Vol. 40 (Number 25) Year 2019. Page 14

EREMEEVA N. 1; ROITER L. 2 & ROITER Ya. 3

Received: 02/04/2019 • Approved: 12/07/2019 • Published 22/07/2019

ABSTRACT: The analysis of the current state of the food industry in the context of the main indicators of the dynamics of production and consumption of eggs and meat of this type of poultry, as well as its range, updated the need to find alternatives to expand the market . The development of the market potential of poultry products is possible by expanding their range and quality through deep processing and diversity of bird species. As an imperative for the implementation of this task, the perspective of its solution was justified by increasing the volume and quality indicators of the products received from waterfowl. The study was carried out using several general scientific and statistical methods. The convenience of considering the production of waterfowl products and their assortment in conjunction with the basic platform of the domestic genetic resources of waterfowl and the innovative technologies of their reproduction is demonstrated. Proposals are presented on the mechanisms to realize the market potential of waterbirds, in which it was recommended to strengthen the provision of state support to both genetic and genetic centers (BGC) and producers of marketable breeding products. |

RESUMEN: El análisis del estado actual de la industria alimentaria en el contexto de los principales indicadores de la dinámica de producción y consumo de huevos y carne de este tipo de aves de corral, así como su rango, actualizó la necesidad de encontrar alternativas para expandir el mercado. El desarrollo del potencial de mercado de los productos avícolas es posible expandiendo su rango y calidad a través del procesamiento profundo y la diversidad de especies de aves. Como imperativo para la implementación de esta tarea, la perspectiva de su solución se justificó al aumentar el volumen y los indicadores de calidad de los productos recibidos de las aves acuáticas. El estudio se llevó a cabo utilizando varios métodos científicos y estadísticos generales. La conveniencia de considerar la producción de productos de aves acuáticas y su surtido en conjunto con la plataforma básica de los recursos genéticos domésticos de las aves acuáticas y las tecnologías innovadoras de su reproducción está demostrada. Se presentan propuestas sobre los mecanismos para realizar el potencial de mercado de las aves acuáticas, en el que se recomendó fortalecer la provisión de apoyo estatal tanto a los centros genéticos como genéticos (BGC) y a los productores de productos comercializables de cría. |

The development of the market potential of poultry enterprises of the Russian Federation is a promising direction for increasing their economic viability. Among the factors characterizing the performance of market potential is the range and quality of poultry products that can meet the needs of consumers.

Poultry farming in Russia steadily increases the production of eggs and poultry meat, ranking 5th and 4th in the world rankings, respectively. For 2017, the growth is 7.0% (meat) and 2.8% (egg) if compared to 2016.

The generated reporting data for 2018 and the forecast values for 2020 indicate that the dynamics of these products remained positive and their consumption per capita increased (2017: meat – 33.6 kg; egg – 305 pcs).

Moreover, the level of target indicators for eggs and poultry meat is exceeded, stipulated by the Doctrine of Food Security of the Russian Federation and the industry, successfully realizes its market potential, increasing the export of edible eggs (2 times the level of 2016) and poultry meat (42% more than the level of 2016).

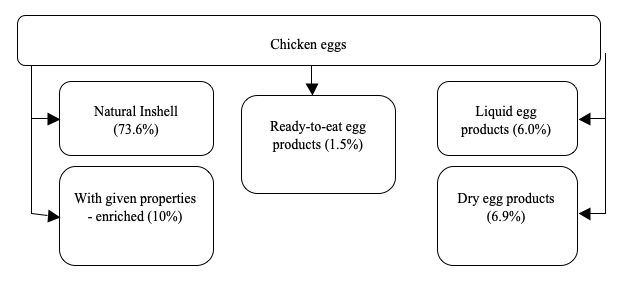

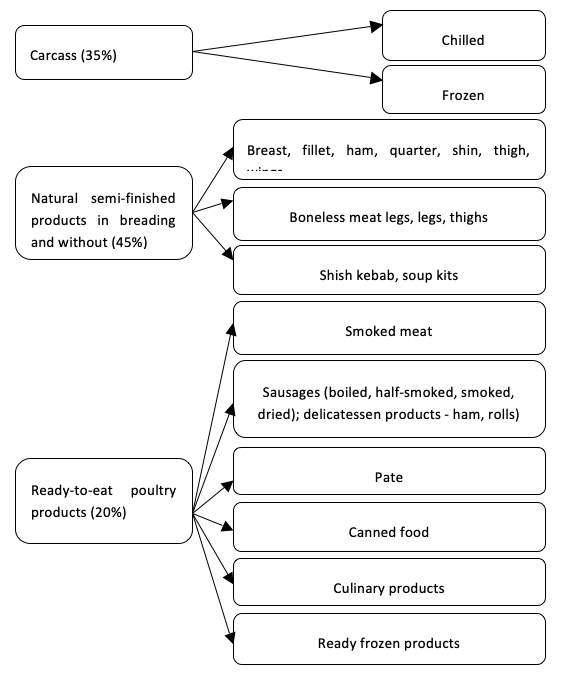

The branch expands the range of eggs and chicken meat (Figures 1 and 2)

Figure 1

Assortment of poultry products in 2017

The solution of this issue is carried out in the framework of two areas: (a) deep processing of products and (b) the species diversity of poultry. Analytics of the data presented indicates the presence of reserves in the market potential of eggs, since only 14.4% is processed, and the rest is sold in kind. The assortment group “Ready-to-eat egg products: in the total volume of processed eggs is 1.5%, which does not correspond to world trends (20-25%) (Kakushkin, 2017). This is primarily due to the Russian traditions of nutrition. At the same time, the participants of this segment believe that these are high-margin products that would increase the profitability of enterprises of this profile by 25% compared to the sale of eggs in the shell; and in terms of protein unit, the production of egg products is more profitable by 15% (Kakushkin, 2017). Today there is a ready-made line of new food products for the market, but innovative marketing approaches are needed to promote them (Vedenkina et al., 2011).

Figure 2

The range of poultry meat in 2017

The segment of production of non-food products from eggs also has a huge market potential for its growth and sale (Ping et al., 2017). Regarding the range of products from chicken meat (broilers and adult chickens), one can talk about its wide range, from whole carcasses (35.0%) to ready-to-eat products from it (20.0%). Prospects for the development of this segment are to increase the production of functional and organic products (Askew, 2017; Siekmann, 2018; Lopez-Andres et al., 2018), and this is adequate to the main trend of the global food market, namely the growth in demand for environmentally friendly products of high quality (Santerano et al., 2018).

In 2014, the increase in the production of organic products in the United States was 14%. Broiler chickens occupy the main share in this product line. However, this market segment in the USA is insignificant and is within 5% of the total sales volume (Donskova et al., 2018).

At the same time, the production of eggs and chicken meat is carried out mainly by intensive methods, which require significant financial costs to maintain veterinary well-being, and, consequently, increase the risks of reducing the sustainability of the products obtained. Orientation to the range of products from waterfowl is one of the solutions to this problem. This product has a significant margin of safety in terms of quality parameters, since its content traditionally uses semi-extensive and extensive technologies.

The niche of this market segment was underused by domestic producers due to a number of reasons, the most significant of which for a long time was considered the problem of low genetic potential of productivity of these bird species (ducks, geese) (McKay, 2009). In this regard, analysis of the state and prospects for the development of the market potential of products obtained from modern domestic breeds, cross lines of geese and ducks is extremely important.

The proposed hypothesis is that the expansion of the market potential of the production of goose breeding and duck breeding should be considered within the framework of the modern domestic breeding base of waterfowl and resource-saving technologies of its reproduction.

The purpose of the study is to analyze the current state of development of the goose and duck breeding, to identify the factors hindering the production of waterfowl products, and to determine the mechanisms for realizing its market potential.

Theoretical and methodological aspects of rational production of products from waterfowl are reflected in the research of several scientists (Makhalov et al., 2011; Roiter, 2005; Roiter & Kutushev, 2006; Gadiev & Tsoi, 2014; Dankvert, Kholmanov & Osadchaya, 2014; Roiter et al., 2016; Sukhanova & Azaubayeva, 2009; Fisinin et al., 2005). The works of domestic and foreign authors are devoted to issues of market potential. These works are multidimensional both in the conceptual apparatus of this economic category, and in the methods of its assessment and mechanisms of implementation (Igoshin, Kuts & Lipets, 2005; Malysheva, Oksanich & Romashin , 2010); (Bronnikova & Kotrin, 2012).

At the same time, it can be stated that many scientists consider the market potential in the country as a whole, the region, the economic entity, and from the positions of the products produced there are practically no studies. Highly appreciating the results of the works we reviewed, we note that the synthesis of various points of view on the identified problem actualized the need to deepen both theoretical and practical analytics of market potential in conjunction with the basic platform of the genetic resources of waterfowl.

Different scientific approaches and statistical methods were used as the instruments for the data processing and analysis. Current condition of poultry breeding branch including breeder pool of the waterfowl was analyzed using clustering and comparison of the data presented as tables and graphs. The trends of the development of waterfowl production were identified via the comparison of average and relative values of the production and consumption of waterfowl products in Russian and worldwide.

To conduct the research, the following data were collected and used: (a) the data coming from the Federal State Statistics Service of the Russian Federation, including on the priority national project “Development of the AIC” and the “Strategy for the development of the agro-industrial complex until 2020” (Rosstat, n.d.); (b) the data from the "Rosptitsesoyuz"; (c) reference materials and information resources of the Internet (cited in the text); (d) materials of the Ministry of Agriculture of the Russian Federation; (d) the data of accounting and statistical reporting of poultry enterprises (Ministry of Agriculture of the Russian Federation & Russian Academy of Agricultural Sciences, 2011).

In solving the problems of increasing and expanding the range of poultry products, a special place belongs to the waterfowl (geese and ducks). By precocity, payment of feed products, the viability of fattening, not only in the capital premises but also in summer camps, as well as in water bodies, ducks and geese occupy a special place. Of all the biological characteristics of geese and ducks, poultry farmers prefer those that contribute to the efficient production of meat, as well as feather-down raw materials for light industry.

In the Soviet period, the population of geese in the country ranged from 242 thousand heads to 5.3 million heads of adult poultry, and the production of duck meat accounted for more than 10% of the total poultry meat production, so total production of duck meat exceeded 250 thousand tons in 1990 (Roiter, 2011).

By the mid-90s of the last century, the number of waterfowl in Russia has drastically decreased and amounted to geese – 218-265 thousand heads, and ducks – 100-1,160 thousand heads (Roiter, 2011). This situation was caused by the increase in energy prices, the saturation of the market with relatively inexpensive meat products of foreign production, as well as the low quality of geese and duck carcasses obtained in industrial conditions.

At the same time, in some regions of the country, the demand of the rural population for goslings and ducks in the spring-summer period was not satisfied, which resulted in a sharp rise in prices (Roiter, 2011). Also, the deficit was felt in high-quality down-feather raw materials, the cost of which has sharply increased.

In this regard, mechanisms were implemented for realizing the market potential for the production of products from waterfowl, through the introduction of a scientifically-based comprehensive program to create competitive breeding material for geese and ducks, ensuring high productivity in various methods of cultivation and maintenance (intensive, semi-intensive). Moreover, these studies were carried out in conjunction with the optimization of the conditions of feeding and maintenance of poultry.

Comprehensive introduction of breeding and genetic methods against the background of resource-saving cultivation and content technologies allowed creating, improving, and universally introducing into production industrially important breeds of geese (Linda, Krasnoser, Gubernatorial, Ural White, Ural Gray), the breed of Bashkir colored ducks, and two-line crosses ducks “Blagovarsky,” “BC ВЦ 12,” “BC 123,” “Agidel 34”, and “Agidel 345.” Systematization and analytics of data on created and improved breeds, lines of geese and ducks demonstrates breeding progress in genetic potential, which is characterized by the following indicators of productivity for waterfowl. The Linda geese of the heavy type have a live weight 5.1-5.3 kg at 10 weeks of age, with feed costs per 1 kg of gain – 2.8 kg. In the adult state, their live weight corresponds to 10-12 kg, while for individual individuals the live weight reaches 13–14 kg. The egg production of geese for 4.5 months of the productive period is 48.6; the output of goslings is 70.2%. At the same time, the geese demolish up to 70% of eggs in the season of maximum demand from the population and farms with seasonal production (Roiter, 2011; Roiter et al., 2008).

High productivity and displacement of egg-laying for the season of increased demand for geese were achieved by selecting poultry for the duration of egg production for the first productive cycle (at least 125 days), by the number of sperm in the ejaculate at 55 weeks (over 250 million). In general, during the period of family breeding, the output of meat from the parent pair increased by 17.5% (Roiter et al., 2016). The competitiveness of the Linda breed of geese is that they surpass other breeds of geese in egg production by 5.5-8.7%, in live weight of young stock in 9(10) weeks by 8.0-22.4%. At the same time, they are well adapted to various cultivation and production technologies.

In Russia, their livestock is more than 400 thousand heads (55-60% of all adult geese in the country), according to (Rosstat, n.d.). The Krasnozerskiye breed of geese differs from other breeds by its specific exterior and branched down structure, due to which it is adapted to be kept in unheated houses with a lightweight construction in the conditions of the sharply continental climate of the Siberian region. This type surpasses other breeds bred in the Siberian region, by egg-laying by 5.7%, adult poultry keeping by 5.1%, live weight gain by 2.4%, and young stock keeping by 4.4%.

The expediency of their cultivation is explained by higher productivity (by 5-7%) and a decrease in production costs for cultivation and maintenance as compared to the rocks imported into the region by 12.1-16.6%.

The Ural White and Gubernatorial breeds are of the middle type geese. They are autosex on the color of down, characterized by high reproductive productivity indicators during their five-year content in the parent flock. The egg production of geese of the maternal form is 51-53 pcs. The output of hybrid young animals is 79.5-80.2%. Live weight at 9 weeks is 4.0-4.4 kg, with the cost of feed per 1 kg increase in live weight being around 2.7-2.8 kg and the safety of 96.0 - 97.0%. In the adult state, the live weight of geese is 6.0-6.5 kg. The bird is characterized by high reproductive performance; the output of goslings from one parent pair per cycle (4.5 months) is 35-36 goslings (Roiter et al., 2008). They are characterized by high quality parameters and the yield of feathers and down (4.5-4.6% based on live weight). These geese breeds surpass other breeds in meat output from the parent pair by 8.0–8.4%, while the cost of growing and keeping poultry is 15.3-18.2%. In the structure of the population of adult geese in the country, they occupy 15.0-20.5%, respectively. Compared to other breeds, the Ural Gray Geese are distinguished not only by the color of the plumage, but also by the good taste of the meat, as well as by the ability of fattening to “fatty liver”, the weight of which varies on average from 600 grams to 650 grams (Roiter et al., 2008).

The two-line cross duck "Blagovarsky" has a live weight of broiler ducklings at 7 weeks of 3.4 kg, and feed costs per 1 kg increase of 2.8 kg. The output of meat in live weight per one parental pair is 501 kg, the output of feathers and down is 25 kg. This cross duck surpasses other crosses in egg production by 5-18%, the live weight of broiler chickens – by 6.5-19.8% with lower feed costs per 1 kg of the product produced – by 3.8–12.2%.

The Bashkir colored duck breed differs from other duck breeds in terms of plumage color, high productivity, and reduced fat content in the carcass by 5.4-6.8%. The output of meat in live weight from the parent pair is 510-515 kg. This bird is in demand among amateur poultry farmers and in small farms.

In recent years, duck meat production in the Russian Federation is based on industrial duck crosses with the white plumage “Agidel 34” and “Agidel 345”. These crosses provide meat output from laying duck of the parent flock of 525-530 kg, and feed costs per 1 kg increase in live weight (2.0-2.1 kg), and it is 2.2-2.3 kg up to 7 weeks when raising poultry up to 6 weeks old (Roiter & Kutushev, 2006).

Selection-genetic and resource-saving methods and techniques based on a comprehensive study of the genetic, ethological, physiological characteristics of geese and ducks, their productive and reproductive indicators allowed not only to create a new generation of birds but also to develop promising technologies with the possibility of keeping geese in a productive period in lightweight premises with constant access to the paddock. in an unproductive period, they are kept in a summer camp with access to natural pasture, water or stubble after harvesting grain crops, with double help (Roiter et al, 2016). The portfolio of these developments and "sparing" technology call molting from drakes and ducks followed by the maintenance of birds in the summer camp. At the same time, these technologies in the complex ensure a reduction in the cost of growing young stock by 25.5-31.2%, the content of adult geese and ducks – by 22.5-27.7%.

The review of the modern breeding base of the waterfowl of Russia fully corresponds to the best world analogues (Roiter et al., 2016).

Currently in the country, production from created geese is almost 100%, ducks are more than 75%, i.e there are all the prerequisites for expanding the market potential for production from waterfowl. This fact is adequate to the statistics of the increase in the production of relevant products in industrial enterprises. The positive trend of increasing the waterfowl population is mainly characteristic of the regions where geese and ducks are traditionally in demand among the population (Republic of Bashkortostan, Tatarstan, Chuvashia, as well as the Orenburg, Kurgan, Novosibirsk, Rostov, Krasnodar regions and other areas of the Russian Federation). Much of the production of meat from waterfowl is concentrated in the private sector, in home gardens and farms. Accordingly, in these areas there is a demand for breeding eggs and day-old poults. These consumer requests are satisfied by such economic entities as the Plemzavod Makhalov LLC of the Kurgan region, the Blagovarsky Breeding Plant (Bashkortostan), and the Vurnarets LLC of the Republic of Chuvashia, and the Gayskaya poultry farm of the Orenburg region, etc.

In recent years, the situation with the gross production of meat from waterfowl in Russia has begun to change. Large industrial poultry enterprises for the production of duck meat and corresponding assortment positions are being built and successfully operate in the country.

Among them, first of all, we should mention the leader in the production of duck meat: the Donstar LLC, Rostov region (2016 - 28 thousand tons); the PC Domestic Poultry LLC (Belgorod region, 1.73 thousand tons of live weight in 2016); the Chicken Duck Company LLC (Altai region, 2.2 thousand tons of live weight in 2016); the State Unitary Enterprise “Blagovarsky” (Republic of Bashkortostan, 1.2 thousand tons of live weight in 2016), the Gayskaya poultry farm (Orenburg region, 1.7 thousand tons of live weight in 2016), and also the second largest industrial production in Russia was opened in 2015 in the Chelyabinsk region, the Duck Farms LLC (6.5 thousand tons of live weight in 2016); the farm “Ramaevskoe” (the Republic of Tatarstan, 2.2 thousand tons of live weight in 2016) (National Association of Waterfowl Meat Manufacturers, 2017).

As for the production of geese meat and its products, its main producers are the above-mentioned breeding plants and reproduction farms, the main focus of which is the production of hatching eggs and day-old poults.

The effectiveness of geese breeding and laying in Russia can be judged by the dynamics of gross meat production from waterfowl (Table 1, 2).

Table 1

Gross production of meat of geese and

ducks in Russia in live weight, tons

Product type |

Years |

|||

2013 |

2014 |

2015 |

2016 |

|

Duck meat |

101799 |

116790 |

124900 |

133345 |

Goose meat |

62532 |

68202 |

74358 |

75872 |

-----

Table 2

Growth rates of gross production of

meat of geese and ducks in Russia

Product type |

Years |

||

2014 |

2015 |

2016 |

|

Duck meat |

1.15 |

1.07 |

1.07 |

Goose meat |

1.09 |

1.09 |

1.02 |

Over the four-year period, the growth in the production of goose meat by 25.9% and of duck meat by 44.1% is noted.

The difference in the deltas of meat gain from waterfowl is explained by the large proportion of goose meat production in the private sector (Table 3).

Table 3

The proportion of meat production from

waterfowl in the private sector

Product type |

Years |

|||

2013 |

2014 |

2015 |

2016 |

|

Duck meat (%) |

73.2 |

67.5 |

54.7 |

46.2 |

Goose meat (%) |

88.9 |

86.3 |

82.1 |

80.9 |

According to the presented data, the production volumes of duck meat in private farming and collective farm decreased significantly as a result of an increase in the number of large commodity farms producing similar products. This trend is less apparent in goose meat.

In the general structure of poultry meat produced in the country, the share of related products from geese and ducks is insignificant (Table 4).

Since 2000, the world meat production from waterfowl has grown by 38.2% for geese, and by 68.5% for duck meat compared to 2016. Four-year analytics covering 2013 to 2016 indicates a steady growth trend in duck meat production (9.6%), while the opposite situation is observed in geese meat, i.e. there is a decrease in its volume by 8.4%. This change is due to shifts in the structure of world poultry meat production in favor of turkey meat.

Table 4

Structure of production of geese and ducks from

the total production of poultry meat in Russia

Product type |

Years |

|||

2013 |

2014 |

2015 |

2016 |

|

Duck meat (%) |

2.66 |

2.81 |

2.83 |

2.92 |

Goose meat (%) |

1.64 |

1.64 |

1.64 |

1.64 |

The growth rate of this product over the study period is characterized by a 38.2% increase in the meat of geese and 65.0% in goose meat (Table 5).

Table 5

Dynamics of meat production

from waterfowl in the world

Product type |

Years |

|||

2013 |

2014 |

2015 |

2016 |

|

Duck meat (mln. tons) |

4424 |

4449 |

4600 |

4850 |

Goose meat (mln. tons) |

2690 |

2400 |

2417 |

2465 |

-----

Table 6

The growth rate of production of duck

meat and geese to the previous period

Product type |

Years |

||

2014 |

2015 |

2016 |

|

Duck meat |

1.06 |

1,03 |

1,05 |

Goose meat |

0.89 |

1,01 |

1,02 |

Moreover, the world production of meat ducks and geese in the total structure of poultry meat in 2013 was 4.01% and 2.44%, respectively, and it was 4.14% and 2.1% in 2016, respectively (Table 7).

Table 7

The structure of world production of geese

and ducks in the total volume of poultry meat

Product type |

Years |

|||

2013 |

2014 |

2015 |

2016 |

|

Duck meat (%) |

4.01 |

3.93 |

3.95 |

4.14 |

Goose meat (%) |

2.44 |

2.12 |

2.08 |

2.1 |

A comparative analysis of data on the structure of meat of waterfowl in Russia and the world shows a multidirectional trend: in the first case, almost steady growth was noted for duck meat in Russia and the world. With respect to the geese meat, its structure has not changed in Russia since 2014, while as noted throughout the world during the study period, there is a slight decrease. At the same time, the proportion of waterfowl meat in the overall structure of poultry meat in the world is higher than in Russia.

The production of duck and goose meat per capita is a significant economic and statistical parameter characterizing, first of all, the productive abilities of the studied bird, laid down by geneticists and breeders in the biological model of the breeds, lines, and crosses.

It should be noted that the deviation of the structure of the production of waterfowl meat in the world and Russia is insignificant. At the same time, a significant range of fluctuations is noted in terms of per capita meat production from waterfowl, that is, these products can be classified as niche and promising in terms of increasing their market potential.

Countries such as China, Taiwan, Bulgaria, Hungary, Malaysia, France are considered to be the leading consumers of duck meat per capita, where every inhabitant consumes from 2 to 4.5 kg of duck meat each year (McKay, 2009).

Nevertheless, the situation with the consumption of meat from waterfowl in the future will change, as evidenced by statistics on the sales of this type of product, the development of retail forms, as well as a change in consumer preferences among the population. The interest in new types of poultry meat is gradually increasing, the interest of the population in food culture is increasing, a diverse and healthy diet is becoming fashionable.

The growth of the Muslim population (according to forecasts, the share of this population in the world will reach 26% by 2030) would also increase the consumption of duck meat (Gushchin, Rusanova & Riza-Zadeh, 2015). At the same time, industry experts believe that despite the fact that the market potential of this area is still niche, the forecasts for its development are, by their estimates, promising. In particular, they provide for an increase of the volume of duck meat production in 3-4 times, and a more modest increase in production volumes goose meat (National Association of Waterfowl Meat Manufacturers, 2017).

For example, the Donstar LLC plans to expand its production capacity and increase duck meat production to 70 thousand tons per year by 2020. Meanwhile, the Duck Farms LLC to 12 thousand tons per year.

According to forecasts from BusinessStat, the supply volume of the Russian market will reach 87.8 thousand tons by 2020. And the natural sales of duck meat will be 80.8 thousand tons (National Association of Waterfowl Meat Manufacturers, 2017).

The growth of real disposable incomes of the population, which for two years (2016-2017) have decreased by 7.5%, will serve as a powerful driver of the growing interest of the Russian population to non-traditional types of meat (Table 8).

Table 8

The main indicators of economic development

of the Russian Federation

|

2017 (forecast) |

2017 (fact) |

2018 (forecast) |

2019 (forecast) |

2020 (forecast) |

Real disposable income |

1.3 |

-1.7 |

2.3 |

1.1 |

1.2 |

Population with income below subsistence level (%) |

12.8 |

13.4 |

12.3 |

ё11.8 |

11.2 |

Expansion of the product range from waterfowl, both by increasing the volume of naturally produced products directly from poultry (meat, fat, down, feather), and by means of their deep processing, is quite a significant vector of attracting customers to use these products.

The breeds, lines, crosses of geese and ducks created and widespread in the country are universal from the standpoint of receiving products from them. However, each of them has a specialized primary focus, which allows one to more effectively and efficiently engage in this business.

Juicy meats, fatty liver (“foie gras”), goose fat, feather-down raw materials are the main assortment positions directly obtained from farmed poultry. The meat of these types of poultry is characterized by high taste, and it is superior in nutritional value to chicken meat. Geese meat contains: water – 73-75%, protein – 18.8%, fat – 5.3-7.3%, mineral substances – 1-1.16% (Juodka et al., 2012).

Duck meat in 100 grams of pure meat contains the following level of daily nutrients: 47% is protein; 23-25% – vitamins B2, B3; 15-17% – vitamins B1, B5; 13% – vitamin B6; 7% – vitamin B12; 17% – fat; 32% – selenium; 20% – phosphorus; 17% – zinc; 15% – iron; 12% – copper; 7% – potassium; 5% – magnesium; 65 mg – vitamin B4; 8.4 mg – betaine; 1-3% – manganese, calcium, sodium (Retailleau, 1993; Maksimova, 2007).

Although duck meat is high in cholesterol, it also contains fatty acids in the omega-3 and omega-6 series. Regarding goose and duck fat, it should be noted that both of them are similar in content of fatty acids to olive oil. Goose fat is low in cholesterol. Today, in EU countries, the purchase prices for goose fat exceed the prices of butter; it is a promising raw material for use in the pharmaceutical, cosmetic, and perfume industries.

Characterization of the qualitative parameters of goose and duck meat and fat is quite consistent with their classification as healthy and natural products that have a logical basis for increasing the consumption of the country's population. Concomitant down and feather material from waterfowl is very valuable (Snitkin, 2003). These raw materials are characterized by high thermal insulation properties and wear resistance.

According to these parameters, the goose down is inferior only to the down of the loon. The world prices for goose down in the lifetime of the plume are 100-130 USD per 1 kg, and feather-down raw materials with a fluff content of 30% cost 50-58 USD per 1 kg.

Currently, feather products in Russia are completely dependent on raw materials produced by the private sector (20%) and imported raw materials (70%) mainly from Europe and Asian countries (China, Indonesia, Malaysia). Asian countries occupy 10% of the market for imported raw materials. Moreover, if a feather-down duck raw material in Europe costs 17 euros (EXW) terms, then the Chinese feather-down raw material is white in a 70/30 ratio (feather / down), and it costs 4 USD per 1 kg (EXW). At the same time, it is fragile and quickly loses rigidity (Dankvert, Kholmanov & Osadchaya, 2014).

Thus, if the feather-down raw materials are produced in territories with predominantly low temperatures, which also include Russia, then the potential for expanding this market segment is very high.

Large fatty liver ("foie gras") refers to the deli meats. This is a fairly expensive product for which wholesale purchase prices range from 25-40 USD per 1 kg. Hungary (57.8% of the world's total) and France are the leaders in the production of foie gras. In Russia, 48 tons of these products are produced. The main advantage of domestic producers of fatty liver is the ability to promptly deliver products in a chilled rather than frozen form, in which it is usually imported to Russia.

Along with unsatisfied demand for chilled waterfowl meat, significant demand exists for their processed products, namely canned food, meat and liver pates of geese and ducks, main dishes, numerous semi-finished products and always a snack group. These products are successfully consumed in Europe, USA, China. Their import to Russia is carried out at an unattractive price to the consumer.

The assortment of the largest company, Donstar LLC, includes more than 100 items. However, downstream products take about 10%, which means there is a potential for the development of this market segment.

Thus, the product portfolio of products from waterfowl is unique in its quality parameters, multidirectional in relevant positions, in demand not only as food but also in light, pharmaceutical, cosmetic and other industries. In addition, each segment of the above assortment positions is a niche.

At the same time, there are all prerequisites for filling these niches and solving the important task of import substitution of products from waterfowl, which in the past centuries of the country was traditional and had a good export potential.

The study of the market potential of products from waterfowl began with an analysis of the current state of the industry in the context of the main indicators of the dynamics of production and consumption of eggs and poultry meat, the range of products with an assessment of their trends and development prospects.

At the same time, the need to expand the market potential of the industry market by producing products from waterfowl has been updated, because the market for the food industry is practically saturated, and there is only a niche for building up functional and organic products. At the same time, limited genetic resources and related technologies is a problem area in the implementation of this task. On the other hand, it is the products of duckering that have predominant prerequisites in expanding the market potential, since fully provided with modern domestic breeding base, unique, effective, extensive and semi-extensive technologies of keeping, raising and feeding of poultry, high quality characteristics, unique product line, which in all positions is high-marginal.

At the same time, analytics of products from waterfowl is today a beggar, its market capacity remains insufficiently filled, despite the positive dynamics of an increase in goose and duck meat and their processed products. The market potential of feather-down raw materials is mainly provided by the private sector and imported raw materials. The possibilities of using goose and duck fat are inexhaustible in various sectors of the economy.

A set of measures with the study of appropriate mechanisms for their implementation should be an impetus for the further development of this area. These should include the provision of state support for both SGC and producers of marketable products from waterfowl in the provision of preferential investment loans for innovation-technical-technological development in the production and processing of relevant products, the implementation of customs tariff regulation measures to protect domestic producers.

The assortment portfolio can be substantially filled with sensitivity to innovative and technological changes in the finished product segment, by varying the formulation and the wider use of modern technological aseptic packaging.

The HoReCa segment is promising for the sale of duck meat. The whole range of products can be realized in this direction, especially in Thai, Chinese, Japanese restaurants. The growth potential of fast food products and snack products is available (Parker et al., 2018). Stimulating demand for products from waterfowl may be increased by correct positioning and adequate pricing.

There are ample opportunities to expand the export potential of such products, including offal to neighboring countries and countries of the Asian region. The vector of increasing purchasing power in the process of selling waterfowl can be the use of various technologies:

Today, two thirds of the country’s population lives in cities with a developed system of supermarkets, purchases are made in 67% of these trade enterprises (markets – 19%, food shops – 13%, tents, mobile shops – 2%, others – 3%), this indicates the prospects for the potential of the waterfowl market.

Summarizing the results of the study, we can state the presence of a complex of factors of perspective mechanisms for realizing the market potential of production from waterfowl.

Askew, K. (2017). Europen shopper trends: health, organic, Vegetarian, 5. Retrieved fromFoodNavigator.com.

Bronnikova, T. S. & Kotrin, V. V. (2012). Development of methodology for the formation of the market potential of the enterprise: monograph (p. 134). Korolev, Russia: FTA.

Dankvert, S. A., Kholmanov, A. M. & Osadchaya, O. Yu. (2014). International trade in live agricultural animals (p. 247). Moscow, Russia: Economy.

Donskova, L. A., Zueva, O. N. & Belyaev, N. M. (2018). Meat of poultry as product of organic production, problems and decisions of management. Modern Problems of Science and Education, 1, 64-70.

Fisinin, V. I., Dankvert, S. A., Kholmanov, A. M., Osadchaya, O. Yu. (2005). Poultry farming in the world at the end of the 20th century (Moscow, Russia) p. 344.

Gadiev, R. R. and Tsoi, V. T. (2014) Hungarian technology of breeding geese: a training manual (p. 102). Ufa, Russia: Bashkir State Agrarian University.

Gushchin, V. V., Rusanova G. E., & Riza-Zadeh N. I. (2015). Innovations in the field of industrial processing of poultry and the production of poultry products abroad. Bird and Poultry Products, 5, 15-17.

Igoshin, I. N., Kuts, V. I. & Lipets, P. A. (2005). The mechanism for realizing the competitive advantages of Russian enterprises in the process of their innovative development: monograph. Moscow, Russia: Publishing House "Company Sputnik +" Ltd. p.156.

Juodka, R., Kiskiene, A., Skurdeniene, Y., Ribikauskas, V., Nainiene R. (2012) Lithuanin wishtiness goose breed. World’s Poultry Science, 68(1), pp. 51-62.

Kakushkin, A. (2017). The niche of egg products remains free. Agroinvestor, 1, pp. 38-41

Makhalov, A. G., Sukhanova, S. F. & Roiter, Ya. S. (2011). Geese: Breeds, technologies ... and even recipes (p. 332). Kurgan, Russia: Kurgan State Agricultural Academy named after T. S. Maltsev (Lesnikovo).

Maksimova, T. (2007). Breeding geese profitable. Poultry Farm, 3, 39-47.

Malysheva, E. N., Oksanich, N. I. & Romashin, N.S. (2010). Organizational and economic factors to increase the efficiency of poultry production Dissertation Abstracts. Moscow, Russia: All-Russian Scientific Research Institute for Organizing Production, Labor and Management in Agriculture.

Ministry of Agriculture of the Russian Federation National project “Development of the agro-industrial complex. Retrieved from: http://old.mcx.ru/navigation/docfeeder/show/181.htm

National Association of Waterfowl Meat Manufacturers (2017) Bird for the range. Retrieved from: http://russianduck.ru/analitika?mode=view&post_id=9277209.

Retailleau, B. (1993). Breeding and rearing Muscovy ducks. Poultry International, 32(14), p. 38-40.

Roiter, Ya. S. (2005). Modern methods of breeding waterfowl. Bird and Poultry Products, 6, pp. 6-8.

Roiter, Ya. S. (2011). Geese and ducks. Guide to breeding and maintenance (p. 416). Moscow, Russia: AST: Aquarium Print.

Roiter, Ya. S. & Kutushev, R. R. (2006). Highly productive duck crosses with white plumage “Agidel 34”, “Agidel 345”. Bird and Poultry Products, 1, pp. 16-17.

Roiter, Ya. S., Egorov, I. A., Davtyan, A. D. et al. (2008). Breeding and maintenance of geese: guidelines (p. 59). Sergiev Posad, Russia: All-Russian Research and Technological Institute of Poultry.

Roiter, Ya. S., Egorova, A. V., Konopleva, A. P. et al. (2016). Selection and breeding work in poultry farming (Sergiev Posad, Russia: All-Russian Research and Technological Institute of Poultry) p. 287.

Russian Academy of Agricultural Sciences (2011). Strategy of development of the AIC up to 2030. Retrieved from: http://vniiesh.ru/documents/document_9509_Стратегия%20АПК%202020.pdf.

Snitkin, M. (2003). The potential of geese is far from being exhausted. Russian Animal Husbandry, 3, 5-6.

Sukhanova, S. F. & Azaubayeva, G. S. (2009). Productive and biological features of geese (p. 298). Kurgan, Russia: Kurgan State Agricultural Academy.

Vedenkina, I. V., Roiter, L. M., Ternovskaya, T. S., Bulgakov V. V. (2011). ABC and XYZ analysis in assortment policy management. Poultry and Poultry Products, 6, 62-66.

Ping, Y., Yang, L., DanXian, X., YuPing, W. (2017), Analysis of monitoring results of veterinary drugs and banned drugs in eggs in some areas of Yunnan province in 2016. Journal of Food Safety and Quality, 8(10), 3854-3857.

Siekmann, L., Meier-Dinkel, L., Janisch, S., Altmann, B., Kaltwasser, C., Sürie, C., Krischek, C. (2018), Carcass quality, meat quality and sensory properties of the dual-purpose chicken Lohmann dual. Foods, 7(10), 2-16.

Parker, C., Carey, R., Scrinis, G. (2018),

Lopez-Andres, J. J., Aguilar-Lasserre, A. A., Morales-Mendoza, L. F., Azzaro-Pantel, C., Perez-Gallardo, J. R., Rico-Contreras, J. O. (2018), Environmental impact assessment of chicken meat production via an integrated methodology based on LCA, simulation and genetic algorithms. Journal of Cleaner Production, 174, 477-491.

Santeramo, F.G., Carlucci, D., De Devitiis, B., Secci, A., Stasi, A., Viscecchiaa, R., Nardone, G. (2018), Emerging trends in European food, diets and food industry. Food Research International, 104, 39-47.

McKay, J. C. (2009), The genetics of modern commercial poultry. In P. Hocking (Ed.), Biology of Breeding Poultry. Cambridge, MA: CABI.

Rosstat. (n.d.). Statistical data of the Russian Federation. Retrieved from http://www.gks.ru.

1. Russian State Agrarian University - Moscow Timiryazev Agricultural Academy, 49 Timiryazevskaya str., 127550, Moscow, Russia

2. All-Russian Research and Technological Poultry Institute of the Russian Academy of Sciences, 10 Ptitsegradskaya str., 141311, Sergiyev Posad, Russia. E-mail: department.economy.vnitip@yandex.ru

3. All-Russian Research and Technological Poultry Institute of the Russian Academy of Sciences, 10 Ptitsegradskaya str., 141311, Sergiyev Posad, Russia