Vol. 40 (Number 24) Year 2019. Page 29

SULTANOVA, Muslima K. 1; ALLAKHVERDIYEVA, Leyla Madat K. 2; SULTANOVA, Shakhnoza S. 3 & ALIMOVA, Maria V. 4

Received: 13/05/2019 • Approved: 01/07/2019 • Published 15/07/2019

ABSTRACT: In a majority of developing countries, remittances from labor migrants, being an influential development factor, represent the source of external financing of households and the flow of foreign exchange. Additionally, they are also closely intertwined with achievements in poverty reduction. This article studies the economic function of remittances based on the example of the Republic of Tajikistan as the main supplier country of labor in the post-Soviet space. The example of Tajikistan, a country whose economy is significantly dependent on external procyclical trends, allowed for a more accurate assessment of the functions of remittances. The hypothesis about the investment potential of the financial flows generated by the remittances of migrants was partially confirmed. Based on econometric methods of panel analysis, it has been established that there is a clear correlation between the GDP of a country and its remittances. The provision on remittances’ impact on investments was not confirmed, primarily because of their ambiguous impact on financial indicators and exports. The proposed model describes the impact of migrant remittances on the growth potential of the economy, allowing for an explanation of the reasons behind the controversial influence of remittances on the processes of accumulation and investment of capital as well as the extreme difficulty of assessing the financial flows generated by them. |

RESUMEN: En la mayoría de los países en desarrollo, las remesas de los migrantes laborales, por ser un factor de desarrollo influyente, representan la fuente de financiamiento externo de los hogares y el flujo de divisas. Además, también están estrechamente relacionados con los logros en la reducción de la pobreza. Este artículo estudia la función económica de las remesas basándose en el ejemplo de la República de Tayikistán como el principal país proveedor de mano de obra en el espacio postsoviético. El ejemplo de Tayikistán, un país cuya economía depende significativamente de las tendencias procíclicas externas, permitió una evaluación más precisa de las funciones de las remesas. La hipótesis sobre el potencial de inversión de los flujos financieros generados por las remesas de los migrantes fue parcialmente confirmada. Sobre la base de métodos econométricos de análisis de panel, se ha establecido que existe una clara correlación entre el PIB de un país y sus remesas. La disposición sobre el impacto de las remesas en las inversiones no se confirmó, principalmente debido a su impacto ambiguo en los indicadores financieros y las exportaciones. El modelo propuesto describe el impacto de las remesas de los migrantes en el potencial de crecimiento de la economía, lo que permite explicar las razones detrás de la controversial influencia de las remesas en los procesos de acumulación e inversión de capital, así como la extrema dificultad de evaluar los flujos financieros. generados por ellos. |

The process of globalization along with the accelerated financial capital flow and technologies and expanding labor markets intensify the migration processes. This subject has the universal character of being not merely systemic but also integrative.

A research on migration is in the closest possible way to connect not only with the economic but also with the social, political, spiritual, cultural, ideological, and other aspects of social life. Often a stepped-up population transfer from developing countries to the more developed ones and the flow of migrants’ transfers, predominantly in the opposite direction, forms the so-called “bilateral corridors.” This phenomenon, accompanied by a counter movement of labor and financial resources between countries with different levels of development, may as well generate acute social and economic problems.

It is important to note that, in countries that provide labor migrants, the migration culture supplements the culture of dependency, causing strong dependence not only on the part of the population but also on the part of the country's economy. This mostly relates to external migration, the study of which is relevant both for developed countries with demographically aging populations and less prosperous countries and territories with excessively large workforces (Sultanova M., Sultanova Sh., 2017).

Developing countries solve the problems of migration mainly through their efforts and only considering the solution of short-term domestic objectives. National economic growth slows and the state's social responsibility and economic and political sovereignty are undermined due to the lack of employment opportunities and the absence of the desire to work for wages much lower than those in the host countries.

Nevertheless, there are known cases of the countries’ coincidence of wants and their achievement of harmony in their interrelationships. A classic example thereof is New World development. The circumstances concerned during that period (the excess of labor resources in Europe and the need for them in America, as well as the motivation of migrants to achieve higher standards of living) fully met the interests of the involved parties.

However, now, the essential and potential resource opportunities of home countries are aimed at supporting the economies of foreign countries. Undoubtedly, these circumstances pose a severe threat to the home countries’ economic security and political sovereignty.

For most countries, remittances, as a vital source of foreign exchange earnings, constitute a significant part of GDP, and present the second largest source of external financing (after foreign direct investment), exceed revenues from significant exports, and cover a significant part of imports (Kumo Kazukhiro, 2015).

Hypothesis. Under certain conditions, financial flows generated by migrant remittances have particular investment potential and can be considered as a significant addition to the movement of capital, primarily through transformation into savings.

In general, the global scale and severity of migration processes, as well as the further deterioration of the economic situation of countries-issuers in the international arena, determine the relevance of this study.

For the benefit of this argument promptly growing dynamics of migration testifies. According to the World Bank annual statistics, the number of international migrants in 2008 amounted to 3% of the world's population, and by 2018 it had made 3,4% (more than 260 million people).

The volume of personal transfers of migrants to developing countries in 2018 grew by more than two times compared with 2006 and reached a new record high of about USD 600 billion, of which 70% were sent to developing countries. According to the same source, while maintaining this trend, the number of international migrants is expected to double by 2050.

The most intensive migration processes occur in the former Soviet Union republics. Half of them were among the leaders as to the volume of remittances received or the share thereof in the GDP, while Russia has entered the list of the countries being sources of such transfers.

For Russia, the financial and economic effects of migration are becoming more relevant as it is a country that both send migrants to more developed countries and receives them from the CIS countries and the far abroad.

According to the Bank of Russia, 2017 saw cross-border transfers from the country grow by 12.3% in annual terms and amount to almost 13 billion dollars, including more than $8 billion transferred to the CIS countries. From abroad, Russia received transfers worth $9.4 billion, which was 1.1% less than the previous year. Of this amount, the transfers from the CIS countries amounted to $ 2.8 billion, and those from the far abroad - to $ 15.6 billion.

Table 1

Cross-border monetary transfers of natural persons from

Russia (the sum of the translations of nonresidents, USD)

Country |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

In total over the countries |

15489 |

10672 |

12 685 |

15798 |

18 327 |

20 312 |

19 163 |

10 508 |

11 116 |

12529 |

Foreign countries |

7 761 |

5 641 |

6 781 |

5 961 |

6 613 |

6 140 |

6 633 |

3 452 |

4 328 |

4285 |

CIS countries, including: |

7 728 |

5 030 |

5 903 |

9837 |

11 714 |

14 172 |

12 529 |

7056 |

6 787 |

8025 |

Kyrgyzstan |

690 |

497 |

575 |

727 |

694 |

1 129,0 |

1 195 |

838 |

1170 |

1469 |

Moldova |

645 |

402 |

438 |

743 |

798 |

863 |

860 |

405 |

274 |

297 |

Tajikistan |

1 460 |

931 |

1 142 |

2 297 |

2 548 |

3306 |

3 009 |

1 669 |

1548 |

1818 |

Uzbekistan |

1 725 |

1 109 |

1 465 |

3 559 |

4 879 |

5842 |

4 893 |

2 625 |

2413 |

3 131 |

Ukraine |

1 127 |

803 |

1 016 |

1 116 |

1 317 |

1336 |

922 |

462 |

345 |

229 |

As is clear from Table 1, a sharp decrease in money transfers to the non-CIS countries (more than double compared to the 2008 level ($ 7.761 billion) occurred in 2015($ 3.452 billion). The share of these countries in the pre-crisis period (until 2015) accounted for more than half of all such transfers. After 2015, the CIS countries advanced in this indicator, and their share over the past two years has reached almost 70% of all transfers.

Nevertheless, due to the crisis and the migration policy tightening, transfers to the CIS countries decreased by 43.7% in 2015 and by 3.4% in 2016. The deterioration of the situation in Russia was caused by a severe tightening of migration legislation, a drop in oil prices, a high level of the ruble devaluation, and several economic structural factors.

As a result, external shocks significantly reduced the remittances by migrants coming from Moldova and the countries of Central Asia. The peak of transfers to these countries was observed in the pre-crisis 2014: Kyrgyzstan - $ 1.2 billion, Tajikistan - $3.0 billion, Uzbekistan - $4.89 billion. In 2015, money transfers to Tajikistan decreased by 44.3%, those to Uzbekistan - by 46.0%, and to Kyrgyzstan - by 30.0%. As to 2016, money transfers decrease was as follows: to Tajikistan - by 7.3%, and to Uzbekistan - by 8.1%.

The high sensitivity of these countries macroeconomic indicators to external procyclical trends is caused, first of all, by the low GDP in general and per capita in particular. A powerful indicator of the economic situation here is the dynamics of the world prices for essential resources and the host country national currency exchange rate. Socio-economic problems of society (availability of jobs, meeting consumer demand, etc.) are addressed through mass migration and imports of goods.

Given the negative socioeconomic consequences of the structural reforms carried out in the last 30 years, it is necessary to note the pro-cyclical dependence of these countries' economies on external factors; in particular, lower export potential of the country, dependent on the world energy prices, on foreign labor or remittances, negatively affects employment, contributes to higher inflation, and intensifies the economic downturn (Pitukhina M.A., 2015).

In general, despite the impact of financial and economic crises of 2008 and 2014-2015, remittances from Russia tend to increase.

According to the World Bank, the growth of migrants’ money transfers is interconnected with the decrease of at least half of poverty indices in Tajikistan: from 72% in 2003 to 54% in 2017, and those in Kyrgyzstan: from 50 to 35% over the same period, as well as with a sharp increase in the Central Asian countries gross domestic product (GDP).

The scale of migration impact on macroeconomic indicators can be judged by the level of remittances vs. the country's GDP. As to this indicator, among the CIS countries, Tajikistan and Kyrgyzstan occupy a stable leading position. E.g., according to the data of the Bank of Russia, in some years the share of money transfers in Tajikistan's GDP reached 49.6%, the one in Kyrgyzstan made 31.1%.

Although Tajikistan is the most dependent on remittances state in the world, and in terms of GDP per capita takes one of the last places - the 158th place out of 187 (USD 802 in 2018), the natural population growth here is sufficiently high. Such demographic success (24 newborns per thousand people) is promoted by the resilience of the institution of marriage, a roughly equal sex ratio of men and women, as well as a commitment to the lifestyle of ancestors.

Besides, according to the World Bank, more than 40% of the working-age population, mostly young people from 18 to 29 years old, are forced to look for work outside own country, 90% of which are looking for work in the near abroad. According to official sources, their number in the Russian Federation varies around the mark of 1.0-1.2 million people, which is from 12 to 13% of the total population. According to this indicator, Tajikistan is out-grossed only by Uzbekistan and Ukraine, whose population is 3.5–5.0 times more massive.

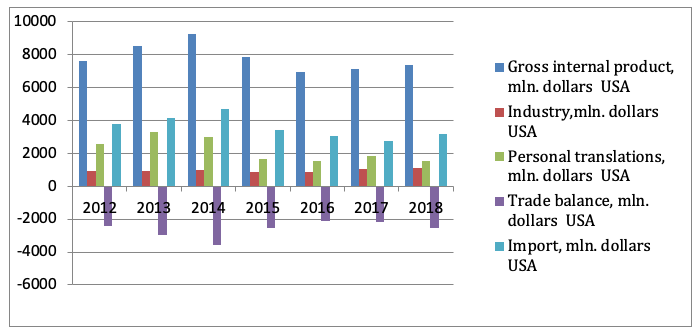

If the dynamics of the remittances is compared with the GDP and the import volumes of Tajikistan, then it is quite logical to assume that there is a high correlation between them. In the first approximation, this is evidenced by the data in Fig. 1.

Figure 1

Dynamics of money transfers and leading

indicators of the economy of Tajikistan

As can be seen from the graph, the real sector of the economy during the reviewed period contributes only 12.8% to the GDP, whereas remittances comprise almost two-thirds of the GDP, and cover a significant part of imports (60% on average).

It should be noted that the worsening world trade conditions are undermining the economic growth of Tajikistan. Thus, as a result of weakening demand and lower prices that can be charged for the primary export goods of Tajikistan, such as aluminum and cotton, in 2014, the current operations deficit increased. This led to a sharp (21.4%) increase in the trade deficit and, as the national currency depreciated, consumer prices rose by 7.4%, against 3.4% in 2013.

Official unemployment rate, based on the number of registered job seekers, still underestimates the actual level. For example, according to the latest World Bank study, the unemployment rate was 12.5%, which is almost five times higher than the registered unemployment rate.

In terms of paid employment by type of economic activity, work in the agricultural sector remains in the lowest paid group, although Tajikistan is an agrarian country in terms of its geo-economic opportunities.

As a result of the trend noted for the reviewed period, the average rate of inflation (6.03%) was twice as high as the growth rate in industrial product and agricultural output (3.08%), and more than 60% of the trade deficit was covered by remittances from abroad.

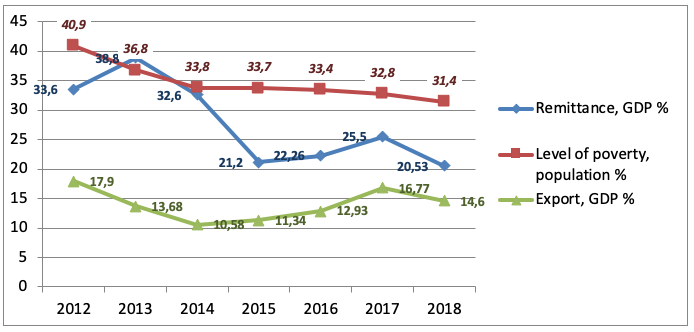

As shown in Figure 2, although remittances significantly exceed the country's income from the main export items, they are of great importance for the fight against poverty.

As can be seen from the graph, in 2013, the gap between export figures (13.68%) and remittances (38.8%) was the greatest. The decline in world prices for the primary export goods of Tajikistan led to a further decline in the export volume, which represented only 10.58% of the GDP in 2014.

An impressive increase in remittances occurred in 2013 (38.8% of the country’s GDP). However, in 2014, the progress in poverty reduction started to decline. The main reason for this adverse development was the deterioration in the Russian economy as a result of the 2014−2015 crisis, which led to restrictions on the migrants' stay in this country.

Figure 2

Dynamics of poverty and currency receipts

(remittance and exports) in Tajikistan.

It is particularly noteworthy that, despite the continued decline in the share of remittances, in 2018, poverty levels also decreased. In the reviewed period, poverty has reduced from 41% to 31%. However, it is premature to claim that the implemented structural changes have led to the internal inclusive economic growth in the country.

All these findings suggest that the pressure on the labor market will soon increase because, if the economic situation worsens in the receiving countries, migrants will likely return, but will struggle to find employment in either agriculture or the service sector—the two largest employers in the country.

It is important to note that the tasks of economic restructuring, and ensuring the development of the employment system and national welfare and livelihood are being solved at meager rates.

Thus far, no unified interstate migration strategy has been developed or implemented, yet it is urgently needed to ensure that all related mechanisms and instruments are logically integrated into the migration policy of the countries and be considered through the prism of the financial strategy primary goals. Such an approach will make it possible to identify the most advantageous areas of interstate cooperation and emphasize efforts needed to achieve a synergistic effect (Netz and Jaksztat, 2017).

Owing to the interdisciplinary nature of the present study, and in order to test the stated hypothesis, a comprehensive toolkit was used to ensure the necessary completeness of the research carried out and to obtain reliable results. The econometric approach was thus adopted and correlation and regression data analyses were conducted to achieve the individual research objectives. This allowed for testing a priori economic and theoretical arguments using empirical evidence and mathematical modeling.

An important aspect of migration processes is their ambiguous impact on the socio-economic situation of countries and brewing problems that, without proper research, are impossible to detect and evaluate in a timely manner (Pitukhina, 2015).

In this regard, the classical theories of migration put forth by Ravenstein, Farrah, and Leigh had an enormous influence on the development of neoclassical theory in the modeling and conceptualizing migration processes.

Friedman and Samuelson (1970) succeeded in clearly and somewhat objectively distinguishing the essential characteristics of migration, pointing out the factors characterizing the economic movement of the population. These authors argued that migration is driven by a wide range of market factors, at both micro and macro scale. The conceptual provisions of this theory are based on the principles of free competition, which is argued to assist with efficient resource allocation and labor market balancing in certain territories.

However, the labor market cannot be perfect for a wide range of reasons, one of which is inability to eradicate unemployment. Thus, at least in the short term, migration is unable to balance the supply and demand for labor, and by extension the market for goods and services.

According to the dual labor market theory developed by M. Priore (late 1970s), international migration is caused by the labor market’s own needs of the modern industrial society, which is due to such fundamental characteristics as structural inflation, economic agents motivation, economic dualism between labor and capital, as well as the demographics of labor.

The dualism between labor and capital extends to labor in the form of a “segmented labor market structure” leading to its bifurcation (Priore M., 1979).

In the event of a fall in demand or at low cost to the employer, unskilled workers will be dismissed in the labor-intensive secondary sector. The labor of skilled workers in the capital-intensive primary sector becomes a fixed factor, similar to capital due to the high investment by employers in these workers. Accordingly, unstable low-wage jobs in the secondary sector make it difficult to attract local workers, thus, creating a constant demand for foreign workers. However, employers can hire migrants without raising wages. Moreover, the low level of wages in the host country may decrease with an increase in the number of migrants.

Of considerable interest is the theory of the "World System" by I. Wallerstein, who considers economic migration in the context of dividing the world (or territory) into a center and periphery. Thanks to the neo-colonial government and transnational corporations, the expansion of capitalism to the periphery is increasing, which forms a "mobile population that is prone to migrate abroad." As a result of the penetration of capitalist relations, the structure of the periphery is changing. The peasants are becoming landless; the development of global cities creates the demand for migrant labor (Wallerstein I. 1989).

In fundamental works by Zh. Zaychenkovskaya, V.A. Iontseva, mainly cover socio-economic aspects of migration in terms of its impact on the labor market and demographic situation. For example, the works by S.V. Ryazantsev and A.A. Tkachenko, as a rule, describe the socio-cultural environment and political and legal situation of migrants, as well as changes in the legislation to regulate the flow of migrants in the host country.

Leading western researchers - G. Simon, V. Bening, D. Berks, et al., consider international migration of the population mainly in terms of regulating the labor market, its economic, demographic, and social aspects.

Despite quite extensive studies of migration problems, the socio-economic aspects of the cross-border cash flows movement associated with this phenomenon remain scantily explored.

Consequences of migration in the context of economy financialization, in particular, the impact of cross-border flows of money transfers by individuals on the macroeconomic indicators of developing countries practically are not investigated.

At the same time, the importance of studying the transformation of remittances into investments is noted in numerous reports of the World Bank and the works by individual researchers. In particular, as a new source of capital, remittances were investigated by A.P. Ryazantsev, G.I. Glushchenko, L.G. Gotovtseva, and others. These authors view remittances as economic rents that inevitably need to be adapted to the social investment process in developing countries.

Thus, despite the absence of a unified, coherent theory of migration, the potential of a massive flow of remittances requires further research to the extent that it is possible to solve critical economic problems of developing countries.

The information base of the study is the statistical data of regulatory agencies of remittances, such as the Federal Migration Service of Russia, the World Bank, the Bank of Russia, the National Bank of Tajikistan, statistical bodies, empirical material, as well as the authors' research.

According to the World Bank methodology, the indicator of "money transfers" is compiled from three components: remittances by workers, in particular, migrant workers, having resided in the host country for more than one year, irrespective of their immigration status; remuneration of workers and other payments in favor of seasonal, casual, and border workers, residing in the host country; transfers related to migration being the cash equivalent of the value of property and financial assets of migrants moving across the border.

To make up the balance of payments, countries use the above information sources on remittances by physical entities, which embrace international accounting systems based on reporting by money transfer operators, banks and other financial institutions.

These sources do not include a block of issues related to determining the number of remittances in kind, identifying the characteristics of entrepreneurial transfers, establishing the purpose of household expenditure, etc.

These issues are commonly included in indirect assessments done based on surveying household budgets and the data on the use of labor through mathematical models. In the field of remittance statistics, since the mid-2000s, there have been significant conceptual changes, related to a noticeable increase in the flows of different forms of migration, spread, and easing of remittances. The said changes are accompanied by the formation and improvement of the cross-border remittances accounting quality. Nonetheless, in order to organize a qualitative statistical observation of migrants' money transfers, the use of approaches applied in scientific work is challenging for several reasons.

Firstly, for the migration processes, causal relationship disclosure different countries use different spatiotemporal and social criteria. Secondly, there are real difficulties associated with singling out the flows in cash and kind, as well as with taking into account expenditures of migrants in the host country and various transactions related to the flows through informal channels, personal purchases through relatives, gifts, etc.

The studied indicators of the volume of personal transfers and other macroeconomic indicators are presented by official statistics in the form of time series. Based on the task, it would be natural to conduct a multifactor correlation-regression analysis of the relationship between remittances and a number of macroeconomic indicators, since it is in this case that you can determine the correlation indicators and build a regression, applying the levels of the studied series directly, thereby taking into account the initial information in full.

The interrelation model of macroeconomic indicators and remittances is formed by statistical data that are adequate for the maximum and minimum values and correspond to official sources. However, there is a data quality problem here, caused by the difficulty of quantifying remittances due to some inconsistency of the general methodological approach to this issue in different countries. Available data allowed for the selection of quarterly observations for five factors for 2012–2018: GDP, industrial output, remittances, the volume of imports and exports, savings and investments of the population in the securities. The share of the latter factor is negligible, on average - 0.28% of GDP so that it can be omitted from the model.

Analyzed the model with one dependent variable - Tajikistan's GDP and three independent variables: the volume of industrial products, personal transfers of migrants and the country's trade balance.

Table 2

A matrix of pair correlations

for quantitative variables

Indicators |

Уi |

Х1 |

Х2 |

Х3 |

Gross domestic product (Уi) |

1 |

|||

Industry (Х1) |

0.777717436 |

1 |

||

Personal translations (Х2) |

0.441789691 |

0.058137362 |

1 |

|

Trade balance (Х3) |

-0.26789103 |

-0.04450724 |

-0.4744497 |

1 |

As the table shows, there is a strong correlation between GDP and the independent variables. At the same time, there is multicollinearity between the indicators of remittances and trade balance. The effect of this dependence on changes in GDP can be considered indirect. However, as regression statistics show, the calculated parameters of the model by 76.5% explain the relationship between the studied variables.

Regression statistics

Multiple R: 0.874827945

R-square: 0.765323933

Rated R-square: 0.735989424

Standard mistake: 577.9662161

-----

Table 3

Dispersive analysis

Indicators |

Df |

SS |

MS |

F |

Importance –F |

Regression |

3 |

26145240.49 |

8715080.162 |

26.08954346 |

9,95035E-08 |

Rest |

24 |

8017078.728 |

334044.947 |

||

Total |

27 |

34162319.21 |

In order to study the features of existing relationships in the initial array of information, a preliminary descriptive analysis of quantitative variables based on panel data (Table 4)

Table 4

Descriptive statistics of quantitative variables

Indicators |

Coefficients |

Standard mistake |

t-statistics |

P-value |

Least |

Most |

Gross domestic product (Y) |

-3572.3612 |

669.0568 |

-5.3394 |

1,76404E-05 |

-4953.2266 |

-2191.4957 |

Industry (Х1) |

18.1551 |

2.3867 |

7.6066 |

7,61483E-08 |

13.2290 |

23.0811 |

Personal translations (Х2) |

1.7761 |

0.5395 |

3.2917 |

0.0031 |

0.6625 |

2.8896 |

Trade balance (Х3) |

-0.3249 |

0.6214 |

-0.5229 |

0.6057 |

-1.6074 |

0.9575 |

As it can be seen, the value of the trade balance indicator varies from negative to positive, and the standard deviation of the GDP indicator is rather high, which suggests the possibility of unobservable effects on the regressors. The most significant variable in this model is the volume of industrial production. The significance of this parameter (18.2) for GDP is ten times greater than the value of personal transfers of citizens (1.8), which partially rejects our hypothesis.

From the results of the analysis, it follows that only two of the three variables are significant. Although the importance of the trade balance is quite high (32.5%), it is very likely that the included coefficients do not reflect reality, since they can correlate with unobservable effects fixed for GDP. External effects may also be significant, in virtue by the dependence of the economy on the world market, for example, fluctuations in world prices and the exchange rate of the Russian ruble.

In order to check the correctness of the subsequent t-statistic checking, residues were checked for normality using the Shapiro-Wilk and Shapiro-Francia test.

Table 5

Shapiro-Wilk and Shapiro-Francia test results

Variable |

Number of observations |

Statistics of the test |

Covariation

|

z- statistics |

Significance value probability |

GDP |

112 |

0.98772 |

1.082 |

0.175 |

0.43041 |

GDP |

112 |

0.99051 |

0.920 |

0.165 |

0.56571 |

Tests have shown that the hypothesis about the normal distribution of residues is accepted at a 5 percent level of significance, i.e., the probability of normal distribution is higher than 0.05.

Based on the analysis, it is possible to distinguish the following patterns in the relationship of variables:

1- Most of the variation in GDP is due to the unobservable effects of remittances on prices and tariffs, on the country's creditworthiness, its production potential and several other determinants of migration, which is consistent with the results of the World Bank study.

2- Remittances have a positive effect on the dynamics of GDP due to the expansion of consumption, which corresponds to the provisions of the neoclassical theory of migration on the positive correlation between remittances and GDP. The World Bank research also shows that remittances can lead to economic growth through increased consumption, savings and investment. Directly or indirectly, having an impact on investments, remittances have a positive effect on labor productivity and employment, through a multiplier effect, especially in construction and infrastructure, contribute to an increase in tax revenues to the budget. However, consumption in Tajikistan is satisfied mainly at the expense of imports, which confirms our hypothesis that the export of labor resources primarily stimulates imports to the detriment of the country's long-term development goals.

3- In terms of its volume, remittances exceed other sources of external financing, and even in times of crisis, they do not sharply decrease, in contrast to foreign direct investment, or external assistance. This conclusion confirms the countercyclical remittances and is entirely consistent with the theory of the dual labor market by M. Priore.

4- Expected investment opportunities in the real sector have a positive effect on the growth potential of the economy. This conclusion is confirmed by the result of a study by the National Bank of Kyrgyzstan that in the countries of Central Asia the investment potential of remittances is partially implemented (construction - 1%, education and health care - 0.7%, durable goods - 2%), which is significantly lower than in countries such as China, Mexico, Colombia, and Guatemala (IOM.KG).

5- This view is also supported by studies of the experience of Eastern European countries, where economic growth was largely due to the rapid growth of GDP since the late 1990s. - a period of high migration activity of the population of these countries (R. Lukas, 2005)

6- Decisions on long-term investments are, in principle, more difficult because of the low standard of living of the majority of the population and the long planning horizon. The Gallup expert group also obtained the same conclusions: revenues in the form of money transfers are used unproductively from the point of human capital development in the countries of Central Asia. Money was mainly spent on current consumption – 92%, on education - 2%, on starting their own business - 3%, on savings - 3% (NEWS.GALLUP.com).

7- The insignificance of the sum of savings of the population of Tajikistan does not allow us to confirm or refute our hypothesis about the significant positive effect of this factor on economic growth through the expansion of savings and investments. However, M. Clément’s research showed that transfers increase the share of current household consumption by 1.7%, and reduce the share of savings in the same proportion (Clément M., 2011).

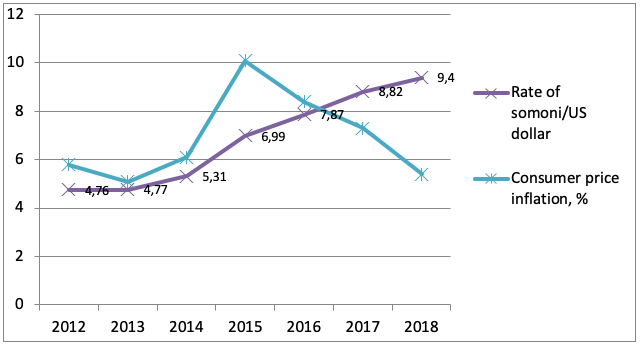

The authors believe that it is appropriate to take into account the additional pressure exerted on the national currency (somoni) rate, due to the strong dependence of the Tajik economy on remittances from Russia with a weakening ruble.

Figure 3

Dynamics of monetary indicators: rate of national currency and inflation

When comparing the dynamics of remittances with the rate of change of financial indicators from Figure 3, it can be seen that from 2012 to 2015, the average depreciation rate of somoni remained lower than the rate of inflation, which means an increase in somoni in price. Undoubtedly, this harms export performance (World Bank, 2015). However, the situation has changed since 2016, but exports continue to decline (see Fig. 2).

Thus, the authors believe that the assessments allowed for partially answering the authors' initial question about how well the remittances contribute to the economic growth of Tajikistan. The hypothesis about the existence of a clear correlation between GDP and remittances has been confirmed. However, the provision on the investment potential of the financial flows generated by remittances was partially confirmed, primarily because of their ambiguous effect on financial indicators, and exports.

Following this, in terms of social and economic effect, the degree of the positive impact of monetary transfers by migrants depends on how they are redistributed in the country supplying the workforce. From an optimistic point of view, it may be expected that transfers stimulate investment, and from a pessimistic one - that they are used in the current household consumption.

It is represented to us that there are the certain optimum minimum number of migrants for both the sending and receiving countries, upon reaching which, according to the scale effect, the negative migration impact begins to predominate

The manuscript assesses the impact of migrant remittances on economic growth in the recipient country of remittances. To this end, a model has been built that describes the effect of remittances on the growth potential of the economy of Tajikistan. The findings suggest that in Tajikistan there is a unique migration situation, on the one hand, contributing to the reduction of poverty and social upheavals in the context of a deep decline in its production, on the other - having an ambiguous impact on the development of the economy in the future. First of all, because migration has a short-term effect and cannot be relied on to solve the strategic tasks of developing countries.

In general, in the authors' model, the impact of the remittances on economic stability is subject to several factors. First, the positive impact of remittances on changes in GDP does not have a long-term effect, since the economy is supported mainly due to the expansion of current consumption, which is satisfied mainly by imports, and not by its production. Secondly, the role of savings and investments of the population is minimized in virtue by the low standard of living of the majority of the population and the long planning horizon. Thirdly, the strong dependence of the economy of Tajikistan on remittances, which in their volume exceed other sources of external financing, creates an environment for increasing pressure on the exchange rate of the national currency, which in turn adversely affects exports.

Thus, the obtained results make it possible to explain the economic reasons for the different influence of remittances on the processes of accumulation and investment of capital, as well as the extreme complexity of estimating the financial flows generated by them.

An essential result of the study is also the conclusion that the inadequate realization of the investment potential of remittances is more likely a consequence of a number of structural barriers that exist at the endogenous level, further study of which will provide a search for adequate opportunities for the emergence of viable models of economic growth in Tajikistan. However, at this stage of the study, the authors were not able to take into account several factors associated with the monetization of the economy as a result of the expansion of cash receipts of citizens, which most likely affect the level of prices and tariffs. In addition, since the authors' access was limited to official statistical data on macroeconomic indicators, it was impossible to include a number of factors in the model (for example, the country's production potential, labor productivity dynamics, etc.) and assess their importance from the point of view of efficient use of remittances within the national economy.

These aspects leave room for future assessments and are precise directions for further research in this area.

Sultanova, M., & Sultanova, S. (2017). Financial and economic aspects of the cross-border cash flows connected with migration. The impact of migration processes on the distribution of Russian in the world. Collection of theses and articles of participants of the international congress, 199-214.

Bank of Russia. (n.d.). Bank of Russia. Retrieved August 1, 2018, from https://www.cbr.ru/: https://www.cbr.ru/statistics/prtid

Cartinescu, N., Leon-Ledesma, M., Piracha, M., & Quillin, B. (2009). Remittances, Institutions and Economic Growth. World Development, 37(1), 81-92.

Clément, M. (56-87). Remittances and Household Expenditure Patterns in Tajikistan: A Propensity Score Matching Analysis. Asian Development Review2011, 2.

DCenter. (n.d.). The market for international money transfers. Retrieved August 18, 2018, from https://dcenter.hse.ru: https://dcenter.hse.ru/data/2018/01/31/1114338513

Denisenko, M., & Chernina, E. (2017). Labor migration and earnings of migrants in Russia. Economy questions, 3, 40-57.

Dushanbe: the agency statistically at the president of the Republic of Tajikistan. (2017). Statistical year-book of RT. Dushanbe.

Dushanbe: the agency statistically at the president of the Republic of Tajikistan. (2017). Tajikistan in figures. Dushanbe.

Dushanbe: the agency statistically at the president of the Republic of Tajikistan. (2018). Tajikistan in figures. Dushanbe.

International Organization for Migration. (2015). Migrants and Cities: New Partnerships to Manage Mobility. World Migration Report. IOM.

IOM. (n.d.). Kyrgyzstan: expanded migration profile. Retrieved November 7, 2018, from http://iom.kg: http://iom.kg/wp-content/uploads/2016/09/ Migration-Profile-Extended-Kyrgyzstan-Rus-2010-2015.pdf

Ismailova, M., & Nasirova, U. (2015). Market transformation of economy and standard of living of the population. Tajikistan bulletin of the Tajik state university of the right, business and policy. Series of social sciences, 2(63), 5-13.

Kaukhiro, K. (2015). Tajik labor migrants and their international money transfers. Region economy, 2, 285-300.

Lucas, R. (n.d.). nternational Migration and Economic Development: Lessons from Low-Income Countries. Retrieved September 16, 2018, from Stockholm: Expert Group on Development Issues (EGDI), Swedish Ministry for Foreign Affairs: http://www.egdi.gov.se/pdf/International_Migration_and_Economic_Development.pdf

Netz, N., & Jaksztat, S. (2017). Explaining Scientists Plans for International Mobility from a Life Course Perspective. Research in Higher Education, 58(5), 497-519.

Ortega, F., & Peri, G. (2013). The Effect of Trade and Migration on Income. Migration Studies, 1(1), 1-28.

Ozcan, B. (2011). The Relationship between Workers' Remittances and Real Exchange Rate in Developing Countries. International Research Journal of Finance & Economics, 80, 84-93.

Pitukhina, M. (2015). Developing bases of world migration policy: contribution of Russia. World economy and international relations, 12, 99-104.

Priore, M. (1979). Birds of passage. Migrant labor and industrial societies. New York: Cambridge University Press.

Ryazantsev, A. (2012). Financial and economic characteristics and trends of interstate labor migration. Studies on Russian Economic Development, 383-387.

Tkachenko, A. (2014). Remittance as the new phenomenon of global economy. Economies. Taxes. Law., 2, 36-42.

Vakulenko, E., Mkrtchyan, N., & Furmanov, K. (2011). Econometric Analysis of Internal Migration in Russia. Montenegrin Journal of Economics, 7(2), 21-33.

Wallerstein, I. (1989). The Modern World-System, vol. III: The Second Great Expansion of the Capitalist World-Economy, 1730-1840's. San Diego: Academic Press.

World Bank. (2008). Migration and Remittances. Eastern Europe and the Former Soviet Union. Under Ali Mansour's edition Bruce Kuillin. Moscow: A whole world publishing house.

World Bank. (2016). igration and Remittances: Recent Developments and Outlook. Migration and Development Brief.

World Bank Group. (2015). Tajikistan: the slowing-down growth, the growing uncertainty. Report on economic development of Tajikistan. World Bank Group.

World Bank. (n.d.). World Bank Official Web-Site. Retrieved September 8, 2018, from http://www.vsemirnyjbank.org: http://www.vsemirnyjbank.org/ru/news/feature/2013/10/02/

Yesipova, N., & Ray, J. (n.d.). Migration policy, the relations in synchronization around the world. Retrieved December 28, 2018, from https://news.gallup.com: https://news.gallup.com /poll/187856/migration-policies-attitudes-sync

1. The Moscow State Humanitarian and Economic University, Moscow, Russian Federation. Contact email: muslima.k.sultanova@yandex.ru

2. The Moscow State Humanitarian and Economic University, Moscow, Russian Federation. Gzhel State University. Gzhel, Russian Federation

3. Peoples' Friendship University of Russia, Moscow, Russian Federation

4. Peoples' Friendship University of Russia, Moscow, Russian Federation