Vol. 40 (Issue 38) Year 2019. Page 16

PIDKHOMNYI, Oleg M. 1; DEMCHYSHAK, Nazar B. 2 & DROPA, Yaroslav B. 3

Received: 23/07/2019 • Approved: 28/10/2019 • Published 04/11/2019

ABSTRACT: The purpose of the article is to assess the financial activity of the population as a factor in the formation of indicators for public confidence and shadow economy risks, because, hypothetically, the collective mind of the population can be some alternative to the intellectual resources of specialized analytical units. It is substantiated that the collective mind of the population and its ability to make financial decisions in some country can be found based on the certain indicators' analysis. |

RESUMEN: El propósito del artículo es evaluar la actividad financiera de la población como un factor en la formación de indicadores para la confianza pública y los riesgos de la economía en la sombra, ya que, hipotéticamente, la mente colectiva de la población puede ser una alternativa a los recursos intelectuales de las especiales unidades analíticas. Está comprobado que la mente colectiva de la población y su capacidad para tomar decisiones financieras en algún país se pueden detectar en base al análisis de ciertos indicadores. |

The idea of the collective mind's existence is of considerable interest for the past and present scientific research. However, some scholars refute this thesis, while others, on the contrary, argue for its confirmation. Accordingly, we can state that there are directly opposing views on the effectiveness of the collective mind, in particular regarding the adoption of effective financial decisions based on a certain level of public confidence, that continues to emphasize this issue.

Thus, the work of some scientists is devoted to research of problems of the crowd (population) behavior and the identification of its key factors and probable consequences, in particular regarding financial activity (see, e.g. Surowiecki, 2005; Mackay, 1841; Soros, 1987, 1998). At the same time, a number of modern scientific research is devoted to the study of prediction markets (predicative markets) and their impact on the behavior of participants in some countries’ business life (see, e.g. Ozimek, 2014; Gjerstad, 2004; Abramowicz, 2008; Bell, 2006). The individual scientists consider the impact of the public confidence level on different economic indicators (see, e.g. Fukuyama, 1995; Gritsenko, 2012). The works of the Nobel Prize laureates laid the foundations for studying the behavioral economy (see, e.g. Kahneman et al., 1990; Thaler, 2008; Tversky, 1992), as well as institutional factors and institutional modernization problems (see, e.g. North, 1990; Coase, 1992).

Thus, the idea of so-called collective mind existence in society as a whole and the economy in particular remains questionable. However, we believe that the further public confidence problem study in this context is of significant importance, since its level may be too high or too low, that is, adequate or inadequate compared with the level of the national economy real problems. Therefore, it is actual the specific financial indicators' analysis, the results of which would be able to assert the effectiveness of the collective mind in the country and the possibility of making rational decisions based on the public confidence level formed collectively.

At the same time, the results of such studies can be used to conduct a national risk assessment for illegal financial transactions in any country. Such an assessment is one of the FATF's recommendations and is essential for the international standards of combating money laundering and terrorist financing implementation. Therefore, the addition of tools for national risk assessment with financial indicators to diagnose trends in the country's business life taking into account changes in the public confidence level and the crowd's reaction to the course of economic processes is a promising area of research.

Correlation coefficients are the common means for the measuring of relation tightness of different variables. There are some limits for using one most well-known of these indicators, namely Pearson Linear Correlation Coefficient. The obligatory condition for its applying is a normal distribution law of both variables the relation tightness of which is measured. The skewness and the kurtosis values of the related indicators should be close to zero. However, these conditions are hardly met regarding the economic indicators involved in this study. Therefore, we use the Fechner correlation coefficient, which is applied to check the relationships of abnormal distributed and small series of data. The Fechner correlation coefficient takes into account the coincidence and differences of the signs of the studied variables' deviations from their mean values. Therefore, it relates to nonparametric correlation coefficients.

In this research, we have adjusted all the absolute monetary indicators to the inflation rate and calculated their annual changes. Structural and relative indicators have been taken to correlation coefficients calculations without adjustment. The logical method has been used to formulate hypotheses and to explain the revealed relations. A table method has been applied to summarize statistical data. A graphical method has been used to improve data visualization and analysis in order to identify the corresponding patterns of the investigated indicators relations.

As you know, in the scientific literature there are two opposing positions regarding the role of the population as the carrier of some collective mind and its ability to make effective economic and financial decisions. Thus, in the book "The Wisdom of Crowds" (Surowiecki, 2005), the author affirms the important role of the population as a whole and the potential of the crowd to make important decisions and to influence the business environment, economic situation and socio-political processes in the country more effectively than it is possible do it alone. In addition, the crowd's potential to solve specific financial problems and achieve certain goals in funding projects, in particular, socially important, is evidenced by the widespread use of crowdfunding. In today's globalized economy, it is precisely the crowdfunding platforms that have become a new effective tool for the significant amounts of financial resources accumulation during relatively short time, avoiding bureaucratic obstacles with the use of IT-technologies.

In contrast to these attitudes, in the "Extraordinary Popular Delusions and the Madness of Crowds" (Mackay, 1841) there are indicated many mistakes made in the crowd behavior and, consequently, the population inability to affect the socio-economic life of the country constructively. George Soros, the developer of the reflexivity theory, argues that market conjuncture is conditioned by the expectations of market participants and this scientist states that the crowd is inclined to mistaken often (Soros, 1987, 1998).

Separately, it is necessary to note a number of interesting modern scientific studies of the prediction markets (predictive markets, information markets, decision markets, idea futures, event derivatives, or virtual markets). The idea of their functioning is that current market prices can be interpreted as a prediction probability of some future event (Abramowicz, 2008; Ozimek, 2014). At the same time, some researchers emphasize the role of such markets as an instrument for promotion or even advancement of certain ideas, for example, the progress of science (Bell, 2006), and the inducement of some events in the financial and economic area (Gjerstad, 2004).

We believe that the "wisdom" of the crowd (population) and its ability to make decisions in terms of business life and financial activity in any country can be detected based on an analysis of the number of key indicators. Those indicators include: 1) interest rates on deposits, including household deposits; 2) the number of credit unions members; 3) the amount of capital investments in the country. Consider such an analysis on the example of the Ukrainian economy specific financial indicators. At the same time, we believe that the chosen indicators are the key indicators of the public confidence level in any country. Output data for calculating correlation coefficients for the period 2005-2017 are given in the Table 1.

Table 1

Output data for the analysis of the confidence relations

with the indicators of the Ukrainian economy

Year |

GDP, billion UAH |

Capital Investments, billion UAH |

Consumer price index, % to the previous year |

The shadow economy level, % of the official GDP |

Interest rates of banks on deposits of residents in national currency, % |

Interest rates of banks on new household deposits, % |

Number of members of credit unions, thousand members at the end of the period |

2004 |

357,544 |

89,314 |

109 |

30,7 |

7,8 |

7,9 |

785,13 |

2005 |

457,325 |

111,174 |

113,5 |

30,3 |

8,5 |

7,7 |

1231 |

2006 |

565,018 |

148,972 |

109,1 |

29,8 |

7,6 |

6,9 |

1791,4 |

2007 |

751,106 |

222,679 |

112,8 |

28,81 |

8,2 |

7,4 |

2391,6 |

2008 |

990,819 |

272,074 |

125,2 |

31,1 |

9,9 |

8,7 |

2669,4 |

2009 |

947,042 |

192,878 |

115,9 |

39 |

14 |

12,2 |

2190,3 |

2010 |

1120,585 |

180,5755 |

109,4 |

38 |

10,3 |

11,4 |

1570,3 |

2011 |

1349,178 |

241,286 |

108 |

34 |

8,1 |

9,1 |

1062,4 |

2012 |

1459,096 |

273,256 |

100,6 |

34 |

13,4 |

11,9 |

1095,9 |

2013 |

1522,657 |

249,8734 |

99,7 |

35 |

10,9 |

12,4 |

980,9 |

2014 |

1586,915 |

219,4199 |

112,1 |

43 |

11,9 |

13,2 |

821,6 |

2015 |

1988,544 |

273,1164 |

148,7 |

40 |

13 |

12,2 |

764,6 |

2016 |

2383,182 |

359,2161 |

113,9 |

35 |

11,4 |

10,4 |

642,9 |

2017 |

2983,88 |

448,4615 |

114,4 |

32 |

9,1 |

7,8 |

564,1 |

Average during 2005-2017 |

- |

- |

- |

34,6 |

10,5 |

10,1 |

1367,4 |

Sources: State Statistics Service of Ukraine, National Bank of Ukraine, Ministry

of Finance of Ukraine, Ministry of Economic Development and Trade of Ukraine

Results of adjustment for inflation and calculation of changes in indicators from Table 1 for determining the Fechner correlation coefficients are shown in Table 2.

Table 2

Data adapted to calculate the Fechner correlation coefficients for the analysis

of the confidence's relationship with the Ukrainian economy indicators

Year |

Consumer price index up to 2005, in the coefficients |

GDP adjusted for inflation, UAH billions |

Capital investments adjusted for inflation, UAH billions |

Changes in GDP adjusted for inflation, UAH billions |

Changes in capital investments adjusted for inflation, UAH billions |

2005 |

1,135 |

402,930 |

97,951 |

45,386 |

8,637 |

2006 |

1,238 |

456,291 |

120,305 |

53,361 |

22,354 |

2007 |

1,397 |

537,739 |

159,422 |

81,448 |

39,117 |

2008 |

1,749 |

566,579 |

155,58 |

28,840 |

-3,843 |

2009 |

2,027 |

467,253 |

95,162 |

-99,326 |

-60,417 |

2010 |

2,217 |

505,371 |

81,437 |

38,118 |

-13,725 |

2011 |

2,395 |

563,392 |

100,757 |

58,021 |

19,319 |

2012 |

2,409 |

605,658 |

113,426 |

42,266 |

12,670 |

2013 |

2,402 |

633,943 |

104,032 |

28,285 |

-9,394 |

2014 |

2,693 |

589,381 |

81,493 |

-44,562 |

-22,540 |

2015 |

4,004 |

496,669 |

68,215 |

-92,712 |

-13,278 |

2016 |

4,560 |

522,595 |

78,771 |

25,926 |

10,556 |

2017 |

5,217 |

571,957 |

85,962 |

49,362 |

7,192 |

Average |

- |

402,930 |

97,951 |

16,493 |

-0,258 |

Source: calculated by the authors based on data from the State Statistics Service of Ukraine,

the National Bank of Ukraine, the Ministry of Finance of Ukraine, the Ministry of Economic

Development and Trade of Ukraine

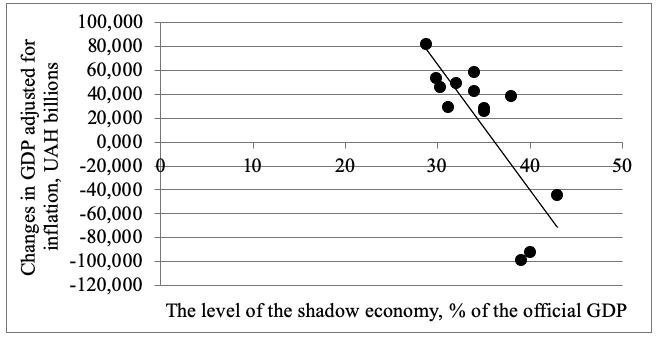

Decreasing the confidence level of business entities is a consequence of the illegal financial transactions growth and, accordingly, the shadow economy growth, which, among other things, negatively affects the real GDP dynamics. Studies have shown a very close inverse relationship of GDP change and the shadow economy level (Fechner correlation coefficient is -0.54). This indicates a significant decrease in the level of confidence in state institutions through ineffective government financial policy (Figure 1).

Figure 1

Relationship of the shadow economy level and the change

in Ukraine's GDP adjusted for inflation during 2005-2017

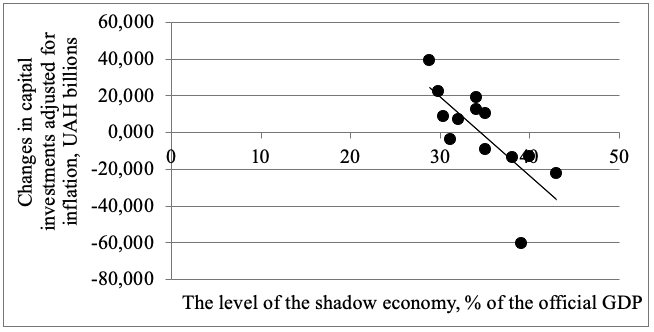

Investments in the real sector of the economy also have an inverse relationship with the shadow economy, since lowering the economic actors confidence level leads to a decrease in investment amount. The study of the shadow economy influence on the change in capital (real) investments has confirmed the inverse relationship of these variables (Fechner's correlation coefficient is -0.69 versus -0.54 for the correlation of the shadow economy and GDP). That is, among the various GDP components, investments are the most sensitive to the public confidence level (Figure 2).

Figure 2

Relationship of the shadow economy level and the capital

investments change adjusted for inflation during 2005-2017

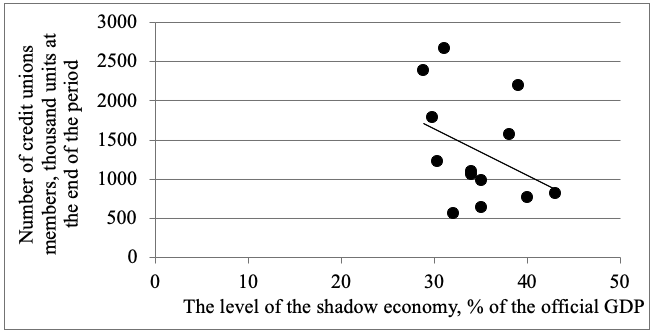

As you know, credit unions are financial institutions that attract financial resources on a share participation basis and direct them to lend their members. Share institutions are more susceptible to lack of confidence than contractual ones. Therefore, characteristics of credit unions are important indicators of confidence in the financial system, because these institutions attract contributions on a share basis. In a high level of economic shadowing, the level of confidence in the financial system of the country is low (and vice versa), which reduces the efficiency of the financial market in general and credit unions as its participants, in particular. In the process of research, it is identified an insignificant inverse relationship of credit unions members number and the shadow economy level (Fechner correlation coefficient is -0.08, Figure 3).

Figure 3

Relationship of the shadow economy level and the

credit unions members’ number during 2005-2017

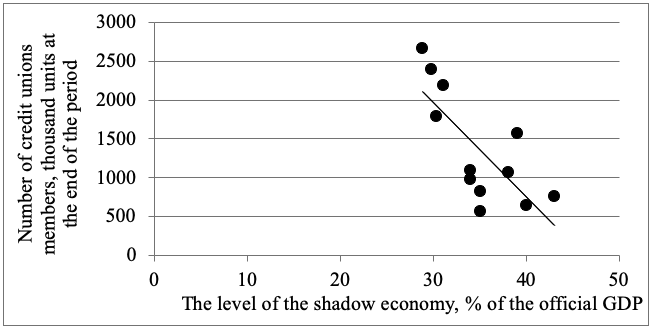

It should be noted that the correlation of the credit unions members' number and the level of the shadow economy is closer if it is the lag in one year (the Fechner correlation coefficient is -0.50). This confirms the opinion that, with the help of the credit unions indicators, it is only with some delay to diagnose the confidence level in the national economy and judge the shadow economy size (Figure 4).

Figure 4

Relationship of the shadow economy level and the credit unions

members' number during 2005-2017 with a one year lag

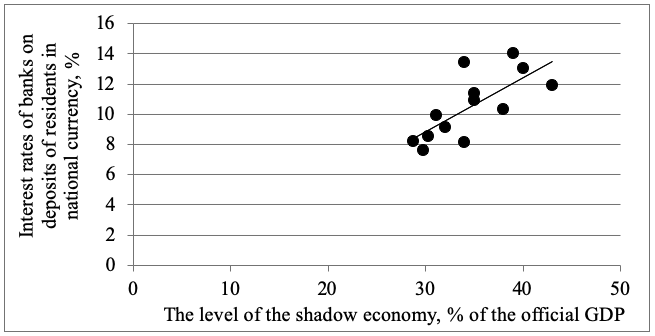

Lowering the level of confidence in the economy creates a situation where it is becoming increasingly difficult for banking institutions to form their resources in the form of deposits. In order to stimulate business entities and the population to invest their free resources in deposits, banks raise interest rates. It is revealed a direct relationship of the shadow economy level and the banks interest rates of resident deposits in the national currency (the Fechner correlation coefficient is 0.69, Figure 5).

Figure 5

Relationship of the shadow economy level and the banks interest rates

of residents deposits in the national currency during 2005-2017

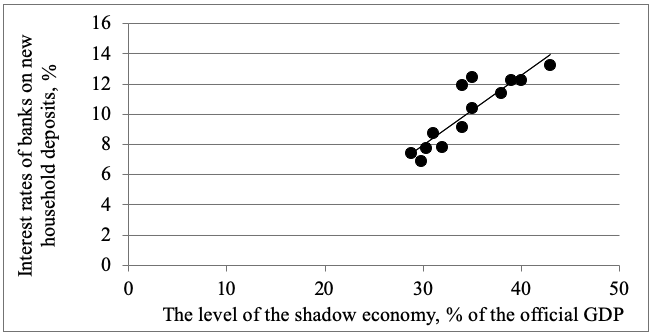

It is appropriate to assume that namely households are largely forming the confidence level in the economy. By the analysis, it was found that Ukrainian households are reacting to a change of the confidence level with greater sensitivity; therefore, the banks interest rates of new household deposits are more closely related to the direct dependence on the shadow economy size (Fechner correlation coefficient is 0.85). Such results indicate that it is the country citizens who form the confidence level in the national economy and thus influence the dynamics of the main macroeconomic indicators (Figure 6).

Figure 6

Relationship of the shadow economy level and the banks

interest rates on new household deposits during 2005-2017

The results of the survey show a close correlation of bank deposits interest rates and other important macroeconomic indicators. In addition, the use of the credit unions indicators' analysis will help to draw conclusions about the public confidence level in society and assess the reliability of the shadow economy size's indicator. This will increase the effectiveness of the government's financial policy and the probability of preventing negative socio-economic phenomena in the country.

In our opinion, the public confidence level can be measured not only by sociological methods. We suppose that the actual economic indicators of public confidence include the level of the shadow economy, the size of interest rates, and so on. If it is a decrease in the public confidence level then there should be verification by the increase in the economy shadowing level and the growth of deposit rates. Macro-level manifestations of the corresponding problems can be investigated using the correlation analysis tool.

The inverse correlation of the shadow economy level and the official GDP in Ukraine is revealed, which emphasizes that the named indicators do not change in proportion to the total volume of production, but are in a competitive relationship. Among various components of GDP, investments are the most sensitive to the public confidence level. The inverse relationship of the credit unions members' number and the level of the shadow economy is revealed. There is a direct relationship of the shadow economy level and the interest rates of banks on deposits. Households in Ukraine are reacting to a change in the public confidence level with greater sensitivity than other bank depositors. The best indicators of the public confidence level in the financial system of Ukraine, among considered ones, are rates on household deposits.

The restoration of confidence in the state, which forms the macroeconomic policy, and in the numerous financial institutions, is the main task, the solution of which will contribute to increase the savings volume in the economy as an investments key source. Also, according to our opinion, the key financial indicators of the public confidence level that are analyzed in the article can be used in the process of forming a national risk assessment methodology in accordance with the international recommendations of the FATF, both in Ukraine and in other countries of the world.

1. Abramowicz, M. (2008). Predictocracy: Market Mechanisms for Public and Private Decision Making. New Haven, CT: Yale University Press.

2. Bell, T. (2006). Prediction Markets for Promoting the Progress of Science and the Useful Arts. George Mason Law Review 14, no. 37.

3. Coase, R. (1992). The Institutional Structure of Production. American Economic Review. 82 (4), 713–719.

4. Fukuyama, F. (1995). Trust: The Social Virtues and the Creation of Prosperity. New York, Free Press, 457 pp.

5. Gjerstad, S. (2004). Risk Aversion, Beliefs, and Prediction Market Equilibrium. Econ.Arizona.edu, 17 p.

6. Gritsenko, A. (2012). The Institute of Trust in the coordinates of the economic space. Kyiv: NAS, 212 pp.

7. Kahneman, D., Knetsch, J., Thaler, R. (1990). Experimental Tests of the Endowment effect and the Coase Theorem. Journal of Political Economy. 98(6), 1325–1350.

8. Mackay, Ch. (1841). Extraordinary Popular Delusions And The Madness Of Crowds. London, 410 pp.

9. North, D. (1990). Institutions, Institutional Change and Economic Performance. Cambridge, Cambridge University Press, 152 pp.

10. Ozimek, A. (2014). The Regulation and Value of Prediction Markets. Mercatus working paper. Available at SSRN: https://ssrn.com/abstract=3211624 or http://dx.doi.org/10.2139/ssrn.3211624.

11. Surowiecki, J. (2005). The Wisdom of Crowds. Anchor Books, 336 pp.

12. Soros, G. (1987). The alchemy of finance. Hoboken, NJ: Wiley & Sons.

13. Soros, G. (1998). The crisis of global capitalism: Open society endangered. New York, NY: Public Affairs.

14. Thaler, R., Cass, R. (2008). Nudge: Improving decisions about health, wealth, and happiness. New Haven, Yale University Press, 293 pp.

15. Tversky, A. Kahneman, D. (1992). Advances in Prospect Theory: Cumulative Representation of Uncertainty. Journal of Risk and Uncertainty. 5(4), 297–323.

1. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: olegpidkhomnyi@ukr.net

2. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: nazar_dem@ukr.net

3. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: dropa@ukr.net