Vol. 41 (Issue 05) Year 2020. Page 14

ARSENIEVA, Natalya V. 1; BARSOVA, Tatyana N. 2; PUTYATINA , Lyudmila M. 3 & LAVROVA , Lyudmila A. 4

Received: 09/10/2019 • Approved: 26/01/2020 • Published 20/02/2020

2. The total composition of the enterprise’s working capital elements and their economic importance

3. The general structure of the enterprise’s working capital detailed analysis

4. The system of indicators for analyzing the trends in the enterprise’s working capital

5. Trends analysis of the working capital structure change

6. Factorial analysis of the enterprise’s working capital changes

7. The enterprise’s working capital use effectiveness analysis

ABSTRACT: The article is devoted to modern aspects of the movement and use of machine-building enterprises’ working capital detailed analysis due to their importance in the process of economic activity. The main directions of such an analysis, as well as a system of indicators used in the process of its implementation, are considered. An interpretation of indicators’ changes and the changes’ effectiveness evaluation in dynamics are given. It is emphasized that the analysis of changes in the structure of working capital largely depends on the industry and specialization of the enterprise. The analysis of the individual components’ growth rates correlation of the working capital, which are the most favorable for the enterprise. Based on the study’s results, a conclusion is drawn on the importance of a comprehensive analysis of working capital for increasing profits and profitability of an enterprise. |

RESUMEN: El artículo está dedicado a los aspectos modernos del movimiento y el uso del análisis detallado del capital de trabajo de empresas de fabricación de máquinas debido a su importancia en el proceso de la actividad económica. Se consideran las principales direcciones de un sistema de indicadores utilizados en el proceso de su implementación. Se da una interpretación de los cambios de estos indicadores y la evaluación de la efectividad de los cambios dinámicos. Se enfatiza que el análisis de los cambios en la estructura del capital de trabajo depende en gran medida de la industria y la especialización de la empresa. El análisis de la correlación de las tasas de crecimiento de los componentes individuales del capital de trabajo, que son las más favorables para la empresa. Con base en los resultados del estudio, se llega a una conclusión sobre la importancia de un análisis exhaustivo del capital de trabajo para aumentar las ganancias y la rentabilidad de una empresa. |

In the conditions of the innovative development of machine-building production and limited financial resources, enterprises require a particularly careful attitude to the resources used, an analysis of their prospective needs and an increase in the use efficiency.

The working capital of enterprises is extremely important in the economy of any enterprise, since it largely determines:

The study of the methodological aspects of its comprehensive analysis can increase the enterprise’s resource management efficiency as a whole and the most important element of working capital. Accelerating the working capital turnover allows it, along with the improvement of technological processes and a decrease in the production cycle duration for manufacturing industrial products, to reduce the need for credit and investment resources and thereby reduce enterprise’s costs and production costs (Savitskaya, 2018).

To ensure a continuous production process, the enterprise ought to have material and supplies in sufficient quantities that are necessary for products’ manufacturing and maintenance of technological processes.

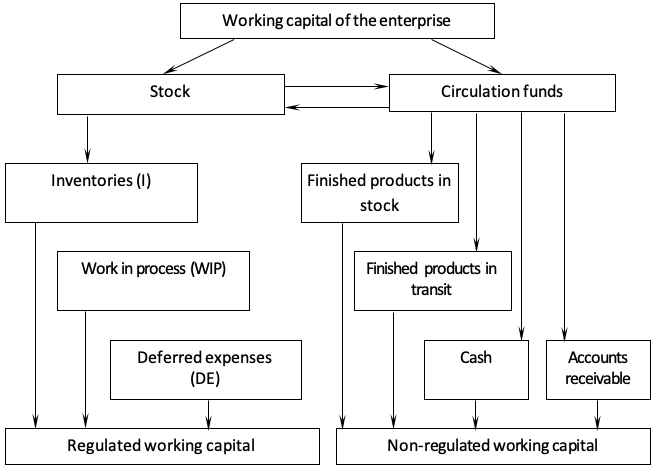

The working capital of the enterprise consists of revolving production assets and circulation funds (Figure 1).

Under working capital assets is comprehended the necessary material and supplies totality, expressed in value form, which:

Under the circulation funds there is comprehended a part of the enterprise’s funds necessary to service the sphere of circulation and sale of finished products.

Working capital assets include (Figure 1):

The circulation funds include:

Revolving production assets and circulation funds are in direct relationship and dependence, as they serve the production process, cash flow and settlement relations.

The need for uninterrupted provision of the enterprise with material resources leads to the particular importance of planning and working capital management. For this, regulation of working capital is used, i.e. determination of the needs for the enterprise’s planned operation (Petrova, 2016).

The following should be regulated: inventories, work in progress, deferred expenses, as well as the remnants of finished goods in the enterprise’s warehouse. These elements relate to regulated working capital. All the other elements of working capital related to circulation funds, that is, finished goods in transit, cash and funds in the calculations relate to non-regulated working capital (Raheman, Nasr, 2007).

Figure 1

The enterprise’s working

capital composition

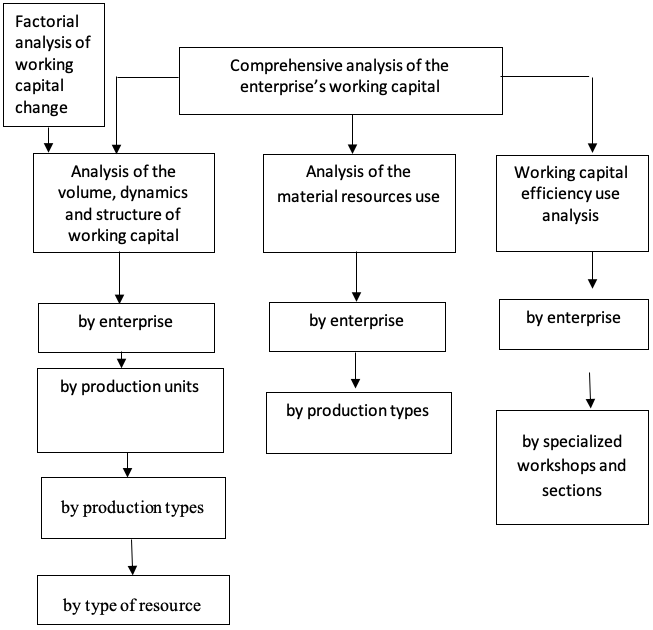

In economic practice, the following types of working capital analysis are most often used (Figure 2):

- Analysis of the working capital dynamics and structure, which allows to evaluate the production material sphere development level, the funds’ distribution rationality between the individual components of the enterprise’s working capital;

- Analysis of the material resources use reflects the level of their supply rhythm, the sufficiency of their provision, the regulation quality in the production process, waste reduction in the process of improving production processes and other aspects;

- The efficiency analysis of the working capital use, allowing to evaluate the acceleration or deceleration of its turnover, the impact of changes in performance indicators on the resulting performance indicators of the enterprise.

- Factorial analysis of the enterprise’s working capital change the allows to evaluate the positive and negative trends in the working capital change in general and its individual components.

Figure 2

The main directions of the enterprise’s

working capital detailed analysis

Depending on the objectives of the study, such an analysis can be carried out: by enterprise, by production units, by type of product, by type of material resources.

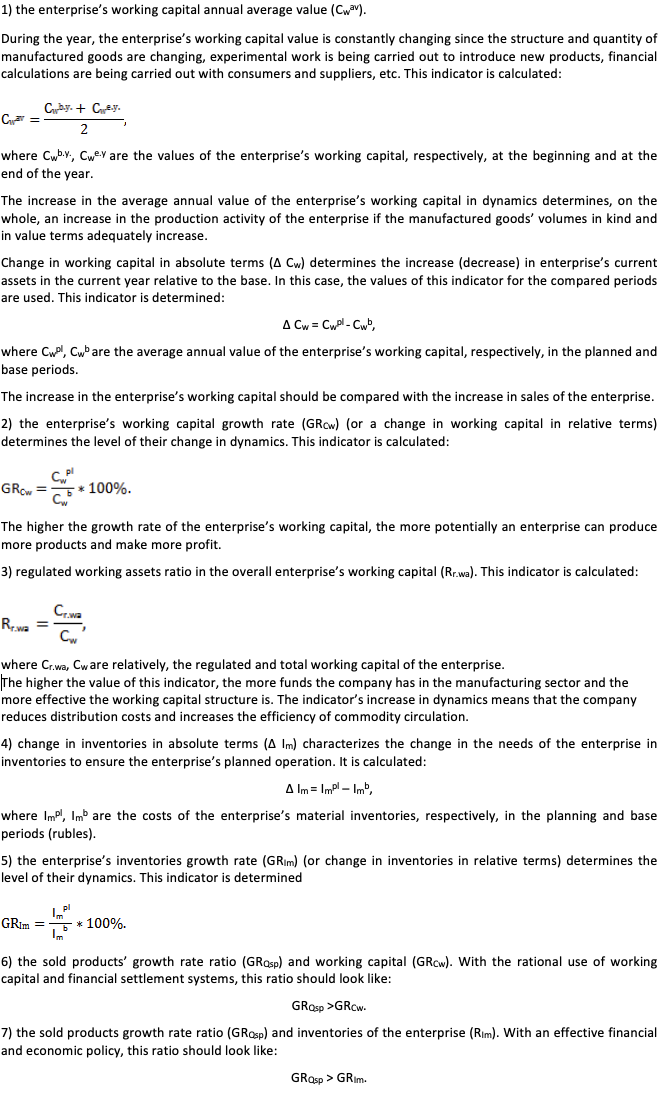

If the analysis is implemented within the enterprise, then it begins with the volume and dynamics of working capital for the following indicators (Rodinov, Putyatina, 2006):

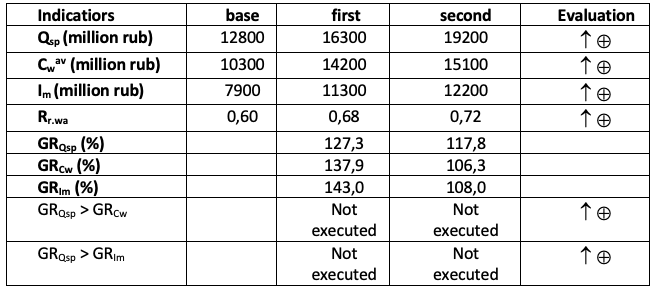

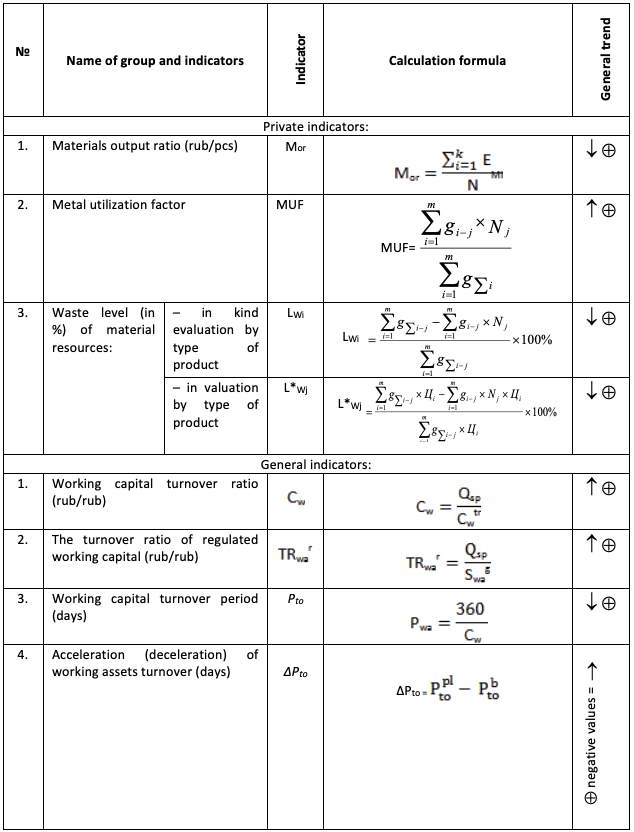

Table 1 shows the main indicators of the studies taking into account the general positive trend in time.

Table 1

Key indicators for analyzing trends in

the enterprise’s working capital change

-----

Table 2

The source and estimated data for the

working capital dynamics analysis

Based on the calculation results, the following conclusions can be drawn:

In general, by the end of the period under review, the changes dynamics in the enterprise’s working capital ought to be recognized as proportional and effective.

With an in-depth analysis of working capital, its structure plays an important role, which is understood as the percentage ratio of each working capital group to its total amount.

The working capital structure largely depends on the industry sector of the enterprise and its specialization. It is based on many factors: the features of the production processes organization, contractual conditions for the supply of goods of the enterprise, the rhythm of obtaining raw materials and materials, suppliers’ and consumers’ location, and many others (Lazaridis, Tryfonidis, 2006).

In engineering, compared with other industries, the share of inventories may be slightly lower, however, usually a higher level of work in progress due to the long production cycle of goods (Rishar, 2016).

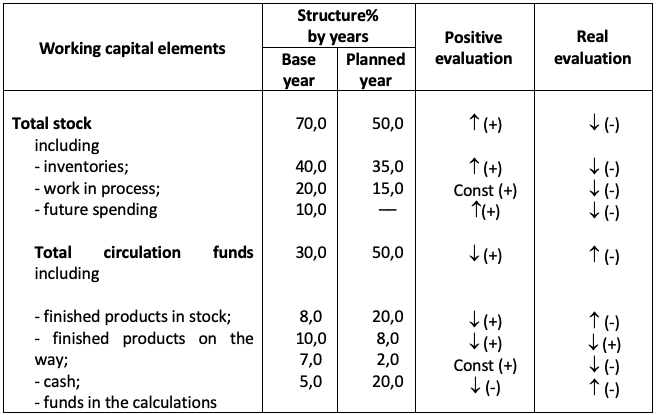

Table 3 shows the working capital dynamics structure of a machine-building enterprise, where the dynamics evaluation of its main elements is given.

Table 3

The enterprise’s working capital structure dynamics

In this case, the change in the working capital structure occurred for the worse, since the share of working capital assets directly affecting the development of the enterprise’s production activity decreased by 20% with a corresponding increase in the circulation funds share involved in servicing its business operations Gill et al., (2010). Herewith:

Analysis of the working capital structure is an important component of the enterprise’s economic analysis, because it allows to evaluate: the degree of complexity of the products; the level of production organization; the market demand level for the company's products, the solvency of the main consumers and other aspects. The enterprise’s working capital dynamics analysis reveals: a change in the enterprise’s specialization, its financial condition, the degree of market conditions rational use by the enterprise, etc (Novikov, Dmitriev, 2018).

Let’s turn to the factorial analysis of the enterprise’s working capital changes, which is carried out with the aim of determining the main components, due to which there was a change in the enterprise’s working capital in the current year relative to the previous one. In the process of factorial analysis, it is established the most accurately effective or ineffective growth of working capital realized at the enterprise (Mathuva, 2010).

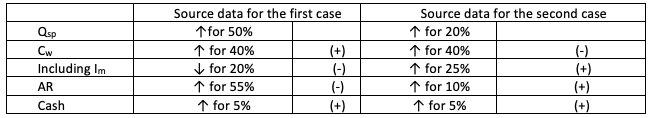

Two cases are represented.

In the first case (Table 4), the increase in revenue (Qsp) in the current year relative to the base year occurred by 50%, and working capital by 40%.

Formally, in this case, an increase in working capital occurred in proportion to the volume of sold products.

Let’s consider in more detail the change in the individual components of working capital. As a result of factorial analysis, it was revealed that the increase in working capital was due to:

In the second case (Table 4), the increase in revenue (Qsp) in the current year relative to the base year occurred by 20%, and working capital by 40%. This ratio of the growth rates of enterprise indicators does not correspond to its development proportionality. In this case, the increase in working capital was due to:

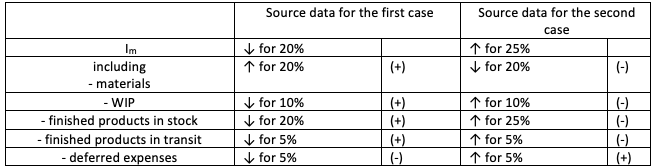

For a more detailed factorial analysis, we consider the structure of changes in inventories (Im) for both cases (Table 5).

In the first case, factor analysis showed:

1) the working capital growth (Cw) occurred mainly due to the growth of accounts receivable (AR), which in itself complicates the financial and economic situation of the enterprise;

2) a 20% reduction in inventories (Im) was mainly due to favorable production trends:

3) raw materials and materials at the same time increased by 20%, providing large volumes of production.

Table 4

The source data for the enterprise’s factorial

analysis of the working capital changes

-----

Table 5

The source data for the enterprise’s factorial

analysis of the inventories changes

In the second case:

The most effective and proportional should be recognized the working capital growth in the first case.

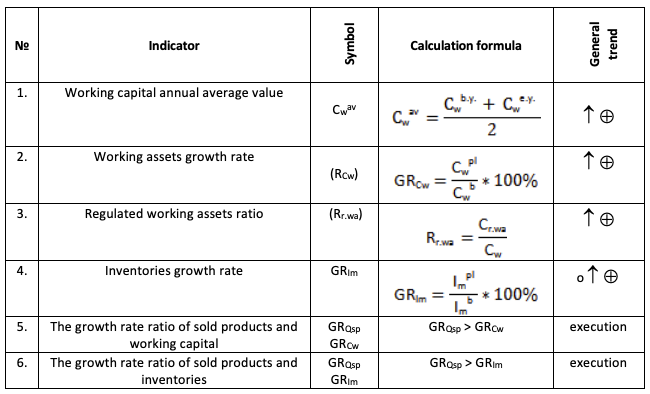

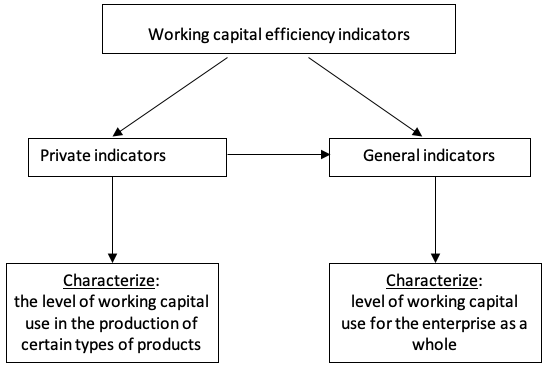

Nowadays, with the active innovative products and technologies introduction, there is an acute problem of increasing enterprises’ efficiency in general. All performance indicators of the enterprise’s working capital use are divided into two groups (Figure 3).

Figure 3

The main groups of indicators for evaluating

the working capital use effectiveness

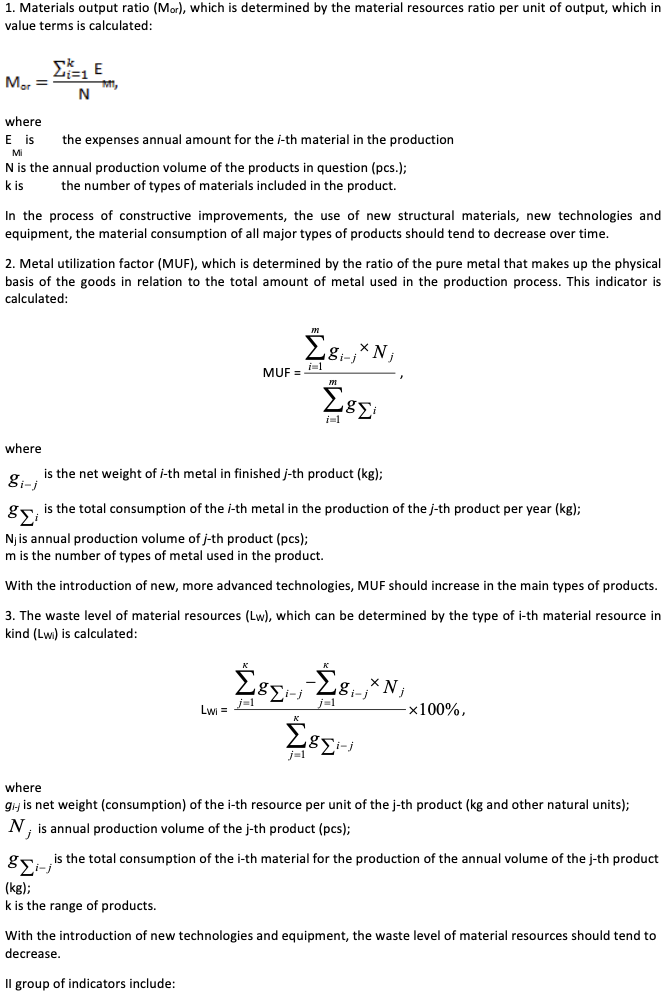

I group is private indicators that evaluate the efficiency of material resources use in the production of certain types of products.

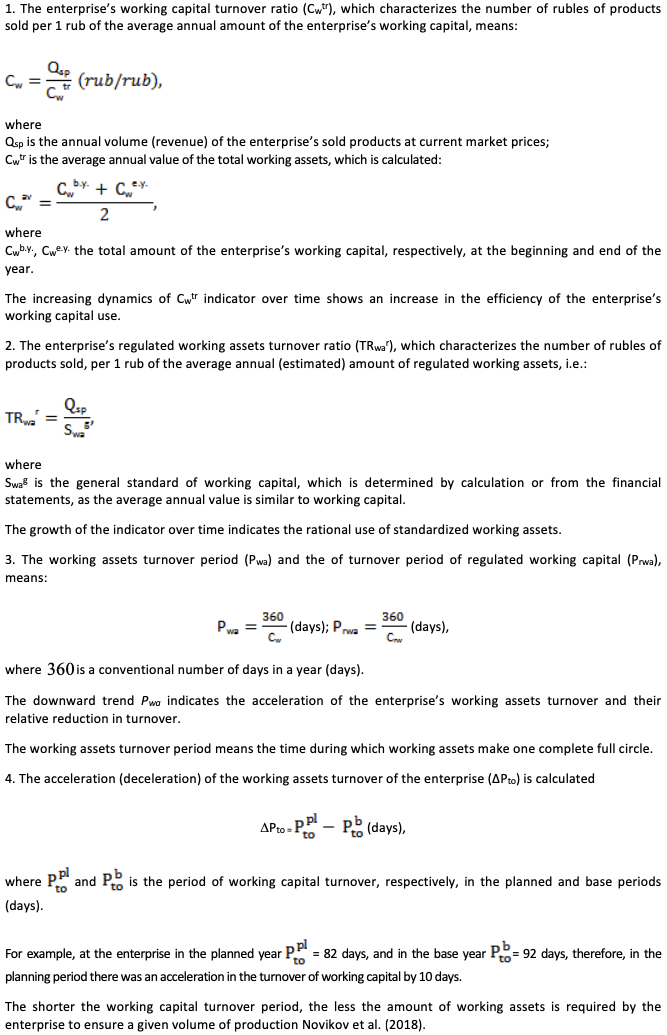

II group is general indicators that determine the efficiency of all regulated working assets use and the enterprise’s working capital.

I group of indicators includes:

The calculation formulas for the determination of private and general indicators of the working capital efficiency use while taking into account their positive trends are shown in Table 6.

Table 6

Key indicators of the enterprise’s working assets use

An in-depth and comprehensive analysis of the enterprise’s working assets determines their movement in the process of economic activity, allows to see bottlenecks that reduce the their use efficiency and determines the reserves for carrying out planned work to increase profit and profitability of the enterprise.

The novelty of the study consists in an integrated approach to the enterprise’s working capital management for current and future planned activities. This allows identifying imbalances in the production activities development, bottlenecks, adjusting credit policy and optimizing production and non-production costs.

In this case, analysis is subject not only to the dynamics of the enterprise’s working capital, its compliance or non-compliance with the change in the company's revenue, but also the dynamics of individual components that have certain causes of non-compliance, which are also subject to analysis and adjustment.

The division of working capital into working capital assets and circulation funds in dynamics allows to evaluate the effectiveness of production activities, financial policies and economic relations not only by the enterprise’s suppliers of material resources, but also with its consumers. It is in increasing the efficiency of working capital management that the huge reserves of increasing the rhythm and efficiency of the enterprise’s business operations lie.

Gill, A., Biger, N., Mathur, N. (2010). The relationship between working capital management and profitability: evidence from the United States. Business and Economics Journal. 1-10.

Lazaridis, I., Tryfonidis, D. (2006). Relationship between working capital management and profitability of listed companies in the Athens stock exchange. Journal of Financial Management and Analysis. 19(1), 1-12.

Mathuva, D.M. (2010). The influence of working capital management components on corporate profitability. Research Journal of Business Management. 4(1), 1-11.

Novikov, S.V., Dmitriev, O.N. (2018). Vision of Genesis of Presentation of Hi-Tech Project during Competitive Selection. Russian Engineering Research. 38(4), 320-322.

Novikov, S.V., Veas Iniesta, D.S. (2018). State regulation of the development of the connectivity of the Russian territory. Espacios. 39(45), 8.

Petrova, V.I. (2016). Analysis of the economic activity of a machine-building enterprise. Moscow: Mashinostroenie.

Raheman, A., Nasr, M. (2007). Working capital management and profitability - case of pakistani firms. International Review of Business Research Papers. 3(1), 279-300.

Rishar, J (2016). Audit and analysis of the economic activity of the enterprise. Moscow: Audit, Unity.

Rodinov, V.B., Putyatina, L.M (2006). Economics and finance of the enterprise. Moscow: Economics and finance.

Savitskaya, G.V. (2018). Analysis of the economic activity of the enterprise. Moscow: Novoe izdanie.

1. PhD of Economics, Docent, Moscow Aviation Institute (MAI), 125993, Russia, Moscow, Volokolamskoe highway, 4. E-mail: natars2002@yandex.ru

2. PhD of Economics, Docent, Moscow Aviation Institute (MAI), 125993, Russia, Moscow, Volokolamskoe highway, 4. E-mail: natars2002@yandex.ru

3. Doctor of Economics, Professor, Moscow Aviation Institute (MAI), 125993, Russia, Moscow, Volokolamskoe highway, 4. E-mail: natars2002@yandex.ru

4. Senior lecturer, Moscow Aviation Institute (MAI), 125993, Russia, Moscow, Volokolamskoe highway, 4. E-mail: natars2002@yandex.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License