Vol. 40 (Number 32) Year 2019. Page 12

NOHONG, Mursalim 1; ALI, Muhammad 2; SOHILAUW, Muhammad 3; SOBARSYAH, Muhammad 4 & MUNIR, Abdul 5

Received: 24/05/2019 • Approved: 13/09/2019 • Published 23/09/2019

ABSTRACT: The objective of this research is to explain the factors that affect the competitiveness of SMEs in Makassar. This research uses primary and secondary data collected through questionnaires and publications related to SME. The research sample was 60 SME obtained by using purposive sampling. The results of the study show that financial literacy can improve competitiveness through capital structure policies. Financial literacy also can improve risk management through capital structure policies. |

RESUMEN: El objetivo de esta investigación es explicar los factores que afectan la competitividad de las PYME en Makassar. Esta investigación utiliza datos primarios y secundarios recopilados a través de cuestionarios y publicaciones relacionadas con las PYME. La muestra de investigación fue de 60 PYME obtenidas mediante muestreo intencional. Los resultados del estudio muestran que la educación financiera puede mejorar la competitividad a través de políticas de estructura de capital. La educación financiera también puede mejorar la gestión de riesgos a través de políticas de estructura de capital. |

Historically, SMEs have contributed and are strategic towards economic growth in Indonesia. It is indicated by the absorption of labor in various sectors so that SMEs can be referred to as support and sources of income for households in Indonesia (Balakrishnan & Gurtoo, 2016; Hamdani & Wirawan, 2012; Pawitan, 2012; and Setyaningsih, 2012). Sharma & Wadhawan (2009) stated that the importance of the SME could significantly improve the social and economic systems for various purposes. Also, the number of SMEs that are increasing every year can support the economy to become stronger.

SMEs had been contributed more to economic growth compared to large companies because of their dependence on formal markets and credit so that they can respond quickly compared to large companies (Berry, Rodriguez, & Sandee, 2001). The contribution of SMEs to Gross Domestic Product (GDP), employment and exports were quite substantial. It was noted, in the last five years, the contribution of the SME sector to GDP increased from 57.84% to 60.34%. Labor absorption from the industry also grew from 96.99% to 97.22%. These facts and data provide evidence that SMEs have contributed to economic growth in Indonesia.

The experience of these countries shows that SMEs can compete effectively in both foreign and domestic markets. However, to develop and be competitive, the biggest problem faced by SMEs in some developed and developing country is the problem of financing (Beck, Demirgüç-Kunt, & Maksimovic, 2006). Many banks think that SMEs in Indonesia are not bankable. For this reason, SME owners will try to find additional funds from family, friends or savings themselves or even from informal sources that set high interest. The Indonesian government has tried to solve this problem by providing financial support for MSMEs which are divided into three categories, namely financial support through the Ministry of Cooperatives and MSMEs, mandatory regulations to finance MSMEs from the banking sector, and financial support by State-Owned Enterprises. In the case of loan assistance, financial institutions must monitor and evaluate loan performance so that it can be used correctly and correctly (Sohilauw, Ali, Pahlevi, & Nohong, 2019). If there is a misuse of loan funds, it will increase the non-performing loan (NPL).

Development economists, entrepreneurs, governments, venture capital companies including financial institutions and non-governmental organizations have given appreciation to the performance achieved by SMEs (Eniola & Ektebang, 2014). This success cannot be separated from the effectiveness of performance management by building an understanding of what must be achieved, whether the plan will be achieved; and approaches to managing human resources in relation to performance achievement that refers to an agreed framework of planned targets, standards and individual and group capability needs (Armstrong, 2006).

Financial literacy, in the perspective of business start-up, is the ability to monitor financial resources appropriately in the business life cycle directly linked to financial products and services. Financial literacy focuses on policy and effective decision making regarding the implementation of financial management. Financial literacy requires knowledge, skills, attitudes, and experiences that aim to maintain the survival of the company; maximize profits; sales maximization; capture particular market share; minimization of staff turnover and internal conflict; and maximizing shareholder wealth. Financial literacy can be one of the strategic tools to be effective in allocating financial resources and building the company's financial strength. In the meantime, Financial Literacy is sufficient knowledge of facts about personal finance and is the key to personal financial management (Taft, Hosein, Mehrizi, & Roshan, 2013).

Research by Adomako & Danso (2014) found a relationship between financial literacy on the performance of entrepreneurial firms through capital availability and resource mobility. Referring to the research of Adomako & Danso (2014), it was concluded that the knowledge and financial literacy capabilities of entrepreneurs were able to improve company performance if reinforced by capital availability and the extent of resource mobility.

Based on the previous description, this study explained several factors that influence competitiveness and minimization of business risks.

Data and information in this study were obtained by using questionnaires submitted to SMEs (see appendix). The population in this study are all SMEs in the city of Makassar, which is spread in 15 districts. Makassar City is an area that has a better MSME development compared to other regions. The unit of analysis of this study is the SME players who have used capital from both external and own capital. By using purposive random sampling technique, respondents will be interviewed using questionnaires. Sixty respondents spread across several locations will represent each district.

In conducting data analysis, this research emphasizes quantitative analysis. The form of causal relationship as the nature of this study requires an analytical tool that can explain the relationship in the model, then the Structural Equation Modelling (SEM) based on variance which is known as the Partial Least Square (PLS) method was employed to test our hypotheses.

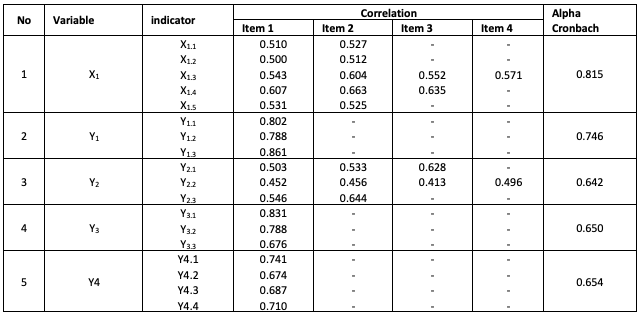

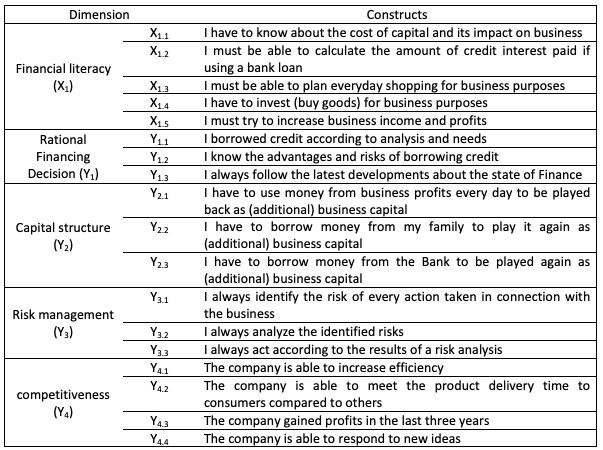

This research used 37 items questions consists of 11 indicators of 5 research variable. Validity test use Pearson correlation coefficients with criteria r of > 0.3 then all indicators are considered valid (Ghozali, 2013 in Ilyas and Munir, 2017)(Ilyas & Munir, 2017). Reliability test used alpha Cronbach with coefficient criteria > 0.6, the all variables are considered reliable. Table 1 shows the outputs of validity and reliability test of the instrument from the test sample.

Table 1

Instrument validity

and reliability testing

Source: Result of analysis, 2018

Validity and reliability analysis at Table 1 shows general correlation > 0.3 stating that all items are declared valid. On the other hand, the results of reliability testing show the Cronbach alpha value > 0.6 which states that all variables are declared reliable. Therefore, it can be stated that the instrument is declared valid and reliable.

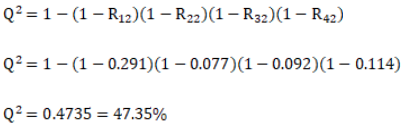

To find out the feasibility of research can be analyzed by the multivariate determination coefficient expressed by Q-Square (Q2). If Q2 > 0 conclude that the model has predictive relevance. The criteria for the strength of the weak model are measured by value Q-square predictive relevance between 0 – 1 (Latan & Ghozali, 2015). Getting closer 0 value of Q-Square predictive relevance gives a clue that the research model is getting weaker, on the contrary getting away from zero (0) and getting closer to 1, means that research model better. Based on the value of R2 it can be calculated Q2 or Stone Geiser Q-Square test, namely:

The results of the calculation show the value of predictive-relevance as 0.4735 or 47.35%. Value predictive relevance of 47.35%, indicated that the research model can explain the diversity of data by 47.35%. Therefore, 47.35% of the information in the data can be explained by the model. At the same time, these results also indicate that there are as many as 52.65% explained by other variables not included in the model.

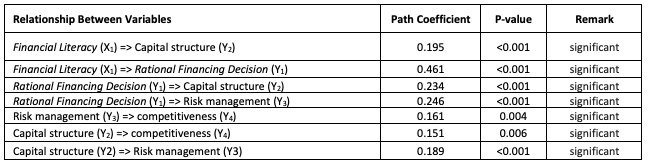

The test of the structural model in this research principally tests the hypothesis. Hypothesis testing is based on the value of the t-test for each path of partial direct effect. The results of the PLS analysis and the results of testing the influence hypothesis as shown in Table 2.

Table 2

Structural Model of PLS Results: Direct effect

Source: Results of the analysis, 2018

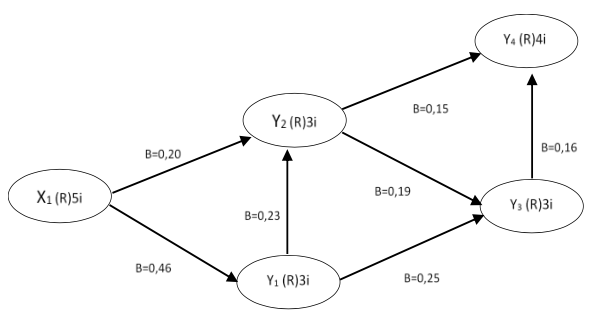

Based on Table 2 and Figure 1, it can be seen that the financial literacy variable (X1) affects the Capital Structure (Y2). These results explain the knowledge and skills related to financial literacy (X1) for SMEs will increase the proportion of their capital structure (Y2). Financial literacy (X1) also opposes rational financing decisions (Y1). It shows that financial literacy (X1) has an impact on increasing the knowledge and skills of SME entrepreneurs who will be increasingly rational in choosing to finance. The rationality in making financing decisions in this study also increases risk and at the same time will increase the competitiveness (Y4) of SMEs. This is intended as a risk for an SME that needs to be managed because it will increase competitiveness (Y4). In addition to financial loans, SME business risk management is also used by the capital structure used. For every entrepreneur, the decision to change the composition of capital must consider the cost of capital which will be the cost of each period. Therefore, SMEs must be careful in using capital sources. The choice of using internal and external capital sources is a strategic decision-making process.

Figure 1

Result analysis

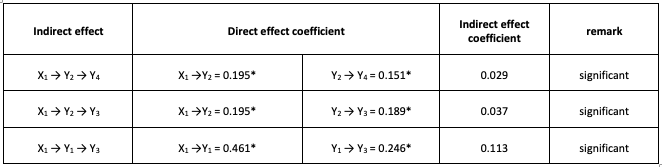

Mediation testing is obtained from several studies of direct influences that form mediation. The following are the results of the mediation test.

Table 3

Structural Model Results

of SEM Mediation

Source: Result of analysis, 2018

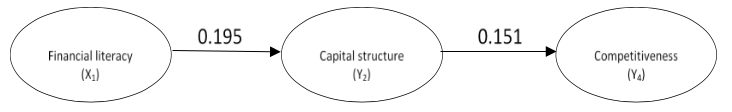

The influence of financial literacy (X1) on competitiveness (Y4) through the capital structure (Y2), obtained an indirect effect coefficient of 0.029. The direct effect of financial literacy (X1) to capital structure (Y2) is significant, and the direct influence between capital structure (Y2) toward competitiveness (Y4) is also significant. It means that there is a significant effect of financial literacy (X1) on competitiveness (Y4) through the capital structure (Y2). The positive coefficient means that the higher the financial literacy (X1), the higher the competitiveness (Y4) which will be through the capital structure (Y2).

Figure 2

Mediation effects of capital structure on the

effect of financial literacy on competitiveness

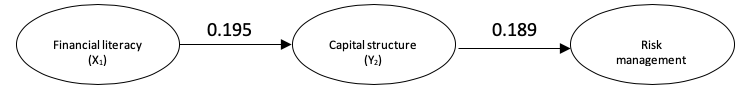

The indirect influence of financial literacy (X1) on risk management (Y3) through the capital structure (Y2), obtained an indirect coefficient of the influence of 0.037. The direct effect of financial literacy (X1) on the capital structure (Y2) is significant, and the direct influence between capital structure (Y2) on risk management (Y3) is significant. Based on these results, it can be said that knowledge and skills about financial literacy can improve risk management performance if supported by a combination of optimal capital structures. The indication is that the combination of capital used can provide greater benefits than the cost or sacrifice of the company.

Figure 3

The effect of mediating capital structure on the

financial literacy effect on risk management

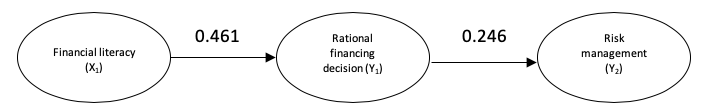

The indirect influence between financial literacy (X1) on risk management (Y3) through rational financing decisions (Y1), obtained an indirect effect coefficient of 0.113. The direct effect of financial literacy (X1) on rational financing decisions (Y1) is significant, and the direct influence between rational financing decisions (Y1) on risk management (Y3) is significant. Therefore, it can be concluded that financial literacy affects risk management (Y3) which is reinforced by rational financing decisions (Y1).

Figure 4

Effect of rational financing decision mediation on

the financial literacy influence on risk management.

Based on the analysis, it can be concluded that financial literacy for SMEs has a strategic impact on improving the competitiveness of companies that are moderated by the capital structure. In addition, financial literacy also influences risk management through the capital structure and rational financial decision. The study also shows that for SME competitiveness is influenced by financial literacy, rational financing decision, and risk management.

Adomako, S., & Danso, A. (2014). Financial Literacy and Firm performance: The and resource flexibility. International Journal of Management & Organizational Studies, 3(4), 2–15.

Armstrong, M. (2006). PERFORMANCE MANAGEMENT. The British Journal of Psychiatry (3rd ed., Vol. 112). London: Kogan Page. https://doi.org/10.1192/bjp.112.483.211-a

Balakrishnan, B. A., & Gurtoo, A. (2016). Environmental Vulnerabilities and Impact of EMS : Study of Indian Pharmaceutical Small and Medium Scale Industries. International Journal of Small and Medium Enterprises and Business Sustainability, 1(4), 1–27.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2006). The influence of financial and legal institutions on firm size. Journal of Banking and Finance, 30(11), 2995–3015. https://doi.org/10.1016/j.jbankfin.2006.05.006

Berry, A., Rodriguez, E., & Sandee, H. (2001). Small and medium enterprise dynamics in Indonesia. Bulletin of Indonesian Economic Studies, 37(3), 363–384. https://doi.org/10.1080/00074910152669181

Eniola, A., & Ektebang, H. (2014). SME firms performance in Nigeria: Competitive advantage and its impact. International Journal of Research Studies in Management, 3(2), 75–86. https://doi.org/10.5861/ijrsm.2014.854

Ghozali, I. (2013). Aplikasi Analisis Multivariate Dengan Program IBM SPSS 21 Update PLS Regresi (7th ed.). Semarang: Badan Penerbit Universitas Diponegoro. Retrieved from https://www.researchgate.net/publication/289671928_Aplikasi_Analisis_Multivariate_Dengan_Program_IBM_SPSS_21_Update_PLS_Regresi

Hamdani, J., & Wirawan, C. (2012). Open Innovation Implementation to Sustain Indonesian SMEs. Procedia Economics and Finance, 4(Icsmed), 223–233. https://doi.org/10.1016/S2212-5671(12)00337-1

Ilyas, G. B., & Munir, A. R. (2017). The Influence of Exotic Service Quality Towards Overall Satisfaction at Hotels in Makassar. INTERNATIONAL JOURNAL OF BUSINESS RESEARCH, 15(4), 311-319.

Latan, H., & Ghozali, I. (2015). Partial Least Squares: Concepts, Techniques and Applications using SmartPLS 3 (2nd Editio). Semarang: Diponegoro University Press.

Pawitan, G. (2012). Characteristics of Small Medium Manufacturing Industries In the Era of ACFTA: Case Study from West Java. Procedia Economics and Finance, 4(Icsmed), 130–139. https://doi.org/10.1016/S2212-5671(12)00328-0

Setyaningsih, S. (2012). Using Cluster Analysis Study to Examine the Successful Performance Entrepreneur in Indonesia. Procedia Economics and Finance, 4(Icsmed), 286–298. https://doi.org/10.1016/S2212-5671(12)00343-7

Sharma, M., & Wadhawan, P. (2009). A Cluster Analysis Study of Small and Medium Enterprises. The IUP Journal of Management Research, 8(10), 7–23.

Sohilauw, M. I., Ali, M., Pahlevi, C., & Nohong, M. (2019). Moderation of Customer Mentoring and Relationship Management (CMRM) to the relationship between capital structure decision with SME financial performance in Makassar City. IOP Conference Series: Earth and Environmental Science, 235, 012087. https://doi.org/10.1088/1755-1315/235/1/012087

Taft, M. K., Hosein, Z. Z., Mehrizi, S. M. T., & Roshan, A. (2013). The Relation between Financial Literacy, Financial Wellbeing and Financial Concerns. International Journal of Business and Management, 8(11), 63–75. https://doi.org/10.5539/ijbm.v8n11p63

Appendix 1

Questionnaire items

1. Lecturer, Department of Management, Faculty of Economics and Business, Hasanuddin University, Indonesia, contact email: mursalimnohong@fe.unhas.ac.id

2. Lecturer, Department of Management, Faculty of Economics and Business, Hasanuddin University, Indonesia, contact email: muhd.alilakatu@gmail.com

3. Lecturer, Department of Management, Faculty of Economics and Business, STIEM Bongaya, Indonesia, contact email: sohilauw1899@gmail.com

4. Lecturer, Department of Management, Faculty of Economics and Business, Hasanuddin University, Indonesia, contact email: msobarsyah@gmail.com

5. Correspondence Author, Department of Management, Faculty of Economics and Business, Hasanuddin University, Indonesia. Contact e-mail: arazak.munir@gmail.com