Vol. 40 (Number 30) Year 2019. Page 17

TONYSHEVA, Lyubov L. 1; YAKUNINA, Olga G. 2; YAKUNIN, Dmitry E. 3

Received: 30/05/2019 • Approved: 16/08/2019 • Published 09/09/2019

ABSTRACT: This paper considers the issues regarding oilfield service companies’ strategic development and their features in a dynamically changing environment. The concept “strategic development” is specified within the research context. An algorithm to select the priorities for such a strategic development is developed; and operations composition and content within the framework of the algorithm stages have been individualized. Economic modelling is used to substantiate the matrix method with respect to choosing the company’s development strategy, while accounting for service zoning. |

RESUMEN: Este trabajo se enfoca en los problemas relacionados con el desarrollo estraégico de las compañías de servicios petroleros y sus características en un entorno que cambia dinámicamente. El concepto de "desarrollo estratégico" se especifica dentro del contexto de la investigación. Se desarrolla un algoritmo para seleccionar las prioridades para tal desarrollo estratégico; y la composición y el contenido de las operaciones en el marco de las etapas del algoritmo se han individualizado. El modelo económico se utiliza para corroborar el método matricial con respecto a la elección de la estrategia de desarrollo de la empresa, al tiempo que representa la zonificación de servicios. |

The development of oil services as one of the most important areas of modern businesses is quite clearly defined as a result of institutional transformation processes that are widely used in the oil and gas sectors of the economy that are particularly associated with organizational changes in vertically integrated oil companies (Takhumova et al., 2018; Osadchy et al., 2018). The necessity of oil and gas production enterprises to focus on targeted types of work in order to ensure high incomes while minimizing the costs for oilfield services has not only led to the separation of auxiliary and service facilities but also the creation of specialized oilfield service structures. At the same time, the successful development of these companies in the context of an environment marked by economic instability, which is currently aggravated by the extension of economic sanctions, especially informs the actual issues regarding the strategic management of economic entity development at each stage of its functioning within a company’s life cycle (Plenkina et al., 2018).

Determining the priorities for the development of oilfield services requires the creation and study of models, real-life facilities, the processes involved, and the related phenomena, in order to obtain explanations of such phenomena, as well as evaluate their possible results, especially those valuable to the top management.

Modelling as a special method of studying social and natural reality is based on creating special kinds of analogs - models. The economic model as a formalized description of an economic process or phenomenon, the structure of which is determined both by its objective properties and the subjective target character of the research, has certain advantages. These advantages contribute to the separation of the main parameters of the object under study from secondary ones, internal ones from external ones, and constantly reproducible ones from random ones; help to formalize events occurring in the object of the study; allow the more accurate identification and characterization of current regularities that could not manifest themselves before the creation of the model; define the structures of phenomena and processes, time lags in changing parameters, etc.; and contribute to the establishment of essential higher-level interrelationships (Orekhov, 2006).

The range of modelling methods is quite diverse. The matrix method should be referred to as a decision-making method, which involves finding areas of the object’s sustainable competitive advantage. Matrix tooling, which is widely used in management and especially in strategic management, does not have clear methodological substantiation. Without aspiring to universality, it allows the graphic, visual, and easy presentation of the information necessary for strategic management and the exploration of the factors influencing the object under study.

The methodological approach of the research, represented by the matrix of the oilfield service company’s development strategy, focuses on identifying service areas characterized by a specific set of activities. It also focuses on providing service products of a certain level of competitiveness that meet customization requirements and are especially important for the economic entity based on the system of the oilfield services’ market attractiveness indicators and the available strategic competitive advantages of companies. This allows to define a set of actions to ensure their strategic development trends taking into account the spatiotemporal interrelationship and the potential to provide required oilfield services.

The most important prerequisite, and the factor influencing the further strategic development of the oilfield services’ business, is the necessity to accomplish the tasks set within the framework of the Energy Strategy of Russia for the period up to 2030, associated with the increase of raw hydrocarbons output capacity: the promotion to create Russian independent engineering companies; the government support to import key complex technologies with obligations to localize them; the development of maintenance and engineering services’ market in the field of the subsurface management; the gradual increase of the independent segment share in the field of services and engineering to 50 percent (Tonysheva et al., 2013; Ministry of Energy of Russian Federation, 2009).

The successful strategic development of oilfield service companies requires the theoretical and methodological support and its timely updating, which meet modern requirements and the technological mode. Specifically, it is necessary to clarify the concept of the “development strategy” or “strategic development”, which can be used as identical concepts. Various authors dealing with strategic management issues have provided their own semantic meaning and understanding of this definition. Gradova (2003) determines the development strategy as a set of rational methods to achieve long-term goals in the context of the unstable environment. Katkalo’s (2006) interpretation focuses on the fact that this is the proactive management style based on the vision of the company’s future image and on its dynamic organizational capacity for the renewal, while taking into account both environment changes and its business model, allowing for the appropriation of economic benefits inaccessible to competitors. Kruglov (1998) considers the company’s development strategy from the perspective of trends applied by its top management or methods of its activities to achieve an important result having a long-lasting effect. Many foreign scientists whose works deal with strategic management and planning have paid great attention to the company’s development strategy (Ackoff, 1985; Ansoff, 1999; Porter, 2005; Lorange, 2004; Thompson & Strickland, 2002; Mintzberg et al., 2001).

Unlike the interpretation of the term “strategy”, the concept of the “development strategy” is undoubtedly associated with the dynamics and focus on the long-term perspective. In this article, under oilfield service company’s strategic development a generalized model of actions is aimed at achieving set goals, implying the company’s ability for organizational and economic transformations in the dynamic market environment by applying effective management tools using strategic competitive advantages.

It should also be noted that the concepts of competitive advantages and strategic competitive advantages are not synonymous, and are used depending on the business situation under consideration (Matveyeva, 2018). In the context of the study, strategic competitive advantages as unique tangible and intangible assets should be aimed at the long-term perspective and should be formed on the basis of forecasts for the development of the environment, industry market, and its segments, as well as the increase of the company’s service potential within the framework of possible strategic development trends, while taking into account interests of strategic stakeholders (Tonysheva & Chumlyakova, 2016).

The algorithmization process does not have a strictly expressed formalized mathematical scheme; therefore, the use of the heuristic approach based on the non-standard vision of possibilities to solve problems to substantiate and decompose main components of the algorithm, as well as external and internal influencing factors, is fully justified.

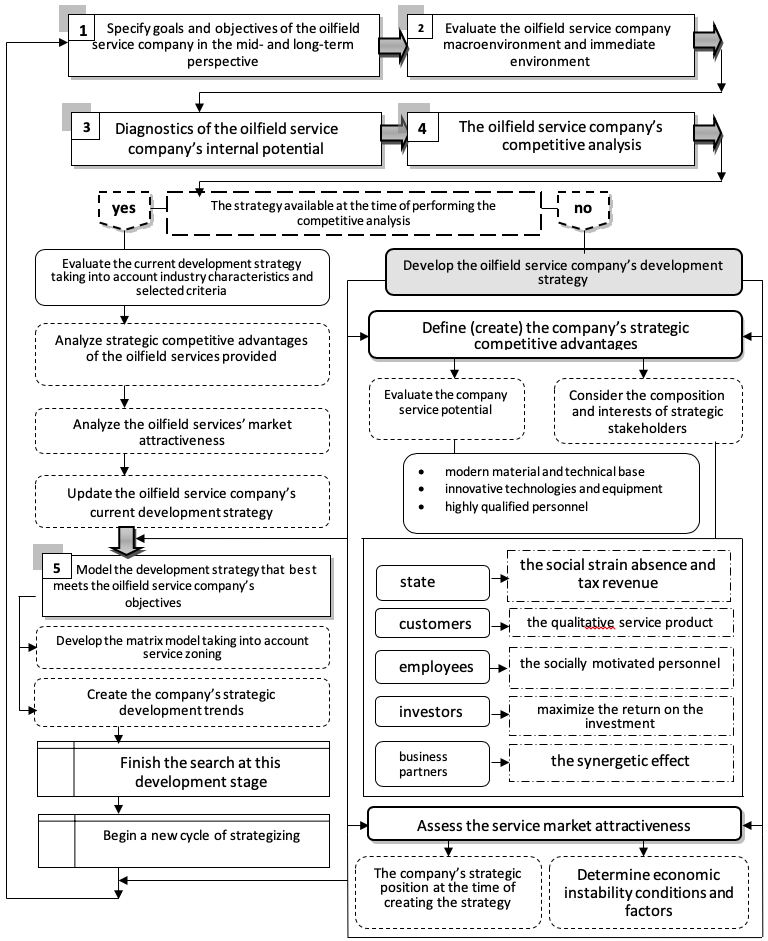

The entire sequence of actions within the framework of the algorithm should be structured operationally (Figure 1). At the first stage, it is envisaged to clarify strategic benchmarks of the oilfield service company in the current economic environment by clarifying goals and objectives of its activities, allowing to position the company in a certain way as the economic agent in the mid- and long-term perspective, as well as to specify its position in relation to other competing enterprises and further intentions. The second stage is devoted to evaluating environmental parameters and their impact on oil and gas service enterprise development. Macroeconomic and immediate environmental factors of the enterprise are to be evaluated, including market conditions for oilfield services, sectoral sanctions for oil and gas sector enterprises, the increase of the cost to acquire equipment by oilfield service enterprises to render services, difficulties in acquiring and using innovative technologies, the imperfection of the legal and regulatory framework of relations between oil-gas and independent service companies, the pressure on the part of oil services’ customers in the field of prices, the low competitiveness of domestic oilfield services against foreign competitors, etc.

At the third stage, the diagnostics of the internal potential of the oilfield service company is performed, the essence of which is to identify strengths and weaknesses of the company. Diagnostics is performed in the context of basic components of the internal potential. The diagnostics of human resources, the compliance of the professional and qualification level of the company’s personnel with set goals and objectives, the loyalty of the company’s employees and motives of their work, and the labor payment and stimulation mechanism are studied. In evaluating the organizational component, the following should be specified: the rationality of the allocation of functions within the organizational structure, the level of management expenses, and the possibility to reduce them. The production unit analyzes the adequacy of the production capacity to render competitive services at the current level of modern technology and engineering, researches and developments and their economic efficiency, the cost value in comparison with competitors, etc. When studying the marketing component, the price factor is of importance, since fixing the price for services of oilfield service companies today largely determines their positioning in the market and the company’s revenues. To perform the diagnostics of the financial component, it is necessary to evaluate changes in profit indicators and costs to render services, opportunities to raise investment resources on a mid- and long-term basis.

When forming the fourth stage of the algorithm, one should take into account that at the time of performing the strategic analysis, the object of the study is already implementing a certain development strategy. In this case, the current strategy is being evaluated and updated. In case of the absence of the development strategy, its development is assumed. Particularly relevant is the definition (or creation) of strategic competitive advantages of the enterprise against the background of the current market conditions and the environment dynamic development. Currently, there is no universal system of indicators reflecting the competitiveness of services in general and oilfield services in particular, therefore the composition of estimated indicators, their content and formalized presentation is one of tasks to be solved in the process of the strategic algorithmization. To determine competitive advantages of services, it seems appropriate to use: the characteristics of the oilfield services provided; the price level and quality of services provided; the growth rate of the oilfield service company’s profit and cost-effectiveness; the growth of oilfield services’ sales and customer loyalty; the degree of use of innovative technologies and equipment by the oilfield service company; improving the reputation and strengthening the brand position in the market of oilfield services, etc.

Indicators to identify the oilfield services’ market attractiveness are the following: the size and growth rate of the oilfield services’ market in terms of its segments; the profitability of the oilfield services’ market target segment and the share occupied by this service company; the cyclical nature of the oilfield services’ market (annual fluctuations of sales); market shares of large companies (concentration index); the variation of total sales among companies in the oilfield service industry; strategic and non-strategic barriers to enter the oilfield services’ market as per the nature of policies of dominant companies in relation to competitors, etc.

Figure 1

The Specified Algorithm to Select the Oilfield

Service Company’s Development Strategy

In the concluding part of the algorithm (the fifth stage) the oilfield service enterprise’s development strategy is finally created on the basis of the performed diagnostics and identified development opportunities in the mid- and long-term perspective.

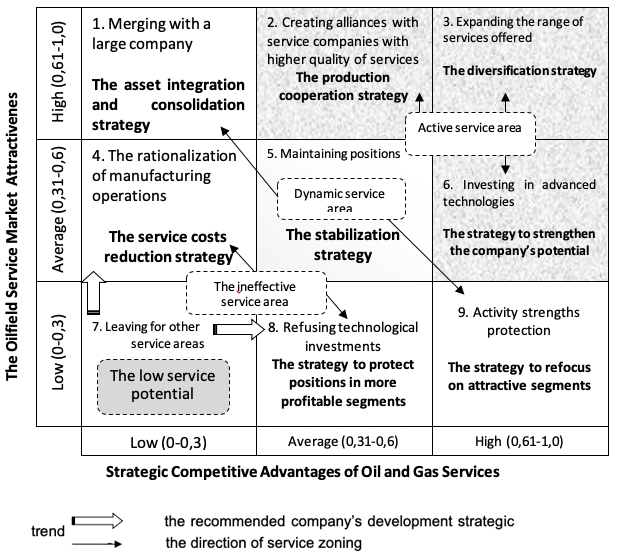

One of fairly common methodological approaches used to model the enterprise development strategy is the matrix approach. Currently, the theory and practice of strategic management offers a variety of matrix tooling that is suitable to solve multi-scale tasks. Advantages of using matrix tools, in addition to clear visualization, include the possibility to interconnect the most significant factors selected as the basis for a particular matrix model and to develop the company’s strategic development trends. The main disadvantages of matrix tools are the lack of dynamics in evaluating strategic processes and the company’s potential, operating a limited number of parameters chosen as the basis to construct a matrix (Deryabina, 2014; Loginov, 2005; Yefremov, 1998). Some inconsistency in the use of matrix models is in the fact that the possibility of standardizing strategies, provided earlier as an advantage, is at the same time a disadvantage, since the model does not specify the strategy implementation direction. These drawbacks are not an obstacle to use the matrix method to select strategic benchmarks to develop oilfield service companies. The proper version of the matrix model includes such basic parameters as oilfield services’ strategic competitive advantages and the oilfield services’ market attractiveness as integral criteria (Figure 2).

Figure 2

The Proposed Matrix Model to Choose the Oilfield

Service Company’s Development Strategy

A distinctive feature of this development is the possibility to synchronize the evaluation of the company’s strategic position in the industry with the allocation of service areas, as well as the development and justification of the strategic development trend, in particular, due to current competitive advantages of oilfield services. The service area in the author's interpretation is a set of companies having an identical level of service potential and providing service products of a certain level of competitiveness (Tonysheva et al., 2013). The proposed matrix identifies the following service areas or service zones, and corresponding development strategies depending on the company’s potential, available competitive advantages of oilfield services, and conditions in the market environment:

1) the area of active and dynamic development of the company’s service activities (quadrants 2,3,6). The best positions of the company rendering oilfield services are visualized diagonally from the left to the right and from the bottom to the top. This area is characterized by a rather high potential of service activities and allows to accumulate competitive advantages to maintain strong positions in the market.

2) the area of moderately dynamic development of service activities (or a dynamic service area). These are quadrants 1, 5, 9, located diagonally having the direction from the right to the left and from the bottom to the top. The service area considered is not characterized by a high activity but still allows to move to adjacent quadrant areas using either competitive advantages of services or environment opportunities - the industry market.

3) the area of the inefficient service activity/industry is characterized by a certain inertness from the development point of view (quadrants 4, 8). In other words, it can be called a neutral service area since the active use of strategic management tools at this stage is very difficult.

4) the area of the low service potential to maintain and develop the company’s activity (quadrant 7) where the combination of low estimates of the parameters under study makes a cardinal breakthrough into more attractive areas of the service activity impossible.

The matrix model provided allows to outline options for the strategic dynamics in the denoted area and to clarify viable strategies to be implemented in prevailing conditions. Within the limits of the active service area and as one moves towards it from the side of adjacent service areas, one can speak of the company’s intensive strategic development trend. The combination of high and average estimates of the parameters set provides conditions to strengthen and/or develop the company’s potential, including by expanding the intragroup range of services offered, investing in advanced technologies, and establishing production partnership relations with other service companies. Recommended strategies for the active service area can be: the diversification strategy, the strategy to strengthen the company’s potential, the production cooperation strategy.

The trend of supporting (or stabilizing) strategic development is more characteristic for the area of the moderately dynamic development of service activities. This is more of a wait-and-see attitude which allows, nevertheless, to completely and comprehensively evaluate the situation in the oilfield services’ market and to determine the motion in a more acceptable direction of the company development. In this case, it is advisable to implement the position maintenance strategy (or the stabilization strategy), as well as the strategy to refocus on more attractive market segments.

When the company operates in quadrant 1, and when making the decision to merge with a larger company (or to restructure by consolidating), on formal grounds the original business unit ceases to exist independently as a legal entity. Obviously, the asset integration and consolidation strategy reflects in some sense the regressive strategic development trend. However, with low estimates of competitive advantages of the company’s services and the high market attractiveness, it is preferable to merge with a competitor to preserve the company’s asset package and qualified personnel as opposed to leaving the market.

The activity ineffective service area is characterized by the selective strategic development trend, the essence of which consists in influencing individual elements of the service activity in order to improve them. Under present circumstances, it is advisable to speak about the acceptability to implement the strategy to reduce costs for service activities and strategies to protect positions in more profitable segments. In the area of the low service potential, having the combination of the low market attractiveness and low competitive advantages of oilfield services, the company can use the only reasonable strategy to move to the nearest adjacent service areas. In case of changing the strategic development trend, the company will certainly have to make some efforts to accumulate elements of its inner potential.

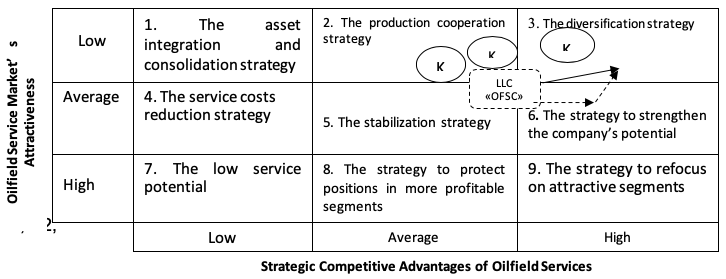

Following the technology described, the matrix model has been constructed to determine the current strategic position of the oilfield service company under study and main competitors referred to the strategic group in the object activity area of the same service segment. The matrix model is shown in a simplified version (Figure 3).

Figure 3

Strategic Development Trends of the

Oilfield Service Company under Study

Note: K3 – the strategic group of competitors, LLC “OFSC” –

the oilfield service company under study

Due to the need to preserve the confidentiality of the information about activities of companies under study, competing enterprises have been assigned sequence numbers, and the company under study has been assigned the conventional name LLC “Oilfield Service Company” (LLC “OFSC”). Obviously, the competing enterprise 1, a large domestic company having strong advantages and operating in an active service area, has a significant advantage over its competitors, while the remaining competing objects (2 and 3) are approximately in the same “weight category” and tend to take best positions. The position of LLC “OFSC” is noteworthy because being on the border of service areas and smaller in size and the number of employees than the main strategic competitive group, the company still aspires to improve its strategic position by implementing strategic competitive advantages described above in the subsections of the article.

Achieving the best positions of the oilfield service company under study is associated with two possible strategic development trends. Having favorable environment conditions and the company adequate service potential, as well as the proper use of its strategic competitive advantages, in particular, based on developing innovative solutions, the “breakthrough” strategic development trend to the active service area is possible. At the same time, the neighborhood of a major competitor will not interfere with the company activities, since there are buyers with different levels of solvency in the market. In addition, taking into account the investment of LLC ”OFSC” in its own developments in the adjacent segment (field surveys of wells the demand for which is currently growing), there is a high probability of developing and increasing a market share due to expanding the range of services offered to customers. This trend corresponds to the diversification strategy. The second strategic development trend is a “softer” (gradual) version of moving to the active service area. First, the company invests in advanced technologies, implementing the strategy to strengthen the company potential, and then advances into the matrix quadrant, which is preferable in terms of services and increments of service revenues in a more profitable market segment.

Works of both domestic and foreign scientists, including those reflecting issues of creating the company development strategy (Kruglov, 1998; Vikhansky, 1998; Gradova, 2003; Katkalo, 2006; Mintzberg et al., 2001; Porter, 2005; Lorange, 2004; Thompson & Strickland, 2002; Peleckis, 2015; Banabakova & Georgiev, 2018) are devoted to researches in the field of strategic management and planning. In scientific publications devoted to issues of strategic planning and management, a relatively typed classification of schools of the strategic planning is traced, whose representatives are united by common views on the process of creating and implementing the strategy (Tonysheva & Yakunin, 2018). A special attention to the establishment and development of the concept of strategic planning and management was given in the book of Mintzberg "Strategy Safari: A Guided Tour Through The Wilds of Strategic Management" co-authored by Lampel, Ahlstrand, in which scientific schools are fully and comprehensively characterized and described from the point of view of supporters of the strategic process, and advantages and disadvantages of each scientific school are specified (Mintzberg et al., 2013).

At the same time, the insufficient development of theoretical concepts, various approaches to the definition of key concepts used in the process of strategic management, in particular, the “strategic development”, “strategic competitive advantages” have served as a motive to elaborate and clarify the essential characteristics of these categorical concepts in the context of the oilfield service company’s development in modern economic conditions. In addition, the necessity to adapt traditional matrix tools to model the strategic development of the oilfield service company has led to the expediency to create an individualized matrix model for the object under study.

The analysis of the cause and effect relationships of the initiation and development of the oilfield service business in Russia has shown the availability of objective prerequisites determining the separation of this business into an independent activity. This has predetermined enhancing the role of strategic management of the oil and gas service enterprise development.

For the purposes of a more detailed structuring of the process of choosing the oilfield service company’s strategic development the authors have specified the algorithm that was individualized for the specific object under study. The distinctive feature of the algorithm is the fundamental competitive analysis, including the evaluation of strategic competitive advantages and the market attractiveness on the basis of the updated organizational and methodological support.

There has been created the matrix model allowing to define service areas and development strategies corresponding to them, depending on the company potential, available competitive advantages of oilfield services, and conditions in the market environment. The model is intended to select the strategic development trend and further specify the strategic development of the oilfield service company. Evaluating the proposed matrix model for a particular oilfield service company has allowed to:

- identify the service potential by the activity type, taking into account factors having a constructive (a destructive) effect on its creating. Positioning the company in the coordinates “strategic competitive advantages of oilfield services - the attractiveness of the oilfield services’ market” has shown that, having sufficiently strong positions for the sustainable development, it has certain disadvantages impairing the effectiveness of the systematic approach to the process of strategizing;

- evaluate the company strategic position and perform the diagnostics of the company business activity as the “dynamic service area”, predict the company strategic development trend and its movement to the “active service area”, taking into account the company active efforts to acquire and use advanced technologies in its activity, as well as investing in the development and implementation of its own innovations which are of interest to the oil and gas industry as a whole.

Thus, the comprehensive integrated approach to modelling the oilfield service company’s strategic development based on the strategic analysis of the company service potential, the generated analytical and methodological support, the developed balanced system of indicators seems to be highly expedient in conditions of the environment high dynamism, often characterized by economic instability.

Ackoff, R. (1985). Planning the Future of the Corporation. Moscow: Progress.

Ansoff, I. (1999). A New Corporate Strategy. Saint Petersburg: Peter Kom.

Banabakova, V., and Georgiev, M. (2018). The Role of the balanced scorecard as a tool of strategic management and control. In 5th International Conference on Education and Social Sciences (pp. 468-483). Istanbul, Turkey: International Organization Center of Academic Research.

Deryabina, V. Yu. (2014).Advantages and disadvantages of matrix methods of strategic planning. Innov, 1(18). Retrieved from http://www.innov.ru/science/economy/preimushchestva-i-nedostatki-matrichnykh-metodov-strategicheskogo/

Gradova, A. P. (ed.). (2003). The Economic Strategy of the Company: Study Guide. Saint Petersburg: SpetsLit.

Katkalo, V. S. (2006). The Evolution of Strategic Management Theory. Saint Petersburg: Publishing House of Saint Petersburg State University.

Kruglov, M. I. (1998). Strategic Management of the Company. Moscow: Russian Business Literature.

Loginov, G. V. (2005). Matrix tooling for developing strategies for the development of industrial enterprises (Candidate Thesis). Yekaterinburg.

Lorange, P. (2004). New Vision for Management Education: Leadership Challenges. Moscow: Olimp-Business.

Matveyeva, Ya. A. (2018). Evaluating strategic competitive advantages of an industrial company in the context of social responsibility (Candidate Thesis). Yekaterinburg.

Ministry of Energy of Russian Federation. (2009, November 13). The Energy Strategy of Russia for the Period Up to 2030. Retrieved from https://minenergo.gov.ru/node/1026

Mintzberg, H., Ahlstrand, B., and Lampel, J. (2013). Strategy Safari: A Guided Tour through the Wilds of Strategic Management. Мoscow.

Mintzberg, H., Quinn, J. B., and Ghoshal, S. (2001). The Strategy Process: Concepts, Context, Cases. Saint Petersburg: Piter.

Orekhov, A. M. (2006). Economic Research Methods: Study Guide. Moscow: INFRA-M.

Osadchy, E. A., Akhmetshin, E. M., Amirova, E. F., Bochkareva, T. N., Gazizyanova, Y. Y., and Yumashev, A. V. (2018). Financial statements of a company as an information base for decision-making in a transforming economy. European Research Studies Journal, 21(2), 339-350.

Peleckis, K. (2015). Strategic management schools and business negotiation strategy of company operations. Economics and Management, 7(2), 26-34.

Plenkina, V., Andronova, I., Deberdieva, E., Lenkova, O., and Osinovskaya, I. (2018). Specifics of strategic managerial decisions-making in Russian oil companies. Entrepreneurship and Sustainability Issues, 5(4), 858-874.

Porter, E. M. (2005). Competitive Strategy: Techniques for Analyzing Industries and Competitors. Moscow: Alpina Business Books.

Takhumova, O. V., Kasatkina, E. V., Maslikhova, E. A., Yumashev, A. V., and Yumasheva, M. V. (2018). The main directions of increasing the investment attractiveness of the Russian regions in the conditions of institutional transformations. Espacios, 39(37), 6.

Thompson, Jr. А. А., and Strickland, III A. J. (2002). Crafting and Implementing Strategy. Texts and Reading. Moscow: Williams.

Tonysheva, L. L., and Chumlyakova, D. V. (2016). The Integration of Corporate Social Responsibility into the System of the Company Strategic Management. Tyumen.

Tonysheva, L. L., and Yakunin, D. Ye. (2018). The development of the algorithm for strategic planning of the oil and gas service enterprise development. Society: Politics, Economics, Law, 4, 21-28.

Tonysheva, L. L., Zaruba, O. V., Nazmutdinova, E. V., and Fedorova, O. B. (2013). Strategic Management of the Development of the Service Economy of the Region. Tyumen: Tyumen State Oil and Gas University.

Vikhansky, O. S. (1998). Strategic Management. Moscow: Gardarika.

Yefremov, V. S. (1998). Classic models of the strategic analysis and planning: Shell / DPM model. Management in Russia and Abroad, 3. Retrieved from https://www.cfin.ru/press/management/1998-3/07.shtml

1. Industrial University of Tyumen, Russian Federation.

2. Industrial University of Tyumen, Russian Federation. oyakunina57@gmail.com

3. Industrial University of Tyumen, Russian Federation.