Vol. 40 (Issue 40) Year 2019. Page 22

HIDAYAT, Riskin 1; WAHYUDI, Sugeng 2; MUHARAM, Harjum 3; SHAFERI, Intan 4 & PUSPITASARI, Intan 5

Received: 17/04/2019 • Approved: 11/11/2019 • Published 18/11/2019

2. Literature Review and Hyphotesis Development

ABSTRACT: This study test the effect of liquidity, debt policy and investment to improvement level of firm value. This study conducted on Indonesia Stock Exchange. The results reveal that liquidity, debt and investment have positive influence on the firm value of all samples. Liquidity have positive influence on low firm value, however does not have a significant influence on high firm value. Debt has a positive influence on the high firm value, however debt has negative influence on the low firms value. |

RESUMEN: Este estudio prueba el efecto de la liquidez, la política de deuda y la inversión para mejorar el nivel de valor de la empresa. Este estudio realizado en la Bolsa de Indonesia. Los resultados revelan que la liquidez, la deuda y la inversión tienen una influencia positiva en el valor firme de todas las muestras. La liquidez tiene una influencia positiva en el bajo valor de la empresa, sin embargo, no tiene una influencia significativa en el alto valor de la empresa. La deuda tiene una influencia positiva en el alto valor de la empresa, sin embargo, la deuda tiene una influencia negativa en el bajo valor de la empresa. |

It is still an interesting topic to discuss the firm value on the issue of corporate finance. This is because the main purpose of the firm is to increase its value. If the value of the firm increases, it will also increase the income of its owners (stakeholders), which will ultimately increase the prosperity of the owner. The public (in this case the investor) can see the firm value from stock prices, stock returns, earnings per share (EPS), price earnings ratio (PER), Tobin's Q, and price to book value (PBV). In this study the firm value is proxied by Tobin's Q. Tobin's Q is one indicator measuring firm performance from an investment perspective that has been tested in various top management situations. Tobin's Q is used to measure firm performance, especially for the firm value which shows a management performance in managing the firm assets. Tobin's Q value describes a condition of investment opportunities owned by the company (Lang et al, 1989) or the firm growth potential (Tobin and Brainard, 1968; Tobin, 1969).

The value of its stock can reflect its condition. Thus, potential investors can judge it well if it will invest in the capital market. Consequently, it will not lose in investing although there is still the systematic risk that is usually influenced by external factors firms, especially macroeconomic conditions (Bodie et al. 2008), because they can minimize the risk. In addition to the external factors of firm, its value is also influenced by its internal factors or commonly referred to as fundamental factors of the firm, including liquidity (Prombutr et al. 2010; Azmat 2014; Chen et al. 2016; Van Heerden and Van Rensburg 2016), debt policy (de Jong et al. 2011; González 2013) and investment decisions (Golec and Gupta 2014; Hsiao-Fen et al. 2011; Chang et al. 2013; Dewenter et al. 2010; Abreu 2016; Aktas et al. 2015). Liquidity, debt policy, and firm investment decisions can increase the firm value if the liquidity conditions are good and the debt policy in association with the needs and investment decisions are made precisely.

The firms should pay close attention to their liquidity conditions. This is because liquidity is one of the most important things for a firm to fulfill its short-term obligations (Brigham and Houston 2012), 2012). It is related to the firm's ability to meet the financial obligations that must be fullfiled immediately (Brigham and Ehrhardt 2013). The firm can pay its financial obligations with its liquid assets, which usually come from non-fixed assets such as cash and receivable accounts. If the firm is able to meet its financial obligations immediately, it can be said that the firm is liquid. Conversely, if it is unable to meet the obligations that must be paid immediately, the firm is called illiquid.

If the firm's non-fixed assets such as cash and receivable accounts are getting bigger, its ability to immediately pay its obligations will be even greater. It means that the firm can show its good internal financing ability so that it will be trusted by investors. Such investor trust can have a good impact on increasing its value. The results of Chen et al. (2016), Van Heerden and Van Rensburg (2016), Azmat (2014) and Prombutr et al. (2010) found that liquidity has a positive influence on firm value. In contrast, the results of Meier et al. (2013), Zangina and Godfred Alufar (2009), Fang et al. (2009), Larrain and Yogo (2008) found that liquidity has negative influence on firm value. However, firms need to be careful when the free cash flow of a firm is too large because it can cause manager irregularities and agency conflicts (Jensen and Meckling 1976).

One of the mechanisms used to increase the firm value is increasing the proportion of debt. In agency theory, one of the bonding mechanisms for limiting manager opportunist behavior is increasing debt. It is because adding debt can reduce agency costs that can increase firm value (Jensen and Meckling 1976). The more debt increases, the smaller the idle funds the manager can spend on unnecessary expenses. Furthermore, the more the debt, the more cash the firm must reserve to pay interest on the debt and also repay the principal of the debt. Thus, debt can reduce agency costs and also increase the value of the firm. Because of the debt, the company can increase its operational funds as well as its profitable investment activities.

Debt will increase the firm value through an increase in the stock market price. Likewise, if the firm's debt decreases, it will lower the stock market price. According to Modigliani and Miller (1958), the debt ratio would be able to increase the value of the firm, but at some point, additional debt would result in the risk of bankruptcy. To the extent, interest payments can be used to reduce the tax burden, and the debt reduction benefits the firm owner. The research results of Meier et al. (2013), Cassell et al. (2012), Akbar et al. (2013) and González (2013) showed that debt has a negative influence on firm value, while the research result of de Jong et al. (2011) indicates that debt has a positive influence on firm value.

The firm value can also be influenced by investment decisions. Fama (1974) stated that the firm value is solely determined by the investment decisions made by the firm. According to Fama (1974), could be interpreted that if the firm wants to increase its value, the firm must be brave to do investment activities. The investment decisions made by the firm, in this case, is the investment in fixed assets that will affect the value of the firm. If the firm invests in buildings, factories, machinery equipment, and other fixed assets, it will be able to develop and ultimately increase its value. Research on the influence of investment decisions has been done by Dewenter et al. (2010), Hsiao-Fen et al. (2011), Chang et al. (2013), Golec and Gupta (2014), Aktas et al. (2015) and Abreu (2016). The results indicated that investment decisions have a positive influence on firm value.

Based on the description and results of the research, there is a research gap from previous research. The previous research only tested the value of the firm in all samples without being divided into several levels. Therefore, this study aims to further test the effects of liquidity, debt policy and investment decisions on the level of firm value in firm incorporated in the Jakarta Islamic Index (JII) on Indonesian emerging market.

Agency theory is derived from a conflict of interest between the manager as an agent and the principal as the firm owner. In the agency theory, the firms are seen as a set of contracts between managers and firm owners. The managers appointed by the owner to manage the firm, often have a conflict of interest with themselves, in which they try to earn more profits. As a result, they often abuse the authority given by owners so they run the firm only for their own benefit and ignore the interests of shareholders or owners (Jensen and Meckling 1976).

The agency theory is also seen as a version of the game theory that creates a contractual model between two or more persons, in this case, agents and principals. The relationship between agents (commonly called management) and shareholders or principals, in agency theory, is often referred to as the relationship between agents and principals (Jensen 1986). The shareholder or principal expects the agent or manager to act in the best interests of the principal so as to delegate authority to the agent. Therefore, managers must make the best business decisions to increase shareholder wealth. They take the business decision to maximize the firm's resources (utilities).

In addition, the agency theory provides an explanation of the framework for analyzing on the basis of the contractual relationship (Jensen 2003). In order to prevent the managers from harming outside investors, there are two ways to do: 1) managers monitor outside investors; and 2) managers themselves restrict their own actions (bonding). On the one hand, the two ways will reduce the opportunity of deviation so they can increase the value of the firm. On the other side, both of them will need the cost that will eventually reduce the value of the firm. Investors will try to anticipate both these costs and the possibility of residual losses although they do monitoring and bonding. So, the agency cost aroused is the total amount of the cost from: 1) the contract between the principal and the agent; 2) supervision by the principal; 3) bonding by agent or manager; and 4) residual loss.

Liquidity is an important factor that must be considered in the firm financial function. It is the firm's ability to meet its immediate financial obligations (Brigham and Ehrhardt 2013). So, if the firm has the ability to immediately meet its financial obligations, the firm is said to be liquid. It means that the firm's ability to meet its obligations makes the outside investors believe that the firm is in good shape and this condition can arouse investors' trust. Then, their trust causes them to buy the firm's shares, thereby it will able to affect the increase of the firm value.

The tendency of firms in the context of agency theory, according to Jensen and Meckling (1976), managers like to use their internal financing sources such as cash flow to invest with the aim of increasing the value of the firm. This is done by managers to reduce outside supervision. When the cash flow is left idle, especially free cash flow and let the cash flow itself in large quantities, the manager can be blamed for abuse for his own use. Therefore, cash flow is better used by the firm to finance the firm's financial needs with the aim of increasing the firm value.

The use of internal financing sources by managers for investments is aimed at enhancing firm value. The use is also because of the information asymmetry between agents and principals (Ross 1973) relating to both activities and information. Research on the influence of liquidity on the firm value has been done by Chen et al. (2016), Van Heerden and Van Rensburg (2016), Azmat (2014) and Prombutr et al. (2010). The results showed that liquidity has a positive effect on firm value. Based on the above description, the hypothesis proposed in the research is"Liquidity has a positive influence on the firm value, both on the sample firm as a whole and in firms that have low and high value”.

The use of internal financing sources by managers for investments is aimed at enhancing firm value. The use is also because of the information asymmetry between agents and principals (Ross 1973) relating to both activities and information. Research on the influence of liquidity on the firm value has been done by Chen et al. (2016), Van Heerden and Van Rensburg (2016), Azmat (2014) and Prombutr et al. (2010). The results showed that liquidity has a positive effect on firm value. Based on the above description, the hypothesis proposed in the research ismanagers are considered not to always act in accordance with the interests of shareholders. Therefore, one of the mechanisms is to increase the proportion of debt. Adding debt can reduce agency costs and lead to an increase firm value. The more the debt increases, the smaller the idle funds the manager can spend on unnecessary expenses. The more the debt, the more the cash firm must reserve to pay interest on it and also repay the principal of the debt. Thus, the debt can reduce agency costs as well as increase the firm value, because by the debt, the firm can increase its operational funds as well as profitable investment activities.

Brigham and Ehrhardt (2013) stated that the use of debt would increase the value of the firm through an increase in stock market prices, as well as if it downs, it will lower stock market prices. Modigliani and Miller (1958) stated that the debt ratio would be able to increase the firm value, but at some point, additional debt would result in the risk of bankruptcy. To the extent that interest payments can be used to reduce the tax burden, the debt reduction benefits the firm owner. However, such benefits will be recognized by the cost of bankruptcy and possible personal tax differences between income from equity and from debt. Theoretically, the firm should use the debt that will minimize the cost of the firm's capital.

A good firm whose performance can signal a high proportion of its debt towards its capital structure can raise the firm value. Meanwhile, a less good firm will not dare to use the large amounts of debt because the probability of bankruptcy will be high (Ross, 1977). The research results of Modigliani and Miller (1958), Jensen and Meckling (1976), (Ross, 1977), de Jong et al (2011) and Gonzales (2013) showed that debt has a positive effect on firm value. In contrast, the results of Meier and Laurin (2013), Cassell et al. (2012), and Akbar et al (2013) indicated that it has a negative effect on firm value. Based on the description, the hypothesis proposed in this study is "The debt policy has a positive influence on the firm value, both on the sample firm as a whole and on firms with low and high value”.

Investment is the activity of delaying consumption to get the value of greater consumption in the future. An investment decision is said to be optimal if such consumption time settings can maximize utility expectations. To maximize utility, a person or firm will only invest if the expected benefits of a consumption delay are greater than if the money is spent now (Fama and Miller 1972).

One of the factors that can increase firm value is an investment decision. The firm value is solely determined by investmentdecisions (Fama 1974). The opinion can be interpreted that the investment decision is important. It is because increasing the firm value, as the firm's goal, also means increasing the wealth of the owners generated through the firm's investment activities. The purpose of firm investment decisions is to obtain a high level of profit and minimize the risk level. A high level of profit with manageable risks is expected to increase the firm value. In this case, if the firm in investing is able to maximize its profits by using own assets efficiently, it will increase investor trust to invest in the firm's stock, which will have a good impact on increasing the value of the firm.

Investment decisions used by the firms, in this study, are investments in fixed assets or commonly referred to as capital expenditure such as land or property, buildings, and equipment. Capital expenditures are funds spent by the firms to get benefit from those investments for more than one year (Brigham and Ehrhardt, 2013).

At the time the firm will invest a fixed asset, it should have to analyze the assets to invest. Investment in fixed assets submitted must be aligned with the overall planning and the firm objectives. In analyzing an investment in a fixed asset, it should pay attention to the benefits, estimated costs, and risks so that it will know whether the investment is feasible or not to increase the firm value.

If the investment is considered feasible by the firm, it should really focus to run it so that the investments can increase the value of the firm. The success of investments made by the firm will also be assessed by the investors. The investors will respond positively if the investments made by the firm succeed. Likewise, if the investment actually results in losses, the investors will respond negatively. This is in accordance with the results of Dewenter et al. (2010), Hsiao-Fen et al. (2011), Chang et al. (2013), Golec and Gupta (2014), Aktas et al. (2015) and Abreu (2016). They found evidence that investment decisions have a positive effect on firm value. Based on the description, the hypothesis proposed is "An investment decision positively influence the firm value, both on the sample firm as a whole and on firms with low and high value”.

This study uses panel data. The population in this study is the firm listed on the Indonesia Stock Exchange, with the sample is non financial firms. Data required in this study is the firm's financial statements from 2013 to 2017. Data obtained from the IDX and ICMD (Indonesia Capital Market Directory). Criteria for sampling in this study are non financial firms on the Indonesia Stock Exchange that publish its financial statements from the year 2013 - 2017 consistently. Based on the selection of samples, the sample obtained is 127 firms with 635 observations (the number of firm sampled is multiplied by the year of observation = 127 firm x 5 years).

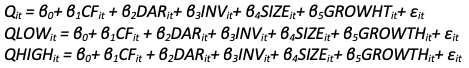

The independent variables in this research are liquidity measured by cash flow, debt policy measured by debt to equity ratio (DAR), and investment decision (INV), which is net capital expenditure. Cash flow is measured by net income plus depreciation and/or amortization divided by fixed assets; DAR is measured by total debt divided by total assets; and investment is measured by fixed assets t minus fixed assets t-1 divided by fixed assets. The kinds of fixed assets in this study are land, buildings, equipment, and tool. Firm Size is measured by natural logarithm (Ln) total assets and firm Growth is measured by total sales t minus total sales t-1 divided total sales. Cash flow and investment are divided by fixed assets to control the effect of firm scale differences. Menawhile, dependent variable is firm value. The firm value is measured using Tobin’s Q. Tobin’s Q is measured by the market value of all outstanding stock plus market value of all debt divided by replacement value of all production capacity. Data analysis uses linear regression of panel data with common effect model. The regression equation model uses three equations as follows:

In this case, Q (Tobin’s Q) is the proxy of firm value as the dependent variable for the sample of the firm as a whole; QLOW is the proxy of firm value as a dependent variable for a sample of firms with low firm value, i.e. firms having a Q score below the average value of the whole sample; QHIGH is a proxy of firm value as a dependent variable for a sample of firms with high firm value, i.e. firms having Q values above the mean overall value of the sample; CF (cash flow) is a proxy of liquidity as an independent variable; DAR (debt to assets ratio) is the proxy of debt policy as an independent variable; INV is a measure of investment decisions as an independent variable; firm size abbreviated with SIZE as an control variable; firm growth abbreviated with GROWTH as an control variable; β is the slope coefficient; and ε is the error term.

Based on the sampling selection criteria, from the firms included in the Jakarta Islamic Index listed on the Indonesia Stock Exchange (IDX) that publish their financial statements from 2013 to 2017 consistently, the obtained samples are 127 firms over five years with the number of observations of 635. The statistical description variable of all samples can be seen in Table 1.

Table 1

Descriptive Statistics

Variable of All Sample

Variable |

Min |

Max |

Mean |

SD |

Q |

0,240 |

7,230 |

2,798 |

2,595 |

CF |

1,031 |

2,973 |

1,867 |

0,528 |

DAR |

0,150 |

2,380 |

0,833 |

0,543 |

INV |

0,102 |

0,905 |

0,270 |

0,156 |

SIZE |

1,275 |

8,566 |

3,188 |

1,494 |

GROWTH |

0,121 |

4,094 |

2,185 |

2,237 |

N |

635 |

|||

Note: Q (the market value of all outstanding stock plus market value of all debt divided by replacement value of all production capacity) as the dependent variable; CF (cash flow divided by fixed assets) DAR (total debt divided by total assets) and INV (investment divided by fixed assets) as independent variable, SIZE (Ln total assets) and GROWTH (total sales t minus total sales t-1 divided total sales) as control variable.

Based on the classification of firm that has low and high firm value, there are two criteria: 1) if the value of Q is below the average value (3,317), it belongs to the category of firm with low firm value, and 2) firm with Q value above the average value (3,317) is categorized into the firm with high firm value. From the results of the classification, the obtained samples are 351 firms with low firm value and 284 firms with high firm value. The description of statistics for firms that have low and high firm value can be seen in Table 2.

Table 2

Descriptive Statistics

Level of Firm Value

Variable |

Low |

High |

||||||

Min |

Max |

Mean |

SD |

Min |

Max |

Mean |

SD |

|

Q |

0,240 |

1,709 |

1,538 |

1,376 |

1,256 |

7,230 |

2,871 |

1,685 |

CF |

1,031 |

2,874 |

1,705 |

0,476 |

1,051 |

2,973 |

2,095 |

0,457 |

DAR |

0,150 |

2,380 |

0,818 |

0,494 |

0,130 |

2,260 |

1,214 |

0,607 |

INV |

0,102 |

0,603 |

0,229 |

0,117 |

0,104 |

0,905 |

0,421 |

0,217 |

SIZE |

1,275 |

2,500 |

1,762 |

0,379 |

2,590 |

8,566 |

3,549 |

0,721 |

Growth |

0,121 |

1,709 |

1,538 |

1,133 |

0,230 |

4,090 |

2,069 |

1,420 |

N |

351 |

284 |

||||||

Note: Q (the market value of all outstanding stock plus market value of all debt divided by replacement value of all production capacity) as the dependent variable and to classification low and high firm value, CF (cash flow divided by fixed assets), DAR (total debt divided by total assets) and INV (investment divided by fixed assets) are independent variables, SIZE (Ln total assets) and GROWTH (total sales t minus total sales t-1 divided total sales) as control variable.

The results of the data, both on the sample of the firm as a whole and in firms that have low and high firm values can be seen in Table 3.

Table 3

The Result of the Study

Variable |

Total Sample |

Low Firm Value |

High Firm Value |

|||

coefficients |

P value |

coefficients |

P value |

coefficients |

P value |

|

CF |

0,589 |

0,000 |

0,391 |

0,001 |

0,103 |

0,727 |

DAR |

0,166 |

0,297 |

-0,108 |

0,981 |

0,336 |

0,097 |

INV |

0,646 |

0,031 |

0,299 |

0,027 |

1,359 |

0,033 |

SIZE |

0,099 |

0,042 |

0,044 |

0,135 |

0,117 |

0,225 |

GROWTH |

0,038 |

0,501 |

-0,042 |

0, 176 |

-0,523 |

0,049 |

Constanta |

0,043 |

0,960 |

2,354 |

|||

The result of the data in Table 3 shows that liquidity has a positive influence on firm value in the sample of the firm as a whole and on the firm with low firm value. This means that when the firm has a high level of liquidity, the firm value will be high. The results of this study support the research conducted by Chen et al. (2016), Van Heerden and Van Rensburg (2016), Azmat (2014) and Prombutr et al. (2010). The firm must be able to maintain good liquidity so that the firm can meet the obligations immediately. In this case, the firms included in the Jakarta Islamic Index (JII) are chosen to be the sample because they are able to fulfil all obligations that must be paid promptly so that they are responded by investors positively and finally has a good impact on increasing the firm's value. These results are in line with agency theory, in which the firms must use their internal financing sources such as cash flow for profitable activities in order that the cash flow is not used to enrich the managers (Jensen and Meckling 1976). Furthermore, the firms that have high liquidity is an increasingly liquid firm. From the results of this study, it can be said that the firms in Indonesian emerging market belong to the liquid firms so the investors believe in the firm Indonesian emerging market being a sample and can eventually increase the firm value. However, the results of the study indicate that liquidity positively has insignificant influence on high value firms. This means that liquidity has not significantly contributed to high-value firms. In other words, liquidity in high firm value is likely to use more external financing source such as debt.

The results also show that the debt policy has a positive but insignificant influence on the firm value on the overall sample. This means that the sample of Indonesian emerging market firms can implement the agency theory although it is not maximally implemented. The agency theory states that one way of bonding mechanisms is to indebted because by the debt the firm can reduce free cash flow, so it can also reduce the behaviour of managers who can reduce the opportunistic value of the firm (Jensen and Meckling 1976). The results of this study indicate that the sample of JII firms has not been able to maximally utilize the debt to increase the value of the firm. Modigliani and Miller (1958) argued that the debt ratio would increase the value of the firm, but at some point the additional debt would result in the risk of bankruptcy. The Indonesian emerging market firms may still not take advantage of its debts for profitable investment opportunity activities or projects, so the firm's value has not increased significantly. The results of this study also support the research of Modigliani and Miller (1958), Jensen and Meckling (1976), (Ross, 1977), de Jong et al (2011) and Gonzales (2013). Findings of different results occur in firms with high and low value. Briefly, debt has a positive and significant influence on high firm value. This is in line with the statement of Modigliani and Miller (1958) that the debt would increase the value of the firm. On the other hand, debt is negatively insignificant to low firm value. This shows that the firms with high value tend to use the debt, while low firm value tends not to use it as the low firm value tend to use its internal financing source such as cash flow.

Investment decisions made by the Indonesian emerging market firm turn out to increase the value of the firm. This is based on the results of this study indicating that the investment decisions have a significant positive influence on the firm value, both on the firm as a whole and on firms with low or high value. The results of this study are also suitable for the statement of Fama (1974) that the value of the firm is determined by the investment decisions. The firms that invest appropriately, they will be able to increase their value. In this case they invest in fixed assets such as buildings, factories, machinery, and others in order to develop their business. So, it can be said that the investment decisions of the Indonesian emerging market firms are right and able to have a good impact on increasing the firm value. Aditionally, this study supports the results of research conducted by Dewenter et al. (2010), Hsiao-Fen et al. (2011), Chang et al. (2013), Golec and Gupta (2014), Aktas et al. (2015) and Abreu (2016). Besides, the Indonesian emerging market firms can take advantage of the best possible investment opportunities by investing so that the value of the firm will increase.

Based on the results of the data analysis, it can be concluded: first, liquidity has a significant positive influence on the firm value on all samples of non financial firm listed on the Indonesia Stock Exchange and on firms with low value. This means that the higher the liquidity of the non financial firm that becomes the whole sample, the higher the firm value is. Low firms value tend to use a lot of liquidity, in this case by cash flow. However, high firms value tend to use small cash flows so they cannot significantly increase their value. Second, the debt policy has a positive influence but not significant to the firm value on the overall sample. This indicates that the debts owned by non financial firms cannot be maximally utilized to increase the firm value. High value firms use large amounts of debt to increase their value, while low value ones do not use debt but they tend to use internal financing. In summary, the investment decisions have a significant positive influence on the firm value, both on the sample of the firm as a whole and on firms with low and high value. This means that the non financial firms are right in making investment decisions, in other words, the investment made is right on target to increase the firm value. For further researchers, it is better to use more sample firms, e.g. all companies on Indonesia Stock Exchange or compare with other developing countries in Southeast Asia or Asia. In addition, the time period of the study may be longer to get a lot of observation.

Abreu, R. 2016. From Accounting to Firm Value. Procedia Economics and Finance 39:685-692.

Akbar, S., S. u. Rehman, and P. Ormrod. 2013. The impact of recent financial shocks on the financing and investment policies of UK private firms. International Review of Financial Analysis 26:59-70.

Aktas, N., E. Croci, and D. Petmezas. 2015. Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance 30:98-113.

Azmat, Q.-u.-a. 2014. Firm value and optimal cash level: evidence from Pakistan. International Journal of Emerging Markets 9 (4):488-504.

Bodie, Z., A. Kane, and A. J. Marcus. 2008. Investments. 7 ed. New York: Mc Graw Hill.

Brainard, W.C. and Tobin, J. 1968. Pitfalls in Financial Model Building. The American Economic Review 58 (2): 99-122.

Brigham, E. F., and M. C. Ehrhardt. 2013. Financial management: Theory & practice: Cengage Learning.

Brigham, E. F., and J. F. Houston. 2012. Fundamentals of financial management: Cengage Learning.

Cassell, C. A., S. X. Huang, J. Manuel Sanchez, and M. D. Stuart. 2012. Seeking safety: The relation between CEO inside debt holdings and the riskiness of firm investment and financial policies. Journal of Financial Economics 103 (3):588-610.

Chang, L.-L., F. D. Hsiao, and Y.-C. Tsai. 2013. Earnings, institutional investors, tax avoidance, and firm value: Evidence from Taiwan. Journal of International Accounting, Auditing and Taxation 22 (2):98-108.

Chen, R.-R., T.-H. Yang, and S.-K. Yeh. 2016. The Liquidity Impact on Firm Values: the Evidence of Taiwan's Banking Industry. Journal of Banking & Finance.

de Jong, A., M. Verbeek, and P. Verwijmeren. 2011. Firms’ debt–equity decisions when the static tradeoff theory and the pecking order theory disagree. Journal of Banking & Finance 35 (5):1303-1314.

Dewenter, K. L., X. Han, and P. H. Malatesta. 2010. Firm values and sovereign wealth fund investments. Journal of Financial Economics 98 (2):256-278.

Fama, E. F. 1974. The Empirical Relationship Between the Dividend and Investment Decisions of Firm. The American Economic Review 64:304-318.

Fama, E. F., and M. H. Miller. 1972. The Theory of Finance. Illinois: Dryden Press.

Fang, V. W., T. H. Noe, and S. Tice. 2009. Stock market liquidity and firm value. Journal of Financial Economics 94 (1):150-169.

Golec, J., and N. J. Gupta. 2014. Do investments in intangible customer assets affect firm value? The Quarterly Review of Economics and Finance 54 (4):513-520.

González, V. M. 2013. Leverage and corporate performance: International evidence. International Review of Economics & Finance 25:169-184.

Hsiao-Fen, H., H. Chuan-Ying, L. Chun-An, and H. Ai-Chi. 2011. The Relationship Among Managerial Sentiment, Corporate Investment, and Firm Value: Evidence from Taiwan. Emerging Markets Finance & Trade 47 (2):99-111.

Jensen, M. C. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76 (2):323-329.

______. 2003. A Theory of The Firm. 2 ed. London: Harvard University Press.

Jensen, M. C., and W. H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3:305-360.

Lang, L.H.P, Stulz, R.M. and Walkling. 1989. Managerial Performance, Tobin's Q, and the Gains from Successful Tender Offers. Journal of Financial Economics, September, 137-154.

Larrain, B., and M. Yogo. 2008. Does firm value move too much to be justified by subsequent changes in cash flow? Journal of Financial Economics 87 (1):200-226.

Meier, I., B. Yves, and L. Claude. 2013. Financial flexibility and the performance during the recent financial crisis. International Journal of Commerce and Management 23 (2):79-96.

Modigliani, F., and M. H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review:261-297.

Prombutr, W., L. Lockwood, and J. D. Diltz. 2010. Investment Irreversibility, Cash Flow Risk, and Value-Growth Stock Return Effects. Financial Review 45 (2):287-305.

Ross, S. A. 1973. The economic theory of agency: The Principal's Problem. The American Economic Review 63 (2):134-139.

Tobin, J. 1969. A General Equilibrium Approach To Monetary Theory. Journal of Money, Credit and Banking 1 (1): 15-29.

Van Heerden, J. D., and P. Van Rensburg. 2016. The Impact Of Liquidity On The Cross Section Of Equity Returns On The Johannesburg Securities Exchange. Economics, Management & Financial Markets 11 (2):59-86.

Zangina, I., and B. Godfred Alufar. 2009. Corporate liquidity management of listed firms in Ghana. Asia-Pacific Journal of Business Administration 1 (2):189-198.

1. Management Departement Faculty of Economis and Business, Diponegoro University and STIE YPPI Rembang, Indonesia. e-mail: riesk_qien@yahoo.co.id

2. Management Departement Faculty of Economis and Business, Diponegoro University, Indonesia. e-mail: sug_w@yahoo.com

3. Management Departement Faculty of Economis and Business, Diponegoro University, Indonesia. e-mail: hardjum@gmail.com

4. Management Departement Faculty of Economis and Business, Jenderal Soedirman University, Indonesia. e-mail: ishaferi@yahoo.com

5. Management Departement Faculty of Economis and Business, Muhammadiyah Purworejo University, Indonesia. e-mail: intasnps.msc@gmail.com