Vol. 40 (Nº 30) Año 2019. Pág. 11

GÓMEZ, Danny A. 1

Recibido: 28/05/2019 • Aprobado: 23/08/2019 • Publicado 09/09/2019

RESUMEN: El fraude contable ha incrementado últimamente su relevancia en los estudios científicos como fenómeno social que afecta directamente a personas, organizaciones y comunidad. La presente investigación tiene como objetivo la revisión y análisis del impacto bibliográfico sobre el fraude contable en las investigaciones científicas, a través del paradigma metaanalítico, que permite la integración y la revisión, cuantitativa y sistemática de resultados obtenidos de las principales colecciones de la web of science, 243 resultados obtenidos y su nivel de impacto. |

ABSTRACT: Accounting fraud has recently increased its relevance in scientific studies as a social phenomenon that directly affects people, organizations and the community. The present investigation has like objective the review and analysis of the bibliographical impact on the accounting fraud in the scientific investigations, through the metaanalítico paradigm, that allows the integration and the revision, quantitative and systematic of obtained results of the main collections of the web of science 243 results obtained and their level of impact. |

Para establecer un acercamiento etimológico al Fraude Contable, es importante asentar las siguientes apreciaciones. Conforme a Crespo (2009), el fraude es un acto intencional por parte de una o más personas de la administración, los encargados del gobierno corporativo, empleados o terceros, que implica el uso de engaño para obtener una ventaja injusta o ilegal. Respecto al fraude administrativo, involucra a uno o más miembros de la administración o de los encargados del gobierno corporativo; el fraude de empleados, cuando el fraude involucra sólo a empleados de la entidad; en cualquiera de los dos casos, puede haber complicidad dentro de la entidad o con terceros fuera de ella.

La corrupción es más que un hecho inmoral y lesivo a los intereses de la sociedad y los países por que fomenta el subdesarrollo, el analfabetismo, pobreza, desnutrición, desempleo y otros males sociales, frena el crecimiento económico y el bienestar social de la región, generando un daño directo y colateral no solo al entorno actual sino a las generaciones siguientes.

Torres (2015) infiere que la corrupción en su sentido clásico, es el abuso autoritario del poder, hasta llegar incluso a su ejercicio tiránico, entendiendo que la corrupción no es solo un problema local, sino también internacional, que tiene efecto en todos los países, sin mencionar que solo prolifere en los países más vulnerables o pobres, pues de igual manera se encuentra presente en las grandes economías y en majestuosas organizaciones, llevando este evento a todos los escenarios sociales donde actúa el individuo o la persona.

La presencia de la corrupción en la actualidad se presenta en sus modalidades más comunes de fraude, adulteración de estados financieros y apropiación indebida de activos, de acuerdo a Castillo et al. (2012); es sin duda la mayor preocupación del mundo de los negocios y las organizaciones, por lo que combatir estas maniobras delictivas es uno de los principales objetivos corporativos a nivel gubernamental.

Si se toma como referencia el significado jurídico y el origen etimológico de la palabra fraude, resalta que en su concepto aparecen los mismos términos que utilizan los diferentes autores para describir el fenómeno de la alteración de información financiera; conforme a Guevara & Cosenza (2004), esto permite, por analogía, inferir que se trata de lo mismo, ya que en el sentido jurídico de la palabra fraude existe la culpa y/o el culpable: lo cual, en el contexto de la contabilidad creativa y alteración de información financiera, puede referirse a la responsabilidad social y al gerente de la empresa como al culpable.

El campo que ha ido ganando la corrupción a pasos agigantados en los últimos años se debe por una parte al gran matiz y ámbitos en la que se encuentra; el fraude está presente no solo en el político que se vende a sus intereses personales, si no también, al ciudadano que ofrece un soborno al funcionario, y éste en recibirlo; al profesor que no exige a sus alumnos, y estos al copiar o plagiar un trabajo (Gaitán & Niebel, 2015).

En el ámbito organizacional todo fraude contable está casado con la falta de ética en cada funcionario indistintamente del nivel que pertenezca, y está a su vez crece proporcionalmente a la ausencia ética que exista.

López et al. (2012) mencionan a Donald Cressey, quien desarrolló uno de los modelos más aceptados sobre el cual personas buenas cometen fraude; esta investigación se centra en desfalcadores que fueron llamados como violadores de la confianza, y distingue en tres factores que deben estar presentes para que una persona cometa un fraude; estos factores son:

1. Poder o incentivo, presión: La administración u otros empleados tienen un estímulo o trabajan bajo presión, lo que les da una razón para cometer fraudes.

2. Oportunidad: Existen circunstancias que facilitan la oportunidad de perpetrar un fraude, por ejemplo, la ausencia de controles, controles ineficaces o la capacidad que tiene la administración para abrogar los controles.

3. Racionalización, actitud: Aquellas personas que son capaces de racionalizar un acto fraudulento en total congruencia con su código de ética personal o que poseen una actitud, carácter o conjunto de valores que les permiten, consciente e intencionalmente, cometer un acto deshonesto.

Este último factor es el que busca una oportunidad de coherencia de la actitud fraudulenta justificándola y volviéndola aceptable desde un enfoque ético personal del individuo.

De esta forma se destaca cómo la corrupción, en sus diversos escenarios, envuelve a individuos con actitudes éticas, así como también a individuos con actitudes no éticas, pero siempre la consideración final parte de la decisión de dicho individuo.

Se presenta un estudio descriptivo basado en el análisis documental a través de las publicaciones indexadas de la comunidad científica y aspectos de interés resultantes de la búsqueda en las colecciones principales de las bases de datos de la Web of Science (WoS), de la combinación de palabras claves “Accounting” y “Fraud”; a través de un estudio de metaanálisis, cuyo objetivo principal es la revisión y análisis del impacto bibliográfico sobre el fraude contable en las investigaciones científicas.

El Metaanálisis de acuerdo a Chalmers, Hedges & Cooper (2002), y Meca (2010), es un análisis estadístico de una gran colección de trabajos individuales con el propósito de integrar y comparar un resumen cuantitativo de resultados globales.

Todo esto dentro de un paradigma metaanalítico, que permite la integración y la revisión, cuantitativa y sistemática, de los resultados, para obtener evidencias empíricas sobre la adecuación y concreción de dichas investigaciones (Sánchez & Ato, 1989).

La visión metaanalítica, afirman Catalá, Tobías & Roqué (2014), materializa el enfoque que utiliza únicamente la información obtenida en el análisis. Se fundamenta en la significación estadística para evaluar una hipótesis, a partir de los datos del estudio que se realiza. Para este estudio, se trabajó las bases de datos de la Web of Science con una búsqueda para las palabras clave: “Accounting” y “Fraud” en el periodo 2008-2018.

Se aplicó un análisis descriptivo de la cantidad de publicaciones, el orden cronológico y años de publicación; para medir el impacto bibliográfico sobre el fraude contable en las investigaciones científicas, se revisó y analizó a través del examen estadístico de frecuencias de las citas realizadas en el periodo estudiado; el nivel de impacto se determinó conforme a la mayor frecuencia observada de dichas citas en las investigaciones posteriores realizadas.

Atendiendo a las variables de estudio cantidad de publicaciones por año, y publicaciones clasificadas de acuerdo al número de veces citadas para medir el impacto, los resultados obtenidos se presentan de la siguiente manera:

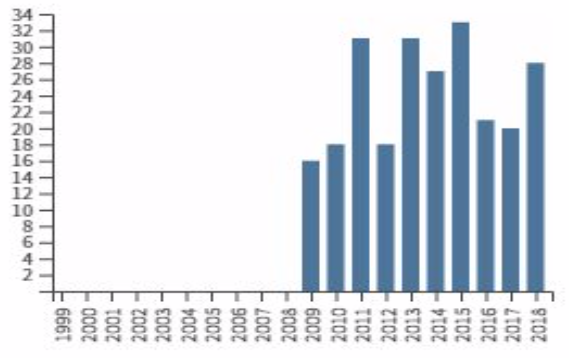

La búsqueda de las palabras claves: “Accounting” “Fraud”, en el periodo 2008-2018, en las que aplicaron los filtros específicos para Títulos dentro de las tres colecciones principales de la Wos, Science Citation Index Expanded (SCI-EXPANDED), Social Sciences Citation Index (SSCI), y Arts. & Humanities Citation Index (A&HCI), ha dado como resultado la obtención de 243 referencias en total. Como se comprueba en la tabla 1, considerando que durante los últimos años se ha experimentado un crecimiento relevante del número de investigaciones para los periodos 2015, 2013, 2011 y 2018.

gráfico 1

Elementos publicados cada año periodo 2009-2018

Fuente: Elaboración propia a partir de Clarivate Analytics (Web of Science)

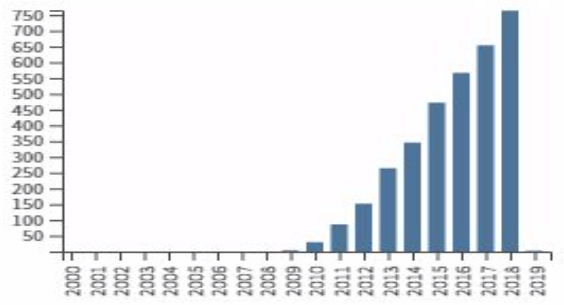

Para el periodo estudiado, luego de analizar las frecuencias sobre las citas como factor de impacto en la bibliografía científica se expresa lo siguiente:

Tal como lo demuestra la tabla 2, para los 243 artículos obtenidos en los resultados anteriores se observa un total de citas que asciende 3.340, como nivel de impacto en las publicaciones científicas multidisciplinarias en las principales colecciones de la Web of Science (Wos), resaltando de forma considerable una conducta ascendente tras el paso de los años dentro del periodo estudiado 2008-2018.

Tabla 2

Elementos publicados cada año periodo 2009-2018

Fuente: Elaboración propia a partir de Clarivate Analytics (Web of Science)

El factor de impacto de las publicaciones científicas estudiadas medibles a través de la cantidad de veces citadas en la bibliografía científica presenta los trabajos, autores y journals con mayor impacto en la comunidad científica tal como lo demuestra la tabla 3, en orden descendente desde los que tienen mayor impacto hasta los menos citados, dejando por fuera de esta lista los que para el momento de la realización del estudio no habían sido citados.

Tabla 3

Nivel de impacto para el periodo 2009-2018

|

Artículo |

Autores |

Journal |

Proporción impacto |

Total de citas |

|

Predicting Material Accounting Misstatements |

Dechow, Patricia M.; Ge, Weili; Larson, Chad R.; Sloan, Richard G. |

CONTEMPORARY ACCOUNTING RESEARCH |

7,754% |

259 |

|

Chief Executive Officer Equity Incentives and Accounting Irregularities |

Armstrong, Christopher S.; Jagolinzer, Alan D.; Larcker, David F. |

JOURNAL OF ACCOUNTING RESEARCH |

6,317% |

211 |

|

WHY EMPLOYEES DO BAD THINGS: MORAL DISENGAGEMENT AND UNETHICAL ORGANIZATIONAL BEHAVIOR |

Moore, Celia; Detert, James R.; Trevino, Linda Klebe; Baker, Vicki L.; Mayer, David M. |

PERSONNEL PSYCHOLOGY |

4,072% |

136 |

|

Market and Political/Regulatory Perspectives on the Recent Accounting Scandals |

Ball, Ray |

JOURNAL OF ACCOUNTING RESEARCH |

2,904% |

97 |

|

Why do CFOs become involved in material accounting manipulations? |

Feng, Mei; Ge, Weili; Luo, Shuqing; Shevlin, Terry |

JOURNAL OF ACCOUNTING & ECONOMICS |

2,844% |

95 |

|

The Economics of Fraudulent Accounting |

Kedia, Simi; Philippon, Thomas |

REVIEW OF FINANCIAL STUDIES |

2,844% |

95 |

|

Do the SEC's enforcement preferences affect corporate misconduct? |

Kedia, Simi; Rajgopal, Shiva |

JOURNAL OF ACCOUNTING & ECONOMICS |

2,605% |

87 |

|

Big Five Audits and Accounting Fraud |

Lennox, Clive; Pittman, Jeffrey A. |

CONTEMPORARY ACCOUNTING RESEARCH |

2,605% |

87 |

|

Corporate Governance Research in Accounting and Auditing: Insights, Practice Implications, and Future Research Directions |

Carcello, Joseph V.; Hermanson, Dana R.; Ye, Zhongxia (Shelly) |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

2,575% |

86 |

|

Do Strategic Reasoning and Brainstorming Help Auditors Change Their Standard Audit Procedures in Response to Fraud Risk? |

Hoffman, Vicky B.; Zimbelman, Mark F. |

ACCOUNTING REVIEW |

1,826% |

61 |

|

Audit Quality and Auditor Reputation: Evidence from Japan |

Skinner, Douglas J.; Srinivasan, Suraj |

ACCOUNTING REVIEW |

1,796% |

60 |

|

A new measure of accounting quality |

Hribar, Paul; Kravet, Todd; Wilson, Ryan |

REVIEW OF ACCOUNTING STUDIES |

1,617% |

54 |

|

Corporate Fraud and Managers' Behavior: Evidence from the Press |

Cohen, Jeffrey; Ding, Yuan; Lesage, Cedric; Stolowy, Herve |

JOURNAL OF BUSINESS ETHICS |

1,587% |

53 |

|

Fact and Fiction in EU-Governmental Economic Data |

Rauch, Bernhard; Goettsche, Max; Braehler, Gernot; Engel, Stefan |

GERMAN ECONOMIC REVIEW |

1,467% |

49 |

|

Cooking the books: Recipes and costs of falsified financial statements in China |

Firth, Michael; Rui, Oliver M.; Wu, Wenfeng |

JOURNAL OF CORPORATE FINANCE |

1,437% |

48 |

|

The World Has Changed - Have Analytical Procedure Practices? |

Trompeter, Greg; Wright, Arnold |

CONTEMPORARY ACCOUNTING RESEARCH |

1,407% |

47 |

|

Board Interlocks and Earnings Management Contagion |

Chiu, Peng-Chia; Teoh, Siew Hong; Tian, Feng |

ACCOUNTING REVIEW |

1,347% |

45 |

|

Auditors' Use of Brainstorming in the Consideration of Fraud: Reports from the Field |

Brazel, Joseph F.; Carpenter, Tina D.; Jenkins, J. Gregory |

ACCOUNTING REVIEW |

1,228% |

41 |

|

A Synthesis of Fraud-Related Research |

Trompeter, Gregory M.; Carpenter, Tina D.; Desai, Naman; Jones, Keith L.; Riley, Richard A., Jr. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

1,198% |

40 |

|

Internal Audit Outsourcing and the Risk of Misleading or Fraudulent Financial Reporting: Did Sarbanes-Oxley Get It Wrong? |

Prawitt, Douglas F.; Sharp, Nathan Y.; Wood, David A. |

CONTEMPORARY ACCOUNTING RESEARCH |

1,138% |

38 |

|

How Do Restatements Begin? Evidence of Earnings Management Preceding Restated Financial Reports |

Ettredge, Michael; Scholz, Susan; Smith, Kevin R.; Sun, Lili |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

1,138% |

38 |

|

CEO Gender, Ethical Leadership, and Accounting Conservatism |

Ho, Simon S. M.; Li, Annie Yuansha; Tam, Kinsun; Zhang, Feida |

JOURNAL OF BUSINESS ETHICS |

0,928% |

31 |

|

Tax Aggressiveness and Accounting Fraud |

Lennox, Clive; Lisowsky, Petro; Pittman, Jeffrey |

JOURNAL OF ACCOUNTING RESEARCH |

0,928% |

31 |

|

Detecting and Predicting Accounting Irregularities: A Comparison of Commercial and Academic Risk Measures |

Price, Richard A., III; Sharp, Nathan Y.; Wood, David A. |

ACCOUNTING HORIZONS |

0,928% |

31 |

|

Financial Restatements, Audit Fees, and the Moderating Effect of CFO Turnover |

Feldmann, Dorothy A.; Read, William J.; Abdolmohammadi, Mohammad I. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,928% |

31 |

|

The influence of the institutional context on corporate illegality |

Gabbioneta, Claudia; Greenwood, Royston; Mazzola, Pietro; Minoja, Mario |

ACCOUNTING ORGANIZATIONS AND SOCIETY |

0,898% |

30 |

|

Corporate social responsibility and tax aggressiveness: a test of legitimacy theory |

Lanis, Roman; Richardson, Grant |

ACCOUNTING AUDITING & ACCOUNTABILITY JOURNAL |

0,898% |

30 |

|

The spillover effect of fraudulent financial reporting on peer firms' investments |

Beatty, Anne; Liao, Scott; Yu, Jeff Jiewei |

JOURNAL OF ACCOUNTING & ECONOMICS |

0,868% |

29 |

|

The Influence of Documentation Specificity and Priming on Auditors' Fraud Risk Assessments and Evidence Evaluation Decisions |

Hammersley, Jacqueline S.; Bamber, E. Michael; Carpenter, Tina D. |

ACCOUNTING REVIEW |

0,868% |

29 |

|

Auditor Mindsets and Audits of Complex Estimates |

Griffith, Emily E.; Hammersley, Jacqueline S.; Kadous, Kathryn; Young, Donald |

JOURNAL OF ACCOUNTING RESEARCH |

0,808% |

27 |

|

State privatization and the unrelenting expansion of neoliberalism: The case of the Greek financial crisis |

Morales, Jeremy; Gendron, Yves; Guenin-Paracini, Henri |

CRITICAL PERSPECTIVES ON ACCOUNTING |

0,808% |

27 |

|

The Anatomy of Corporate Fraud: A Comparative Analysis of High Profile American and European Corporate Scandals |

Soltani, Bahram |

JOURNAL OF BUSINESS ETHICS |

0,808% |

27 |

|

Optimal Auditing with Scoring: Theory and Application to Insurance Fraud |

Dionne, Georges; Giuliano, Florence; Picard, Pierre |

MANAGEMENT SCIENCE |

0,808% |

27 |

|

SEC enforcement: Does forthright disclosure and cooperation really matter? |

Files, Rebecca |

JOURNAL OF ACCOUNTING & ECONOMICS |

0,778% |

26 |

|

An Intertemporal Analysis of Audit Fees and Section 404 Material Weaknesses |

Hoag, Matthew L.; Hollingsworth, Carl W. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,778% |

26 |

|

Can Identifying and Investigating Fraud Risks Increase Auditors' Liability? |

Reffett, Andrew B. |

ACCOUNTING REVIEW |

0,778% |

26 |

|

Post-listing performance and private sector regulation: The experience of London's Alternative Investment Market |

Gerakos, Joseph; Lang, Mark; Matfett, Mark |

JOURNAL OF ACCOUNTING & ECONOMICS |

0,749% |

25 |

|

Internet Auction Fraud Detection Using Social Network Analysis and Classification Tree Approaches |

Chiu, Chaochang; Ku, Yungchang; Lie, Ting; Chen, Yuchi |

INTERNATIONAL JOURNAL OF ELECTRONIC COMMERCE |

0,749% |

25 |

|

The Legitimacy of Loan Maturity Mismatching: A Risky, but not Fraudulent, Undertaking |

Bagus, Philipp; Howden, David |

JOURNAL OF BUSINESS ETHICS |

0,749% |

25 |

|

An Examination of the Effects of Procedural Safeguards on Intentions to Anonymously Report Fraud |

Kaplan, Steven E.; Pany, Kurt; Samuels, Janet A.; Zhang, Jian |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,749% |

25 |

|

Narcissus Enters the Courtroom: CEO Narcissism and Fraud |

Rijsenbilt, Antoinette; Commandeur, Harry |

JOURNAL OF BUSINESS ETHICS |

0,719% |

24 |

|

Understanding Widespread Misconduct in Organizations: An Institutional Theory of Moral Collapse |

Shadnam, Masoud; Lawrence, Thomas B. |

BUSINESS ETHICS QUARTERLY |

0,719% |

24 |

|

Earnings Manipulation and the Cost of Capital |

Strobl, Guenter |

JOURNAL OF ACCOUNTING RESEARCH |

0,659% |

22 |

|

Financial Statement Fraud Detection: An Analysis of Statistical and Machine Learning Algorithms |

Perols, Johan |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,659% |

22 |

|

Executives' off-the-job behavior, corporate culture, and financial reporting risk |

Davidson, Robert; Dey, Aiyesha; Smith, Abbie |

JOURNAL OF FINANCIAL ECONOMICS |

0,629% |

21 |

|

Fraud in accounting, organizations and society: Extending the boundaries of research |

Cooper, David J.; Dacin, Tina; Palmer, Donald |

ACCOUNTING ORGANIZATIONS AND SOCIETY |

0,629% |

21 |

|

Defensive Practice Adoption in the Face of Organizational Stigma: Impression Management and the Diffusion of Stock Option Expensing |

Carberry, Edward J.; King, Brayden G. |

JOURNAL OF MANAGEMENT STUDIES |

0,629% |

21 |

|

The Effects of Satisfaction with a Client's Management During a Prior Audit Engagement, Trust, and Moral Reasoning on Auditors' Perceived Risk of Management Fraud |

Kerler, William A., III; Killough, Larry N. |

JOURNAL OF BUSINESS ETHICS |

0,629% |

21 |

|

Evidence on the Association between Financial Restatements and Auditor Resignations |

Huang, Ying; Scholz, Susan |

ACCOUNTING HORIZONS |

0,599% |

20 |

|

Risk-Based Auditing, Strategic Prompts, and Auditor Sensitivity to the Strategic Risk of Fraud |

Bowlin, Kendall |

ACCOUNTING REVIEW |

0,599% |

20 |

|

The impact of corporate reputation and reputation damaging events on financial performance: Empirical evidence from the literature |

Gatzert, Nadine |

EUROPEAN MANAGEMENT JOURNAL |

0,569% |

19 |

|

Breaking up the sky The characterisation of accounting and accountants in popular music |

Smith, David; Jacobs, Kerry |

ACCOUNTING AUDITING & ACCOUNTABILITY JOURNAL |

0,569% |

19 |

|

Linking Ethics and Risk Management in Taxation: Evidence from an Exploratory Study in Ireland and the UK |

Doyle, Elaine M.; Hughes, Jane Frecknall; Glaister, Keith W. |

JOURNAL OF BUSINESS ETHICS |

0,569% |

19 |

|

Auditors' Internal Control over Financial Reporting Decisions: Analysis, Synthesis, and Research Directions |

Asare, Stephen K.; Fitzgerald, Brian C.; Graham, Lynford E.; Joe, Jennifer R.; Negangard, Eric M.; Wolfe, Christopher J. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,539% |

18 |

|

Auditor Perceptions of Client Narcissism as a Fraud Attitude Risk Factor |

Johnson, Eric N.; Kuhn, John R., Jr.; Apostolou, Barbara A.; Hassell, John M. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,509% |

17 |

|

The Use of Remedial Tactics in Negligence Litigation |

Cornell, Robert M.; Warne, Rick C.; Eining, Martha M. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,509% |

17 |

|

Accounting complexity, misreporting, and the consequences of misreporting |

Peterson, Kyle |

REVIEW OF ACCOUNTING STUDIES |

0,449% |

15 |

|

Corruption culture and corporate misconduct |

Liu, Xiaoding |

JOURNAL OF FINANCIAL ECONOMICS |

0,419% |

14 |

|

Accounting Variables, Deception, and a Bag of Words: Assessing the Tools of Fraud Detection |

Purda, Lynnette; Skillicorn, David |

CONTEMPORARY ACCOUNTING RESEARCH |

0,419% |

14 |

|

The Ties that Bind: The Decision to Co-Offend in Fraud |

Free, Clinton; Murphy, Pamela R. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,419% |

14 |

|

Nominal versus Interacting Electronic Fraud Brainstorming in Hierarchical Audit Teams |

Chen, Clara Xiaoling; Trotman, Ken T.; Zhou, Flora (Hailan) |

ACCOUNTING REVIEW |

0,419% |

14 |

|

CEO demographics and accounting fraud: Who is more likely to rationalize illegal acts? |

Troy, Carmelita; Smith, Ken G.; Domino, Madeline A. |

STRATEGIC ORGANIZATION |

0,419% |

14 |

|

Democratic Business Ethics: Volkswagen's Emissions Scandal and the Disruption of Corporate Sovereignty |

Rhodes, Carl |

ORGANIZATION STUDIES |

0,389% |

13 |

|

Good Apples, Bad Apples: Sorting Among Chinese Companies Traded in the US |

Ang, James S.; Jiang, Zhiqian; Wu, Chaopeng |

JOURNAL OF BUSINESS ETHICS |

0,389% |

13 |

|

The Impact of CEO and CFO Equity Incentives on Audit Scope and Perceived Risks as Revealed Through Audit Fees |

Kannan, Yezen H.; Skantz, Terrance R.; Higgs, Julia L. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,389% |

13 |

|

Social network analysis in accounting information systems research |

Worrell, James; Wasko, Molly; Johnston, Allen |

INTERNATIONAL JOURNAL OF ACCOUNTING INFORMATION SYSTEMS |

0,389% |

13 |

|

Auditor Commitment to Privately Held Clients and its Effect on Value-Added Audit Service |

Herda, David N.; Lavelle, James J. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,389% |

13 |

|

Accounting Regulation, Financial Development, and Economic Growth |

Akisik, Orhan |

EMERGING MARKETS FINANCE AND TRADE |

0,389% |

13 |

|

Accounting Restatements and the Timeliness of Disclosures |

Badertscher, Brad A.; Burks, Jeffrey J. |

ACCOUNTING HORIZONS |

0,389% |

13 |

|

The Impact of Regulation on the U.S. Nonprofit Sector: Initial Evidence from the Nonprofit Integrity Act of 2004 |

Neely, Daniel G. |

ACCOUNTING HORIZONS |

0,389% |

13 |

|

Shell Games: The Long-Term Performance of Chinese Reverse-Merger Firms |

Lee, Charles M. C.; Li, Kevin K.; Zhang, Ran |

ACCOUNTING REVIEW |

0,359% |

12 |

|

A HYBRID LINGUISTIC FUZZY MULTIPLE CRITERIA GROUP SELECTION OF A CHIEF ACCOUNTING OFFICER |

Kersuliene, Violeta; Turskis, Zenonas |

JOURNAL OF BUSINESS ECONOMICS AND MANAGEMENT |

0,359% |

12 |

|

Data Diagnostics Using Second-Order Tests of Benford's Law |

Nigrini, Mark J.; Miller, Steven J. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,359% |

12 |

|

Evidence on Contagion in Earnings Management |

Kedia, Simi; Koh, Kevin; Rajgopal, Shivaram |

ACCOUNTING REVIEW |

0,329% |

11 |

|

Auditor Fees and Fraud Firms |

Markelevich, Ariel; Rosner, Rebecca L. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,329% |

11 |

|

Where Did They Go Right? Understanding the Deception in Phishing Communications |

Wright, Ryan; Chakraborty, Suranjan; Basoglu, Asli; Marett, Kent |

GROUP DECISION AND NEGOTIATION |

0,329% |

11 |

|

Proxies and Databases in Financial Misconduct Research |

Karpoff, Jonathan M.; Koester, Allison; Lee, D. Scott; Martin, Gerald S. |

ACCOUNTING REVIEW |

0,299% |

10 |

|

Corporate General Counsel and Financial Reporting Quality |

Hopkins, Justin J.; Maydew, Edward L.; Venkatachalam, Mohan |

MANAGEMENT SCIENCE |

0,299% |

10 |

|

The Silent Samaritan Syndrome: Why the Whistle Remains Unblown |

MacGregor, Jason; Stuebs, Martin |

JOURNAL OF BUSINESS ETHICS |

0,299% |

10 |

|

Dividend Policy at Firms Accused of Accounting Fraud |

Caskey, Judson; Hanlon, Michelle |

CONTEMPORARY ACCOUNTING RESEARCH |

0,299% |

10 |

|

Short Interest as a Signal of Audit Risk |

Cassell, Cory A.; Drake, Michael S.; Rasmussen, Stephanie J. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,299% |

10 |

|

Forging success: Soviet managers and accounting fraud, 1943-1962 |

Harrison, Mark |

JOURNAL OF COMPARATIVE ECONOMICS |

0,299% |

10 |

|

Accounting fraud, auditing, and the role of government sanctions in China |

Lisic, Ling Lei; Silveri, Sabatino (Dino); Song, Yanheng; Wang, Kun |

JOURNAL OF BUSINESS RESEARCH |

0,269% |

9 |

|

The effect of securities litigation on external financing |

Autore, Don M.; Hutton, Irena; Peterson, David R.; Smith, Aimee Hoffmann |

JOURNAL OF CORPORATE FINANCE |

0,269% |

9 |

|

Fuzzy rule optimization for online auction frauds detection based on genetic algorithm |

Yu, Cheng-Hsien; Lin, Shi-Jen |

ELECTRONIC COMMERCE RESEARCH |

0,269% |

9 |

|

Experiential learning in accounting education: A prison visit |

Dellaportas, Steven; Hassall, Trevor |

BRITISH ACCOUNTING REVIEW |

0,269% |

9 |

|

Commentary from the American Accounting Association's 2011 Annual Meeting Panel on Emerging Issues in Fraud Research |

Brody, Richard G.; Melendy, Sara R.; Perri, Frank S. |

ACCOUNTING HORIZONS |

0,269% |

9 |

|

The Long-Term Performance and Failure Risk of Firms Cited in the US SEC's Accounting and Auditing Enforcement Releases |

Leng, Fei; Feroz, Ehsan H.; Cao, Zhiyan; Davalos, Sergio V. |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

0,269% |

9 |

|

The Value of Political Ties Versus Market Credibility: Evidence from Corporate Scandals in China |

Hung, Mingyi; Wong, T. J.; Zhang, Fang |

CONTEMPORARY ACCOUNTING RESEARCH |

0,240% |

8 |

|

Psychopathy, Academic Accountants' Attitudes toward Unethical Research Practices, and Publication Success |

Bailey, Charles D. |

ACCOUNTING REVIEW |

0,240% |

8 |

|

Equilibrium earnings management and managerial compensation in a multiperiod agency setting |

Dutta, Sunil; Fan, Qintao |

REVIEW OF ACCOUNTING STUDIES |

0,240% |

8 |

|

Discussion of Chief Executive Officer Equity Incentives and Accounting Irregularities |

Core, John E. |

JOURNAL OF ACCOUNTING RESEARCH |

0,240% |

8 |

|

Drawing the line: how inspectors enact deviant behaviors |

Suquet, Jean-Baptiste |

JOURNAL OF SERVICES MARKETING |

0,240% |

8 |

|

The revolving door and the SEC's enforcement outcomes: Initial evidence from civil litigation |

deHaan, Ed; Kedia, Simi; Koh, Kevin; Rajgopal, Shivaram |

JOURNAL OF ACCOUNTING & ECONOMICS |

0,210% |

7 |

|

Points to Consider When Self-Assessing Your Empirical Accounting Research |

Evans, John Harry, III; Feng, Mei; Hoffman, Vicky B.; Moser, Donald V.; Van der Stede, Wim A. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,210% |

7 |

|

Foreign corporations and the culture of transparency: Evidence from Russian administrative data |

Braguinsky, Serguey; Mityakov, Sergey |

JOURNAL OF FINANCIAL ECONOMICS |

0,210% |

7 |

|

Losses from Failure of Stakeholder Sensitive Processes: Financial Consequences for Large US Companies from Breakdowns in Product, Environmental, and Accounting Standards |

Coleman, Les |

JOURNAL OF BUSINESS ETHICS |

0,210% |

7 |

|

Restructuring to Repair Legitimacy - A Contingency Perspective |

Wang, Pengii |

CORPORATE GOVERNANCE-AN INTERNATIONAL REVIEW |

0,210% |

7 |

|

Responses of the American Accounting Association's Tracking Team to the Recommendations of the Advisory Committee on the Auditing Profession |

Carcello, Joseph V.; Bedard, Jean C.; Hermanson, Dana R. |

ACCOUNTING HORIZONS |

0,210% |

7 |

|

Determinants of banks' risk exposure to new account fraud - Evidence from Germany |

Hartmann-Wendels, Thomas; Maehlmann, Thomas; Versen, Tobias |

JOURNAL OF BANKING & FINANCE |

0,210% |

7 |

|

Finding Needles in a Haystack: Using Data Analytics to Improve Fraud Prediction |

Perols, Johan L.; Bowen, Robert M.; Zimmermann, Carsten; Samba, Basamba |

ACCOUNTING REVIEW |

0,180% |

6 |

|

Regulatory Sanctions on Independent Directors and Their Consequences to the Director Labor Market: Evidence from China |

Firth, Michael; Wong, Sonia; Xin, Qingquan; Yick, Ho Yin |

JOURNAL OF BUSINESS ETHICS |

0,180% |

6 |

|

Are Fraud Specialists Relatively More Effective than Auditors at Modifying Audit Programs in the Presence of Fraud Risk? |

Boritz, J. Efrim; Kochetova-Kozloski, Natalia; Robinson, Linda |

ACCOUNTING REVIEW |

0,180% |

6 |

|

Accounting and the fight against corruption in Italian government procurement: A longitudinal critical analysis (1992-2014) |

Sargiacomo, Massimo; Ianni, Luca; D'Andreamatteo, Antonio; Servalli, Stefania |

CRITICAL PERSPECTIVES ON ACCOUNTING |

0,180% |

6 |

|

Oil and Water Do Not Mix, or: Aliud Est Credere, Aliud Deponere |

Bagus, Philipp; Howden, David; Gabriel, Amadeus |

JOURNAL OF BUSINESS ETHICS |

0,180% |

6 |

|

Managing audits to manage earnings: The impact of diversions on an auditor's detection of earnings management |

Luippold, Benjamin L.; Kida, Thomas; Piercey, M. David; Smith, James F. |

ACCOUNTING ORGANIZATIONS AND SOCIETY |

0,180% |

6 |

|

In Defence of 'Demand' Deposits: Contractual Solutions to the Barnett and Block, and Bagus and Howden Debate |

Evans, Anthony J. |

JOURNAL OF BUSINESS ETHICS |

0,180% |

6 |

|

Birds of a feather: Value implications of political alignment between top management and directors |

Lee, Jongsub; Lee, Kwang J.; Nagarajan, Nandu J. |

JOURNAL OF FINANCIAL ECONOMICS |

0,180% |

6 |

|

Serving Fraudulent Consumers? The Impact of Return Policies on Retailer's Profitability |

Uelkue, M. Ali; Dailey, Lynn C.; Yayla-Kuellue, H. Muege |

SERVICE SCIENCE |

0,180% |

6 |

|

Do Compensation Committees Pay Attention to Section 404 Opinions of the Sarbanes-Oxley Act? |

Hsu, Audrey Wen-Hsin; Liao, Chih-Hsien |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

0,180% |

6 |

|

Lessons to be Learned: An Examination of Canadian and US Financial Accounting and Auditing Textbooks for Ethics/Governance Coverage |

Gordon, Irene M. |

JOURNAL OF BUSINESS ETHICS |

0,180% |

6 |

|

Virtuous Professionalism in Accountants to Avoid Fraud and to Restore Financial Reporting |

Lail, Bradley; MacGregor, Jason; Marcum, James; Stuebs, Martin |

JOURNAL OF BUSINESS ETHICS |

0,150% |

5 |

|

Accounting Ethics in Unfriendly Environments: The Educational Challenge |

Tormo-Carbo, Guillermina; Segui-Mas, Elies; Oltra, Victor |

JOURNAL OF BUSINESS ETHICS |

0,150% |

5 |

|

How interactive marketing is changing in financial services |

Stone, Merlin; Laughlin, Paul |

JOURNAL OF RESEARCH IN INTERACTIVE MARKETING |

0,150% |

5 |

|

Insights for Research and Practice: What We Learn about Fraud from Other Disciplines |

Trompeter, Gregory M.; Carpenter, Tina D.; Jones, Keith L.; Riley, Richard A., Jr. |

ACCOUNTING HORIZONS |

0,150% |

5 |

|

Accounting, ethics and human existence: Lightly unbearable, heavily kitsch |

Boyce, Gordon |

CRITICAL PERSPECTIVES ON ACCOUNTING |

0,150% |

5 |

|

Environmental accounting and the FADN as a basis of model for detecting the material flow cost accounting |

Kourilova, Jindriska; Sedlacek, Jaroslav |

AGRICULTURAL ECONOMICS-ZEMEDELSKA EKONOMIKA |

0,150% |

5 |

|

Under Which Conditions are Whistleblowing Best Practices Best? |

Zhang, Jian; Pany, Kurt; Reckers, Philip M. J. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,150% |

5 |

|

Financial Misrepresentation and Its Impact on Rivals |

Goldman, Eitan; Peyer, Urs; Stefanescu, Irina |

FINANCIAL MANAGEMENT |

0,150% |

5 |

|

Vague Auditing Standards and Ambiguity Aversion |

Bigus, Jochen |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,150% |

5 |

|

Conservatism, SEC investigation, and fraud |

Alam, Pervaiz; Petruska, Karin A. |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,150% |

5 |

|

Company Duplication - Plain Fraud or a 'Poor Man's' Bankruptcy? A Case Study in the Financial Distress of Small Businesses |

Rotem, Yaad |

INTERNATIONAL INSOLVENCY REVIEW |

0,150% |

5 |

|

Fraudulent Management Explanations and the Impact of Alternative Presentations of Client Business Evidence |

Wright, William F.; Berger, Leslie |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,150% |

5 |

|

Consumer morality in times of economic hardship: evidence from the European Social Survey |

Lopes, Claudia Abreu |

INTERNATIONAL JOURNAL OF CONSUMER STUDIES |

0,150% |

5 |

|

The nexus of white collar crimes: shadow economy, corruption and uninsured motorists |

Goel, Rajeev K.; Saunoris, James W. |

APPLIED ECONOMICS |

0,120% |

4 |

|

Modeling operational risk incorporating reputation risk: An integrated analysis for financial firms |

Eckert, Christian; Gatzert, Nadine |

INSURANCE MATHEMATICS & ECONOMICS |

0,120% |

4 |

|

CEO power and CEO hubris: a prelude to financial misreporting? |

Cormier, Denis; Lapointe-Antunes, Pascale; Magnan, Michel |

MANAGEMENT DECISION |

0,120% |

4 |

|

Social responsibility, professional commitment and tax fraud |

Shafer, William E.; Simmons, Richard S.; Yip, Rita W. Y. |

ACCOUNTING AUDITING & ACCOUNTABILITY JOURNAL |

0,120% |

4 |

|

Social Cognitive Theory: The Antecedents and Effects of Ethical Climate Fit on Organizational Attitudes of Corporate Accounting Professionals-A Reflection of Client Narcissism and Fraud Attitude Risk |

Domino, Madeline Ann; Wingreen, Stephen C.; Blanton, James E. |

JOURNAL OF BUSINESS ETHICS |

0,120% |

4 |

|

Are bad times good news for the Securities and Exchange Commission? |

Lohse, Tim; Thomann, Christian |

EUROPEAN JOURNAL OF LAW AND ECONOMICS |

0,120% |

4 |

|

Work identification and responsibility in moral breakdown |

O'Leary, Majella |

BUSINESS ETHICS-A EUROPEAN REVIEW |

0,120% |

4 |

|

Privacy, Publicity, and Reputation: How the Press Regulated the Market in Nineteenth-Century England |

Taylor, James |

BUSINESS HISTORY REVIEW |

0,120% |

4 |

|

The effects of accounting restatements on firm growth |

Albring, Susan M.; Huang, Shawn X.; Pereira, Raynolde; Xu, Xiaolu |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,120% |

4 |

|

Financial restatements and Sarbanes-Oxley: Impact on Canadian firm governance and management turnover |

Kryzanowski, Lawrence; Zhang, Ying |

JOURNAL OF CORPORATE FINANCE |

0,120% |

4 |

|

An Analysis of Accounting Frauds and the Timing of Analyst Coverage Decisions and Recommendation Revisions: Evidence from the US |

Young, Susan M.; Peng, Emma Y. |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

0,120% |

4 |

|

Unintended? The effects of adoption of the Sarbanes-Oxley Act on nonprofit organizations |

Nezhina, Tamara G.; Brudney, Jeffrey L. |

NONPROFIT MANAGEMENT & LEADERSHIP |

0,120% |

4 |

|

A dynamical approach to operational risk measurement |

Bardoscia, Marco; Bellotti, Roberto |

JOURNAL OF OPERATIONAL RISK |

0,120% |

4 |

|

Explaining functional principal component analysis to actuarial science with an example on vehicle insurance |

Segovia-Gonzalez, M. M.; Guerrero, F. M.; Herranz, P. |

INSURANCE MATHEMATICS & ECONOMICS |

0,120% |

4 |

|

What Plato Knew About Enron |

Henderson, Michele C.; Oakes, M. Gregory; Smith, Marilyn |

JOURNAL OF BUSINESS ETHICS |

0,120% |

4 |

|

The Deterrent Effect of Employee Whistleblowing on Firms' Financial Misreporting and Tax Aggressiveness |

Wilde, Jaron H. |

ACCOUNTING REVIEW |

0,090% |

3 |

|

Internal Control Weaknesses and Financial Reporting Fraud |

Donelson, Dain C.; Ege, Matthew S.; McInnis, John M. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,090% |

3 |

|

Explaining CEO retention in misreporting firms |

Beneish, Messod D.; Marshall, Cassandra D.; Yang, Jun |

JOURNAL OF FINANCIAL ECONOMICS |

0,090% |

3 |

|

Data mining applications in accounting: A review of the literature and organizing framework |

Amani, Farzaneh A.; Fadlalla, Adam M. |

INTERNATIONAL JOURNAL OF ACCOUNTING INFORMATION SYSTEMS |

0,090% |

3 |

|

Fraud Risk Awareness and the Likelihood of Audit Enforcement Action |

Eutsler, Jared; Nickell, Erin Burrell; Robb, Sean W. G. |

ACCOUNTING HORIZONS |

0,090% |

3 |

|

How do different payment methods deliver cost and credit efficiency in electronic commerce? |

Grueschow, Robert Maximilian; Kemper, Jan; Brettel, Malte |

ELECTRONIC COMMERCE RESEARCH AND APPLICATIONS |

0,090% |

3 |

|

Cost Accounting for War: Contracting Procedures and Cost-plus Pricing in WWI Industrial Mobilization in Italy |

Vollmers, Gloria; Antonelli, Valerio; D'Alessio, Raffaele; Rossi, Roberto |

EUROPEAN ACCOUNTING REVIEW |

0,090% |

3 |

|

The effect of alternative fraud model use on auditors' fraud risk judgments |

Boyle, Douglas M.; DeZoort, F. Todd; Hermanson, Dana R. |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,090% |

3 |

|

The Timeliness of Restatement Disclosures and Financial Reporting Credibility |

Hirschey, Mark; Smith, Kevin R.; Wilson, Wendy M. |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

0,090% |

3 |

|

Ex Ante Severance Agreements and Earnings Management |

Brown, Kareen E. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,090% |

3 |

|

Cumulative Prospect Theory and Managerial Incentives for Fraudulent Financial Reporting |

Fung, Michael K. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,090% |

3 |

|

How Do Auditors Address Control Deficiencies that Bias Accounting Estimates? |

Mauldin, Elaine G.; Wolfe, Christopher J. |

CONTEMPORARY ACCOUNTING RESEARCH |

0,090% |

3 |

|

Fostering an ethical organization from the bottom up and the outside in |

Hess, Megan F.; Broughton, Earnest |

BUSINESS HORIZONS |

0,090% |

3 |

|

What Causes Fraudulent Financial Reporting? Evidence Based on H Shares |

Yen, Shih-Chung |

EMERGING MARKETS FINANCE AND TRADE |

0,090% |

3 |

|

Selecting Audit Samples Using Benford's Law |

da Silva, Carlos Gomes; Carreira, Pedro M. R. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,090% |

3 |

|

Overcoming selectivity bias in evaluating new fraud detection systems for revolving credit operations |

Hand, David J.; Crowder, Martin J. |

INTERNATIONAL JOURNAL OF FORECASTING |

0,090% |

3 |

|

Fraud detection in play-money prediction markets |

Blume, Michael; Luckner, Stefan; Weinhardt, Christof |

INFORMATION SYSTEMS AND E-BUSINESS MANAGEMENT |

0,090% |

3 |

|

Keeping Up with the Joneses: A Model and a Test of Collective Accounting Fraud |

Fernandes, Nuno; Guedes, Jose |

EUROPEAN FINANCIAL MANAGEMENT |

0,090% |

3 |

|

Corporate fraud culture: Re-examining the corporate governance and performance relation |

Tan, David T.; Chapple, Larelle; Walsh, Kathleen D. |

ACCOUNTING AND FINANCE |

0,060% |

2 |

|

Ethics in Finance and Accounting: Editorial Introduction |

Mele, Domenec; Rosanas, Josep M.; Fontrodona, Joan |

JOURNAL OF BUSINESS ETHICS |

0,060% |

2 |

|

DO THE DATA ON MUNICIPAL EXPENDITURES IN THE CZECH REPUBLIC IMPLY INCORRECTNESS IN THEIR MANAGEMENT? |

Pucek, Milan; Placek, Michal; Ochrana, Frantisek |

E & M EKONOMIE A MANAGEMENT |

0,060% |

2 |

|

Analysis of earnings management influence on the investment efficiency of listed Chinese companies |

Shen, Chung-Hua; Luo, Fuyan; Huang, Dengshi |

JOURNAL OF EMPIRICAL FINANCE |

0,060% |

2 |

|

Between a Rock and a Hard Place: A Path Forward for Using Substantive Analytical Procedures in Auditing Large P&L Accounts: Commentary and Analysis |

Glover, Steven M.; Prawitt, Douglas F.; Drake, Michael S. |

AUDITING-A JOURNAL OF PRACTICE & THEORY |

0,060% |

2 |

|

Analysis of predictors of organizational losses due to occupational corruption |

Timofeyev, Yuriy |

INTERNATIONAL BUSINESS REVIEW |

0,060% |

2 |

|

Detection Model of Legally Registered Mafia Firms in Italy |

Ravenda, Diego; Argiles-Bosch, Josep M.; Valencia-Silva, Maika M. |

EUROPEAN MANAGEMENT REVIEW |

0,060% |

2 |

|

The Market's Valuation of Fraudulently Reported Earnings |

Hui, Kai Wai; Lennox, Clive; Zhang, Guochang |

JOURNAL OF BUSINESS FINANCE & ACCOUNTING |

0,060% |

2 |

|

Detecting Problems in Military Expenditure Data Using Digital Analysis |

Rauch, Bernhard; Goettsche, Max; Langenegger, Stephan |

DEFENCE AND PEACE ECONOMICS |

0,060% |

2 |

|

Analysis of fraudulent behavior strategies in online auctions for detecting latent fraudsters |

Chang, Jau-Shien; Chang, Wen-Hsi |

ELECTRONIC COMMERCE RESEARCH AND APPLICATIONS |

0,060% |

2 |

|

The retention of directors on the audit committee following an accounting restatement |

Carver, Brian T. |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,060% |

2 |

|

The Great Escape: The Unaddressed Ethical Issue of Investor Responsibility for Corporate Malfeasance |

Wesley, Curtis L., II; Ndofor, Hermann Achidi |

BUSINESS ETHICS QUARTERLY |

0,060% |

2 |

|

The link between supervisory board reporting and firm performance in Germany and Austria |

Velte, Patrick |

EUROPEAN JOURNAL OF LAW AND ECONOMICS |

0,060% |

2 |

|

ACCOUNTING ETHICS - AN EMPIRICAL INVESTIGATION OF MANAGING SHORT-TERM EARNINGS |

Jooste, Leonie |

SOUTH AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT SCIENCES |

0,060% |

2 |

|

Is accounting at odds with corporate governance? |

LoBue, Robert M. |

EUROPEAN JOURNAL OF INTERNATIONAL MANAGEMENT |

0,060% |

2 |

|

CEO Wrongdoing: A Review of Pressure, Opportunity, and Rationalization |

Schnatterly, Karen; Gangloff, K. Ashley; Tuschke, Anja |

JOURNAL OF MANAGEMENT |

0,030% |

1 |

|

See You in Court: How CEO narcissism increases firms' vulnerability to lawsuits |

O'Reilly, Charles A., III; Doerr, Bernadette; Chatman, Jennifer A. |

LEADERSHIP QUARTERLY |

0,030% |

1 |

|

Corporate Scandals and Regulation |

Hail, Luzi; Tahoun, Ahmed; Wang, Clare |

JOURNAL OF ACCOUNTING RESEARCH |

0,030% |

1 |

|

Fraud recovery and the quality of country governance |

Curti, Filippo; Mihov, Atanas |

JOURNAL OF BANKING & FINANCE |

0,030% |

1 |

|

Accrual management as an indication of money laundering through legally registered Mafia firms in Italy |

Ravenda, Diego; Valencia-Silva, Maika M.; Maria Argiles-Bosch, Josep; Garcia-Blandon, Josep |

ACCOUNTING AUDITING & ACCOUNTABILITY JOURNAL |

0,030% |

1 |

|

Imperfect Accounting and Reporting Bias |

Fang, Vivian W.; Huang, Allen H.; Wang, Wenyu |

JOURNAL OF ACCOUNTING RESEARCH |

0,030% |

1 |

|

Denunciatory technology: forging publics through populism and secrecy |

Sanscartier, Matthew D. |

ECONOMY AND SOCIETY |

0,030% |

1 |

|

The Earnings Quality Information Content of Dividend Policies and Audit Pricing |

Lawson, Bradley P.; Wang, Dechun |

CONTEMPORARY ACCOUNTING RESEARCH |

0,030% |

1 |

|

Do Opinions on Financial Misstatement Firms Affect Analysts' Reputation with Investors? Evidence from Reputational Spillovers |

Lee, Lian Fen; Lo, Alvis K. |

JOURNAL OF ACCOUNTING RESEARCH |

0,030% |

1 |

|

Problem directors on the audit committee and financial reporting quality |

Habib, Ahsan; Bhuiyan, Md. Borhan Uddin |

ACCOUNTING AND BUSINESS RESEARCH |

0,030% |

1 |

|

Interactive visual analysis of anomalous accounts payable transactions in SAP enterprise systems |

Singh, Kishore; Best, Peter |

MANAGERIAL AUDITING JOURNAL |

0,030% |

1 |

|

Professional scepticism in two economies with cultural differences and the public interest: evidence from China and the United States |

Law, Philip; Yuen, Desmond |

APPLIED ECONOMICS |

0,030% |

1 |

|

The Role of Directors' and Officers' Insurance in Securities Fraud Class Action Settlements |

Donelson, Dain C.; Hopkins, Justin J.; Yust, Christopher G. |

JOURNAL OF LAW & ECONOMICS |

0,030% |

1 |

|

CONTRACTING FOR INFRASTRUCTURE PROJECTS AS CREDENCE GOODS |

Dulleck, Uwe; Gong, Jiong; Li, Jianpei |

JOURNAL OF PUBLIC ECONOMIC THEORY |

0,030% |

1 |

|

Pay Convexity, Earnings Manipulation, and Project Continuation |

Laux, Volker |

ACCOUNTING REVIEW |

0,030% |

1 |

|

REDUCE EMPLOYERS' SOCIAL SECURITY CONTRIBUTIONS AND CONTROL LABOR FRAUD: REMEDIES FOR SPAIN'S AILING ECONOMY? |

Teresa Alvarez-Martinez, Maria; Polo, Clemente |

ECONOMIC SYSTEMS RESEARCH |

0,030% |

1 |

|

A delisting prediction model based on nonfinancial information |

Hwang, In Tae; Kang, Sun Min; Jin, Shun Ji |

ASIA-PACIFIC JOURNAL OF ACCOUNTING & ECONOMICS |

0,030% |

1 |

|

The use of financial ratio models to help investors predict and interpret significant corporate events |

Ak, B. Korcan; Dechow, Patricia M.; Sun, Yuan; Wang, Annika Yu |

AUSTRALIAN JOURNAL OF MANAGEMENT |

0,030% |

1 |

|

Creative Accounting, Fraud and International Accounting Scandals |

Stolowy, Herve |

ACCOUNTING REVIEW |

0,030% |

1 |

|

Earnings quality and Rule 10b-5 securities class action lawsuits |

Chalmers, Keryn; Naiker, Vic; Nayissi, Farshid |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,030% |

1 |

|

Bankrupt accountants and lawyers Transition in the rise of professionalism in Victorian Scotland |

Lee, Thomas A. |

ACCOUNTING AUDITING & ACCOUNTABILITY JOURNAL |

0,030% |

1 |

|

The aftermath of public attention on accounting improprieties: Effects on securities class action settlements |

Simmons, Laura E. |

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

0,030% |

1 |

|

Creative Accounting, Fraud and International Accounting Scandals |

Barnes, Paul |

ACCOUNTING AND BUSINESS RESEARCH |

0,030% |

1 |

|

A COMPARISON OF ETHICAL PERCEPTIONS OF EARNINGS MANAGEMENT PRACTICES |

Jooste, Leonie |

SOUTH AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT SCIENCES |

0,030% |

1 |

|

Totales |

100,000% |

3.340 |

||

Fuente: Elaboración propia a partir de Clarivate Analytics (Web of Science)

Luego de analizar el contenido de la búsqueda en Web of Science (Wos), para el periodo comprendido entre 2008-2018; de las palabras claves “Accounting Fraud” en las que aplicaron los filtros específicos para Títulos dentro de las tres colecciones principales de la Wos: Science Citation Index Expanded (SCI-EXPANDED), Social Sciences Citation Index (SSCI), y Arts. & Humanities Citation Index (A&HCI), se concluye lo siguiente:

Doscientos cuarenta y tres artículos fueron publicados en relación a “Accounting Fraud”en los últimos diez (10) años, con un nivel de impacto en las publicaciones científicas de la Web of Science de 3.340 citas, resaltando así un incremento generalizado y patrón de crecimiento en el interés de los investigadores e impacto para los últimos periodos, siendo de esta manera 2016, 2017 y 2018 los años con más citas de publicaciones en el campo científico tradicional y emergente.

En función al análisis realizado, los resultados arrojan que el fraude contable ha adquirido una relevancia durante los últimos años, hecho que se ha demostrado en función del impacto creciente en las investigaciones científicas, dando una mayor importancia al aporte de datos, análisis y estado del arte en dicha productividad.

Castillo, Figueredo Y Méndez (2012). La Auditoria Forense en América Latina (casos: Colombia, Ecuador y Venezuela). Gestión y Gerencia. Vol. 6. UCLA Venezuela.

Castro, R. M., & Cano, M. A. (2016). Buen gobierno corporativo, solución a la crisis de confianza: Cambios en la contabilidad y la auditoría, aporte de los estándares internacionales, apuntes de la comparación de los casos Parmalat-Enron. Contaduría Universidad de Antioquia, (44), 17-51.

Catalá-López, F., Tobías, A., & Roqué, M. (2014). Conceptos básicos del metaanálisis en red. Atención Primaria, 46(10), 573-581.

Chalmers, I., Hedges, L. V., & Cooper, H. (2002). A brief history of research synthesis. Evaluation & the health professions, 25(1), 12-37.

Crespo, J. A. M. (2009). Detección del fraude en una auditoría de estados financieros. Perspectivas, (24), 227-242.

Gaitán, R. E., & Niebel, B. W. (2015). Control interno y fraudes: análisis de informe COSO I, II y III con base en los ciclos transaccionales. Ecoe ediciones.

Guevara, Ivan. Y Cosenza, J. (2004). Los auditores independientes y la contabilidad creativa, Estudio empírico comparativo, Compendium, UCLA, Barquisimeto, Venezuela.

López Moreno, Walter; Sánchez Ríos, José A. (2012) El Triángulo del Fraude, Centro de Investigaciones Comerciales e Iniciativas Académicas. Puerto Rico.

Marc Gürtler, Thomas Paulsen, (2018) "Forecasting performance of time series models on electricity spot markets: a quasi-meta-analysis", International journal of energy sector management. Vol. 12 Issue: 1, pp.103-129

Meca, J. S. (2010). Cómo realizar una revisión sistemática y un meta-análisis. Aula abierta, 38(2), 53-64.

SÁNCHEZ, J., & ATO, M. (1989). Meta-análisis: Una alternativa metodológica a las revisiones tradicionales de la investigación. J. Arnau y H. Carpintero (Coords.), Tratado de psicología general, 1, 617-669.

Torres Vásquez, Cesar Augusto (2015). Corrupción Política, Revista de Investigación Jurídica de Estudiantes, NOUS. Universidad Privada Antonio Guillermo Urrelo. Cajamarca, Perú.

1. Académico de la Facultad de Administración y Negocios. Universidad Autónoma de Chile. danny.gomez@uautonoma.cl