Vol. 40 (Number 30) Year 2019. Page 15

KAPRANOVA, L.D. 1; ERMOLOVSKAYA, O. Yu. 2; TYUTYUKINA, E.B. 3 & CHERNIKOVA, L.I. 4

Received: 29/05/2019 • Approved: 30/08/2019 • Published 09/09/2019

2. Statement of the problem and research methods

ABSTRACT: The article is based on the analysis of the investment processes in a Russian energy complex, distancing the main problems and priorities of the development of the branches of this complex based on an exhaustive analysis of its innovation and investment activities. |

RESUMEN: El artículo se basa en el análisis de los procesos de inversión en un complejo energético ruso, distacando los principales problemas y prioridades del desarrollo de las ramas de este complejo en base a un análisis exhaustivo de sus actividades de innovación e inversión. |

The fuel and energy complex of Russia (FEC) is the basic structural component of the economy, ensuring the functioning of the country's productive forces. It forms a significant part of the country's budget revenues.

About 40% of the country's budget consists of the sale of fuel and energy resources. The fixed assets of the FEC account for a third of the country's production assets. In 2017, the share of the fuel and energy sector in the country's GDP was 22.6%, in exports - 58.9%. The FEC of Russia is one of the most sustainable sectors of the country's economy, which is the basis for putting the country on the path of sustainable development and determines its geopolitical influence. To maintain the functioning of the FEC and preserve its position in the economy, the issue of financing of further development FEC, its modernization, introduction of innovations, increasing production profitability and using new opportunities to strengthen market positions is topical. The formation of a system of financial support for the complex development of the FEC also depends on the volume of necessary cost for upgrading and production facilities and their implementation, as well as the timing of financial resources, interest rates on borrowed sources of financing, which together affect the formation of the resource base in the fuel and energy sector complex.

The fuel and energy sectors, being basic and systemically important in the Russian economy, ensure the energy security of the country, and the main parameters for the development of its industries influence foreign policy, the development of the economy as a whole, the maintenance of economic growth and the maintenance of social stability in the country. The FEC unites a number of high-tech industries that create a multiplier effect, since they contribute to the development of engineering, construction and a wide range of services. Due to this, the economy creates a large number of jobs and, to a certain extent, solves employment problems.

Throughout the recent history of Russia, the question of the role of the FEC in the Russian economy remains quite relevant. At present, it is necessary to ensure the enhancement of the role of the fuel and energy complex in solving the strategic tasks of the Russian economy. Scientific studies prove the interrelation of long-term economic growth with the development of primarily basic industries and a significant increase in the level of technological innovations (Tenyakov, 2015). More than a quarter of Russia's products is produced in the fuel and energy sectors, they have a significant impact on the formation of the country's budget and provide half of foreign exchange earnings. In addition, the fixed assets of the FEC make up a third of the productive assets of industry, the enterprises of the complex employ more than three million people.

By supporting the innovation activities of energy companies, the state is able to influence a significant part of the national economy. The state owns an essential part of ownership in the FEC and, accordingly, the possibility of a high degree of participation in the activities of its companies through the implementation of long-term development programs (Maslennikov et al., 2017).

So, the state program "Energy Efficiency and Energy Development", approved by the Government of the Russian Federation in April 15, 2014 No. 321 and calculated until 2020, is aimed at:

• providing the country with highly reliable energy resources;

• increasing the efficiency of their usage;

• reducing the environmental impact of their production and transportation.

The section of this program “Development of the oil industry” provides for measures aimed at creating conditions under which the oil industry will be able to function, achieving the best financial and economic indicators.

In the section “Development of the gas industry”, among the main measures, the need for new developments in the field of technologies for liquefied natural gas, technological modernization of enterprises, construction of new enterprises, as well as modernization of existing underground storage facilities is indicated.

It should also be noted the great importance of the state program "Development of the nuclear power industry", approved by the Government of the Russian Federation on 02.06.2014 No. 596-12. Thus, in subprogramme 3, “Ensuring the innovative development of the civilian sector of the nuclear industry and expanding the usage of nuclear technologies,” the task is to develop innovative nuclear technologies and expand the scope of their application; development of international cooperation in the field of search and development of new ways of using the energy of the atomic nucleus (Ermolovskaya et al., 2018).

The adoption of programs indicates the interest of the state in the technological modernization of the FEC. This is confirmed by the forecast of the scientific and technological development of the Russian fuel and energy sectors for the period up to 2035, approved by the Minister of Energy of the Russian Federation of 10/14/2016 as a part of the implementation of measures ("roadmap") "Implementation of innovative technologies and modern materials in the FEC industries" approved by the order of the Government of the Russian Federation dated July 3, 2014 No. 1217р. (Order of the Government of the Russian Federation of 28.07.2017 N 1632-Р).

For analysis and evaluation of investment activities in the FEC of Russia, methods of economic and statistical research were used. On the basis of Rosstat data and materials of the Ministry of Energy of the Russian Federation, the dynamics of investments in the FEC of Russia were investigated by means of statistical analysis. The dynamic method allowed us to highlight the most important stages in the development and technological transformations of the FEC, including the findings of the main trends for the nearest future (Mottaeva and Chernukhina, 2018)

With the help of a comparative analysis, the strengths and weaknesses of the development of the FEC of Russia were identified. Correlation analysis made it possible to determine the most significant factors affecting the dynamics of investment processes in the generation and network complex.

In 2018, investments in the fixed capital of the Russian economy increased by almost 2% (the data will be updated), that is, by the same amount as in 2017. Moreover, if in 2017 more than 60% of the growth was provided by the FEC, in 2018 energy investments, especially in power generation, reduced by more than 17% due to excess capacity (most likely temporary) and the lack of new mechanisms to stimulate them. For comparison, in general, the volume of investment in the FEC in 2015 amounted to about 3.1 trillion rubles, in 2016 - 3.7 trillion rubles. in 2017 - 3.5 trillion rubles, an increase of 10% compared with the period 2015–2016.

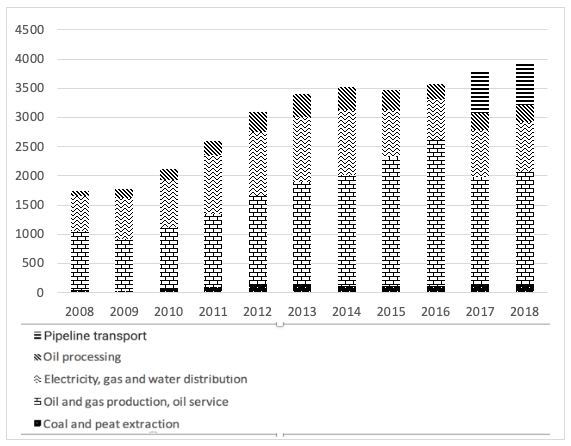

According to the data of the Analytical Centre under the Government of the Russian Federation, such a high rate was achieved due to the growth of investments in the production and supply of oil and gas - up to $ 1.13 trillion, or up to 62% of the total investment in the FEC. As follows from Figure 1, investments in the FEC of Russia in 2008–2018 were continuously growing (at nominal prices), although their growth rates began to decline as early as since 2013 due to the unfavorable investment climate, as well as problems investors themselves have to face (Official site of the Federal State Statistics Service)

Figure 1

Investments in the fuel and energy sector in

Russia in 2008–2018 (nominal prices) (2018)

At the present stage, the main increase in investment occurs in the oil and gas production sector and in the provision of services in this area. For 2008–2016, the volume of investments in oil and gas production increased almost 2.4 times (taking into account nominal prices) and reached 2.4 trillion rubles. in 2016, mainly due to the implementation of projects in the north and east of the country, as well as in areas of the shelf zone.

In 2015–2016, the volume of investment in the oil and gas industry decreased significantly due to a decrease in oil prices, which led to a drop in total investment in the FEC. In 2016, the volume of investment in the fuel and energy sector of Russia was about $ 80 billion, and the country ranked 4th in the world after China, the United States and India (Kirsanova, 2016).

In 2017, there is a negative trend in the financing of the oil industry, which manifested itself in 2014. The devaluation of the ruble led to a reduction in ruble costs for the extraction of raw materials and an increase in costs in dollar terms for the purchase of new equipment under the program for upgrading processing facilities. At the same time, in 2017, 129.2 billion rubles were invested in the modernization of oil refineries, and the accumulated investment since 2011 exceeded 1.3 trillion rubles. Of the 128 units envisaged by the plan for the modernization of oil refineries in 2011–2020, 78 were introduced and reconstructed by the end of 2017 [3]

Investment in fixed assets in the coal industry of Russia after a reduction that occurred in recent years, in 2017 increased by 37.5%.

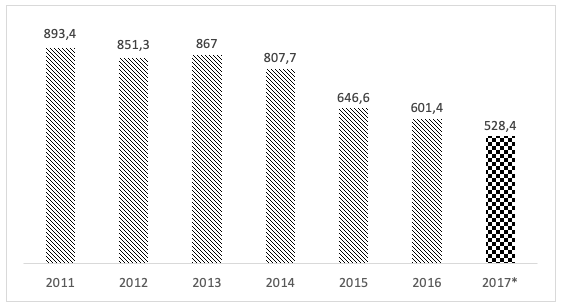

The decline in investment in the development of generation and the grid complex is explained by a decrease in the intensity of inputs under the electric generation modernization program in the country (Fig. 2).

Figure 2

Investments in the development of generation

and network complex (billion rubles)

In 2018, the growth of investments in fixed assets (statistics will be updated) is obviously related to the growth of investments in the extractive sector and, above all, in oil production. If we consider the statements of large and medium-sized companies (excluding small businesses), here the volume of investments grew by 3.2%. It should be emphasized that investment in mining as a whole, together with oil refining (2395 billion rubles in January-September 2018), is more than twice the investment in the processing industry minus oil refining (1107 billion rubles) and in mining minerals, these investments account for about 60% of retained earnings, in the manufacturing industry they do not reach 50%.

In 2018, it will be up to date. If we consider the statements of large and medium-sized companies (excluding small businesses), it has grown by 3.2%. Oil refining (2395 billion rubles in January-September 2018), 50% of retained earnings, in the manufacturing industry.

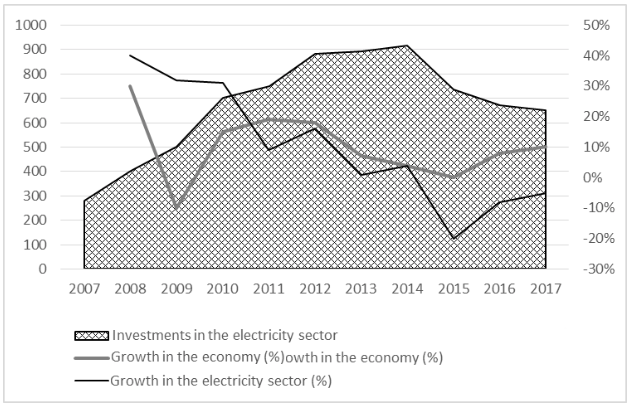

However, the growth rate of investments in the basis of capital in the power industry since 2011 is lower than in the country's economy as a whole (Fig. 3).

Figure 3

Capital investments in the electric power

industry in 2007–2017, billion rubles

Currently, the FEC is facing tasks related to structural changes in production, including the transition to the development of reserves of unconventional oil and oil occurring at great depths in dense rocks, which will lead to an increase in production costs. Therefore, in the fuel and energy sector, equipment modernization that is substantial in scale, the introduction of new innovative technologies for the extraction and processing of raw materials, the creation of independent oil and gas companies, and the integration of science with production are required.

Based on the Innovative Development Strategy of the Russian Federation, approved by the Government of the Russian Federation No. 2227-p dated December 8, 2011, the Corporate Innovation Development Programs (hereinafter - the PIR) were developed for a period of five to seven years, which contain descriptions of a set of measures necessary for implementation and market launch of innovative technologies, innovative products and services, as well as measures to modernize existing facilities and technological development of oil and gas companies. These programs provide for the adoption of such measures as the stimulation of innovation processes and the rationalization of approaches to the introduction of innovations, taking into account the unstable economic situation and global trends in the development of the FEC. Each company developing PIR focuses them on the business strategy of its business, taking into account the main market trends and national priorities of the country's technological development in the system of state strategic planning (Kozlov et al., 2014). At present, PIR is implemented by more than 60 companies, providing about 20% of Russian GDP. Among them are the largest state-owned companies in the mining industry (Gazprom, Rosneft).

According to the Action Plan (“Road Map”) “Introduction of innovative technologies and modern materials in the fuel and energy sector” for the period up to 2018, a set of tools to support innovative development of fuel and energy companies was formed, one of which is the selection and implementation of effective projects of national importance. In 2015–2017, 20 national projects on the implementation of innovative technologies and modern materials in the FEC were approved. The use of domestic technologies with the use of Russian materials, components and equipment will stimulate the development of heavy petroleum engineering in the country. Currently, the Ministry of Energy of Russia, together with the Ministry of Industry and Trade of Russia, is working to improve the measures of state support for national projects, and also together with major banks and financial institutions are negotiating to provide them with access to preferential sources of debt financing (Tenyakov, 2015).

September 28, 2016 was approved by the Council under the President of the Russian Federation for the modernization of the economy and innovative development of Russia "road map" in the direction of "Energy" of the national technology initiative and the concept of "Intelligent Energy System of Russia", which implies the modernization of the entire power industry of Russia in the next 15-20 years in order to achieve the leading position of Russian companies in the high-tech markets of the global energy industry. The road map in the direction of "Energy" represents the development of technologies and intellectual services, as well as the transformation of business models of organizations that will change the structure of the power industry, increase its reliability and safety.

The Ministry of Energy of Russia, having approved the “roadmap” for the introduction of innovative technologies, created a mechanism for stimulating innovative activity and introducing modern technologies in the fuel and energy sector. The “roadmap” emphasizes the need to implement national projects in the FEC, which are integrated programs for the introduction of technological innovations with high economic effect. It is assumed that these innovations will ensure the country's energy security and reduce its dependence on Western technologies and equipment. The largest Russian fuel and energy companies are gradually introducing digital and “intelligent” technologies, including those made in Russia, which are in line with the advanced global trends.

In the oil and gas sector, the most promising areas for innovative development are technologies for increasing oil recovery, developing hard-to-recover oil reserves, including the shelf zone, as well as technology for producing liquefied natural gas and its delivering. According to expert estimates, the technology of "smart wells" and "digital fields" can reduce the cost of field exploitation by about 20%. According to the calculations of the independent national industry consultant on the development of the FEC of Russia Vygon Consulting, by 2030 digital technologies will produce about 155 million tons of oil over the current level of production and at the same time they will compensate for the decline in oil production at depleted oil fields where oil production has lost economic sense.

In the coal industry, the development of high-performance tunneling complexes and the use of modern remote control and monitoring of bottomhole processes are the top priorities.

Currently, the power industry is working to improve the reliability of the national energy systems due to the development of active-adaptive power grid technologies, Smart Grid and Energy Net technology concepts, the introduction of automated protection and control systems for electrical substations (“digital substation”), new electrical and electronic equipment, the use of new structural materials, including composite materials, etc.

One of the most important global trends is the growing market for distributed energy resources. According to the Skolkovo Energy Center, the global market for distributed energy technologies is growing at an average of 6–9% per year. According to the International Energy Agency (IEA), by 2030, distributed energy will provide up to 75% of new connections during global electrification (Bogoviz et al., 2018).

In the nuclear power industry, the advanced digital project management system Multi-D has been created in the Rosatom state corporation, which makes it possible to effectively manage all stages of the NPP life cycle.

Large-scale modernization of the fuel and energy complex will require substantial investments and support from the state. The main sources of investment in innovation can be enterprises, large corporations, small innovative companies, the state, investment funds, innovation development funds, etc.

Financing of the FEC is carried out at the expense of internal and external sources. However, domestic sources of investment resources (retained earnings, depreciation funds and funds received from the sale of own assets) prevail. External sources (budget allocations to investment programs that have national priorities, bank loans, foreign investment) are used to a much lesser extent.

The Federal State Statistics Service of the Russian Federation as of 2017 in 85 constituent entities of the Russian Federation carried out a selective survey of investment activity of organizations engaged in mining, electricity, gas and steam, air conditioning, water supply, water disposal, waste collection and recycling. This activity includes the elimination of pollution, and the manufacturing industry. It was attended by 23.7 thousand organizations. It was found that the main source of financing investment in fixed assets for most organizations in 2017 was their own funds, they were used by 81% of respondents. In organizations engaged in the extraction of crude oil and natural gas, coal mining, metallurgical production, production of coke and petroleum products, the provision of services in the field of mining and the provision of electric energy, gas and steam; air conditioning, on the use of own funds, as the main source of financing indicated from 95% to 98% of managers. The main purpose of investing in fixed assets is to replace worn-out machinery and equipment, as indicated by 65% of respondents. Investments to improve production efficiency, such as: automating or mechanizing the existing production process, were carried out by 45% of organizations, reducing production costs by 39%, saving energy resources by 38% and introducing new production technologies by 34% of respondents (Schueffel, 2016).

The high share of own funds in the investment structure indicates the priority of investment programs of energy companies aimed at solving current problems.

As for the budget expenditures, in the FEC they are regulated by two state programs: “Development of the nuclear power industry” and “Energy efficiency and energy development”. In the first direction, in 2019 expenses will amount to 66.2 billion rubles (and in 2020 - 66.9 billion rubles). To implement the activities of the state program "Energy Efficiency and Energy Development" in 2019, 13.4 billion rubles were allocated, and in 2020 - 15.2 billion rubles.

Supposed that as a result of the implementation of the above measures by 2020, the energy intensity of GDP will be reduced by 9.41% compared to 2007, the depth of refining of crude oil will increase to 85% and annual oil and condensate production will stabilize at 548 million tons.

In general, this will ensure not only accelerated development of the FEC, but also will stimulate the development of other sectors of the Russian economy.

The FEC of Russia is one of the most important and sustainable developing industrial complexes of the country, which not only meets the needs of society for energy products and services, but also the national energy security of the country, as well as being the backbone of the economy. The volume of investments in the FEC of Russia and the energy supply of the country's economy from 2011 to 2035 can range from $ 2.8 trillion to $ 3.2 trillion (in 2010 prices), according to forecasts provided by the analytical centre under the Government of the Russian Federation and taking into account the energy strategy of the Russian Federation to 2035 of the year. Thus, over the next years, $ 114-127 billion will be sent annually to the FEC and energy supply. This is significantly more than the current level of investment. And regardless of the scenario of the development of the FEC, there will be no simportant changes in the structure of investments. According to the forecast, the largest share of funds will be directed to the oil and gas sector (from 61% of all investments - in the target scenario to 64% - in the conservative scenario).

However, various factors have a substantial notable influence on investment activity. Correlation analysis allowed identifying the most substantial notable factors affecting the dynamics of investments in the largest energy companies. The results of the analysis are presented in Table 1.

Table 1

Assessment of the influence of the most significant factors on the formation of investment

policy in the largest fuel and energy companies for 2008-2017

(on the example of Gazprom, Rosneft, Surgutneftegaz, Lukoil, Tatneft, Rusneft, NOVATEK)

# |

Economic factors |

Correlation coefficient |

Link character |

11 |

The degree of deterioration of production assets |

0,90 |

The link is direct strong |

22 |

Dynamics of production |

0,89 |

The link is high and direct |

33 |

World energy market conjuncture |

0,85 |

The link is high and direct |

44 |

The level of innovation activity of companies in the fuel and energy complex |

0,72 |

The link is high and direct |

55 |

Volumes of geological exploration |

0,64 |

The link is high and noticeable |

66 |

The structure of oil reserves |

0,62 |

The link is high and noticeable |

According to the analysis, the most significant factors are: the depreciation of OPF, the dynamics of production, the situation on the world energy market, the level of innovation activity.

After the successful implementation of the CDM program (power supply contract) aimed at building new generating capacity in the Russian electric power industry, the Government developed a new program, CDM-2, according to which it is planned to modernize outdated heat generating electric power (over 45 years old) in a total volume of up to 41 GW. to reduce operating costs and improve fuel efficiency. The program will allow for 10 years to attract 1.9 trillion rubles of private investment in the modernization of thermal power plants. According to economists, a more significant effect is expected than just updating equipment at power plants. While implementing this program, mainly domestic equipment will be used. At the same time, it is intended to address such issues as expanding of the localization of advanced foreign technologies and equipment produced by domestic machine-building companies. The program is valid until 2035. In 2019, this program will be the first selection of projects for the modernization of thermal generation on a competitive basis.

In order to increase extraction, expand the interest of companies to invest in equipment modernization and innovation, as well as increase the attractiveness of production in regions with a huge resource base, it is necessary to introduce a set of stimuluting measures. At present, the Ministry of Energy offers a range of stimulus, including the use of a higher depreciation rate for investments in fields in Western Siberia, the introduction of incentives for geological exploration, a change in the procedure for granting benefits on new fields, the introduction of a reduction coefficient of MET for companies using tertiary oil recovery methods, as well as oil rims, the development of which is currently unprofitable. According to some estimates, in aggregate, these measures will allow the working out of more than 4 billion tons of reserves, the development of which is currently unprofitable, thereby reducing the share of existing unprofitable reserves from 50% to 37%.” (Meeting of the Public Council under the Ministry of Energy of Russia).

The most important place in the FEC belongs to the oil industry, the development of which is given primary attention. Among the proposed measures for maintaining and developing the industry among researchers and the Ministry of Energy, various mechanisms are discussed.

In the oil and gas sector, it is planned to introduce a taxation system depending on the economic efficiency of field development - the additional income tax (NDD) for pilot projects, which can stimulate the development of new fields and oil production from depleted wells. The application of the tax will allow taking into account the peculiarities of the fields, production conditions, costs and other economic indicators, as well as transfer the main part of the fiscal burden to the later stages of field development. In the future, oil fields in Western Siberia are likely to switch completely to NDD. According to experts, the effect of the expansion of NDD will bring the budget 1.2 trillion rubles. taxes, and the increase in investment in the oil industry will be about 3.5 trillion rubles. until 2035 year. It is proposed to apply the reduction coefficient of the mineral extraction tax on additional oil production volumes obtained using methods of enhanced oil recovery. It is proposed to legislatively change the criteria and provide benefits to new fields instead of fixing specific dates of commencement and termination of the mineral extraction tax (mineral extraction tax) benefits. Namely, to provide benefits from the moment when the degree of depletion of the deposit is reached at the level of 1%. In the current edition of the Tax Code, benefits for such projects are valid until the cumulative oil production is reached from 10 to 35 million tons or for a period up to 2021 (Dmitrievsky et al., 2016).

In order to stimulate exploration, a tax deduction on income tax is proposed, which can be spent on land exploration.

As another fiscal measure, the possible consequences of the entry into force on January 1, 2019 of a law that will reduce the risks associated with price volatility on world markets are discussed. This is a damping excise on oil that will be paid to refineries under the condition that their parent companies are subject to sanctions, and if they processed more than 600 thousand tons of oil in 2017 and within one quarter the production of gasoline or naphtha for petrochemical companies is 10% of the oil processed at the refinery, and the total supply of the total volume of products to the domestic market reached 5 th. tons. The state can provide independent refineries that do not produce the necessary gasoline with the opportunity to receive a reverse excise tax on oil if they enter an agreement with the Ministry of Energy to modernize production to 2024 in the amount of not less than 60 billion rubles.

Among other support mechanisms for the oil industry, of interest is uplift, which involves the use of an increased investment depreciation rate for Western Siberia, which allows to increase free cash flow per barrel of extracted oil from $ 3.1 to $ 6.2, and additional production from 2019 to 2035 may increase to 461 million tons. Moreover, the increase in tax revenues to the consolidated budget of the country can reach, according to expert estimates, 5.3 trillion rubles, and additional investments will amount to 1.85 billion rubles (Menshikov and Chuprikova, 2016).

It is also proposed to apply the stimulation of the development of sub-gas deposits. As emphasized by the Ministry of Energy, today they are not introduced into the development for economic reasons, although according to specialists' estimates, these deposits would additionally bring 6.9 billion tons of oil. The Ministry of Energy proposes to start the development of thin oil rims, providing oilmen with tax breaks.

New incentive measures will be applied in 2019, because, according to economists, maintaining the current taxation system may cause a drop in oil production in Western Siberia from the current 330 million to 180 million tons by 2035, and in some cases up to 146 million tons. It is predicted that the largest volume of oil production, if nothing is changed, will be 570 million tons in 2021. Without stimulating the oil industry, the country's budget starting from 2022 will receive less taxes by 3.3 trillion rubles, and investments will decrease by 1.3 trillion rubles. According to the energy strategy, $ 46-49 billion will be sent annually to the oil industry (Khokhlov, 2018). The growth of investments in the oil sector will not be aimed at increasing the volume of oil production or refining, but at maintaining the current level of production, which is associated with the need for large amounts of investment to finance more costly projects in the industry due to the development of difficult-to-recover oil reserves in remote areas of the east and the north of the country, as well as on the shelf.

By 2024, the tax maneuver in the oil industry should be completed. By this period, a gradual reduction of the export duty rate from the current 30% to 0% should be introduced, while the mineral extraction tax (MET) should be increased, and excise taxes on petroleum products should be adjusted. Before that, the government had already done a small tax maneuver in 2014–2017, when the oil duty was reduced from 60% to 55%, and a large tax maneuver in 2015–2017, when the duty was reduced from 55% to the current 30%. with simultaneous growth of MET.

There is a fear that the growth of the mineral extraction tax and the reduction of export duties on oil may lead to an increase in its domestic price, resulting in an increase in the cost of production of petroleum products. To dampen domestic fuel prices, damping mechanisms will be applied when the state compensates companies for the difference between export price.

The gas industry will become another branch of the fuel and energy complex in terms of capital investments, with an annual investment volume of up to 2035 estimated at $ 27-29 billion. The increase in investment in the gas industry is expected both due to the projected increase in gas production (by almost 44% in 2035 compared to 2010), and through the implementation of infrastructure projects for the transportation and storage of gas. The volume of investments in the power industry is estimated at $ 23-29 billion. Investments in solar and wind energy in Russia are low, they amounted to about 4.5 billion dollars over the past three years. The reason for this situation is the lack of a targeted government program for the use of non-traditional energy resources in Russia. Experts in this area assert that only nuclear power plants can provide enough electricity. Although in Russia, from an economic point of view, it is necessary to develop all types of alternative energy, including the production of biofuels.

The proposed measures should stimulate the production of new modern, high-performance facilities and will allow the transition to long-term regulation of the fuel and energy sector. According to the Ministry of Energy, the competitiveness of power and heat-and-power engineering should increase, issues related to the development of the electric grid complex, which should switch to a digital model of operation, have been resolved. Petromarket analysts in their study emphasize that the tax maneuver will allow a certain gain to petrochemical companies, airlines, as well as consumers of gasoline and diesel fuel due to a "damping surcharge" to returnable excise. Oil refineries will receive this premium if they keep prices for motor fuels no higher than a predetermined level.

Investments are one of the most important factors of a country's economic development, which together with innovations provide technological renewal of production processes, restructuring and diversification of production both as a whole and the FEC, which is a backbone complex of the Russian economy and makes a significant contribution to ensuring the economic development of the country.

The main focus of investment activity in the FEC is to develop new technologies, modernize the technical base, develop modern methods of coal mining and increase oil recovery, create favorable economic conditions for the start of industrial production of hard-to-recover reserves, transition to carbon-free sources of energy and to energy carriers able to reduce energy consumption and reduce their cost, as well as reduce the negative impact of the FEC on the environment.

Being the largest customer for many related industries (mechanical engineering, metallurgy, chemistry, etc.) and the economy (construction, transport), the Russian FEC will make a tangible contribution to the investment support of the innovative development of the domestic economy.

The government’s fiscal measures, primarily related to the oil-producing and oil-refining sectors of the economy, will stimulate production, increase investment in the industry and increase budget revenues, as well as gain control over domestic gas and engine prices. Measures to stimulate stimulation of exploration, as well as expanding the value added tax on all fields in Western Siberia and expanding the list of benefits for new fields will lead to an increase in oil production and, accordingly, taxes, budget revenues and an increase in investment in the fuel and energy sector. The government received more rights to raise the export duty on petroleum products as an extreme measure, allowing to regulate the volume of supply in the domestic market and, accordingly, to prevent a sharp rise in retail fuel prices.

Bogoviz, A.V., Chernukhina, G.N., Mezhova, L.N. (2018). Subsystem of the territory management in the interests of solving issues of regional development. Quality - Access to Success, 19, 152-154.

Dmitrievsky, A.N., Kamkov, N.I., Krotova, M.V., Romantsov, V.S. (2016). Strategic Alternatives for Import Substitution of Equipment for Oil and Gas Complex. Problems of Forecasting, 8, 18-34

Ermolovskaya, O.Y. Telegina, Z.A. Golovetsky, N.Y. (2018). Economic incentives of creation of highproductive jobs as a basis for providing globallyoriented development of the economy of modern Russia. Quality - Access to Success, 19(S2), 43-47.

Investments in the fuel and energy sector in Russia in 2008–2018 (nominal prices) (2018). Energy Bulletin, 61. Retrieved from: http://ac.gov.ru/files/publication/a/17203.pdf (In Russ.)

Khokhlov, A.D. (2018). Distributed energy - potential in Russia. Moscow: Energy Center. Retrieved from: https://energy.skolkovo.ru/downloads/documents/SEneC/Research/SKOLKOVO_EneC_DER-3.0_2018.02.01.pdf (In Russ.)

Kirsanova, E.V. (2016). Overview of the activities of small and medium-sized enterprises in a crisis external environment. Management in Russia and abroad, 2, 141-142 (In Russ.)

Kozlov, K.K., Sokolov, D.G., Yudaeva, K.V. (2014). Innovative Activity of Russian Firms. Economic Journal of the Higher School of Economics, 8(3), 399-420 (In Russ.)

Maslennikov, V.V., Fedotova, M.A., Sorokin A.N. (2017). New financial technologies are changing our world. Journal of Finance: theory and practice, 2(98), 6-11 (In Russ.)

Menshikov, V.I., Chuprikova, N.V. (2016). State programs to support investment projects implemented in the Russian regions. Socio-economic developments and processes, 11, 45-52. https://cyberleninka.ru/article/v/gosudarstvennye-programmy-podderzhki-investitsionnyh-proektov-realizuemyh-v-rossiyskih-regionah (In Russ.)

Meeting of the Public Council under the Ministry of Energy of Russia. Retrived from: https://oilcapital.ru/news/regulation/22-03-2018/sostoyalos-zasedanie-obschestvennogo-soveta-pri-minenergo-rossii (In Russ.)

Mottaeva, A.B., Chernukhina, G.N. (2018). Venture entrepreneurship: specificity, the most important areas and development prospects in the Russian Federation. Economy and entrepreneurship, 12(101), 656-660. (In Russ.)

Official site of the Federal State Statistics Service. Retrieved from: http://www.gks.ru. (In Russ.)

Order of the Government of the Russian Federation of 28.07.2017 N 1632-Р. The program "Digital Economy of the Russian Federation. Retrieved from: http://static.government.ru/media/files/9gFM4FHj4PsB79I5v7yLVuPgu4bvR7M0.pdf (In Russ.)

Schueffel, P. (2016). Taming the Beast: A Scientific Definition of Fintech. Journal of Innovation Management, 4(4), 32-54.

Tenyakov, I.M. (2015). Modern economic growth: sources, factors, quality. Moscow: Moscow State University Lomonosov. (In Russ.)

1. Financial University under the Government of the Russian Federation.

2. Financial University under the Government of the Russian Federation

3. Financial University under the Government of the Russian Federation

4. Financial University under the Government of the Russian Federation