Vol. 40 (Number 20) Year 2019. Page 21

PIDKHOMNYI, Oleg M. 1; DEMCHYSHAK, Nazar B. 2 & DROPA, Yaroslav B. 3

Received: 22/03/2019 • Approved: 28/05/2019 • Published 17/06/2019

ABSTRACT: The article's purpose is a regularities' justification of the public confidence influence on economic variables based on the set of indicators and the analysis of the respective interdependencies. The relationship between money supply and inflation, generally recognized in science, is refuted based on the use of the Fechner correlation coefficient. The example of Ukraine's economy revealed a lack of close direct link between these indicators. The discrepancies revealed led to the need to find other factors to explain the situation. |

RESUMEN: El propósito del artículo es una justificación de las regularidades de la influencia de la confianza pública en las variables económicas basadas el análisis de las respectivas interdependencias. La relación entre la oferta monetaria y la inflación, se refuta basándose en el uso del coeficiente de correlación de Fechner. Se reveló la ausencia de un vínculo directo entre estos indicadores en la economía ucraniana. Las discrepancias reveladas llevaron a la necesidad de encontrar otros factores para explicar la situación. |

Certain discrepancies between well-known economic laws and empirical data on Ukraine's economy, which are also likely in other countries, need to be adequately explained. Many scholars have pointed to public confidence as an inflation factor. Hypothetically, the level of public confidence can affect a number of economic indicators more than financial tools that are at the disposal of government agencies. The public confidence level is the result of complex behavior of the society members using disinformation to achieve their own goals. A set of micro-level interactions provided by a wide spread of certain models of economic actors behavior can have significant macro-consequences. The current economic problem is the choice of economic indicators that would testify directly or indirectly the public confidence level. Identifying the links of the relevant indicators with a number of other important economic variables would simultaneously confirm their analytical value and create the basis for the state regulatory policy guidelines formulation.

Over the past decades, economists from different countries increasingly focus on the dependence of socioeconomic processes on the factors related to the economic agents’ behavior, the provision of their interests and the likely on this basis conflicts. The economic discourse of confidence in the context of a human-centric approach is also actualized in the part of the study of the national economy pricing system. The perspective of conducting such scientific researches is also modernizing in the modern scholars’ conceptual approaches.

Socio-economic instability and socio-political uncertainty in Ukraine in the context of a military conflict predetermine the need to curb the shadowing and check pricing factors in the national economy for equity and rationality. The public confidence phenomenon remains poorly understood in this context. The analysis of modern scientific achievements made it possible to assert a reappraisal of traditional approaches in economic science and reorientation to a more detailed study of the influence of the economic actors’ behavior and the institutional environment of their functioning. An attempt is made to study inflation as an informational-behavioral phenomenon. The influence of disinformation on the economy macro level in the context of the public confidence problem in Ukraine is considered. Attention is drawn to the level of the shadow economy as a public confidence expression. Correlation of some economic variables with the level of the shadow economy and interest rates on deposits in Ukraine is revealed, which confirms the significance of the public confidence phenomenon in the macroeconomic indicators formation. It is argued that restoration of confidence to the state and financial institutions is a prerequisite for the growth of savings amount and investment activity in the economy. The prospect for further scientific research in this area is the examination of the hypotheses considered in the article based on the economic indicators of other countries.

Thus, the scientific work of some scientists is devoted to research of inflationary processes and their factor conditionality (see, e.g. Barro, 2013; Solow, Taylor, 1999; Fischer, 1993; Crosby, Otto, 2000; Setterfield, 2004; Woodford, 2002). Also the individual scientists consider the impact of the public confidence level in pricing (see, e.g. Fukuyama, 1995; Gritsenko, 2012). At the same time, the works of the Nobel Prize laureates laid the foundations for studying the behavioral economy (see, e.g. Tversky, 1992; Kahneman, 1990; Thaler, 2008), as well as institutional factors and institutional modernization problems (see, e.g. Coase, 1992; North, 1990).

The achievements of these experts make it possible to assert a reappraisal of traditional approaches in economic science and a reorientation to a more detailed study of the economic actors’ behavior influence and the specific institutional environment of their functioning. At the same time, there are practically no scientific researches taking into account new approaches in the part of the inflation expectations and pricing study in the country. The establishing a confidence level's problem in entrepreneurial activity is one of the key in the institutional direction of economic science and is of great practical importance. This can be fully explained, because the confidence level is a prerequisite for the modernization of modern economies and society as a whole. Confidence lack prevents economic growth, constrains investment activity and causes other negative consequences. This circumstance led to the domination of misconfidence and suspicions in relations between economic actors, which does not contribute to the effective implementation of socio-economic programs and the sustainable development of the national economy.

However, the complexity of the analysis of the public confidence impact does not diminish the solving existing problems significance in the context of identifying variables that would serve as benchmarks for assessing the confidence level impact on price risks in the country. At the same time, there is a need to elucidate further their influence on economic system in order to substantiate the priorities of economic policy taking into account the current world economy trends.

Calculation of correlation coefficients is a common method for the measuring of links tightness between different variables. The Pearson Linear Correlation Coefficient is the most well-known of these indicators. At the same time, the obligatory condition for its applying is a both variables' normal distribution law, the tightness of link between which is measured. The asymmetry and the excess values of the corresponding indicators should be close to zero. However, these conditions regarding the economic indicators involved in this study are not met. Therefore, we use the Fechner correlation coefficient. In addition, the Fechner correlation coefficient is applied to check the relationships between small series of data. Fechner signs' correlation coefficient is a number from -1 to 1, which characterizes the direction coherence degree of the values' deviations of dependent and independent random variables. It is based on the comparison of the deviation signs of the two variables' individual values from their averages. The conclusion on the correlation between the two variables is made based on counting the number of matches and differences between these signs. In the paper, we have adjusted all the absolute monetary indicators to the inflation rate and calculated their annual changes. The formulation of hypotheses concerning the patterns of public confidence influence on economic variables and the corresponding indicators’ selection are carried out using the logical method and the synthesis for appreciation of micro-level effects on the economic system macro level. For example, we believe that a significant set of disinformation episodes that arise in relations between the national economy subjects is synthesized in the indicator of the shadow economy. A graphical method was used to summarize statistical data, to improve their visualization and analysis in order to identify the corresponding patterns of relationships between the investigated indicators.

The spread of disinformation reduces the public confidence level and is accompanied by an economy shadowing. In modern conditions, confidence is an important characteristic of the society development, which determines its further progress. Confidence in the broadest sense of the word means the person's assurance in honesty, sincerity and the correctness of the others' attitude towards something. It is about creating in the majority of the population confidence in the actions of various economic agents, politicians or scientific concepts, the quality of goods or statistics, family members, etc (Gritsenko, 2012, p. 11). In the field of economy, confidence has two important components, namely the confidence of the population and business entities in financial institutions and national monetary unit.

To study the role of confidence factor in the national economy of Ukraine, we used the data presented in Table 1. As the main characteristics of the public confidence level, we consider the shadow economy level and interest rates on bank deposits. The higher the values of these indicators in the some country, the lower we appreciate the public confidence level.

Table 1

Output data for the analysis of the confidence influence

on the indicators of the Ukrainian economy

Year |

The level of the shadow economy, % of the official GDP |

Interest rates of banks on deposits in national currency, % |

Money supply M3, billion UAH |

Average annual exchange rate, UAH / 100 USD USA |

GDP, billion UAH |

Tax revenues, billion UAH |

The level of tax pressure in the national economy, % |

State and state guaranteed debt, billion UAH |

Consumer price index, % to the previous year |

2001 |

26,7 |

11,2 |

45,8 |

533,24 |

211,175 |

36,7 |

17,4 |

74,6 |

99,4 |

2002 |

26,6 |

7,8 |

64,9 |

532,7 |

234,138 |

45,4 |

19,4 |

75,7 |

100,8 |

2003 |

30,6 |

7,1 |

95 |

533,3 |

277,355 |

54,3 |

19,6 |

77,5 |

105,2 |

2004 |

30,7 |

7,8 |

125,8 |

531,9 |

357,544 |

63,2 |

17,7 |

85,4 |

109 |

2005 |

30,3 |

8,5 |

194,1 |

512,5 |

457,325 |

98,1 |

21,4 |

78,1 |

113,5 |

2006 |

29,8 |

7,6 |

261,1 |

505 |

565,018 |

125,7 |

22,3 |

80,5 |

109,1 |

2007 |

28,81 |

8,2 |

396,2 |

505 |

751,106 |

161,3 |

21,5 |

88,7 |

112,8 |

2008 |

31,1 |

9,9 |

515,7 |

526,7 |

990,819 |

227,2 |

22,9 |

189,4 |

125,2 |

2009 |

39 |

14 |

487,3 |

779,1 |

947,042 |

208,1 |

22 |

316,9 |

115,9 |

2010 |

38 |

10,3 |

597,9 |

793,6 |

1120,585 |

234,4 |

20,9 |

432,2 |

109,4 |

2011 |

34 |

8,1 |

685,5 |

796,8 |

1349,178 |

334,7 |

24,8 |

473,1 |

108 |

2012 |

34 |

13,4 |

773,2 |

799,1 |

1459,096 |

360,6 |

24,7 |

515,5 |

100,6 |

2013 |

35 |

10,9 |

909 |

799,3 |

1522,657 |

354 |

23,2 |

584,8 |

99,7 |

2014 |

43 |

11,9 |

956,7 |

1188,7 |

1586,915 |

367,5 |

23,2 |

1100,8 |

112,1 |

2015 |

40 |

13 |

994,1 |

2184,5 |

1988,544 |

507,6 |

25,5 |

1572,2 |

148,7 |

2016 |

35 |

11,4 |

1102,7 |

2555,1 |

2383,182 |

644,2 |

27 |

1929,8 |

113,9 |

Sources: State Statistics Service of Ukraine, National Bank of Ukraine, Ministry of Finance of

Ukraine, Ministry of Economic Development and Trade of Ukraine, calculation of the

tax pressure level by authors as the tax revenues to GDP ratio

Table 2 contains data on the dynamics of the indicators involved in the analysis. It is the magnitude of the changes in the respective indicators compared with the values of the previous year used to calculate the Fechner correlation coefficients and to assess the economic regularities in Ukraine that affect public confidence.

Table 2

Data adapted to calculate the Fechner correlation coefficients for the analysis

of the confidence's relationship with the Ukrainian economy indicators

Year |

Changes in the level of the shadow economy, % |

Changes in interest rates of banks on deposits in national currency, % |

Relative changes in money supply |

Relative UAH / USD exchange rate changes |

Changes in the level of tax pressure in the national economy, % |

Relative changes in state and state-guaranteed debt |

Changes in the consumer price index, % to the previous year |

2002 |

-0,1 |

-3,4 |

0,42 |

0,006 |

2,0 |

0,01 |

0,8 |

2003 |

4 |

-0,7 |

0,47 |

0,000 |

0,2 |

0,02 |

5,2 |

2004 |

0,1 |

0,7 |

0,32 |

-0,005 |

-1,9 |

0,10 |

9 |

2005 |

-0,4 |

0,7 |

0,54 |

-0,048 |

3,8 |

-0,09 |

13,5 |

2006 |

-0,5 |

-0,9 |

0,35 |

0,000 |

0,8 |

0,03 |

9,1 |

2007 |

-0,99 |

0,6 |

0,52 |

0,000 |

-0,8 |

0,10 |

12,8 |

2008 |

2,29 |

1,7 |

0,30 |

0,525 |

1,5 |

1,14 |

25,2 |

2009 |

7,9 |

4,1 |

-0,06 |

0,036 |

-1,0 |

0,67 |

15,9 |

2010 |

-1 |

-3,7 |

0,23 |

-0,002 |

-1,0 |

0,36 |

9,4 |

2011 |

-4 |

-2,2 |

0,15 |

0,004 |

3,9 |

0,09 |

8 |

2012 |

0 |

5,3 |

0,13 |

0,000 |

-0,1 |

0,09 |

0,6 |

2013 |

1 |

-2,5 |

0,18 |

0,000 |

-1,5 |

0,13 |

-0,3 |

2014 |

8 |

1 |

0,05 |

0,973 |

-0,1 |

0,88 |

12,1 |

2015 |

-3 |

1,1 |

0,04 |

0,522 |

2,4 |

0,43 |

48,7 |

2016 |

-5 |

-1,6 |

0,11 |

0,133 |

1,5 |

0,23 |

13,9 |

Average |

0,55 |

0,013 |

0,25 |

0,143 |

0,6 |

0,28 |

12,3 |

Source: calculated by the authors based on data from the State Statistics Service of

Ukraine, the National Bank of Ukraine, the Ministry of Finance of Ukraine, the Ministry

of Economic Development and Trade of Ukraine

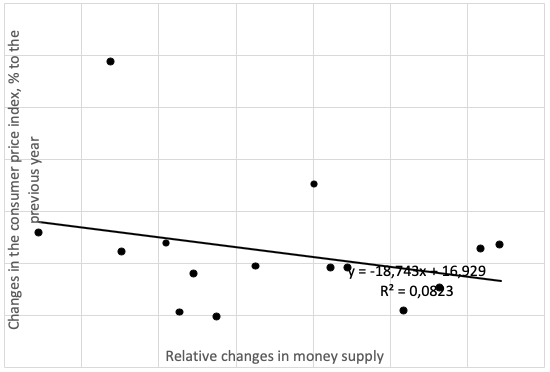

According to the established postulates of economic science, the price level for other unchanged conditions increases with an increase in money supply. In fact, this is the basis for conducting monetary policy by the country's central bank. Our attempt to confirm empirically the generally accepted pattern of linking money supply and inflation to data on the Ukrainian economy has led to an unexpected result (see Figure 1). This corresponds to the value of the Fechner correlation coefficient at the level of 0.067, which indicates the absence of a tight coupling of these variables.

Such a clear discrepancy between the facts and the logical assumptions led to the need to identify other factors that could explain the situation. We have resorted to studying inflation as an informational-behavioral phenomenon, since price indices, on the one hand, carry some information, and on the other hand, price setting is the result of decision-making, that is, the information processing consequence through the certain behavior strategies' prism.

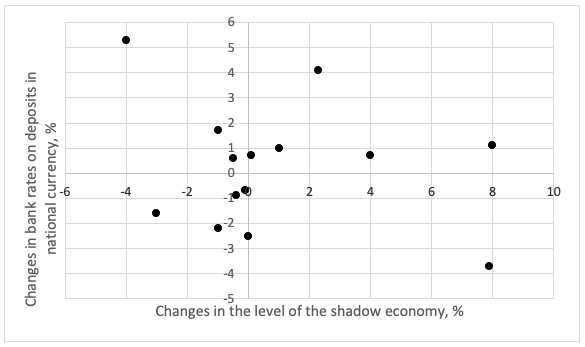

Figure 1

Relationship between the growth rate of money supply and

the level of consumer prices in Ukraine during 2002-2016

In addition to the use of reliable information, a circulation of disinformation is possible in the economy, which may also affect the price level. From the synthesis method's point of view, disinformation at the economy macro level is appropriate to consider it in the context of the public confidence problem. With regard to this problem, there are alternatives to the methodology of the study with the relevant indicators. We drew attention to the shadow economy level as a public confidence's expression. In our opinion, this indicator takes into account the conflict potential of economic relations in a particular country. The level of the shadow economy has not been revealed closely related to the consumer price index in Ukraine (for the period from 2001 to 2016, the Fechner correlation coefficient for these indicators is 0.067). At the same time, a significant correlation with one year's time lag is found on the Fechner coefficient (0.286) between the level of the shadow economy and the interest rates on bank deposits in national currency (see Figure 2). As well known, the interest rate on deposits is a valid indicator of public confidence in the country financial system. Quite usual, the high Fechner correlation coefficient (0.467) appears which expresses the relation between interest rates on deposits in national currency and inflation.

Figure 2

Influence of the shadow economy on the bank deposits rates in the

national currency in Ukraine during 2002-2016 with one year time lag.

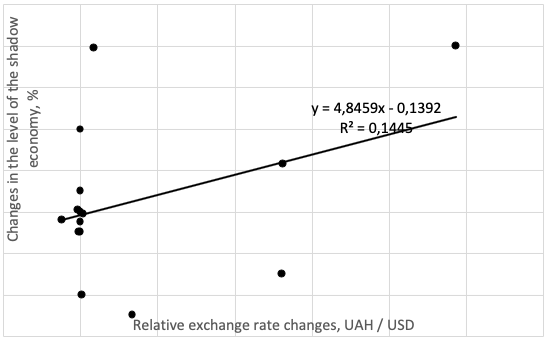

It is important to note the rather close direct relationship between the level of the shadow economy in Ukraine and the exchange rate of its national currency, which is characterized by the Fechner correlation coefficient at 0.467 (see Figure 3).

Figure 3

Relationship between the level of the shadow economy in Ukraine

and the hryvnia/US dollar exchange rate during 2002-2016

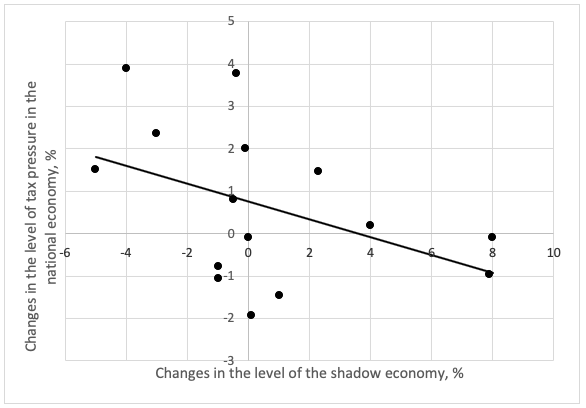

In the context of economy shadowing and inflation processes, the tax factor is often mentioned. According to our research, a direct correlation between inflation and the level of taxation in Ukraine was confirmed (Fekhner's correlation coefficient is 0.333), which corresponds to generally accepted economic views on the fiscal component of inflation. At the same time, the inverse relationship between the tax pressure and the level of shadow economy with a Fechner correlation coefficient of -0.333 looks odd. This leads to the idea that not the tax burden is a factor in the economy's shadowing, and the level of shadowing determines the volume of tax revenues to the state budget. The same level of the economy shadowing is determined, among other factors, by the degree of public confidence in the authorities. As it is shown above, a essential devaluation of the national currency may have a significant negative impact on public confidence.

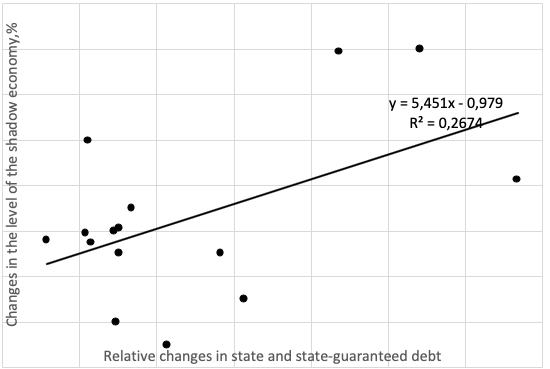

However, it would be too simplistic to explain the phenomenon of public confidence only by currency exchange rate formation. Identifying additional factors has drawn our attention to the indicator of the state debt. It turned out that state debt dynamics is closely related to the processes of Ukraine national economy shadowing with the Fechner correlation coefficient 0.467 (see Figure 4).

Figure 4

Relationship between the shadow economy level and the amount of

Ukraine's state debt and guaranteed state debt during 2002-2016

The similarity of the Fechner correlation coefficients of the shadow economy with 1) the exchange rate and 2) public debt indicate that significant amounts of Central Bank refinancing and government borrowing are related to suspicious financial transactions that lead to the movement of funds in the shadow economy. After such events, the level of public confidence in the state is significantly reduced. Another confirmation of the tax pressure status as a consequence and not as a reason in the context of the public confidence factors study is the inverse relationship with the Fechner correlation coefficient at -0.333 between the tax pressure and the shadow economy in Ukraine (see Figure 5). Considering the shadow economy level a public confidence indicator, we can conclude that during periods of growing public confidence taxpayers are inclined to transfer a larger portion of their income to the state.

Figure 5

Relationship between tax pressure and the shadow

economy level in Ukraine during 2002-2016

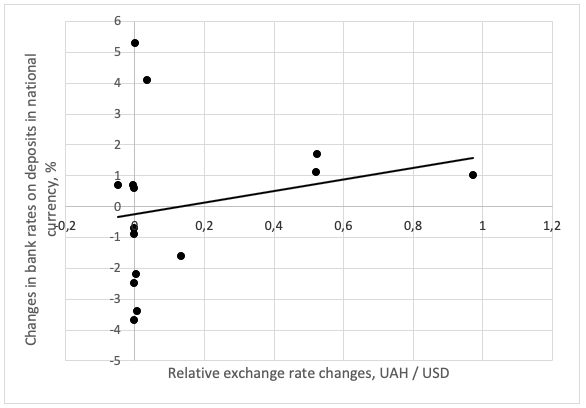

In addition, the role of bank deposit rates as a public confidence measure is underlined by a direct correlation of these rates with the devaluation of the national currency of Ukraine (Fechner correlation coefficient 0.333, see Figure 6).

Figure 6

Relationship between the hryvnia to the US dollar exchange rate and

Ukrainian bank deposit rates on national currency during 2002-2016

The revealed correlations of some economic variables with the level of the shadow economy and bank deposit rates in Ukraine are likely to be non-random, but are evidence of the public confidence importance in the macroeconomic indicators formation. The verification of the hypotheses discussed in the article with using the other countries' economic indicators is promising.

According to the results of the Ukraine national economy study, certain differences between the economic system behavior and some generally accepted economic laws could be stated. Thus, according to established views, the level of consumer prices in the country should depend, first, on the volume of money supply. Another weighty factor in inflationary processes can be the level of tax burden. An economic agents' attempt to cover additional tax liabilities by increasing their products’ selling price seems natural. In addition, the tax burden can be considered as a factor in increasing the level of shadow economy. Nevertheless, a significant array of statistical indicators in the Ukrainian economy does not correspond always to generally accepted scientific views. We argue that a number of economic phenomena in Ukraine and, possibly, in other countries depend on factors that are difficult to be formalized, namely from the factor of public confidence. In our opinion, the public confidence level can be measured not only by sociological methods. We suppose that the actual economic indicators of public confidence include the level of the shadow economy, the size of interest rates, and so on. With a decrease in the public confidence level one should expect an increase in the economy shadowing level and the growth of deposit rates. Macro-level manifestations of the corresponding problems can be investigated using the correlation analysis tool. The restoration of confidence in the state, which forms the macroeconomic policy, and in the numerous financial institutions, is the main task, the solution of which will contribute to increase the savings volume in the economy as an investment resources key source.

1. Barro, R. (2013). Inflation and Economic Growth. Annals of Economics and Finance. 14-1. Retrieved from http://down.aefweb.net/AefArticles/aef140106Barro.pdf.

2. Coase, R. (1992). The Institutional Structure of Production. American Economic Review. 82 (4), 713–719.

3. Crosby, M., Otto, G. (2000). Inflation and the Capital Stock. Journal of Money, CreditandBanking. 32 (2), 236–253.

4. Fischer, S. (1993). The role of macroeconomic factors in growth. National Bureau of Economic Research (NBER). 4565, 45–66.

5. Fukuyama, F. (1995). Trust: The Social Virtues and the Creation of Prosperity. New York, Free Press, 457 pp.

6. Gritsenko, A. (2012). The Institute of Trust in the coordinates of the economic space. Kyiv, NAS, 212 pp.

7. Kahneman, D., Knetsch, J., Thaler, R. (1990). Experimental Tests of the Endowment effect and the Coase Theorem. Journal of Political Economy. 98(6), 1325–1350.

8. North, D. (1990). Institutions, Institutional Change and Economic Performance. Cambridge, Cambridge University Press, 152 pp.

9. Setterfield, M. (2004). Central banking, stability and macroeconomic outcomes: a comparison of new consensus and post-Keynesian monetary macroeconomics, in M. Lavoieand M. Seccareccia (eds), Central Banking in the Modern World: Alternative Perspectives, Edward Elgar, Cheltenham, pp. 35-56.

10. Solow, R., Taylor, J. (eds) (1999). Inflation, Unemployment, and Monetary Policy. Cambridge, MIT Press (Mass.)

11. Thaler, R., Cass, R. (2008). Nudge: Improving decisions about health, wealth, and happiness. New Haven, Yale University Press, 293 pp.

12. Tversky, A. Kahneman, D. (1992). Advances in Prospect Theory: Cumulative Representation of Uncertainty. Journal of Risk and Uncertainty. 5(4), 297–323.

13. Woodford, M. (2002). Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton and Oxford, Princeton University Press.

1. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: olegpidkhomnyi@ukr.net

2. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: nazar_dem@ukr.net

3. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: dropa@ukr.net