Vol. 41 (Issue 05) Year 2020. Page 7

SASKARA, Ida Ayu N. 1; MARHAENI, A.A.I.N. 2 & YULIARMI, Ni Nyoman 3

Received: 12/09/2019 • Approved: 31/01/2020 • Published 20/02/2020

ABSTRACT: Village credit institutions (LPD) are one of the institutional elements that manage the financial potential of a village in Bali. LPDs as microfinance institutions (IMF) are one of the effective development tools to reduce the problem of poverty due to low access to financial capital. The purpose of this research is to discover the relationship between local wisdom, the costs of detecting and social capital for the economic empowerment of people in the province of Bali. Data collected through questionnaires were analyzed using the structural equation modeling (SEM) approach based on variance or partial least squares (PLS). Based on the results of the analysis and discussion of data, it can be concluded that local wisdom and the costs of LPD analysis have a positive and significant effect on the economic empowerment of people in the province of Bali. |

RESUMEN: Las instituciones de crédito de la aldea (LPD) son uno de los elementos institucionales que gestiona el potencial financiero de una aldea en Bali. Las LPD como instituciones micro financieras (IMF) son una de las herramientas de desarrollo efectivas para reducir el problema de la pobreza debido al bajo acceso al capital financiero. El propósito de esta investigación es descubrir la relación entre la sabiduría local, los costos de transacción y el capital social para el empoderamiento económico de las personas en la provincia de Bali. Los datos recopilados a través de cuestionarios se analizaron utilizando el enfoque de modelado de ecuaciones estructurales (SEM) basado en la varianza o el mínimo cuadrado parcial (PLS). Con base en los resultados del análisis y la discusión de datos, se puede concluir que la sabiduría local y los costos de transacción de LPD tiene un efecto positivo y significativo en el empoderamiento económico de las personas en la provincia de Bali. |

Bali is one of the provinces in Indonesia which is famous for its tourism, culture and customs. One of the uniqueness of institutions in Bali is the existence of traditional villages or commonly called custom village or desa pakraman. The financing policy of the Bali provincial government has not yet reached the level of custom village, therefore, custom village needs to have economic governance. To realize this, in 1984, the Bali Provincial Government triggered the establishment of a Village Credit Institution (LPD) in all custom villages in Bali.

Raydika (2013) explained that the legal position of LPDs cannot be equated with People's Credit Bank or Bank Perkreditan Rakyat (BPR), Microfinance Institutions (MFI), and Cooperatives. The LPD's constitutional foundation is different from BPRs, MFIs, and Cooperatives, as well as its legal basis. Factors supporting the success of the LPD as a people's economic institution based on customary law communities in Bali depend on the quality of human resources, namely morality and the desire to progress, followed by village staff HR who always support LPD programs. The Local Law on the LPD outlines that the LPD is a village-owned financial enterprise that carries out business activities in the village environment and for krama desa (members of the custom village).

The development of LPD’s in Bali during 2012 to 2016 is shown in Table 1.

Table 1

The Development of LPD in Bali Province, Year 2012 – 2016

Indicator |

2012 |

2013 |

2014 |

2015 |

2016 |

Amount of LPD |

1,418 |

1,422 |

1,423 |

1,433 |

1,433 |

% Coverage of Custom Village |

96.59 |

96.34 |

96.08 |

96.43 |

96.43 |

Total Asset (million Rp.) |

8,585,121 |

10,692,916 |

12,565,001 |

14,692,698 |

15,069,928 |

Mean of Asset (million Rp./LPD) |

6,054 |

7,519 |

8,829 |

10,253 |

10,516 |

Total of Loan Portfolio (million Rp.) |

6,002,042 |

7,815,843 |

9,564,758 |

11,040,107 |

11,121,144 |

Total of Loan Accounts |

414,623 |

421,408 |

417,199 |

426,628 |

419,409 |

Total of Fixed Deposit (million Rp.) |

3,463,458 |

4,434,791 |

5,196,862 |

6,169,470 |

6,589,857 |

Source: Promotion of Small Financial Institutions

(http://www.profi.or.id)

Village Credit Institutions (LPD) as microfinance institutions have a role as one of the effective development tools to reduce poverty problems due to low access to financial capital. The main business activity carried out by the LPD is lending. Its main function is as an intermediary, which connects parties with excess funds with those who need funds, so that their existence can encourage more effective allocation of economic resources. This role further strengthens the reason for the importance of maintaining the efficiency of the LPD as an MFI in order to remain sustainable.

Yustika (2010) states that the efficiency of institutional design of an organization or business unit can be measured using an analytical tool, namely transaction costs. The greater the transaction costs, the institutional design made by a banking institution is increasingly inefficient. For this reason, this research was conducted to see how the transaction costs of the LPD, with the strength of social capital owned by the Balinese people, are expected to be able to reduce the transaction costs that arise in the credit mechanism process in the LPD. The transaction cost component in this study consisted of screening costs, administrative costs, monitoring costs, negotiation costs, and enforcement costs.

LPD is an institution that is tied to custom village, where the user is krama desa. Until now, krama desa is very respectful of custom village leadership. Moreover, the elements of the custom village leadership were at the same time LPD supervisors. Some forms of transaction costs, such as information costs can be minimized, because information about the LPD can take advantage of the meeting (sangkep) followed by the krama desa. However, the LPD Non Performing Loan (NPL) rate of 8.1% should be watched out, where the NPL standard is 5%. Therefore, efforts and costs are needed to reduce LPD NPL numbers. One of them is by compiling a study of LPD transaction costs in Bali, considering that transaction costs are an analytical tool to measure the efficiency of the institutional design of an organization or business unit. Transaction costs that arise in rural financial institutions in general as well as in the LPD are such as negotiation costs, information costs, coercive costs, screening costs, and if later with the strength of existing social capital, these costs are expected to be minimized. Furthermore, if there is bad credit, there is no need to do direct action by the LPD, because the village leaders in custom village will facilitate communication as well as customary sanctions if necessary.

Therefore it is very important to do research on the role of the LPD on the economic empowerment of the people in Bali Province. The purpose of this research is to find out the relationship between local wisdom, transaction costs, and social capital towards the economic empowerment of the people in Bali Province.

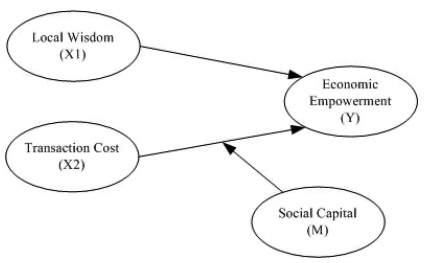

As explained earlier that this study aims to examine the influence between variables, the research conceptual framework is as shown in Figure 1.

Figure 1

Conceptual Framework

Source: Data processed by researchers

The operational of each variable as described in Table 2.

Table 2

Operational of Research Variables

Variables and Indicators |

Code |

|

1. |

Local Wisdom

|

X1 X11 X12 X13 X14 |

2. |

Transaction Cost

|

X2 X21 X22 X23 X24 X25 X26 X27 X28 |

3. |

Social Capital

|

M M1 M2 M3 M4 M5 |

4. |

Economic Empowerment

|

Y Y1 Y2 Y3 Y4 |

Source: Data processed by researchers

The population in this study were all LPDs in Bali Province, while the total sample was 312 LPDs. The sampling technique used is proportional cluster random sampling, so that the sample is distributed proportionally to each district/city in the Province of Bali. The method of data collection was carried out through a questionnaire instrument with a Likert Scale (1 - 5). Data analysis techniques that will be used include descriptive analysis and inferential analysis with the approach of Structural Equation Modeling (SEM) based on variance or Partial Least Square (PLS).

There are three research hypotheses that will be tested in this study, namely:

According to Yustika (2010), defining can be seen as a process and purpose. As a process, institutions refer to efforts to design patterns of interaction between economic actors so that they are able to carry out transaction activities. If it relates to the goal, then the institution concentrates on creating economic efficiency based on the structure of economic, political and social forces between the actors. Harris et al. (2009), explains that there are three fundamental understandings related to the New Institutional Economy, namely: 1) is a theory that emerges based on the Neo Classical Economics framework; 2) very important in the context of economist policy because of its presence against the role of the market that is highly honored by the orthodox Neo Classical Economics; 3) become very important because it is a theory built on the basis of adjustments to change in relation to efforts to increase economic growth.

Institutions are believed by most economists to be a source of efficiency and economic progress (Yustika, 2010). Furthermore, by new institutional economic figures (New Institutional Economics/NIE), namely North (1994) institutions are interpreted as rules that limit human deviant behavior (humanly devised) to build a structure of political, economic, and social interaction. In line with North, Robbins in Yustika (2010) selects a specific form of behavior, which is an economic subject when talking about scarcity and rationality. Definitions of institutional economics focus on the study of the structure and function of a human or cultural relations system, which explicitly includes group behavior and public (public) goals. Furthermore, Kapp in Yustika (2010) concluded that institutional economics does not attempt to study rational behavior, but also tries to recognize forms of behavior, such as traditional behavior patterns of individuals and groups, namely patterns that donate stability and uniformity that can institutionalized.

NIE is considered as a result of the expansion of economics into the area of social science, especially law, politics, and sociology, so that it is a multidisciplinary study. Kherallah and Kirsten (2002) in Yustika (2010) explain in general the branches of NIE can be divided into two categories. First known as new economic history and public choice school, which focuses on macro analysis (second institutional environment, the theory of transaction cost economics and economics information), only in part, which focuses on institutional arrangement and forms of governance of economic activities, in addition there are still several other branches studied such as new social economics, the theory of collective action (collective action theory).

Quality with the performance of the institution on the one hand and the results of development on the other, strong positive correlation exists as stated by the majority of researchers who use qualitative and quantitative approaches related to the role of institutions in the development process.

Institutionality in general is a formal and informal tool that involves manners and rules that facilitate coordination or regulation of individual or group relations. As a formal tool concerning law, contracts, political systems, organizations, markets and others, while informal instruments are related to norms, traditions, customs, religious values systems, sociological tendencies and so on. These formal and informal institutions can influence a person's behavior which gives more certainty in conducting interactions, so that it can produce output, such as economic performance, efficiency, growth and economic development (Kherallah and Kirsten, 2001).

Social capital is information, trust, and norms of reciprocity inherent in social networks (Woolcock in Voydanoff 2001). Social capital refers to the characteristics of social organizations such as networks, norms, and beliefs that facilitate mutual coordination and cooperation. Social capital also adds subjective elements, cultural processes such as mutual trust and norms that facilitate social action. This difference shows a reciprocal relationship between social capital, community social organizations, and social networks. Social networks and community social organizations provide resources that can be used to facilitate action. Social capital in turn produces further resources that contribute to community social organizations and social network resources.

Social capital is a series of processes of human relations that are supported by networks, norms, and social beliefs that enable efficient and effective coordination and cooperation for mutual benefits and virtues (Cox Eva, 1995). Social capital is the appearance of social organizations such as trust, respiration, networks that can improve community efficiency by facilitating coordination of cooperation for mutual benefit (Putnam, 1993). While Ridell (1997), classifies three parameters of social capital, namely network, trust, and norms. The research conducted by Saskara and Marhaeni (2017) states that empowerment of a community allows it to occur if there is a network of cooperation with one another, as well as empowerment strategies that are in accordance with the characteristics of the local community.

The transaction cost economy is one of the most popular analytical tools in institutional economics. The inefficiency of an institution can be reflected in the high transaction costs. Therefore an efficient institution, if it can reduce transaction costs as low as possible. North (1991) and Mburu (2002) in Yustika (2010), defining transaction costs is the costs spent to negotiate, measure, and impose exchange. Transaction costs are costs incurred including search and information costs, negotiation costs and decisions or executing contracts, including the costs of supervision, coercion and implementation.

Transaction costs, such as production costs, can also be grouped into fixed transaction costs related to specific investments made in the preparation of institutional agreements. and variable transaction costs, relating to costs incurred based on the number and volume of transactions. North and Wallis (1994), Mburu (2002) in Yustika (2010), see that transaction costs arise because of ownership transfers or ownership rights. Transaction costs are costs for land, labor, capital, and entrepreneurial skills needed to physically move inputs into output. The high transaction costs make the industry inefficient. Industrial/company irregularities caused by high transaction costs can be seen from the example of research conducted by Yustika (2010). Yustika's results show that the transaction costs of sugarcane farmers contribute around 42% of total costs and the remaining 58% in the form of production costs. The decline of the national sugar industry is caused by institutional inefficiency, both at the level of institutional environment, as well as institutional agreements.

The emergence of transaction costs is at least caused by two things, namely limited rationality and opportunistic behavior (Williamson, 2000). Humans have limitations in terms of receiving, storing, processing and searching for information without making mistakes. Limitations possessed by individuals or groups such as this will always be faced with information that is incomplete or gives rise to information uncertainty. Whereas opportunist behavior is the efforts made to benefit by ways or practices that are not honest in economic activities. However, if the benefits derived from competition based on competitive advantage from an individual or a group are not opportunistic behavior.

Villages in Bali have a special order, as stipulated in the Regional Regulation of Bali Province Number 3 of 2001 concerning custom village. Villages can have business entities, for which villages in Bali have established Village Credit Institutions (LPDs). The establishment of LPDs is in line with the government's efforts to empower the community and all national economic forces, especially small, medium and cooperative entrepreneurs, including LPDs based on a people's economy.

Village Credit Institutions (LPD) are financial institutions with two unique characteristics: (a) as institutions owned and regulated by traditional villages, are fully integrated into Balinese culture, (b) unlike other financial institutions, are inclusive in outreach, covering almost all of Bali's traditional villages and most of its inhabitants.

According to Article 2 paragraph (1) of the Regional Regulation of Bali Province Number 8 of 2002, the LPD is a village-owned financial enterprise that carries out business activities in the Village and for the krama desa. Furthermore Article 17 of the Regional Regulation of Bali Province Number 8 of 2002 states that LPD business fields include:

Saskara and Yuliarmi (2017) explained that the LPD is a traditional financial institution in villages in Bali that is able to connect surplus citizens to residents who need credit. LPD as one of the villages' wealth, carrying out its functions in the form of efforts towards improving the standard of living of village officials and in its activities has supported village development. LPD efforts are carried out with the aim of:

Etymologically, local wisdom consists of two words, namely wisdom, also called wisdom, and local (local) or local. Local wisdom is a local idea that is wise, full of wisdom, good value, embedded and followed by members of the community.

In anthropological disciplines, local wisdom is also called local genious. The term local genious itself was first developed by archaeologist H. Quaritch Wales in his writing entitled The Making of Greater India: A Study in South-East Asia Culture Change, which was published in the Journal of the Royal Asiatic Society (1948) (Koentjaraningrat, 1986). The emergence of the term local genious by Wales is a response to the opinion expressed by F.D.K. Bosch in 1946 in his inaugural address as professor of the University of Leiden, entitled Het Vraagstuk van de Hindoe-columnist van den Archipel. In his speech, Bosch emphasized the importance of the characteristics that exist in every national culture. The characteristic or commonly referred to as "native" is what Wales termed local genious, which contains meaning as the basic personality of each culture. In subsequent developments, for example Anderson (2002) referred to as cultural artefacts of a particular kind, a special type of cultural artifact.

According to Haryati Soebadio (in Ayatrohaedi 1986), local genious is also a cultural identity, identity/personality of the national culture that causes the nation to be able to absorb and cultivate foreign cultures according to their own character and abilities. While Moendardjito (in Ayatrohaedi, 1986) says that regional cultural elements are potential as local genious because they have proven their ability to survive until now, with characteristics: (1) able to survive against external culture; (2) has the ability to accommodate outside cultural elements; (3) has the ability to integrate external cultural elements into indigenous cultures; (4) have the ability to control; (5) able to give direction to cultural development.

Local wisdom can also be interpreted as good cultural values that exist in a society. This means that to know a local wisdom in an area we must be able to understand the good cultural values that exist within the region. Generally the values of local wisdom are passed down from generation to generation to the next generation.

The results of the tabulation of data on the research questionnaire were analyzed descriptively to determine respondents' perceptions of each variable. Given that the research instrument is a questionnaire with a Likert scale (scale 1 - 5), then the results of univariate analysis on each variable can be explained as follows. The implementation of local wisdom is perceived to be very high with a mean of 4.51. Furthermore, the transaction cost variable is perceived to be efficient with the mean worth 4.21. Social capital is even given very high ratings by respondents with a mean of 4.49. Finally, the variables of community economic empowerment are also very well perceived by respondents with a mean of 4.29

SEM-PLS analysis is done through two stages, namely the analysis of the outer model to determine the validity and reliability of the indicators in each construct, and followed by an analysis of the inner model to find out the relationship between constructs.

In the analysis of the outer model, several stages of testing are carried out, namely testing the validity by analysed the outer loading. Validity test results as Table 3.

Table 3

Outer Loading

Code of Indicators |

Code of Construct |

||||

M |

X1 |

X2 |

X2*M |

Y |

|

M1 |

0.798 |

||||

M2 |

0.655 |

||||

M3 |

0.772 |

||||

M4 |

0.714 |

||||

M5 |

0.696 |

||||

X11 |

0.613 |

||||

X12 |

0.624 |

||||

X13 |

0.717 |

||||

X14 |

0.747 |

||||

X2 * M |

0.944 |

||||

X21 |

0.618 |

||||

X22 |

0.611 |

||||

X23 |

0.648 |

||||

X24 |

0.697 |

||||

X25 |

0.639 |

||||

X26 |

0.672 |

||||

X27 |

0.679 |

||||

X28 |

0.357 |

||||

Y1 |

0.731 |

||||

Y2 |

0.781 |

||||

Y3 |

0.496 |

||||

Y4 |

0.697 |

||||

Source: Results of data analysis

(Output of Smart PLS Analysis)

Given that the outer loading cut is 0.6, then based on Table 5.9 it can be concluded that there are two invalid indicators because the outer loading value is <0.6, namely: (1) Indicator X28 (using third party valuation), on variable X2 ( transaction costs); and (2) Indicator Y3 (community controls), on variable Y (economic empowerment). Therefore, an invalid indicator is eliminated from the model, and continued with a retest. The results of the retest as shown in Table 4.

Table 4

Outer Loading (After the Elimination of Invalid Indicators)

Code of Indicators |

Code of construct |

||||

M |

X1 |

X2 |

X2*M |

Y |

|

M1 |

0.800 |

||||

M2 |

0.656 |

||||

M3 |

0.776 |

||||

M4 |

0.715 |

||||

M5 |

0.688 |

||||

X11 |

0.622 |

||||

X12 |

0.607 |

||||

X13 |

0.715 |

||||

X14 |

0.756 |

||||

X2 * M |

0.956 |

||||

X21 |

0.609 |

||||

X22 |

0.618 |

||||

X23 |

0.666 |

||||

X24 |

0.721 |

||||

X25 |

0.656 |

||||

X26 |

0.670 |

||||

X27 |

0.663 |

||||

Y1 |

0.752 |

||||

Y2 |

0.774 |

||||

Y4 |

0.721 |

||||

Source: Results of data analysis

(Output of Smart PLS Analysis)

Table 4. shows that all indicators have an outer loading > 0.6 so that it can be stated that all indicators are meeting the criteria of convergent validity.

In addition to the convergent validity test, discriminant validity tests were also carried out by analysed the cross loading value. The results of the discriminant validity test are as shown in Table 5.

Table 5

Cross Loading

Code of Indicators |

Code of Construct |

||||

M |

X1 |

X2 |

X2*M |

Y |

|

M1 |

0.800 |

0.370 |

0.388 |

0.016 |

0.441 |

M2 |

0.656 |

0.294 |

0.321 |

0.052 |

0.418 |

M3 |

0.776 |

0.406 |

0.377 |

-0.027 |

0.450 |

M4 |

0.715 |

0.390 |

0.394 |

0.190 |

0.489 |

M5 |

0.688 |

0.342 |

0.391 |

-0.041 |

0.457 |

X11 |

0.358 |

0.622 |

0.292 |

-0.005 |

0.326 |

X12 |

0.267 |

0.607 |

0.272 |

0.119 |

0.312 |

X13 |

0.321 |

0.715 |

0.391 |

-0.031 |

0.321 |

X14 |

0.393 |

0.756 |

0.401 |

0.119 |

0.359 |

X2 * M |

0.056 |

0.076 |

0.094 |

1.000 |

0.130 |

X21 |

0.281 |

0.339 |

0.609 |

0.096 |

0.333 |

X22 |

0.286 |

0.388 |

0.618 |

0.020 |

0.271 |

X23 |

0.374 |

0.403 |

0.666 |

0.026 |

0.324 |

X24 |

0.456 |

0.340 |

0.721 |

0.040 |

0.403 |

X25 |

0.355 |

0.322 |

0.656 |

0.040 |

0.297 |

X26 |

0.356 |

0.292 |

0.670 |

0.052 |

0.385 |

X27 |

0.245 |

0.257 |

0.663 |

0.155 |

0.331 |

Y1 |

0.469 |

0.319 |

0.365 |

0.215 |

0.752 |

Y2 |

0.510 |

0.399 |

0.400 |

0.088 |

0.774 |

Y4 |

0.414 |

0.376 |

0.393 |

-0.012 |

0.721 |

Source: Results of data analysis

(Output of Smart PLS Analysis)

Indicators are valid if the indicator correlation with the construct is greater than the correlation of the indicator with other constructs. When compared, the correlation of all indicators with their constructs is greater than the correlation with other constructs.

Related to the results of reliability tests are presented in Table 6 below.

Table 6

Construct Reliability and Validity

Code of Construct |

Cronbach's Alpha |

rho_A |

Composite Reliability |

Average Variance Extracted (AVE) |

M |

0.777 |

0.778 |

0.849 |

0.531 |

X1 |

0.603 |

0.608 |

0.771 |

0.460 |

X2 |

0.783 |

0.787 |

0.842 |

0.434 |

X2*M |

1.000 |

1.000 |

1.000 |

1.000 |

Y |

0.611 |

0.613 |

0.794 |

0.562 |

Source: Source: Results of data analysis

(Output of Smart PLS Analysis)

The construct is declared reliable if Cronbach's Alpha and Composite Reliability are greater than 0.6. All constructs have Cronbach's Alpha and Composite Reliability values greater than 0.6 so the construct is declared valid

Inner model analysis includes R-square analysis and path coefficient analysis.

Table 7

R Square and R Square Adjusted

Endogenous Variable |

R Square |

R Square Adjusted |

Y |

0.462 |

0.455 |

Source: Results of data analysis

(Output of Smart PLS Analysis)

Variability in economic empowerment can be explained by local wisdom, transaction costs, and social capital by 46.2%, and the remaining 53.8% is explained by other factors outside the model.

Table 8

Path Coefficient

Path |

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values |

M |

0.430 |

0.432 |

0.049 |

8.752 |

0.000 |

X1 |

0.166 |

0.168 |

0.052 |

3.196 |

0.001 |

X2 |

0.203 |

0.204 |

0.052 |

3.869 |

0.000 |

X2*M |

0.078 |

0.078 |

0.040 |

1.973 |

0.049 |

Source: Results of data analysis

(Output of Smart PLS Analysis)

All regression coefficients are positive and p-values <0.05 so that all hypotheses in this study are acceptable.

Village Credit Institutions (LPD) are a non-bank financial institution owned by custom village in Bali Province. The main service provided by the LPD to the residents of custom village is providing loans without collateral. Thus the funding needs for various needs of the residents of custom village can be fulfilled through the LPD. Institutionally LPD also helps the needs or activities of custom village which can also be enjoyed by residents of custom village. Various traditional and religious ceremonies carried out by traditional villages can be supported by the local LPD. Thus the existence of the LPD for custom village in Bali is very important, so studies relating to efforts to maintain the existence of LPDs through improving LPD performance must be carried out on an on going basis.

LPDs are closely related to social capital, especially the element of trust. So that credit can be done without collateral. So far there have been no rigid sanctions for creditors whose credit payments have stalled, and LPD transaction costs have not been taken into account. Even though transaction costs are a component that must be taken into account, so that the real conditions of expenditure and the benefits obtained by the LPD will be photographed.

Balinese indigenous people are very obedient to traditional villages, so the LPD which is an institution formed by traditional villages can be quickly accepted. In addition, the community also did not dare to take actions that could harm the LPD for fear of social sanctions and customary sanctions. Compliance with these customs is the main point of local wisdom of indigenous peoples in Bali. Although in the modern or global era, Balinese people still place customary institutions as a role or way of life that must be followed.

Indigenous peoples in Bali are very trusting and obedient to the concept of “Catur Guru”. Catur Guru or in English ‘four teachers’ is a based that must be learn by the hindu Balinese. It has the aim to create harmony and balance in hindu society. Catur Guru is a foundation to build a good behavior in a daily life. Like its name, ‘catur’ mean ‘four’ and ‘guru’ means ‘teacher’. Catur Guru consist of (https://www.balilostadventure.com/):

Devotion to the four teachers is to create harmony, harmony, and balance in achieving holiness and the virtue of life, and if all that can be done in carrying out life undoubtedly the norms that exist in the teachings of Hinduism, to be able to respect each other, trust each other, in carrying out life in all fields will be able to materialize well. If this teaching is then applied in the management of the LPD which includes matters relating to mutual trust, a sense of belonging in an organization, and a culture of honesty because it is related to the law of karma, then all costs that arise in the mechanism process in the LPD can be pressed. Because the transaction costs that arise in rural financial institutions in general and in the LPD are such as negotiation costs, information costs, coercive costs, screening costs, and if later with the strength of existing social capital, the costs are expected to be minimized.

As explained earlier, the LPD was formed to provide financial capital for indigenous village communities in Bali. LPD managers must be careful in lending LPDs, including by examining economic conditions and the ability to pay the community. In addition, the components of transaction costs that are often ignored also need to be taken into account.

As we know, there are several conditions that must be owned to obtain credit, one of which is a guarantee. However, to apply for credit in the LPD there is no guarantee, due to the existence of a traditional village membership system. Where people in a traditional village will not leave the village just like that. Even though he did not live in his village, Balinese indigenous people still had an attachment to their native village. This element of trust is one component of social capital that has remained strong in Bali. In addition, public compliance with the norm elements of social capital is also the basis of consideration for the Bali provincial government to establish LPDs.

Then the question arises, how to manage LPD profits? Bali Provincial Regulation Number 8, 2002 concerning the LPD which requires LPDs to divide their profits by 20% for village development and 5% for social funds. The social fund referred to here is almost the same as corporate social responsibility (CSR) in private companies. So it can be concluded that the LPD has a strategic role for the economic empowerment of rural communities in Bali. First, LPDs provide financial capital through unsecured loans, and the benefits of the next LPD are also used for village development and CSR.

Based on the results of data analysis and discussion it can be concluded that local wisdom has a positive and significant effect on the economic empowerment of the people in Bali Province. LPD transaction costs have a positive and significant effect on the economic empowerment of the people in Bali Province. Social capital significantly strengthens the effect of LPD transaction costs on community economic empowerment in Bali Province.

There are several things that can be recommended as a follow up to the results of this study. Given that LPD transaction costs have been efficient, LPDs need to optimize social capital to continue to minimize transaction costs. Regarding the conditions of the NPL, LPD and custom village need to work together to clarify sanctions given to krama desa/villagers who are late or not paying off credit. LPDs need to develop various types of financial services as a form of innovation and in accordance with people's needs for financial services. Given the characteristics of the Balinese people who have a sense of trust and attachment to customs.

Anderson, B. (2002). Imagined Communities. Second Edition. Yogyakarta: INSIST & Pustaka Pelajar.

Ayatrohaedi. (1986). National Culture Behavioral (Local Genious). Jakarta: Pustaka Jaya.

Cox Eva. (1995). A Truly Civil Society. Sydney: ABC Books.

Harris, K.J., Wheeler, A.R., & Kacmar, K.M. (2009). Leader–member exchange and empowerment-Direct and interactive effects on job satisfaction, turnover intentions, and performance. The leadership quarterly, 20: 371-382.

Kherallah, M. & Kirsten, J. (2001). The New Institutional Economics: Applications for Agricultural Policy Research in Developing Countries. MSSD Discussion Paper. 41.

Koentjaraningrat. (1986). The Role of Local Genious in Acculturation. Jakarta: Pustaka Jaya.

North, D.C. (1994). Institutions. Journal of Economic Perspectives, 5, 97-112.

Putnam, R.D. (1993). The Prosperous Community: Social Capital and Public Life. The American of Prospect, 1(13), 35-42.

Raydika. (2013). Legal Position and Performance of Village Credit Institution (LPD). Denpasar: LPLPD Provinsi Bali.

Ridell, M. (1997). Social Capital and Policy Development. Wellington: Institute of Policy Studies.

Saskara, I.A.N. & Marhaeni, A.A.I.N. (2017). The Role of Social Capital and Business Strategies in Developing the Business of Banten to Increase Balinese Women’s Employment. Journal of Comparative Asian Development, 16(1), 68-86.

Saskara, I.A.N. & Yuliarmi, N. N. (2017). Traditional and Formal Institutions Synergies to Support Agricultural Development in Kertalangu Cultural Village, Denpasar City-Bali. International Journal of Sciences: Basic and Applied Research (IJSBAR), 32(2), 282-292.

Voydanoff, P. (2001). Conceptualizing community in the context of work and family. Community, Work and Family, 4(2), 133-156.

Williamson, O.E. (2000). The New Institutional Economics; Taking Stock, Looking Ahead. Journal of Economics Literature, 38(3), 595-613.

Yustika, A.E. (2010). Institutional Economics (Definition, Theory, and Strategy). Second Edition. Malang: Bayumedia Publishing.

1. Doctor of Faculty of Economics and Business, Udayana University, Denpasar, Bali, Indonesia. saskara@unud.ac.id

2. Doctor of Faculty of Economics and Business, Udayana University, Denpasar, Bali, Indonesia. aainmarhaeni@yahoo.com

3. Doctor of Faculty of Economics and Business, Udayana University, Denpasar, Bali, Indonesia. ninyomanyuliarmi@yahoo.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License