Vol. 41 (Issue 07) Year 2020. Page 25

FESENKO, Valeriia V. 1; VAKULCHYK, Olena M. 2; SKASKO, Oleh I. 3; VOSKALO, Volodymyr I. 4 & PROTASOVA, Yelizaveta V. 5

Received: 15/11/2019 • Approved: 14/02/2020 • Published 05/03/2020

ABSTRACT: The article's purpose is to develop methods for parametric audit of the reliability of foreign affiliates and to analyze the risks of foreign transactions with related parties. The article proposes procedures for determining the reliability status of an enterprise as a component of a group of international companies by the non-financial parameters of its activity, which is proposed to compare with financial criteria for the formation of the tactics and strategy of foreign economic activity of a group of international companies. |

RESUMEN: El propósito del artículo es desarrollar métodos para la auditoría paramétrica de la confiabilidad de las filiales extranjeras y analizar los riesgos de las transacciones extranjeras con partes relacionadas. El artículo propone procedimientos para determinar el estado de confiabilidad de una empresa como componente de un grupo de compañías internacionales por los parámetros no financieros de su actividad, que se propone comparar con criterios financieros para formar las tácticas y la estrategia de la actividad económica extranjera de un grupo de empresas internacionales. |

Globalization, as a process, has created favorable conditions for the expansion of transnational corporations (TNCs) in the world. Ukraine is also gradually becoming a full-fledged player in international business through European integration, which helps to increase the number of entities that are resident and part of various groups of international companies. Increasing of business activity of foreign corporations in the market of Ukraine and Ukrainian subjects of foreign economic activity abroad actualizes scientific researches in the field of audit of foreign economic operations and evaluation of the enterprises-components of multinational companies operating in a different regulatory environment with specific economic conditions. Improvement of the methodological provisions of the audit in the sphere of foreign economic transactions with related parties will ensure a level playing field for international business and its economic security.

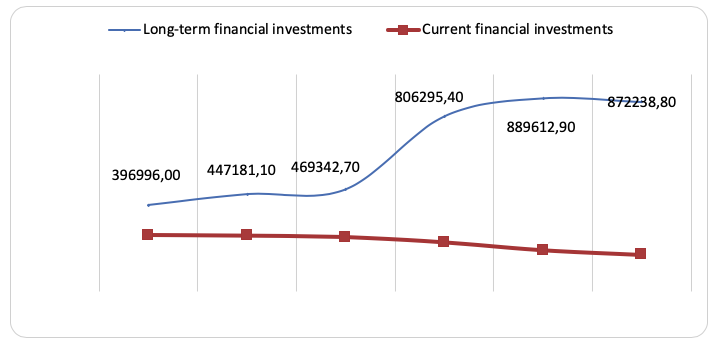

The study of statistics on the size of financial investments of domestic enterprises (Fig. 1) makes it possible to determine their positive growth dynamics that change their structure towards increasing the share of long-term financial investments. This indicates that Ukrainian enterprises are increasingly using the path of diversifying their business risks through long-term participation in the capital of other enterprises, which updates scientific research in the field of enterprise reliability assessment in terms of reducing the risk of investor capital loss through related party transactions that involve inherent risk of accounting fraud.

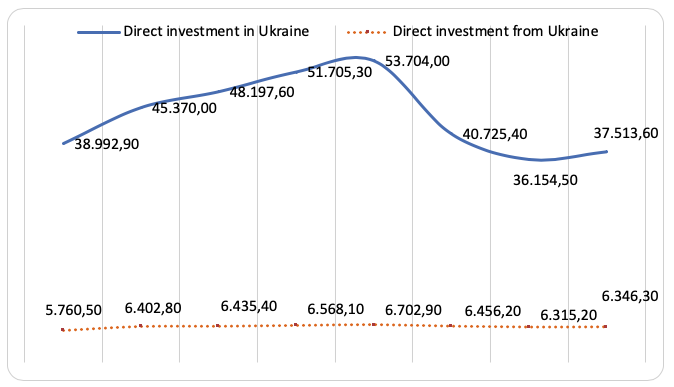

Analysis of the dynamics of share capital formed by direct investment in the capital of Ukrainian enterprises (Fig. 2) allows to determine the fact of its size increase from 2010 to 2014, and a slight decrease in the period from 2014 to 2016.The total volume of investments and their dynamics confirm the importance of investigating the operations of enterprises that invest in the capital of other entities or are themselves the objects of such foreign investment. Analysis of the statistics on the volume of financial investments and foreign direct investment in the equity of Ukrainian enterprises makes it possible to confirm that the interconnectedness of capital of a certain level is observed in the Ukrainian economy.

Figure 1

Dynamics of financial investments of the enterprises

of Ukraine for 2012-2017, million uah

-----

Figure 2

Dynamics of share capital generated by direct investments in Ukraine

(from Ukraine) for the period 2010-2017, $ million USA [6]

Mutual foreign investment between enterprises leads to the emergence of international mergers of enterprises that are interdependent through the owners of capital or management and can carry out foreign economic transactions. Some mergers of such companies are transformed into transnational corporations, which include several enterprises (mostly manufacturing ones) from different countries. From the point of view of audit (both internal and external), mergers of enterprises (from different countries and industries), under the overall control of one owner (one group of owners) are considered a group of international companies. The value of intra-corporate audit is updated for such mergers, as the specific nature of the organization of groups of international companies poses high risks for saving the invested capital.

The development of the evaluation system was carried out on the basis of parametric analysis of the activities of affiliated enterprises, which allowed to identify specific groups of parameters and qualitative characteristics of the assessment.

Based on the main risks of FEA implementation, it is necessary to formulate appropriate directions for assessing the reliability of linked enterprises and the security of operations with them, which will allow to carry out a comprehensive assessment of important qualitative and quantitative characteristics of an enterprise, which is a component of a group of companies and (or) is a counterparty in foreign economic operations. Based on the assessment of the reliability of the linked company, the top executives of the group of companies (the parent company) will be able to make decisions about further cooperation with such enterprise and retain a share of capital in it.

The following should be distinguished as targets for the creation of a group and for managing its effect: ensuring the economic interests of the group (saving capital and return on investment); strengthening the reputation of the group; increasing the capacity of the group.

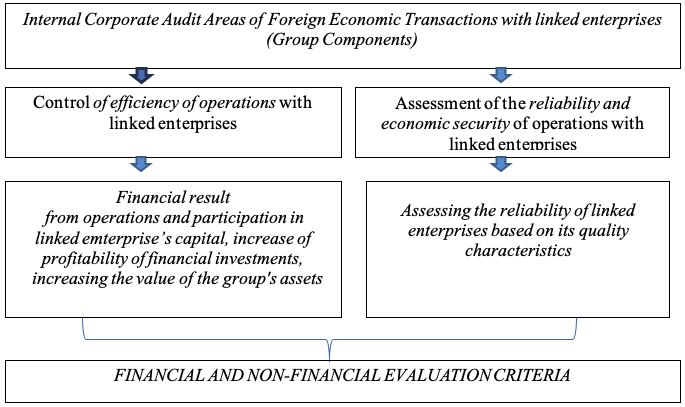

Therefore, the specific tasks of the internal audit of foreign economic transactions of an enterprise with related parties can be defined two main: ensuring the effectiveness of operations with linked enterprises; ensuring economic security of operations with linked companies (Fig. 3).

The basis for the auditor's judgment in the internal audit transactions may be formed both on the basis of a quantitative financial criterion (the total financial result from participating of linked enterprise’s capital, an increase in return on investment, an increase in the value of assets), and taking into account the quality characteristics of linked enterprise that form its reliability.

Such criteria can be applied when planning the next substantive audit procedures, as well as to develop internal auditor recommendations for improving the management of the group as a whole.

Figure 3

Basis of Auditor's Professional Judgment in

Internal Corporate Audit of Related Parties

An internal audit of the reliability of related party transactions is performed by a reliability assessment of the linked enterprise itself, according to the risks of its business. We assume that the required level of operations' effectiveness with linked enterprises is only ensured in operations with such enterprises that have a high level of reliability and economic security. Although in the traditional sense, it is thought that the risk and return on investment are directly proportional.

In the context of research into the risks of foreign economic activity of linked enterprises, both systematic and specific risks are actively manifested. Thus, the economic security of conducting foreign trade operations is influenced by the systematic risk that arises in the country of the linked enterprise and global economic processes. At the same time, the effectiveness of foreign trade transactions between linked enterprises is influenced by the specific risk of management in a particular enterprise. The development of measures aimed at reducing the specific risk of foreign economic activity of linked enterprises will make it possible to compensate for the impact of systematic risk, which is not influenced by management activities.

Determining that the effectiveness of operations and their economic security are different aspects of assessing the feasibility of such operations, we analyze the possible interdependence between these categories.

We propose to evaluate the economic security of foreign trade operations through an assessment of the reliability of the linked enterprise itself, where certain formal or informal links exist.

If we consider foreign economic transactions between linked enterprises of one group as a system whose properties can be measured through the prism of the parameters that characterize it, it is advisable to assess the reliability of the linked enterprise on the basis of parametric estimation, which will allow to fully characterize the linked enterprises, with which foreign trade operations are carried out. The assessment of linked enterprise by the managers of the group of companies should ensure that the activities of the linked enterprise and its relationship with the corporate objectives are consistent with: achieving and improving the efficiency of foreign economic operations, increasing the capacity of the group as a whole, security of operations and strengthening of the group’s reputation.

In accordance with each objective, a list of parameters was developed according to two aspects of evaluation: financial aspect by quantitative criteria, non-financial aspect by qualitative criteria. Thus, the financial parameters make it possible to quantify the effect of having a link with an enterprise through the indicators of overall financial result (OFR), financial investment efficiency( return of invest) (EPIC), asset value (A) and net quick assets (NA), financial investment value (FI).

The non-financial parameters of the internal audit of external economic transactions with related parties make it possible to assess the level of security of operations and the link with such enterprise. Table 1 provides the qualitative characteristics of the non-financial parameters and the quantitative indicators of the financial parameters of the linked enterprise's reliability assessment.

Table 1

Characteristics of financial and non-financial parameters for assessing

the reliability of a linked enterprise in an internal audit system

Reliability assessment options of linked enterprise |

Characteristics of parameters |

|

1 |

2 |

|

Non-financial valuation options of linked enterprise |

||

1. Level of control of the capital’s owner |

The share of participation in the capital determines the degree of control over the activity and the possibility of influencing on the operations and management decisions. |

|

2.Currency risk |

The risk of exchange rate losses due to currency exchange rate volatility, which conducts transactions with the investigated linked enterprise. |

|

3. The system of accounting, reporting, internal control and qualification of accounting staff |

The reliability of the accounting system on linked enterprise, the reliability of the credentials, the effectiveness of the internal control system of the enterprise, which is determined by the ability to prevent and detect accounting errors. Reliability of computer systems, protection of information and reporting. Compliance of the accounting, taxation and reporting system with the legislative and regulatory requirements of the country of activity. |

|

4. Compliance with customs standards of reliability and safety |

Reliability and security of international logistics, compliance with the legislative requirements in the field of customs, simplified procedures for customs clearance. |

|

5. The level of transparency of reporting |

The degree of openness, completeness and timeliness of disclosure in the financial and non-financial statements, which makes it possible to evaluate the enterprise to all interested parties for making sound decisions. |

|

6.Compliance with international quality and environmental standards |

Determines the level of application in the activity of international quality standards (ISO) and environmental management, compliance with international agreements in the field of ecology and environmental protection. |

|

7. The level of social responsibility in a linked enterprise |

Determines the degree of enterprise-wide implementation of social responsibility principles that can provide economic benefits. |

|

Financial valuation options |

||

1. Total financial result from related party foreign economic transactions (FIUs) |

||

1.1. Financial result from exchange differences |

The amount of additional economic benefits (losses) resulting from the conversion of foreign currency transactions by changing the exchange rates at the date of conversion. |

|

1.2. The financial result of mistakes and penalties |

The amount of additional economic losses due to the accrual of fines for late or incorrect submission of company reports. |

|

1.3. Profit paid on equity participation of linked enterprise |

The amount of the paid-in part of the profit on the results of participation in the capital of linked enterprise |

|

1.4. Amount of debt written off |

The amount of bad debt and unrelated costs oflinked enterprise that is attributed to the group's financial results. |

|

2. Return on invested capital |

Absolute and relative performance indicators for equity investments of linked enterprise |

|

3. Fair value of assets (A, NA, FI) |

Increase (decrease) in the value of the group's assets by participating in linked enterprise's equity |

|

Source: Developed by the authors

For each non-financial reliability parameter of linked enterprise, a list of qualitative characteristics has been developed to assess the reliability status of corporate governance and internal audit of linked enterprise.

Based on the assessment, the enterprise-component of the group is given a status of reliability that can determine the policy of controlling foreign trade transactions with such a linked enterprise by the parent company. The assessment provides for the provision of 5 types of reliability status: A, B, C, D, Z. The statuses are given in Table. 2.

Table 2

Characterization of the reliability statuses that are provided to the linked

enterprise based on the evaluation of the reliability parameters

Status type |

Reliability status characteristic |

Status A |

Provided to the linked enterprise that meets all the qualitative assessment criteria - the risk of loss of economic security is minimal. |

Status B |

Provided to the linked enterprise that has a small degree of risk but is managed |

Status C |

It is provided to the linked enterprise that has part-managed risks for a particular component. |

Status D |

There is a risk and it identified as unmanaged. |

Status Z |

There is uncertainty about the reliability of the linked enterprise. |

Source: Developed by the authors

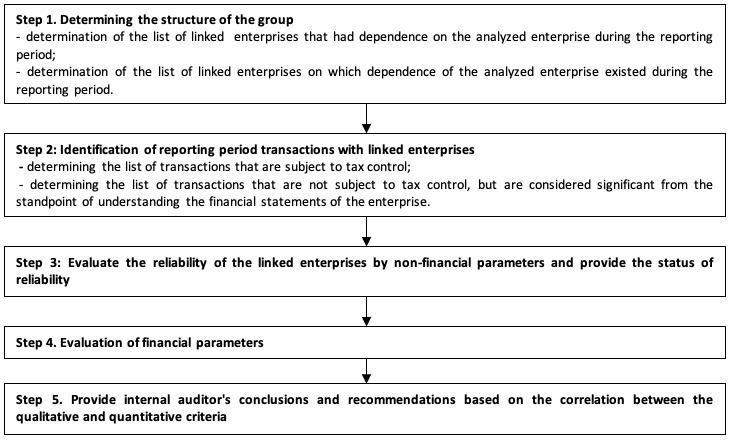

The proposed parametric system for assessing the reliability of the linked enterprise is intended to be based on the assumption that the reliability of the linked enterprise he actually provides economic benefits from its operations. It is proposed to perform the estimation of the reliability of the linked enterprises on the basis of the algorithm (Fig. 4).

Consider the process of assessing the reliability of the linked enterprises using the example of “Dneprometiz”, a Private Joint Stock Company, which submits consolidated financial statements to International Financial Reporting Standards. In the first stage, a visualized structure of the group of enterprises is defined, which allows to clearly illustrate the interdependence of the capital of the enterprise with other components of the group.

Figure 4

Algorithm of estimation of linked enterprises’ reliability within a

group taking into account financial and non-financial parameters

The results of the assessment of the qualitative reliability criteria of the linked enterprises of PJSC “Dniprometiz” in 2017 are shown in Table 3. The results of the linked enterprise reliability assessment make it possible to state that the risk of fraud is minimized in operations with such linked enterprises as Severstal-Metiz OJSC, PJSC Severstal, LLC SeverstalDistribution, SeverstalInfocom OJSC. Almost all the parameters of the linked enterprise reliability assessment have defined high statuses of reliability (A to C), due to the affiliation of all the above enterprises to the composition of one group with a single corporate strategy and enterprise policy.

The subsidiary of KM Dniprometiz LLC, which is linked to PJSC Dniprometiz through its participation in the capital, received the status D according to the parameters "Reporting Transparency Level" and "Compliance with International Quality and Environmental Safety Standards" due to the lack of published information on these parameters, which is due to the peculiarities of the legislation in the field of publication of financial and non-financial information for limited liability companies.

Table 3

The results of the assessment of the qualitative reliability criteria

of the linked enterprises of PJSC “Dneprometiz” in 2017

No. in order |

The legal form of business and the name of the enterprise |

Determination of reliability status by non-financial parameters |

Quantitative interpretation of evaluation results |

||||||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|||

1 |

Severstal-Metiz OJSC |

C |

B |

B |

А |

А |

А |

C |

22 |

2 |

Severstal PJSC |

C |

B |

B |

А |

А |

А |

C |

22 |

3 |

SeverstalDistribution LLC |

C |

B |

B |

С |

А |

А |

C |

22 |

4 |

SeverstalInfocomOJSC |

C |

B |

B |

А |

А |

А |

C |

22 |

5 |

KM Dniprometiz LLC |

A |

А |

B |

С |

D |

D |

C |

17 |

6 |

UPCROFT LIMITED |

Z |

Z |

Z |

Z |

Z |

Z |

Z |

0 |

7 |

LYBICA HOLDING |

C |

С |

Z |

Z |

Z |

Z |

Z |

4 |

Source: identified and calculated by the authors

Quantitative interpretation of the linked enterprise reliability assessment was carried out by assigning an appropriate number of points to the determined reliability status: status A - 4 points, status B - 3 points, status C - 2 points, status D - 1 point, status Z - 0 points. The sum of the points assigned to the reliability parameters corresponds to the result of the quantitative assessment of the reliability of the linked enterprise in the table. 3.

The linked enterprises registered in Cyprus and the Netherlands (UPCROFTLIMITED and LYBICAHOLDING, respectively) received the lowest reliability statuses across all valuation parameters, which poses the greatest risks in dealing with these businesses. The results of such an assessment identify the need to expand the list of internal auditor audit procedures to obtain sufficient and relevant evidence that could substantiate the economic viability of UPCROFTLIMITED and LYBICAHOLDING operations.

The proposed parametric system for analyzing and evaluating the reliability of an affiliate in order to ensure the effectiveness of the internal audit of a group of interconnected entities is based on determining the status of its reliability as a component of a group of international companies based on the non-financial parameters of the enterprise, such as: level of control of the owner of the capital, currency risk, system of accounting, reporting, internal control and qualification eof accounting personnel, compliance with customs standards of reliability and security, level transparency of reporting, compliance with international standards of quality and environmental safety, the level of social responsibility of a related company, which allows the internal auditor to determine the compliance of the activity of the related enterprise and its relationship with the corporate goals of the group (achieving and improving the efficiency of foreign economic operations, increasing the capacity of the group in general, security of operations and strengthening of the group's reputation).

Avi-Yonah, R., Clausing, K., Durst, M., (2009). Allocating Business Profits for Tax Purposes: A Proposal to Adopt a Formulary Profit Split, Florida Tax Review, (5), 497-553. Retrieved from:https://repository.law.umich.edu/articles/774/

Beebeejaun, A., (2019). The fight against international transfer pricing abuses: a recommendation for Mauritius. International Journal of Law and Management, Vol. 61, No. 1, 205-231. https://doi.org/10.1108/IJLMA-05-2018-0083

Clifford, S., (2019). Taxing multinationals beyond borders: Financial and locational responses to CFC rules, Journal of Public Economics, Vol. 173, 44-71. https://doi.org/10.1016/j.jpubeco.2019.01.010

Customs Code of Ukraine. (2012). Retrieved from http://zakon3.rada.gov.ua/laws/show/4495-17

Devereux, M., & Maffini, G. (Eds). (2007). Proceedings of European Tax Policy Forum conference «The Impact of Corporation Taxes across Borders». Oxford University Centre for Business Taxation. Retrieved from:http://eureka.sbs.ox.ac.uk/3395/1/WP0702.pdf

Dischinger, M., T., Riedel, N., (2012). Corporate Taxation and the Location of Patents within Multinational Firms, Journal of International Economics, 88(1), 176-185.https://doi.org/10.1016/j.jpubeco.2010.12.002

What is wrong with it and how to x it, Colchester: ECPR Press.

Eccleston, R., & Smith, H. (2016). The G20, BEPS and the future of international tax governance. In P. Dietsch & T. Rixen (Eds.), Global tax governance: What is wrong with it and how to fix it (pp. 175–198). Colchester: ECPR Press.

Fesenko, V.V. (2018). Зовнішньоекономічні операції підприємства з пов’язаними сторонами : аудит і аналіз [Zovnishnjoekonomichni operaciji pidpryjemstva z pov'jazanymy storonamy: audyt i analiz] (301 p.). Dnipro: Dominanta print.

Hira, A., Murata, B., & Monson, S. (2019). Regulatory Mayhem in Finance: What Panama Papers Reveal. In A. Hira, N. Caillard & T.H. Cohn Editor (Eds.), The Failure of Financial Regulation (191-232). Burnaby: Simon Fraser University.

Huda, M., Nugraheni, N., Kamarudin, K., (2017). The Problem of Transfer Pricing in Indonesia Taxation System. International Journal of Economics and Financial Issues, 7(4), 139-143. Retrieved from:https://www.econjournals.com/index.php/ijefi/article/view/4793/pdf

International Convention on the simplification and harmonization of Customs procedures. Retrieved from : http://zakon4.rada.gov.ua/laws/show/995_643/.

Ivashova, L.M., Ivashov, M. F. (2014). Experience of public financial control in EU countries and directions of its implementation in Ukraine [Dosvid has sovereign financial control in the regions of the Visnik Academy of Mytnoy Service of Ukraine, [Dosvid is a sovereign financially control in the regions of ZheS that directly implements to Ukraine]. Visnik of the Academy of Mytnoy Service of Ukraine, № 2 (11). 12-23. Retrieved from : http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN= UJRN&Z21ID=&S21REF=10&S21CNR =20&S21STN=1&S21FMT =ASP_meta&C21COM= S&2_S21P03= FILA=&2_S21STR=vamcudu_2014_2_4

Khalatur, S., Radzevicius, G., Velychko, L., Fesenko, V., & Kriuchko, L. (2019). Global deoffshorization and its impact on the national and regional economies of eastern european countries. Problems and Perspectives in Management, 17(3), 293-305. doi:10.21511/ppm.17(3).2019.24

Larsen, M. M. (2015). Failing to estimate the costs of off shoring: A study on process performance. International Business Review, 25(1), 307-318. https://doi.org/10.1016/j.ibusrev.2015.05.008

Lohse, T., Riedel, N. (2013). Do Transfer Pricing Laws Limit International Income Shifting? Evidence from European Multinationals. CESifo Working Paper Series No. 4404. Retrieved from: https://ssrn.com/abstract=2334651

Marques, M., Pinho, С. (2015). Is transfer pricing strictness deterring profit shifting within multinationals? Empirical evidence from Europe. Accounting and Business Research, 46 (7), 703-730. Retrieved from: https://ssrn.com/abstract=2709035

Marques, M., Pinho, С. , Montenegro, T., (2019). The effect of international income shifting on the link between real investment and corporate taxation. Journal of International Accounting, Auditing and Taxation, 36. https://doi.org/10.1016/j.intaccaudtax.2019.100268

Melnychenko, R., Pugachevska, K., Kasianok, K. (2017). Tax control of transfer pricing. Investment Management and Financial Innovations, 14(4), 40-49. http://dx.doi.org/10.21511/imfi.14(4).2017.05

Official site of the State Committee of Statistics of Ukraine [Electronic resource]. - Mode of access: http // www.ukrstat.gov.ua

Petryk, O. A., Marynich, I. O. (2015). Роль незалежного аудиту в проведенні пост-митного контролю [Rolj nezalezhnogho audytu v provedenni post-mytnogho kontrolju]. Tekhnologhichnyj audyt i rezervy vyrobnyctva, № 1/6 (21), 57-60. Retrieved from: http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR=20&S21STN=1&S21FMT=ASP_meta&C21COM=S&2_S21P03= FILA=&2_S21STR=Tatrv_2015_1(6)__14

Petryk, O. A., Kasych, A. O., Ghrynenko, Ju. I. (2016). Трансфертне ціноутворення на підприємстві: проблеми та можливості використання [Transfertne cinoutvorennja na pidpryjemstvi: problemy ta mozhlyvosti vykorystannja]. Investyciji: praktyka ta dosvid, № 24, 19-23. Retrieved from: http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR= 20&S21STN=1&S21FMT=ASP_meta&C21COM=S&2_S21P03= FILA=&2_S21STR=ipd_2016_24_6

Prettl, A. (2018). Profit Shifting & Controlled Foreign Corporation Rules the Thin Bridge between Corporate Tax Systems, SSRN Electronic Journal. http://dx.doi.org/10.2139/ssrn.3102553

Ruf, M., Weichenrieder, A. (2015). The Taxation of Passive Foreign Investment: Lessons from German Experience, Canadian Journal of Economics. https://doi.org/10.1111/j.1540-5982.2012.01737.x

1. Doc.Sc. in Economics, Professor. Department of Accounting, Audit, Analysis and Taxation. University of Customs and Finance. E-mail: fesenkovaleriia@gmail.com

2. Doc.Sc. in Economics, Professor. Department of Accounting, Audit, Analysis and Taxation. University of Customs and Finance. E-mail: elvak2016@gmail.com

3. Doc.Sc. in Economics, Professor. Department of Accounting and Analysis. Lviv Polytechnic National University. E-mail: skasko72@gmail.com

4. PhD, Associate Professor. Department of Accounting and Analysis. Lviv Polytechnic National University. E-mail: voskalo@ukr.net

5. PhD, Associate Professor. Department of Production Planning and Organization. Pridneprovsk State Academy of Civil Engineering and Architecture. E-mail: lizvak81@gmail.com

6. Excluding the results of the activities of banks, budgetary institutions, the temporarily occupied territory of the Autonomous Republic of Crimea, the city of Sevastopol, and part of the area of anti-terrorist operation.

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License