Vol. 41 (Issue 05) Year 2020. Page 23

MOHANTY, Manoj Kumar 1; MISHRA, Padma Charan 2; CHOUDHURY, Sasmita 3 y SAMANTARAY, Alaka 4

Received: 03/11/2019 • Approved: 28/01/2020 • Published 20/02/2020

ABSTRACT: The study explores attributes, which clients of large scale manufacturing industries would like to see, rate and identify by listening directly from end clients. 128-samples of client organization pertaining to large scale discrete manufacturing industry as supplier organization, were analyzed. Expert opinions from both selling and buying organization were explored and weightage of each feedback attribute. This study expects to provide clarity to large scale manufacturing suppliers about expectations of product/system buyers across each interaction lines of organization. |

RESUMEN: El estudio explora los atributos que los clientes de las industrias manufactureras a gran escala quisieran ver, calificar e identificar escuchando directamente de los clientes finales. Se analizaron 128 muestras de organizaciones de clientes pertenecientes a la industria de fabricación discreta a gran escala como organización proveedora. Se exploraron las opiniones de expertos de las organizaciones de compra y venta y el peso de cada atributo de retroalimentación. Este estudio espera proporcionar claridad a los proveedores de fabricación a gran escala sobre las expectativas de los compradores de productos / sistemas en cada línea de interacción de la organización. |

Customer feedback is one of the prominent form of organizational self-review. In business scenario the feedbacks are real in nature and it helps organizations to revisit its own product, process and strategy to build a better tomorrow. This is not only about product or process improvement, this is all about measuring customer satisfaction, understanding what market is expecting from the organization, customer base enlargement and retention, knowing who is advocating good or bad about you and an opportunity to tell the client, “we count your opinion”. Customer feedback is directly and indirectly linked with many organizational outcomes like employee morale, skill enhancement, developing strategic partners in both up and down stream of supply chain, design improvement and aligning business processes. Normally buying organization / customer interacts in various level and functions of the supplier organization in a typical large scale discrete manufacturing industry (LSDMI). Based on the experience of the function and product, customer forms an impression, which remains for last. As feedback system is based on some predefined attributes, for a fair feedback it is necessary to understand how client should judge one organization and provide their honest feedback. The interacted functions, persons and related attributes across the interaction line should be included in the feedback system, which must be understood correctly and collected from the clients, own organization and field experts.

Indian manufacturing sector is one of the most promising sectors from the perspective of gross domestic product (GDP), employment generation, foreign direct investment (FDI) and socio economic balance. India is expecting the fifth position in the world in manufacturing production by 2020, 25 percent of total GDP and creation up to 90 million domestic jobs by 2025 (www.ibef.org). By the help of make in India drive by the government FDI investments increased by 82 percent in the 3rd quarter of 2016-17 (www.ibef.org). Government of India is formulating various industry friendly schemes, encouraging foreign investors with single door contacts, modifying obsolete policies and motivating small scale entrepreneurs to ensure the growth story. Considering such ambitious plan and action it is very important that each stake holders of the manufacturing sector not only produce volume and quality products, but also ensure that the requirement and expectation of the other side i.e. end customer must be met with a high degree of satisfaction. Understanding the expectations of the customer and what they are like to rate across the interaction lines of supply should be explored correctly and included in the feedback system for a mutual advancement.

This study is about exploring the customer expectations from large scale discrete manufacturing industry from the perspective of buying product and complete systems. The impact of each interaction stations and what they feel about each sub function of that station is counted from client perspective. The expected weightage of each master function also explored through survey. This study expects to provide clarity to the large scale manufacturing suppliers about the expectations of product or system buyers across the interaction lines.

The challenges of the current business scenario are to fulfilling the ever growing demand of customers seeking low cost of the product, high quality, compressed delivery and immediate response. Garvin (1987) crafted eight dimensions of quality which mostly describes expectations of client from a manufacturing supplier. The eight dimensions are operating characteristics through performance, reliability, speed of service, accessibility, ease of repair, product conformance with standard, durability, taking care of the basic functions of the product, aesthetics and perceived quality through reputation of the producer. Voss (1992) describes four roles for field service: competitiveness, profit, sales support, and user-base support. The performance of the field service can be measured in terms of cost, mean time between failure, response time and repair times. The softer form of such service also can be attitudes and appearance of the service representative, the quality of the service documentation, perceived completeness of repair and perceived efficiency of the company and its representatives. Higher efficiency, greater flexibility, better product quality and lower cost have changed the face of industrial manufacturing sector (Rao et al., 1993). The need of the customer is also getting changed substantially with time, which calls for organizations to make their process more flexible and responsive all the times (Bunce and Gould 1996: James Moore, 1996). Literatures are also witnessing customer satisfaction leads to repeat purchase, loyalty, positive word of mouth and increased long term profitability (Heskett et al., 1994). The famous statement “what is not measured is not managed’’ (Srinivasan, 1996) forced organizations to understand and track customer satisfaction continuously by providing superior quality product with lower cost and compressed delivery. The most common expectations of buying organization are product quality, delivery time, quantity of supply, after sales service and lower cost of product from suppliers. In addition to this location, technical expertise, reciprocate behavior and salesmanship are also desired attributes, which customer looks for (Sheth, 1973). Quick response also considered as a critical element which client expects from the supplier (Kusiak and He, 1997). Understanding the expectations of customer is one of the prime responsibilities of supplier organization, so that they can be competitive and stay in the market. Therefore, it will be a distinct advantage if organizations can succeed in effectively capturing the genuine and major customer requirements, analyzing them and transform such requirements to various action plans like enhancing product attributes, design, performance and quality. This will determine the strength of relationship with customers (Fung et al., 1998). A manufacturing firm can be competitive by quickly recognize the changes, flexible enough to be responsive to changes in customer needs and demands and understand its own capabilities relative to demand. (Love & Gunasekaran, 1999).

Customer satisfaction also can be through agile manufacturing, which is characterized by joint action from both supplier and buyer for product design, manufacturing, marketing, and support services. Agile manufacturing requires enriching of the customer to achieve their competitiveness, leveraging people and information sharing. (Gunasegaram & Yusuf, 2002). Manufacturing is currently facing conflicting pressure from market i.e. reduced cost of product, improved cycle time, enhanced quality with improved customer satisfaction (Campbell, 2004). Machine equipment require a different kind of service starting from acquisition, installation, operation, upgrades, decommission, maintenance, spare parts, etc. (Gebauer, 2006). So organizations have to prepare product specific service i.e. inspection, pre-testing before commissioning, repair, maintenance, providing spare parts and machine health check-up audits at appropriate time. Organizations adopts several strategic option including product quality, fostering innovation and technology, cost leadership, compressed cycle time to take care of the customer needs, however service enabled manufacturing is found to be having highest potential of margin (Gebauer & Fleisch, 2007).

Due to increasing competition in the manufacturing industry, many companies have extended their offer of functionality through the creation of additional service opportunities (Biege et al., 2012). The services after sales create dependency on the suppliers from spares and service point of view, which indirectly creates requirement bondage between two parties. The strength of manufacturing organization is its products and processes; people and commitment to quality. Further, supports to customer like attending delivery needs, after sales requirements and knowing the engineering needs by constant feedback. Assisting internal and external groups through quality movement, cost reduction and development of new product are also considered as strength of manufacturing (Lightfoot, 2013). Customer satisfaction is derived from the performance of the product beyond perceived value and dissatisfaction comes from falling short of performance with respect to standards (Karna, 2014). Satisfaction of the customer can create longer business relationships with the supplier. Quality of after sales service and service training are the two prominent factors which provides improved customer satisfaction in the manufacturing industries (Feng et al., 2014). Feedbacks are expected to be more positive and business relationships are likely to be stronger, if these two things are address. Abbasi et al. (2016) conducted research in Iran’s equipment manufacturing suppliers and found trust, bonding, communication, shared values, empathy and reciprocity are the attributes expected by the clients and with these attributes organization can build long term relationships. Research from France, Hungary and the U.K suggests the quality of product and aftersales service helps in generating trust and loyalty among customers. This also helps in retaining the customer and keeps the business relationship strong (Paparoidamis et al., 2017).

Gap analysis was carried out by taking feedbacks from both LSDMI and their end clients having 20-years of working experience through one to one interview method. The attributes which were not surfaced out so far by previous researches are system knowledge of marketing, ability to provide alternate solutions, submission of technical details by execution in time, status of project, over all support from execution, safety features of machine and training quality from the service department.

Table 1

Summary of customer

feedback attributes for LSDMI

Functions |

Sub-Functions |

Marketing |

Responsiveness |

Technical competency |

|

Quality of offer submitted |

|

System knowledge |

|

Capable of suggesting alternatives |

|

Execution |

Submission of drawing & other technical data |

Project status |

|

Overall Support |

|

Delivery |

|

Product |

Product quality |

Reliability |

|

safety features |

|

Maintainability |

|

Performance |

|

Aesthetics |

|

After Sales |

Rate of response during erection |

Rate of response during Breakdown |

|

Cost of spares |

|

Availability of spares |

|

Training Quality |

This research work is carried out in the discrete manufacturing industries and their end clients in India. Samples were selected from both large scale discrete manufacturing industry (LSDMI) and their end clients for primary data. As the end client contact points at LSDMI are marketing, execution and after-sales service, samples were selected accordingly. Apart from that product bears a significant role in customer feedback, samples from operations also considered to provide completeness. 13-senior executives with minimum 20-years of experience from LSDMI were considered for expert opinion to explore the gap of literature. Similarly the interaction agencies from end clients with LSDMI are supply chain management (SCM), Projects, Design, Operations, Maintenance and Dispatch section. Based on this interaction concept, samples were selected from nine end clients (Three clients per LSDMI). Executives with minimum 5-years of experience were considered for the data collection. Total 230 numbers of samples were selected for data collection, out of which 136-responses were received. 8 responses were found not suitable, hence 128-responses were considered for data analysis. Data collected through questionnaire method with open ended questions to get the weightage considered by representatives of end clients for each functional performance i.e. marketing, projects, product and after-sales service. In the 2nd phase rating system is developed for all the functions considered for taking feedback. For this task 29-experts having minimum 20-years of experience (depending on the availability at client end) were considered to frame the rating scales. MS office is used for data analysis.

This research work is carried out in selected discrete manufacturing industries of India. Three manufacturing industries were selected for the study. These industries are involved in supplying complete system / specific equipment to coal, paper, cement, power and steel sectors to both private and public firms. The annual turnover of each firm is around 2500 million in Indian rupees. For data collection purpose, the end clients of these three firms were selected. The end clients are the producer of cement, Coal crushing units, manufacturer of papers and steel. These end clients are the user of the machines / systems supplied by the three large scale manufacturing companies mentioned above.

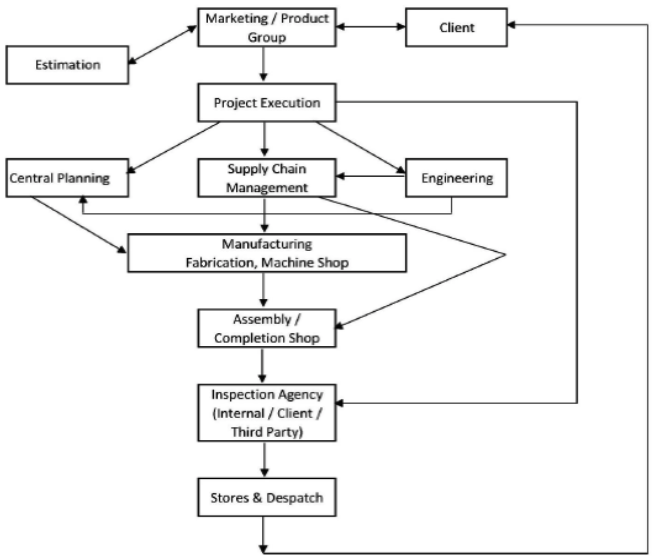

The process flow is derived from the working philosophy of large scale discrete manufacturing industries. The same is exhibited in Figure 1. Manufacturing organizations are largely divided into three parts i.e. pre-manufacturing (marketing, estimation, engineering, process cell and central planning), manufacturing (Fabrication, Foundry, Machine and Assembly shop) and post-manufacturing (quality control, stores, dispatch and after-sales service). Some common departments like human resource, accounts, security, health care and town administration takes care of the balance activities of the organization. Once the order is booked the contract copy and the customer required technical details are handed over to project execution for initiating the project. Project execution ensures release of all engineering documents for manufacturing and procurement documents for supply chain cell through engineering department. Central planning releases manufacturing plans for different shops / plans for outsourcing in coordination to project execution based on work load at different points. Raw material and semi-finished materials procured by supply chain department based on the purchasing requisition initiated by engineering. Raw materials are directly given to concerned manufacturing shops for further processing (mostly available in stock). Semi-finished materials are directly handed over to assembly shop for assembling the final product. Quality assurance team carried out stage inspection or final inspection during the production process based on requirement of quality plan. Once the job is completed in all respects client inspection is arranged by project execution for final inspection and dispatch clearance. After the clearance of the job by client / nominated third party inspection job is packed and dispatched by stores and dispatch department to client. Further payment process and statutory documents managed by project execution.

Figure 1

Process flow of LSDMI

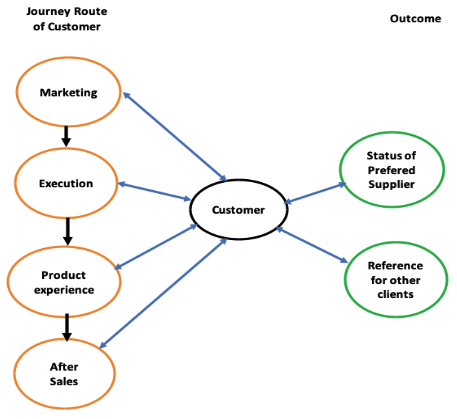

In a typical large scale discrete manufacturing set-up, client gets an opportunity to interact the start point, middle point and the end point of the supplier organization i.e. marketing, execution and after sales service. However after delivery of the product customer gets an experience of the product before touching after sales service. So, this study considered four touching points of end client from supplier organization perspective. The journey route of client with possible outcomes is explained in Figure 2.

Figure 2

Customer interaction sources and

outcomes in manufacturing sector

When an enquiry is based on specific requirements, approved supplier and sub-supplier list is floated by the client, the marketing team submits the data sheets, completion schedule along with the bid as per the client’s requirements and specifications. The terms and conditions which include detailed scope of work, technical specifications, commercial aspects and deviations (if any) are discussed. Subsequently the offer is finalized and the purchase order from the client is received to start the work. The purchase order received from the client along with technical specifications, approved sub-vendor list and detailed scope is forwarded by marketing to execution. The execution team submits drawings, quality plan for approval, Bank Guarantee documents and details required for transportation to the client. Execution team seeks clarifications from client (if required) for any ambiguity during execution. Once the equipment is ready, inspection call is raised to client asking for deputation of inspection agency. Inspection is carried out either by the client or client’s nominated agency. The material test certificates are submitted to client. Upon receipt of material dispatch clearance certificate MDCC from client, equipment is dispatched. Subsequently, payment, C-form is collected by execution form client. Once the product reaches the site, the erection and commissioning is done under the supervision of service engineers ensuring smooth and trouble‐free operation of all the systems, equipment and components. Maintainability, reliability, life and ease of operation are expected from client. Service team renders efficient and prompt after sales service and provides all the technical information as are necessary to enable proper erection and commissioning and efficient operation and maintenance of equipment supplied. Training is also imparted to the client’s personnel enabling them for operation and maintenance of equipment. Any corrective action such as repairs, replacements (if any) are done during the warranty period based on the feedbacks from client / machine performance at site. Supply of spares is considered very vital from customer’s point of view. Response time of service team is also an important aspect when there is any breakdown in the equipment supplied within and outside of the warranty period.

Based on the objective of the study, data were collected and analyzed from 128-respondents representing nine end clients of large scale discrete manufacturing industries. The departments involved in the interaction process and experiencing the product from buying organization were considered for data collection i.e. Supply chain management (SCM), Design, Projects, Operations, Maintenance and Dispatch section. The distribution of samples client wise and department wise are exhibited in Table 2. Distribution of experts is exhibited in Table 3. “C1” represents the 1st and “C9” represents the 9th client / buying organization considered for data collection.

Table 2

Sample distribution

Function / Client |

C1 |

C2 |

C3 |

C4 |

C5 |

C6 |

C7 |

C8 |

C9 |

Total |

SCM |

3 |

2 |

4 |

2 |

1 |

2 |

3 |

2 |

2 |

21 |

Design |

2 |

2 |

3 |

2 |

2 |

2 |

3 |

2 |

3 |

21 |

Projects |

2 |

1 |

3 |

1 |

1 |

2 |

4 |

3 |

3 |

20 |

Operations |

5 |

4 |

3 |

5 |

2 |

3 |

4 |

4 |

6 |

36 |

Maintenance |

2 |

3 |

3 |

2 |

1 |

1 |

3 |

2 |

1 |

18 |

Dispatch |

1 |

1 |

2 |

1 |

1 |

1 |

2 |

2 |

1 |

12 |

Total |

15 |

13 |

18 |

13 |

8 |

11 |

19 |

15 |

16 |

128 |

-----

Table 3

Distribution of experts

for rating system design

Function / Client |

C1 |

C2 |

C3 |

C4 |

C5 |

C6 |

C7 |

C8 |

C9 |

Total |

SCM |

1 |

1 |

|

1 |

|

1 |

1 |

|

|

5 |

Design |

|

1 |

1 |

1 |

|

|

|

1 |

|

4 |

Projects |

1 |

|

|

|

1 |

1 |

|

|

1 |

4 |

Operations |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

8 |

Maintenance |

1 |

1 |

1 |

|

1 |

1 |

|

|

|

5 |

Dispatch |

1 |

|

|

|

|

|

1 |

|

1 |

3 |

Total |

5 |

4 |

3 |

3 |

3 |

4 |

3 |

2 |

2 |

29 |

Through an open ended questionnaires weightage for each function i.e. marketing, execution, product experience and after sales service were asked to provide, keeping the sum as 100. Total and average functional scores from each buying organization tabulated in Table 4.

Table 4

Functional score

from clients

Function / Client |

Clients |

Score |

|||||||||

C1 |

C2 |

C3 |

C4 |

C5 |

C6 |

C7 |

C8 |

C9 |

Total |

Average |

|

Marketing |

19 |

17.7 |

18.6 |

17 |

18.6 |

20.2 |

18.4 |

20 |

19 |

168.5 |

18.7 |

Execution |

19 |

20 |

20.2 |

21 |

17 |

18.6 |

17.4 |

19 |

20 |

172.2 |

19.1 |

Product |

35 |

35 |

36 |

35 |

30.3 |

29.8 |

35.1 |

31 |

33 |

300.2 |

33.4 |

After sales Service |

27 |

27.3 |

25.2 |

27 |

34.1 |

31.4 |

29.1 |

30 |

28 |

259.1 |

28.8 |

Total |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

900 |

100.0 |

Further function wise and attribute wise average scores tabulated based on number of attributes in each function. The figures were rounded up for better understanding and calculation purpose. The same is exhibited in Table 5.

Table 5

Function wise weighted

average score

Weightage Average Score ( Function / Sub function) |

||||

Function / Score |

Average Score |

No. of Variables |

Round up Value for feedback sheet Per Function |

Round up Value for feedback sheet Per variable |

Marketing |

18.72 |

5 |

20 |

4 |

Execution |

19.13 |

4 |

20 |

5 |

Product |

33.36 |

6 |

30 |

5 |

After sales Service |

28.79 |

5 |

30 |

6 |

Total Score |

100 |

|

||

Rating system is developed with the help of expert opinions for each function. 29-experts were asked to provide rating scale with percentage of score against each rating. Based on the opinion of maximum numbers of experts rating scale is named as Outstanding for 100% , Very good for 80%, Good for 60%, Needs improvement for 40% and Poor for 20% satisfaction against a particular attribute. Accordingly the scores will vary against each attribute of each function. For example in marketing function highest score will be 100% of 4*5 i.e. 20 and the lowest score will be 20% of 4*5 i.e. 04.

Table 6

Rating system

with score

Rating Nomenclature / Marking system |

Rating System |

||||||

Outstanding |

Very Good |

Good |

Needs Improvement |

Poor |

|||

Functions |

No. of Variables |

Score of each variable |

Scores based on Rating category |

||||

100% |

80% |

60% |

40% |

20% |

|||

Marketing |

5 |

4.0 |

4.0 |

3.2 |

2.4 |

1.6 |

0.8 |

Execution |

4 |

5.0 |

5.0 |

4.0 |

3.0 |

2.0 |

1.0 |

Product |

6 |

5.0 |

5.0 |

4.0 |

3.0 |

2.0 |

1.0 |

After sales Service |

5 |

6.0 |

6.0 |

4.8 |

3.6 |

2.4 |

1.2 |

Based on the attributes evolved from literature review and gap, criteria of customer feedback were selected. Based on the data analysis and expert opinion the scoring pattern and the scale is developed. This study proposes the complete format in six sub sets and each set is exhibited starting from Figure 3 to Figure 8 as shown below. Combination of these sub sets will form the complete feedback form. The sub sets are consists of buying organization detail, equipment detail, and experience about marketing, execution, about product and after sales service. The final part is the outcome of the experiences and that is long term business relationship and referral to other clients about the selling organization. The complete format is attached as annexure in the end of the paper.

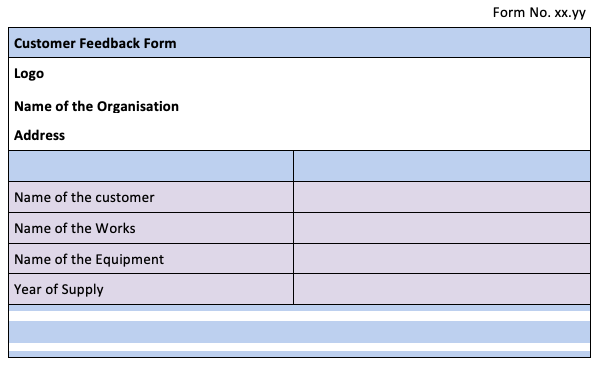

In the first segment the organization details, works details, equipment details for which feedback is taken and the year of manufacturing of that particular equipment to be mentioned. If any specific format number to be maintained that should appear in the format

Figure 3

Initial information

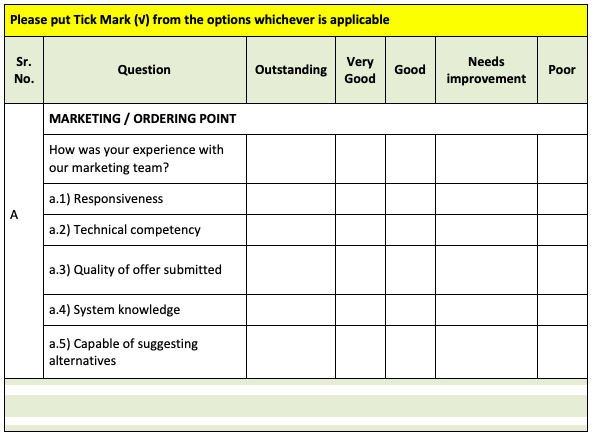

Marketing / ordering segment consists of five parameters i.e. responsiveness, technical competency, quality of offer submitted, knowledge about the system / product categories and capability of suggesting alternatives for improvement in efficiency or reduction of cost. The total score of this segment is restricted to 20. Each attribute is having a maximum score of 4 and minimum score of 0.8. Summing up all scores the maximum score can be 20 (100%) and the minimum score can be 4 (20%).

Figure 4

Marketing score calculation

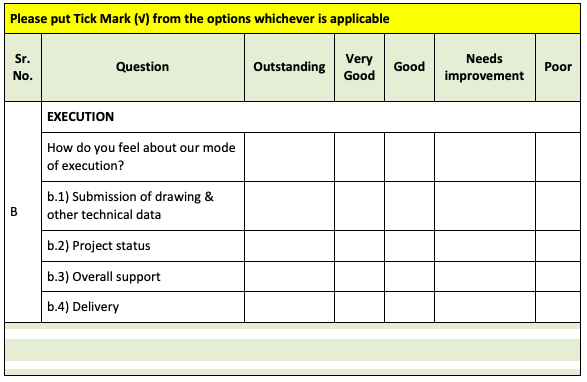

Execution consists of four parameters i.e. submission of drawing and technical data’s in time, submitting project status in time, maintaining delivery and over all support during project life. The total score of this segment is restricted to 20. Each attribute is having a maximum score of 5 and minimum score of 1. Summing up all scores the maximum score can be 20 (100%) and the minimum score can be 4 (20%).

Figure 5

Execution score calculation

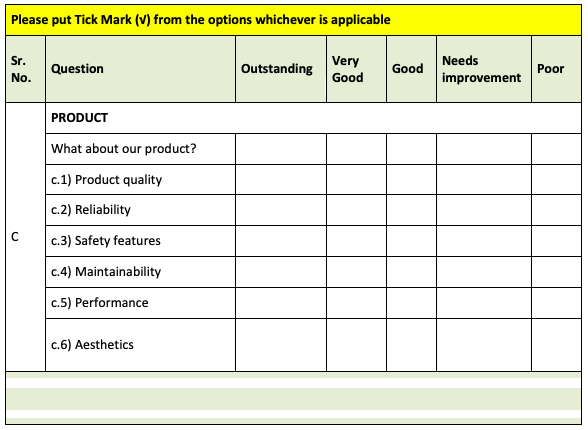

Product category consists of six parameters i.e. quality of the product, reliability of the machine, safety features of the equipment, maintainability, performance and aesthetics. The total score of this segment is restricted to 30. Each attribute is having a maximum score of 5 and minimum score of 1. Summing up all scores the maximum score can be 30 (100%) and the minimum score can be 6 (20%).

Figure 6

Product score calculation

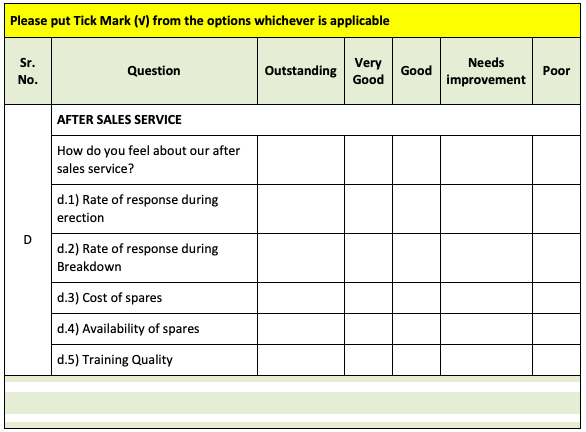

After sales service consists of five parameters i.e. response during erection, response during breakdown, cost of the spares, availability of spares and train quality from supplier organization. The total score of this segment is restricted to 30. Each attribute is having a maximum score of 6 and minimum score of 1. Summing up all scores the maximum score can be 30 (100%) and the minimum score can be 6 (20%).

Figure 7

After sales score calculation

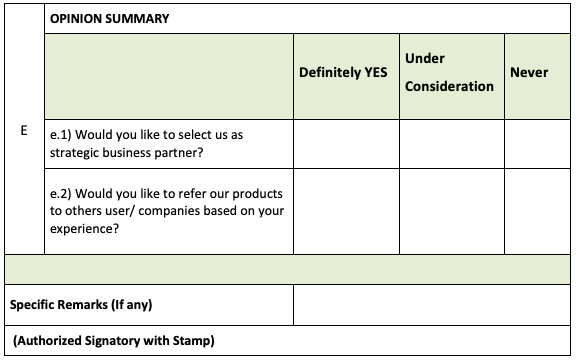

Final outcome is consists of two categories i.e. consideration of the buying organization as strategic partner / long term partnership and referring the product / selling organization to similar buyers. Depending upon the experience from marketing, execution, product and after sales service one organization can use definitely yes, under consideration or never as their opinion summary.

Figure 8

Final Outcomes

The expectation of Indian government from manufacturing sector in terms of contribution to GDP, job creation and world leadership position is quite ambitious. This calls for a strong customer base and proper understanding of the expectations from the end client. The purpose of the paper is to explore the attributes, which the end-clients of the large scale discrete manufacturing industries expect from the product and system suppliers. Mostly the clients of large scale discrete manufacturing industry are concerned and like to evaluate marketing knowledge, style of execution, product features and after-sales service attributes. These experiences can make or break a customer base. Largely clients of such type of industry interacts with marketing during order finalization, project execution till delivery and payment release, product features experience during use and after sales department for erection and commissioning, any product and process issues and subsequent knowledge sharing for daily maintenance. The sub factors or functions of each principal department play a substantial role in creating impression about the organization. Based on the feedback of the clients, large scale discrete manufacturing industries can add/modify specific product features, improve after-sales services. The technical and behavioral aspects of marketing and project team also can be reviewed and should be put in line with the customer expectations for long term business relationships. Many attributes with reference to the large scale discrete manufacturing industries, specifically marketing and project execution related are unexplored by the previous researches. This study explored such attributes by directly listening to the clients, which the clients are interacting and wish to provide feedback for the betterment of the both organizations.

Today’s current business scenario does not allow organizations to dissatisfy customers in any form. This indicates organizations have to understand the expectations of the customer through structured feedback and deliver the desired value to stay competitive. Meaningful customer feedback can derived improved product and productivity: right decision making: reliable and timely service; long term relationship and profitability to organization. Large scale manufacturing industries needs to be very focused as all the key functional areas are exposed to the customer and customer is having a regular interaction with the representatives of such areas. Starting from enquiry stage to operation of machines and in fact beyond that client feels each situation and remembers each response, based on which the complete picture of the organization made inside the mind of client. From this study it is very clear that end clients of the manufactured products and services wants to rate marketing, execution, product and aftersales services. The varying weightage also indicates that product and service are the prime focus of the clients. Organizations must take continues feedbacks from the respective clients and respect their view point by implementing desired change and rectify / modify respective areas such as product design, process improvement, features of product and mode of operation. This will directly and indirectly hold the clients for a longer path and will improve organizational effectiveness.

Every business is unique, so also is every industry. Discrete manufacturing is one of the driving forces due to its inherent innovative strength. Optimized & expertise production processes are coming up against increasing complexity and shorter product life cycles and hence tightening competition. With an ever-shorter product lifecycles discrete manufacturing industries are facing growing challenges. They have to reduce time to market, curtailing on lead-times and address compelling customer support services. These demands are omnipresent and effective solutions are need of the hours which may be in form of optimized value chains, streamlined manufacturing operations, cutting-edge sensor technology and effective customer service. The business has to keep up with its customers’ needs & drive business transformation by adopting many modern applications.

The research is limited only to discrete manufacturing sector and restricted to Indian set-up only. It may be different in other environments. The sampling is limited to few experts available in field due to specific nature of field. Sample size is smaller considering Indian manufacturing spread out.

Abbasi, M. R., Esmailpour, H., & Heidari, H. (2016). A survey of the factors of relationship continuance with suppliers of industrial equipment of Gas Refinery Company in Ilam. Procedia economics and finance, 36, 480-489. Available at: http://dx.doi.org/10.1016/s2212-5671(16)30071-5.

Biege, S., Lay, G. & Buschak, D., 2012. Mapping service processes in manufacturing companies: industrial service blueprinting M. Morita, ed. International Journal of Operations & Production Management, 32(8), pp.932–957. Available at: http://dx.doi.org/10.1108/01443571211253137.

Bunce, P., (1996). From lean to agile manufacturing. IEE Colloquium on `Next Generation Manufacturing: Future Trends in Manufacturing and Supply Chain Management’. Available at: http://dx.doi.org/10.1049/ic:19961444.

Campbell, S. T. E. V. E. (2004). Tracking lean (automated shop floor data-capture technologies for lean automotive manufacturing). Manufacturing Engineer, 83(1), 38-41. Available at: http://dx.doi.org/10.1049/me:20040107.

Feng, T., Wang, D., & Prajogo, D. (2014). Incorporating human resource management initiatives into customer services: Empirical evidence from Chinese manufacturing firms. Industrial Marketing Management, 43(1), 126-135. Available at: http://dx.doi.org/10.1016/j.indmarman.2013.08.007.

Fung, R. Y., Popplewell, K., & Xie, J. (1998). An intelligent hybrid system for customer requirements analysis and product attribute targets determination. International Journal of Production Research, 36(1), 13-34. Available at: http://dx.doi.org/10.1080/002075498193912.

Garvin, D. A. (1987). Competing on the eight dimensions of quality. Harv. Bus. Rev., pp.101-109.

Gebauer, H., & Fleisch, E. (2007). Managing sustainable service improvements in manufacturing companies. Kybernetes, 36(5/6), 583-595. Available at: http://dx.doi.org/10.1108/03684920710749686.

Motwani, J. G., Sower, V. E., Gebauer, H., Friedli, T., & Fleisch, E. (2006). Success factors for achieving high service revenues in manufacturing companies. Benchmarking: An International Journal. Available at: http://dx.doi.org/10.1108/14635770610668848.

Gunasekaran, A. (1999). Agile manufacturing: a framework for research and development. International journal of production economics, 62(1-2), 87-105. Available at: http://dx.doi.org/10.1016/s0925-5273(98)00222-9.

Gunasekaran, A., & Yusuf, Y. Y. (2002). Agile manufacturing: a taxonomy of strategic and technological imperatives. International Journal of Production Research, 40(6), 1357-1385. Available at: http://dx.doi.org/10.1080/00207540110118370.

Heskett, J.L., Jones, T.O., Loveman, G.W., Sasser, W.E. and Schlesinger, L.A., (1994). Putting the service-profit chain to work. Harvard business review, 72(2), pp.164-174.

https://www.ibef.org/industry/manufacturing-sector-india.aspx (Accessed on 25.03.2017, 20:18 pm)

James-Moore, S. M. R. (1995). Agility is easy, but effective agile manufacturing is not. IEE Colloquium on Agile Manufacturing. Available at: http://dx.doi.org/10.1049/ic:19951099.

Kärnä, S. (2004). Analysing customer satisfaction and quality in construction–the case of public and private customers. Nordic journal of surveying and real estate research, 2.

Kusiak, A., & He, D. W. (1997). Design for agile assembly: an operational perspective. International Journal of Production Research, 35(1), 157-178. Available at: http://dx.doi.org/10.1080/002075497196037.

Lightfoot, H., Baines, T., & Smart, P. (2013). The servitization of manufacturing: A systematic literature review of interdependent trends. International Journal of Operations & Production Management, 33(11/12), 1408-1434. Available at: http://dx.doi.org/10.1108/ijopm-07-2010-0196.

Love, P. E., & Gunasekaran, A. (1999). Learning alliances: a customer-supplier focus for continuous improvement in manufacturing. Industrial and Commercial Training, 31(3), 88-96. Available at: http://dx.doi.org/10.1108/00197859910269167.

Paparoidamis, N.G., Katsikeas, C.S. & Chumpitaz, R., (2019). The role of supplier performance in building customer trust and loyalty: A cross-country examination. Industrial Marketing Management, 78, pp.183–197.

Rao, M., Wang, Q., & Cha, J. (1993). Integrated distributed intelligent systems in manufacturing (Vol. 2). Springer Science & Business Media.

Sheth, J. N. (1973). A model of industrial buyer behavior. Journal of marketing, 37(4), 50-56. Available at: http://dx.doi.org/10.1177/002224297303700408.

Srinivasan, M. (1996). Marketing impact rests on resource allocation. Marketing News, 30(6), 4-4.

Voss, C. (1992). Applying service concepts in manufacturing. International Journal of Operations & Production Management, 12(4), 93-99. Available at: http://dx.doi.org/10.1108/01443579210011633.

1. Sr. Manager (Supply Chain), Larsen & Toubro Limited, Kansbahal, Sundargarh, Odisha, India- 770034. Contact e-mail: manojacademics@gmail.com

2. Dy. Manager (Engineering), The Bisra Stone Lime Company Limited, Birmitrapur, Sundargarh, Odisha, India-770033. Contact e-mail: pcmishra71@gmail.com. (Corresponding Author)

3. Manager (RBSK), Rourkela Government Hospital, Rourkela, Odisha, India. Email:sasmita9090@gmail.com

4. Assistant Professor, Institute of Business and Computer Studies, Siksha O Anusandhan (Deemed to be university), Khandagiri, Bhubaneswar, Odisha, India- 751030. Contact e-mail: alka.sray_2007@yahoo.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License