Vol. 40 (Issue 38) Year 2019. Page 11

YESHCHENKO, Maryna 1; KOVAL, Viktor 2 & TSVIRKO, Olena 3

Received: 18/07/2019 • Approved: 28/10/2019 • Published 04/11/2019

2. Theoretical basis and methodology

ABSTRACT: The purpose of the paper is to study the state regulation of incomes of the population under the conditions of stabilization of socio-economic. The main objective of the study is to analyze the current priorities of the state regulation of incomes of the population and to offer some measures to ensure an increase in the incomes of the population of Ukraine under the current crisis conditions. The state regulation of the population’s incomes is important leverage that has a direct impact on the level of incomes of the population. |

RESUMEN: El propósito del trabajo es estudiar la regulación estatal de los ingresos de la población bajo las condiciones de estabilización socioeconómica. El objetivo principal del estudio es analizar las prioridades actuales de la regulación estatal de los ingresos de la población y ofrecer algunas medidas para garantizar un aumento de los ingresos de la población de Ucrania en las actuales condiciones de crisis. La regulación estatal de los ingresos de la población es un apalancamiento importante que tiene un impacto directo en el nivel de ingresos de la población. |

The main task of the state policy at the present stage of stabilization of socio-economic development and integration of Ukraine into the world economy is improving the quality of life of the population, providing the basis for its further growth depending on the state of the economy, as well as providing common social standards throughout the state.

In today’s Ukraine, the problem of the state regulation of incomes of the population has become acute. The main reason for this situation is the low income of the population and their main part – wages. It should be noted that the level of socio-economic development of the country directly depends on the state income policy. That is why the issue of regulation of wages at the state level requires thorough research and improvement.

Ensuring a high level of well-being of its citizens is one of the important functions of any state. Ukraine is of no exception in this sense, declaring it in the relevant legislative and regulatory documents and ratifying in a number of international acts.

However, despite the steady tendency to increase the general level of incomes, the problems such as low wages of the majority of the working population, a significant share of social transfers in the structure of incomes, increasing income differentiation, the presence of a significant number of citizens who receive incomes below the minimum of subsistence remain pressing and urgent, etc. The presence of a large number of problems requires improving the state policy of regulating the incomes of the population and identifying the regulatory leverage.

To solve the problem, it is used the theoretical method – the method of studying and analysing scientific and methodological literature, systematizing, comparing, generalizing the obtained research results.

The population’s incomes, as the most important socio-economic category, have always been the subject of scientific interest by leading foreign and domestic researchers. In the works of Boeri (2012), Fernandez-Macias (2016), Macerinskaite (2016), Tamasauskiene (2017). Enrique of the world the fundamental issues of the formation and state regulation of incomes have been analysed.

The International Labour Office in Geneva (2016) reports that some 90% of countries around the world have legislation supporting a minimum wage. The minimum wage in countries that rank within the lowest 20% of the pay scale is less than $2 per day, or about $57 per month. The minimum wage in the countries that represent the highest 20% of the pay scale is about $40 per day, or about $1,185 per month. Those in favor of increasing the minimum wage argue that such an increase lifts people out of poverty, helps low-income families make ends meet and narrows the gap between the rich and poor. Boston University defines minimum wage as, "the lowest level of earnings for employees set by government legislation." In general there are two fiscal and social arguments on the minimum wage. Supply side economists see a minimum wage as a overreaching burden placed on small businesses while demand side economists argue wages set too low will result in higher levels of poverty.

The author is also studying the regulation of the minimum wage that constitutes an important measure of state's social and economic policy. The effectiveness of its implementation is highly dependent upon the socioeconomic situation (Macerinskaite et al, 2016).

The literature analyzing the distributional effects of regulation suggests that regulation may be particularly detrimental to low-income households (Bailey et al, 2019).

The wage is a financial remuneration of an employee for the work performed. The wage is a big motivating factor for carrying out the work, whether psychologically or economically. The main aim of this paper is to examine and compare the wages in selected countries of world. The authors - examine the evolution of the minimum wage and the average wage in selected countries. The average wage will also be investigated in individual countries.

According to the conclusion (Suhanyi et al, 2016) that the wage level and the possibility of applying for a different job markets are (from the perspective of economic theory) the most significant although not the only factors of international migration. Some countries face a greater influx of workers to their labor markets; other countries need to deal with the outflow of workers. Slovak Republic belongs to the second group.

This article contributes to the growth of discussions on the coordination of the level of minimum wages at the level of the European Union (EU). The author considers the hypothetical European minimum, which is 60 percent of the average wage in each of the European countries. The institutional impact of this common European threshold will be greater in those countries where the minimum wage is currently collectively taken into account by social partners than those countries where they are established by statutory regulation. But, according to a statistical analysis, such a minimum wage in the EU affects a larger share of labor in countries where there is a minimum wage, as they have a lower wage (Fernandez-Macias and Vacas-Soriano 2016).

The share of wages in most countries and regions has been declining for more than three decades. It is believed that a decrease in the share of wages has a negative impact on the costs of private consumption, since the propensity to consume at the expense of labor income is higher than at the expense of capital income. There are conflicting data on the impact of wage reductions on investment spending. The decrease in the share of wages has a positive effect on investment due to increased profits and a negative impact due to a decrease in demand. If the overall effect is positive, then the domestic demand regime is considered profit-oriented; otherwise, he is considered a wage slave (Tamasauskiene et al, 2017). The Eurozone crisis has revived the debate among economists about the role wages play in open economies. Wages paid to employees are at the same time the main source of aggregate demand and the determining factor in the competitiveness of international companies.

With higher wages in one country, this leads to a temporary decline in the country's current account and a slowdown in the short-term prospects. However, over a longer period, as a rule, increase wages, improve the efficiency of innovation business through increased competition, providing long-term benefits in productivity, allowing the economy to recover. Despite the fact that they will be waging salaries in all countries that do not affect their activities, you will benefit from the real GDP, productivity and government finances of countries that do not affect unemployment and the external balance of countries (Caiani et al, 2019).

Germany did not set the statutory minimum wage until 2015. The new minimum wage was set at an initial level of € 8.50 per hour. When it was introduced, about 11 percent of German workers earned less than this amount. Based on descriptive numbers, qualitative research and analysis of differences in differences, we provide an overview of the available data on some of the topics that have attracted the most attention in international scientific research and policy debates: the impact on wages and wage distribution, including compliance issues regarding introducing a new minimum wage, poverty risk, employment and business impact, for example, in terms of productivity, prices or profits.

The facts show that the minimum wage has increased significantly in hourly rates, and the impact on monthly wages was much less significant, as companies partially shortened the agreed working hours. In addition to reducing working time or increasing labor intensity, companies heavily affected by the introduction of a minimum wage used price increases and had to accept a reduction in profits as a response to the new minimum wage. If the research revealed any effect on employment, it was positive or negative or insignificant in relation to the total number of jobs. As in other countries, the minimum wage did not help reduce dependency on welfare and the risk of poverty. Non-compliance remains a challenge for the introduction of a new statutory minimum wage (Bruttel 2019).

Raising the minimum wage leads to a decrease in compensating differences in undesirable jobs with low qualifications, because they increase wages in the most desirable work with low qualifications — work with minimal wages. This change in hedonistic compensation may result in some people optimally leaving unwanted low-wage jobs and looking for more desirable jobs. If the supply of labor falls on undesirable low-wage jobs, employers will increase wages in accordance with the ripple effect (Phelan and Brian , 2019).

The wage gap between men and women is a global problem that persists despite political will and intervention. Women of relatively high qualifications who perform similar work with men continue to earn less. There are conflicting opinions in the literature on the state of the gender pay gap (Adelekan et al, 2018).

In the presented paper the attention is focused on considering the problems that, in our opinion, have been insufficiently investigated, in particular, improving the state regulation of incomes under the conditions of Ukraine’s integration into the world economy.

One of the main indicators that reflect the quality of life of the population is the standard of living. The concept of a standard of living is determined by the ratio of monetary incomes of the population and subsistence level, the proportion of the poor and rich, the purchasing power of the middle layers, the provision of housing, objects of household and communal services and utilities, etc. In other words, the living standards of the population are the availability of high paid jobs and decent wages, the opportunity to use the guaranteed quality services. In recent years, the problems associated with ensuring the growth of incomes of the population are of particular relevance.

We live in a complex world. People, countries and economies are more interconnected than ever, and just as the global development of the problem we face. These problems are related to the boundaries of the social, economic and environmental spheres and can be permanent or repetitive (Human Development Indices and Indicators, 2018).

The largest innovations in HDR have been new measurement tools, including the Human Development Index (HDI): National development should be measured not only by per capita income, as long as practiced, but also by advances in health and education (Human Development Indices and Indicators, 2018). Consider some of the data studied in Table 1.

Table 1

Human Development Index

Place among other country |

Country |

Human Development Index (HDI) |

3 |

Australia |

0.939 |

4 |

Ireland |

0,938 |

5 |

Germany |

0.936 |

10 |

Netherlands |

0,931 |

12 |

Canada |

0.926 |

13 |

USA |

0,924 |

17 |

Belgium |

0.916 |

19 |

Japan |

0,909 |

21 |

Luxembourg |

0.904 |

24 |

France |

0,901 |

29 |

Malta |

0.878 |

33 |

Poland |

0,865 |

38 |

Slovakia |

0.855 |

47 |

Argentina |

0,825 |

51 |

Bulgaria |

0.813 |

64 |

Turkey |

0,791 |

Source: Human Development Indices and Indicators ( 2018)

One of the components of the income of citizens of each state is their wages; it can be minimal, established by the state, and the average in the country.

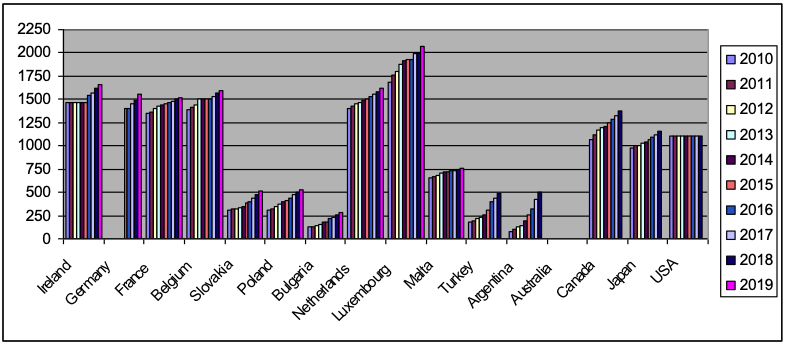

The nominal rates of statutory minimum wages were increased in the majority of Member States in January 2019, compared with the same reference month in 2018. The monthly rates now range from €286 in Bulgaria (BGN 560) to €2,071 in Luxembourg for a full-time working employee. Eight countries have monthly minimum wages of above €1,000, while four countries have a rate of below €500 (Table 2, 3; Figure 1,2). In nominal terms, a worker in Luxembourg receives 7.2 times the minimum wage of a worker in Bulgaria, a slight improvement on the previous year when the multiplier of Luxembourg compared with Bulgaria was 7.7. (Macerinskaite et al., 2016).

Table 2

Minimum wage per month, Euro

Country |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Ireland |

1461,85 |

1461,85 |

1461,85 |

1461,85 |

1461,85 |

1462 |

1546,35 |

1563,25 |

1613,97 |

1656,2 |

Germany |

|

|

|

|

|

1402,5 |

1402,5 |

1458,6 |

1497,79 |

1557,09 |

France |

1343,8 |

1365,03 |

1398,4 |

1430,25 |

1445,42 |

1457,55 |

1466,65 |

1480,3 |

1498,47 |

1521,22 |

Belgium |

1387,49 |

1415,24 |

1443,54 |

1501,82 |

1501,82 |

1501,82 |

1501,82 |

1531,93 |

1562,59 |

1593,76 |

Slovakia |

307,7 |

317 |

327,2 |

337,7 |

352 |

380 |

405 |

435 |

480 |

520 |

Poland |

309,37 |

325,58 |

352,36 |

375,85 |

394,64 |

411,09 |

434,58 |

469,81 |

502,75 |

523,09 |

Bulgaria |

122,71 |

122,71 |

138,05 |

158,5 |

173,84 |

184,07 |

214,75 |

235,2 |

260,76 |

286,33 |

Netherlands |

1407,6 |

1424,4 |

1446,6 |

1469,4 |

1486 |

1502 |

1524,6 |

1551,6 |

1578 |

1615,8 |

Luxembourg |

1682,76 |

1757,56 |

1801,49 |

1874,19 |

1921,03 |

1922,96 |

1922,96 |

1998,59 |

1998,59 |

2071,1 |

Malta |

659,92 |

664,95 |

685,14 |

702,82 |

717,95 |

720,46 |

728,04 |

735,63 |

747,54 |

761,97 |

Turkey |

176,92 |

193,3 |

215,14 |

237,49 |

259,91 |

309,06 |

399,7 |

431,37 |

492,53 |

- |

Argentina |

80,04 |

98,18 |

122,72 |

142,46 |

192,09 |

251,63 |

323,34 |

430,06 |

506,89 |

- |

Australia |

1.602,74 |

1.680,02 |

1.737,14 |

1.787,54 |

1.833,46 |

1.889,46 |

1.936,50 |

1.982,42 |

2.048,50 |

- |

Canada |

1065,19 |

1121,62 |

1163,66 |

1190,18 |

1202,78 |

1249,45 |

1287,88 |

1323,27 |

1377,16 |

- |

Japan |

973,47 |

996,69 |

1006,24 |

1022,63 |

1043,11 |

1064,95 |

1089,53 |

1123,66 |

1157,79 |

- |

USA |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

1110,25 |

- |

Source: Industrial relations. Minimum wages in 2019: (Annual review 2019)

-----

Figure 1

Dynamics of changes in the minimum wage

Source: Industrial relations (2019)

-----

Table 3

Minimum wage for 1 hour, euro

Country |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Ireland |

8,65 |

8,65 |

8,65 |

8,65 |

8,65 |

8,65 |

9,15 |

9,25 |

9,55 |

9,8 |

Germany |

|

|

|

|

|

8,5 |

8,5 |

8,84 |

8,84 |

9,19 |

France |

8,86 |

9 |

9,22 |

9,43 |

9,53 |

9,61 |

9,67 |

9,76 |

9,88 |

10,03 |

Belgium |

8,41 |

8,58 |

8,75 |

9,1 |

9,1 |

9,1 |

9,1 |

9,28 |

9,22 |

9,41 |

Slovakia |

1,77 |

1,82 |

1,88 |

1,94 |

2,02 |

2,18 |

2,33 |

2,5 |

2,76 |

2,99 |

Poland |

1,79 |

1,88 |

2,04 |

2,17 |

2,28 |

2,38 |

2,51 |

2,72 |

2,84 |

2,95 |

Bulgaria |

0,73 |

0,73 |

0,82 |

0,95 |

1,04 |

1,06 |

1,24 |

1,42 |

1,47 |

1,62 |

Netherlands |

8,64 |

8,74 |

8,87 |

9,01 |

9,12 |

9,21 |

9,35 |

9,52 |

9,68 |

9,91 |

Luxembourg |

9,73 |

10,16 |

10,41 |

10,83 |

11,1 |

11,12 |

11,12 |

11,55 |

11,55 |

11,97 |

Malta |

3,81 |

3,84 |

3,95 |

4,05 |

4,14 |

4,16 |

4,2 |

4,24 |

4,31 |

4,33 |

Turkey |

0,91 |

0,99 |

1,1 |

1,22 |

1,33 |

1,58 |

2,05 |

2,21 |

2,53 |

|

Argentina |

0,4 |

0,49 |

0,61 |

0,71 |

0,96 |

1,26 |

1,62 |

2,15 |

2,53 |

|

Australia |

9,71 |

10,18 |

10,53 |

10,83 |

11,11 |

11,45 |

11,74 |

12,01 |

12,42 |

|

Canada |

6,16 |

6,48 |

6,73 |

6,88 |

6,95 |

7,22 |

7,44 |

7,65 |

7,96 |

|

Japan |

5,63 |

5,76 |

5,82 |

5,91 |

6,03 |

6,16 |

6,3 |

6,5 |

6,69 |

|

USA |

6,42 |

6,42 |

6,42 |

6,42 |

6,42 |

6,42 |

6,42 |

6,42 |

6,42 |

|

Source: Industrial relations (2019)

-----

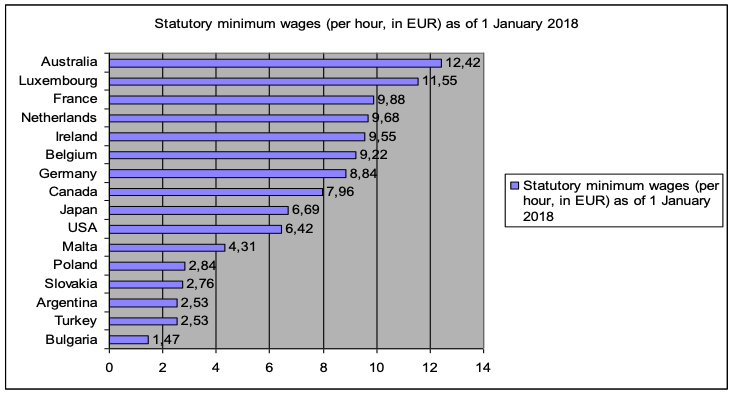

Figure 2

Minimum wage for 1 hour, euro

Source: Industrial relations (2019)

From the table 3 we can conclude that in many countries of the world and in all European countries, during the last decade, the minimum wage has significantly increased.

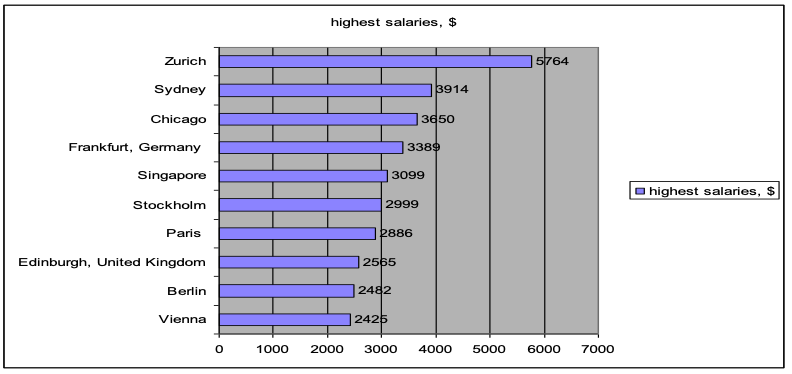

The study also looked at data on the level of average wages in the countries of the world, as reflected in EURO (Reinis Fischer, 2018): Ireland-2564; Germany-2360; France-2225; Belgium-2170; Slovakia-894; Poland-846; Bulgaria-495; Netherlands-2152; Luxembourg-3416; Malta-1,379; Canada-2432.

Figure 3

Average salary, euro

Source: Reinis Fischer (2018)

It should be noted that actual social efficiency is limited to the capabilities of the national economy and the type of macroeconomic system on which social relations depend. Such restrictions, ultimately, result in a logical link between the minimum and average wage of employees. Obviously, when developing the policy of raising the minimum wage, it should be guided by its importance and timing, in which the balance of social and economic efficiency is achieved.

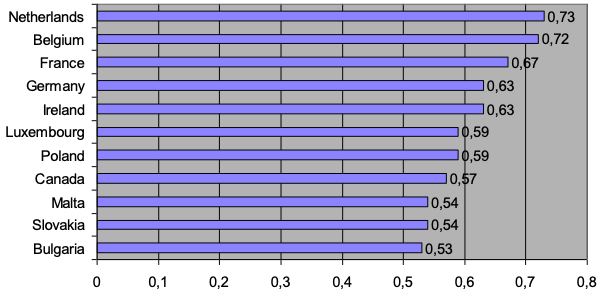

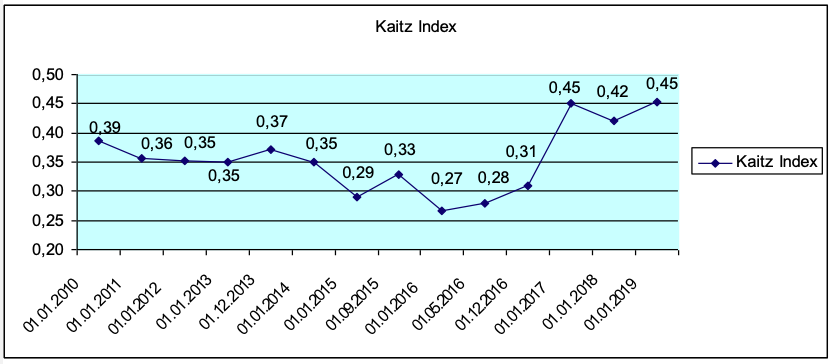

That is, the criterion for assessing the balance of social and economic efficiency is Kaitz index, which as an indicator is characterized by a ratio of minimum (PPM) and average wage (ZPsm) (Boeri, 2014):

![]()

According to the methodology, the average monthly wage of employees includes taxes. This approach is used by the International Labor Organization and the European Union when valuing the Kaitz index. Thus, the value of the Keitz index should be in the range of 50 - 60%.

The calculation of Kaitz index is presented to Figure 4.

Figure 4

Kaitz index in the countries of the world

Source: OECD (2017)

Consequently, the Kaitz index is within the limits set by the norms of the International Labor Organization and the European Union.

According to the State Statistics Committee of Ukraine, in the structure of incomes, the main part is wages. The change in the ratio of average wages and the size of the subsistence minimum in recent years has not been in favour of wages. The increase in the population’s incomes, the growth of purchasing power and consumer demand are largely dependent on reviving and expanding industrial production. In its turn, increasing the well-being of the population and associated with it the increase in solvent demand will contribute to developing the country’s economy.

The Law of Ukraine “On Remuneration of Labour” provides the following definition of wages: it is a remuneration, calculated, as a rule, in monetary terms, which, according to an employment contract, the owner or an authorized body of the employee pays the worker for a kind of work performed by him/her. The state wage policy is a system of principles, approaches and practical state measures aimed at ensuring timely, fair and decent wages. It involves: 1) receiving wages by the employee in the statutory terms; 2) paying wages in full; 3) receiving by the employee a salary, which is not lower than the minimum wages established by the state; 4) receiving wages by the employee, which ensures the existence of the worker and his/her family members. The state wage policy is practically implemented through the mechanism of its regulation. The main aim of the state regulation of wages is creating the necessary conditions for ensuring the fulfilment of wages of all their essential functions (reproductive, stimulating, forming a solvent demand of the population, etc.), as well as restraining unreasonable wage growth that is not related to the volume of production and sales of products (works, services).

The main indicator of the effectiveness of the state’s economic and social policies is the high standard of living of the population. It is the achievement of a high standard of living which is most often identified with the achievement of the European standards of well-being. Several indicators can be used to study the standard of living in Ukraine, but they all indicate a low level of well-being in our country. The index of human development (the IHD) is often used to compare living standards. According to this indicator in 2012 Ukraine occupied the 78th place in the world, in 2014 – the 83rd place among 187 countries, in 2016 – the 84th place among 188 countries, in 2017 – the 88th place among 189 countries of the world (Human Development Indices and Indicators, 2018).

Today, Ukraine is far behind the European countries by most indicators of economic development. Although economic growth has increased the incomes of the population during recent years, many years are still needed to reach the average European well-being level. As a rule, the income management policy covers all the hierarchical levels at which income formation occurs – from national to the household level (Koval et al., 2019).

The main purpose of income regulation at the household level is the fair distribution of financial-economic, social resources among households provided that they receive the maximum possible income. As for state intervention, its role is rather social rather than economic. In particular, all three levels (national, regional, local) are in continuous interaction. As a rule, regulation of the regional and local levels is carried out through territorial, sectoral and collective agreements. Sectoral agreements regulate the minimum tariff rate for the main vocational qualification groups, the form and the systems of wages, the size of social payments and benefits. Collective agreements regulate issues of the size and differentiation of tariff rates, bonuses and surcharges, wage indexation, shareholdings, social payments and benefits, as well as working hours.

Thus, the direct state income management process is aimed at creating certain conditions that will contribute to the normal reproduction of labour, the accumulation of human capital, the development of which leads to economic growth of the well-being of the population, the strengthening of the motivation of employees to work activity, provision of the help for those who cannot provide for themselves a certain level of income.

One of the priorities of the state income policy is the labour remuneration system. Regulating the remuneration system provides for establishing minimum wages, norms and guarantees of payment, conditions and rates of remuneration of employees of institutions and organizations financed from the budget, as well as regulating the remuneration funds of monopoly enterprises, etc.

In addition, the elimination of imbalances between pay and labour productivity should be performed by bringing the average wage share to an increase in labour productivity at least to the level of Eastern European countries. This should be one of the main tasks of the state regulation of incomes in Ukraine.

The aspirations and challenges of a society in achieving social justice require various measures to regulate the incomes of the population from the state authorities. One of the key state social standards of living standards is the subsistence minimum, which should be used as a criterion for the poverty of society. Therefore, one of the main tasks of an effective state policy of the population income regulation should be the need for the state to take steps to gradually bring the subsistence minimum to the minimum wages.

Consequently, despite the existence in Ukraine of the developed legislative framework in the field of ensuring constitutional guarantees for social protection of the population, the standard of living of the population remains unchanged. At the same time, its basic social standard – the subsistence minimum – is used only for general estimates of living standards of the population. In particular, during the calculation of the minimum wages and subsistence minimum, the projected level of growth of the macroeconomic indicators of the Ukrainian economy is not taken into account. As the size of the minimum wages and subsistence minimum is not always reviewed, according to the level of inflation throughout the year.

The following indicators may demonstrate the effectiveness of the state wage regulation policy:

1. The ratio of nominal and real wages as well as the consumer price index. Nominal wages and real wages do not necessarily change at the same rate. 2. The ratio of minimum wages and average wages, as well as the subsistence minimum. The main target of establishing the minimum wages is to combat poverty.

At the same time, it should be noted that state minimum standards should be reflected both in the state budget and in local budgets, which will help to equalize the level of social security of citizens within different regions, districts and other administrative units, etc. It should also be noted that, as dated 2018, the indexation of monetary incomes is one of the main state instruments of income regulation aimed at supporting the solvency of vulnerable groups of people with fixed income. Indexes are subject to cash flows of citizens received in hryvnias on the territory of Ukraine, which are not of a single nature: a) pensions; b) scholarships; c) wages and salaries of employees of enterprises, institutions, organizations in monetary terms, which includes wages for the kind of work performed in accordance with the tariff rates (salaries) and piece rates, surcharges, allowances, bonuses, guarantee and compensatory payments provided for by the law, as well as other compensatory payments of a permanent nature; d) the monetary support for servicemen, policemen, persons of ordinary and commanding personnel, customs officials; f) the amount of alimony determined by the court in a solid monetary amount; g) the unemployment benefit provided in accordance with the law on compulsory state social insurance against unemployment; h) amounts of compensation for damage caused to a physical person by injury or other damage to health etc.

On the 1st of January, 2018, according to the amendments to the Law of Ukraine “On the State Budget of Ukraine for 2018” (in relation to raising the subsistence minimum and minimum wages), the minimum wages in Ukraine are 3723 UAH and the subsistence wages are 1762 UAH (State Statistics Service of Ukraine, 2019). According to the course of the National Bank of Ukraine, the minimum wages on the 1st of January, 2019 are 4172 UAH, in the equivalent it is 111 EUR (the subsistence wages are almost 53 EUR), which even does not correspond approximately to the minimum wages of the poorest countries of the European Union. In the course of the research, the dynamics of the subsistence wage level for a capable person in Ukraine for the period from 2010 to April 2019 has also been analysed and a comparative analysis of the size of the subsistence wages with the size of the minimum wages in Ukraine for the period of 2010 – 2019 was made (Table 4).

Table 4

Summary of the Data on the Established Value of the Subsistence

Minimum and Minimum Wages in Ukraine (2010 – 2019)

Date |

Subsistence Minimum, UAH |

Minimum Wages, UAH |

01.01.2010 |

825 |

869 |

01.01.2011 |

894 |

941 |

01.01.2012 |

1017 |

1073 |

01.01.2013 |

1108 |

1147 |

01.12.2013 |

1108 |

1218 |

01.01.2014 |

1176 |

1218 |

01.01.2015 |

1176 |

1218 |

01.09.2015 |

1176 |

1378 |

01.01.2016 |

1330 |

1378 |

01.05.2016 |

1330 |

1450 |

01.12.2016 |

1330 |

1600 |

01.01.2017 |

1544 |

3200 |

01.01.2018 |

1700 |

3723 |

01.01.2019 |

1853 |

4173 |

Source: the State Statistics Service of Ukraine (2019)

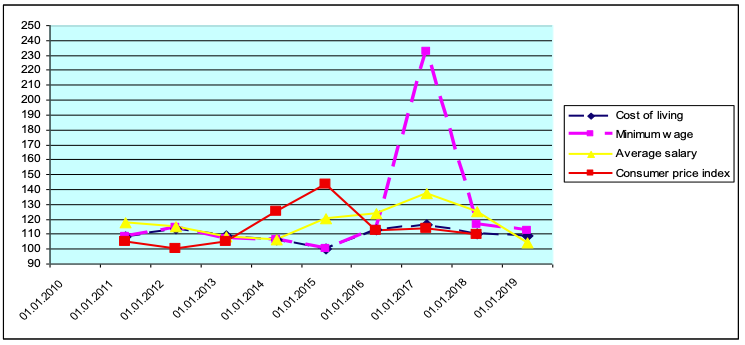

The Council of Europe recommends setting the minimum wages at the level of 60% of the national average wages. According to the EU standards, the minimum wages should be 2.5 times the subsistence minimum. In 2018, the minimum wages in Ukraine were 3723 UAH, and the subsistence minimum was 1841.3 UAH (2,02 of the value of the subsistence minimum). On the 1st of January, 2019, the minimum wages are 4173 UAH, and the subsistence wages are 1921 UAH (2.17 of the value of the subsistence minimum), at the end of 2019 it is planned 2102 UAH (1.98 of the value of the subsistence minimum), which, as it is seen, does not correspond to the EU standards and generally tends to decrease. It should also be noted that the annual increase of the minimum wages does not keep pace with the overall growth of the average wages, while the Kaitz Index in Ukraine (the percentage of the minimum and average wages) is today 45 %, not reaching the recommended range by the ILO and the World Bank at 50%–60%.

3. The ratio of the growth rates of the minimum wages and the consumer price index to the fall in the purchasing power of low-wage workers, and, thus, to the increase in poverty. In the course of the research period in Ukraine, the worst situation was observed in 2011 and 2015, when the growth rate of the minimum wages was lower than the growth of the consumer price index.

4. The share of average wages in the structure of the GDP and total incomes of the population. One of the constituent elements of the gross domestic product (the GDP) is the payment of labour. In Ukraine, this index is less than 40% today, whereas, in the developed countries such as the United States and Japan, wage share in the GDP is more than 75%.

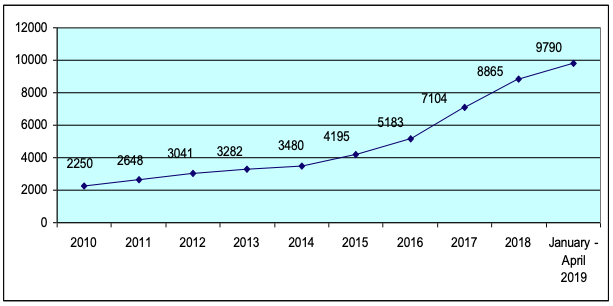

Increasing the minimum wages in Ukraine from 01.01.2019 from 3723 UAH up to 4173 UAH is insufficient because our country falls behind the level of wages established in the EU countries. Also, the planned future increase of the minimum wages will not lead to an increase in the living standards of the Ukrainians, as it is approximately consistent with the rate of inflation. And the real increase in prices for all goods and services, of course, turns out to be higher. Therefore, in terms of increasing the well-being of the population, it is very difficult to say that raising the minimum wages by 12% will increase the well-being level. It should also be taken into account that in Ukraine the minimum wages are taxed on personal incomes at a rate of 18%, and the non-taxable minimum of incomes is set at 17 hryvnias. For the state regulation of incomes, one of the ways of raising the level of employees’ incomes could be to apply a gradual increase of this non-taxable minimum, with the gradual approximation to the size of the minimum wages. Also, in the course of the study, the changes in the level of average wages in Ukraine for the period from 2010 to April 2019 were analyzed. Nominal wages include tariff rates (salaries), bonuses, surcharges, allowances, payments for an unprocessed time, as well as compulsory deductions: personal income tax, military salary. The analysis of the average wages, subsistence minimum and minimum wages is presented in Figure 6.

Figure 5

Dynamics of Growth of Average Wages

in Ukraine for the Period of 2010 – 2019

Source: State Statistics Service of Ukraine (2019)

When analysing the nominal wages during 2018 and 2019, it was established that the average nominal wages of a full-time employee of enterprises, institutions and organizations in January 2019 amounted to 9223 UAH, which is 2.2 times higher than the minimum wages (4173 UAH). Compared to December 2018, the rate of change in the average nominal wages amounted to 87.2%. The decrease in charges in January to the previous month is due annually and due to the fact that in December, accruals of one-time payments are paid: rewards for the results of work during a year, for seniority, compensatory payments for unused vacation, etc.

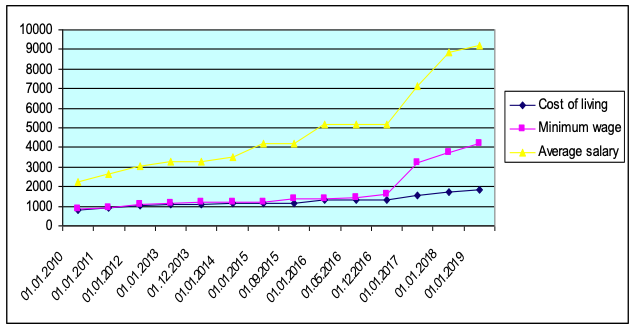

Figure 6

The Ratio of Minimum wages and Average

wages, the Subsistence Minimum

Source: State Statistics Service of Ukraine (2019)

-----

Figure 7

The Growth rates of Minimum wages and Average wages,

the Subsistence Minimum for the Period 2010 – 2019

Source: Author's development

-----

The rate of change in the average nominal wages compared to January 2018 was 119.6%.

It should be noted that the necessary criterion for assessing the economic and social situation in the country is to use the Kaitz index. Based on the calculations, we can conclude that in Ukraine the 50% -60% norms set by the the EU are not met.

Figure 8

Kaitz index in Ukraine for

the Period 2010 – 2019

Source: Author's development

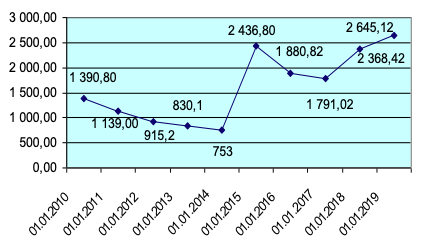

It should be noted that one of the areas of the state regulation of incomes is the control over the payment of wages to employees and the payment of arrears of wages. In the course of the study, the state of wage arrears for the period 2010 – 2019 on the 1st of January, 2019 was analyzed and it was established that with the increase of the average monthly wages, the arrears of wages from 2010 increased almost 2 times and its state on the 1st of January, 2019 is 2.64 billion UAH (State Statistics Service of Ukraine, 2019). The dynamics of changes in the amount of wage arrears in Ukraine is graphically presented in Figure 9.

Figure 9

Dynamics of changes of wage arrears in Ukraine

for the period of 2010-2019 (dated 01.01.2019)

Source: State Statistics Service of Ukraine (2019)

An investment climate is a very important factor for economic development in Ukraine. Let us examine the data of the State Statistics of Ukraine during the period from 2015 to the beginning of 2019. On the 1st of January, 2019 the largest countries-investors are Cyprus – $ 9531.5 million (29.0%), the Netherland – $ 7190.7 million (21.8%), the United Kingdom – $ 2090.3 million (6.4%), Germany – $ 1698.5 million (5.2%).

Despite the state of the economy in Ukraine, foreign investors consider it possible to invest in Ukraine, which will enable it to develop and generate profits. Another important factor affecting the incomes of the Ukrainians is the labour migration of the Ukrainians to other countries of the world. The impact of external labour migration on the economic development of Ukraine is ambiguous. On the one hand, the money arriving in the country from the migrants promotes the development of domestic production and maintains a balance of payments. On the other hand, the outflow of workers abroad reduces the supply of the domestic labour market and also creates risks for the stable functioning of the social security system. Taking into account these circumstances, the substantiated assessment of the impact of external labour migration on the country’s economic development is an important condition for forming an effective state migration policy. Without such an assessment it is impossible to determine the objectives of the migration policy, which achievements will contribute to the rapid and sustainable growth of the well-being of society.

In order to provide social protection for the Ukrainian labour migrants working abroad, Ukraine has concluded bilateral social security agreements with Bulgaria, Estonia, Spain, Latvia, Lithuania, Portugal, Slovakia, the Czech Republic and Poland. These social security agreements apply to migrant workers, persons who are permanently residing abroad, and stateless persons and refugees protected by the relevant national legislation. They cover the whole range of social security benefits, that is, old-age pensions, in the case of invalidity and in the event of loss of breadwinners, assistance in connection with temporary incapacity for work, sickness and pregnancy and childbirth, as well as assistance in connection with labour damages. According to the results of the migration survey conducted by the ILO in 2013, 1.2 million people, or 3.4% of the population of Ukraine, were migrant workers. Among the population of the capable age, the share of migrant workers in the period of the survey was 4.1%. In the age group of 25–29 years old, the majority (4.3 times more) of these persons were men, while women predominated in the age group of 60–70 years old (6.8 times) (International Labour Organization, 2016).

Also, migration of the population for recent decades has contributed to spreading the European values and norms of market consciousness in Ukraine, forming a society open to the world capable of innovation. Labour migrations reduce tension in the labour market. In the absence of employment abroad, the number of the unemployed more than twice exceeds their actual number (International Labour Organization, 2016).

The study of the priorities of the state regulation of incomes of the population acquires an exceptional significance in the modern socio-economic realities. Therefore, it is indisputable that public policy in the field of income regulation is one of the main elements of managing the level of socio-economic development of the country.

Reforming the pension policy, the stability of the inflation process, raising the subsistence wage level, and economic growth have created objective conditions for increasing real incomes, in particular, wages and increasing its share in total incomes of the population. However, the overall level of actual incomes in the country remains low.

We believe that overcoming the negative phenomena that characterize the standard of living, consumer demand and the force of labour motivation is possible through a way of radical transformation of the mechanism of remuneration. This problem needs to be solved at the macro and micro levels together with the tasks of reforming taxation and pricing.

The experience of Poland, Slovakia, Hungary, Croatia, and the Czech Republic proves that real changes in the economy of these states began only when the average wages rose to a level equivalent to 300 USD and above per month.

Based on the data on income, the level of minimum wages, and average wages, it can be seen that the requirements of the International Labor Organization in the EU and other analyzed countries are being met, and the wage level is worthwhile, although it has a shadow increase. The study also calculated the Kaitz Index, which found that the ILO requirements are not being implemented in Ukraine, and the level of the index is low. In modern Ukraine labor migration occupies a significant place in the lives of citizens, which also has an impact on other states, and allows them to receive income from foreign countries.

In this connection it is necessary: to fix legislatively the procedure for establishing and reviewing the minimum wages, criteria for determining social well-being protection for low-wage workers; to ensure the implementation of the rights of workers to the minimum wages, the size of which should not be less than the value of the poverty line; to ensure the increase of the minimum wages to 60% of the average wages in the national economy in accordance with the recommendations of the International Labour Organization, which will increase the purchasing power of the population; to ensure the further development of the social partnership system in order to establish equal rights in matters of remuneration between the employer, employees and government bodies; to implement a range of legal and organizational-economic measures aimed at legalizing shadow incomes of the population; to reform the tax regulation of means for the remuneration of labour; to increase the size of the non-taxable minimum; to improve normative-legal acts on labour remuneration, in particular, to strengthen control over observance of legislation and timely payment of wages (repayment of all arrears on payment of wages); to strengthen the financial, administrative and criminal liability for tax evasion.

At the same time, the priorities of the state policy of regulating the incomes of the population should be not only socially oriented but also to be vector-oriented to achieve European social standards. In addition, they should be based and consistent with the strategy of economic and social development of Ukraine as a whole. Consequently, the state policy of income regulation should have clear benchmarks, targets, and appropriate resource-financial provision for them being implemented.

Adelekan, A.M., and Bussin, M.H.R. (2018). Gender pay gap in salary bands among employees in the formal sector of South Africa. SA Journal of Human Resource Management, 16(0), a1018. https://doi.org/10.4102/sajhrm.v16i0.1018

Bailey, James B., Thomas, Diana W., Anderson, and Joseph R. (2019). Regressive effects of regulation on wages. Public choice,180 (1-2), 91-103.

Boeri, T. (2012). Setting the Minimum Wage. IZA DP 4335.

Boeri, T. (2014). Setting the Minimum Wage. Labour Economics, 19 (3), 281–290.

Bruttel, O. (2019). The effects of the new statutory minimum wage in Germany: a first assessment of the evidence. Journal for labour market research, 53 (1), 10.

Caiani, A., Catullo, E., and Gallegati, M. (2019). The effects of alternative wage regimes in a monetary union: A multi-country agent based-stock flow consistent model. Journal of Economic Behavior & Organization, 162, 389-416.

Fernandez-Macias, E., and Vacas-Soriano, C. (2016). Acoordinated European Union minimum wage policy? European journal of industrial relations, 22 (2), 97-113.

Human Development Indices and Indicators (2018). Statistical Update. Retrieved from: http://hdr.undp.org/sites/default/files/2018_human_development_statistical_update.pdf.

Industrial relations (2019). Minimum wages in 2019: Annual review. Retrieved from: https://www.eurofound.europa.eu/sites/default/files/ef_publication/field_ef_document/ef19028en.pdf.

International Labour Organization (2016). Decent Work Program for Ukraine 2016 – 2019. Retrieved from: https://www.ilo.org/budapest/countries-covered/ukraine/WCMS_470684/lang--en/index.htm

Koval, V., Duginets, G., Plekhanova, O., Antonov, A., and Petrova, M. (2019). On the supranational and national level of global value chain management. Entrepreneurship and Sustainability Issues, 6(4), 1922-1937.

Macerinskaite, R., Kedaitis, V., and Balezentis, T. (2016). The linkages between minimum wage and macroeconomic indicators in the European Union. Management theory and studies for rural business and infrastructure development, 38 (1), 36-47.

OECD. (2017). Earnings: Minimum wages relative to median wages (Edition 2017). OECD. Employment and Labour Market Statistics (database). http://dx.doi.org/10.1787/daa2eed1-en.

Phelan, Brian J. (2019). Hedonic-Based Labor Supply Substitution and the Ripple Effect of Minimum Wages. Journal of Labor Economics,37 (3), 905-947.

Reinis Fischer(2018). Average Salary in European Union 2018. Retrieved from: https://www.reinisfischer.com/average-salary-european-union-2018.

State Statistics Service of Ukraine (2019). Statistical information.Retrieved from: www.ukrstat. gov.ua.

Suhanyi, L., Suhanyiova, A., and Horvathova, J. (2016). Research in wages in selected countries of the european union and in regions of Slovakia. 3rd International Multidisciplinary Scientific Conference on Social Sciences and Arts, SGEM Albena, BULGARIA . AUG 24-30.

Tamasauskiene, Z., Seputiene, J., and Balvociute, R. (2017) The impact of wage share on domestic demand in the European Union. Eurasian Economic Review?, 7 (1), 115-132.

1. Department of Menegement, Donbas National Academy of Civil Engineering and Architecture, Ukraine

2. Head of Department of Applied Economics, Odessa Institute of Trade and Economics of Kyiv National University of Trade and Economics, Ukraine. E-mail: victor-koval@ukr.net

3. Department Macroeconomic and Public Administration, Black Sea Research Institute of Economics and Innovations (Odessa),Ukraine