Vol. 40 (Number 32) Year 2019. Page 5

ILIMZHANOVA, Zaida А. 1; TULESHOVA, G.B. 2; BURNASHEVA, Venera R. 3 & GUSSENOV, Barkhudar Sh. 4

Received: 05/05/2019 • Approved: 13/09/2019 • Published 23/09/2019

ABSTRACT: The initial data for writing a scientific article was the Register of standards of state tax services of the Republic of Kazakhstan. The role of the state is obvious in assessing the quality of public services, but must be justified and defined in the procedure for their creation, approval and regulation. The subject of the study is the content and purpose of the standards of tax services. The proposals allow to reduce administrative barriers for consumers of public services, ensure the availability, certainty and understanding of the relationship between the service provider and the recipient of quality services. |

RESUMEN: Para este artículo se utilzó el Registro de normas de servicios fiscales estatales de la República de Kazajstán. El papel del estado es fundamental al evaluar la calidad de los servicios públicos, pero debe justificarse y definirse en el procedimiento para su creación, aprobación y regulación. El tema del estudio es el contenido y el propósito de los estándares de los servicios tributarios. Las propuestas permiten reducir las barreras administrativas para los usuarios de servicios públicos, garantizar la disponibilidad, la certeza y la comprensión de la relación entre el proveedor de servicios y el receptor de servicios de calidad. |

The need for public services is associated with the standardization and regulation of the management process in the fiscal authorities. A rational classification of the list of public services approved by the Government of the Republic of Kazakhstan in the state revenue bodies in the performance of tax obligations by taxpayers is proposed (Alibekova, 2014).

The article updates the content of the tax obligation, its fulfillment, as well as termination within the framework of the provided state tax services (Ansoff, 1989).

The objectives of the study are to streamline the process of providing standardization and regulation as part of the management process. At the same time, the study reveals the features of standardization and regulation of tax services provided by the state revenue authorities (Barkhudar Sh. Gussenov, Korabaeva, Zhunusova, Tolamisova & Aitkulova, 2018).

The taxpayer's obligation to the state arises in monetary form and unilaterally, since the state acts as the regulator of the obligation, and the subjects of taxation participate in this process according to its provisions (Barulin, Ermakovam & Stepanenko, 2007).

The obligation is a set of public interests of the state and the obligation of taxpayers, a characteristic feature - the urgency and frequency of its execution (Vylkova, 2014).

Taxation, from an economic point of view, is a fixed collection and calculation of taxes within the framework of state policy (Baitarakova, Turysbekova, Gajiyev, Subebaeva, Syrlybaeva & Gussenov, 2018).

At the same time, the basic objectives of state policy are to increase the rate of economic growth in order to improve the standard of living in the country in a fair progressive taxation (Crişan, 2014).

The tax code of 2001 introduced for the first time a definition of a tax obligation, which implies a clear definition of the rights and obligations of the parties to tax relations, entailing the establishment of ways to ensure the fulfillment of a tax obligation. Moreover, violation of each provision of the tax obligation entails legal liability in accordance with the tax and other legislation of the Republic of Kazakhstan, both on the part of taxpayers and on the part of officials of tax authorities (Ergozhin, 2014).

Thus, the legal instruments for the fulfillment of tax obligations have been formed.

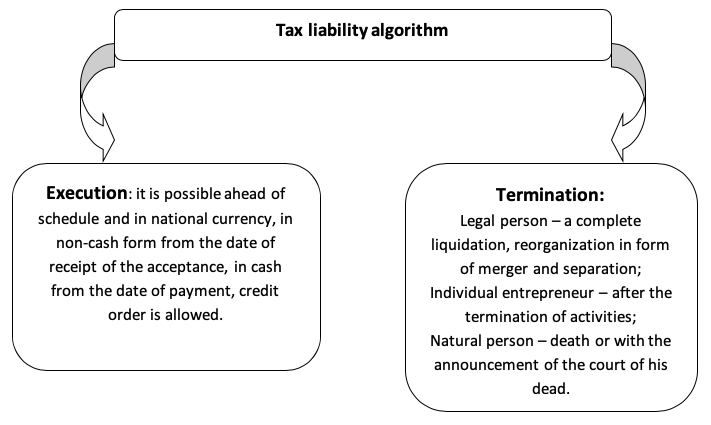

If a taxpayer has a tax obligation to the state within the framework of the tax legislation of the Republic of Kazakhstan, it is necessary to carry out mandatory registration with the state revenue authorities and timely calculate, prepare and submit forms of tax reporting, pay taxes and other mandatory payments to the budget (Fig.1).

Figure 1

Execution and termination of tax obligations,

compiled by the authors themselves

The tax obligation must be fulfilled by the taxpayer in the manner and terms established by the tax legislation of the Republic of Kazakhstan.

The taxpayer has the right to fulfill the tax obligation ahead of schedule.

Late receipt of taxes to the budget is considered to be outstanding debt suspending some actions of state structures implementing state policy (Ignatova & Ashirova, 2015).

Also, in practice, deferred tax liability is applied in taxation. At the same time, deferred tax involves an obligation to be performed in the next period in respect of taxable temporary differences (Zaitseva, Radugin, Radugin & Rogacheva, 2000).

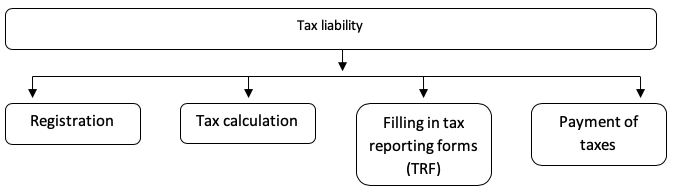

The state, represented by the authorized body, has the right to demand from the taxpayer the fulfillment of its tax obligation in full, and in case of non-fulfillment of the improper fulfillment of the tax obligation to apply methods for its provision and measures of enforcement in the manner prescribed by the Tax code (2019) (Fig. 2).

Figure 2

The content of the tax liability,

compiled by the authors themselves

In order to ensure the stability of revenues to the state budget and create favorable conditions for the taxpayer in the work of the fiscal authorities were introduced controlled by the Government and public organizations public services that affect the change in public spending and taxes collected in order to stimulate economic growth (Ilimjanova, Kaldiyarov & Burnasheva, 2016).

However, the processes of globalization complicate the tax system and economic relations in general, but at the same time increase the role of tax management.

Tax management is aimed at optimizing the procedure of calculation and payment of taxes through the use of favorable opportunities of the current legislation (Ilimjanova, 2015).

Foreign experience of administrative reforms has shown that the improvement of public services is considered part of the extensive reforms in the field of public administration, taking into account the rational formulation and selection of appropriate tasks and principles (Kaldiyarov, Ilimzhanova & Burnasheva, 2017).

The evolution of Kazakhstan's taxation at the sixth (modern) stage is characterized by the introduction of standardization and regulation of public services in management.

For the first time in Kazakhstan, the concept of "public service" was introduced in 2007 in the Law "On administrative procedures" (Maiga & Xu, 2017).

The implementation of the Law of the Republic of Kazakhstan "On public services" № 88-V dated April 15, 2013 (as amended on 04.03.2009) has practically become a part of the management process in the fiscal authorities (Magerova & Maksimov, 2015).

The concept of "public service" is interpreted as follows: "public service – one of the forms of implementation of individual state functions carried out individually on the treatment of service recipients and aimed at the realization of their rights, freedoms and legitimate interests, the representation of their respective tangible and intangible benefits".

There are a number of administrative public services in Kazakhstan. In the Law of the Republic of Kazakhstan "On public services" administrative services are public services provided by the consumer of public services, regardless of the scope of public relations, documentation of individuals, issuance of permits (including licensing, registration, certification), expert and scientific opinions, certificates and other information documents using the principle of "one window" through public service Centers (McConnell, Brue & Flynn, 2017).

The budget code of the Republic of Kazakhstan provides for budget programs aimed at the implementation of state functions, powers and the provision of public services arising from them, their cost includes all current expenses on this subject. In this regard, the names of budget programs should reflect the content of the state functions, powers and related public services (Porokhov, 2001).

In order to implement the constitutional rights assigned to the citizens of the Republic of Kazakhstan, the basis for improving the quality of services provided by state bodies established standardization and regulation of the processes of public services (Rossi, 2017).

The characteristic of the standard of the state service – the legal act establishing requirements to rendering the state service, and also including characteristics of process, forms, the maintenance and result of rendering the state service is given (Shuvalova, Kurochkina & Sibatulina, 2016).

In contrast to the standard of public services, the regulation is a legal act that establishes requirements for compliance with the standard of public services and determines the procedure for the activities of service providers, including the procedure for interaction with other service providers, service centers, as well as the use of information systems in the provision of public services (Tom Clendon & Sally Baker, 2009).

Service recipients are individuals and legal entities. Services determined by the Central state bodies, foreign institutions of the Republic of Kazakhstan local Executive bodies (Vavrova & Bikar, 2016).

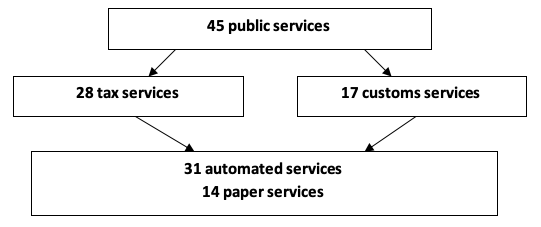

Public services (Law, 2013) are provided on the principles of equal access to the service recipient, the inadmissibility of manifestations of bureaucracy and red tape; quality and availability, efficiency and effectiveness, continuous improvement of the process of providing public services (Fig. 3).

Figure 3

The composition of the existing fiscal services,

compiled by the authors themselves

In the Message of the President of the Republic of Kazakhstan to the people of Kazakhstan dated January 27, 2012 "Socio-economic modernization – the main vector of development of Kazakhstan" one of the tasks is to improve the quality of public services (Zaida А. Ilimzhanova, Venera R. Burnasheva & Barkhudar Sh. Gussenov, 2018).

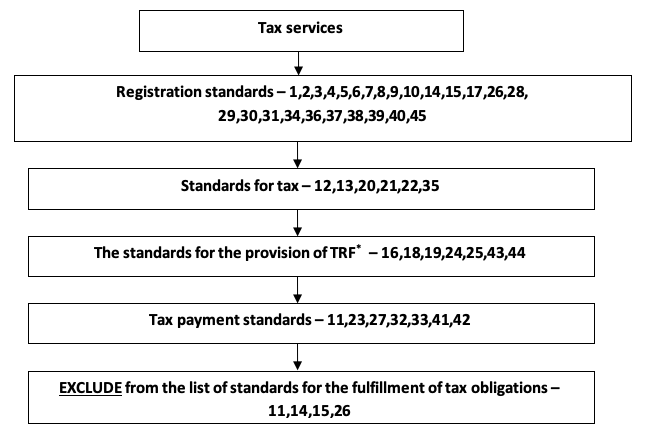

Approved standards are grouped to simplify service delivery and increase employee productivity (Fig.4).

Figure 4

The proposed classification and rationalization of standards of tax services in

terms of the fulfillment of tax obligations, compiled by the authors themselves.

*tax reporting form

Standards of public services, approved by the Order of the Minister of Finance of the Republic of Kazakhstan dated April 27, 2015 № 284 "On approval of standards of public services provided by the state revenue bodies of the Republic of Kazakhstan" are as follows (Tab. 1):

Table 1

Standards of public services.

№ |

Name of standard |

Characteristic |

1 |

Standard of public service "Registration of a person engaged in private practice» |

Acceptance of the application and issuance of the result of the public service is carried out by the service provider: 1) through service centres; 2) through the non-profit joint stock company " State Corporation "Governments for citizens"; 3) through web portal of "electronic government" www.egov.kz – at check-in. |

2 |

Standard of the state service "Registration of taxpayers» |

1. The standard of public service is developed by the Ministry of Finance of the Republic of Kazakhstan. 2. The state service is provided by the territorial bodies of the state revenue Committee of the Ministry for districts, cities and districts in cities, in the territory of special economic zones. Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider through service centers; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz. |

3 |

"Registration accounting of value added tax payers» |

Issuance of the result of the public service is carried out by the service provider through: 1) service centers; 2) taxpayer's office. |

4 |

"Registration accounting of the electronic taxpayer» |

|

5 |

"Assignment of the personal identification number (PIN) to producers (importers) of separate types of oil products, and also on goods of producers and importers of some types of excisable production, aviation fuel and fuel oil» |

The state service is provided by the territorial bodies of the state revenue Committee of the Ministry of regions, cities Nur-Sultan, Almaty and Shymkent. Acceptance of the application and issuance of the result of the public service are carried out: 1) the service provider through the information system " Control over the production and turnover of excisable products and certain types of petroleum products"; 2) through the non-profit joint stock company "State Corporation "Government for citizens" . |

6 |

"Issue of the license for production of tobacco products» |

|

7 |

"Issue of the license for production of ethyl alcohol» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz |

8 |

"Issue of the license for production of alcoholic products» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz |

9 |

"Issue of the license for storage and wholesale of alcoholic products, except for activity on storage and wholesale of alcoholic products in the territory of its production» |

From the moment of delivery of the package of documents to the service provider or to the State Corporation, as well as when contacting the portal: 1) issue of the license or the motivated answer on refusal in rendering the state service in cases and on the bases specified in point 10 of this standard of the state service-no later than 1 (one) working day; 2) license renewal – within 3 (three) working days; 3) issuance of duplicate licenses – within 2 (two) working days. The service provider shall check the completeness of the submitted documents within 2 (two) working days from the date of receipt of the documents of the service recipient. In case of establishment of the fact of incompleteness of the submitted documents the service provider within the specified terms gives the written motivated refusal in further consideration of the application; 2) the maximum allowable waiting time for delivery of documents by the service recipient to the service provider is 20 (twenty) minutes, in the State Corporation-15 (fifteen) minutes; 3) the maximum allowable service time of the service recipient by the service provider is 20 (twenty) minutes, in the State Corporation – 15 (fifteen) minutes. |

10 |

"Issue of the license for storage and retail sale of alcoholic products, except for activity on storage and retail sale of alcoholic products in the territory of its production» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz |

11 |

"Representation of data on absence (availability) of tax debt on which accounting is conducted in bodies of the state income |

Acceptance of the request for information about the absence (presence) of debt, accounting for which is conducted in the state revenue authorities (hereinafter-the request) and the issuance of the result of the provision of public services are carried out: 1) through the web application "taxpayer's office" of the service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 2) through web portal of "electronic government": www.egov.kz |

12 |

"Issue of the certificate on the amounts of the received income from sources in the Republic of Kazakhstan and the withheld (paid) taxes» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider through service centers; 2) through the non-profit joint stock company "State Corporation "Government for citizens". |

13 |

"Confirmation of residence of the Republic of Kazakhstan» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz |

14 |

"Issue of accounting and control marks on alcoholic products (except for wine and beer)» |

Reception of statements and issue of result of rendering of the state service are carried out by the service provider through the office or information system service provider "Control over production and turnover of alcoholic production with use of accounting and control stamps with holographic security elements". |

15 |

"Issue of excise stamps on tobacco products» |

Reception of statements and issue of result of rendering of the state service are carried out by the service provider through the office or information system service provider "Control over production and turnover of excisable products and some oil products". |

16 |

"the Suspension (extension, resumption) of submission of tax reporting» |

Acceptance of applications and issuance of the result of the public service is carried out by the service provider: 1) through the service centers or the web application "taxpayer's office", or the information system " tax reporting processing services"; 2) through the non-profit joint stock company " State Corporation "Governments for citizens" (hereinafter-the State Corporation); 3) through web portal of "electronic government": www.egov.kz |

17 |

"Introduction of new models of cash registers in the State register of cash registers» |

The standard of public service was developed by the Ministry of Finance of the Republic of Kazakhstan. 1. The state service is provided by the state revenue Committee of the Ministry. Acceptance of the application and issuance of the result of the provision of public services are carried out by the service provider through the office. |

18 |

"Reception of the tax reporting» |

through web portal of "electronic government": www.egov.kz |

19 |

"Revocation of tax reporting» |

through web portal of "electronic government": www.egov.kz |

20 |

"Carrying out offsets and returns of taxes, payments to the budget, penalties, penalties» |

Acceptance of the application and issuance of the result of the public service are carried out: 1) service provider; 2) through the non-profit joint stock company "State Corporation" of the Government for citizens"; 3) through web portal of "electronic government": www.egov.kz |

21 |

"Return of value added tax from the budget» |

|

22 |

"Return of income tax withheld at the source of payment» |

|

23 |

"Change of terms of execution of the tax obligation on payment of taxes and (or) payments» |

|

24 |

"Acceptance of tax forms for export (import) of goods in the Eurasian economic Union» |

|

25 |

"Statement and deregistration of cash registers (KKM)» |

|

26 |

"Carrying out qualification examination of the persons applying for the right to carry out activity of the administrator (temporary administrator, rehabilitation, temporary and bankrupt managers)» |

|

27 |

"Inclusion of objects of copyright and related rights, trademarks, service marks and appellations of origin of goods in the customs register of intellectual property» |

|

28 |

"Issue of statements from the personal account on the state of settlements with the budget, as well as on social payments» |

|

29 |

"Inclusion in the register of authorized economic operators» |

|

30 |

"Inclusion in the register of customs representatives» |

|

31 |

"Inclusion in the register of customs carriers» |

|

32 |

"Adoption of preliminary decisions on the origin of goods» |

|

33 |

"Adoption of the preliminary decision on classification of goods» |

|

34 |

"Issue of the decision on classification of goods in the unassembled or disassembled look, including in the incomplete or incomplete look which import is supposed by various parties within a certain period of time» |

|

35 |

"Customs clearance of goods» |

|

36 |

"Issue of the certificate on the admission of the vehicle of the international transportation to transportation of goods under customs seals and seals» |

|

37 |

"Inclusion in the register of owners of temporary storage» |

|

38 |

"Inclusion in the register of owners of duty-free shops» |

|

39 |

"Inclusion in the register of owners of warehouses of storage of own goods» |

|

40 |

"Registration of execution of the duty on payment of customs duties, taxes, special, anti-dumping, countervailing duties, and also ensuring execution of duties of the legal entity performing activity in the field of customs, and (or) the authorized economic operator» |

|

41 |

"Change of terms of payment of import customs duties» |

|

42 |

"Apostille of the official documents coming from structural divisions of the Ministry of Finance of the Republic of Kazakhstan and (or) their territorial divisions" |

|

43 |

"Acceptance of the customs Declaration on the vehicle» |

|

44 |

"Acceptance of the passenger customs Declaration» |

|

45 |

"Issue of the special permission for journey of heavy and (or) large-size vehicles" |

Source: compiled by the authors themselves

Existing regulations of public services are approved in accordance with subparagraph 2) of article 10 of the Law of the Republic of Kazakhstan dated April 15, 2013 "On public services" and the order on amendments and additions to the order of the Minister of Finance of the Republic of Kazakhstan dated December 28, 2018 № 1117 "On approval of standards of public services provided by the state revenue bodies of the Republic of Kazakhstan".

The process of forming the standards of public services in Kazakhstan involves the development of the authorized body, as it has all the information about the methods and techniques of the procedure of providing, that is, it independently or practically subjectively justifies their need. That is, there is a great risk of protection of own interests by the state body – developer in the process of their design.

Any long process structures itself over time. Long-term operation takes its form.

Justification for the exception:

- 11 the standard of the state service "Representation of data on absence (availability) of debt accounting on which is conducted in bodies of the state income" - is included in the complex of the services which are successfully provided by the Center of service of the population, and also are independently realized by electronic taxpayers through the corresponding WEB portal, that is the staff of the Centers of reception and processing of the reporting in rendering service of direct participation don't accept as this process is completely automated;

- 14 standard "Issue of accounting and control marks (ACM) for alcoholic beverages (except for wine, beer and beer beverage)" - transfer the functions of applying the bar-coding ACM banknote factory of the Republic of Kazakhstan, i.e. manufacturers apply and purchase ACM directly from the manufacturer ACM. State revenue authorities should leave the functions of monitoring the completeness and timeliness of excise revenues to the budget;

- 15 the standard of the state service "Issue of excise stamps on tobacco products" - the procedure is not peculiar to the state revenue authorities, does not affect the receipt of taxes to the budget. At the same time, it requires significant human resources of the Department. To perform this work, other employees of the Department (members of the Commission), as well as employees of district offices are constantly involved to establish compliance with qualification requirements. State revenue authorities should retain the functions of direct control over the turnover of alcoholic beverages, rather than review and issue permits. In this regard, it is possible to transfer this procedure to the local Executive body or other relevant organizations;

- 26 standard "Qualification examination of persons applying for the right to carry out the activities of the administrator (temporary administrator, rehabilitation, temporary and bankruptcy managers)" – the service is provided by the Central office of the state revenue Committee of the Ministry of Finance of the Republic of Kazakhstan, that is, the control body carries out the licensing procedure, which can be the basis for a conflict of interest and it is more expedient to transfer the state service to the relevant certified educational centers.

The current Order of the Chairman of the Agency of the Republic of Kazakhstan for civil service Affairs and anti-corruption of December 8, 2016 № 78 "On approval of the Rules of state control over the quality of public services" (as amended as of November 28, 2018) is aimed at improving the quality of public services, compliance with the terms of provision and appeal of public services, and most importantly to improve customer satisfaction with public services provided by public authorities.

Conclusion: in accordance with the criteria of the current Rules, in terms of updating the standards of services, it is proposed to abolish four standards: 11 the standard of public services "Submission of information on the absence (availability) of debt, accounting for which is maintained in the state revenue bodies", 14 the standard "Issuance of accounting and control stamps for alcoholic beverages (except for wine, beer and beer)", 15 the standard "Issuance of excise stamps for tobacco products", 26 the standard "Conduct of qualification examination of persons, applicants for the right to carry out the activities of the administrator (temporary administrator, rehabilitation, temporary and bankrupt managers)" formatting them in terms of the fulfillment of the tax obligation.

The rules of state control over the quality of public services, in addition to assessing the quality of services, are aimed more at assessing measures to improve the processes of public services. The combination of the process approach and functions of administrative management, as well as the position of the state providing a range of services for its citizens is the basis for improving management processes.

The role and place of standards and regulations of tax and customs services are defined in the process management as follows. It is known that A. Fayol - the founder of administrative management identified the following management principles: planning, organization, management, coordination and control.

Let us consider in this aspect the standards and regulations of public services.

Indeed, they are modeled, planned by the authorized body - these standards and regulations of public services are approved by the authorized body in the field of public services.

As part of the organization, to continuously improve the quality of services provided, new centers for receiving and processing information are being created on a systematic basis, in the future, the creation of four largest centers for processing documentation in the country on the eve of the universal Declaration of income and expenses.

Electronic organizational measures (electronic queue in the Centers of reception and processing of information, automatic call-up of taxpayers-debtors, sending SMS by mobile operators, the possibility of information systems "taxpayer's office", tax reporting processing system, a single data warehouse, centralized personal accounts) implement the management principle "organization" and are aimed at improving the conditions for obtaining public services.

In the process of providing public services such management principles as planning, organization, management, coordination is implemented simultaneously and are part of the control.

Effective implementation of tax planning involves a thorough study of the tax environment, the volume of tax revenues and the impact of external and internal factors.

And from the economic point of view of public administration, the improvement of the business environment affects the competitiveness of the country.

The international center for taxes and investments when considering innovative approaches to business process management in tax administrations, the following expectations of corporate taxpayers are defined:

What is necessary for the taxpayer is also necessary for the Government.

The proposed rationalization is convenient for the distribution of the functional performance in the provision of public services. Such specialization of public services within the framework of tax obligations fulfillment by taxpayers will reduce waiting time in the queue and improve the quality of the service, which will undoubtedly reduce the costs of consumers of services and increase the efficiency of tax collection.

Thus, it is possible to solve the problem of improving the service of public services and the level of voluntary fulfillment of tax obligations by the population and business through the simplification of management processes.

Alibekova, R. (2014). On the principles of evolution and open dialogue. Kazakhstanskaya Pravda. May 24. №101 (27722). 1p.

Ansoff, I. H. (1989). Strategic management. M: Economy, 107p.

Barkhudar Sh. Gussenov, N. B. Korabaeva, G. A. Zhunusova, A.G. Tolamisova & S. N. Aitkulova. (2018). The development of foreign trade in the era of globalization. Espacios. Vol. 39 (Number 47). Page 22. http://www.revistaespacios.com/a18v39n47/18394722.html. http://orcid.org/0000-0003-0275-8029.

Barulin, S. V., Ermakovam E. A. & Stepanenko V. V. (2007). Tax management. Textbook. – Moscow: Publishing House: "Omega-L". 272p.

Bota D. Baitarakova, Rayhan K. Turysbekova, Farrukh A. Gajiyev, Zhuldyz K. Subebaeva, Makpal T. Syrlybaeva & Barkhudar Sh. Gussenov. (2018). Using the principles of project financing as an effective instrument of management of transport infrastructure (Using elements of public - private partnerships). Espacios. Vol. 39 (Number 19). Page 42.

Crişan C. (2014). Taxes funding source of the public area // Quality - Access to Success. Volume 15. Issue SUPPL 3. June.- рр.114-120

Code of the Republic of Kazakhstan "On taxes and other obligatory payments to the budget" (Tax code) (with amendments and additions as of 21.01.2009), Nur - Sultan. 803p.

Ergozhin, D. E. (2014). "Strategy Kazakhstan – 2050". Quality fiscal policy and administration as the Foundation of a strong small and medium-sized business. Finance. №10. 18p.

Ignatova, T. V. & Ashirova, M. N. (2015). Foreign experience in management of institutional changes in the sphere of public services. State and municipal management. Scientific notes of sc., Issue 2. P. 20-27

Ilimjanova, Z. A., Kaldiyarov, D. A. & Burnasheva, V. R. (2016). Modern fiscal management of Kazakhstan. Textbook. Almaty: Economy. 186p.

Ilimjanova, Z. A. (2015). Improvement of management process in the fiscal authorities of Kazakhstan: Monograph. T.: ZHSU n.a. I. Zhansugurov. 188p.

Kaldiyarov, D.A., Ilimzhanova, Z.A. & Burnasheva, V.R. (2017). Training manual taxation in the republic of Kazakhstan at the present stage. Almaty: «Credos LTD S», 305р.

Law of the Republic of Kazakhstan "On public services". Nur-Sultan: Akorda, April 15, 2013. № 88. V3RK with changes from 13.06.18 (with changes and additions as of 13.06.2018) [Electronic resource].URL: https: online.zakon.kz (date accessed:04.03.19).

Maiga, S. & Xu F.J. (2017). The growth of government annual budget through taxes collection // IOP Conference Series: Materials Science and Engineering. International Seminar on Advances in Materials Science and Engineering. Volume 231. Issue 1. 19 September, ISAMSE 2017, Singapore. рр.3-4.

Magerova, A., Maksimov, C. (2015). Improving delivery of public services in the Republic of Kazakhstan. Academy of public administration under the President of the Republic of Kazakhstan. 209p.

McConnell, K. R., Brue, S. L. & Flynn, S. M. (2017). Economics: principles, problems and policies: Textbook: Trans. from english. -19th ed.-M.: INFRA. XXVIII, 1028p.

Message of the President of the Republic of Kazakhstan to the people of Kazakhstan "Socio-economic modernization – the main vector of development of Kazakhstan" dated January 27, 2012 [Electronic resource].URL: http://www.akorda.kz (date accessed: 04.03.19).

Porokhov, E. V. (2001). Theory of tax liabilities. Almaty, 155p.

Rossi, GAS (Santi Rossi, Gustavo Afonso), dos Santos, WJL (Ladeira dos Santos, Waldir Jorge). (2016). Peculiarities of levy and tax revenues of active debt in public administration. Revista ambiente contabil. Volume:8. Issue:1. JAN-JUN. Pр.205-225.

Standards of public services and regulations. Approved by order No. 284 of the Minister of Finance of the Republic of Kazakhstan dated 27.04.15 (as amended and supplemented on 28 December 2018 No. 1117) [Electronic resource]. URL:http://kgd.gov.kz (accessed 04.03.19).

Shuvalova, E., Kurochkina, I. & Sibatulina, N. (2016). Тах environment and the market value of the corporation SGEM 2016, BK 2: political sciences, law, finance, economics and tourism conference proceedings, Vol III. //International Multidisciplinary Scientific Conferences on Social Sciences and Arts. Albena, BULGARIA. AUG 24-30. рр.1067-1072.

Taxes and taxation. Collection of tasks and test questions on the program of independent work. Nur - Sultan: JSC "Center for training, retraining and advanced training of specialists of the financial system, 2011. 96p.

Tom Clendon & Sally Baker. (2009). Deferred tax. Student accountant. Association of Chartered Certified Accountants. Translation from eng.№8. 10p.

Vavrova, K. & Bikar, M. (2016). Effective tax administration as a factor affecting the competitiveness of Slovakia at the global level //Globalization and its socio-economic consequences, 16th International Scientific Conference on Globalization and its Socio-Economic Consequences, PTS I-V. Rajecke Teplice, SLOVAKIA. рр. 2324-2331.

Vylkova, E. S. (2014). Tax planning. Theory and practice: Textbook for universities 2nd edition, revised and additional. Moscow: Yurayt, 660p.

Zaida А. Ilimzhanova, Venera R. Burnasheva & Barkhudar Sh. Gussenov. (2018). Trends in the development of fiscal authorities of Kazakhstan. Espacios. Vol. 39 (Number 12). Page 26.

Zaitseva, O. A., Radugin, A. A., Radugin K. A. & Rogacheva N. (2000). Fundamentals of management: Textbook for universities. M.: Center. 432p.

1. Candidate of economic sciences, acting associate Professor (docent). Zhetysu State University named after I. Zhansugurov

2. Candidate of economic sciences, acting associate Professor (docent). Zhetysu State University named after I. Zhansugurov

3. Master of economics, senior lecturer. Zhetysu State University named after I. Zhansugurov

4. Zhetysu State University named after I. Zhansugurov. Email: king_bara@mail.ru