Vol. 41 (Issue 10) Year 2020. Page 9

AN, Yuliya N. 1; FRIK, Olga V. 2; IVANOVA, Elena V. 3; MARKOV, Sergey N. 4; SIMONOVA, Natalya Yu. 5 & EVSEENKO, Sergey V. 6

Received: 07/11/2019 • Approved: 08/03/2020 • Published 26/03/2020

ABSTRACT: The article examines the role and importance of taxes for the formation of the budget system, highlighted the shortcomings of the tax collection system, examined approaches to defining the concept of tax administration, and evaluating its effectiveness. The existing problems in terms of calculating the effectiveness of tax administration are identified. The assessment methodology was developed and tested on the example of several tax authorities in the Russian Federation. |

RESUMEN: El artículo examina el papel y la importancia de los impuestos para la formación del sistema presupuestario, destaca las deficiencias del sistema de recaudación de impuestos, examina los enfoques para definir el concepto de administración tributaria y evalúa su efectividad. Se identifican los problemas existentes en términos de cálculo de la efectividad de la administración tributaria. La metodología de evaluación fue desarrollada y probada en el ejemplo de varias autoridades fiscales en la Federación de Rusia. |

The existence of any state and the implementation of its functions are directly related to the need to form revenue sources of the state budget. In all countries of the world, tax revenues are the basis for providing the state with financial resources. The use of tax administration is due to several reasons: the reluctance of some taxpayers to fully pay for their tax obligations, the instability of tax legislation, and the presence of arrears in budget revenues.

The problem of budget filling is acute for the economy at a time when extensive methods of increasing tax revenues have actually been exhausted. An increase in the tax burden may lead to a reduction in entrepreneurial activity, the inability of business entities to timely update and introduce new more advanced technologies and equipment into production. All this contributed to the strengthening of the work of state regulatory bodies in the fight against tax arrears, the adoption of measures against tax evaders. In this regard, not only new forms of tax administration are being introduced, but also attempts are being made to introduce a system for assessing the effectiveness of the tax services themselves. The creation of such a system will make it possible to disseminate the best practices of the most effective tax authorities and will generally contribute to improving the quality of tax administration and increasing tax revenue to the budget.

The aim of the study is to develop theoretical aspects and a methodology for assessing tax administration in the Russian Federation as the basis for ensuring the revenue side of the budget.

The research methodology is based on the application of a number of methods in assessing certain aspects of the issue under consideration. So for the study of the theoretical foundations of tax control, such general scientific research methods as formalization, theoretical generalization, analysis and synthesis, scientific abstraction were used. In studies of the quality of tax administration and the development of a model for assessing tax administration, economic and statistical, design and construction methods were used. When testing the results, the experimental method was used.

The information base of the study includes regulatory legal acts, statistical data of the Federal Tax Service of the Russian Federation, as well as a number of publications by both Russian and foreign scientists on issues of assessing the quality of tax control. Among modern authors, a theoretical study in the field of the nature and effectiveness of tax administration can distinguish the works of K. Ball, W. Dong, M. Thomsen and K. Watrin (Boll, 2018; Dong, 2011; Thomsen and Watrin, 2018). Methodological issues of assessing the effectiveness of tax administration are reflected in the works of E. Dabla-Norris, F. Misch, D. Cleary, M. Khwaja, M. Keen, J. Slemford, A. Zárate-Marco and J. Vallés-Giménez (Dabla-Norris et al., 2019 ; Keen and Slemford, 2017; Zárate-Marco and Vallés-Giménez, 2019).

The research plan includes an analysis of approaches to determining the quality of tax administration, development of a methodology for assessing the effectiveness of tax administration, testing the results of the study on the example of individual tax authorities in the Russian Federation.

The practical significance of the results of the study lies in the possibility of applying the obtained scientific research results in the development of a methodology for assessing the effectiveness of tax administration in the Russian Federation. The developed integrated indicator can also be used in assessing tax administration in other countries along with other indicators reflecting the particularities of building the tax system of these states.

To consider tax administration, it is necessary to explore approaches to the definition of this concept.

This term appeared in Russia from the late 90s of the twentieth century, before that it was considered in the framework of management activities. Since this definition has not yet been legislatively fixed, several positions of scientists on its interpretation have been formed.

So E.P. Belova and M.A. Solyarik consider tax administration as a mechanism for managing the tax system (Belova and Solyarik, 2017). S.S. Khasanova, E.I. Aliyeva and E.A. Abdulzazizova believe that it is a tax collection organization (Khasanova et. al., 2017). V.V. Roshchupkina and Z.B. Sarkisov identify this concept with tax control (Roshchupkina and Sarkisov, 2019). In the writings of foreign authors V. Dong, tax administration is defined as the organizational and administrative activity of state bodies that exercise tax control (Dong, 2011). These interpretations allow us to consider tax administration as organizational and administrative activities to ensure the full and timely payment of tax payments to the budget.

There is no single approach to the interpretation of the effectiveness of tax administration, which is manifested in the constant transformation of the system for evaluating the results of the work of tax authorities. The first methodology was introduced in 1993, later it was refined and adjusted in 2003, 2004, 2007, 2008, 2011, 2017 and included a different number of indicators - from 15 to 27 indicators, most of which were estimates of individual parties to tax control (Musaeva, 2017).

The motivation of tax administration, according to W. Dong, should improve the assessment of the level of implementation of the law, for this it is necessary to create a system of assessment indicators, the core of which is the measurement of the level of implementation of tax legislation (Dong, 2011). “The motivation of tax administration by law is to improve the evaluation of execution level of law, and it is necessary to establish an evaluation indicator system, the core of which is to measure the execution level of tax law» (Dong, 2011, p.277).

In foreign studies, the following indicators are proposed: C. Van Stolk and K. Wegrich consider the ratio of forces and results (the difference between the number of accrued payments and tax administration costs) as indicators (Van Stolk and Wegrich, 2008). M. Klun additionally includes as indicators the number of days of incapacity for work per tax inspector as a social aspect of the quality of tax administration (Klun, 2004). In the works of I. Gashenko, Y. Zima, A. Devidyan tax administration and control are aimed at maximizing the amount of tax revenues and minimizing the scale of the shadow economy and the ratio of these indicators determines their effectiveness (Gashenko et al., 2019). “The tax administration and control aimed at maximizing the amount of tax revenues and minimizing the shadow economy scale (tax evasion)—the ratio of these performances decides its effectiveness” (Gashenko et al., 2019, p.44).

In a number of countries, in particular in Germany and France, the assessment is carried out through the prism of determining the effectiveness of tax inspectors. The scoring mechanism is used in accordance with the categories and results of tax audits (Simonova, 2016).

In general, an analysis of the methods used showed that the effectiveness of tax administration is assessed according to three main criteria: profitability, effectiveness and quality of tax administration. Improving the system of tax administration will reduce costs and ensure compliance with tax laws by both the state and taxpayers (Mirazizov et al., 2017). “Improved the tax administration system, which reduced the level of expenditures and ensured the abidance by tax laws on the part of both the state and taxpayers” (Mirazizov et al., 2017, p.26).

Since the main function of tax administration is the formation of the revenue side of the budget, the dynamics of the indicator of tax collection can be considered as a performance criterion (see Table 1).

Table 1

Dynamics of tax collection,

in% of the planned value

Types of taxes |

2014 |

2015 |

2016 |

2017 |

2018 |

Income tax |

102,9 |

98,9 |

96,3 |

102,2 |

100,3 |

Value added tax |

95,7 |

94,6 |

93,5 |

97,3 |

96,7 |

Excise taxes |

99,0 |

99,5 |

97,4 |

100,6 |

98,8 |

Mining tax |

100,1 |

99,9 |

100,8 |

100,7 |

101,2 |

Corporate property tax |

98,2 |

99,7 |

98,9 |

99,6 |

99,0 |

Transport tax |

85,8 |

89,3 |

80,1 |

89,8 |

88,4 |

Land tax |

100,2 |

95,1 |

90,9 |

93,5 |

94,2 |

Personal property tax |

84,6 |

94,8 |

75,4 |

91,7 |

88,2 |

Other taxes and fees |

95,6 |

95,8 |

96,2 |

97,3 |

99,8 |

Total tax revenue |

97,6 |

96,5 |

95,7 |

96,2 |

96,8 |

Source: Official site of the Federal Tax Service of the Russian Federation

Based on the data presented, it can be noted that the taxes actually paid do not exceed the planned figures. At the same time, there is a slight decrease in indicators throughout 2015-2016. And a slight improvement in 2017-2018, which generally leads to an increase in tax arrears and may be the reason for the use of poor quality tax revenue planning methods.

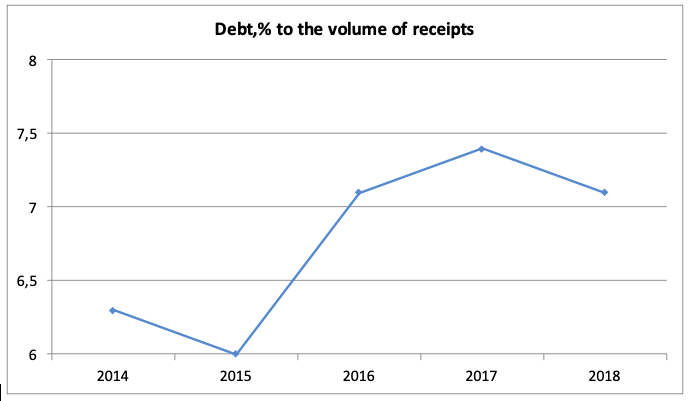

The dynamics of tax debt on tax revenue of the budget is presented in Fig. 1.

Figure 1

Dynamics of tax payments

arrears,% of revenue

Source: Developed by the authors

The growth of tax debt acts as a deterrent to the formation of budget revenues. Despite the fact that in 2018 there was a tendency to reduce tax debt, its value remains quite significant.

As an indicator of the effectiveness of tax administration, certain indicators are used, such as the amount of additional charges, the share of effective tax audits, the amount of additional charges per one effective audit. The results of assessing the quality of tax administration are presented in table 2.

Table 2

Assessment of the quality

of tax administration

Indicators |

2014 |

2015 |

2016 |

2017 |

2018 |

The number of checks, thousand |

32905,0 |

31972,4 |

40002,9 |

59719,2 |

42054,3 |

Number of checks with violations |

1999,0 |

1978,6 |

2279,2 |

3034,4 |

2545,3 |

Percentage of Successful Audits |

6,1 |

6,2 |

5,7 |

5,1 |

6,1 |

Accrued according to the results of tax control, thousand rubles |

345406,4 |

351089,1 |

449158,1 |

372999,1 |

363400,2 |

Accrued for one check, thousand rubles |

10,5 |

11,0 |

11,2 |

6,3 |

8,6 |

Accrued for one effective check, thousand rubles |

172,8 |

177,4 |

197,1 |

122,9 |

142,8 |

Source: Developed by the authors

Based on the data presented, it can be concluded that tax administration indicators are generally declining. Over the course of five years, the tax control performance indicator has not changed, however, the amount of additional charges for one audit conducted has decreased by 1.9 thousand rubles, and for one effective audit by 30.0 thousand rubles. This may indicate a decrease in the effectiveness of tax administration.

The indicators used in the practice of the activity of the tax authorities, shown in Table 2, make it possible to evaluate only certain aspects of tax administration. With their help, it is impossible to form a holistic view of the quality of activity of a particular tax authority. In this regard, a methodology for the formation of an integrated indicator of assessing the effectiveness of tax administration is proposed.

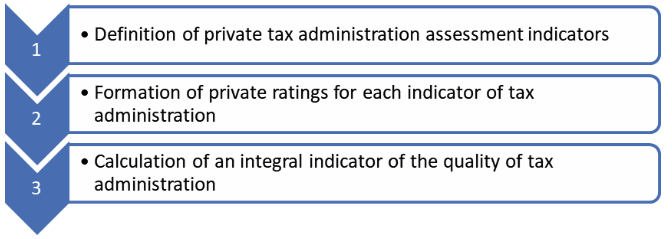

The tax administration assessment mechanism can be represented in the form of the following algorithm (see Fig. 2).

Figure 2

An algorithm for developing an integrated indicator

of assessing the quality of tax administration

Source: Developed by the authors

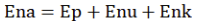

The integral indicator of the quality of tax administration will be calculated using the following formula:

(1)

(1)

where Ena is an integral indicator of the quality of tax administration;

Ep – tax planning quality indicator;

Enu – quality indicator of the organization of accounting and analysis;

Enk – tax control quality indicator.

To form an integral indicator at the first stage, it is proposed to evaluate the private indicators of tax administration.

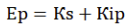

Each of the private indicators, in turn, is also complex. So, to assess the quality of tax planning, the following formula is used:

(2)

(2)

where Кs – tax collection ratio, defined as the share of taxes received in the total amount of taxes accrued;

Кip – the coefficient of performance of planned indicators, defined as the ratio of the difference between received and planned taxes to the amount of taxes received.

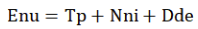

To assess the quality of accounting and analysis, the following formula is used:

(3)

(3)

where Tp – growth rate of the number of registered taxpayers;

Nni – the level of tax burden per tax inspector is defined as the ratio of the total number of registered taxpayers to the number of tax authority employees conducting tax control activities;

Dde – the share of tax returns submitted to the tax authority via telecommunication channels.

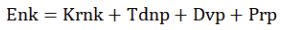

The quality control of tax control is calculated using the following formula:

(4)

(4)

where Krnk – tax control performance ratio, defined as the share of effective tax audits in the total number of audits;

Tdnp – growth rate of the volume of additionally accrued tax payments based on the results of tax control;

Dvp – share of collected payments in the total amount of additional accrued payments based on the results of tax control;

Prp – volume of additionally accrued tax payments based on the results of tax control per one effective audit.

At the second stage, ratings are determined for each of the indicators of assessing the quality of tax administration. This approach is necessary due to the different units of measurement of particular indicators (the use of both absolute and relative values). The following formula is used to calculate ratings:

(5)

(5)

where Ri – rating of a private indicator of the quality of tax administration;

Кei – coefficient of effectiveness of a private indicator of tax administration in a particular tax authority;

Кe – coefficient of effectiveness of a private indicator of tax administration in the Russian Federation or a subject of the Russian Federation.

At the third stage, the integral indicator of the effectiveness of tax administration is calculated.

This indicator is compared with similar indicators of other tax authorities and average indicators of tax authorities in the subject of the Russian Federation and in the whole country.

Consider the application of this technique based on data from two tax inspectorates in the Omsk region.

The calculation of private indicators is presented in table 3.

Table 3

Calculation of private indicators

of tax administration

Private indicators of the quality of tax administration |

2014 |

2015 |

2016 |

2017 |

2018 |

Inspectorate of the Federal Tax Service for the Kirov Administrative District of Omsk |

|||||

Кs, in % |

75 |

100 |

94 |

91 |

97 |

Кip, in % |

112 |

101 |

93 |

90 |

97 |

Tp, in % |

90 |

95 |

100 |

95 |

95 |

Nni, in pieces |

685 |

725 |

625 |

640 |

500 |

Dde, in % |

63 |

76 |

73 |

70 |

69 |

Krnk, in % |

100 |

100 |

100 |

100 |

100 |

Tdnp, in % |

102 |

101 |

84 |

147 |

122 |

Dvp, in % |

58 |

48 |

42 |

43 |

26 |

Prp, in thousand rubles |

8899 |

10822 |

7560 |

13200 |

13500 |

Inspectorate of the Federal Tax Service for the Soviet Administrative District of Omsk |

|||||

Кs, in % |

74 |

99 |

100 |

97 |

98 |

Кip, in % |

68 |

99 |

100 |

96 |

98 |

Tp, in % |

83 |

95 |

100 |

92 |

100 |

Nni, in pieces |

675 |

700 |

705 |

656 |

612 |

Dde, in % |

67 |

77 |

76 |

85 |

83 |

Krnk, in % |

100 |

100 |

100 |

100 |

100 |

Tdnp, in % |

102 |

100 |

106 |

66 |

84 |

Dvp, in % |

59 |

44 |

43 |

47 |

48 |

Prp, in thousand rubles |

7197 |

8640 |

9200 |

7580 |

6360 |

Office of the Federal Tax Service in the Omsk Region |

|||||

Кs, in % |

79 |

94 |

100 |

98 |

95 |

Кip, in % |

88 |

94 |

100 |

98 |

96 |

Tp, in % |

88 |

91 |

100 |

99 |

99 |

Nni, in pieces |

567 |

560 |

547 |

542 |

531 |

Dde, in % |

56 |

70 |

69 |

67 |

70 |

Krnk, in % |

100 |

100 |

100 |

99 |

99 |

Tdnp, in % |

104 |

93 |

175 |

84 |

58 |

Dvp, in % |

58 |

45 |

43 |

48 |

57 |

Prp, in thousand rubles |

8056 |

8215 |

14700 |

13500 |

7810 |

Source: Developed by the authors

Based on the calculated indicators, we determine the ratings of private indicators of tax administration (see Table 4).

Table 4

Private Tax Administration Ratings

Private tax administration quality score ratings |

2014 |

2015 |

2016 |

2017 |

2018 |

Inspectorate of the Federal Tax Service for the Kirov Administrative District of Omsk |

|||||

Кs |

0,95 |

1,06 |

0,94 |

0,93 |

1,02 |

Кip |

1,27 |

1,07 |

0,93 |

0,92 |

1,01 |

Ep |

2,22 |

2,13 |

1,87 |

1,85 |

2,03 |

Tp |

1,02 |

1,04 |

1,00 |

0,96 |

0,98 |

Nni |

1,21 |

1,29 |

1,14 |

1,18 |

0,94 |

Dde |

1,13 |

1,09 |

1,06 |

1,04 |

0,99 |

Enu |

3,36 |

3,42 |

3,20 |

3,18 |

2,91 |

Krnk |

1,00 |

1,00 |

1,00 |

1,01 |

1,01 |

Tdnp |

0,98 |

1,09 |

0,48 |

1,76 |

2,10 |

Dvp |

1,00 |

1,07 |

0,98 |

0,90 |

0,46 |

Prp |

1,10 |

1,32 |

0,51 |

0,98 |

1,73 |

Enk |

4,08 |

4,48 |

2,97 |

4,65 |

5,30 |

Ena |

9,66 |

10,03 |

8,04 |

9,68 |

10,24 |

Inspectorate of the Federal Tax Service for the Soviet Administrative District of Omsk |

|||||

Кs |

0,94 |

1,05 |

1,00 |

0,99 |

1,03 |

Кip |

0,77 |

1,05 |

1,00 |

0,98 |

0,98 |

Ep |

1,71 |

2,10 |

2,00 |

1,97 |

2,01 |

Tp |

0,94 |

1,04 |

1,00 |

0,93 |

1,01 |

Nni |

1,19 |

1,25 |

1,29 |

1,21 |

1,15 |

Dde |

1,20 |

1,10 |

1,10 |

1,27 |

1,19 |

Enu |

3,33 |

3,39 |

3,39 |

3,41 |

3,35 |

Krnk |

1,00 |

1,00 |

1,00 |

1,01 |

1,01 |

Tdnp |

0,98 |

1,08 |

0,61 |

0,79 |

1,45 |

Dvp |

1,02 |

0,98 |

1,00 |

0,98 |

0,84 |

Prp |

0,89 |

1,05 |

0,63 |

0,56 |

0,81 |

Enk |

3,89 |

4,11 |

3,24 |

3,34 |

4,11 |

Ena |

8,93 |

9,60 |

8,63 |

8,72 |

9,47 |

Source: Developed by the authors

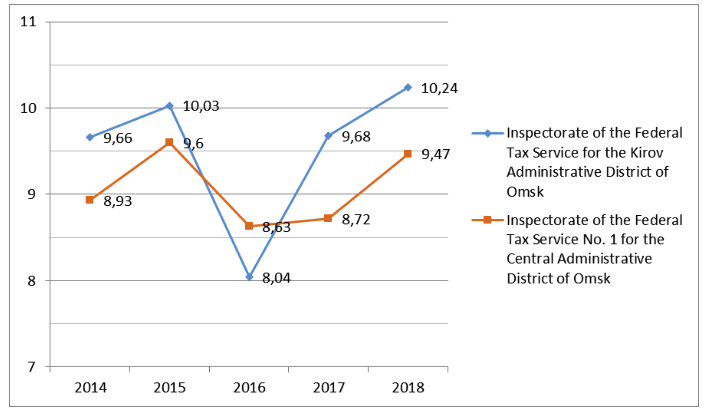

The application of this technique allows you to compare the performance of tax administration both in dynamics and the results of various tax authorities with each other. Dynamic indicators of changes in the quality of tax administration as a whole and for individual indicators are presented in Fig. 3.

Figure 3

Dynamics of changes in tax administration quality indicators

Source: Developed by the authors

Based on the data, it can be concluded that the quality of tax administration and the dynamics of these indicators.

The proposed system for assessing the quality of tax administration allows a comprehensive assessment of the effectiveness of the tax authority, to identify the most problematic places, to optimize the work of tax control.

The advantage of the developed methodology for assessing the quality of tax administration is the ability to consider different aspects of this process: tax planning, accounting and control work of tax authorities. The authors consider these aspects the most important and reflect the key areas of the tax service. However, it should be noted that this methodology does not take into account such indicators as the efficiency of work with taxpayers - conducting thematic seminars, raising the level of tax culture. According to the authors, these indicators are reflected in the results of tax control, in this regard, their allocation to a separate group seems inappropriate.

Further improvement of the methodology for assessing the quality of tax administration will be carried out as part of the expansion of the number of private indicators that will more accurately determine the value of the integral indicator. These indicators can be supplemented by criteria for evaluating the effectiveness of the work of tax authorities with taxpayers, as T. Efremova suggests in her work (Efremova, 2017).

The proposed methodology is quite simple in calculations and obvious; however, to get a more complete overview of the situation with tax administration, it is possible to supplement it with indicators characterizing certain aspects of tax work.

The results of the study are to obtain the following scientific results:

1. An analysis of theoretical studies of the concept of tax administration has led to the conclusion that tax administration is considered as organizational and administrative activities to ensure the full and timely payment of tax payments to the budget;

2. An analysis of the methodology for assessing the quality of tax administration has led to the conclusion that the main indicators in the methods used are the criteria of profitability, effectiveness and quality of tax control. However, these indicators evaluate only certain aspects of tax administration. In this regard, a methodology has been developed for determining the integral indicator of the quality of tax administration, based on the use of tax planning criteria, analytical and accounting activities of tax authorities and the effectiveness of tax control. The use of a single indicator allows a comprehensive assessment of the quality of tax administration.

3. The proposed methodology was tested on the basis of two inspections of the Federal Tax Service of the Russian Federation and the calculation results are presented. The mechanism for determining the indicator is clearly demonstrated, the results are presented on the basis of which the performance of a specific tax authority can be evaluated. The results obtained show the scope of this methodology: conducting a comparative analysis of the effectiveness of individual tax authorities to develop a material incentive system, assessing tax administration in the whole of the Russian Federation, and comparing the quality of tax administration in Russia and other countries.

Belova, E.P. & Solyarik, M.A. (2017) Nalogovoe administrirovanie kak osobyj instrument obespechenija jekonomicheskoj bezopasnosti Rossii [Tax administration as a special tool for ensuring the economic security of Russia]. Kaluga Economic Bulletin, 1, 3-6

Boll, K. (2018) Outcome-based Performance Management Systems: Experiences from the Danish and Swedish Tax Agencies. In H. Byrkjeflot, & F. Engelstad (Eds.), Bureaucracy and Society in Transition, Bingley: Emerald Group Publishing, 89-107.

Dabla-Norris, E., Misch, F., Cleary, D. & Khwaja, M. (2019) The quality of tax administration and firm performance: evidence from developing countries. International Tax and Public Finance. 1–38

Dong, W. (2011) Several measures to perfect tax administration by law. Communications in Computer and Information Science, № 210, CCIS (PART 3), 227-231

Efremova, T.A. (2017) Povyshenie jeffektivnosti nalogovogo administrirovanija kak neobhodimoe uslovie razvitija nalogovoj sistemy [Improving the efficiency of tax administration as a necessary condition for the development of the tax system]. Taxes Journal, 2, 27-3

Gashenko, I.V., Zima, Y.S. & Davidyan, A.V. (2019) Tax Administration and Control. Tax Policy of the State, in: Optimization of the Taxation System: Preconditions, Tendencies and Perspectives, Springer, 41-47

Khasanova, S.S., Alieva, E.I. & Abdulazizova, E.A. (2017) Preobrazovanija v nalogovom administrirovanii kak ob#ektivnaja neobhodimost' sovershenstvovanija nalogovoj politiki strany [Transformations in tax administration as an objective need to improve the country's tax policy]. Economics and Entrepreneurship, 10-1, 90-93

Keen, M. & Slemrod, J. (2017) Optimal tax administration. Journal of Public Economics, 152, 133–142

Klun, M. (2004) Performance measurement for tax administration: The case of Slovenia. International Review of Administrative Sciences, 70 (3), 567-574

Mirazizov, A., Radzhabova, I., Abdulaeva, M., Rasulov, N., Faizulloev, M., Mamatkulov, A., Davlatzoda, D., Azimov, H., Dzhuraeva, G. & Ahmadov, B. (2017) The Effectiveness of Financial and Monetary Instruments of Sustainable Development in Tajikistan’s Economy and Ways of Improving Them. Espacios, Vol. 38, 43, 26

Musaeva, H.M. (2017) Nalogovoe administrirovanie v kontekste stanovlenija razvitija nalogovoj sistemy Rossijskoj Federacii [Tax administration in the context of the development of the tax system of the Russian Federation]. Economics and Entrepreneurship, 7 (84), 69-73

Roschupkina, V.V. & Sarkisov, Z.B. (2019) Gosudarstvennyj nalogovyj menedzhment v sisteme nalogovogo administrirovanija: regional'nyj aspekt [State tax management in the tax administration system: regional aspect]. Stavropol: North Caucasus Federal University

Simonova, N.Yu. (2016) Metodologicheskie osnovy nalogovogo planirovanija [Methodological foundations of tax planning]. Omsk: Publishing House of Omsk state technical university

The official website of the Federal Tax Service of the Russian Federation. Retrieved from https://www.nalog.ru

Thomsen, M. & Watrin, С. (2018) Tax avoidance over time: A comparison of European and U.S. firms. Journal of International Accounting, Auditing and Taxation, December, 40-63

Van Stolk, C. & Wegrich, K. (2008) Convergence without diffusion? A comparative analysis of the choice of performance indicators in tax administration and social security. International Review of Administrative Sciences, №74 (4), 589-614

Zárate-Marco, A. & Vallés-Giménez, J. (2019) Regional tax effort in Spain. Economics: The Open-Access, Open-Assessment E-Journal, 13 (2019-31), 1–32

1. Associate Professor, Siberian Institute of Business and Information Technology, Omsk, Russian Federation, E-mail: an27091975@mail.ru

2. Candidate of Philosophical Sciences, Associate Professor, Siberian Institute of Business and Information Technology, Omsk, Russian Federation, E-mail: ofrik@mail.ru

3. Candidate of Economic Sciences, Associate Professor, Department of Finance and Accounting, Financial University under the Government of the Russian Federation, Omsk Branch; Siberian Institute of Business and Information Technology, Omsk, Russian Federation, E-mail: iva-ev@yandex.ru

4. Candidate of Economic Sciences, Associate Professor, Department of Finance and Accounting, Financial University under the Government of the Russian Federation, Omsk Branch; Russian Federation, E-mail: markovsn79@mail.ru

5. Candidate of Economic Sciences, Associate Professor, Department of Finance and Accounting, Financial University under the Government of the Russian Federation, Omsk Branch; Siberian Institute of Business and Information Technology, Omsk, Russian Federation, E-mail: sim_nu_a@mail.ru

6. Candidate of Economic Sciences, Associate Professor, Department of Finance and Accounting, Financial University under the Government of the Russian Federation, Omsk Branch, Russian Federation, E-mail: svevseenko@ufrf.onmicrosoft.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License