Vol. 40 (Number 24) Year 2019. Page 10

CORONEL, Carlos 1; MARTÍNEZ-GÓMEZ, Javier 2; DELGADO-YÁNEZ, Mónica 3 y RODRIGUEZ, Francisco 4

Received: 11/03/2019 • Approved: 01/07/2019 • Published 15/07/2019

ABSTRACT: The Ecuadorian Government is promoting several policies in order to boost energy savings, among which the National Plan for Energy Efficiency (P.L.A.N.E.E.) stands out. The initiative fosters the development of Energy Service Companies (ESCOs) in the country. This research aims to highlight the causes and actions that should be generated so that the introduction of ESCOs can be encouraged. This multi-criteria analysis is based on the bibliographic reviews of energy-saving actions carried out in several countries. The main results highlight the importance to introduce the ESCOs market nationwide since there is currently no regulation that requires the adoption of efficiency improvements at industrial level. |

RESUMEN: El Gobierno de Ecuador se encuentra promoviendo diversas políticas de impulso al ahorro energético, entre las cuales destaca el Plan Nacional de Eficiencia Energética – PLANEE. Este impulsa el desarrollo de Empresas de Servicios Energéticos (ESEs). Mediante el presente análisis se resaltará las posibles causas y acciones que deben generarse para que pueda fomentarse la introducción de ESEs. Este estudio se fundamentará en la revisión bibliográfica de las acciones llevadas a cabo en diversos países a través de un análisis multicriterio. Los principales resultados resaltan la importancia de introducir el mercado de ESEs en todo el país, ya que actualmente no existe una regulación que requiera la adopción de mejoras de eficiencia a nivel industrial. |

Ecuador's primary energy matrix has historically been dominated by oil production. Nevertheless, According to the 2016 energy balance, there is evidence of an increase of 51% in the renewable energy supply, due to an increment in hydropower production, products derived from sugar cane, and other non-conventional renewable sources during the period 2005-2015.

Currently, the demand for energy has been surpassed by the production of primary energy, which makes Ecuador an energy exporting country. However, because the demand for secondary energy is exceeded by production, it is necessary to import energy to supply the sectoral demand (MEER, Balance Energético, 2016).

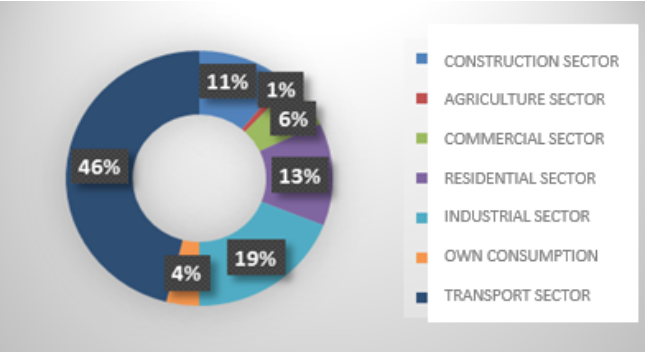

Energy demand increased from 55 million BOE in 2000 to 94 million BOE in 2015, representing an increment of 71% during that period. Historically, the transport sector has been the largest energy consumer. In fact, the participation of no less than 40% is shown during that period, followed by the industrial sector with an estimated 20% and finally, the residential sector (Villacís et al. 2015).

Figure 1

Energy demand by sector 2015 (Villacís et al. 2015)

Next, some information will be exposed to know the circumstances of the business model, thought the sections 1.1. Energy and Industrial Sector perspective in Ecuador; 1.2. ISO 50001 Energy Management System establishment; 1.3. EPC (Energy Performance Contract) mechanism; 1.4. ESCO as a business model; 1.5. Limiting factors that prevent the development of ESCOs market

Ecuador started the planning of a transition towards a more renewable-based power grid in 2009, with the first issuance of the National Plan for Good Living (FNPGL) (Martínez et al. 2017). By 2009, electricity installed nominal capacity in Ecuador was dominated by conventional thermal generation, with a 53.71 % of the share, followed by hydroelectric energy with 46.23 % and nonconventional renewable energy (in this work represented by solar photovoltaic, wind, geothermal and biomass processing) with 0.05 % of the total (Martínez-Gómez et al., 2016). The objectives stated in the FNPGL for the electric sector were to guarantee the energetic sovereignty, offer a trustworthy and quality service, and achieve a cleaner electricity system. This set of policies allowed increasing the percentage of renewable energy sources in the electricity generation mix (Goldemberg et al., 2018). Following the development of several emblematic projects, mainly hydroelectric, the electricity generation mix saw an increase in the share of renewable energy (Table 1). The power of renewable energy reached 56.51 %, 54.15 % from hydropower, 0.25 % from wind energy, 0.32 % from photovoltaic, 1.74 % from biomass and 0.04 % coming from of biogas (Kastillo et al., 2017).

Power from renewable energy reached 43.49%, with 24.42% being generated by internal combustion engines, 13.51 by gas turbine and 5.56% by steam turbine. The tendency is to increase the use of renewable energies through hydroelectric plants due to their low cost of electricity production (Espinoza et al., 2016).

Table 1

Nominal power in electric power generation based on Agencia

de Regulación y Control de Electricidad, (ARCONEL, 2018).

Renewable energy |

Hydraulic |

4.496,36 |

54,15% |

Wind |

21.15 |

0.25% |

|

Photovoltaic |

26.48 |

0.32% |

|

Biomass |

144.30 |

1.74% |

|

Biogas |

3.40 |

0.04% |

|

Total renewable energy |

4,691.69 |

56.51% |

|

Non-Renewable energy |

Thermal internal combustion engines |

2,027.67 |

24.42% |

Thermal Gas turbine |

1,121.85 |

13.51% |

|

Thermal Steam turbine |

461.87 |

5.56% |

|

Total non-renewable energy |

3,611.38 |

43.49% |

|

Total Nominal power |

8.303,06 |

100,00% |

|

Imports |

MW |

% |

|

Imports |

Colombia |

540.00 |

83.08% |

Perú |

110.00 |

16.92% |

|

Total production of energy and imports are shown in Table 2. It is observed that 73.63% of Total Production of Energy and Imports is due to renewable energy sources, 26.30% to non-renewable energy sources and 0.07% to imports. It can be notice that 71.60 % of the production of electricity is due to hydroelectric energy and 26.30 % is production by no renewable energy. The rest of the production is grouped in wind, photovoltaic, biomass, biogas and imports to Colombia and Perú.

Table 2

Total production of energy and

imports based on ARCONEL (2018).

Total Production of Energy and Imports |

GWh |

% |

|

Renewable energy |

Hydraulic |

20,084.37 |

71.60% |

Wind |

73.40 |

0.26% |

|

Photovoltaic |

37.48 |

0.13% |

|

Biomass |

430.85 |

1.54% |

|

Biogas |

27.82 |

0.10% |

|

Total renewable energy |

20,653.93 |

73.63% |

|

Non-renewable energy |

Thermal internal combustion engines |

4,441.29 |

15.83% |

Thermal gas turbine |

1,643.88 |

5.86% |

|

Thermal steam turbine |

1,292.22 |

4.61% |

|

Total non-renewable energy |

7,377.40 |

26.30% |

|

Total production |

28,031.32 |

99.93% |

|

Imports |

Colombia |

18.52 |

0.07% |

Perú |

- |

0.00% |

|

Total Imports |

18.52 |

0.07% |

|

Total Production of Energy and Imports |

28,049.84 |

100.00% |

|

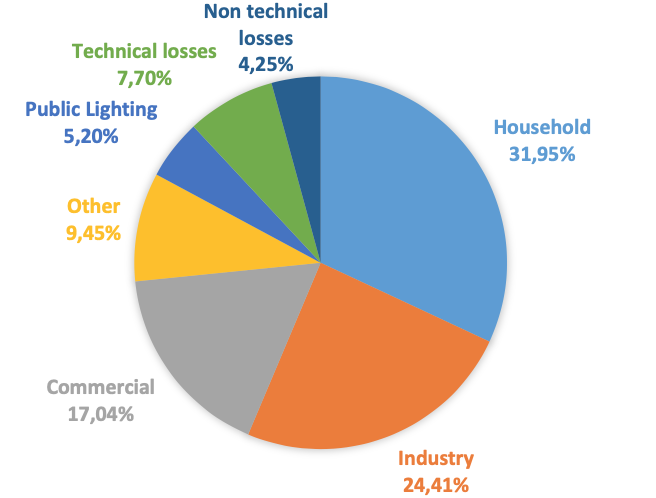

Figure 2 shows the electric energy consumption and electric losses by sector in GWh. The three largest sectors of energy consumption are the residential sector, consuming 7,169.36 GWh, which corresponds to 31.96 %; the industrial sector, with 5,476.06 GWh, which corresponds to 24.41 %, and the commercial sector, with 3,824.36 GWh, which corresponds to 17.05 %. The rest is grouped into public lighting, technical losses, non-technical losses and others.

Figure 2

Electric energy consumption and electric losses

by sector based on ARCONEL (2018).

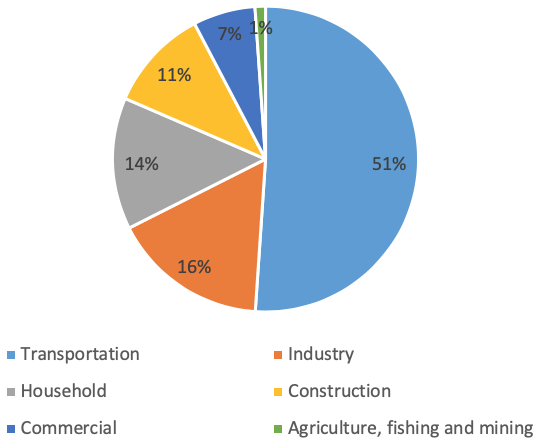

The production of petroleum products in Ecuador is limited by its low refining capacity. Ecuador is a country whose economy depends mainly on oil, and its capacity to supply the demand for secondary energy is limited. Imports of derivatives reach 42,348 KBEP, out of the total demand of 82,905 KBEP in 2016 (MEER, 2018). Figure 3 shows the structure of the country's energy consumption, with transport being the main consumption sector, followed by industry and the residential sector third.

Figure 3

Structure of the country's energy

consumption (MEER, 2018)

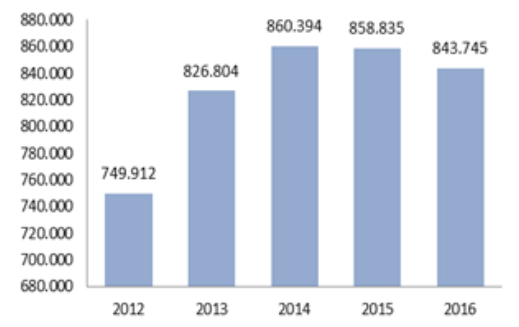

The development in the number of companies established in Ecuador during the period 2012-2016 presents an average annual growth of 3% in accordance with data obtained from Instituto Nacional de Estadísticas y Censo (INEC) of Ecuador. There were 843,745 companies registered in 2016. This scenario is shown in Figure 4.

Figure 4

Development in the number of companies established in

Ecuador during 2012-2016 (Chávez and García, 2018)

The increase in the number of companies results in much higher electric power consumption due to their industrial activities; this increment has generated concern about the fact that this huge consumption caused by the industrial and underlying systems is environmentally unsustainable, which raises questions about their degree of functionality in the future.

According to ARCONEL (2018) data, up to April 2017, 44,246 subscribers with an industrial tariff were registered, of which 87.45% operate with low-voltage, 12.32% with medium-voltage and 0.22% with high-voltage. Industries that predominate operate with low-voltage. However, in relation to the total consumption, these industries barely represent 7.6%.

These results show that it is necessary to consider the development and implementation of new initiatives capable of satisfying social needs in a sustainable manner. Fundamental actions are needed to improve the way in which energy is used, either through energy efficiency programs or enhancing the management of energy systems (through ISO 50001 standards), within the industries in the processes of lighting, air conditioning, compressed air, motive power, boilers, generation and efficient steam distribution, among others.

The ISO 50001 Energy Management System was created with the objective of providing organizations with a recognized framework that allows the integration of energy efficiency in their management practices. It also aims to systematize the processes that take place in an organization with the purpose of promoting energy-saving criteria.

A number of industries have already opted to improve, implement or maintain their management system through the ISO 50001 standard worldwide. In the specific case of Ecuador, in 2016 there were seven companies certified under this standard.

In addition, during the period 2012-2015 in Ecuador, the Ministry of Electricity and Renewable Energy - MEER, with the support of international funds, executed the project called Eficiencia Energética para la Industria (Energy Efficiency for Industry, (EEI)), through which the implementation of Energy Management Systems (SGEn) was achieved in 39 companies. As a result, significant benefits were achieved as well as the reduction in electricity consumption of 13,400 MWh/year and 57,272 BOE/ year in fuels.

The implementation of this type of activities generates important energy saving in the industry. However, each implementation action that is undertaken requires monetary investments, for this reason in many cases the industries prefer not to carry them out. Notwithstanding the financing need of organizations that intend to carry out this type of activity, the initiative to consider the financing of such implementation action through ESCOs comes in response.

Energy performance contracting (EPC) is a mechanism for organizing the energy efficiency financing. The EPC involves an Energy Service Company (ESCO) which provides various services, such as finances and guaranteed energy savings. The remuneration of the ESCO depends on the achievement of the guaranteed savings. The ESCO stays involved in the measurement and verification process for the energy savings in the repayment period. ESCO and energy performance contracting are mostly found in the public sector and to a lesser extent in the industrial and commercial building sectors (Hannon et al., 2015).

Energy Service Companies (ESCOs) were born in the early 1980s as a new innovative business model aimed at combating the increase in energy prices resulting from the oil crisis during 1973. Generally, they are private firms that are not financial entities, since some of them do not finance the projects directly, but they are supported by banking entities (Vieira de Carvalho et al., 2017). They offer technical and financial services to implement energy efficiency programs and guarantee that the energy savings obtained from these projects will be enough to cover the project costs over a certain period of time (Ellis, 2010). The payment is calculated based on the energy savings generated and taking into account a contractual agreement called Energy Savings Performance Contract (ESPC) that is carried out between the company in charge of implementing the program and the client.

ESCOs provide services related to energy efficiency, guarantee energy savings and its compensation is linked in some way to the performance of the project (Larsen et al., 2012).

“Energy service companies provide energy services to their clients through energy service contracts; such contracts constitute the transfer of decision-making rights over key elements of energy equipment under the terms and conditions of a long-term contract, including incentives to maintain and improve the team's performance over time” (Hannon, Foxon, & Gale, 2015).

ESCOs are companies dedicated to improving the energy efficiency in the facilities, in order to achieve reduction in consumption, also obtaining a certain degree of risk in doing so. It must also be considered that the payment of the services provided by the ESCO, will be paid at least a certain part, through the savings achieved, in this sense, the risk of the ESE will be linked, to different parameters, and / or to the model through which the benefits are carried out.

This business model, which has been identified as a potential and viable medium from the financial point of view, could meet energy needs in a way that could help better address the growing challenges of climate change, energy security and accessibility; challenges that the international energy community is facing.

In Ecuador such companies have not yet been established, so it is necessary to know what has hindered its effective introduction as well as what actions should be taken in order to achieve the goal set out.

With regards to energy efficiency strategies in the country, the Ecuadorian Government is promoting several policies in order to boost energy savings. Several energy efficiency strategies have been implemented, among which PLANEE stands out (Martínez-Gómez, J. 2017). This plan has been executed by the Ministry of Electricity and Renewable Energy since May 2017. It comprises six sectoral axes; one that focuses on legal, and institutional aspects and access to information; a residential, commercial and public axis; an industrial axis, a transportation axis; another that has to do with the consumption as part of the energy sector own use, and the Galapagos axis. Each of these axes has established lines of action that focus on energy saving activities. For example, the industrial axis has established a line of action concerning the "Motivation to develop a market of Energy Service Companies (ESCOs) in the country", which proposes an ambitious goal, 80% of the energy-intensive companies will have implemented energy efficiency programs with the support of ESCOs by 2035.

To achieve this goal, the design and execution of the following line of action is proposed:

A program for the development and promotion of an ESCO market in Ecuador that will allow generating the enabling conditions for the creation of ESCOs. Financial entities will be trained; technical assistance will be provided for energy appraisals, and the results will be shared so that the private sector is motivated to implement energy efficiency measures under this scheme.

This line of action aims to be executed through the following actions:

a) Create incentives for the operation of ESCOs in the country.

b) Promote and disseminate an ESCO database.

All this strategy helps us identify in the methodology what possible causes and actions should be generated at the country level so that the introduction of ESCOs can be encouraged in order to develop the line of action proposed by the Ecuadorian National Government.

In this sense, this study attempts to highlight the possible causes and actions that should be generated at the country level so that the introduction of ESCOs can be encouraged to develop the line of action proposed by the National Government of Ecuador. This research was based on bibliographic reviews of actions carried out in various countries where this type of companies has started their business activities; taking into account their experiences, benefits, incentives, barriers, etc., and conducting a multicriteria analysis; the recommendations on how those actions could be replicable in Ecuador shall be presented.

Within the document 20 Recommendations on Energy Efficiency Policies developed by the IEA, various points closely related to the development of a regional market of ESCOs are introduced. The study includes several barriers that in some way, are opposed to ESCOs market’s development in the region (IEA, 2017), namely:

Subsidized energy

Limited local capacity in EE

Lack of institutional coordination

Limited planning capacity and inter-sectoral coordination

Disparity in the quality of information and data availability at the sector level

Scarce incentives for energy companies to promote EE

Inadequate financing mechanisms for EE

This investigation is based on bibliographic reviews of the actions carried out in various countries by conducting a multi-criteria analysis.

ESCO has been studied in the energy business landscape and how it has been applied in countries with the United Kingdom, the European Union, China and the United States. All this information helps to identify the relationship between ideas and practice, as well as rationalize the meaning of the problem, when exposing the situation in Ecuador

For the preparation of the work, a systematic review was carried out. The Scopus, Scielo, latindex and google scholar databases were consulted to develop it, with a search strategy designed to obtain results related to studies of the ESCOS landscape and its implementation in other countries with the methodology of preparing a literature review. Twenty-two documents were selected that addressed, in their thematic contents, the perspective of ESCO and energy services, global development and Ecuador's energy and industrial context. Google scholar was used to complete the search of readings of the context of Ecuador and bibliography tracking referenced in the selected documents.

The methodology of the systematic review used is explicit and precise, and also follows a clearly delineated, standardized and replicable protocol that ensures the quality, consistency and transparency of the review process. It also includes the decision process that determines which items are eligible for inclusion in the study. Information regarding this systematic review methodology can be found more extensively in Coughlan et al. (2013).

Present the knowledge in a critical way, indicating the limitations of its conclusions and showing the perspective in several countries. The works tried to be current (between 5 and 10 years before the publication of the research report). In this sense, it helps that ESCOs are a type of business that is starting.

The analysis approach of this study aims to point out the possible causes and actions that should be generated at the country level so that the introduction of ESCOs can be encouraged to develop the line of action proposed by the Ecuadorian National Government.

Energy service companies (ESCOs) design, install and also sometimes finance, energy efficiency projects through contractual agreements with customers, typically in the form of an energy performance contract (EPC). Given the need to rapidly increase finance for energy efficiency, focus on ESCO financing models is increasing.

In relation to this context, the perspective will be explained general results in sections 3.1. The value of the global ESCO market is growing; 3.2. Despite differences across countries and regions, ESCO projects are generating energy and financial savings; 3.3. A global overview of ESCO activity. These results have led to results in different countries such as 3.4. ESCO developments in United Kingdom; 3.5. ESCO developments in European Union; 3.6. ESCO developments in China; 3.7. ESCO developments in United States. All this information puts in perspective the development of the business of the ESCO to future in 3.8. Ecuador’s situation.

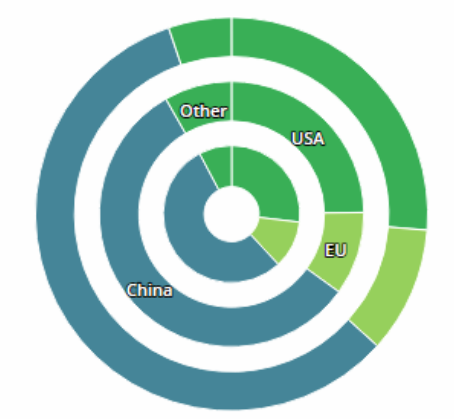

The value of the global ESCO market grew 8% to USD 28.6 billion in 2017, up from USD 26.8 billion in 2016. China continues to underpin the global ESCO market, growing 11% to USD 16.8 billion in 2017. The market in the United States, where ESCOs have been operating for well over 30 years, grew to USD 7.6 billion in 2017. In Europe, the ESCO market remains somewhat underdeveloped compared to other major regions, representing 10% of the global total (Figure 5).

Figure 5

ESCOs Revenue by Region (IEA, 2017)

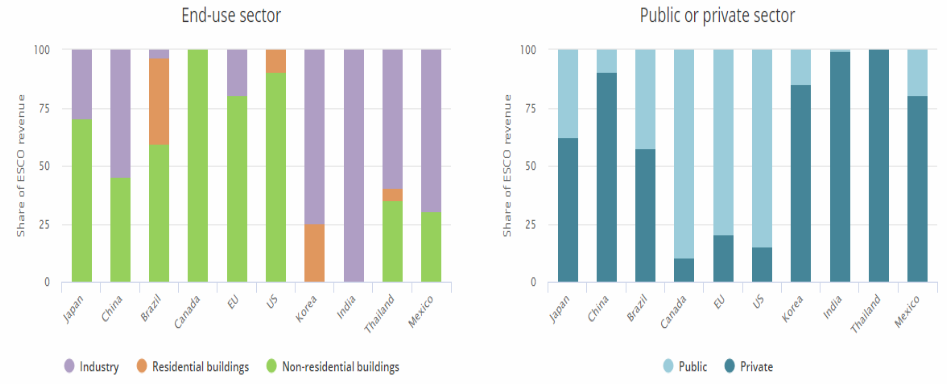

There are notable differences in ESCO markets between countries and regions. These include the definition of an energy performance contract (EPC), the restrictions and policies ESCOs are subject to, and technical capability. However, on average, ESCO projects are delivering energy savings upwards of 25%. While ESCOs have the ability to work in buildings, industry and transport in both the private and public sectors, the majority of ESCO projects takes place in the non-residential buildings sector, followed by industry, with virtually no projects in the transport sector.

In the majority of Asian markets, ESCO activity within the industry sector represents the largest share of market activity, as a result of favorable policy measures, which have incentivized ESCO engagement. In North America and Europe, industry plays a marginal role in the ESCO market, due to a mismatch between the contract durations on offer from ESCOs and the terms desired by companies, as well as a preference to use internal expertise to implement efficiency measures.

There is also variation in terms of whether ESCO projects are carried out in the private or public sector, influenced by government policy. In China, while policies incentivized ESCO engagement in the private sector, it has also prevented extensive public sector engagement, as there are restrictions on public sector engagement with ESCOs. In North America, public sector asset owners are able to obtain debt on favorable terms, which can be used to finance ESCO contracts (Figure 6).

Figure 6

Share of ESCOs revenue by End-use Sector and Public or private Sector (IEA, 2017)

Relevant stakeholders have identified ESCOs as a potential, viable means from the financial point of view, to meet energy needs in a way that could help address the growing challenges of climate change. ESCOs, thereby embrace the European Energy Efficiency Directive, which in turn, obliges member states to eliminate any regulatory and non-regulatory barriers that may impede the acceptance of contracting energy services, and examines how government policy can improve the prospects of ESCOs activity through financial incentives. (Hannon et al., 2015).

However, the national government's policy has not been able to easily address all barriers to contracting services through Product-Service Systems (PSS). These barriers include customer preferences at the international level, technological progress and inherent weaknesses of the business model, which points to the need for other complementary solutions. For example, considering other government stakeholders who with the support of the national government could also implement PSS support policies.

Both in the European Union and in neighboring countries, an overview of the ESCO industry has been carried out through a large-scale survey of experts. It focuses on market development during 2010-2013; the barriers found are analyzed and sound suggestions and recommendations regarding the additional measures that must be taken are given in order to further promote the ESCO markets (Bertoldi & Boza-Kiss, 2017).

The year 2018 marked the 40th anniversary of China’s Economic Reform and 20th anniversary of China’s ESCO industry. China’s ESCO market now represents 59% of global total. Much progress has been made since the beginning of China's reform, and the industry is gearing towards greater focus on quality, productivity and deeper structural changes.

According to the EMCA’s Annual Report 2018 the ESCO market grew by 15.1%, project investment by 5.2%, employment grew by 44000 people. Total number of ESCOs is now 6439 (+302 compared to 2017). Industry still takes up majority share of ESCO market (67%), but the number of ESCO projects in buildings sector is growing as well as size of projects.

There is significant potential in the building sector too, with 60 million m2 currently under renovation. The Ministry of Housing and Urban-Rural Development (MoHURD) is providing support to ESCOs with new guarantees to facilitate ESCO projects in the building sector.

ESCO projects in China are still primarily focused on delivering energy savings. However, some companies are starting to buy energy directly from the wholesale market (from utilities who have an energy efficiency target) to distribute to end users (Kostka & Shin, 2013).

China’s ESCO market growth has been a result of favorable policies. Policies including tax incentives, a directive specifically for ESCOs and accounting systems that have accommodated ESCO projects are responsible for ESCOs central role in delivering energy efficiency improvements in China. In June 2010, the Ministry of Finance (MOF) and National Development and Reform Commission (NDRC) pledged USD 3 million to support ESCOs projects in industry, building and transport sectors. Local governments followed central government lead by enacting policies to promote ESCO activity. A further act of good will towards ESCOs followed in December 2010 when the Ministry of Finance and Tax Bureau detailed financial incentives for ESCOs including; three years of corporate income tax exemption, 50% reduction in corporate income tax the following three years, exemption from sales tax VAT, and a statement ensuring that ESCOs may be subsidized by both central and local governments for eligible EPC projects (IEA, 2018). The 12th Five-Year Plan for Energy Saving and Emission Reduction enacted in 2012 set the targets for a 16% reduction in energy consumption per unit of GDP by 2015 compared to 2010, a decrease of 8-10% in total emissions of major pollutants for the same period, and established specific goals for industries, key areas and major energy-consuming equipment. Additionally, public institutions were requested to undertake energy efficiency operations and actions. Motivation to achieve entity targets is ensured by incorporating the achievement of goals into provincial government assessment.

There are a number of barriers, which may be addressed in order for China's ESCO market to evolve and scale up further:

According to Laurence Berkeley´s Laboratory in 2013, in the United States, the reference market of ESCOs was 2,000 million dollars in 2000; it has evolved to 7,500 million dollars in 2014, which shows that ESCOs service has been well received by the market. However, it is essential to find out what the incentives were, and how such incentives were attractive to the investor.

EBCO’s market has not yet been established nationwide. However, as a government policy stated in PLANEE project, it is intended to promote the development of ESCOs market in Ecuador. To carry out its implementation, key stakeholders such as the Ministry of Electricity and Renewable Energy - MEER, the Ministry of Industries and Productivity - MIPRO, the Ministry of the Environment - MAE, the Industrial and Commercial Chambers, the Academy, International Cooperation Agencies and related International Organizations shall be proposed to be part of this initiative.

Based on the fact that Ecuador is going through a transition process in its energy matrix, which involves greater use of renewable sources, it is important to implement activities aimed at the efficient use of energy. Therefore, ESCOs market is an activity that could greatly contribute to achieve important energy-saving benefits in the industrial sector. Consequently, it is vital to analyze the barriers and incentives that could allow the effective introduction of this market in the country.

In this sense, it is necessary to define what results are going to be obtained by implementing this initiative, and if the international experiences found through bibliographic reviews made it possible to meet the objectives proposed in this study.

The fact that Ecuador is dependent on energy resources means that in many cases the tariff item is high. For this reason, green energies represent a great opportunity since they allow obtaining clean energy in our own territory in an efficient and environmentally-friendly way.

Prospects in terms of study should be raised, for example, what the application of the results would be, and the possibilities for further research that may be derived from the introduction of ESCOs in the country.

Finally, it is important to introduce the ESCOs market nationwide since there is currently no regulation that requires the adoption of efficiency improvements at industrial level. Besides as observed at the beginning of the study, the industrial sector is the second largest energy consumer group.

ARCONEL-(2018) Estadísticas del Sector Eléctrico. Balance Multianual de Energía. Cited April 2018] Available from: http://www.regulacionelectrica.gob.ec/estadistica-del-sector-electrico/balance-multianual-de-energia/

Bertoldi, P., & Boza-Kiss, B. (2017). Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy, 107, 345-355.

Chávez, C. R. A., & García, M. I. G. (2018). El marketing y la fidelización empresarial como apuesta estratégica para pymes en Ecuador. Dominio de las Ciencias, 4(1), 131-140.

Coughlan, M; Cronin, P y Ryan, F. (2013) Doing a literature review in Nursing, Health and Social Care. London: Sage.

Ellis, J. (2010). Energy Service Companies (ESCOs) in Developing Countries. Energy Service Companies (ESCOs) in Developing Countries. International Institute for Sustainable, Winnipeg, Manitoba, Canada.

Espinoza, S., & et al. (2016). Informe Nacional de monitoreo de la eficiencia energética de la República del Ecuador, 2016. Cepal. Retrieved from http://repositorio.cepal.org/bitstream/handle/11362/40474/S1600584_es.pdf?sequence=1&isAllowed=y

Goldemberg, J., Martinez-Gomez, J., Sagar, A., & Smith, K. R. (2018). Household air pollution, health, and climate change: cleaning the air. Environmental Research Letters, 13(3), 030201.

Hannon, M. J., Foxon, T. J., & Gale, W. F. (2015). ‘Demand pull ‘government policies to support Product-Service System activity: the case of Energy Service Companies (ESCos) in the UK. Journal of Cleaner Production, 108, 900-915.

IEA. (2017) Market Report Series: Energy Efficiency 2018 Analysis and Outlooks to 2040. Energy Service Companies Chapter. Available from: https://www.iea.org/topics/energyefficiency/escos/

IEA. (2018). Market Report Series: Energy Efficiency 2018 (Chinese - Abridged) Analysis and Outlooks to 2040. Available from: https://webstore.iea.org/market-report-series-energy-efficiency-2018-chinese-abridged

Kastillo, J. P., Martínez, J., Riofrio, A. J., Villacis, S. P., & Orozco, M. A. (2015). Computational fluid dynamic analysis of olive oil in different induction pots. Paper presented at the PANACM 2015 - 1st Pan-American Congress on Computational Mechanics, in Conjunction with the 11th Argentine Congress on Computational Mechanics, MECOM 2015, 729-741.

Kastillo, J. P., Martínez-Gómez, J., Villacis, S. P., & Riofrio, A. J. (2017). Thermal natural convection analysis ofolive oil in different cookware materials for induction stoves. International Journal of Food Engineering, 13(3), 1-15, doi:10.1515/ijfe-2016-0065.

Kostka, G., & Shin, K. (2013). Energy conservation through energy service companies: Empirical analysis from China. Energy Policy, 52, 748-759.

Larsen, P. H., Goldman, C. A., & Satchwell, A. (2012). Evolution of the US energy service company industry: Market size and project performance from 1990–2008. Energy Policy, 50, 802-820.

Llanes Cedeño, E. A., Rocha - Hoyos, J. C., Peralta Zurita, D. B., Gómez, J. M., & Celi Ortega, S. C. (2018). Project-based learning case of study education in automotive mechanical engineering. Espacios, 39(25), 1-10.

Martínez-Gómez, J. (2017). Analysis of physicochemical and microbiological measurements of food prepared using different stoves. Carpathian Journal of Food Science and Technology, 9(1), 68-79.

Martínez, J., Martí-Herrero, J., Villacís, S., Riofrio, A. J., & Vaca, D. (2017). Analysis of energy, CO2 emissions and economy of the technological migration for clean cooking in Ecuador. Energy Policy, 107, 182-187.

Martínez-Gómez, J., Guerrón, G., & Riofrio, A. J. (2017). Analysis of the “Plan Fronteras” for clean cooking in Ecuador. International Journal of Energy Economics and Policy, 7(1), 135-145.

Martínez-Gómez, J., Ibarra, D., Villacis, S., Cuji, P., & Cruz, P. R. (2016). Analysis of LPG, electric and induction cookers during cooking typical Ecuadorian dishes into the national efficient cooking program. Food Policy, 59, 88-102.

Ministerio de Electricidad y energía Renovable MEER. (2018). Plan Nacional de Eficiencia Energética 2016-2035. Quito- Ecuador

Moreno Jiménez, G. A., Martinez-Gomez, J., Gómez Rosero, S. V., & Bustamante Villagómez, D. F. (2019). Behavioral effects on the participation of students in research projects at the area of mechanical engineering. Espacios, 40(2)

Vieira de Carvalho, A., Rojas Sánchez, L., Nour, S., Gal, A., Dufresne, V., Langlois, P., ... & Flamand, S. (2017). Guía F: El modelo de negocio ESCO y los contratos de servicios energéticos por desempeño.

Villacís, S., Martínez, J., Riofrío, A. J., Carrión, D. F., Orozco, M. A., & Vaca, D. (2015). Energy efficiency analysis of different materials for cookware commonly used in induction cookers. Energy Procedia, 75, 925-930.

1. Master student Carlos Coronel at Universidad Internacional SEK – Quito. E-mail: cbcoronel.mee@uisek.edu.ec

2. PhD in Material Science and Engineering Javier Martínez Gómez, Academic staff, Universidad Internacional SEK – Quito. Research at Instituto de Investigación Geológico y Energético (IIGE), Quito, Ecuador. E-mail: javier.martinez@uisek.edu.ec

3. Master’s in Information System Mónica Delgado Yanez, Academic staff, Universidad Internacional SEK – Quito. E-mail: monica.delgado @uisek.edu.ec

4. Master´s in Networking and Communications, Master´s in Systems Management, Master´s in Innovation Francisco Rodríguez Clavijo, Academic staff, Pontificia Universidad Católica del Ecuador PUCE – Quito. E-mail: frodriguez@puce.edu.ec