Vol. 40 (Number 20) Year 2019. Page 30

IVANOVA, Elena V. 1; MAKOVETSKAYA, Elena N. 2; MAKOVETSKY, Mikhail Yu. 3; MARKOV, Serge N. 4 & SIMONOVA, Natalya Yu. 5

Received: 30/03/2019 • Approved: 25/05/2019 • Published 17/06/2019

ABSTRACT: The objective is to develop theoretical and methodological guidelines and practical recommendations on program budget application in Russia as a tool to improve the effectiveness of public spending. To substantiate the research findings, the authors utilized many sources in the field of effectiveness of public spending, program budget and management of government and municipal expenditures. General scientific methods such as formalization, grouping, analysis, synthesis, and comparison were employed as the methodological background for this research. |

RESUMEN: El objetivo es desarrollar directrices teóricas y metodológicas y recomendaciones prácticas sobre la aplicación del presupuesto por programas en Rusia como herramienta para mejorar la eficacia del gasto público. Para fundamentar los hallazgos de la investigación, los autores utilizaron muchas fuentes en el campo de la efectividad del gasto público, el presupuesto por programas y la gestión de los gastos gubernamentales y municipales. Se utilizaron métodos científicos generales como la formalización, agrupación, análisis, síntesis y comparación como antecedentes metodológicos para esta investigación. |

Defined figuratively, a conventional state budget is the famous “black box,” its content being hidden, which does not provide insight into what results can be obtained when undertaking annual planned expenditures. In the traditional approach to budgeting, it is almost impossible to assess what goals will be achieved, what tasks will be solved, and what social and economic effects will be obtained.

Program budgeting as a qualitatively different way to present a budget is an effective tool for improving the state budget effectiveness. Heightened requirements for the quality of government function performance in the 1990s naturally initiated the process of reforming the public finance system in developed countries, most of which began to implement new budgeting methods (Balynskaya & Ponomarev, 2018; Akhmetshin et al., 2018).

Recently, a number of countries (such as France, New Zealand, Australia, Sweden, South Korea, and Brazil, among others) have been trying to switch to a program budget with varying degrees of success. Russia is no exception to this “fashion” trend.

A completely new stage of Russian economic development in the budgeting process was adoption of the Federal Law of May 7, 2013, No. 104-FZ, “On Amendments to the Budget Code of the Russian Federation and Certain Legislative Acts of the Russian Federation with Reference to the Budgeting Process Improvement.” This law marked a full-scale and full-fledged transition of the Russian Federation to special-purpose financing since 2014, which involves budget establishment within the budget system of the Russian Federation over subsequent budget cycles exclusively in the programmatic format.

The need for such drastic measures is associated with the government’s attempts to achieve the best results within the framework of limited financial resources. It is no secret that in the current geopolitical situation that significantly affects energy prices, Russia is losing a significant part of its budget revenues. The decline in government revenues, a budget deficit, and a public debt together with the desire to improve the quality of services rendered to the public have led to a need to more carefully evaluate the results of public expenditures undertaken. A program budget is the most effective way to solve this problem. All of this confirms the relevance of the study.

It is believed that program budget is a tool to improve the effectiveness of budget expenditures. But, the problems of improving the effectiveness of public spending go back dozens of years. Thus, a large number of scientific works has addressed the problems of increasing the effectiveness of budget financing. In modern economic literature, theoretical studies of the essence of effectiveness and efficiency of public spending and its classification are dealt with in the works of foreign authors, such as North and Cecil (1990), Hanushek (1991) and others, as well as in the works of Russian authors, such as Bachurin (1988), Zadorozhny (n.d.), Ilyina (2011), Kotlyachkov and Kotlyachkova (2014), Konyarova and Osipov (2009), Rastvortseva (2008), Sukharyov (2015), and Yaroshenko (2011).

Methodological issues of evaluating the effectiveness of budget financing reflect in the works of foreign researchers, such as Atkinson et al. (1997), Johansson (1993), Mishan (1988), Musgrave and Musgrave (1989), Stiglitz (2000), Garber and Phelps (1997) (methods for assessing the effectiveness of budgetary funds), as well as Seiler et al. (2006) (models for evaluating the effectiveness of public spending).

Program budget issues are dealt with by scientists and economists from many countries, both from the developed ones (the US, the UK (Spahn & Bernd, 1996), Canada (Hurley et al., 1997), Norway (Anderson et al., 2006), Sweden (Paulsson, 2006), Australia (Blöndal, 2008), New Zealand (New Zealand Treasury, 2003), China (Wu & Wang, 2013), Taiwan (Su et al., 2015), etc.) and the developing ones (Nigeria (Aregbeyeni & Kolawole, 2015), Colombia (Aldret, 2017), Ukraine, and Kazakhstan). No country has proposed a universal method of transition to program budget. Each country has its own features based on the goals and objectives of the state.

The problems of transition to program budget in the Russian Federation have also been covered by the print media to a certain extent, although a major effort remains to be taken in area.

In modern economic literature, the problem of program budget presentation and improvement of the efficiency and effectiveness of public spending is studied in the works of domestic authors: Afanasiev (2017), Beryozkin (2016), Kudrin (2018), Lavrov (2011), Podyablonskaya (2013), Pridachuk (2005), Prokofyev (2014), Yakobson (2006), and others.

It should be noted that publications devoted to program budgeting are predominantly poorly systematized and miscellaneous in nature. All of the above confirms the relevance of the research.

The research objective was to develop theoretical and methodological background and practical recommendations on the use of program budget in Russia as a tool to increase the effectiveness of public expenditure.

To substantiate the research findings, the authors used scientific works of domestic and foreign scholars in the field of effectiveness of public spending, program budgeting and management of government and municipal expenditures. General scientific methods, such as formalization, grouping, analysis, synthesis, and comparison laid the methodological foundation of the research.

The authors conducted a study on program budget application in Russia in the following successive stages:

1. The concept, essence, purpose of a budget program and an algorithm for its development was considered.

2. Types of budget programs were classified.

3. Benefits of practical use of program budgeting were identified.

4. Conditions for transition to program budgeting in Russia were defined.

5. The significance of government programs in the framework of Russia’s economic development was analyzed.

In terms of considering program budget, it is essential to understand what a government program is.

In accordance with Federal Law No. 172-FZ of June 28, 2014 “On Strategic Planning in the Russian Federation”, a government program is a strategic planning document containing a package plan of activities that are interconnected in terms of objectives, timeframes, executors and resources, and state policy tools that ensure achievement of priorities and objectives of the state policy in the field of socio-economic development and national security of the Russian Federation within the framework of implementation of key state functions.

A program is essentially a system of activities (actions) of production and technology, scientific and technical, social or organizational nature, which are interconnected in terms of content, timeframes, executors, and resources and aimed at achieving a shared objective and solving a common problem.

Each program requires coordination in terms of time, resources, and executors; it may cover:

- a number of industries (and even regions in case of need for support);

- solving the most critical tasks as part of attaining strategic goals of the state.

The goal of a program is a certain projected outcome to be achieved upon its implementation. The goal of any government program should be clear, realistic and attainable.

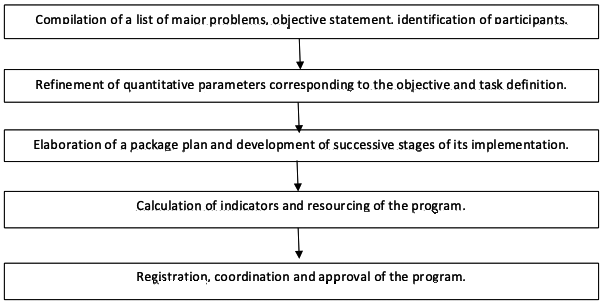

A general algorithm for a government program development can be presented as follows (Figure 1).

Figure 1

Algorithm for Government Program Development

Source: Compiled by the authors

Government programs can be classified on various grounds:

- Nature of the results obtained;

- Economic performance;

- The state management level of programs implemented;

- Method of program implementation.

Depending on the nature of the results obtained, four main groups of programs can be distinguished:

- Programs to achieve societal goals;

- Provision of services to citizens (service delivery programs);

- “Permitting” programs;

- Administrative programs.

Examples of programs to achieve societal goals could be programs aimed at:

a) Production of public goods (benefits);

b) Counteracting external negative impacts;

c) Efficient income distribution and /or social justice.

Service delivery programs (“core” programs) are aimed at obtaining immediate public benefit in the form of rendering public services to the population as part of implementation of public functions by certain ministries/departments.

A special place is held by the so-called “permitting” programs, which can be called subsidiary or providing, since, without bringing obvious benefits to society, they create conditions for effective implementation of the “core” programs. A program for elaborating a sectoral development strategy, a program for sectoral market regulation, etc. can serve as examples.

As for administrative programs, they are designed to “serve” other groups of programs; they are not linked to key results (strategic outcomes of activities) of ministries (departments). A number of researchers believe that each department should have a program aimed at ensuring implementation of the other programs.

Depending on their economic effect, programs can be divided into current programs and development programs.

Current programs are aimed at ensuring execution of government functions and obligations. Development programs are aimed at budget investment (Shash, 2013).

Thus, implementation of program budgeting allows one to:

- Evaluate and select preferred options for socio-economic development in target, sectoral and territorial terms;

- Ensure direct correlation between budget resource allocation and actual/planned results of their use in accordance with the government policy priorities;

- Commit budgetary resources to achievement of quantifiable public deliverables;

- Monitor and control the achievement of goals and results;

- Substantially influence the effectiveness of public spending through the mechanism of priority budgeting of successful programs;

- Improve the quality of medium-term and strategic budget planning.

Program budget is usually sustainable and long-term. While executive budget is based on past work experience, program budget is premised on an assessment of performance results expected in the future. From this standpoint, program budget is better adapted for shaping a long-term socio-economic state policy.

Practical use of program budgeting is complicated by mandatory use of income and expenditure classification that is uniform for all budgets and is incompatible with the goal and objectives of the programs adopted; it is difficult to initiate sectoral target programs as a means of additional financial support.

Transition to program classification is accompanied by the need for a certain reduction of fiscal control. In this regard, the following conditions must be observed:

- Budget projections and medium-term forecasts should be well-grounded, preferably by means of projected outcomes and unit costs;

- Strict fiscal discipline rules should be introduced to ensure that the expenditure limits set for ministries are not exceeded.

The first condition requires quality justification of branch prognoses. Clarification through projected/realized outcomes and unit costs would allow the Ministry of Finance and the Parliament, to the extent of their control functions, to shift focus from resources to projected outcomes. In general, it is more feasible to provide justification via analysis of expected outcomes and unit costs for programs pertaining to the production of individual goods and services (education, health care, licensing, etc.) than for programs aimed at delivering public benefits (ensuring public order, national defense, road construction, etc.). The discrepancy arises due to a much lower complexity of the funding norms for the production of individual goods/services relative to those pertaining to public benefits. However, in both cases, these norms are usually extremely difficult to capture in the budget documentation. For this reason, it is necessary to limit justification based on unit costs to a brief statement of current funding norms that allow their users (the Ministry of Finance, the Parliament, and the society) to evaluate the accuracy and reasonableness of forecasts. On the other hand, unit cost justifications should adhere to the existing funding norms governing service financing. For projected outcomes that are not used to finance the provision of services—such as services provided by one agency (foreign relations, the army) or unique infrastructure projects (construction of airports, ports or bridges)—justification should be resources-based (number of personnel, equipment status of offices, construction materials, etc.).

It should be noted that management on the basis of free decision making by sectoral ministries and budget holders is an integral aspect of program budgeting. In particular, it enables transferring resources between costs items based on aggregation of expenses, even though aggregated cost items can be justified by final figures. If realized outcomes are not used to finance the provision of services and the items must be justified in terms of costs, at the end of a fiscal year, it may be discovered that the resources were used for purposes that were not reported in the item justification according to the budget documentation. This will be problematic if the current use of resources is included in the financial data reporting during a fiscal year. Forecasts should be justified in such a way as to be understandable for each Member of Parliament and every citizen, preferably by means of projected/realized outcomes and unit costs. Even if justified by costs, program classification can fulfill its function in allowing for free decision making by ministries without reducing the control function of the Ministry of Finance and the Parliament.

The second condition requires that sectoral ministries accept the obligation not to exceed their budgets. This is the most important information that should be communicated to each participant in the process of budget reclassification. Indeed, program classification is a contract between the Ministry of Finance and sectoral ministries, whereby independent decision making on expenditures is replaced by recognition of the fiscal discipline rules. This is not to say program classification should not allow transfer of resources across items. While reducing the need for automatic transfer where individual items cover most of the ministerial resources, there will still be a need to reassign funds among items (programs) in order to be able to respond to new circumstances, such as changing political priorities or unforeseen shifts in demand for services. This is also true for budget projections established once by the budget legislation, but this statement is more likely to be related to medium-term projections that cover a more distant and therefore less determinate future. However, these transfers must be subject to strict fiscal discipline, requiring approval by the Ministry of Finance or authorization by additional regulators related to the budget legislation. In particular, transfers must comply with compensation rules that create reliable barriers to expenditure excesses surpassing the budgets of ministries.

The second condition for transition to program budget in Russia yields several advantages related to the actual use of budgeting. Specifically, transition to program classification of expenditures would reduce the number of special-purpose items, which would lead to diminished fiscal control. Consequently, this would change the function of structural unit managers, who would dispose of budgetary funds more freely to achieve their goals due to the consolidation of target costs. The possibility of transferring funds between new consolidated items would remain, but its implementation would require compliance with the budgetary discipline.

Larger discretion of departmental heads in management decision making related to financial flows can lead to a risk of redistribution of financial resources in favor of government expenditures. In this regard, the experience of the OECD (Organization for Economic Cooperation and Development) member states should be used, recognizing the feasibility of classifying ministries and departments as “production” (where program costs prevail) and administrative (where administrative costs prevail), with the former having larger discretion in managing financial resources.

In addition, program classification is based on projected outcomes to a greater extent, while any deviation of the actual values of final figures from those planned with a certain interrelation between the degree of result achievement and the amount of financing (excluding critical, priority expenditures) indicates a need to analyze the expenditure pattern of business entities, which would allow for improved efficiency of the operation of ministries and departments (Afanasiev, 2017).

It should also be noted that program budget is related to the organizational structure of the government, ministries and departments, which optimally reflects current political objectives. Thus, according to the modern concept, when introducing program budget presentation, there is no need to restructure the organization of the government, ministries and departments every time a new budget is passed.

Ultimately, the program classification would improve the macroeconomic function of the budget, in particular, in terms of managing the total amount of expenditures and maintaining budget discipline. The total amount of expenses should be regulated within a medium-term period (from 1 to 5 years) due to a high inertia of the state policy. This necessitates expansion of budget planning horizons.

The rules of fiscal discipline are an integral component of transition to program budgeting and loosening control over resources. They must guarantee consistency and compliance with the maximum amount of expenditures by ministries. The purpose of applying the rules of fiscal discipline is to prevent both budget overrun and inadequate funding of programs.

In this regard, performance indicators are a tool for improving policies and evaluating the effectiveness of programs implemented in the budgeting process, which allows one to take into account the effectiveness and efficiency of measures taken during the allocation of budgetary funds, as well as to track budgetary implications of the measures proposed for implementation and enforcement of new laws.

Considering the nature, features and advantages of applying program budget, an objective and comprehensive assessment of the effectiveness of government budget programs is particularly important. Let us take a look at them in more detail.

It should be noted that, during the study period, all government programs were distributed over five fixed areas:

1. New quality of living.

2. Innovative development and modernization of economy.

3. Good governance.

4. Sustainable regional development.

5. Maintenance of national security.

It is worth noting that the data in areas 1-4 are open, while access to the information on national security is restricted. In this regard, the authors analyzed the expenses for government programs in 2014-2017 (actual) and 2018 (planned) only in the first four areas.

The areas remain unchanged every year, only the number of programs included in each specific area changes. Thus, 39 state programs were implemented in 2014, 38 state programs in 2015, and 40 government programs in 2016-2017. For 2018, 43 government programs are planned.

For 2014-2017 (actual) and 2018 (planned) there was a slight increase in the number of government programs from 39 to 43 programs.

The following government programs are currently implemented: “Health Care Development”, “Development of Education”, “Social Safety of Citizens”, “Employment Promotion”, “Accessible Environment”, “Development of the Pension System in 2020-2035”, etc (The Portal of Government-Sponsored Schemes of the Russian Federation, 2019).

Based on the data presented in reports of the Ministry of Finance of the Russian Federation on the federal budget and the budget system for the 2014-2018, let us analyze the significance of government programs in the framework of Russia’s economic development (Table 1).

Table 1

Share of Government Programs in the Federal Expenditures

in 2014-2017 (Actual) and 2018 (Planned)

Year |

Total Federal Expenditures, trillion rubles |

Federal Expenditures on Government Programs, trillion rubles |

Share of Government Programs in the Federal Expenditures, as % |

2014 |

13.96 |

7.64 |

54.73 |

2015 |

15.42 |

10.41 |

67.51 |

2016 |

16.40 |

10.37 |

63.23 |

2017 |

16.73 |

10.71 |

64.02 |

2018 |

16.53 |

11.18 |

67.63 |

Source: Compiled by the authors based on the data from the Russian Ministry of Finance

(Ministry of Finance of the Russian Federation, n.d.; Anderson et al., 2006)

Based on the table, it can be seen how quickly the program-targeted budgeting mechanism was into integrated into Russia’s economy. As early as in 2014, at the initial stage of the government program implementation, they accounted for slightly more than a half of federal expenditures (54.73 %). Since 2015, the share of government programs in the federal expenditures increased to 67.63% in 2018. In absolute terms, from 2014 to the present, there has been an increase in federal budget spending on government programs from 7.64 trillion rubles to 11.18 trillion rubles by 2018 (by 46.3%).

This analysis was carried out without taking into account the costs of government programs to maintain national security due to restricted access to information. It can be assumed that the share of government programs in the federal expenditures is actually much higher than that presented in Table 1.

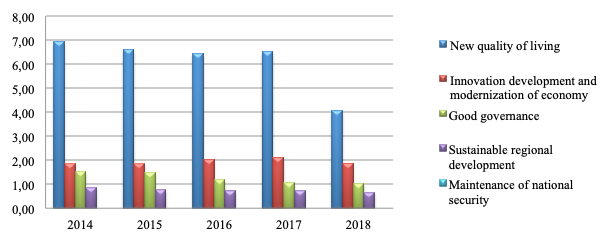

Let us analyze the federal expenditure pattern and structure within the framework of the core areas of government programs in (Figure 2) and (Table 2).

According to the diagram, the major part of federal expenditures in 2014-2018 were accounted for government programs in the “New Quality of Living” area, their amount varying from 4.05 trillion rubles in 2014 to 6.93 trillion rubles in 2018. This is due to the fact that the government programs implemented within this area (13 state programs for 2018) are related to improvement of education, health care and social policy, whereby the required quality, level and availability of social benefits are ensured. The share in federal expenditures on government programs in this area over the last three years has been 62%. From 2014 to the present, 30.54 trillion rubles has been allocated.

Figure 2

Federal Budget Expenditure Pattern in Key Areas of Government

Programs in 2014-2017 (Actual) and 2018 (Planned), trillion rubles

Source: Compiled by the authors based on the data from the Russian Ministry of

Finance (Ministry of Finance of the Russian Federation, n.d.; Anderson et al., 2006)

The area “Innovative Development and Modernization of Economy” (18 government programs) ranks second in terms of expenditures and amounts to 1.85 trillion rubles in 2018. It should also be noted that there was a slight reduction in this area compared to 2015. Thus, in 2015, spending on the “Innovative Development” was 2.1 trillion rubles. The share of federal expenditures in the “Innovative Development and Modernization of Economy” area in the total structure of expenditure on government programs is 17% in 2018, whereas it accounted for 25% of the all expenses in 2014. As part of this area, development of incentive mechanisms for innovation is ensured and a strategic vector is created based on the priority use of intellectual capital in ensuring sustainable socio-economic development of the country; 9.7 trillion rubles has been spent over five years.

Table 2

Federal Expenditure Structure by Areas of Government

Programs in 2014-2017 (Actual) and 2018 (Planned)

Year |

New Quality of Living |

Innovative Development and Modernization of Economy |

Good Governance |

Sustainable Regional Development |

Total Expenditure on Government Programs, trillion rubles |

||||

trillion rubles |

% |

trillion rubles |

% |

trillion rubles |

% |

trillion rubles |

% |

||

2018 |

6.93 |

0.62 |

1.85 |

0.17 |

1.52 |

0.14 |

0.88 |

0.08 |

11.18 |

2017 |

6.61 |

0.62 |

1.85 |

0.17 |

1.48 |

0.14 |

0.77 |

0.07 |

10.71 |

2016 |

6.43 |

0.62 |

2.02 |

0.19 |

1.20 |

0.12 |

0.72 |

0.07 |

10.37 |

2015 |

6.52 |

0.63 |

2.10 |

0.20 |

1.06 |

0.10 |

0.73 |

0.07 |

10.41 |

2014 |

4.05 |

0.53 |

1.88 |

0.25 |

1.04 |

0.14 |

0.67 |

0.09 |

7.64 |

Total |

30.54 |

- |

9.70 |

- |

6.30 |

- |

3.77 |

- |

50.31 |

Source: Compiled by the authors based on the data from the Russian Ministry of Finance

(Ministry of Finance of the Russian Federation, n.d.; Anderson et al., 2006)

The “Good Governance” area (4 state programs) ranks third in terms of expenditures. It is worth noting that the amount of financing has been gradually increasing from 1.04 billion rubles in 2014 to 1.52 trillion rubles in 2018. The share of federal expenditures in the “Good Governance” area in the overall structure of expenditures is 14% in 2018.

The “Sustainable Regional Development” area ranks fourth in terms of volume in the federal expenditures with a share of approximately 7%-9%.

In the context of limited budgetary resources, a need arises to assess the effectiveness of government programs during the allocation of the resources (Kozhevnikov & Ponomareva, 2017).

To evaluate the effectiveness of budget programs is very difficult due to the following problems.

Firstly, there is no generally accepted concept of “effectiveness of budget programs” that would be enshrined in the Russian budget legislation, which entails varying interpretations of this concept and the use of other terms with similar meanings (performance, expediency, cost effectiveness).

Secondly, there are no uniform criteria, principles, and methodological approaches to evaluating the effectiveness of budget programs in regulatory legal acts at various levels of governance. The current Methodology for evaluating the effectiveness of local governments: municipalities and municipal districts, approved by Order No. 1313-r of the Government of the Russian Federation on September 11, 2008, and Methods for evaluating the effectiveness of activities of the executive authorities of the constituent entities of the Russian Federation, approved by Government Decree No. 322 on April 15, 2009 allow one to assess the performance rather than the effectiveness of budget programs (Markov, 2016).

Thirdly, it is difficult to translate indicators of social effect of the activities conducted by educational institutions into a quantitative or monetary equivalent. Social effect is objectively difficult to measure. For example, improvement in the quality of general education can be assessed using the USE (Unified State Examination) results, but as regards professional education, indicators such as enrollment and graduation of students, undergraduate and post-graduate student population do not exhaustively describe the quality of education as such, and the overall assessment of the effectiveness of budget programs may be distorted.

To develop a methodology for evaluating the effectiveness of budget programs is equally important, which makes it possible to identify problem points and determine ways to solve them, as well as to develop measures to reduce the share of ineffective budget expenditures.

Such a methodology should be based on indicators evaluating the effectiveness of budget programs.

As an example, the authors offer a performance indicator that allows for government program evaluation (1).

The effectiveness of a government program:

where Eff is the government program effectiveness;

Ri is the i-th result of the government program, i = 1... n;

Z is the cost of the government program.

The proposed indicator of government program effectiveness shows how many units of the government program result were received from the expenses used upon the budget-funded program (Markov, 2016).

Scientific novelty of the research is the following scientific results obtained: advantages of using program budget in Russia as a tool to improve the effectiveness of public spending were identified; the significance of government programs in the framework of Russia’s economic development was analyzed; the existing problems in assessing the effectiveness of government programs were defined; an indicator that allows for evaluation of the effectiveness of government programs was developed.

Practical implications of the research findings lies in the possibility of applying the scientific research results obtained during the development of a methodology for evaluating the effectiveness of government programs in Russia.

Thus, it is possible to draw an overriding inference that program budget presentation in conjunction with the extensive use of advanced countries’ experience in this area serves to create tools to improve the effectiveness of budget spending in Russia. To improve the effectiveness of program budgeting, it is necessary to combine its implementation with public administration reforms and other reforms in public finance management, such as comprehensive budget, medium-term budget constraints, improved predictability of budget implementation, and reforming the budgetary accounting system. The system for evaluating the effectiveness of government programs is also to be improved.

Afanasiev, M. P. (2017). Program Budget. Moscow: Magistr.

Akhmetshin, E. M., Vasilev, V. L., Mironov, D. S., Yumashev, A. V., Puryaev, A. S., and Lvov, V. V. (2018). Innovation process and control function in management. European Research Studies Journal, 21(1), 663-674.

Aldret, A. D. (2017). Citizen engagement in public policy and public management. Gestión y Política Pública, 26(2), 341-379.

Anderson, B., Curristine, T., and Merk, O. (2006). Budgeting in Norway. OECD Journal on Budgeting, 6(1), 7-43.

Aregbeyeni, O., and Kolawole, B. (2015). Oil revenue, public spending and economic growth relationships in Nigeria. Journal of Sustainable Development, 8(3), 114-123.

Atkinson, A., Banker, R., Kaplan, R., and Young, S. (1997). Management Accounting. New York: Prentice Hall, Inc.

Bachurin, A. V. (1988). Economic Methods in the Management System. Мoscow: Myisl.

Balynskaya, N. R., and Ponomarev, A. V. (2018). Topical Issues of Development of Modern Political and Economic Processes in Russia and Europe. Economics and Politics, 2(12), 5-7.

Beryozkin, D. I. (2016). Research of Higher Education Budget Financing Efficiency and Effectiveness. Moscow: Infra-M.

Blöndal, J. (2008). Budgeting in Australia. Paris: OECD Publishing.

Federal Law No. 104-FZ “On Amendments to the Budget Code of the Russian Federation and Certain Legislative Acts of the Russian Federation with Reference to the Budgeting Process Improvement”. (2013, May 7). Retrieved from https://rg.ru/2013/05/14/budzet-dok.html

Federal Law No. 172-FZ (as amended as of Dec 31, 2017) “On Strategic Planning in the Russian Federation”. (2014, June 28). Retrieved from http://www.consultant.ru/document/cons_doc_LAW_164841/

Garber, A., and Phelps, C. (1997). Economic foundations of cost–effectiveness analysis. Journal of Health Economics, 16, 1-32.

Hanushek, E. (1991). When school finance 'reform' may not be good policy. Harvard Journal on Legislation, 28(2), 423-456.

Hurley, J., Lomas, J., and Goldsmith, L. (1997). Physician responses to global physician expenditure budgets in Canada: a common property perspective. Milbank, 75(3), 343-363.

Ilyina, T. A. (2011). Current trends in the development of the financial control system in Russia. In International Correspondence Scientific and Practical Conference "The Use of Finance for Innovative Economics Development”. Izhevsk, Russia: Institute of Economics and Management, Udmurt State University.

Johansson, P.–O. (1993). Cost–Benefit Analysis of Environmental Change. Cambridge: Cambridge University Press.

Konyarova, E. K., and Osipov, A. K. (2009). Management of Reproduction of the Region’s Financial Capacity. Izhevsk: Udmurt State University.

Kotlyachkov, O . V ., and Kotlyachkova, N. V. (2014). Development of assessment methodology for innovative activity. In Proceedings of Annual International Research and Practice Conference “Fotin Readings – 2014” (pp. 174-182). Izhevsk, Russia: East European Institute.

Kozhevnikov, A. V., and Ponomareva, S. A. (2017). On the evaluation of the effectiveness of regional government programs. Finances, 9, 18-23.

Kudrin, A. L. (2018). Theoretical and methodological approaches to the implementation of a balanced and effective budget policy (Doctoral Thesis). Russian Presidential Academy of National Economy and Public Administration. Moscow.

Lavrov, А. М. (2011). Program budget as a tool to increase the openness of the budget process. Finance, 3, 5-19.

Markov, S. N. (2016). Improving the Efficiency of Budget Spending on Education. Omsk: Publishing House of the Omsk Humanitarian Academy.

Ministry of Finance of the Russian Federation. (n.d.). Retrieved from https://www.minfin.ru/ru/statistics/fedbud/execute/

Mishan, E. (1988). Cost–Benefit Analysis. London: George Allen and Unwin.

Musgrave, R. A., and Musgrave, P. B. (1989). Public Finance in Theory and Practice. New York: McGraw–Hill.

New Zealand Treasury. (2003). Managing for Outcomes Guidance. Wellington: The Treasury.

North, D., and Cecil, D. (1990). Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press.

Paulsson, G. (2006). Accrual accounting in the public sector: Experiences from the central government in Sweden. Financial Accountability and Management, 22(1), 47-62.

Podyablonskaya, L. M. (2013). Finance. Мoscow: Unity-Dana.

Pridachuk, M. P. (2005). Budget Process in the Russian Federation: Peculiarities, Priorities and Development Mechanism. Volgograd: Volgograd State University of Architecture and Civil Engineering,

Prokofyev, S. Ye. (2014). Integrated management of cash flows in the sphere of the Russian public finances. Finance, 9, 7-12.

Rastvortseva, S. N. (2008). Socio-economic efficiency management as a perspective direction of management theory. Economic Herald of the Donbass, 2, 114-121.

Seiler, M. F., Ewalt, J. G., Jones, J. T., Landy, B., Olds, S., and Young, P. (2006). Indicators of Efficiency and Effectiveness in Elementary and Secondary Education Spending. Frankfort: Legislative Research Commission.

Shash, N. N. (2013). Problems of Transition to the Program Budget: New Challenges of the Budget Policy of Russia. Moscow: Terra Economicus.

Spahn, A., and Bernd, P. (1996). Intergovernmental Transfers in Switzerland and Germany in Ahmad, Ehtisham. Financing Decentralized Expenditures: An International Comparison of Grants. Cheltenham: Edward Elgar.

Stiglitz, J. (2000). Economics of the Public Sector. New York: W.W. Norton & Company.

Su, T.-T., Sun, W., and Tsai, H.-F. (2015). The Feasibility of Participatory Budgeting Model in Taiwan. Taipei: National Development Council.

Sukharyov, O. S. (2015). Systematic approach to the analysis of budget expenditures efficiency and economy development directions. Journal of Economy and Entrepreneurship, 1(54), 83-94.

The Portal of Government-Sponsored Schemes of the Russian Federation. (2019). Retrieved from https://programs.gov.ru/opendata/

Wu, A., and Wang, W. (2013). Determinants of expenditure decentralization: Evidence from China. WorldDevelopment, 46(2), 176-184.

Yakobson, L. I. (2006). Budget reform: Federalism or results-based management? Voprosy Ekonomiki, 8, 31-45.

Yaroshenko, T. P. (2011). The model and methodical toolkit of the budgetary expenses efficiency valuation of municipal union. Science Vector of the Togliatti State University, 3, 259-262.

Zadorozhny, V. N. (n.d.). Influence of political image of the state on economic growth. Retrieved from http://www.elitarium.ru/vlijanie_imidzha_gosudarstva_na_jekonomicheskijj_rost/

1. Candidate of Economic Sciences, Associate Professor. Department of Finance and Credit. Omsk Branch of the Financial University under the Government of the Russian Federation

2. Candidate of Economic Sciences, Associate Professor. Department of Finance and Credit. Omsk Branch of the Financial University under the Government of the Russian Federation

3. Candidate of Economic Sciences, Associate Professor. Department of Finance and Credit. Omsk Branch of the Financial University under the Government of the Russian Federation. Contact email: . makovetskym@bk.ru

4. Candidate of Economic Sciences, Associate Professor. Department of Finance and Credit. Omsk Branch of the Financial University under the Government of the Russian Federation

5. Candidate of Economic Sciences, Associate Professor. Department of Finance and Credit. Omsk Branch of the Financial University under the Government of the Russian Federation