Vol. 40 (Issue 40) Year 2019. Page 5

PANCHENKO, Natalya B. 1; FEDOROV, Boris V. 2; BERDOVA, Yuliya S. 3; ARYASOVA, Dina V. 4 & ZOBNIN, Yurii A. 5

Received: 10/06/2019 • Approved: 10/11/2019 • Published 18/11/2019

ABSTRACT: In connection with the modern economic collapse of the housing policy reform, there has been a significant change in the housing availability of Russian citizens. At the same time, the peculiarity of housing as a long-term economic good causes the need for an effective state housing policy. It should be noted that for the majority of Tyumen citizens it is impossible to improve their living conditions or solve the housing problem on their own due to the high cost. The article presents the sociological study results of Tyumen residents’ needs in housing improvement, it points toward the fact that the housing purchase at their own expense is available to less than 10% of the population, and due to this fact, the ways to solve the housing problem are proposed. |

RESUMEN: En relación con el colapso económico moderno de la reforma de la política de vivienda, ha habido un cambio significativo en la disponibilidad de vivienda de los ciudadanos rusos. Al mismo tiempo, la peculiaridad de la vivienda como un bien económico a largo plazo provoca la necesidad de una política de vivienda estatal efectiva. Cabe señalar que para la mayoría de los ciudadanos de Tyumen es imposible mejorar sus condiciones de vida o resolver el problema de la vivienda por su cuenta debido al alto costo. El artículo presenta los resultados del estudio sociológico de las necesidades de los residentes de Tyumen en la mejora de la vivienda, apunta al hecho de que la compra de la vivienda a su propio costo está disponible para menos del 10% de la población, y debido a este hecho, las formas de resolver Se proponen los problemas de vivienda. |

The possibility of housing improvement is an important indicator of the population welfare increase, a prerequisite for social and economic stability of the state (Panchenko, N.B., 2011, Panchenko, N.B., 2015). The consequence of market reforms in Russia is the substantial property differentiation of the population. In view of high housing capital cost, it is impossible to improve their living conditions or solve the housing problem on their own for the majority of Tyumen citizens (Berdova, Yu.S., 2019). The city of Tyumen is not an exception, where the main problem of the housing market consumer demand formation is its low availability (Berdova, Y.S., 2017).

In order to identify social problems in the studied market, the authors have conducted a survey of Tyumen residents, who are the potential housing market consumers, namely, those who:

1. need to improve their housing conditions, but can not implement their needs for various reasons;

2. do not need to improve their housing conditions at the present time, but may need it in the future.

428 people took part in the survey. The main criterion for the selection of respondents was their age of buying activity in the housing market (from 18 to 65 years old) (Panchenko, N.B., 2015), as well as their housing availability in Tyumen. The questionnaire was designed to reveal the satisfaction of city residents, who are potential consumers of the housing market, with existing housing conditions, their expectations, desires and preferences in this market, as well as the main problems in the area of providing the city population with affordable and high-quality housing.

The poll questions were grouped into the following blocks (Berdova, Y.S., 2018):

1. General information about respondents, their families and income levels.

2. Living conditions of respondents.

3. The needs of respondents in the housing improvement.

4. Home purchase availability under existing financing schemes.

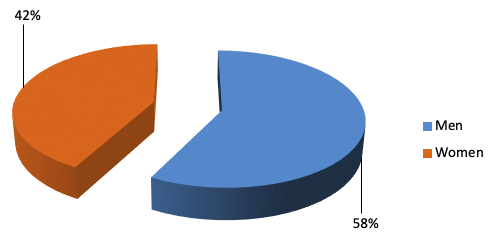

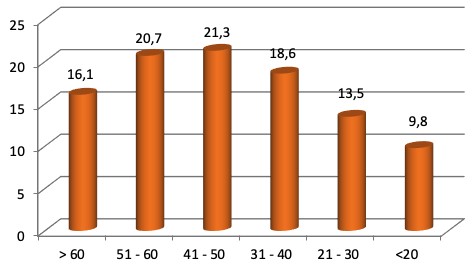

The demographic features of the members of the sample studied is presented in Figures 1 and 2.

Figure 1

The distribution of respondents by sex, %

-----

Figure 2

The distribution of respondents by age, %

About a third of the respondents have secondary vocational education (29.7%) and 66.3% of respondents have higher education, including incomplete higher education. The rest of the respondents received general secondary education.

At the same time, 23.8% of respondents do not work for various reasons (pensioners make up 16.6%, unemployed - 7.2%), 14.5% of respondents are studying, the remaining respondents work. The majority of working respondents are employed in budget organizations (74%), 17.1% are in commercial enterprises, and 8.9% are in private businesses (Pilipenko, L.M., 2015).

The assessment of the respondents’ social status, depending on their position, showed that 15.6% of respondents occupy senior positions, while most of them are middle managers (11.4%). The groups of laborers (16.4%) and employees (17.8%) are the most numerous. The remaining 50.2% of respondents are employees of budget organizations.

Assessment of the marital status of respondents showed that 63.8% are married, the remaining 36.2% are single. Most of the respondents (78.5%) have children.

Every fifth family, about 20% has an average monthly per capita income of less than 5,000 rubles per 1 person, every third family (32.5%) has an average monthly per capita income of 5,000 - 10,000 rubles. It should be noted that these individuals are extremely inactive participants in the housing market due to their low purchasing power. Thus, at this stage of the analysis it can be noted that more than half of the respondents drop out of the real estate market because of the housing unavailability for them for financial reasons.

Only 5.4% of respondent families have an average monthly income of more than 20 000 rubles per person. Thus, it can be assumed that only a few Tyumen families can meet their needs in solving the housing problem on their own.

Table 1 presents the living conditions’ analysis of potential housing market consumers in the city of Tyumen.

Table 1

Analysis of living conditions of respondents, %

Question |

Variant of answer |

Total |

Men |

Women |

Specify your accommodation |

dormitory |

15,9 |

14.4 |

17.1 |

apartment with parents (with adult children) |

23,1 |

22.7 |

23.5 |

|

private house |

10,7 |

11.0 |

10.5 |

|

rented room, apartment |

16,4 |

14.4 |

17.8 |

|

owner-occupied apartment |

29,7 |

33.1 |

27.5 |

|

detached house |

4,0 |

4.4 |

3.6 |

|

Number of people |

one |

16,4 |

15.5 |

17.0 |

two - three |

27,3 |

28.2 |

26.7 |

|

four |

38,3 |

37.6 |

38.9 |

|

five and more |

18,0 |

18.8 |

17.4 |

|

Number of rooms occupied by the family. |

one |

18,0 |

17.8 |

17.4 |

two |

34,1 |

38.2 |

30.8 |

|

three |

27 |

28.9 |

28.7 |

|

four and more |

20,9 |

15.1 |

27.1 |

|

Specify the number of people per room according to formula |

1 person and less |

11,0 |

9.9 |

11.7 |

1.1–1.25 |

20,8 |

21.5 |

20.2 |

|

1.26–2 |

35,5 |

36.5 |

34.8 |

|

2.1–3 |

22,0 |

26.0 |

19.0 |

|

more than 3 persons per one room |

10,7 |

6.1 |

14.3 |

|

Describe satisfaction with your living conditions |

satisfied |

13,1 |

13.8 |

12.6 |

rather satisfied than not |

22,7 |

19.9 |

24.7 |

|

rather no than yes |

36,9 |

40.9 |

34.0 |

|

not satisfied |

27,3 |

25.4 |

28.7 |

|

Indicate the reasons for dissatisfaction with living conditions (several answers are possible) |

small apartment area |

57,9 |

56.4 |

59.1 |

necessity of living together with adult children (parents) |

35,7 |

40.9 |

32.0 |

|

residence area |

29,7 |

27.6 |

31.2 |

|

inconvenient layout |

37,9 |

32.6 |

41.7 |

|

home improvement rate |

21,3 |

17.7 |

23.9 |

|

other |

9,8 |

9.4 |

10.1 |

|

Total |

100 |

100 |

100 |

|

As can be seen from the data presented in Table 1, more than a third of homebuyers in Tyumen have their own apartment or detached house (33.9%). Their living conditions can be considered relatively favorable.

A third of respondents do not have their own housing (rent an apartment or live in a dormitory). 10.7% of respondents live in a private house (limited provision of amenities). 23.1% live with parents (adult children). Thus, the living conditions of 66.1% of the respondents in Tyumen can be attributed to those requiring improvement for one reason or another((Pilipenko, L.M., 2015).

The distribution of respondents by household size is as follows. Families consisting of four people make up 38.3%, families of three people make up 27.3%, families of five people and more make up 18.0%.

As for the number of rooms occupied, 34.1% of respondents’ families live in two-room apartments, 29.7% live in three-room apartments, and 18.0% live in one-room apartments. Only 11% of the surveyed families have four or more rooms per family.

By the ratio of the number of rooms and people living in them, every third family lives in adverse conditions (more than two people per room). Another 35.5% of respondents live in conditions where there are 1.26–2 family members per room. Only 33.9% of Tyumen residents live in relatively favorable conditions. One third of respondents (35.8%) are satisfied or more satisfied with the conditions they live in. The remaining 64.2% are not satisfied with the living conditions of their families.

The main reason for the low satisfaction degree with the living conditions’ level of Tyumen residents is the lack of necessary living space (57.9%), i.e. more than half of the respondents are potential consumers of the housing market (providing that its availability increases). The second point is the layout inconvenience (37.9%). The third point is sharing an accommodation with several families (adult children and parents) (35.7%). Moreover, every third respondent is not satisfied with the residence area (29.7%), and every fifth respondent is not satisfied with the home improvement level (21.3%).

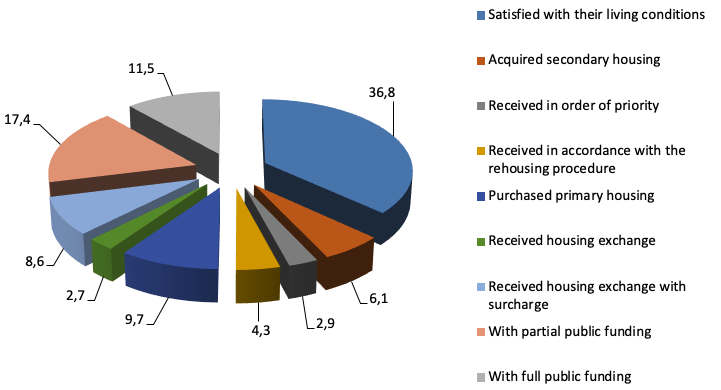

A study of the respondents’ needs and willingness to improve their living conditions showed that only 36.8% of respondents are satisfied with their living conditions and do not want to change them. 19.2% plan to improve their conditions in the near future. The remaining 44% would like to change the situation, but do not have such an opportunity.

Figure 3 presents the analysis of preferred affordable options for the respondents’ living conditions improvement.

Figure 3

Affordable options analysis of respondents’

living conditions improvement, %

As can be seen from the data presented in Figure 3, only 15,8% (6,1% and 9,7%) of 63.2% of respondents are ready and able to solve their housing problems through the house-buying on their own. Another 11.3% consider housing improvement schemes, which include an exchange (8.6%) or an exchange with a surcharge (2.7%) of the housing at their disposal. Respondents in the amount of 36.1% cannot independently solve their housing problems. At the same time, 4.3% of them plan to improve their living conditions in accordance with the rehousing procedure (mainly respondents living in the private sector of the city) and 2.9% plan to do it in the order of priority. 11.5% of respondents believe that they can solve the housing problem only with the full government funding. 17.4% are ready to consider the option with the partial government funding.

Thus, today only 28.2% of those in need can solve their own housing problem, and only 16.9% can afford to buy housing in the real estate market. About a third of respondents are in need of full or partial government support.

In estimating the housing affordability dynamics in Tyumen, the opinions of the respondents were divided as follows. Every fifth believes that housing is affordable for citizens, or it is not very affordable for the majority, but a middle-income family can purchase housing, using various payment schemes, if it is necessary. Three quarters of respondents (78.7%) believe that housing is not available for the residents of Tyumen (Berdova, Y.S., 2017).

The development of mortgage lending schemes is regarded skeptically by Tyumen residents. Only 25.6% of citizens say that the spread of mortgages has made housing more affordable. Another 37.8% of respondents believe that the mortgage does not affect the availability of housing. A third of citizens assess mortgage lending negatively, associating it with the accelerated growth rate of real estate prices.

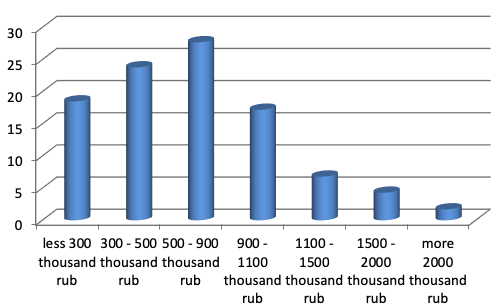

Figure 4 presents the respondents' assessment of the minimum available housing cost threshold.

Figure 4

The minimum housing cost threshold, at which

respondents are ready to purchase it on their own, %

From the data presented in Figure 4, it is clear that only up to 10% of citizens can buy housing at its real value. For the overwhelming majority, the most acceptable housing cost is between 300–900 thousand rubles, i.e. 2.5–3 times lower than its real value.

Thus, it can be assumed that Tyumen housing market development is hampered precisely because of its low affordability for consumers. Obviously, there are only three ways to improve the situation with the demand formation in the housing market:

1. to decrease the housing prices by 2.5–3 times;

2. to increase the income level of the population by 2.5–3 times;

3. to develop the affordable mortgage lending schemes with partial public refinancing and insurance.

In this case, the most promising and actively used way in the developed countries is the third way [1]. In this regard, the respondents were asked which housing purchase schemes they consider to be preferable and the most affordable.

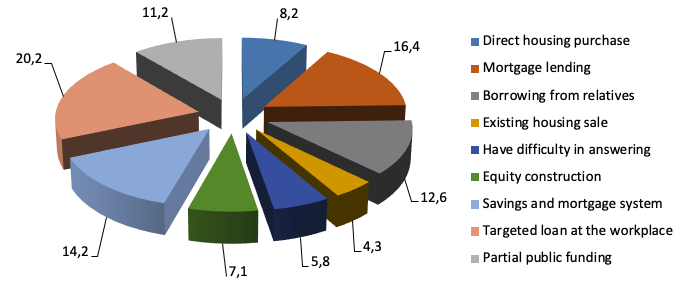

Tyumen residents’ preferences in choosing housing finance schemes are shown in Figure 5.

Figure 5

Tyumen residents’ preferences when choosing housing finance

schemes (respondents evaluated each indicator separately), %

As can be seen from the data presented in Figure 5, the most affordable and preferred financing schemes for housing purchase, in citizens’ opinion, is the partial public financing (32.7%). The scheme of the old living space exchange for a new one with a surcharge is in the second place (21%). In third place is equity construction in installments (16.4%). Mortgage is the fourth most popular: 12.7% of respondents prefer it along with other schemes.

According to the survey, it is clear that only 8.2% of respondents can afford the direct housing purchase at their own expense. At the same time, a very small number of citizens (5.8%) can count on borrowing money from their relatives and acquaintances, they prefer bank mortgage loans. Unfortunately, the savings and mortgage system is not in wide demand among the population, despite all its advantages. It was indicated only by 4.3% of the respondents.

Thus, to buy a house through the direct sale and purchase transaction with a one-time 100% payment is affordable only for a small number of buyers. The equity participation in the construction in installments and long-term mortgage lending are in the greatest demand among Tyumen property buyers. In this regard, the development of affordable mortgage lending schemes with partial public refinancing and insurance is relevant.

Berdova, Y.S., Panchenko, N.B., Aryasova, D.V., Ovchinnikova, S.V. (2018) Effective implementation of the housing policy as one of the main factors in the development of regional economy. International Journal of Civil Engineering and Technology. 9(10), pp. 1124-1130.

Berdova, Y.S., Panchenko, N.B., Fedorov, B.V. (2017). Main trends of the implementation of the state housing policy: Case study of the north of the Tyumen region. Espacios, 38(62).

Berdova, Yu.S., Panchenko, N.B. (2019) Commercial enterprise operation effectiveness’ increase due to the development and implementation of proposals on the profit markup and distribution. International Journal of Mechanical Engineering and Technology, 10(1), pp. 1171-1182.

Panchenko, N.B. (2011) Socio-economic aspects of development of the Tyumen region. Problems of formation of the common economic space and social development in the CIS countries Materials of the International scientific and practical conference. Pp. 79-81.

Panchenko, N.B. (2015) Modeling of consumer behavior in the framework of forecasting socio-economic processes. Economy and entrepreneurship. No. 10-1 (63). Pp. 491-495.

Panchenko, N.B. (2015) Problems of analysis and risk assessment of economic projects. Economy and entrepreneurship. No. 9-2 (62). Pp. 539-543.

Panchenko, N.B. (2015) Modern realities of student entrepreneurship. Economics and Entrepreneurship, №8-2 (61), pp. 922-925.

Pilipenko, L.M., Berdova, Yu.S. (2015) The study of the Tyumen population needs in improving housing conditions. Modern problems of science and education, №1 - 2, p.2018.

1. Senior Lecturer, Department of Business Informatics and Mathematics, Industrial University of Tyumen (e-mail: panchenkonb@tyuiu.ru)

2. Professor, Department of physics, methods of control and diagnostics, Industrial University of Tyumen (e-mail: fedorovbv@tyuiu.ru)

3. Senior Lecturer, Department of Business Informatics and Mathematics, Industrial University of Tyumen ( e-mail: bjordovajs@tyuiu.ru)

4. Senior Lecturer, Department of Business Informatics and Mathematics, Industrial University of Tyumen (e-mail: arjasovadv@tyuiu.ru)

5. Professor, Department of Business Informatics and Mathematics, Industrial University of Tyumen (e-mail: zobninja@tyuiu.ru)