Vol. 40 (Issue 40) Year 2019. Page 29

MIROKHINA, Alla A. 1; SHAPOVALOVA, Ekaterina I. 2; DUBININA, Maria A. 3; KARPENKO, Kristina V. 4 & REVYAKIN, Artem S. 5

Received: 02/08/2019 • Approved: 06/11/2019 • Published 18/11/2019

ABSTRACT: World experience of the past years shows that the formation of regional clusters is one of the most promising forms of spatial economy organization. In the regional management system, this approach concentrates all the effects of public-private partnership and interaction of business entities by stimulating the emergence of synergies within the spatial-network regional structures due to the diffusion of innovations that, ultimately, leads to the rapid socio-economic development of deprived areas. |

RESUMEN: La experiencia mundial de los últimos años muestra que la formación de grupos regionales es una de las formas más prometedoras de organización de la economía espacial. En el sistema de gestión regional, este enfoque concentra todos los efectos de la asociación público-privada y la interacción de las entidades comerciales al estimular la aparición de sinergias dentro de las estructuras regionales de la red espacial debido a la difusión de innovaciones que, en última instancia, conducen a la rápida evolución socio-social-desarrollo económico de zonas desfavorecidas. |

Cluster form of economic organization in Russia became relatively widespread in various industries and fields in the 2000s. Among scientists and specialists in the regional and industrial economy, the organization and operation of clusters are adequately researched. However, there are various theoretical and methodological applied aspects remaining beyond the scope of economic science, reflecting the peculiarities of the cluster establishment and functioning in the agricultural sector of the economy.

Terminological differences in interpreting "cluster" economic category are determined by cluster characteristics allocated as a difidenda, i.e. its essential basis. For descriptive interpreting this economic category, we highlight its signature characteristics enabling to identify the cluster forms of economic development in practice. These are as follows:

- the high share of the industry (a group of enterprises) in the total gross product of the territory and hence the significant export potential;

- spatial characteristics of the cluster elements’ placement supporting active interaction not only within the production elements but also with suppliers, counterparties, consumers, service providers, each of whom enhances its specialization by interacting with the cluster;

- significant advantages in characteristics of the available potential resource (according to M. Porter "factor conditions"), which can be attributed not only to the availability and geographical proximity of natural-resource raw objects, but also to the qualifications of employees, a competitive segment of suppliers, an established system of maintaining the innovative component of the company (interaction with research institutes and universities), the required infrastructure availability, etc.;

- positioning the cluster as the main "employer" for the population in the region (territory);

- effective interaction and high competition in related, servicing and supporting sectors of the economy based upon the principles of a competition combined with cooperation to ensure the collective promotion of innovative goods applying subcontracting practices;

- orienting cluster participants to create a high value-added product based on high consumer requirements and domestic market preferences.

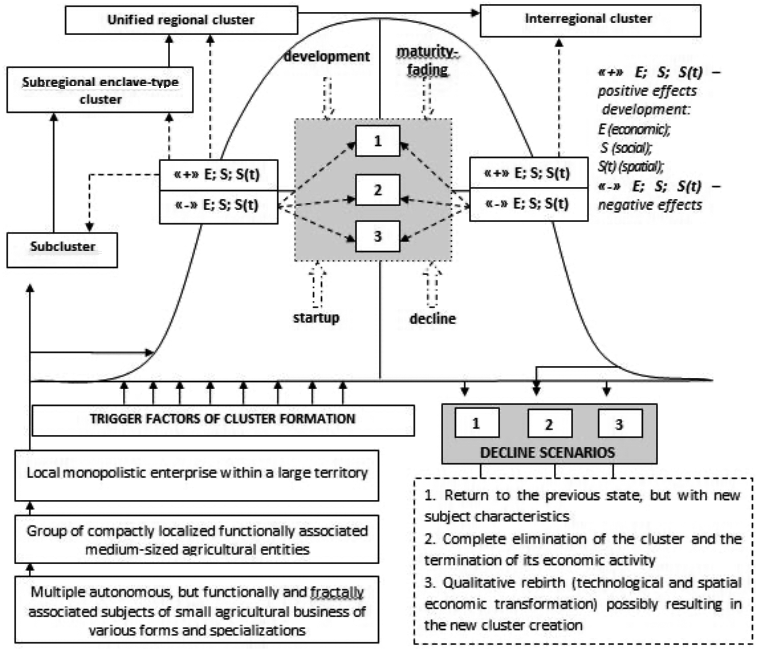

Currently relevant remain the issues of developing mechanisms as well as instrumental and methodological apparatus enabling to identify the life cycle stage and the signature characteristics of the cluster at the startup, development, maturity-fading and decline phases with a large number of works from national and foreign authors dedicated to their research (Ablaev, 2015) (Sosnovskikh, 2017) ( Kopczewska , 2018) ( Porter, Delgado, & Stern, 2016) ( Aggarwa, 2011) ( Behera, Kim, Lee, Suh, & Park, 2012) ( Marchi & Grandinetti, 2014) (Ketels, 2013) (Coulibaly, Erbao, & Mekongcho, 2018).

Clusters including ones of the agricultural sector are characterized by the stages of startup, development, maturity-fading and decline, whereas the effects they produce on the socio-economic systems of traditional agricultural regions will vary in composition and content at each of the life cycle stages (figure 1).

Figure 1

Model-theoretic representation of effects’ trinity at different stages

of cluster initiative implementation in agriculture-based region

It should be noted that each life cycle stage of the cluster initiative has both positive and negative effects. In this regard, for industry authorities, the best viable option for implementing the cluster policy will be to take advantage of positive effects and minimize (compensate) negative ones.

In the modern theory and practice of the regional economy, there are many approaches to a cluster identification (Vertakova, Plotnikov , & Fedotova, 2016) (Goremykin, Sokolov, & Safronova , 2012) (Eraslan, Donmez, & Akgu, 2016). In our research, we use the approach within the framework of the theory of territorial competitive advantages. It involves an assessment of the established cluster development determinants (local competitive advantages), which assesses the resource potential of the territory, the characteristics of related and service industries, the state of demand for output, a common vision for the cluster development, and maintaining principles of competition and cooperation. We selected this approach due to the availability of official statistics for all assessment blocks.

Following the logic of the research, we will proceed with describing the selected quantitative indicators of prospects for cluster formation in the regional economy.

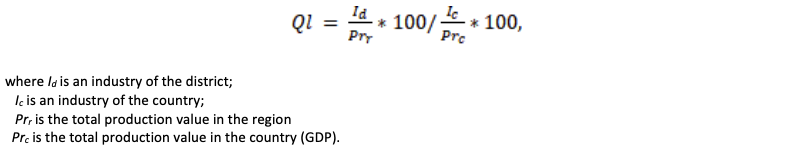

1. Location quotient of production

In calculating this indicator, as total production value in the region and the country we will use the Gross Regional Product value and, accordingly, for GDP the country. This is a classic indicator in the theory of regional specialization, and it can be slightly modified, allowing to assess different aspects of specialization. To calculate the location quotient according to the employed staff number, we will use the employment data in the three sectors of the economy at the regional level in relation to the total population and divide the resulting value by the same country-level ratio. Thus, these quotients show the ratio of the share of the analyzed industry in the production structure (number of employees, fixed assets value) of the region to the share of the same industry in the country.

2. Per capita output quotient is calculated as the ratio of the share of the regional branch of the economy in the corresponding structure of the country industry to the share of the regional population in the country population:

In this, we used not the total population of the region (country) to calculate this indicator but the number of the economically active population. This indicator, in fact, characterizes a comparative performance in the industry of the region being quite relevant in terms of assigned tasks of the in-development methodology.

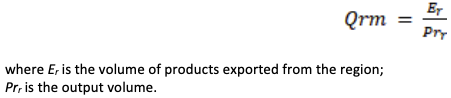

3. Regional merchantability quotient is calculated as the ratio of the export of goods from the territory to its regional production:

In case the actual value of the above indicators exceeds one, these industries can be considered as the basis of the regional market specialization.

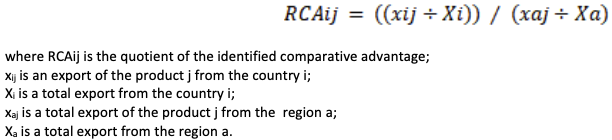

4. Balassa index (index of revealed comparative advantage, (RCA)). Assuming that one of the cluster’s main identification features is that the territory profits off of products’ exporting, this indicator is quite informative in the context of the research. According to this index, a region may be identified as specializing in the product or service export if it’s market share for a given product is above the national average:

In case a regional indicator value exceeds one for a particular industry, it means the export is above expectations based on data on its demand in the total export volume of the region.

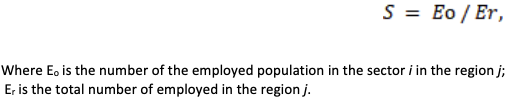

5. Cluster focus (according to M. Porter) (S) is calculated as the ratio of the employed population in the sector i of the region j to the total number of employed in the region j:

In fact, this is one of the variations of localization indicator and according to M. Porter characterizes the size of the agglomeration, i.e. the higher the indicator value is, the greater the agglomeration appears to be.

6. The density of economic space in the sector i of the region. This indicator is a spatial characteristic of a potential cluster functioning. It is calculated as the ratio of industrial enterprises to the size of the territory. The greater the number of enterprises located within 1 sq. km of the region, the higher the density of economic space and the more opportunities for interaction and cooperation therefore are.

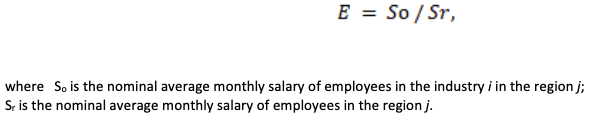

7. The indicator of the industry economic prosperity characterizes the ratio of an employee's salary in the industry to the average annual salary in the region:

This indicator can be interpreted as follows: if the industry is experiencing an increase or the availability of high-paying jobs that paid higher than in other sectors of the economy, the industry can be considered as prosperous.

Table 1

Indicators for calculating location quotients in sectors with

cluster-forming potential of Stavropol territory (ST) (data for 2016)

Indicators |

Potential cluster-forming sectors |

||

Tourism and recreation |

Manufacturing |

Agriculture |

|

Annual average number of employed in industry of ST, thsd. people |

24,9 |

146,4 |

216,7 |

Annual average number of employed in industry of RF, thsd. people |

1217,6 |

10281 |

6730,4 |

Industry production volume of ST, mil. rubles |

11728,1 |

161181 |

103470 |

Industry production volume of RF, mil. rubles |

373985,201 |

22802348 |

3261695 |

Industry value of fixed assets in economy of ST, mil. rubles |

- |

70614 |

87337 |

Industry value of fixed assets in economy of RF, mil. rubles |

- |

8876602 |

3127209 |

Exporting main types of product, mil. rubles (according to average rate of US Dollar for 2011) |

42 |

23862 |

7470 |

Nominal average monthly salary of employees |

10210 |

14685 |

12693 |

It should be noted there is no "tourism and recreation" industry in the classification of types of economic activity. Therefore to calculate selected indicators the data on "hotels and restaurants" was used. In addition, for calculating the index of revealed comparative advantage (RCA) the data on the export of food products and agricultural raw materials was used for agriculture; the data on chemical industry, rubber sector, machinery, equipment and vehicles was used for manufacturing; the data on hotel and restaurant services export was used for tourism.

In addition to the above indicators, some generalized data on the economy of the Stavropol territory and the Russian Federation would be required for the calculation (table 2).

Table 2

Generalized data on economy of Stavropol territory and Russian Federation

for calculating assessment indicators for regional cluster-forming potential

Indicator |

Russian Federation |

Stavropol territory |

Gross product, mil. rubles |

37398520,1 |

316888,9 |

Total number of economically active population, thsd. people |

75752 |

1373 |

Total value of fixed assets, mil. rubles |

30736997 |

360357 |

Annual average number of employed in economy, thsd. people |

67727,2 |

1245,3 |

Nominal average monthly salary of employees |

23369,2 |

15588,7 |

In general, it should be noted that according to the location quotient assessment two industries can be highlighted: "agriculture", i.e. a potential agro-industrial cluster, and "tourism and recreation". Thus, the location quotient according to the volume of output, works and services for these industries amounted to 3.74 and 3.70 respectively, while for manufacturing industries the indicator value was below one (0.83). In turn, the highest location quotient for the number of employed was also identified in "agriculture" – 1.78 (table 3).

Table 3

Calculating location quotients in sectors with

cluster-forming potential (data for 2016)

# |

Indicators |

Potential cluster-forming sectors |

||

Tourism and Recreation |

Manufacturing |

Agriculture |

||

Indicator value / position |

||||

1 |

Location quotient by volume of output, works and services |

3,7010 |

0,8342 |

3,7439 |

II |

III |

I |

||

2 |

Location quotient by number of employed |

1,1282 |

0,7857 |

1,7764 |

II |

III |

I |

||

3 |

Location quotient by value of fixed assets |

0,4342 |

0,6785 |

2,3822 |

III |

II |

I |

||

4 |

Per capita output quotient |

1,7302 |

0,3999 |

1,7502 |

II |

III |

I |

||

5 |

Regional merchantability quotient |

0,0036 |

0,1480 |

0,0722 |

III |

I |

II |

||

6 |

Index of revealed comparative advantage (RCA) |

0,0012 |

0,1854 |

0,1353 |

III |

I |

II |

||

7 |

Cluster focus index (according to M. Porter): ratio of employed population in sector to total number of employed in region |

0,0200 |

0,1176 |

0,1740 |

III |

II |

I |

||

8 |

Density of economic space in sector i of region (enterprises per 1 thsd. sq. km territory ) |

21,1 |

59,1 |

205,1 |

III |

II |

I |

||

9 |

Economic prosperity indicator (ratio of employee salary in industry to average annual salary in region) |

0,6550 |

0,9420 |

0,8142 |

III |

I |

II |

||

10 |

Sum of places |

24 |

18 |

12 |

In terms of per capita output, the benchmark indicator (1) is not exceeded only in the manufacturing sector (0.399), while the maximum value of the regional merchantability quotient is identified in this industry, which export capacity is the highest among the analyzed economic activities. This also confirms the index value of identified comparative advantage with the maximum value registered in "manufacturing" (0.19). Notably, almost all the export capacity of the industry is ensured through the chemical industry. For "agriculture", the ratio between produced goods and exported ones is much lower confirming the sector's orientation mainly towards domestic markets, while the RCA index for "agriculture" is 0.14.

The cluster focus index is another signature indicator of strong economic incentives to clustering processes. According to its value, the largest potential cluster in the Stavropol territory is for "agriculture" (0.17), "manufacturing" is in second place (0.12) with "tourism and recreation" being the third (0.02). At the same time, "agriculture" has the densest economic space that also provides additional incentives for cooperation and deeper interaction (205.1 enterprises per 1,000 sq. m. territory).

For the overall interpretation of the obtained data analysis, it is necessary to rank the calculated indicators according to their value in terms of three industries. This enables applying the method of comprehensive rating for separate types of economic activity in the context of their cluster-forming potential. This method implies summing places: the smaller the sum of places for a particular industry is, the greater this industry’s potential in terms of implementing cluster initiatives appears to be.

As a result of the research, we evaluated the cluster-forming prospects in three basic industries of the Stavropol territory that eventually enabled to identify the promising directions of cluster formation in the economy of a traditional agricultural region (table 4).

Table 4

Characteristics of potential clusters in Stavropol territory

Attribute |

Sector of potential cluster formation |

|||||

TOURISM AND RECREATION |

MANUFACTURING |

AGRICULTURE |

||||

Cluster-forming prospects |

Lowest |

24 |

Medium |

18 |

Highest |

12 |

Features of cluster |

A non-nuclear cluster of tourist-recreational type with a unique natural resource base and a well-known established brand extrapolated to the whole territory. The limiting factor is the small impact and low level of location in relation to the regional economy. It provides significant incentives for the development of supporting and related sectors of the local economy, particularly, small businesses. It’s export potential is low. More effective development is possible through inter-regional cooperation and the creation of a higher-level cluster. |

The cluster of industrial-production type in the field of chemical and petrochemical production. In some industries, the leading enterprises ("nucleus of the cluster") are clearly identified with the low degree of integration around them though. It is the main bearer of the export potential of the entire regional socio-economic system. The cluster is able to function on the principle without dirigiste development from the State, but its proportion in the structure of the regional economy is low. It is not system-forming in terms of employment with a limited role for the local economy to position the industry as a full-fledged cluster. An essential prospect for further development is deepening of integration links with related sectors of the economy. Production support services can become a link between several clusters in the region. |

A non-nuclear production cluster playing an important socio-economic role for the local economy development. The weakest characteristic is the insufficient internal ties between companies for the full cluster development manifesting in the absence of an optimal balance of "trust," "competition" and, most importantly, "cooperation." It is characterized by a high density of economic space, a sufficient degree of location, but a weak innovation and export potential. Further development is largely associated with the influence of unmanageable factors. As a system-forming sector in the region, it has a significant impact from the State. |

|||

Applying this approach will allow to monitor and identify changes in cluster formation of the region as well as provide relevant information for management decision-making in the regional management system.

Selected as a model region for this research, the Stavropol territory generally has the following characteristics according to analytical conclusions of the previous section: a presence of propulsive industries in which enterprises-leaders operate, an advantageous geographical location of the region, available conditions for further enhancement of organizational and economic links between potential cluster participants. All this provide the prerequisites for finding the optimal forms of cluster innovations in the regional economy.

In this regard, the aim of cluster policy in the traditional agricultural region should be seen as forming and strengthening organizational and economic links between economic actors - protocluster and cluster participants – for accessing knowledge, technologies, proportionate risk sharing, consolidated entry into macroregion markets, cost reduction for joint activities through the outsourcing procedures' development, etc.

At the moment, the fact of the attributable socio-economic approach prevailing over the spatial one for various programs and strategies of territorial development is axiomatic in the regional management system. This is manifested in isolation of projected management decisions in the region from the specifics of the spatial development. Programs and projects do not take into account the heterogeneity of spatial socio-economic systems, the territories’ drift in terms of centralization degree, their interconnection between each other and in "core-periphery" pattern.

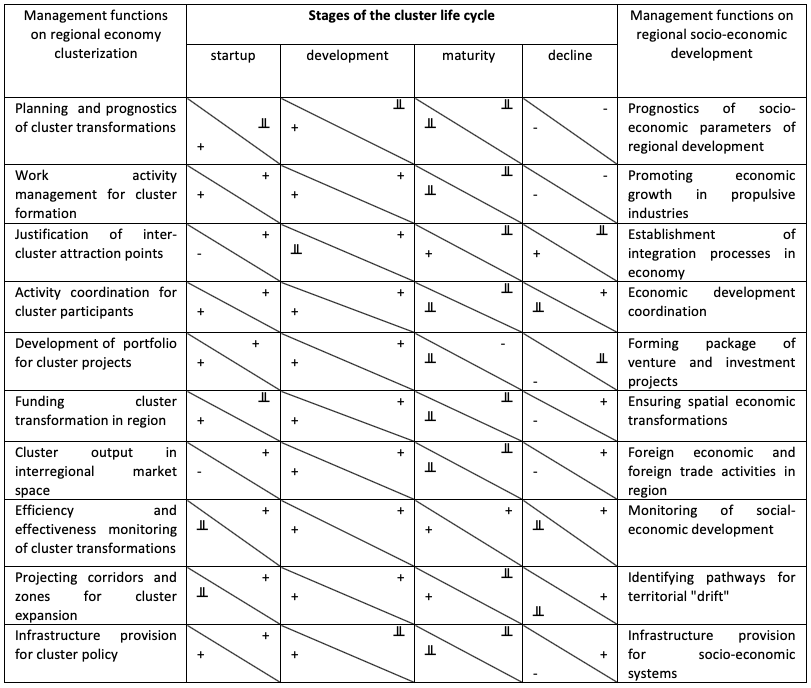

On this basis, we need to identify and highlight the functions of regional management bodies that could combine their substantive content with the implementation of regional cluster policy directions. For this purpose, we will apply the method of cross-tabulation (table data overlay).

Taking into account the specifics of our research, we suggest introducing recording the stages of the cluster life cycle in the cross-tabulation of functions implemented by regional management bodies. This will enable to identify more specifically the substantive functional intersections and figure out stages of the cluster life cycle and functions of regional management bodies to be the most relevant and effective (table 5).

Table 5

Cross-tabulation of functions implementing by regional management

bodies in regional management and cluster development

Note: "z" is for full implementation, "z" is for partial implementation of function, "-" function is not implemented.

Summarizing the results of the implemented research, we consider the concept of regional management according to the cluster-based approach to be grounded on the following provisions:

1. Planning cluster transformations should take into account, first of all, possible spatial effects and consequences for the territorial development;

2. Giving priority to peripheral-type territories in determining cluster locations for territories with the same capacity;

3. Cluster formation should not be at the expense of the established boundaries of administrative territories and municipalities at best taking place in the inter-settlement territories and pioneering areas:

4. Emerging clusters can exploit the existing infrastructure potential of the territory, while in the clustering process the organized infrastructure facilities need to be incorporated into the territorial life support sphere rather than to be assigned to the cluster structure exclusively;

5. Planned cluster spatial changes in economic space should contribute to its equitable development minimizing core-peripheral differentiation.

Our proposed recommendations for the regional management according to the cluster-based approach are grounded in the real level of socio-economic development of the territory enabling to increase the targeting of measures and elaborate specialized scenarios for implementing formulated activities in agro-industrial regions. Implementation of the recommendations is aimed at synchronous incrementing the positive and levelling the negative effects of socio-economic and spatial nature that are specific for each life cycle stage of the formed cluster structures.

Ablaev, I. (2015). Innovation clusters in the Russian economy: Economic essence, concepts, approaches. Procedia Economics and Finance(24), 3-12.

Aggarwa, A. (2011). Promoting agglomeration economies and industrial clustering through SEZs: Evidence from India. Journal of International Commerce, Economics and Policy, 2(2), 201-227.

Behera, S., Kim, J., Lee, S., Suh, S., & Park, H. (2012). Evolution of “designed” industrial symbiosis networks in the Ulsan Eco-industrial Park: “Research and development into business” as the enabling framework. Journal of Cleaner Production, 29-30, 103-112.

Coulibaly, S., Erbao, C., & Mekongcho, T. (2018). Economic globalization, entrepreneurship, and development. Technological Forecasting and Social Change, 127, 271-280.

Eraslan, İ., Donmez, C., & Akgu, M. (2016). The Incoming Paradigm Shift with Globalization and Clustering Approach. Procedia - Social and Behavioral Sciences, 101-109.

Goremykin, V., Sokolov, S., & Safronova , E. (2012). Clustering of the regional economy . Regional economic issues, 2(11), 3-126.

Ketels, C. (2013). Recent research on competitiveness and clusters: what are the implications for regional policy?Cambridge. Journal of Regions, Economy and Society, 6(2), 269-284.

Kopczewska , K. (2018). Cluster-based measures of regional concentration. Critical overview Spatial Statistics,, 27, 31-57.

Marchi, V., & Grandinetti, R. (2014). Industrial districts and the collapse of the Marshallian model: Looking at the Italian experience. Competition & Change, 18(1), 70-87.

Porter, M., Delgado, M., & Stern, S. (2016). Defining clusters of related industries. Journal of Economic Geography, 16(1), 1-38.

Sosnovskikh, S. (2017). Industrial clusters in Russia: The development of special economic zones and industrial parks. Russian Journal of Economics, 3(2), 174-199.

Vertakova, Y., Plotnikov , V., & Fedotova, G. (2016). The System of Indicators for Indicative Management of a Region and its Clusters. Procedia Economics and Finance, 39, 184-191.

1. The Branch of Federal State Budget Educational Institution of Higher Education “MIREA – Russian Technological University” in Stavropol. Russian Federation,355012, Stavropol, Mira street,159. Email: Udovike60@gmail.com

2. North-Caucasian Institute (branch) ANO the Moscow humanitarian-economic University, Russian Federation , 357200, Stavropol territory, Mineralnye Vody, St. Pushkin, 10

3. Krasnodar branch REU after G. V. Plekhanov, Russian Federation, 350002, Krasnodar,st. Sadovaya, 23

4. Institute of service, tourism and design (branch) of NORTHCaucasus Federal University in Pyatigorsk Russian Federation, 357700, Stavropol territory, Kislovodsk, Zhukovsky street, 31

5. North-Caucasus Federal University, Russian Federation,357600, Stavropol territory, p. Canamar, St.Brothers Solomko, 20