Vol. 40 (Number 22) Year 2019. Page 23

MARTÍNEZ-Albarracín, Karen Daniela 1; RIVERA-Roncancio, Lina Marcela 2 & GARCÍA-Cáceres, Rafael Guillermo 3

Received: 02/04/2019 • Approved: 07/06/2019 • Published 01/07/2019

5. General characteristics of the supply chain

6. Characterization of macroprocesses in the supply chain

ABSTRACT: The work follows a recently emerged line of research, which focuses on the characterization of agroindustrial supply chains. In particular, it focuses on specifying the added value of the "Ruta de la Carne," by identifying aspects such as the role, impact and relevance of the different actors, managerial processes and define the components of the supply chain. The results show that the “Ruta de la Carne” Association does not reach the competitive standards of operativity, performance, and service, and, more specifically, it is deficient and presents weaknesses in terms of environmental technical standards, health and safety standards, customer service, sustainability, training of human talent and effectiveness in its supply chain and value chain. The Association has ultimately not been able to consolidate itself as an integrated network. |

RESUMEN: El artículo sigue una línea de investigación de reciente surgimiento enfocada en la caracterización de cadenas de suministro agroindustriales. El trabajo se enfoca en especificar el valor agregado de la cadena de la Ruta de la Carne, para ello identifica aspectos como el rol, impacto y relevancia de los actores, describe los procesos de la gestión y los componentes de la cadena de suministro. Los resultados muestran que la cadena de la Asociación Ruta de la Carne no alcanza los estándares competitivos de funcionamiento, rendimiento y servicio, más específicamente experimenta carencias y debilidades como: Normas técnicas ambientales, normatividad de seguridad y salud en el trabajo, servicio al cliente, sostenibilidad, capacitación del talento humano y efectividad en las cadenas de valor y de suministro, y en definitiva, la Asociación no ha se ha consolidado como una red integrada. |

For the past three decades, the supply chain has figured as one of the most important paradigms of corporate competitiveness (Koberg & Longoni, 2019). this work focuses on the characterisation of the chain as a fundamental base for study and develpment related to it. The literature reveals recent theoretical developments in characterisation methodologies and their application in agroindustrial chains. This work continues in this line of research and, thus, focuses on the characterization of the “Ruta de la Carne” Association (ARC) was legally constituted on September 29, 2014, as an initiative led by the Sogamoso Chamber of Commerce, in order for the sector to become a leading player in the region’s commercial and tourism industry.

The ARC promotes the development of tourism in the Boyacá region through the strengthening of its traditional gastronomy, especially in the Iraka Valley, where quality carne a la llanera (barbequed meat) is traditionally prepared. This article characterizes the supply chain (SC) of the ARC. The results describe the current context of the Association’s activities, the actors and their role within the chain, the relationship between these actors, the links that integrate the chain and the processes developed in each link; finally, conclusions are drawn about its current state, and research prospects are proposed.

The review identified some of the most relevant studies, including both theoretical papers and applied methodologies for the characterization of the SC Table 1.

Table 1

Literature review of methodologies for SC characterization

Author |

Key concept |

Lambert & Cooper (2000) |

Sector: Not applicable, it is a theoretical paper. Frame of reference based on three aspects for chain management: chain structure, management processes and components. |

García-Cáceres & Olaya (2006) |

Sector: Coffee industry. Global and national SC contexts based on function analysis. |

Özelkan & Rajamani (2006) |

Sector: Soft Goods. Frame of reference based on the 5Ps (product, price, place, promotion and people), to describe the chain’s processes, structure and critical points. |

Orjuela, Castañeda Calderón, & Calderón (2008) |

Sector: theoretical study with application in the Agroindustrial sector. Methodology for identifying distribution channels, channel value structure and utility. |

García-Cáceres et al. (2009) |

Sector: Health in Colombia. Material flows, information and resources based on function analysis and the operating reference frame are characterized. |

Ávila & Restrepo (2010) |

Sector: Metalworking Actors, flows, activities and relationships between members are identified using SCOR. |

Adarme (2011) |

Sector: Colombian shipping companies. Based on Lambert & Cooper (2000), the paper characterizes area of influence, actors, processes and relationships. |

Supply Chain Council (SCC), Inc. (2011) |

Sector: Not applicable, it is a theoretical paper. SCOR Methodology (Supply Chain Operations Reference) is used to define and evaluate the scope of chain processes, process evaluation of processes using KPIs (Key Performance Indicators) and implementation of changes. |

Castro & Colmenares (2011) |

Sector: theoretical study with application in the Agroindustrial sector. Methodology for the description of each link and production units that comprise the panela (solid unrefined sugar) market and supply. |

Naranjo, Reyes, & Rodríguez (2012) |

Sector: Construction. SCOR is used to characterize portfolio, processes, flows and links. |

Salazar, Cavazos, & Nuño (2012) |

Sector: Castor Biodiesel. The global network is defined; stakeholders, variables by actor relationships are identified; and a strategic plan is designed using SCOR. |

Castañeda, Canal, & Orjuela (2012) |

Sector: theoretical study with application in the Agroindustrial sector. Methodology for the identification of the central products; the description of strategic, tactical and operational processes supported by 185 variables. |

Mayorga Cerón (2012) |

Sector: theoretical study with application in the food and agricultural sector. Method based on primary sources for the description of the sector, actors, links, critical points and the competitiveness of the SC, relations between actors and the definition of intervention potential. |

Reina & Adarme (2013) |

Sector: Perishable Goods. Characterization of the perishable goods chain using SCOR. |

García-Cáceres, et al. (2014) |

Sector: Cocoa. The SC is characterized on a national level . |

Fernández et al. (2015) |

Sector: Agricultural. Original methodology used to identify components, flows and relevant factors. |

Tiwari, Brintrup, Wang, & Ashutosh (2015) |

Sector: Aerospace Industry. Scientific analysis of networks used to identify key actors and their role, structure, degree of distribution and chain clustering coefficients. |

Herrera & Herrera (2016) |

Sector: Maintenance services. Agents and relationships are identified and processes evaluated using SCOR. |

Lambert & Enz (2017) |

Sector: Theoretical paper. Update of the Lambert & Cooper (2000) methodology, describes the process of chain mapping. |

Mital et al.(2018) |

Sector: Risk Analytic Hierarchy Process (AHP). AHP supports managers in identifying the risk indicators.

|

Source: Authors based on research

The literature highlights that the works of García-Cáceres et al., developed beginning in 2006, focus on the characterization of global and national SC contexts and reveal a strategic decision-making approach. For their part, works by the SCC (2011) and Lambert & Enz (2017) focus on the tactical characterization of SC; although the methodologies are rival ones they are, to a great extent, complementary. This work makes selective use of the three methodologies to conduct a comprehensive characterization of the object of study.

The steps used to characterize the ARC SC are summarized below. The methodology aims to, in the first place –Step 1- provides the global and national context, whereas steps 2 to 4 deal with the tactical characterization of the SC:

Step 1 - Describe the meat industry as it relates to the "Ruta de la Carne": The methodology of García-Cáceres et al (2014) is used to identify the economic and social context of the Association’s chain, which includes market, economic, logistic and normative characteristics specific to the region in question; also, the typical product is characterized with the use of secondary sources and with the information obtained from interviews and surveys of the Association’s members.

Step 2 - Identify the role, impact and relevance of SC actors: In this step, firstly, the flow of materials is approximated, using a representation of the ARC’s SC by means of geographic and thread maps following the SCC guidelines (Supply-Chain Council [SCC], 2011). Additionally, using secondary information and the interviews carried out, the structure of the SC is defined to identify three essential aspects of the SC structure: actors, structural dimensions and relationships of interaction, as suggested by (Lambert & Enz, 2017) methodology. Interviews and surveys were administered to all businesses cataloged as sole suppliers, and samples were taken from the other types of suppliers.

Step 3 - Describe the SC management processes: According to Lambert & Enz (2017) there are eight SC management processes to be described: management of the relationship with the consumer, management of the relationship with the supplier, customer service management, demand management, order fulfillment, production flow management, product development and marketing, and return management. Then, the characterization of flows of information and products existent in certain processes is carried out, following the methodology of Carrillo-Ramírez et al. (2002), which establishes a model that specifies and describes the activities that are considered to be constituent of a typical procedure within SC information and material flows.

Step 4 - Define the management components that make up the SC: The behavioral and technical components carried out during the interaction of the actors in each process are characterized. The components are the management methods which integrate and manage the business processes throughout the SC ( Lambert & Enz, 2017).

The information gathering instruments applied included: surveys, interviews and direct observation of all active Association members. The project analyzed data contributed by the 18 operational establishments. For reference, the glossary presents definitions of key terms and the appendix contains the instruments used.

Meat is a high-value livestock product, deriving its importance from high-quality proteins, which contain all the essential amino acids (FAO, 2016). The meat SC has a production structure that begins with the breeding and fattening of cattle, swine, buffalo, poultry and smaller species (sheep, goats and rabbits); meat production continues with the transport, slaughter, butchery, freezing and commercialization, where at the same time, by-products such as fats, tallow and blood are generated, concluding with the elaboration of products such as cold hams and sausages (DNP, 2014).

Between 2007 and 2016, global production of beef grew at an average annual rate of 0.3%, while production in the leading producer countries decreased at an average annual rate of 0.6%; the European Union, 0.5% and Argentina, 2.2%. In Colombia, total beef production has been decreasing since 2013, between then and 2016 there was a negative variation of 6%. Boyacá is one of the ten departments that together contribute 80% of the national production. A compendium of the national inventory is presented in Table 2, split into three categories: cattle used for milk, dual purpose and meat.

Table 2

Compendium of the cattle inventory

in the leading departments

Dept. |

Milk |

Double purpose |

Meat |

Total Heads (thous.) |

|||

% |

Heads (thous.) |

% |

Heads (thous.) |

% |

Heads (thous.) |

||

Antioquia |

19 |

468 |

28 |

671 |

53 |

1.299 |

2.437 |

Casanare |

1 |

23 |

10 |

239 |

89 |

2.041 |

2.302 |

Córdoba |

7 |

137 |

44 |

896 |

50 |

1.023 |

2.056 |

Meta |

2 |

37 |

17 |

315 |

81 |

1.480 |

1.832 |

Cesar |

20 |

272 |

55 |

732 |

25 |

328 |

1.332 |

Boyacá |

26 |

259 |

46 |

465 |

28 |

282 |

1.005 |

Source: Authors based on the National Agricultural Survey - ENA 2016

The Department with the highest proportion of cattle for milk production is Boyacá with 26% and it is the second producer of milk in the country. The Department with the highest meat production and largest proportion is Casanare.

4.1.2 Consumption

In Colombia, beef consumption was the highest of all livestock products until the beginning of the 21st century. Over the last three years, beef consumption continued to decrease by 2.6%, equivalent to 18.6 kg per person, while chicken consumption increased by 4.4% equivalent to 31.5 kg per person; pork consumption has behaved similarly.

Meat carcasses for domestic consumption are mostly destined for marketplaces, butcher shops and the institutional market which includes: restaurants, schools and hotels among others (DANE, 2017). Table 3 presents a summary of the destination of carcass meat for domestic consumption in 2017.

Table 3

Destination of meat carcasses

for internal consumption 2017

Livestock |

Markets and butcher shops |

Supermarkets |

Institutional market |

|||

% |

Tn |

% |

Tn |

% |

Tn |

|

Sheep |

88 |

138 |

7 |

17,5 |

5 |

3,3 |

Goat |

94 |

142 |

6 |

8,2 |

0 |

1,2 |

Pork |

62 |

59.226 |

33 |

26.765 |

5 |

4.183 |

Buffalo |

67 |

918 |

33 |

457 |

0 |

0,7 |

Beef |

73 |

145.077 |

25 |

32.622 |

1 |

3.938 |

Source. Authors based on the Slaughter Survey third trimester of 2017

One of the worst years recorded for the Colombian meat industry was 2016 (DANE, 2017), with the formal slaughter of animals falling 8.4% compared to 2015, totaling 3,652,236 cattle, 334 thousand animals less than the previous year. The results are explained by an increase in the price of meat for the final consumer due to the decrease in the supply of animals and a slowdown in the economy (FEDEGAN, 2017).

4.1.3 Regulations

The clandestine slaughter and contraband of animals continue to affect the real growth of the meat industry and are a growing threat to health. An estimate for animals illegally slaughtered in 2016 was approximately 4.2 million cattle (FEDEGAN, 2017). In 2018, 1610 abattoirs were registered in Colombia, of that total, in January, INVIMA reported 612 establishments authorized to slaughter animals, of which 320 are private. With a total of 83 plants, 74% of functioning establishments are in Antioquia, of these 87% are dedicated to the slaughter and/or process of cattle, pigs and calves; Bogotá D.C. is next with 68 plants. The department of Boyacá is the sixth department in the country with the highest number of facilities equipped for animal slaughter (28), of which, 89% slaughter pigs and cattle, the municipalities with the largest number of plants authorized to slaughter any species are Duitama (4), Sogamoso (3), Chiquinquirá (2) and Chiscas (2).

In Colombia, the average time active for Small and Medium Enterprises (SMEs) is 12.5 years and in the eastern region (made up of the departments of Arauca, Casanare, Boyacá, Norte de Santander and Santander) the average is 12 years (Confederación Colombiana de Cámaras de Comercio, 2014). The ARC is made up of 25 restaurants, of which 16 are founding members, 4 have entered during recent years and 5 are in the process of entering, currently its members are distributed in the municipalities of Sogamoso, Tibasosa, Firavitoba, Duitama and Monguí. Most of the ARC member establishments have been in the market for more than 15 years, the details on the durability of members is shown in table 4.

Table 4

Duration in the Market of the ARC members in years

Age range (years) |

Establ. |

Age range (years) |

Establ. |

0 >= age < 5 |

2 |

20 >= age < 25 |

0 |

5 >= age < 10 |

2 |

25 >= age < 30 |

2 |

11 >= age < 15 |

0 |

30 >= age < 35 |

2 |

15 >= age < 20 |

5 |

35 >= age < 40 |

0 |

20 >= age < 25 |

0 |

age >= 40 |

4 |

Source. Authors based on research

The department currently has a number of functioning abattoirs, with an average lifespan of 10.9 years, which is higher than the national average and 11.4 years higher than the regional average.

This study determined that 88% of the businesses involved in the ARC are established businesses; that is, they are companies that have paid salaries or another type of compensation to employees for more than 42 months of operation.

Concerning education, in Colombia during 2006, 2007, 2008 and 2010, employers whose highest level of educational attainment was high school graduate dominated, while in 2009 and 2011 the majority of businesspeople had a postgraduate degree (Martínez et al., 2017). In the report Global Entrepreneurship Monitor (GEM, 2016) for Colombia in the period 2015/2016, the largest proportion of established businesspeople, both men and women, had a university education, making up 33.3% and 23.4% of the total respectively. In the ARC, the educational level with the highest proportion is mostly university-trained with 31%, and 25% having technical or technological training, as is presented in Table 5.

Table 5

Entrepreneurial education level in Colombia vs ARC (ARC)

Training |

Women |

Men |

ARC |

Primary |

7% |

9% |

2 businesspeople (13%) |

Secondary |

23% |

23% |

3 businesspeople (19%) |

Technical or technological |

37% |

23% |

5 businesspeople (25%) |

University |

23% |

33% |

6 businesspeople (31%) |

Postgraduate, Master’s or PhD |

8% |

10% |

2 businesspeople (13%) |

DK/NR |

1% |

2% |

(0%) |

Source. The national data is obtained from the GEM Colombia 2015-2016 Report, the totals for the ARC are adapted from the present research

Of the eighteen establishments surveyed in the information collection stage, six have owners or administrators who have completed university studies and five have technical or technological training, emphasizing that the percentage of businesspeople with undergraduate training is higher in the ARC than the national average.

Fifty-six percent of the establishments operate strategic alliances with suppliers, highlighting here the relationship acquired with the craft beer supplier, Bruder, this company has established alliances with four members of the Association.

In this section, the general components that make up the ARC’s most representative dish are described, based on the work of García-Cáceres et al. (2014). Three products were identified by members as their specialty, hamburger is the main dish in one establishment, three establishments serve soups as their specialty, and twelve assert that their main dish is meat, specifically a mixed-meat platter (picada). The picada is mainly made up of pork and beef products alongside accompaniments that can vary according to the establishment, a typical serving is made up of: beef, pork, potatoes (present in 650 of the establishments), blood sausage (93%), envuelto (87%), chorizo (40%), arepa (maize patties) (73%), cassava (87%), plantain (60%) and salad (7%).

When looking at the type of meat, eight establishments specialize in serving beef, three pork and one lamb. Taking into account that 75% of the establishments specialize in the preparation of picada, this dish was identified as the typical product when the SC of the ARC was characterized.

Table 6 shows the conformation of three SC links: 1. Supply, includes meat suppliers, agricultural inputs, processors of meat products (e.g., blood sausage and pork sausage), producers of envueltos (corn dumplings) and arepas (corncakes), others (wood, ice cream, drinks, génova [short round sausages], etc.); 2 and 3 correspond to the production and distribution links, the locations of the ARC members, with these producing the final product and also having direct contact with the final consumer. The actors are defined and categorized in the context of the description of the Association’s typical product.

Table 6

Description of each Link

Link |

Supply |

Production |

Distribution |

Description |

Comprised of the actors that provide the goods and services necessary for the production of picada |

Establishments that are ARC members |

Establishments that are ARC members, there are no intermediaries between the producer and the client. |

Actors |

Suppliers of raw materials, inputs suppliers, processing plant |

BBQ restaurants and Restaurants |

BBQ restaurants and Restaurants – Final Consumer |

Regulatory bodies, guilds and support institutions |

|||

Source. Authors based on research

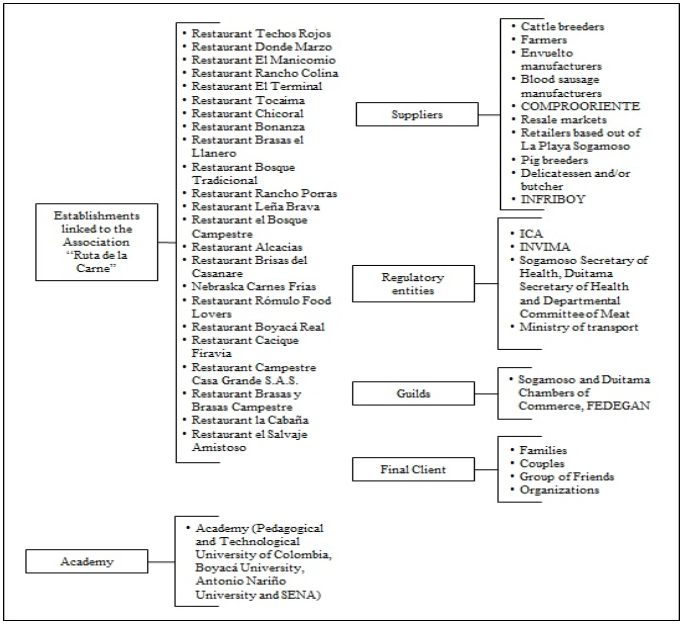

Fig. 1

SC members of the ARC

Source. Authors based on research

SC members include all the companies and organizations with which the focal company interacts directly or indirectly through its suppliers or consumers, from the point of origin to the point of consumption (Lambert & Cooper, 2000). Fig. 1 shows a diagram of the members that directly or indirectly integrate the SC:

The primary actors in the ARC SC are those that add value to the typical product, that is, those that directly influence the transformation of the product (Table 7), while other actors are classified as support actors. The primary actors in the ARC SC are detailed as follows:

Table 7

Primary actors in the ARC SC

Actor |

Aggregated Value Function |

Cattle breeders |

They facilitate the growth of the animals until they reach the ideal size for sale, providing them with the necessary food and care |

INFRIBOY |

Responsible for the transformation of live cattle into meat carcasses |

Retailers based out of La Playa Sogamoso |

Transportation of cattle from farm to market, they serve as intermediaries. |

Pig breeders |

They care for the pigs until they reach the required size |

Delicatessen and/or butcher |

They vacuum pack and prepare cuts of meat for some Association establishments |

Envuelto manufacturers |

They process corn to prepare the accompanying products |

Blood sausage manufacturers |

They process blood together with other ingredients to create the accompanying products |

Arepa manufacturers |

They process the corn to prepare the accompanying products |

COOMPRORIENTE and Resale markets |

They sell the agricultural products used by Association members |

BBQ restaurants and Restaurants |

They process the meat to create the final product that will be offered to the customer |

Final Client |

Consumers of the final product in the establishments |

Source. Authors based on research

The support actors of the ARC SC are suppliers of agricultural and livestock inputs, farmers, ICA, INVIMA, Duitama Ministry of Health, Sogamoso Secretary of Health, Departmental Committee of Meat, Ministry of transport, Sogamoso and Duitama Chambers of Commerce, FEDEGÁN and Academia; because they contribute resources, knowledge and develop activities that both promote and control the SC.

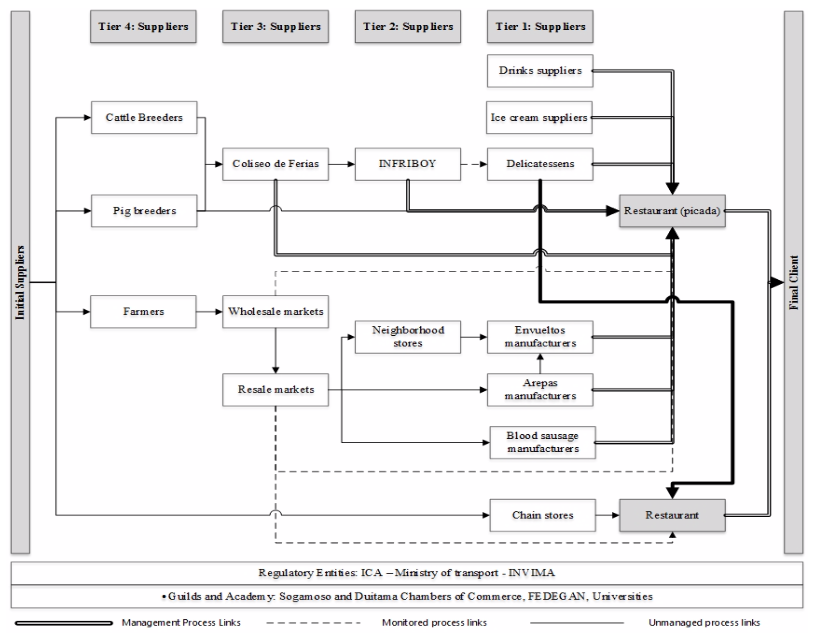

The methodology of Lambert & Enz (2017) establishes that once the SC actors and their position in the chain have been identified, the structural dimension is then described, consisting of the horizontal and vertical structure and the horizontal position. The horizontal structure (see Fig. 2) of the SC identifies the number of tiers that exist in the ARC. To that effect, there are four tiers of suppliers, and a single distribution step, because the establishments offer their products directly to the final consumers. The vertical structure describes the number of suppliers or customers represented in each tier, tier 1 has seven suppliers (drinks, ice cream, delicatessens, envueltos, arepas, blood sausage and chain stores), tiers 2 has two suppliers (INFRIBOY and neighborhood stores), tier 3 has three suppliers (Live cattle (Coliseo de Ferias), wholesale and resale markets) and tier 4 identifies three suppliers (pig breeders, cattle breeders and farmers). Finally, the horizontal position, or the location of the ARC within the SC, is at the point of direct contact with the final consumer.

Successful management of the SC requires that the management of individual functions is surmounted in order to integrate activities within the management of a single process Lambert (2008). This section characterizes the macro processes defined by Lambert & Enz (2016), listed in the third step of the methodology, grouped into the three basic elements of the SC and centered on the Association’s typical product; subprocesses related with the SC are also differentiated by process.

The sourcing stage includes the processes of managing the relationship with the supplier and the management of production flow.

This process provides a structure for the development and maintaining of relationships with suppliers. Through the management of the relationship with the supplier, the groups of suppliers that must be approached as part of the Association's mission are identified. This process comprises two levels, one strategic and the other operational.

Currently the ARC establishments maintain relationships with their suppliers for an average of 6.7 years, the longest relationship with a supplier is 18 years, in this case it is the relationship between the génova supplier and the Bonanza establishment. Carcass meat is the body of the slaughtered animal, bled, skinned, eviscerated, without a head or extremities. The carcass is the primary product; it is an intermediate step in the processing of cuts of meat, which is the finished product. The replenishment at the ARC is weekly. The total estimated weekly consumption of beef is 199.50 arrobas and 94.40 arrobas of pork for 2018. The BBQ restaurants, which represent 62% of the total establishments, acquire the meat first as live cattle in local, or nearby markets, or on the farms, the remaining percentage buys the meat in carcass form or in cuts of meat directly from a butcher or a SC warehouse.

The strategic subprocesses described are obtained from a review of the mission, the strategies and identification of segmentation criteria of the SC. In this regard, the current criteria for segmenting suppliers are: the strategic impact and the supply risk. Table 8 presents the segmentation of the suppliers, using a matrix adapted from the work of Lambert (2008) of the Kraljic matrix (Lee & Drake, 2010).

Table 8

Segmentation of the ARC Suppliers

Strategic Impact

|

High |

Commodities Live cattle (Coliseo de Ferias “La Playa”) Live pigs Cuts of meat (Butcher, delicatessen, SC stores) Raw materials and agricultural inputs (Wholesale marketplace, resale marketplace) |

Strategic Meat carcasses (INFRIBOY) Accompaniments |

Low |

Non – Critical Ice cream (San Jerónimo) |

Bottlenecks Beverage suppliers (Bavaria, Postobón, Bruder and Café Macana) |

|

Low |

High |

||

|

Supply risk |

||

Source. Authors based on research

Table 9 is composed of four quadrants, the first refers to strategic purchases, critical for the success of the ARC and that require a higher level of integration and closer relationships with the supplier; they are characterized by a high supply risk due to the limited number of suppliers or complex delivery. Leveraged purchases or commodities are easy to manage, but have high strategic importance, these products represent a high percentage of profits and at the same time there is a choice of many suppliers so it is easy to change suppliers because the quality is standardized. Bottleneck purchases are products that can only be purchased from one supplier or a limited number of suppliers and have a relatively low impact on financial results. Finally, non-critical purchases refer to products that are easy to buy without any interdependence between the supplier and the buyer, and have a relatively low impact on financial results.

In this stage the characterization seeks to describe the processes of supply management and production flow adapted to the current situation of the SC. The planning and control of ARC supply management operations are important for their downstream impact in order to meet customer needs and abide by profit standards that allow the chain to be sustained over time. For this, great effort is required to both manage and control the processes underpinned by the coordination that is facilitated by process integration; and operationally achieved by the activities carried out through the interaction of areas such as sales forecasts, delivery plans and customer purchase orders that go through the detailed planning of material and capacity requirements.

In this regard, 56.25% of the establishments use a blank notebook for noting down information without a specific order, 18.75% use a template that lists the dishes offered in the establishments and 6.25% use an order form.

The ARC does not handle a forecasting process, determining the volumes or quantity of existing demand in an intuitive way. In this regard, only one of the 18 establishments performs a forecast analysis. Of the establishments, 650 carry out visual inspections of the main product (meat), and 80% verify that the product has arrived with all the required or specified sanitary documentation. Table 9 presents a synthesis of the characteristics of the processes involved in the ARC SC production stage.

Table 9

Synthesis of Characteristics - Production link

Type of activity |

Characteristics of the process: General process |

||

Process for meat |

Process for arepas |

Process for blood sausage |

|

Critical |

Maturation Cutting up of the meat. Temperature-controlled SC |

Dough kneaded

|

Sausage casing prepared |

Activities that affect the quality of the product |

Inspection of Raw Material. Meat marinade. Meat cooking time. The breed of cattle. Cattle sex |

Preparation of Raw material. Homogeneity of the dough. Grilling of the arepas |

Achieve homogeneity. Stuffing the sausages. Cooking the blood sausages. |

Source. Authors based on the methodology of (Vargas-Oviedo & Zaizida-Rodríguez, 2009)

The characterization of this stage describes the different features of the ARC’s current consumer profile, characterizes the consumer relationship management processes, customer service management, order fulfillment, product development and marketing process, and return management, using the guidelines established by Lambert (2008) and Lambert & Enz (2017).

Currently, the ARC establishments only run observation mechanisms and sporadic surveys to measure the satisfaction of consumers. 38.1% of clients visit establishments once a month, and 30.95% visit weekly. 81.1% of the clients are from the department of Boyacá, of which 64.3% reside in the city of Sogamoso. Clients are characterized as family groups (95.2%). 35.7% of customers frequent establishments as a family tradition, 28.6% because of a recommendation from a friend and 64.3% of customers who visit the establishment do so because they consider it to be their favorite.

37.50% of the establishments determine customer satisfaction by listening to clients’ comments, however, there is usually no written record of this interaction; 31.25% of the establishments base their perception of customer satisfaction on the facial expressions of clients as they leave the establishment; 25% of the owners come to the tables and interact with customers, asking about their level of satisfaction with the service and the product offered, only 6.25% of the establishments carry out non-periodic surveys to measure satisfaction.

The clients rated service as excellent in 47.6% of cases and good in 40.7%, and 57.1% rated the personal presentation of personnel as good and 38.1% as excellent. 61.11% of the establishments allow table reservation, however, the vast majority of the establishments indicate that this only takes place on special dates such as Mother's Day. In terms of free tastings, 12 of the 18 establishments (66.67%) offer a small cut of meat to customers, 11.11% of the establishments offer plantain, and two establishments instead offer pepitoria (goat haggis) and chorizo. The method for charging customers was also determined to be a point of contact with customers: most establishments (47.06%) bring the bill to the table and the client then pays at the till, 41.18 % charge the customer at the till once they have made their order and 11.76% leave the decision to customer, who informs the waiter if they want to pay at the table or at the till.

The customer’s order is sent to production, 56.25% of the establishments provide their waiters with a blank notebook to note down the client’s order, 18.75 % use a pre-established list, 6.25% use a purchase order to note down customer orders and 18.75% use different instruments such as, for example, their waiter’s memory skills.

The service staff was rated excellent at 47.6% of establishments and good at 40.7%. The presentation of the front of house personnel was considered good (57.1%) and 38.1% as excellent. Order fulfillment determines the level of customer satisfaction and their experience in relation to their order. 71.43% of clients determined that their order would definitely be delivered on time, and 14.29% said that their order would probably be delivered on time.

The establishments are characterized as offering a traditional product from the Boyacá region which is not subject to innovation. The intent is to maintain standards of quality while accomodating variations in the inputs and preparation techniques.

In the ARC, returns of the raw materials are generated from production to the supply of materials or inputs, this can also happen with finished products in the case of returns made by the client to the production area. Regrettably, no records exist that would allow for a proposal of a process of continuous improvement to be carried out in a technical and traceable way over time.

Figure 2 shows a diagram of the ARC SC that details the dimensional structure, the members comprised within it and the links between them for the production of picada and the provision of service to the final consumer. The diagram shows three types of links: management process links, whose management and integration are important, represented with a thick continuous line. Monitored process links, which are not critical for the company in question, but which need to be integrated and managed appropriately by the SC members, are represented here by the dotted line. Unmanaged process links, represented graphically here using a simple continuous line, are those in which the company in question is not actively involved and does not allocate resources for its monitoring.

Fig. 2

Diagram of the ARC SC

Source: The authors

For the ARC, the commercial relationship of trust dominates the administration of these types of links.

Finally, table 10 lists the management components developed over the course of the different ARC SC processes. The components represent the level of integration of each process, identified using the interview and survey questions answered by the establishments.

Table 10

Components applied in each SC process

Processes / Components |

Planning and control methods |

Structure of work flow |

Organizational structure |

Structure of product flow |

Structure of information flow |

Management methods |

Power and leadership |

Risks and rewards |

Culture and attitude |

Consumer relationship management |

X |

X |

X |

X |

|||||

Management of the relationship with the supplier |

X |

X |

X |

X |

|||||

Customer service management |

X |

X |

X |

X |

X |

||||

Supply management |

X |

X |

X |

||||||

Order fulfilment |

X |

X |

X |

||||||

Production flow management |

X |

X |

X |

X |

X |

X |

|||

Marketing and product development management |

X |

X |

X |

X |

|||||

Returns management |

X |

Source. Authors based on research

Table 10 was constructed based on the management processes and components established by Lambert & Enz (2016), in which an “X” represents the existence or application of a component in each process. Hereafter, the development of each component as part of the processes is explained together with the opportunities for improvement and its importance.

In the process of managing the relationship with the consumer, the culture and attitude component stands out, because customer relations and segmentation are influenced by the fact that the main product is a typical dish in the Association’s area of influence. As part of this process it is important to develop a plan to strengthen management methods focused on providing value to each customer segment.

Central to the management of the relationship with the supplier is the optimization of throughput to ensure quality, efficiency in costs and sufficient final product. In this regard, the ARC should take the opportunity to improve its management methods and planning; specifically, it was observed that the level of service is affected by depleted inventories of the raw materials, the finished product and a limitation in the number of waiters.

Customer service management in the businesses that make up the ARC is determined by the power and leadership of the administrators and owners, which are observed to be significantly dissimilar in terms of vision and business management capacity. The risks and rewards in the SC are handled similarly by ARC establishments, these focus on providing employees with the opportunity to receive tips for the service provided; no technical methods of human resource management are evident.

Supply management in the ARC has drastic room for improvement in the management of methods and planning so that these can be effectively controlled and make demand management more effective.

For order fulfillment, the components developed by the actors are: workflow structure, organizational structure, product flow structure and information flow structure. It was observed that planning and control methods require more work to avoid offering products that are no longer available and also to not exceed the accepted customer waiting time.

In production flow management, establishments must push their limits for planning and execution in order to reach the desired level of efficiency (Lambert, 2008). The upstream key players in this process are Tier 1 suppliers because they affect the ability of establishments to meet customer expectations and in some cases limit the production capacity of the establishments. Final consumers also influence this process since they directly affect the specific attributes of the product, as well as quality, cost and availability.

Product development and commercialization is strongly influenced by the culture and attitude component reflected in the different alternatives that some establishments offer to the public according to trends in society, for example, vegetarian dishes, while taking into account the family atmosphere of some of the restaurants.

In the management of returns, the ARC is deficient in these components because they have no planning and control in place before this situation occurs, instead they focus on responding in the moment to returns as they occur, taking advantage of the fact that they are in direct contact with customers. In the case of returns due to inconsistencies in the picada, the flow structure of the product in place aims to solve the complaint immediately.

This study identified the product portfolio, the market sustainability of the enterprises that make up the Association, the segmentation and characterization of suppliers and customers in relation to ARC’s mission, identified the market behaviors of raw materials, described the production processes, and identified the level of customer satisfaction among other relevant aspects.

The beef industry in Colombia has been improving in quality with the incorporation of premium cattle breeds, although, consumption and production has reduced, explained by the slowdown in the economy, and the existence of alternative foods at lower prices - many of them associated with imports and the growing illegality in the slaughter of animals. Consequently, this context represents an implicit challenge for the sector that should take the opportunity to strengthen efficiency and added value to improve quality and increase demand through market segmentation. Meat in Colombia is practically organic, but it requires a reduction in the number of animals/ha. to reduce its environmental impact.

Regarding the ARC SC, improvement strategies focus on four aspects: 1. The organizational structure and governance of the ARC; 2. Development of the brand; 3. Documentation of good practices and securing of processes in a SC context; 4. Segmentation of the market.

Although the ARC is structured and has appointed a manager in the past, the association has never had a formally delegated leadership or power structure that would allow the chain to be managed in a comprehensive manner. Except for the incipient brand, the ARC is a set of uncoordinated businesses that do not benefit from their organizational potential, for example, in bargaining power and the benchmarking of good practices. In general, the ARC must define the scope of its association in terms of how integrated it wants establishments to be, as this limits the levels of collaboration and knowledge management. This indecision has made it impossible to comply with even the most basic objectives, as evidenced by the fact that 59.5% of customers have not heard of the ARC.

Adarme, W. (2011). Desarrollo metodológico para la optimización de la cadena de suministro esbelta con m proveedores y n demandantes bajo condiciones de incertidumbre: caso aplicado a empresas navieras colombianas. Universidad Nacional de Colombia, Sede Medellín. Retrieved from http://www.bdigital.unal.edu.co/5514/

Ávila, F., & Restrepo, H. (2010). Caracterización y propuesta de mejoramiento de la cadena de suministro (sc) a la que pertenece una industria de tornillería. Universidad ICESI.

Carrillo-Ramírez, M. H. ;, Fiorillo-Obando, G. R., & García-Cáceres, R. G. (2002). Modelo analítico para el estudio de una cadena de abastecimiento. Ingeniería y Universidad, 6(2), 119–136.

Castañeda, I., Canal, J. L., & Orjuela, J. A. (2012). Caracterización de la logística de la cadena de abasteci-miento agroindustrial frutícola en Colombia. Universidad Distrital Francisco José de Caldas, Bogotá.

Castro, J. A. O., & Colmenares, I. A. C. (2011). Caracterización de la cadena de abastecimiento de panela para la provincia de Bajo Magdalena-Cundinamarca. Ingeniería, 16(2), 107–124.

Confederación Colombiana de Cámaras de Comercio. (2014). Las empresas como agentes de transformación productiva y su perdurabilidad en Colombia. Confederación Colombiana de Cámaras de Comercio. Retrieved from http://www.confecamaras.org.co/phocadownload/Libros/Cuaderno_No._5.pdf

DANE. (2017). . Departamento Administrativo Nacional de Estadística. Retrieved from https://www.dane.gov.co/index.php/estadisticas-por-tema/agropecuario/encuesta-de-sacrificio-de-ganado.

DNP. (2014). Análisis Cadenas Productivas. Cadena Cárnicos. Departamento Nacional de Planeación.

FAO. (2016). Carne y Productos Cárnicos. FAO: Food and Agriculture Organization of the United Nations. Retrieved from http://www.fao.org/ag/againfo/themes/es/meat/home.html

FEDEGAN. (2017). Contexto Ganadero. Federación Colombiana de Ganaderos. Retrieved from http://www.contextoganadero.com/regiones/preocupacion-por-aumento-del-sacrificio-ilegal-en-duitama

Fernández, G., Aguilar, A. A., Martínez, G., Ruvalcaba, M. L. G., Correa, J. G., & Martínez-Flores, J. L. (2015). Contexto y Caracterización de la Cadena de Suministro del Limón Persa (Citrus latifolia Tanaka) en Veracruz-México. Conciencia Tecnológica, 50, 21 – 31.

García-Cáceres, R. G., & Olaya, É. S. (2006). Caracterización de las cadenas de valor y abastecimiento del sector agroindustrial del café. Cuadernos de Administración, 19(31), 197–217.

García-Cáceres, R. G., Perdomo, A., Ortiz, O., Beltrán, P., López, K. (2014). Characterization of the supply and value chains of Colombian cocoa. Dyna, 81(187), 30–40.

García-Cáceres, R. G., Torres, S., Olaya, É. S., Díaz, H. B., Vallejo-Díaz, B. M. R., & Castro, H. F. (2009). Creación de Valor en la Cadena de Abastecimiento del Sector Salud en Colombia. Cuadernos de Administración, 22(39), 235–256.

Global Entrepreneurship Monitor -GEM, I. (2016). Global Entrepreneurship Monitor (GEM) de Colombia para el período 2015/2016. Retrieved from http://gemcolombia.org/wp-content/uploads/GEM-Colombia-20165.compressed3.pdf

Herrera-Vidal, G., & Herrera-Vega, J. C. (2016). Modelo de referencia operacional aplicado a una empresa de servicios de mantenimiento. Revista Venezolana de Gerencia, 21(75).

Koberg, E., Longoni, A. (2019). A systematic review of sustainable supply chain management in global supply chains. Journal of Cleaner Production, 207, 1084-1098

Lambert, D. (2008). Supply chain management: processes, partnerships, performance. Supply Chain Management Inst.

Lambert, D. M. ;, & Cooper, M. C. ; (2000). Issues in supply chain management. Industrial Marketing Management, 29, 65–83.

Lambert, D. M., & Enz, M. G. ; (2017). Issues in Supply Chain Management: Progress and potential. Industrial Marketing Management, 62. Retrieved from https://doi.org/10.1016/j.indmarman.2016.12.002

Lee, D. M., & Drake, P. R. (2010). A portfolio model for component purchasing strategy and the case study of two South Korean elevator manufacturers. International Journal Of Production Research, 48(22), 6651–6682. Retrieved from https://doi.org/10.1080/00207540902897780

Martínez, V. J. S., Autónoma, U., Norte, U., Orlando, C., Lajud, D. O., Autónoma, U., & Autónoma, U. (2017). Perfil de los empresarios colombianos a partir de los datos del Global Entrepreneurship Monitor, 22, 1–21.

Mayorga-Cerón, J. H. (2012). Caracterización de la Cadena Productiva de Miel en El Salvador. San Salvador.

Mital, M., Del giudice, M., Papa, A. (2018). Comparing supply chain risks for multiple product categories with cognitive mapping and Analytic Hierarchy Process. Technological Forecasting and Social Change, 131, 159-170

Naranjo, I., Reyes, C., & Rodríguez, J. (2012). Diagnóstico basado en el Modelo Scor para la cadena de suministro de la empresa Matecsa S . A ., 9(1).

Orjuela, A. J., Castañeda Calderón, C. A., & Calderón, M. E. (2008). Análisis de la cadena de valor en las estructuras producti-vas de uchuva y tomate de árbol en la Provincia de Suma-paz y el Distrito Capital, 13(2), 4–12.

Özelkan, E. C., & Rajamani, D. (2006). 5P Framework for Teaching and Characterizing Supply Chains Effectively. IIE Annual Conference. Proceedings, 1–5. Retrieved from https://bdbiblioteca.universidadean.edu.co:2237/docview/192459674?accountid=34925

Reina, M. L., & Adarme, W. (2013). Logística de distribución de productos perecederos : estudios de caso Fuente de Oro ( Meta ) y Viotá Distribution logistics of perishable products : case studies of Fuente de Oro ( Meta ) and Viotá ( Cundinamarca ). Revista Colombiana de Ciencias Hortícolas, 8(1), 80–91. Retrieved from http://www.scielo.org.co/scielo.php?script=sci_arttext&pid=S2011-21732014000100008&lng=en& tlng=es

Salazar, F., Cavazos, J., & Nuño, P. (2012). Strengths and weaknesses of SCOR model: Supply chain biodiesel castor. IIE Annual Conference. Proceedings, 1–10. Retrieved from https://bdbiblioteca.universidadean.edu.co:2237/docview/1151083737?accountid=34925

Tiwari, A. ;, Brintrup, A. ;, Wang, Y., & Ashutosh; (2015). Supply networks as complex systems: a network-science-based characterization. IEEE Systems Journal, 11, 1–12. https://doi.org/10.1109 / JSYST.2015.2425137

Vargas-Oviedo, L. A., & Zaizida-Rodríguez, N. V. (2009). Caracterización de la Cadena de Abastecimiento de Rosas en Colombia. Universidad Pontificia Universidad Javeriana, Bogota.

1. Industrial Engineer, Universidad Pedagógica y Tecnológica de Colombia - UPTC, Colombia. Email: karendaniela.martinez@uptc.edu.co

2. Industrial Engineer, Universidad Pedagógica y Tecnológica de Colombia - UPTC. Email: linamarcela.rivera@uptc.edu.co

3. Industrial Engineer, Universidad Pedagógica y Tecnológica de Colombia - UPTC. MSc and Ph.D. Industrial Engineering, Universidad de los Andes, Colombia. Affiliation: Associate Professor, School of Industrial Engineering, Universidad Pedagógica y Tecnológica de Colombia, Colombia. Email: rafael.garcia01@uptc.edu.co