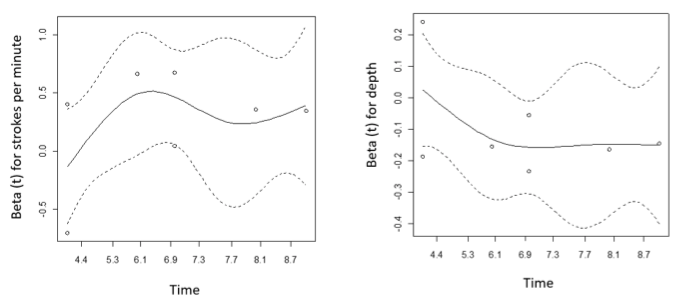

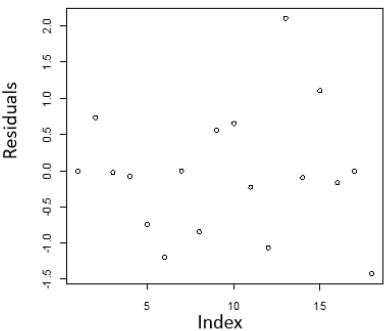

Under the same premise it means that by increasing the depth by one meter, the risk is 0.91 times less likely to fail compared to one meter less. This result shows that depth could be a positive factor, that is, the greater the proportion of the depth in the gold mines, the lower the probability that the company will fail. One of the main hypotheses of the model is that the risk function is proportional, that is, the quotient between the risk for two companies with the same level of depth is constant over time. In order to verify the assumption of proportional risk, the graphs of the Schoenfel residuals versus the time (years of survival) are used.

Figure 4

Verification of supposed proportional risk for Strikes and Depth

Source: self made

Figure 4 shows that the residuals are grouped randomly on both sides of the 0 value of the y axis, without showing a trend with strong changes, it can be concluded that there is no violation of the proportional risk assumption, which is confirmed by the result shown in table 4.

Table 4

Verification of the Cox proportional risk model

Variables |

rho |

Chi-squared test |

p-value |

Origin of capital |

0,2330 |

0,1480 |

0,7008 |

Area of exploitation |

0,7160 |

4,4900 |

0,0341 |

Pylons |

-0,2450 |

0,4370 |

0,5087 |

Strokes per minute |

0,3620 |

1,4360 |

0,2308 |

Depth |

-0,4240 |

1,7040 |

0,1918 |

Source: self made

The assumption of proportional risks variables explanatory nationality, pylons, hits and depth is confirmed. For the case of the surface the assumption is confirmed as long as p is greater than 1%. To verify the assumption that there are no values that influence the estimation of the model, deviance type waste vs. gold companies (individuals) are plotted . As no outliers are observed, the assumption can be made that the gold companies do not negatively affect the estimation of the model (Figure 5).

Figure 5

Verification of deviance residuals

Source: self made

It can be concluded that, for the case of the gold companies at the end of the 19th century in Venezuela, the significant explanatory variables in the model were strokes and depth. Here they are those that would modify the risk of failure of the gold - mining companies. It is also concluded that the proportional risk model presented is adequate since all assumptions are verified. The element of strokes and depth could be associated with the ability to have updated technology, as well as financial resources to acquire this technology. To the extent that the gold companies had financial resources (mainly from abroad) they could last longer.

The gold mining activity in the Guayana region, from the end of the 19th century and the beginning of the 20th century, can not be addressed in its just dimension without taking into account the set of international economic events that took place in that historical period. This is how a common thread is created between the Guayana region and the prevailing capitalist system for the period under analysis. This link or umbilical cord is the global financial architecture: the gold standard. The effects on the domestic market were immediate. In this sense, we proceeded to understand the durability of eighteen (18) gold mining companies, both domestic and foreign, finding that the significant variables to ensure a greater degree of survival were the number of pylons and depth. These elements could be associated with the ability to have updated technology, as well as financial resources to acquire these equipment. In other words, to the extent that the gold companies had financial resources (mainly from abroad) they could last longer.

The decline of gold mining activity in Venezuela also occurs in an adverse international context. The discoveries of new auriferous deposits with greater tenor in South Africa, geographic zone tightly controlled by the British empire, diminished the interest of the foreign investors in the gold region of Guayana and with this, the resources to explore and develop the increasingly less productive mining fields.

Borges, R. (2005) Análisis de sobrevivencia utilizando el lenguaje R. Recovered from the World Wide Web: http://webdelprofesor.ula.ve/economia/borgesr/PaipaREBP.pdf, December 5th 2017.

González, M. (2001). Negocios y política en tiempos de Guzmán Blanco. Caracas: Universidad Central de Venezuela.

Murguey, J. (1989). La explotación aurífera de Guayana y la conformación de la compañía minera de “El Callao” 1870-1900. Caracas: Corporación Venezolana de Guayana.

Rodríguez, A. (2014). El colapso del Callao: la crisis de la producción aurífera en Guayana a fines del siglo XIX. Tiempo y Espacio, 24(62), pp. 187-202.

Tamgac, U. (2013). Duration of fixed exchange rate regimes in emerging economies. Journal of International Money and Finance, 37, pp. 439-467.

1. Professor at the Universidad Industrial of Santander (UIS) and the Universidad Pontificia Bolivariana (UPB). PhD in Economics from the Universidad Central of Venezuela (UCV). Economist at the Universidad de los Andes (Mérida, Venezuela). Email: hvalbuen@uis.edu.co

2. Professor at the Universidad Autónoma of Bucaramanga (UNAB). Master in Statistics from the Universidad de los Andes (Mérida, Venezuela). Degree in Mathematics from the Universidad Industrial of Santander (UIS). Email: efajardo@unab.edu.co

3. Professor at the Universidad Pontificia Bolivariana (UPB). PhD in Statistics. Master in Statistics and Bachelor of Statistics from the Universidad of Los Andes (Mérida, Venezuela). Email: marianela.luzardo@upb.edu.co