Vol. 40 (Issue 42) Year 2019. Page 7

KUSTYSHEVA, Irina N. 1; DUBROVSKY, Alexey V. 2 & MALYGINA, Olesya I. 3

Received: 08/07/2019 • Approved: 02/12/2019 • Published 09/12/2019

2. Review of regulatory legislation and literature

ABSTRACT: The article discusses the leading role of investment, which is to form the economic base for solving socio-economic problems. It justifies the need to maintain a high level of investment attractiveness at the region, which allows concentrating investments on its territory to solve significant problems of the region, increasing the level of competitiveness. The current and significant issues of investment activities in the region have been considered. The purpose of the study was to determine the characteristics of the implementation of investment projects in the Russian Federation. One of the key points was the determination of factors influencing the investment attractiveness of the region and the study of the rational urban planning for the location of the object of the study, the implementation of which is carried out using an investment project. The article suggests options for the implementation of an investment project. |

RESUMEN: El artículo analiza el papel principal de la inversión, que es formar la base económica para resolver los problemas socioeconómicos. Justifica la necesidad de mantener un alto nivel de atractivo de inversión en la región, lo que permite concentrar las inversiones en su territorio para resolver sus problemas importantes y aumentar el nivel de competitividad. Se toman en consideración los temas actuales y significativos relacionados con las actividades de inversión en el ámbito de la Federación Rusa. El propósito del estudio fue determinar las características necesarias para la implementación de proyectos de inversión en la región. Uno de los puntos clave fue la determinación de los factores que influyen en el atractivo de inversión de la región y el estudio de las razones de planificación urbana para la ubicación del objeto de estudio, cuya implementación se lleva a cabo mediante un proyecto de inversión. El artículo sugiere opciones para la implementación de un proyecto de inversión. |

The relevance of the research topic is that at the present stage of development of the society, investments occupy an important place in stimulating the dynamic development of territories of settlements, which are a great opportunity to solve social problems of the population, and also directly affect the economic process of the region and, consequently, the entire state in general.

The development of investment activities in Russia began during the XVIII century. This boundaries of the time frame were the turning points on the development of investment activities caused by the manifestation of nationwide, economic, socio-political and other processes in society.

In a broad sense, “investments” means investments in the future. In the economy, first of all, it is necessary to invest in business, to create conditions and prerequisites for the flow of production processes and only with time to get the desired result.

There are three stages in the development of investment activity in Russia. During these periods there were various sources of financial resources (table 1) (Federal Law No. 39, 2018; Federal Law No. 160, 2017; Yuzovich, 2016).

Table 1

Sources of financial resources at different stages of

investment development in Russia (Ivanov, 2016).

I. Pre-Revolutionary (from the 2nd half of the 18th century until 1917) |

II. Soviet (from 1917 to 1991) |

III. Modern (from 1991 to the present) |

1) external loan; 2) shares; 3) bonds; 4) certificates of deposits in banking institutions; 5) government loans |

1) foreign capital; 2) lending in banks; 3) government loan; 4) voluntary contributions to state funds |

1) public investment; 2) private investment; 3) foreign investment |

The transition to a market economy and the diversity of forms of ownership led to the need to find additional sources of financing, one of which was investment.

In investment activities, the law establishes the regulatory framework and determines the status of all participants in the investment process, the responsibility of each entity, and is governed by the relations between them (Baldin, 2016).

The basic law of the state provides for the separation of powers between the state authorities of the Russian Federation, state authorities of the constituent entities of the Russian Federation, local governments (Article 11 of the Constitution of the Russian Federation, 1993), and the supremacy of federal law (Article 3 of the Constitution of the Russian Federation,1993). Therefore, investment activity is regulated both at the country level and on individual subjects of the Russian Federation.

The Federal Law of February 25 (1999) No. 39 “On investment activity in the Russian Federation carried out in the form of capital investments” is intended to stimulate investment activity in Russia by establishing certain benefits and guarantees to the subjects of investment activity carried out in the form of capital investments. The law declares the triune scope of protection of subjects of investment activities carried out in the form of capital investments (rights, interests and property are protected), as well as equality of provided protection, regardless of ownership forms (Federal Law No. 39, 2018).

The main law of the state enshrines equal recognition and protection on the territory of the country of private, state, municipal and other forms of ownership (Article 8 of the Constitution of the Russian Federation, 1993). Protection extends not only to investors, but also to other subjects of investment activity. Protection, guarantees of rights and conditions of business activity are provided for foreign investors operating in the territory of the Russian Federation.

According to Anna Belitskaya -Associate Professor at the Faculty of Law of the National Research University Higher School of Economics, General Counsel of the Russian Bank due to the current political and economic situation in the world-, think that Russian investors are recognizing an increasingly reliable source of investment taking into account the sanctions imposed against the Russian Federation. One of the promising types of investment activity using domestic capital is becoming a public-private partnership, which, as a new concept of investment projects, receives comprehensive support at the highest levels (Belitskaya, 2015; Van Horne , 2009; Yuzovich, 2016). Public-private partnership is the interaction of public authorities and private business in the field of investment activities.

Federal Law of July 13 (2015) No. 224-FZ “On Public-Private Partnership, Municipal-Private Partnership in the Russian Federation and Amendments to Certain Legislative Acts of the Russian Federation” reflects the legal conditions for attracting investments in the state economy and improving the quality of goods, works, services. The provision of these indicators is under the jurisdiction of public authorities, local governments and is carried out through the formation of the project. A public-private partnership project, a municipal-private partnership project, is a project planned for implementation jointly by a public partner and a private partner on the principles of a public-private partnership (Federal Law No. 224, 2018).

Capital investments are investments in fixed capital (fixed assets), including the costs of new construction, reconstruction and technical re-equipment of existing enterprises, the purchase of machinery, equipment, tools, inventory, design and survey work and other costs (article 1 of the Federal Law 25.02.1999 No. 39 “On investment activity in the Russian Federation, carried out in the form of capital investments”).

The main purpose of capital investments is to make a profit. Tax law provides for income taxation. Tax legislation provides for a number of rules aimed at encouraging investment. It determines the specifics of the taxation system and the system of benefits for investors implementing projects in the territory of the constituent entities of the Russian Federation, establishes responsibilities for maintaining the register of participants for regional investment projects (chapter 3.3 of the Tax Code of the Russian Federation, 1998). Defines the rights and obligations of taxpayers (articles 21, 23 of the Tax Code of the Russian Federation, 1998), the deadlines for the payment of taxes (article 57 of the Tax Code of the Russian Federation, 1998). Tax on incomes of individuals, corporate income tax referred to federal taxes (article 13 of the Tax Code of the Russian Federation, 1998); land tax refers to local taxes (article 15 of the Tax Code of the Russian Federation, 1998).

The implementation of investment activities is directly related to land use. In this case, the land can act as a means of production in cases of investment activities in agriculture and as a spatial basis for investment activities in the country.

On the one hand, land is considered as real property, to which land plots, subsoil plots and everything that is firmly connected with the land are classified, that is, objects whose movement without disproportionate damage to their purpose is impossible, including buildings, structures, construction in progress (article 130 of the Civil Code of the Russian Federation, 2019). On the other hand, it is considered as an object of ownership and other rights. Formation of land plots is carried out through the division, consolidation, redistribution of land plots (articles 11.4-11.7 of the Land Code of the Russian Federation, 2001).

Relations between subjects of investment activity are carried out on the basis of an agreement. Issues related to the conclusion, amendment and termination of contracts are governed by the rules of civil law (chapters 28, 29 of the Civil Code of the Russian Federation, 1994) .

When implementing an investment project in the city, it is necessary to take into account territorial planning documents determining the destination of territories based on social, economic, environmental and other factors in order to ensure the sustainable development of the territories of the Russian Federation, constituent entities of the Russian Federation and municipalities (article 9 of the Urban Planning Code of the Russian Federation, 2004).

For a city, from the territorial planning documents one should take into account the territorial planning scheme of the municipal district of which he is a member (articles 18, 19 of the Town Planning Code of the Russian Federation, 2018) and the General Plan of the settlement or urban district (article 52 of the Urban Planning Code of the Russian Federation, 2004).

When implementing territorial planning documents in urban areas, they develop land-planning projects and land-surveying projects. The territory planning project is a document of urban planning zoning, developed for a part of the territory of the settlements, with the aim of identifying the elements of the planning structure, establishing the boundaries of common areas, the boundaries of the zones of the planned location of capital construction objects, determining the priority of the planned development of the territory (article 42 of the Urban Planning Code of the Russian Federation, 2004).

Another integral document in the construction of urban areas are the rules of land use and development. “The Rules of Land Use and Development” is a document of town planning zoning, which establishes territorial zones, town planning regulations (article 1 of the Urban Planning Code of the Russian Federation, 2004). The rules of land use and development of the city determine the legal regime of land plots and capital construction objects.

Local governments also have the right to regulate investment activities and provide municipal guarantees for investment projects (Federal Law No. 39, 2018).

In Russia, preferential taxation conditions can be provided for participants of regional investment projects. A regional investment project is a project whose goal is the production of goods and which satisfies the following conditions (article 25.8 of the Tax Code of the Russian Federation, 1998):

1) The project can not be directed to the following objectives:

a) The development of the oil and gas industry;

b) The production of excisable goods (with the exception of cars and motorcycles);

c) The implementation of the activity for which the zero tax rate is applied;

2) On the land plots on which the project will be implemented, there are no buildings, structures owned by individuals or an organization that is not a member of such a project;

3) The amount of capital investments in accordance with the investment declaration cannot be less than:

a) 50 million rubles. In this case, capital investments must be made within a period not exceeding three years from the date the organization is included in the register of participants of regional investment projects;

b) 500 million rubles. At the same time, the term for making capital investments should not exceed five years, calculated from the date the organization is included in the specified register;

4) each project is implemented by a single participant (Urban Planning Code of the Russian Federation, 2004).

To make a positive decision on the inclusion in the register of participants of regional investment projects, an organization should:

1) be registered as a legal entity;

2) be registered with the tax authority;

3) not be part of a consolidated group of taxpayers;

4) not be previously a participant in regional investment projects;

5) not have separate subdivisions located outside the territory of the region;

6) not be a member of a non-profit organization, non-state pension fund.

Thus, investments are cash, securities, other property, including property rights, other rights that have a monetary value, invested in objects of entrepreneurial and (or) other activities in order to generate profit and (or) to achieve a different beneficial effect. Investments invest in fixed assets of production and economic facilities and processes that require cash for a long period of time ( Nikolaev, 2017).

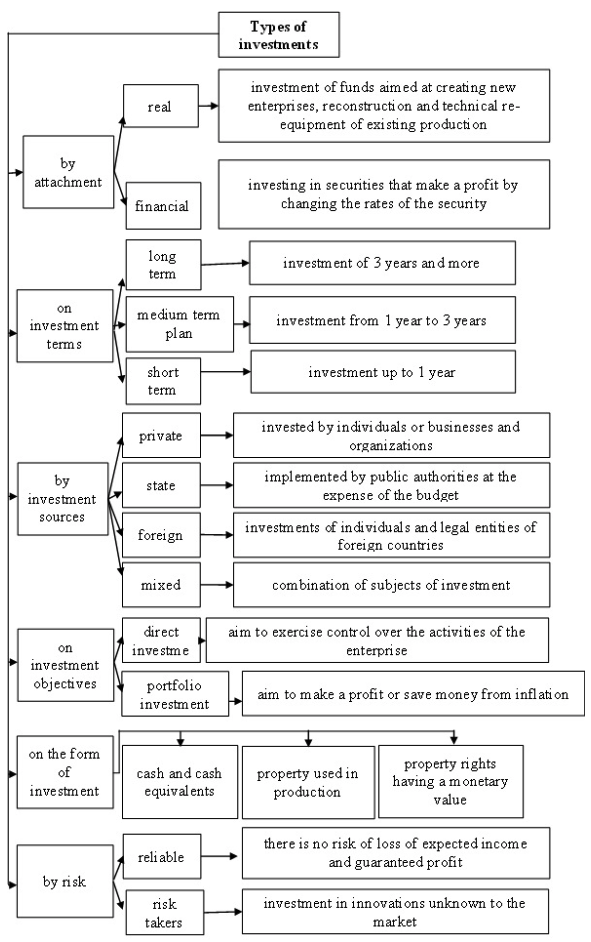

The reasons for encouraging owners of free money to engage on investment activities are diverse, as are the economic conditions with which the sphere of activity is diverse. All this determines the various types of investment (fig. 1) (Marcus, 2018). The subjects of investment activity are investors, customers, contractors, users of capital investment objects and other persons (table 2).

Table 2

The basic concepts of the subjects involved in the implementation

of investment projects(Federal Law No. 39, 2018).

Subject name |

Definition |

Investors |

Persons engaged in capital investments (individuals and legal entities created on the basis of a joint venture agreement, and not having the status of a legal entity, an association of legal entities, government bodies, local governments, foreign business entities) |

Customers |

Actually investors and (or) their authorized individuals and legal entities |

Contractors |

Persons engaged in direct work on the construction of production facilities in accordance with the requirements of the project. Contractors must have a license to carry out those activities that are subject to licensing |

Capital Investment Users |

Investors, as well as any natural and legal persons, including foreign, state bodies, local governments, foreign states, international associations and organizations for which these objects are created |

-----

Figure 1

Types of investments

The objects of investment include newly created and modernized enterprises, securities, scientific and technical products and other activities.

Since legal entities and individuals can act as investors, civil law explains and defines the list of legal entities of their rights and obligations (chapter 4 of the Civil Code of the Russian Federation, 1994). All investors have equal rights to carry out investment activities, independently the volumes and directions of investments, dispose of investment objects and the results of investments (Baldin, 2016).

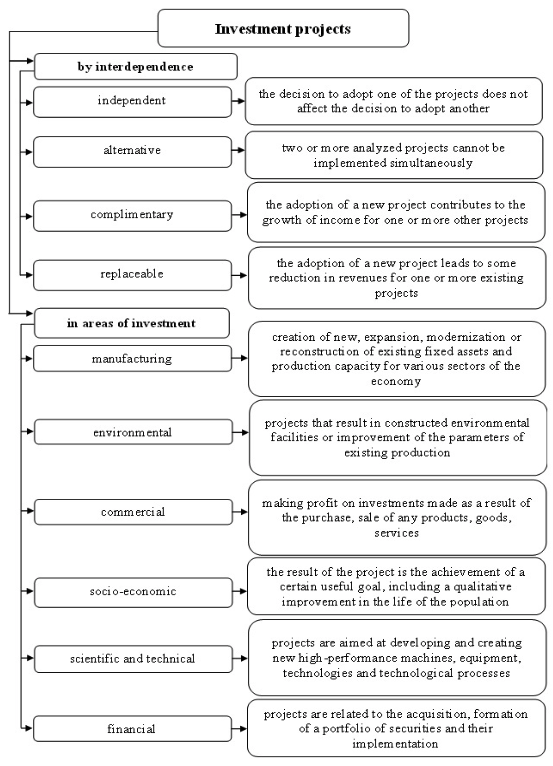

In practice, investments are made in the form of investment projects. An investment project is a justification of the economic feasibility, amount and timing of capital investments, including the necessary project documentation, as well as a description of practical actions to make investments (fig. 2).

Figure 2

Classification of investment projects

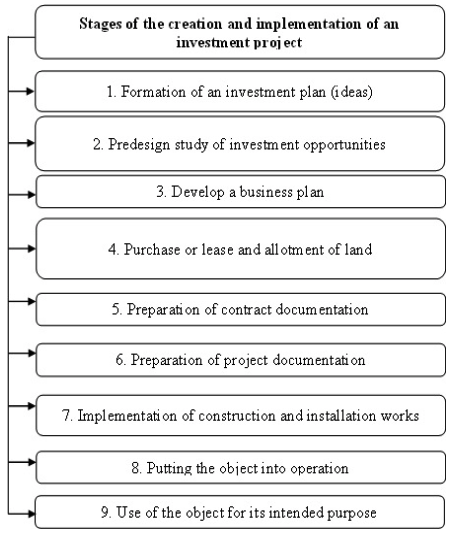

The stages of creating and implementing an investment project are shown in fig. 3.

Figure 3

Stages of creation and implementation

of an investment project

Investment activity creates the basis for the stable development of the economy and its individual industries. The investment policy of the state is purposeful activities to ensure a favorable environment for the implementation of investment, the effective use of investment potential in order to improve the economy and meet the challenges of socio-economic development. With the help of investment policy, the state can directly influence the pace and volume of production, the acceleration of scientific and technical progress, changes in the structure of social production, the solution of social problems (Marcus, 2018).

Effective and flexible regulation of investment activity is possible only with the creation of certain legal norms. The right is a set of mandatory rules of conduct established by the state, non-compliance with which is punishable by law.

The Associate Professor of the Department of Public Administration and Finance of Orlovsky State University, Denis Vavulin suggests introducing the concept of investment funds. Investment funds are the mechanism by which individuals transfer money or assets to professional managers for management. Investments of investors then form a single portfolio in which each investor has a share proportional to his investments. In the history of modern Russia, the emergence of the first investment funds is associated with the process of privatization of state property, in which investment funds were given the role of one of the instruments for denationalizing property of the Russian Federation (Vavulin, 2001; Hitchner, 2006).

The Federal Law of November 29 (2001) No. 156 “On Investment Funds” regulates relations connected with raising funds and other property by placing shares in a special licensing fund, or concluding trust management contracts in order to pool funds and then invest in objects (Federal Law No. 156, 2018).

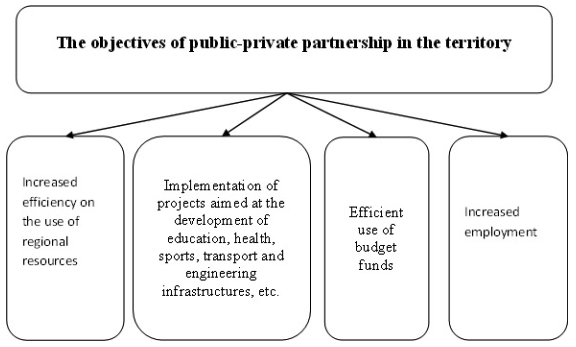

In our opinion, it is necessary to attract private investment in the regions of the country, to which government agencies can provide access to goods, works, services and improve their quality through the implementation of public-private partnerships. The objectives of public-private partnerships are presented in the diagram in fig. 4 (Sarkar,2011).

Figure. 4

The objectives of public-private

partnership in the territory

In order to attract investors to the region, it is necessary to create a consolidated register of investment sites with a graphic display on the map of the territory, which gives a clear idea of their location. The register should contain information about the region, its advantages and the region’s investment policy.

Based on the study of the regulatory regulation of investment activity, the following conclusions can be drawn. Investment is the driving force of a country's economy. The country's economy is the successful development of its individual subjects. The rational management of investment activity is impossible without the creation of effective levels of regulation at all levels of government. Legal regulation of this sphere at the federal level is sufficient, at the regional level it is necessary to improve the regulatory framework and the adoption of standards in the field of improvement of the investment climate, development of regional competition and revitalization of all industries:

1) To meet with the local business community, to discuss what prevents them from developing and investing money. Jointly develop a program of actions to remove these internal barriers, because every enterprise has universal and individual reasons; and then, to speak about external sources of financing, external investments.

2) To make enterprises as efficient as possible. Industry is a top priority. Understand what can be done to increase the load of existing plants on the existing capacity and move towards the construction of new plants.

3) To develop a priority industry - farming industry.

4) To intensify the work of municipalities to attract investment.

This study analyzed the main regulatory and legal sources governing the investment activities of the Russian Federation.

For the purpose of large-scale, rather than local infrastructure development, in order to increase the standard of living and the comfort of living for residents, it is necessary to elaborate developmental plans for the territories of individual municipalities that will constitute a single developmental plan for the region. The initiative of the government, which understands what specific goals need to be achieved in the field of infrastructure development, economics, social policy, will be supported by the investor. That is why, at the present, special importance is attached to investment activities, which would be in organic connection with state-wide social and economic priorities.

1. Federal Law «On investment activity in the Russian Federation, carried out in the form of capital investments» of 25.02.1999 No. 39 (as amended up to 25.12.2018) [Electronic resource] // Consultant Plus legal system.

2. Federal Law «On foreign investments in the Russian Federation» of July 9, 1999 No. 160 (with amendments and additions as of May 31, 2017) [Electronic resource] // Consultant Plus legal system.

3. Federal Law «On public-private partnership, municipal-private partnership in the Russian Federation and the introduction of amendments to certain legislative acts of the Russian Federation» of July 13, 2015 No. 224 (as amended on 29.07.2018) [Electronic resource] // Legal system "Consultant Plus".

4. Civil Code of the Russian Federation of 30.11. 1994 (as amended on 18.03. 2019) [Electronic resource] Access mode: https://base.garant.ru/10164072/.

5. Tax Code of the Russian Federation of July 31, 1998 No. 146 (with amendments and additions as of 06.06.2019) [Electronic resource] // Access mode: http://base.garant.ru/10900200/

6. Federal Law «On investment funds» of 29.11.2001 No. 156 (with amendments and additions as of 01.02.2018) [Electronic resource] // Consultant Plus legal system.

7. Urban Planning Code of the Russian Federation of29.12.2004(as amended on 28.12. 2018) [Electronic resource] // Access mode: https://base.garant.ru/12138258/

8. Baldin K. (2016). Investment management [Electronic resource]: textbook / K.V. Baldin, E.L. Makridenko, O.I. Shvaika; by ed. Baldina K.V. - Electron. Dan. - Moscow: Dashkov and K, - Access mode: https://e.lanbook.com.

9. Belitskaya A. (2015). Commentary to the Federal Law of July 13, No. 224-FZ “On Public-Private Partnership, Municipal-Private Partnership in the Russian Federation and Amendments to Certain Legislative Acts of the Russian Federation” [Electronic resource] / Access Mode : https://www.libfox.ru.

10. Van Horne J. «Fundamentals of Financial Management», Pearson; 13 edi-tion, 2009 – 760p.

11. Vavulin D. (2001). Commentary to the Federal Law of October 29, “On Investment Funds” [Electronic resource] / Access mode: https://www.lawmix.ru.

12. Hitchner James R. «Financial Valuation», 3rd Edition, John Wiley & Sons, 2011 – 1320 p

13. Nikolaev I. ( 2017). Investments [Electronic resource]: textbook / I.P. Nikolaev. - Electron. Dan. - Moscow: Dashkov and K. - Access mode: https://e.lanbook.com.

14. Yuzovich L. (2016). Investments [Electronic resource]: textbook / L. I. Yuzovich, E.G. Knyazev, S.A. Degtyarev, E.A. Razumovsky. - Electron. Dan. - Ekaterinburg:. - Access mode: https://e.lanbook.com.

15. Ivanov V.V. Stages of development of investment activity in Russia. // Eurasian Scientific Journal. - 2016, No. 12. Access mode: http://journalpro.ru/archive/evraziyskiy-nauchnyy-zhurnal-12-2016/

16. The Constitution of the Russian Federation of 12.12. 1993 (as amended on 21.06. 2014 No. 11) [Electronic resource] // Access mode: http://www.constitution.ru/.

17. Land Code of the Russian Federation of 10.25.2001(as amended on 18.03. 2019) Access mode: https://base.garant.ru/12124624/

18. Marcus Alan J., Body Zvi, Kane Alex. Essentials of Investments. 2018, -984 с.

19. Sarkar, S. Optimal size, optimal timing and optimal financing of an investment Text. / S. Sarkar // Journal of Macroeconomics. 2011. - V. 33. -№4.-P. 681 -689.

1. Tyumen Industrial University, Tyumen, Russia. irina1983kust@gmail.com

2. Siberian State University of Geosystems and Technologies, Novosibirsk, Russia

3. Siberian State University of Geosystems and Technologies, Novosibirsk, Russia