Vol. 40 (Number 27) Year 2019. Page 8

SUVITSAKDANON, Udom 1 & SORNSARUHT, Puris 2

Received: 24/04/2019 • Approved: 22/07/2019 • Published 05/08/2019

ABSTRACT: Systematic random sampling was used to obtain the study’s 303 small business leasee sample. The CFA and SEM analysis used LISREL 9.10 from which it was concluded that all of the variables affecting a Thai small business leasing company’s customer trust were positive. The causal variables influencing customer trust, from highest to lowest, were service quality (SQ), corporate social responsibility (CSR), customer satisfaction (SAT), and socioeconomic status (SES) with total influences of 0.80, 0.76, 0.64 and -0.14 respectively. |

RESUMEN: Se utilizó un muestreo aleatorio sistemático para obtener la muestra del estudio de 303 pequeñas empresas. El análisis de CFA y SEM utilizó LISREL 9.10, de donde se concluyó que todas las variables que afectaban la confianza de los clientes de una empresa tailandesa de arrendamiento de pequeñas empresas eran positivas. Las variables causales que influyen en la confianza del cliente, de mayor a menor, fueron la calidad del servicio (SQ), la responsabilidad social corporativa (CSR), la satisfacción del cliente (SAT) y el estatus socioeconómico (SES) con influencias totales de 0.80, 0.76, 0.64 y -0.14 respectivamente. |

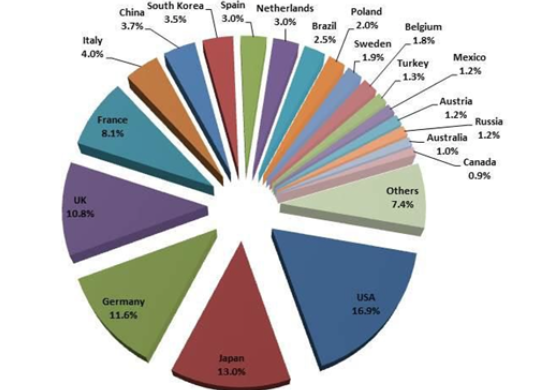

According to Forbes, vehicle leasing is an important financing method used by company car fleets, which had an estimated market size of 24.8 million vehicles across 37 major countries at the end of 2017 (Figure 1). This accounted for almost 20% of all fleet vehicles in operation (Singh, 2018).

Figure 1

Vehicle fleet leasing portfolio (37 countries)

Source: Frost and Sullivan (2018)

In the United Kingdom, it has been reported that finance contracts such as the Personal Contract Purchase [PCP] and the Personal Contract Hire [PCH] will account for almost 90% of all new car sales (Smith, 2018). In Singapore, leasing is popular due to the island nation’s reputation as being one of the most expensive places in the world to own an automobile with expat leasing having become quite popular. In 2019, thus far bids for a new car’s certificate of entitlement [COE] have ranged from $19,231 to $24,977 USD, significantly contributing to the attractiveness of leasing over ownership. Data supporting this comes from Fitch Solutions which has reported that new vehicle registrations are expected to contract 20.1% in 2019, which is much higher than the 11% contraction reported in 2018 (Singapore Business Review, 2018a; 2018b).

Furthermore, according to a Frost and Sullivan (2018) study, the Thai vehicle leasing market is extremely complex and also faces a variety of restraints and challenges, which includes a very competitive environment, high lease rental, and low residual value. Other factors such as political instability, unstable FDI [foreign direct investment], unclear tax regulations, and rising household debt contribute to the industry’s challenges. Furthermore, within the Thai leasing industry various players contend for market share, including domestic and foreign bank finance companies (Bank of Thailand, 2017), captive finance entities (financing offered by auto manufacturers or distributors), and approximately 300 smaller, non-bank leasing companies (Thanadhidhasuwanna, 2017).

Additionally, corporate entities are the most dominant customer segment and financial leasing the most popular product. At the end of 2016, outstanding debts on just vehicle hire purchases alone had reached $26.8 billion, or 22.7% of all Thai consumer loans issued by the commercial banking sector (Thanadhidhasuwanna, 2017). By comparison, in 2017, total Thai auto loans reached $65.751 billion, which included $50.087 billion for new vehicles and $14.087 billion for used cars and trucks (Pinijparakarn, 2017).

Deloitte (2018) has also indicated that when it comes to the auto financing industry’s trends, vehicle leasing has never been higher. This is supported from U.S. data which shows that the lease/loan mix has grown from 15.7% in 2011 to 24% in 2016, with lease payments averaging 23% lower than finance payments.

In Thailand, Thanadhidhasuwanna (2017) also reported that auto hire-purchase agreements provide credit to buyers of automobiles and motorcycles, which for motorcycles is done by the smaller, non-bank leasing companies. Gao (2018) has additionally stated that in these agreements, lenders retain the ownership rights to vehicles bought on hire purchase until all payments have been made in full and on time. At the end of this period, the buyer becomes the owner. This is one way in which hire purchase differs from leasing, because in leasing agreements, the leasee may either extend the period of the lease or return the vehicles when the contract expires. Leases are thus much more popular with corporate buyers, who need to acquire the use of items in large numbers, and want to get the use of vehicles, plant and equipment without paying the full cost all at once (Mott, 2012).

In spite of these challenges, certain factors such as a growing economy, growth in popularity of company cars, expected rise in number of SMEs [small-medium enterprises], rising currency, and changing mindset regarding vehicle ownership, are some of the key drivers that are anticipated to sustain a growing market in the short to medium term (Frost & Sullivan, 2018).

However, a growing body of evidence also suggests that socioeconomic conditions may render some consumers more vulnerable than others (Clifton, Díaz-Fuentes, & Fernández-Gutiérrez, 2014; George, Graham, & Lennard, 2011). Data supports this as in the UK, 12% of vehicle leasees will eventually hand back their car because they cannot afford the payments, which usually results in the individual having to pay a penalty (Smith, 2018).

As such, these issues led to the study’s inclusion of the leasee’s socioeconomic status (SES), which included both the individual’s highest education level (X4) and their monthly income (X5). This is consistent with Winkleby, Jatulis, Frank, and Fortmann (1992), which indicated that SES is usually measured by determining an individuals’ education, income, occupation, or a composite of these dimensions. Furthermore, Brandt, Wetherell, and Henry (2014) demonstrated increases in socioeconomic status as measured by income, predicts increases in social trust.

Although the Thai leasing sector is booming, there are often significant stresses to the multiple parties involved in the contract’s long-term financial commitment. According to Poonsuwan (2018), guarantors have long sustained great disadvantages in hire-purchase company contract obligations. Recently, however, a series of new Thai laws have shifted the focus when the principal debtor defaults in payment. Now, creditors have no right, as enjoyed in the past, to enforce these contracts immediately and directly on the guarantor. Now, if the contract involves an individual, the leasing company must first sue the primary obligor and exhaust their remedy through Thai courts, which could take years, before they have a right of action against the guarantor. This inevitably diminishes the asset’s value.

Some might view these new laws as an outcome of a growing movement concerning a corporation’s social responsibility (CSR) to the community it serves. Scholtens (2006) has suggested that finance can promote socially desirable activities, while also discouraging detrimental activities. This is consistent with policies set forth by the World Business Council for Sustainable Development [WBCSD] in their Vision 2050 plan in which it is suggested that new rules for financing and innovative financial products stimulate widespread entrepreneurship and participation in an inclusive and innovative global economy (WBSCD, 2010). This economy thus creates a significant number of new jobs, while also improving labor productivity. Therefore, after a review of the literature, the authors chose social responsibility (X1), human rights respect (X2), and operating regulations (X3) as CSR’s key observed variables.

Numerous other studies have also determined that service quality (SQ) within the automotive finance and service sectors are key elements in an organization’s success (Chaichinarat, Ratanaolarn, Kiddee, & Pimdee, 2018; Spina & Kleiner, 1997). International automotive marketing campaigns have also thrust quality into the forefront with slogans such as ‘Quality is Job 1’ (Meredith, 1998) and ‘The best built cars in the world’ (Pope, 2016). Quality is, therefore, concerned with product longevity and strength. Service quality is also integral to consumer satisfaction in the after-sales service process (Chaichinarat et al., 2018). Therefore, after a review of the literature, the authors chose service provider performance (Y1), responding to service recipients (Y2), and customer’s trust in company (Y3) as SQ’s key observed variables.

Auh and Johnson (1997) also indicated that customer satisfaction (SAT) is a key element within a highly competitive automotive industry. This is consistent with Berger, Peter, and Herrmann (1997), which additionally indicated that customer satisfaction is a key to customer loyalty within the automotive industry. Therefore, after a review of the literature, the authors chose total satisfaction (Y7), service needs (Y8), and good attitude and feeling (Y9) as SAT’S key observed variables.

Another factor important to the automotive leasing/finance sector is a customer’s trust (TRUST) of the party’s involved in the lease. According to the Open Government Partnership (2017), trust is crucial for business, which is the glue that binds companies to their customers and to the communities where they operate. The Edelman trust surveys support this, as it is reported that 91% of 25-to-64-year-olds globally indicate that they bought a product or service from a company they trusted, while 77% refused to buy a product or service from a company they did not trust (Edelman, 2009). Also, within the financial services sector, 41% of the global respondents used products/services of trusted financial services companies in the last year, with 31% recommending those same services to others (Edelman, 2018). Therefore, after a review of the literature, the authors chose customer’s confidence in company (Y4), the company’s reliability (Y5), and the company’s credibility (Y6) as TRUST’S key observed variables.

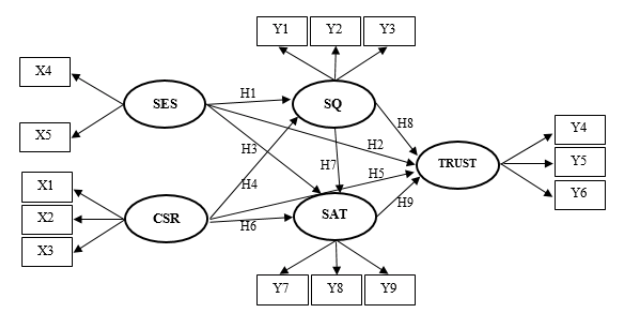

From the introduction’s overview concerning a Thai leasing company’s customer trust (TRUST), several relationships were determined between socioeconomic status (SES), corporate social responsibility (CSR), service quality (SQ), customer satisfaction (SAT), and customer trust (TRUST). From this, a questionnaire was developed, whose validity and reliability were pre-tested and confirmed. A confirmatory factor analysis (CFA) was also conducted prior to the structural equation modeling (SEM) of the following nine hypotheses (Figure 2).

H1: SES positively and directly influences SQ.

H2: SES positively and directly influences TRUST.

H3: SES positively and directly influences SAT.

H4: CSR positively and directly influences SQ.

H5: CSR positively and directly influences Trust.

H6: CSR positively and directly influences SAT.

H7: SQ positively and directly influences SAT.

H8: SQ positively and directly influences TRUST.

H9: SAT positively and directly influences TRUST.

Figure 2

Conceptual model

The study’s population consisted of customers who participated in small business lease agreements from one of 34 leasing companies that were members in 2018 of the Thai Leasing Business Association (2018). The link to the association members can be found here: http://www.thpa.or.th/directory. Concerning the study’s sample size requirement, research has shown there are no ‘hard rules’ on sample size. However, one method that has been suggested in SEM, is to use a ratio of 20 surveys per observed variable (Hair, Tatham, Anderson, & Black, 1998). Furthermore, Norusis (2010) has suggested that a sample should contain at least 300 cases.

Therefore, systematic random sampling was used from August to October 2018 to obtain the study’s sample from every fifth individual who was taking out a small business lease (Tee, Preko, & Tee, 2018). For this study the authors used a multiple of 20 for the 14 observed variables, which established a preliminary target sample size of 280. However, to increase and to adhere to a sample size of at least 300 (Norusis, 2010), 340 were targeted and obtained. From this process, 303 audited surveys were used, representing 89% of the 340 obtained.

For this study, the primary measurement instruments for the constructs was a 7-level Likert scale questionnaire which had six parts. Part 1 contained six items related to the leasee’s personal information including gender, age, education level, marriage status, occupation, and monthly income (Table 1). Items three (highest education level) and item six (monthly income) from Part 1 were used for the study’s SES construct. Part 2 contained 8 items focused on the leasee’s opinions concerning the leasing company’s corporate social responsibility (CSR), Part 3 contained 7 items about the leasing company’s service quality (SQ), Part 4 contained 9 items about the individual’s customer satisfaction (SAT) with the leasing company, Part 5 was concerned with 8 issues concerning the leasee’s customer trust (Trust). There were a total of 32 items in Parts 2-6.

First, in order to investigate whether the factor structure can be replicated in the new dataset from 303 participants, confirmatory factor analysis (CFA) was conducted. Several model fit indices and their criteria were used to examine the goodness-of-fit of the model with the given dataset. These included the goodness-of-fit index (GFI), adjusted goodness-of-fit index (AGFI), normed fit index (NFI), comparative fit index (CFI), and root mean square error of approximation (RMSEA) (Table 7). After evaluating the model fit, construct reliability (CR) was calculated for the convergent validity, while the average variance extracted (AVE) was used for discriminant validity. After performing the CFA, a more suitable structure was determined for the new dataset, after which SEM was done. Finally, the reliability of items in each factor was examined by Cronbach’s α, and LISREL 9.10 software was used for both the CFA and SEM analysis.

Initial questionnaire validity advice and recommendations were obtained from the primary author’s advisory committee. Afterwards, the questionnaire was checked by five experts including two leasing company managers and three academic experts in customer loyalty. The Index of Item-Objective Congruence (IOC) was used so as to find the content validity (Tavakol & Dennick, 2011), with survey items having scores ≥ 0.5 retained.

Table 1 shows the results from the study’s 303 questionnaires. From the respondents’ responses concerning their personal and professional environments, 49.17% indicated they were men, while 50.83% were women. There was also a large concentration of individuals between 31-40 years of age (40.59%). It was also interesting to note that 53.14% of the leasing company’s small business customers surveyed earned less than $626 per month.

Table 1

Respondents’ general characteristics (n=303)

|

Frequency |

% |

Male |

149 |

49.17 |

Female |

154 |

50.83 |

Total |

303 |

100.00 |

|

|

|

Between 21-30 years of age. |

46 |

15.18 |

Between 31-40 years of age. |

123 |

40.59 |

Between 41-50 years of age. |

76 |

25.08 |

Between 51-60 years of age. |

44 |

14.52 |

Over 60 years of age. |

14 |

4.62 |

Total |

303 |

100.00 |

|

|

|

Lower than primary school |

10 |

3.30 |

primary school |

50 |

16.50 |

Lower secondary school |

28 |

9.24 |

High school graduate |

53 |

17.49 |

Vocational certificate/ High vocational certificate/ Diploma |

76 |

25.08 |

B.A./B.S. degree |

84 |

27.72 |

Higher than bachelor's degree |

2 |

0.66 |

Total |

303 |

100.00 |

|

|

|

Single |

73 |

24.09 |

Married |

198 |

65.35 |

Divorced / widowed |

30 |

9.90 |

Other |

2 |

0.66 |

Total |

303 |

100.00 |

|

|

|

Government employee |

15 |

4.95 |

State enterprise employee |

14 |

4.62 |

Private company employee |

102 |

33.66 |

General employee |

97 |

32.01 |

Entrepreneur (small business owner) |

45 |

14.85 |

Other |

30 |

9.90 |

Total |

303 |

100.00 |

|

|

|

Less than 10,000 baht (10,000 Thai baht = $313 USD.) |

69 |

22.77 |

Between 10,001-20,000 baht. |

161 |

53.14 |

Between 20,001-30,000 baht. |

50 |

16.50 |

Between 30,001-40,000 baht. |

16 |

5.28 |

Between 40,001-50,000 baht. |

7 |

2.31 |

Total |

303 |

100.00 |

1 Note. Item 3 and Item 5 were used for the SES construct analysis.

A 2-step analysis was conducted in which analysis of the measurement model and both sets of internal and external variables were conducted separately (Tables 3 and 4), In the second step, the analysis of the SEM for a Thai small business leasing company’s customer trust (TRUST) was measured. Furthermore, Table 2 shows the results from the questionnaire’s analysis, with the 7-level Likert type agreement scale using the following values: strongly agree = 6.11-7.00, agree = 5.26-6.10, agree slightly = 4.41-5.25, no comments = 3.56-4.40, disagree slightly = 2.71-3.55, disagree = 1.86-2.70, and disagree strongly = 1.00-1.85.

Table 2

The questionnaire’s latent variables results

Latent Variable |

Items |

Mean |

S.D. |

Level |

Skewness |

Kurtosis |

Corporate Social Responsibility (CSR) |

8 |

5.45 |

.98 |

agree |

-.65 |

.70 |

Service Quality (SQ) |

7 |

5.72 |

.97 |

agree |

-.68 |

.10 |

Customer Satisfaction (SAT) |

9 |

5.65 |

1.00 |

agree |

-.79 |

.47 |

Customer Trust (TRUST) |

8 |

5.73 |

.95 |

agree |

-.67 |

.10 |

Total and Averages |

32 |

5.64 |

.98 |

agree |

- |

- |

Note. S.D. = standard deviation

-----

Table 3

CFA of the external latent variables

Latent variables |

a |

AVE |

CR |

Observed variables |

Loading |

R2 |

Corporate Social Responsibility (CSR) |

0.92 |

0.77 |

0.91 |

social responsibility (X1) |

0.75 |

0.56 |

human rights respect (X2) |

1.08 |

1.00 |

||||

operating regulations (X3) |

0.76 |

0.57 |

||||

Socioeconomic Status (SES) |

- |

0.34 |

0.49 |

highest education level (X4) |

0.71 |

0.51 |

monthly income (X5) |

0.41 |

0.17 |

Note. a = significance level, Chi-Square=0.02,

df=1, p-value=0.898, RMSEA=0.000.

-----

Table 4

CFA of the internal latent variables

|

a |

AVE |

CR |

Observed variables |

Loading |

R2 |

Service Quality (SQ) |

0.96 |

0.85 |

0.94 |

Service provider performance (Y1) |

0.90 |

0.81 |

|

|

|

Responding to service recipients (Y2) |

0.93 |

0.87 |

|

|

|

|

Customer’s trust in company (Y3) |

0.93 |

0.87 |

|

Customer Trust (TRUST) |

0.97 |

0.85 |

0.94 |

Customer’s confidence in company (Y4) |

0.94 |

0.88 |

|

|

|

Company’s reliability (Y5) |

0.93 |

0.87 |

|

|

|

|

Company’s credibility (Y6) |

0.89 |

0.79 |

|

Customer Satisfaction (SAT) |

0.98 |

0.89 |

0.96 |

Total satisfaction (Y7) |

0.93 |

0.86 |

|

|

|

Service needs (Y8) |

0.95 |

0.90 |

|

|

|

|

Good attitude and feeling (Y9) |

0.95 |

0.90 |

Note. a = significance level, Chi-Square=4.57,

df=14, p-value=0.991, RMSEA=0.000

Table 5 shows the model’s discriminant validity with the diagonal values in bold indicating the square root of the AVE for the construct, while the other values are the correlation between the respective constructs. The discriminant validity is achieved when the diagonal value in bold is higher than the values in its row and column (Ahmad, Zulkurnain, & Khairushalimi, 2016).

Table 5

Discriminant validity

Latent variables |

CSR |

SES |

SQ |

SAT |

TRUST |

Corporate Social Responsibility (CSR) |

1 |

|

|

|

|

Socioeconomic Status (SES) |

-.11 |

1 |

|

|

|

Service Quality (SQ) |

.79** |

-.15** |

1 |

|

|

Satisfaction (SAT) |

.75** |

-.17** |

.87** |

1 |

|

Trust |

.74** |

-.16** |

.85** |

.89** |

1 |

rV (AVE) |

0.85 |

0.34 |

0.86 |

0.88 |

0.84 |

rC (Construct Reliability) |

0.94 |

0.49 |

0.95 |

0.96 |

0.94 |

|

0.92 |

0.58 |

0.93 |

0.94 |

0.92 |

Note. **Sig. < .01

Table 6 presents the DE, IE, and TE of each construct.

Table 6

Standard coefficients of influence in the SEM for small business leasing customer trust

Dependent variables |

R2 |

Effect |

CSR |

SES |

SQ |

SAT |

Service Quality (SQ) |

.72 |

DE |

0.83** |

-0.09* |

|

|

IE |

- |

- |

|

|

||

TE |

0.83** |

-0.09* |

|

|

||

Satisfaction (SAT) |

.65 |

DE |

0.17* |

-.0.09* |

0.72** |

|

IE |

0.60** |

-0.07* |

- |

|

||

TE |

0.77** |

-0.16* |

0.72** |

|

||

Customer Trust (TRUST) |

.63 |

DE |

-0.01 |

-0.01 |

0.34** |

0.64** |

IE |

0.77** |

-0.13* |

0.46** |

- |

||

TE |

0.76** |

-0.14* |

0.80** |

0.64** |

Note. *Sig. < 0.05, **Sig. < 0.01, CSR = corporate social responsibility,

SES = socioeconomic status, direct effect = DE, indirect effect = IE, and total effect = TE

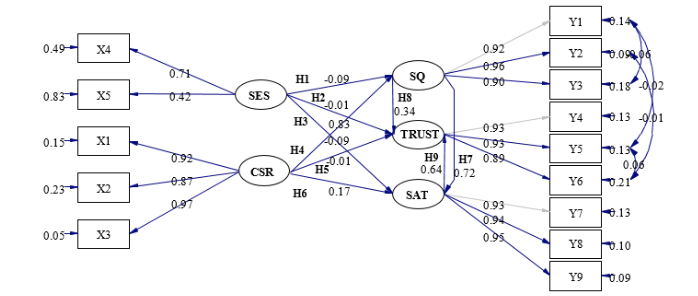

Figure 3’s SEM results show the analysis of the variables’ effects on a Thai small business leasing customer’s trust (TRUST), as the model met the required criteria as the chi-square index was not statistically significant at 34.13, the p-value was = 0.731, and the RMSEA = 0.000. Furthermore, from Table 7 it can be seen that the GFI = 0.99, the AGFI = 0.97, and the standardized root mean square residual [SRMR] = 0.09.

Table 7

Goodness-of-fit appraisal values

Criteria Index |

Criteria |

Values |

Results |

Supporting theory |

Chi-square: χ2 |

p ≥ 0.05 |

0.99 |

passed |

(Jöreskog, Olsson, & Fan, 2016) |

Relative Chi-square: χ2/df |

≤ 2.00 |

0.53 |

passed |

(Byrne, 2010) |

RMSEA |

≤ 0.05 |

0.00 |

passed |

(Hu & Bentler, 1999) |

GFI |

≥ 0.90 |

0.99 |

passed |

(Jöreskog, Olsson, & Fan, 2016) |

AGFI |

≥ 0.90 |

0.97 |

passed |

(Hooper, Coughlan, & Mullen, 2007) |

RMR |

≤ 0.05 |

0.00 |

passed |

(Hu & Bentler, 1999) |

SRMR |

≤ 0.05 |

0.00 |

passed |

(Hu & Bentler, 1999) |

NFI |

≥ 0.90 |

0.99 |

passed |

(Schumacker & Lomax, 2010) |

CFI |

≥ 0.90 |

1.00 |

passed |

(Schumacker & Lomax, 2010) |

Cronbach’s Alpha |

≥ 0.70 |

0.92-0.98 |

passed |

(George & Mallery, 2010) |

-----

Figure 3

SEM modeling results of Thai small

business leasing customer trust

Note. Chi-Square = 34.13, df = 40, p-value = 0.731, RMSEA=0.000,

SES & CSR = external latent variables, SQ, TRUST, & SAT = internal latent variables.

-----

Table 8

Hypotheses testing results

Hypotheses |

Coef. |

t-value |

Results |

H1: SES positively and directly influences SQ. |

-0.09 |

-2.03* |

supported |

H2: SES positively and directly influences TRUST. |

0.00 |

-0.10 |

unsupported |

H3: SES positively and directly influences SAT. |

-0.09 |

-2.09* |

supported |

H4: CSR positively and directly influences SQ. |

0.83 |

15.52** |

supported |

H5: CSR positively and directly influences Trust. |

-0.01 |

-0.12 |

unsupported |

H6: CSR positively and directly influences SAT. |

0.17 |

2.92* |

supported |

H7: SQ positively and directly influences SAT. |

0.72 |

10.73** |

supported |

H8: SQ positively and directly influences TRUST. |

0.34 |

4.62** |

supported |

H9: SAT positively and directly influences TRUST. |

0.64 |

9.29** |

supported |

Note. *Sig. < .05, **Sig. < .01

The study’s SEM analysis concluded that all of the variables affecting a Thai small business leasing customer’s trust were positive, which can be explained by 63% of the variance in a Thai leasing company’s customer loyalty (R2). The causal variables influencing customer trust, from highest to lowest, were service quality (SQ), corporate social responsibility (CSR), customer satisfaction (SAT), and socioeconomic status (SES), with total influences of 0.80, 0.76, 0.64 and -0.14 respectively.

The results from H1 testing verified that the positive role that SES plays on SQ, with the level of education speculated to play a key role. In the current study there was a wide spread of each leasee’s education level, with only 27.7% having a university degree. While in a similar Bahraini commercial bank study concerning the hypothesized relationship between SES and SW, education showed no significant difference as 67% had university degrees (Ramez, 2011). This seems to suggest that the higher the customer’s education level, the less impact there is on service quality. This is consistent with a study from the U.S.A in which satisfaction with quality of life was determined to be influenced by an individual’s satisfaction with their financial status and future plans (Mugenda, 1988).

However, H2’s testing results determined that there was no positive correlation between SES and TRUST. This is supported by other studies including Keijzer and Corten (2017) in which it was stated that there is a fundamental debate about the link between socioeconomic status and attained trust, with the positive effect of SES on trust and trustworthiness not undisputed. Furthermore, research showed that individuals with low SES will be happier following the norm of trustworthiness than individuals with higher SES, because being trustworthy is more important to them (Keijzer & Corten, 2017). The rational for this is that lower status individuals lack material resources which increases their need to rely on others’ resources. However, higher status individuals utilize their economic capital to face life’s challenges and problems, while lower status individuals have to compensate by placing trust and behaving trustworthy.

Concerning SES’s positive role on SAT, this was also determined to be positive in H3. This is consistent with a study across 12 European country’s utility services in which strong evidence was found to support the idea that consumers’ socio-economic characteristics matter. From this, it was determined that consumers with lower levels of education, the elderly and those not employed exhibit particular expenditure patterns on, and lower satisfaction levels with, some utility services (Clifton et al., 2014).

Hypothesis H4 was also determined to be supported, with CSR positively influencing SQ. This is consistent with Kim and Kim (2016) which determined that within the hotel industry, the influence of satisfaction on customer loyalty is mediated by trust.

Concerning H5’s hypothesis that CSR has a positive effect on customer trust (Trust), the study found the hypothesis to be non-supported. Reasons for this are speculated to be the lack of the leasing industry’s focus on CSR and the customer’s lack of understanding concerning the nature of CSR. This is consistent with Choi and La (2013) in which they determined it was the perception of CSR that creates a significant impact on customer trust. Given the low level of education (thus perception) of the study’s participants and the fact that Thai leasing companies have limited exposure to CSR benefits and issues, it is easier to understand why this hypothesis is rejected. Future studies might want to explore how much, if any, CSR activity is undertaken by Thai leasing companies.

Hypothesis H6, however, was supported and CSR was shown to positively affect SAT. Related studies have confirmed that CSR can positively impact consumer assessments by improving the company’s image and trustworthiness and increasing customer satisfaction (Wan, Poon, & Yu, 2016). This is consistent with Luo and Bhattacharya (2006) which found a direct relationship between CSR and customer satisfaction. CSR activities should also involve a frank long-term effort to build customer trust (Choi & La, 2013), with the organization adjusting the guidelines to suit the nature of the organization by considering "what the organization Is going to do" and what the organization ‘wants to be’. This means that the direction of CSR must be transmitted from the top level to the bottom level of the organization clearly y defining the vision, mission, policies, strategies, and guidelines. There is an evaluation process that consists of periods, indicators and goals, as well as a support system to promote the success of the organization's CSR (Hitchcock & Willard, 2008)

The study also determined that SQ had a positive effect on SAT (H4) and Trust (H5). These findings are consistent with other studies including Berry, Bennet, and Brown (1989), which determined that SQ leads to customer loyalty and attracts new customers, while also contributing to the company through a customer’s a positive word-of-mouth influences.

Also, from the study’s survey, the respondent’s indicated that a leasing company’s reliability was very important ( = 5.71) which is consistent with other studies in which reliabilitywas viewed as the most critical factor amongst the SERVQUAL dimensions (Chaichinarat et al., 2018). Angelova and Zekiri (2011) also stated that in a highly competitive environment, high quality service delivery is the key for a sustainable competitive advantage. Berndt (2009) also indicated that a customer’s confidence and trust in an automotive dealership was translated as how knowledgeable the service advisor was and how polite and courteous they were with the customer.

The study also verified the positive relationships between customer satisfaction and customer trust (H9). This is consistent with Fornell, Johnson, Anderson, Cha, and Bryant (1996) which also indicated that overall SAT is obtained from the customer’s quality perception and their value perception. Also, SAT is the result of a customer’s perception of the value received, where value equals the perception of service quality relative to price (Cronan, Brady, & Hult, 2000; Hallowell, 1996). Additional support for customer satisfaction’s importance in reinforcing customers' trust came from research conducted in Taiwan by Liang and Wang (2007). The authors also suggested that managers should segment their customers into groups and target different marketing programs to the characteristics of the each group’s consumers.

The study concluded that Thai small business leasing consumers are overall happy and trusting with the services they are being provided by their leasing companies. Additionally, service quality ranked highest, along with reliability and financial confidentiality. It also appeared that online services were not that important as Thai leasing customers preferred a brick and mortar presence. As such, smiling, helpful, and courteous staff were a must. Word-of-mouth also played a key role in providing positive feedback to other potential customers. Customer level of education and their perception (or lack thereof) of leasing company CSE activities also plays key roles.

Ahmad, S., Zulkurnain, B., & Khairushalimi, F. (2016). Assessing the validity and reliability of a measurement model in structural equation modeling (SEM). British Journal of Mathematics & Computer Science, 15(3), 1 – 8. doi: 10.9734/bjmcs/2016/25183

Angelova, B., & Zekiri, J. (2011). Measuring customer satisfaction with service quality using American customer satisfaction model (ACSI Model). International Journal of Academic Research in Business and Social Sciences, 1(3), 232 – 258. doi: 10.6007/ijarbss.v1i2.35

Auh, S., & Johnson, M. D. (1997). The complex relationship between customer satisfaction and loyalty for automobiles. In M. D. Johnson, A. Herrmann, F. Huber, & A. Gustafsson (Eds.). Customer retention in the automotive industry (pp. 141-166). Wiesbaden, Germany: Gabler Verlag. doi: 10.1007/978-3-322-84509-2_7

Bank of Thailand. (2017). Permission for commercial banks to conduct hire purchase and leasing businesses. Retrieved from https://tinyurl.com/yd4c87mp

Bediako, B. O. (2017). The impact of corporate social responsibility on customer loyalty. A case study of StanBed Tours ky. (Master’s thesis, Vaasa University of Applied Sciences, Vaasa, Finland). Retrieved from https://tinyurl.com/yd9xmgx5

Berger, H., Peter, S., & Herrmann, A. (1997). Customer satisfaction and customer loyalty in the automotive industry - Results of an empirical study. In M. D. Johnson, A. Herrmann, F. Huber, & A. Gustafsson (Eds.). Customer Retention in the Automotive Industry (pp. 293 – 315). Wiesbaden, Germany: Gabler Verlag. doi: 10.1007/978-3-322-84509-2_12

Berndt, A. (2009). Investigating service quality dimensions in South African motor vehicle servicing. African Journal of Marketing Management, 1(1) 01-09. Retrieved from https://tinyurl.com/yaowvs22

Berry, L. L., Bennet, D. R., & Brown, C. W. (1989). Service quality: A profit strategy for financial institutions. Homewood, IL: Dow–Jones–Irwin.

Brandt, M. J., Wetherell, G., & Henry, P. J. (2014). Changes in Income Predict Change in Social Trust: A Longitudinal Analysis. Political Psychology, 36(6), 761 – 768. doi: 10.1111/pops.12228

Byrne, B. M. (2010). Structural equation modeling with AMOS: Basic concepts, applications, and programming (2nd ed.). New York, NY: Routledge. Retrieved from http://tinyurl.com/ze7ze7d

Chaichinarat, P., Ratanaolarn, T., Kiddee, K., & Pimdee, P. (2018). Thailand’s Automotive Service Quality Customer Satisfaction: A SERVQUAL Model CFA of Suzuki Motor. Asia-Pacific Social Science Review, 18(2), 99–113. Retrieved from https://tinyurl.com/ycr2ctql

Chapple, W., & Moon, J. (2005). Corporate social responsibility (CSR) in Asia: A seven-country study of CSR web site reporting. Business and Society, 44(4), 415–441. doi: 10.1177/0007650305281658

Choi, B., & La, S. (2013). The impact of corporate social responsibility (CSR) and customer trust on the restoration of loyalty after service failure and recovery. Journal of Services Marketing, 27(3), 223-233. doi: 10.1108/08876041311330717

Clifton, J., Díaz-Fuentes, D., & Fernández-Gutiérrez, M. (2014). The impact of socio-economic background on satisfaction: evidence for policy-makers. Journal of Regulatory Economics, 46(2), 183 – 206. doi: 10.1007/s11149-014-9251-1

Cronan, J. J., Brady, M. K., & Hult, G. T. M. (2000). Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. Journal of Retailing, 76(2), 193 – 218. doi: 10.1016/s0022-4359(00)00028-2

Deloitte. (2018). Hot topics in auto finance lease residuals. Retrieved from https://tinyurl.com/y7jsmsru

Edelman. (2009). 2009 Edelman trust barometer executive summary. Retrieved from https://tinyurl.com/y9lm624y

Edelman. (2018). 2018 Edelman trust barometer global report. Retrieved from https://tinyurl.com/yambnm9x

Fornell, C., Johnson, M. D., Anderson, E. W., Cha, J., & Bryant, B. E. (1996). The American customer satisfaction index: Nature, purpose, and findings. Journal of Marketing, 60(4), 7 – 14. doi: 10.2307/1251898

Frost and Sullivan. (2018). Assessment of Thailand auto leasing and car rental market. Retrieved from https://tinyurl.com/y9j49nvs

Gao, S. S. (2018). International leasing: Strategy and decision. New York, NY: Routledge.

George, D., & Mallery, P. (2010). SPSS for Windows step by step: A simple guide and reference 17.0 update. (10th ed.). Boston, MA: Pearson.

George, M., Graham, C., & Lennard, L. (2011). Too many hurdles: Information and advice barriers in the energy market. Leicester, UK: Centre for Consumers and Essential Services.

Hair, J. F., Tatham, R. L., Anderson, R. E., & Black, W. (1998). Multivariate Data Analysis (5th ed.). Pearson.

Hallowell, R. (1996). The relationship of customer satisfaction, customer loyalty, and profitability: An empirical study. The International Journal of Service Industry Management, 7(4), 27–42. doi: 10.1108/09564239610129931

Hambleton, R. K. (1984). Validating the test scores. In R. A. Berk (Ed.). A guide to criterion-referenced test construction (pp. 199-230). Baltimore, MD: The Johns Hopkins University Press.

Hitchcock, D. E., & Willard, M. (2008). The step-by-step guide to sustainability planning: how to create and implement sustainability plans in any business or organization. London, UK: Earthscan.

Kim, S-M., & Kim, D-Y. (2016). The impacts of corporate social responsibility, service quality, and transparency on relationship quality and customer loyalty in the hotel industry. Asian Journal of Sustainability and Social Responsibility, 1(1), 39 – 55. doi: 10.1186/s41180-016-0004-1

Liang, C-J., & Wang, W-H. (2007). The behavioral sequence of information education services industry in Taiwan: relationship bonding tactics, relationship quality and behavioral loyalty. Measuring Business Excellence, 11(2), 62-74. doi: 10.1108/13683040710752742

Liang, C-J., Wang, W-H., & Farquhar, J. D. (2009). The influence of customer perceptions on financial performance in financial services. International Journal of Bank Marketing, 27(2), 129 – 149. https://doi.org/10.1108/02652320910935616

Luo, X., & Bhattacharya, C.B. (2006). Corporate social responsibility, customer satisfaction and market value. Journal of Marketing, 70(4), 1 – 18. doi: 10.1509/jmkg.70.4.1

Mugenda, O. M. (1988). Socioeconomic and process variables influencing households' satisfaction with future plans, financial status and quality of life. (Doctoral dissertation). Iowa State University, Ames, Iowa. doi: 10.31274/rtd-180813-8875

Hooper, D., Coughlan, J., &Mullen, M. (2008). Structural equation modelling: Guidelines for determining model fit. Electronic Journal of Business Research Methods, 6(1), 53-60. Retrieved from http://tinyurl.com/zyd6od2

Hu, L. T., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling, 6(1), 1 – 55. doi: 10.1080/10705519909540118

Jöreskog, K. G., Olsson, U. H., & Fan, Y. W. (2016). Multivariate analysis with LISREL. Berlin, Germany.

Keijzer, M., & Corten, R. (2017). In status we trust: A vignette experiment on socioeconomic status and reputation explaining interpersonal trust in peer-to-peer markets. doi: 10.31235/osf.io/pc7nw

Kotler, P., & Lee, N. (2005). Corporate social responsibility. Doing the most good for your company and your cause. Hoboken, NJ: John Wiley and Sons.

Mott, G. (2012). Accounting for non-accountants: A manual for managers and students (8th ed,). London, UK: KoganPage.

Norusis, M. J. (2010). SPSS 17.0 Statistical procedures companion. Chicago, IL: SPSS, Inc.

Open Government Partnership. (2017). The business of trust: How companies can build credibility. Retrieved from https://tinyurl.com/yceyqsnp

Pinijparakarn, S. (2017, February 27). Outstanding auto loans expected to rise 6% this year. The Nation. https://tinyurl.com/y9hzdke6

Poonsuwan, W. (2018, April 10). Thai law: On hire-purchase of cars and motorbikes. Khaosod English. Retrieved from https://tinyurl.com/yaoe86w3

Pope, C. (2016, April 20). Toyota, the ‘best built cars in the world’? Ad watchdog not so sure. The Irish Times. Retrieved from https://tinyurl.com/yby7ys43

Ramez, W. S. (2011). Customers’ socio-economic characteristics and the perception of service quality of Bahraini commercial banks. International Journal of Business and Management, 6(10), 113 – 126. Retrieved from https://tinyurl.com/yagu2m5c

Schumacker, R. E., & Lomax, R. G. (2010). A beginner's guide to structural equation modeling (3rd ed.). New York, NY: Routledge/Taylor & Francis

Spina, J., & Kleiner, B. H. (1997). Practices of excellent companies in the automotive finance industry. Managing Service Quality: An International Journal, 7(4), 179-184. doi: 10.1108/09604529710172999

Scholtens, B. (2006). Finance as a driver of corporate social responsibility. Journal of Business Ethics, 68(1), 19-33. doi: 10.1007/s10551-006-9037-1

Singh, S. (2018, January 25). Can vehicle leasing stay on track as subscription models hit the fast lane? Forbes Online. https://tinyurl.com/y7ff7nr3

Singapore Business Review. (2018a). Car sales market may hit rock bottom in 2021. Retrieved from https://tinyurl.com/ycup5s5o

Singapore Business Review. (2018b). Car insurance costs in Singapore are still cheaper than New York. Retrieved from https://tinyurl.com/yc3sevva

Smith, L. J. (2018, February 19). Car finance WARNING: Avoid making same mistake with your lease deal as millions of drivers. Sunday Express. Retrieved from https://tinyurl.com/y6v2nfmk

Tabachnick, B. G., & Fidell, L. S. (2013). Using multivariate statistics. New York, NY: Pearson Education.

Tanimoto, K. (2013). Keidanren. In S. O. Idowu, N. Capaldi, L. Zu, & A. D. Gupta, Encyclopedia of corporate social responsibility (pp. 1537 – 1540). Berlin, Germany: Springer. doi: 10.1007/978-3-642-28036-8_206

Tavakol, M., & Dennick, R. (2011). Making sense of Cronbach’s alpha. International Journal of Medical Education, 2, 53–55. doi: 10.5116/ijme.4dfb.8dfd

Tee, D. K., Preko, A., & Tee, E. (2018). Understanding the relationships between service quality, customer satisfaction and loyalty: An investigation of Ghana’s retail banking sector. British Journal of Marketing Studies, 6(2), 1-19. Retrieved from https://tinyurl.com/ycw83mf5

Thanadhidhasuwanna, T. (2017). Thailand industry outlook 2017-2020. Auto Hire Purchase. Retrieved from https://tinyurl.com/y7fc6n9j

Wan, L. C., Poon, P. S., & Yu, C. (2016). Consumer reactions to corporate social responsibility brands: the role of face concern. Journal of Consumer Marketing, 33(1), 52–60. doi: 10.1108/jcm-03-2013-0493

WBCSD. (2010). Vision 2050: A new agenda for business. World Business Council for Sustainable Development Retrieved from https://tinyurl.com/yd8zzr67

Welford, R. (2005). Corporate social responsibility in Europe, North America and Asia: 2004 survey results. Journal of Corporate Citizenship, 17(1), 33–52. doi: 10.9774/gleaf.4700.2005.sp.00007

Welford, R. (2005). Corporate social responsibility in Europe, North America and Asia: 2004 Survey Results. Journal of Corporate Citizenship, 17(1), 33–52. doi: 10.9774/gleaf.4700.2005.sp.00007

Winkleby, M. A., Jatulis, D. E., Frank, E., & Fortmann, S. P. (1992). Socioeconomic status and health: how education, income, and occupation contribute to risk factors for cardiovascular disease. American Journal of Public Health, 82(6), 816 - 820. doi: 10.2105/ajph.82.6.816

1. Doctoral candidate with the Faculty of Administration and Management. King Mongkut’s Institute of Technology Ladkrabang (KMITL), Bangkok, Thailand. E-mail: u.suvitsakdanon@gmail.com

2. Assistant Professor and Lecturer with the Faculty of Administration and Management. King Mongkut’s Institute of Technology Ladkrabang (KMITL), Bangkok, Thailand. E-mail: drpuris.s@gmail.com