Vol. 40 (Number 24) Year 2019. Page 23

FLIGINSKIH, Tatiana N. 1; USATOVA, Ludmila V. 2; SOLOVJEVA, Natalya E. 3; KALUTSKAYA, Natalya A. 4; ZABOON, Oleiwi H. 5 & MAJD, Alnakoula 6

Received: 02/04/2019 • Approved: 24/06/2019 • Published 15/07/2019

ABSTRACT: The Russian banking system is undergoing various structural changes under the influence of micro- and macroeconomic factors in the context of the sanctions and countersanctions. New approaches to evaluating the performance of credit institutions and methods of forecasting and evaluating capital adequacy are being searched for. The focus in the article is made on the comparative analysis of the existing approaches and evaluation of the capital adequacy for banks in Russia and abroad, where the place and role of the adequacy forecasting methods in world practice are determined. With due regard to this analysis, recommendations have been proposed aimed at using prognostic methods of capital adequacy for a commercial bank in the domestic practice, which allows to neutralize the undesirable deviations of adequacy. |

RESUMEN: El sistema bancario ruso está experimentando varios cambios estructurales bajo la influencia de factores micro y macroeconómicos en el contexto de las sanciones y contrarestaciones. Se están buscando nuevos enfoques para evaluar el desempeño de las entidades de crédito y los métodos de pronóstico y evaluación de la suficiencia de capital. El enfoque del artículo se centra en el análisis comparativo de los enfoques existentes y la evaluación de la suficiencia de capital para los bancos en Rusia y en el extranjero, donde se determina el lugar y el papel de los métodos de previsión de suficiencia en la práctica mundial. Con la debida atención a este análisis, se han propuesto recomendaciones destinadas a utilizar métodos de pronóstico de adecuación de capital para un banco comercial en la práctica doméstica, lo que permite neutralizar las desviaciones no deseadas de la adecuación. |

Modern economic activity involves a significant amount of financial risks for commercial banks, which, as a result of the development and complication of financial relations, have acquired a more complex and multifaceted structure. In turn, capital, which is the main source for operating activities, has also evolved and, as a result, the requirements for the equity capital of commercial banks and its adequacy have become significantly more complicated.

Since the establishment and complication of financial relationships, much attention has been paid to the approach to assessing the capital of commercial institutions or a separate financial intermediary. The capital of a creditor – a bank or an individual – was considered as the protection of investors and implied the safe keeping of clients' money that was placed under deposits. Against this background, it becomes necessary to introduce the concept of capital adequacy of a commercial bank. The importance of this concept is explained by the fact that, in practical terms, capital adequacy characterizes its availability for continuous operation, the ability to meet the requirements of third parties, reflects the effectiveness of the bank. If one talks about the theoretical side, the capital adequacy ratio of a commercial bank, as a generalizing and multidimensional characteristic of a bank, has a great methodological potential and allows improving existing methods and finding new methods for assessing sufficiency.

Exploring the further development of approaches to the assessment of capital adequacy, we highlighted the key concept that dominated until the second half of the 20th century, namely, the consideration of capital adequacy from the position of deposit protection. However, in the second half of the 20th century, the concept of “protecting the assets of a bank” was first proposed. The transition in the capital adequacy assessment system from deposits to risk-weighted assets is associated with a change in views on the adequacy of the bank's own funds. As a result, the prevailing view was that the bank's need for capital depends not on the size of deposits and the ability of capital to cover their amount, but on the quality of the assets owned by the bank.

At present, the priorities of the Bank of Russia are focused largely on monitoring the adequacy of own funds and improving the quality of the capital base of commercial banks. The Bank of Russia uses such methods of supervision as the establishment of an appropriate structure of own funds of commercial banks and compliance with the mandatory standards for international requirements. However, the past years have shown that the Russian banking system is not coping with the fulfillment of these requirements, and bankruptcy procedures are being carried out for banks due to the identified deficiencies in terms of the structure and amount of equity.

This determines the relevance and importance of developing recommendations in the field of assessing the adequacy of own funds of commercial banks in the Russian Federation, aimed at improving the internal procedures for assessing the adequacy of banks through the use of new approaches, procedures and tools that are adaptive to modern requirements of the regulator.

Hypothesis. If characteristic features (rating, complex, coefficient, statistical) are classified on the basis of studying domestic and foreign theory and practice in assessing the capital adequacy of banks, then restrictions on their use will be identified and will require the development of predicted capital adequacy approaches based on a system of indicators and procedures that ensure the quality of assets in terms of risk.

The current approaches to evaluating the capital adequacy for commercial banks in Russia and abroad are reviewed in this article, based on the assumption of a plurality of sources, forms, and tools aimed at using forecasting in practice, which will allow to control and normalize the deviation of adequacy. At the same time, it will contribute to the improvement of commercial banks’ performance. As a result of the study, areas of improving the banks safety have been proposed in order to strengthen their positions in international financial markets. This is why the emphasis is placed on macroeconomic factors, where the ongoing processes of the Russian banking development in terms of the sanctions and counter-sanctions can be analyzed and evaluated. In this regard, issues related to the development of methods for evaluating the capital adequacy required to secure the continuity of a commercial bank operation are relevant today, and their solution has positive impact on the financial performance of commercial banks and ensures the establishment and development of a stable and reliable banking system.

The issues of the banking system development and its resource base formation were reviewed by such scientists as O.I. Lavrushin, G.N. Beloglazova, Yu.I. Korobova, N.I. Valentseva, N.F. Samsonov, O.V. Tavasiev, A.A. Kiselev and others. The methodology for assessing and identifying banking risks was studied by D. Zéghal (Zéghal and Aou, 2016); M.Z. Haider (Haider and Hossain, 2016); A. Ekinci (2016); A. Hussain (Hussain and Ihsan, 2016); T. Beutler (Beutler et al., 2017); D. Teresienė (2018); J.X. Xu, N. Li, M.I. Ahmad (Xu et al., 2018); N. Kunitsyna, I. Britchenko, I. Kunitsyn (Kunitsyna et al., 2018) and others.

The area of research is the process of forming approaches to evaluating and forecasting the capital adequacy of banks, and the subject is economic and financial relations in the forecasting process and applying methods for assessing the capital adequacy for commercial banks and early prevention of undesirable deviations.

The study made it possible to supplement the concept of capital adequacy with the following interpretation: it is the ability of a commercial bank to ensure compliance with legal requirements for its own funds, to satisfy third-party requirements, including investors and shareholders, to guarantee the continuity and efficiency of a commercial bank’s activities and to eliminate the negative effects of its activities through defensive and backup function.

The methods of research are based on theoretical aspects and practice of foreign and Russian economists on the issue under study. The study of the world and Russian practice in this area allowed us to identify various approaches to assessing the adequacy of the equity capital of a commercial bank and systematize them. Foreign methodologies in the field of capital adequacy assessment are represented by the following systems:

1) rating assessment systems – examples of this system are the Italian system PATROL, the French system ORAP, the American system CAMEL;

2) coefficient analysis systems – an example of this system is the German information system BAKIS;

3) complex banking risk assessment systems operating in the UK called RATE;

4) statistical models: the early risk prevention model SAABA in France and the American FIMS system;

5) separate rating systems of international rating agencies: Moody’s Ratings, Fitch Ratings, S&P Global Ratings.

A comparative analysis of the methodologies used to assess the capital adequacy of commercial banks in Russia and abroad allowed us to identify a number of features:

- Russian practice of approaches to assessing the capital adequacy of banks is largely borrowed from foreign practice, in particular, originates from the CAMEL methodology;

- Russian practice of assessing capital adequacy relies on the definition of actual indicators, without paying attention to the predicted values of the sufficiency indicators.

In-depth analysis of the features inherent in each method, allowed us to identify a number of advantages and disadvantages (Table 1).

Table 1

Advantages and disadvantages of capital

adequacy assessment methodologies

Methodology |

Advantages |

Disadvantages |

Rating methodology |

Orientation to the Basel requirements, the universal nature of the methodology applicable in global practice |

Lack of analysis of sufficiency quality indicators. No prediction element |

Coefficient methodology |

Specific list of coefficients, author rating scales |

No prediction element |

Complex methodology |

A wide range of coefficients of different levels and a bilateral approach to the assessment of the capital base: from the position of capital adequacy for risk-weighted assets, from the position of passive sources of funding for bank assets |

The complexity of the calculations, as it includes an extensive system of indicators that only partly assess the adequacy of capital, most of the indicators are not very informative. No prediction element |

Rating agency methodology |

Specific list of indicators, author's assessment scales |

A specific methodology that covers sufficiency from the standpoint of an overall assessment of sustainability; limited in use. No prediction element |

Statistical methodology of sufficiency deviations early prevention |

Allows predicting and preventing deviations in capital adequacy |

The complexity of the factors selection on the basis of which the predicted value is built |

The study has shown that the statistical development of the early warning of the capital adequacy deviation, which allows identifying and preventing the critical capital adequacy deviations, has received the least development.

The following methods were used for economic research: induction and deduction, analysis and synthesis, evolutionary, statistical, monographic, graphic, extrapolation, coefficient, balance, econometric modeling, rating, standard, expert, factographic, combined, and others.

As the main, a stress test procedure was applied and supplemented with respect to credit, market and liquidity risk using the tests presented in Table 2:

Table 2

Classification features of stress testing

Feature |

Characteristic |

Number of factors |

Single-factor, multifactorial |

Method of conducting |

Value setting, script, reverse script |

Kind of risk |

One risk, several risks, complex |

Coverage |

For a separate bank, for a separate subgroup, for a banking group |

Forecast |

Short-term, medium-term |

Degree of forecast |

Pessimistic, critical, catastrophic |

The assessment of capital adequacy by the proposed stress testing procedure is carried out as the sum of losses from credit, market and other risks and is determined by the amount of capital losses. The use of the direct stress test should take into account the dependence of the amount of capital on changes in factors embedded in the scenario. The system of quantitative and qualitative indicators of capital adequacy of commercial banks not only includes an assessment of the compliance of the bank's capital with the standard values but also assumes the addition of the concept of “capital adequacy”, taking into account risks, their degree of influence and role.

The banking system is in a quandary amid economic instability and constant crisis situations. The main goal of banks in today's financial condition is to maintain stability and make sure that they are resistant to external shocks, while being reasonable and normal from the inside. This means that it is important to find rationality through the best banks in the country, identify weaker parts of this sector, adopt appropriate policies and strategies to improve these sections, and eventually create an environment that forces this banking business to be rational and produce a consistently stable structure (Fliginskih, Tarasova, 2016). As a rule, large banks are those with state capital participation and are owned by the state through a state-owned company or a chain of state-owned companies, or the state (through state-owned companies, again) owns part of the bank's shares (Lukin, 2016).

Let us study the dynamics of the banking system capital of Russia in 2017, which increased by 0.1 % or 10 bln rubles, against the growth of capital by 4.2 % in 2016. The capital gains could be higher in 2017, as some Russian commercial banks demonstrate high profitability and return on capital.

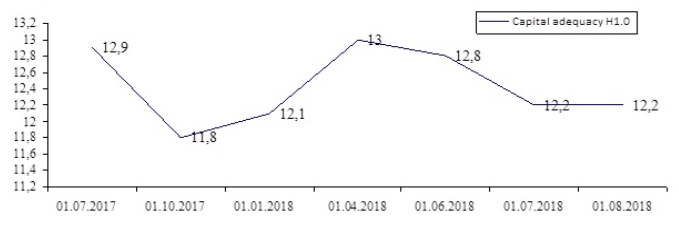

Despite this, the rehabilitation of 3 banking groups at once disclosed their problems and led to a multibillion reduction in their capital. This is why the net assets of Russian banks increased by 2.4 % or by 227 bln rubles, according to the results of the first half of the year, while the weak dynamics of capital were observed in the second half of 2017. Overall, as of January 1, 2018, the net worth of the Russian banks amounted to 9.4 trln rubles, and the historical maximum (9.8 trln rubles) was shown on September 1, 2017. As of October 1, 2018, the total number of credit institutions was 1,160, including 459 operating banks, 40 nonprofit nonbank credit institutions, and 589 credit institutions with a revoked license. The general capital adequacy ratio for the banking sector amounted to 12.2 % (Picture 1).

Figure 1

Capital adequacy

Source: "Overview of the Banking Sector of the

Russian Federation" from the Bank of Russia

The research has revealed that by the end of 2017, 179 banks, or 32 % of the rating participants had reduced their net assets, while 62 % had increased them. At the same time, the largest banks in the country in terms of capital built up their net assets at a rapid pace in the past year. The top one hundred banks showed an increase in their net assets by about 10.1 %, and the increase in the top ten largest banks in Russia was 11.6 % in 2017. In general, the capital concentration grows rapidly: top 10 banks controlled 71 % of the total capital a year before, 79 % by January 1, 2018, and the top 50 banks controlled 90 % and 96 % at the beginning and at the end of the last year, respectively. According to RIA Rating experts, the rapid growth of concentration will most likely continue in 2018, but the successful rehabilitation of major banks with the current negative capital may slow down this process (Bank of Russia, 2018). The results for the banks that were undercapitalized by regulatory standards indicated that the regulation was at least partially efficient during the period under study (Shrieves, Dahl, 1992).

The absolute leader in increasing new assets in 2017 was the leader of the Russian banking system, Sberbank of Russia (+551 bln rubles). A significant increase in the capital at the largest bank in Eastern and Central Europe is associated with a high profit. A good result was also shown by raising a large amount of subordinated loans and shareholders' funds during the SPO of the Moscow Credit Bank (MCB) (+111 bln rubles). These two banks secured the increase in the total capital of the entire banking system of Russia at the level of 7 %, but all the other banks together showed negative results and levelled the cumulative result. A significant increase in the MCB net assets allowed it to strengthen its position in the top 10, and it ranked seventh against tenth at the beginning of the year, as of January 1, 2018.

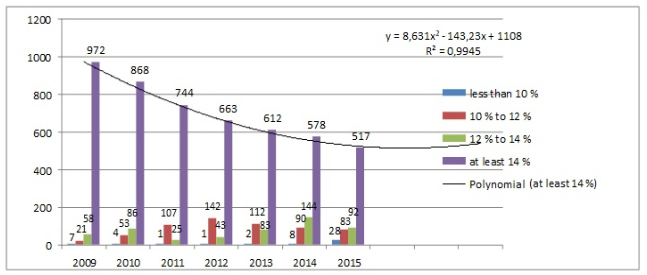

The analysis of compliance with the banking laws demonstrates some negative trends: of 733 banks operating in the territory of the Russian Federation, 51 failed to comply with the Bank of Russia regulations on capital adequacy, and 29 are subject to bankruptcy prevention procedures due to the identified deficiencies in their structure and net assets (Figure 2).

Besides, the number of banks with a capital adequacy ratio of 14 % decreased in 2009, while the number of banks with critically low ratios increased from 7 to 28. As a result, a general trend in the compliance with regulatory indicators by banking institutions is negative and tends to be average for the industry – around 8 % (Bank of Russia, 2018).

Figure 2

Dynamics of the number of commercial banks depending on the

level of the capital adequacy ratio from 2009 to 2015, units.

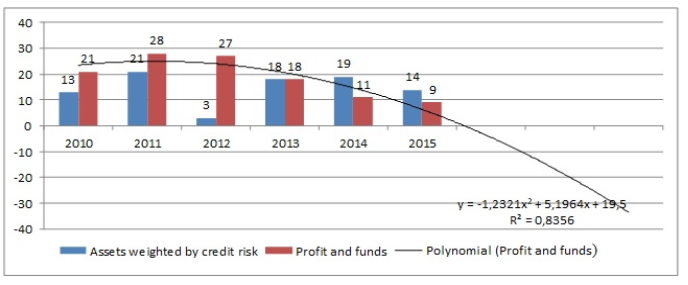

Besides, the analysis of individual financial indicators of the activities of commercial banks in the Russian Federation also indicates signs of recession: the number of profitable banks has decreased and, consequently, the share of net profit in the net assets structure has decreased (Figure 2).

Figure 3

Dynamics of changes in the growth rate of profit and

risky assets of commercial banks from 2009 to 2015, %

This indicates a decrease in the growth rates of net assets – a key mobile component of the capital of commercial banks, which secures their growth. During the analysis of the quality of assets, the volume of assets subject to risks significantly increased and provoked a decline in the ratio between equity and assets (Bank of Russia, 2018).

This confirms the need to develop fundamentally new methods for assessing the ability of commercial banks to continue their activities, which will allow to predict undesirable deviations of financial indicators and seems to be the most preferable prudential measure. At the same time, it is important to determine which indicators it is advisable to analyze and evaluate in order to efficiently use them in building forecasts and determining undesirable deviations.

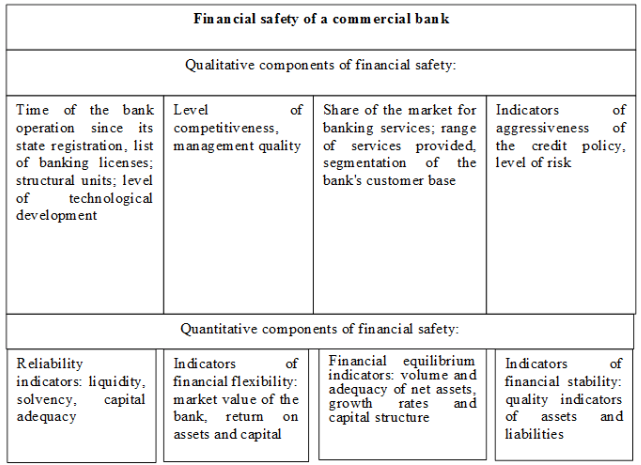

Analysis of the structure of financial safety allows to select a key component, the evaluation of which allows to judge the reliability, flexibility, equilibrium, and stability of the bank, i.e. the general level of financial safety: net assets of a commercial bank (Solovieva, 2018).

Figure 4

Structure of financial safety

of a commercial bank

The capital value should be measured quantitatively and qualitatively within each component of safety: reliability, flexibility, equilibrium, or stability. This is why the evaluation of capital adequacy is a key procedure in monitoring the financial stability of a commercial bank. Being an economic category, adequacy describes the ability of a bank to ensure compliance with the legislation requirements to the amount of its net assets (which is implemented through the regulatory and control functions), to meet the requirements of third parties, including investors and shareholders, through the implementation of the investment function, to ensure the continuity and efficiency of the commercial bank operation through the implementation of the operational and regulatory functions, and to absorb the negative effects of operation through the protective and backup functions.

If a commercial bank prudently issues loans, there is a high probability that it is profitable but risky. It should be noted that assets and liquidity decrease in commercial banks. This is due to a decrease in the purchasing power of money, as well as to the sharp decline in banks' resource base, caused by the reduction in savings of the population and economic entities, which are stored in accounts in commercial banks and are the main way to reduce the level of losses from inflation, against the backdrop of inflation (Fliginskih, Solovjeva, Nefedova, Polunina, Kotsarev, 2016). Prudent lending is inferior to high-quality loans, requires a lower amount securing the loss from loans, leads to low credit, where the risk index and net income are higher, and, consequently, increases the return on net assets (Rivera, Mendoza, 2017).

Based on the described significance of capital adequacy, the authors have substantiated and developed recommendations for improving the current methods for evaluating and forecasting the acceptable limits of capital adequacy for commercial banks. The presented system of methodological approaches indicates that, despite the wide range of the existing methods, the predictive ones are the least developed in the world practice: in fact, none of the existing methods in the Russian Federation provide for making forecasts regarding the structure and amount of capital and its adequacy. Foreign practice in evaluating the capital adequacy is also represented by a limited list of approaches; the statistical system of evaluating the capital adequacy Fims in the US being one of them. The Fims system is a system of evaluating the forecasted financial condition of a commercial bank over the course of two years, which allows to identify undesirable deviations at an early stage (Table 3).

Table 3

Evaluation of capital adequacy for commercial banks

Method |

Indicator |

Limit standard value |

Actual value |

Deviation |

Russia (method of Bank of Russia) |

Capital adequacy (Tier1), % |

At least 8.0 |

12.70 |

Not identified |

Net assets (Tier3), mln rub./bln rub. |

At least 300 mln rub. per 1 bank |

12 bln rub. per 1 bank |

Not identified |

|

Financial leverage, % |

At least 3.0 |

9.00 |

Not identified |

|

Russia (method of DIA) |

PK1((Tier3), % |

At least 8 |

12.70 |

Not identified |

Russia (Kromonov's method) |

General coefficient of capital reliability, units |

Ratio 1 to 1 |

0.14 |

Identified

|

Capital protection ratio, units |

Ratio 1 to 1 |

0.17 |

Identified

|

|

Ratio of stock capitalization of profits, units |

Ratio 1 to 3 |

3.70 |

Not identified

|

|

Russia (method of the rating agency ACRA) |

Level of capital adequacy, % |

At least 7.00 |

12.70 |

Not identified |

Averaged capital generation ratio, % |

At least 0.00

|

1.00 |

There is a trend to deviation |

|

Profit margin

|

For an individual bank above the average in the banking sector |

Decline |

Identified

|

|

Ratio of operating expenses to operating income before reserves, % |

No more than 50.00 |

23.00 |

Identified in the period under study |

|

US (CAMELS method) |

Cumulative capital adequacy (Tier3), % |

At least 8.00 |

12.70 |

Not identified

|

Germany (BAKIS method) |

Net assets adequacy (Tier3), % |

At least 8.00 |

12.70 |

Not identified

|

The results of the adequacy evaluation have revealed that the methods existing in the world practice are aimed at a quantitative evaluation of the current state. At the same time, there are no elaborated criteria for the evaluation of adequacy quality indicators and the construction of forecasted values of adequacy. The ratio of net assets to average assets for previous periods is found to evaluate capital adequacy, which must correspond to at least 2 % (Levkina, Butrina, 2016). At the same time, this evaluation system should also calculate the capital adequacy ratio for the current period for a comparative evaluation.

The lack of such practices in the Russian Federation and significant problems in the banking sector of the country require the development of new approaches to evaluating capital adequacy in addition to the existing ones. It is advisable to introduce additional forecasting procedures, which are combined with the actual ones and are aimed at the current evaluation to provide a more holistic view of the financial condition of the bank.

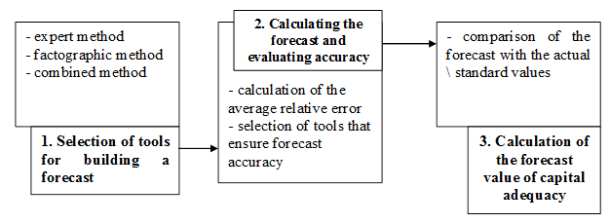

The authors have developed a logical scheme describing the stages of implementing the forecast method of capital adequacy for a commercial bank. The first step, "Selection of tools for building a forecast," suggests a choice of methods for forecasting the capital adequacy from an extensive list of the existing and most suitable methods for the banking sector, which will be used to build forecast values.

The second stage "Calculating the forecast and evaluating accuracy" suggests the calculation of the forecasted value of capital adequacy, which can be built based either on a component of this indicator to predict each element of adequacy, or on a complete forecast of the value of adequacy. At this stage, it is also suggested that the forecast quality is estimated through the calculation of the average relative error. If evaluation results are obtained of poor quality, it is necessary to return to the first stage and revise the forecasting tools.

The logically generalized sequence of application of forecasting methods for calculating capital adequacy is presented in Figure 5.

Figure 5

Logical scheme of the predictive method for evaluating

capital adequacy for a commercial bank

The third stage "Comparison of the forecast with the standard/actual values" suggests the identification of deviations in the forecast values of capital adequacy from the regulatory requirements, which will indicate potential deterioration in the financial safety of a commercial bank and point at the necessary preliminary measures to eliminate potential risks.

Capital requirements for a commercial bank have now significantly increased – a complex capital structure is being formed, and many indicators that evaluate the capital adequacy have been introduced. Against this background, the concept of capital adequacy of a commercial bank is widely used in the science to describe capital. Its role increases due to the fact that in practical terms, capital adequacy describes its availability for continuous operation and ability to meet the requirements of third parties, and indicates compliance with standards.

It follows from the analysis of methods that most of them are typical and originate from the American system of evaluating the financial safety of bank Camels, which is usually adjusted for the national features of the banking sector. At the same time, the statistical method of early warning of the capital adequacy deviation, which allows to identify and prevent the critical deviations of capital adequacy, was the least developed.

The proposed methods allow to complement the current system of indicators for evaluating the capital adequacy with additional parameters – forecast values of the adequacy indicator. The development of a system of indicators allows to fulfill the control functions of capital adequacy more efficiently in the future and serve as a methodical tool for the strategic planning of an individual bank at the macrolevel.

Bank of Russia. 2018. Review of the banking sector of the Russian Federation. Analytical indicators. Retrieved from http://www.cbr.ru/analytics

Beutler, T., Bichsel, R., Bruhin, A., and Danton, J. (2017). The Impact of Interest Rate Risk on Bank Lending. SNB Working Papers, 4. Retrieved from https://www.snb.ch/n/mmr/reference/working_paper_2017_04/source/working_paper_2017_04.n.pdf

Ekinci, A. (2016). The Effect of Credit and Market Risk on Bank Performance: Evidence from Turkey. International Journal of Economics and Financial Issues, 6(2), 427-434.

Fliginskih, T.N., Solovjeva, N.E., Nefedova, E.A., Polunina, Z.A., and Kotsarev, A.A. (2016). Impact of structural changes in deposit operations of credit institutions on inflation Request PDF. Journal of Internet Banking and Commerce, 6(21). Retrieved from https://www.researchgate.net/publication/312118400_Impact_of_structural_changes_in_deposit_operations_of_credit_institutions_on_inflation

Fliginskih, T.N., and Tarasova, T.Yu. (2016). Faktory, opredelyayushchiye razvitiye innovatsiy v vide novykh bankovskikh produktov [Factors determining the development of innovations in the form of new banking products]. Creative economy, 10(10), 1157 – 1168.

Haider, M.Z., and Hossain, B. (2016). Compliance of Core Risk for Smooth Banking Operation. Journal of Research in Economics and International Finance, 5(2), 29-33.

Hussain, A., and Ihsan, A. (2016). Risk Management and Bank Performance in Pakistan. NUML International Journal of Business & Management, 11(2).

Kunitsyna, N., Britchenko, I., and Kunitsyn, I. (2018). Reputational risks, value of losses and financial sustainability of commercial Banks. Entrepreneurship and Sustainability Issues, 5(4), 943-955. http://doi.org/10.9770/jesi.2018.5.4(17).

Levkina, A.V., Butrina, Yu.V. (2016). Metodika formirovaniya integralnoy otsenki konkurentosposobnosti kreditnoy organizatsii [Methods of forming an integrated assessment of the credit institution competitiveness]. Young scientist, 30, 229 – 231.

Lukin, S.G. (2017). Otsenka finansovoy ustoychivosti kommercheskogo banka i puti yeyo povysheniya [Evaluation of the financial safety of a commercial bank and ways to improve it]. Young Scientist, 37, 60-64.

Mendoza, R., and Rivera, J.P. (2017). The effect of credit risk and capital adequacy on the profitability of rural banks in the Philippines. Scientific Annals of Economics and Business, 64(1), 83-96.

Shrieves, R.E., and Dahl, D. (1992). The relationship between risk and capital in commercial banks. Journal of Banking & Finance, 16(2), 439-457.

Solovjeva, N.Е., Bykanova, N.I., and Majd, A. (2018). Puti povysheniya konkurentosposobnosti bankov s gosudarstvennym uchastiyem na natsionalnom rynke bankovskikh uslug [Ways of improving the competitiveness of banks with state participation in the national market for banking services]. Publishing house Belgorod, Scientific bulletin of the Belgorod State University, series Economics. Computer Science, 46(2), 273-281.

Tatarinova, L.V. (2013). Kriterii otsenki finansovoy ustoychivosti kommercheskogo banka s pozitsii subyektnogo sostava rynka [Criteria for evaluating the financial safety of a commercial bank from the position of the subject composition of the market]. News of the Irkutsk State Economic Academy, 3. Retrieved from http://eizvestia.isea.ru/reader/ article.aspx?id=18104

Teresienė, D. (2018). Performance measurement issues in central Banks. Entrepreneurship and Sustainability Issues, 6(1), 176-189. http://doi.org/10.9770/jesi.2018.6.1(12)

Xu, J. X., Naiwen, L., and Ahmad, M. I. (2018). Banking performance of China and Pakistan. Entrepreneurship and Sustainability Issues, 5(4), 929-942. http://doi.org/10.9770/jesi.2018.5.4(16)

Zéghal, D., and El Aou, M. (2016). Enterprise Risk Management in the US Banking Sector Following the Financial Crisis. Modern Economy, 7, 494-513.

1. Belgorod State National Research University, Russia. E-mail: ta.fl.asu@bk.ru

2. Belgorod State National Research University, Russia.

3. Belgorod State National Research University, Russia.

4. Belgorod State National Research University, Russia.

5. Belgorod State National Research University, Russia.