Vol. 39 (Number 16) Year 2018 • Page 42

Lubov Ivanovna GONCHARENKO 1; Elena Yurevna SIDOROVA 2; Alekcey Aleksandrovich ARTEMEV 3; Nataliy Aleksandrovich NAZAROVA 4

Received: 28/02/2018 • Approved: 05/03/2018

3. Findings Of The Investigation

4. Consideration Of Results On Application Of Dividend-Base Scheme

5. Review Of Results On Application Of Interest Payments Scheme

ABSTRACT: Goal of this paper is to consider dividend-based and interest-based schemes of minimization of customs value of goods in deals between related parties (the case of Russian practice). Analytical method and comparison method are used as tools of analysis. Schemes of minimization of customs value of goods are continuously improved and dividend-based scheme and interest-based schemes are most advanced/ Dividend-based scheme can be applied in case when taking into account taxation rate of corporate profit tax and customs duty it seems appropriate to parties of foreign trade operations “to distribute” price into two constituents, the first of which is directly price of goods which within the frames of such a scheme is understated, and the second is dividends which are overstated. The core of interest payments scheme consists of additional fund raising in implementation of foreign trade deal on acquisition of goods. Interest repayable for usage of such a fund raising should not be included in customs value of acquired goods, because such expenses of buyer relate to his financial interrelations but not to relations on acquisition of goods. Minimization models under investigation confirm the fact of understatement of real prices of imported goods with goal to obtain saving of taxpayer's tax liabilities. |

RESUMEN: El objetivo de este documento es considerar los esquemas basados en dividendos y basados en intereses de minimización del valor en aduana de los bienes en los tratos entre partes relacionadas (el caso de la práctica rusa). El método analítico y el método de comparación se utilizan como herramientas de análisis. Los esquemas de minimización del valor en aduana de los bienes se mejoran continuamente y los esquemas basados en dividendos y basados en intereses son los más avanzados / el esquema basado en dividendos puede aplicarse en caso de que teniendo en cuenta la tasa impositiva del impuesto sobre ganancias corporativas y los aranceles aduaneros parece apropiado a las partes de las operaciones de comercio exterior "para distribuir" el precio en dos componentes, el primero de los cuales es directamente el precio de los bienes que, dentro de los marcos de dicho plan, está subestimado, y el segundo son los dividendos que son exagerados. El esquema de pagos del núcleo de intereses consiste en la recaudación de fondos adicionales en la implementación del trato de comercio exterior en la adquisición de bienes. Los intereses reembolsables por el uso de dicha recaudación de fondos no deberían incluirse en el valor en aduana de los bienes adquiridos, porque tales gastos del comprador se relacionan con sus interrelaciones financieras, pero no con las relaciones en la adquisición de bienes. Los modelos de minimización bajo investigación confirman el hecho de la subestimación de los precios reales de los bienes importados con el objetivo de obtener el ahorro de los pasivos tributarios del contribuyente. |

In the recent times issues related to customs valuation and control of customs value of goods in conditions of essentially increased risks of transfer pricing usage come to the fore between questions which countries raise at Technical Committee of WCO (Customs Valuation and Transfer Pricing, n. d.; WCO guide to customs valuation and transfer pricing, n. d.). To a considerable degree this is related to the fact that tendency of continuous increase of share of deals between related parties is observed in foreign trade of goods. The maximum volumes of such deals are accounted for transnational corporations (Sidorova 2015; Sidorova and Tixonova 2017; Artemyev and Baranowski 2016). Parent company of transnational corporation is continuously improving mechanisms of interrelations with subsidiary companies. These mechanisms allow to minimize tax liabilities of the corporation. Important element of this process is optimization of customs value of goods move across the customs border.

- analytical method for investigation of arbitration practice on application of dividend-based scheme;

- comparison method for investigation of dividend-based and interest-based schemes of minimization of goods customs value in deals between related parties.

Schemes of minimization of goods customs value are continuously improved and in the recent times so called dividend-based schemes and interest-based schemes are most advanced. Begin investigation with dividend-based scheme. This scheme can be applied in case when considering taxation rate of corporate profit tax and customs duty it seems appropriate to parties of foreign trade operations “to distribute» price into two constituents, the first of which is directly price of goods which within the frames of such a scheme is understated, and the second is dividends which are overstated.

Such a “distribution” of price of goods is related with the fact that in accordance with item 4 of Explanatory Notes of Article 1 “Price, actually paid or payable” of Agreement for application of Article VII of General Agreement on Tariffs and Trade 1994 (General agreement on tariffs and trade 1994, n. d.; Agreement on the application of article VII General agreement on tariffs and trade 1994, n. d.) dividend payments and other similar payments do not relate to payment for goods and therefore are not recognized in price actually paid or payable (hereafter - PAP) and eventually in customs value of goods.

At that it is assumed that in situation when deals are implemented between related parties, i.e. within the group, parties and/or management of the group have an opportunity to plan which payments will be transferred in the form of payment for goods, and which — in the form of dividends.

In this regard let us consider typical situations related with dividend payments. These situations include the following common conditions.

Entity А (seller) is registered in a country with low or moderate income tax rate (10-25%, taxation rate of corporate profit tax in country of residence А is 10%).

Entity В (buyer) is registered in a country with moderate/average income tax rate (15-25%, taxation rate of corporate profit rate in country of residence В is 20%, taxation rate of corporate profit tax in part of dividends paid to foreign entities is 15%, at that taxation rate of corporate profit tax in part of dividend payments in amount of 5% is provided by agreement on avoidance of double taxation of dividend payment between countries in which entities А and В/ at that “clearing mechanism” directed to avoidance of double taxation of dividend payments is provided) and tax rate of import customs duties (hereafter — customs duty) differentiated depending on imported goods (customs duty rate on imported goods is set at amount of 15%).

In calculations authors proceeded from the following assumptions:

- entity А is owner of 100% of authorized capital of entity В;

- income after taxation as of the end of period under review (year) is transferred completely in the form of dividends by entity В to entity А.

In such a way, the group selecting optimal “script” considers the following options of assigning prices of goods and dividends within the frame of period.

1). Typical situation (script) #1: “Actual price” and "actual dividends”.

Cost of goods supplied during the year, based on prices set in foreign trade sale contract amounts to 100 units.

Expenses of entity А — 80 units.

"Total" customs cost of goods (with account of assumption that in considered example indirect payments subject to inclusion into PAP, and also extra charging subject to addition to PAP for customs validation of goods are absent) is 100 units.

Receipts of entity В from marketing goods into territory of country of import are 130 units.

Expenses on the territory of country of import incurred besides expenses on acquisition of goods are 10 units.

In calculations of indicators authors proceeded from an assumption that in the period under review only goods imported during the period under review were encashed.

In that case tax burden of entities A and B and total tax burden of group can be presented in the form of Table 1.

Table 1

Tax burden of entities А and В and total tax burden of the group for

Typical situation (Script) #1: “Actual price” and "actual dividends” (units)

Operations performed and tax consequences |

Entity A |

Entity B |

Goods encashed |

100 |

|

Taxation base for corporate profit tax evaluated |

100 – 80 = 20 |

|

Tax rate for corporate profit tax |

10% |

|

Incorporate profit tax is computed and paid |

20*10% = 2 |

|

Customs duty is computed and paid |

|

100 * 15% = 15 |

VAT (18%) in tax payments is computed and paid |

|

(100 + 15) * 18% = 20,7 |

Goods encashed |

|

130 |

VAT (18%) is charged to buyer |

|

130 * 18%= 23,4 |

Taxation base for corporate profit tax evaluated |

|

130 – (100+15) = 15 |

Taxation rate for corporate profit tax |

|

20% |

Incorporate profit tax is computed and paid |

|

15*20% = 3 |

VAT as of the end of tax period computed and paid |

|

23,4 – 20,7 = 2,7 |

Amount of after-tax profit evaluated (dividends payable to entity A) |

|

15 – 3 = 12 |

Incorporate profit tax in part of dividends computed and paid by tax agent (entity B) |

|

12*5% = 0,6 |

Incorporate profit tax in country of residence is computed by entity A |

12 * 10% = 1,2 |

|

Entity A decreased amount of liabilities on corporate profit tax in country of residence by amount of corporate profit tax retained by tax agent (entity В) in the country of dividends receipt |

- 0,6 |

|

Amount of corporate profit tax paid by entity A |

1,2 – 0,6 = 0,6 |

|

Total tax liabilities of the group evaluated |

2+ 15 + 3 + 2,7+0,6+0,6 = 23,9 |

|

2) Typical situation (script) #2: “Understated price” and "overstated dividends”. Cost of goods supplied during the year, based on prices set in foreign trade sale contract amounts to 85 units.

Expenses of entity А — 80 units.

“Total” customs cost of goods (with account of assumption that in considered example indirect payments subject to inclusion into PAP, and also extra charging subject to addition to PAP for customs validation of goods are absent) is 85 units.

Receipts of entity В from marketing goods into territory of country of import are 130 units.

Expenses on the territory of country of import incurred besides expenses on acquisition of goods are 10 units.

In calculations of indicators authors proceeded from an assumption that in the period under review only goods imported during the period under review were realized.

In that case tax burden of entities, A and B and total tax burden of group can be presented in the form of Table 2.

Table 2

Tax burden of entities А and В and total tax burden of the group for Typical

situation (Script) #2: “Understated price” and "overstated dividends” (units).

Operations performed and tax consequences |

Entity A |

Entity B |

Goods encashed |

85 |

|

Taxation base for corporate profit evaluated |

85 – 80 = 5 |

|

Taxation rate for corporate profit tax |

10% |

|

Corporate profit tax is computed and paid |

5*10% = 0,5 |

|

Customs duty is computed and paid |

|

85 * 15% = 12,75 |

VAT (18%) in tax payments is computed and paid |

|

(85 + 12,75) * 18% = 17,6 |

Goods encased |

|

130 |

VAT (18%) is charged to buyer |

|

130 * 18%= 23,4 |

Taxation base for corporate profit tax evaluated |

|

130 – (85+12,75) = 32,25 |

Tax rate for corporate profit tax |

|

20% |

Corporate profit tax is computed and paid |

|

32,25*20% = 6,45 |

VAT as of the end of tax period computed and paid |

|

23,4 – 17,6 = 5,8 |

Amount of after-tax profit evaluated (dividends payable to entity A) |

|

32,25 – 6,45 = 25,8 |

Corporate profit tax in part of dividends computed and paid by tax agent (entity B) |

|

25,8*5% = 1,29 |

Corporate profit tax in country of residence is computed by entity A |

25,8 * 10% = 2,58 |

|

Entity A decreased amount of liabilities on corporate profit tax in country of residence by amount of corporate profit tax retained by tax agent (entity В) in the country of dividends receipt |

- 1,29 |

|

Amount of corporate profit tax paid by entity A |

2,58 – 1,29 = 1,29 |

|

Total tax liabilities of the group evaluated |

0,5+ 12,75 + 6,45 + 5,8+1,29+1,29 = 28,08 |

|

Obtained results allow pay attention to the fact than application of “simple” dividend-base scheme may be economically attractive only in the case when. within the frame of foreign trade deals, goods for which high rates of customs duties are set.

Application of schemes based on understated price of goods and overstated dividend size in conditions when, by legislation of importing country, rates of customs duties are, as a rule, less than tax rates on profit of entities, economically expedient only if, within the frames of foreign trade deals, goods, on which high rates of customs duties are set, are acquired.

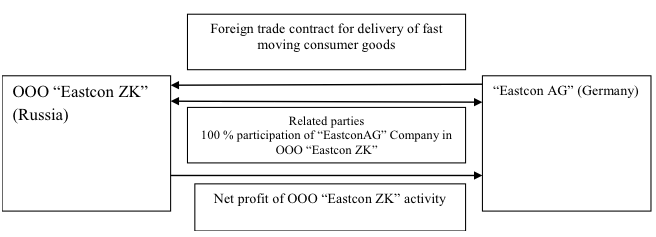

Investigation of arbitration practice on application of dividend-based scheme allows for the conclusion than at the level of foreign trade deal, Customs bodies do not possess have tools for practical detection of dividend-based schemes and avoidance of their application/ Let’s consider one example of such a decision: OOO "Eastcon ZK”

In the first case of OOO "Eastcon ZK” (The decision of Federal arbitration court of Volgo-Vyatsky district from may 28, 2014 case # A43-34050/2012), the issue was concerned with correction of customs value, and by opinion of applicant, OOO “Eastcon ZK” paid dividends to his party which was not a seller. This issue was reviewed in court Arbitration Court of the Nizhni Novgorod Region (court decision as of 06.11.2013 on case # А43-34050/2012).

Dividend-based schemes on the example of OOO "Eastcon ZK” and “EastconAG” Company are shown in Fig. 1.

Figure 1

Dividend-based schemes on the example of OOO "Eastcon ZK” and “EastconAG” Company

Contract value amounts to 1 mln Euro, at that, according to contract addendum, contract sum due to changed supply conditions amounted to 5 mln Euro (Contract Addendum # 5). According to Addendum # 8 total contract value amounts to 8 mln Euro. At that OOO “Eastcon ZK” is a company with one participant in the person of Germany citizen Klaus Rudiger Lipps – “EastconAG” Company. Net profit (of dividends) of OOO "Eastcon ZK” was transferred to Mr. Klaus Rudiger Lipps at the account specified in foreign trade contract between the two entities. Payment of dividends is performed by OOO “Eastcon ZK” by transfer of money in Euro on the ground of bank transfer orders. Recipient of money in column 59 of bank transfer orders as client-beneficiary is “EastconAG”, i.e. seller of goods. In accordance with subcl. 4 cl. 1 art. 19.1 of RF Law as of 21.05.1993 # 5003-1 "Concerning the Customs Tariff" (hereafter - Law) (Law of the Russian Federation "On customs tariff" dated 21.05.1993 G. # 5003-1), subcl. 3 cl. 1 art. 5 of Agreement between Government of the RF, Governor of Republic Belarus and Government of Republic of Kazakhstan as of 25.01.2008 "On Determining the Customs Value of Goods Moved Across the Customs Border of the Customs Union" (hereafter - Agreement) at evaluation of customs value of goods imported by cost of deal, price actually paid or payable is increased by part of income (revenue) obtained in a result of consequent sale, disposal in a different way or utilization of imported goods. This part is directly or indirectly accruing to the seller. In accordance with cl. 8 art. 19 of Law, cl. 7 art. 4 of Agreement, price actually paid of payable for imported goods is related to goods moved across customs border of Customs Union, for which reason, transfer of dividends or other similar payments by buyer to seller in case when they are not related to imported goods, is not a part of customs value. At that OOO "Eastcon ZK” did not get any profit in 2009-2011 from other business activities except encash of goods supplied by “EastconAG” Company.

Based on text of art 19.1 of Law (The decision of Federal arbitration court of Volgo-Vyatsky district from may 28, 2014 case # A43-34050/2012), art. 5 of Agreement, part of profit obtained as a result of consequent sale, disposal in a different way or utilization of imported goods, part of income (revenue) is added to the price of imported goods at determination of customs value by cost of deal with them, in case if this part of profit, directly or indirectly, is accrued to seller of goods. In this case, to “Eastcon AG” Company.

Therefore, dividends got in 2010-2011 by goods supplier of “Eastcon AG” (Germany) by decision of only participant Klaus Rudiger Lipps are related to imported goods and should be added to price actually paid or payable for these goods as part of income obtained as a result of consequent sales of imported goods, which is accrued, directly or indirectly, to seller.

Customs body has detected presence of interrelation in value specified in subcl. d) cl. 3 of Agreement (cl. 2 art. 5 of Law): "related parties" – parties which are responsible for at least one of the following conditions: "one of the parties directly or indirectly controls the other". But Customs body has not detected signs of impact of interrelation between seller and buyer on price actually paid or payable, i.e. signs of non-acceptance of deal cost for purpose of determination of customs cost of goods.

Customs body has not detected reasons of non-application of main method of determination of customs cost of goods (sum of costs of imported all imported items) which is based on deal cost defined by foreign trade contract which, in turn, according to cl. 1 art. 4 of Agreement should be supplemented according to statements of art. 5 of Agreement with additions to deal price of income (revenue) obtained in result of consequent utilization of imported goods, which is directly or indirectly accrued to seller/

It is detected by clause 2 art. 5 Agreement that price actually paid or payable is total cost of all payments for these goods, made or subject to payment by buyer directly to seller or to other party on the account of seller.

At that payments can be made directly or indirectly in any form legal by legislation of the RF.

However, court decision consisted in refusal of settle of claim of OOO "Eastcon ZK" and making correction of customs value of goods by sum of dividends.

OOO "Eastcon ZK” has appealed in the First Arbitration Court of Appeal (judgement dated January 22, 2014 on the case # А43-34050/2012), where also legality of actions of Customs bodies is confirmed but affirmed court decision of court of the first instance.

Judgement of Federal Arbitration Court of Volga-Vyatka District (judgement dated May 28, 2014 on the case # А43-34050/2012) has also affirmed legality of two previous court decisions.

It is also of interest to consider more complex schemes ensuring that within the group “payment” of part of goods price is settled through other payments, real economical meaning of which may not correspond to their title. In that case detection of real economical meaning of such payments may lead to their other qualification (change of their qualification). The result of these actions is necessity of their inclusion in customs value of goods considering their real content.

The following payments are of special interest (Solution 3.1 the inclusion in the customs value of imported goods interest payments):

- interest payments;

- license and other similar payments, in relation of which opinions of group members legally stated conditions of their inclusion in customs value of goods are not satisfied.

Approach initially stated by WTO Committee on customs value of goods (hereafter – Committed) lies the basis this scheme. The core of this approach consists in additional fund raising in implementation of foreign trade deal on acquisition of goods. Interest repayable for usage of such a fund raising should not be included in customs value of acquired goods, because such expenses of buyer relate to his financial interrelations but not to relations on acquisition of goods.

This approach was formed in special decision of the Committee (Law of the Russian Federation "On customs tariff" dated 21.05.1993 G. # 5003-1) which is used by countries as a basis for preparation of national rules of interest payments inclusion in customs value of goods.

At that Committee proceeds from the following concept in the Decision: Interest payments payable with the frames of financial interrelations of buyer and related to purchase of imported goods should be considered as part of customs value. But the following conditions must be simultaneously satisfied to avoid inclusion of interest payments in customs value of goods:

(a) interest payments must be paid separately from price actually paid or payable for goods;

(b) financial relation should be stated in written form;

(с) if necessary buyer can confirm that:

- evaluated goods are actually sold at price, stated as price actually paid or payable,

and

- specified interest rate does not exceed level which would be formed for similar deals prevailing in the country and in the time when financial resources were provided".

The Committee also noted that considered decision should be applied independently of specific provider of financial resources as financing necessary for acquisition of goods: seller, bank or other physical or legal body. Besides, application of stated approach cannot be dependent of method of determination of customs value of goods.

Application of Decision 3.1 (Law of the Russian Federation "On customs tariff" dated 21.05.1993 G. # 5003-1) for countries – members of WTO are not obligatory. At that it should be noted that in case of goods acquisition within the frame of deal between related parties, then as a rule, fulfillment of conditions mentioned above in items (a) – (c) is not a problem. But in such situations one can talk about intentional / conscious “distribution” of price into a series of constituents, one of which is settlement of interest payments for borrowed resources provided to seller.

Example # 1 (The decision of the Board Eurasian economic Commission of 22.09.2015 G. # 118).

In accordance with sales contract entered between related parties, goods actual cost of which amounts to 53 750 monetary units.

But sum of 50 000 monetary units is specified in the invoice issue by seller to buyer.

At that there is a section in the sale contract in accordance with which a delay of payment for goods can be provided for up to 180 days proceeding from interest rate of 15 percent per annum.

Settlement is made by buyer in 180 days after delivery of goods to him. Real amount of payment taking the delay into account is 53 750 monetary units.

Data of the example considered above allow to pay attention to the following:

- in situations of this kind intentional "distribution of price" into constituents may occur: one of which is “positioned” as price of goods, specified in invoices, and the second — as interest payments for provided “delay".

- in a country, where the seller is registered level of interest rates essentially lower than a level, set in relation to interest rate, on which delay is provided. But practical proof of this fact by Customs bodies can be related with significant difficulties, including issues related with the fact that interest rates of country-exporter are not extended to bodies registered in other countries;

Because related parties are participants of foreign trade deal, it is difficult to determine was usage of delay by buyer his choice or a consequence of preliminary understanding between the parties that seller consciously admits to settlement in more late date, but at that obtain payment consistent to real price of goods, i.e. 53750 monetary units.

Other type of payments of interest, which may be used for minimization of customs value of goods are license payments and other similar payments (hereafter – royalties) for intellectual property assets in situations when it is necessary to include royalties into customs value of goods without revealing extra details.

It is expedient to note, that problematic, on its own, related to inclusion of royalties into customs value of goods is a rather complex set of issues which can be considered exclusively within the frames of independent investigations.

Hence, within the frames of current investigation, scientific treatment of the subject about inclusion of royalties into customs value of goods is carried out in relation to existing related parties, typical situations (schemes) of minimization of magnitude of customs value of goods, and does not pretend on fullness of details.

The scope of this paper can pay attention to the following/

In accordance with requirements of WTO, royalties should be included in customs value of goods in a case when royalties (Solution 3.1 the inclusion in the customs value of imported goods interest payments):

- relate to imported goods;

- are paid as conditions of sale of imported goods.

Because checking of these conditions in practice is related with essential methodological difficulties, parties of foreign trade deal can enter into complex license contracts, and it is difficult to come to unanimous conclusion about necessity of inclusion of royalty into customs value of goods or about absence of a necessity.

At that parties of foreign trade deal may proceed from the fact that in regard to typical situations used by them, royalty is not subject to inclusion in customs value of goods.

In this relation, to our opinion, the following typical situation is of interest.

Example # 2.

A foreign trade sale contract (perfumes and cosmetics) is made between two related parties.

There is an image on imported goods. This image in the form of designation which actually represents means of visualization of products of specific legal bodies, but it is not registered as trade mark

Besides, buyer of goods shall enter into a contract with third party which is also related to the seller. Subject of this contract usage of commercial designation.

At that buyer proceeds from the fact that because commercial designation serves for individualization of enterprise, i.e. of business as a whole, but not of separate goods, including imported goods, royalty, paid to right holder, does not relate to imported goods. Therefore, they do not subject in inclusion into customs value of such goods. (Note: Authors of this investigation pay attention to the fact that issue, concerning to appropriateness and economical justification of approach described in this example, according to which, royalty should not be included in customs value of goods in this case, was not considered at this stage of work).

Proceeding from this, the following situation may take place.

In accordance with sales contract entered into between related parties, goods actual cost of which amounts to 50,000 monetary units.

But sum of 50 000 monetary units is specified in the invoice issue by seller to buyer.

At that seller simultaneously with sale contract have entered into a contract with third party, which is also related with seller. Subject of this contract usage of commercial designation. At that presence of such a contract is mandatory condition of sale of goods to buyer. Cost of commercial designation is 1000 monetary units.

Therefore, amount of customs value of such goods is 50000 monetary units.

Considered models of minimization of customs value of goods within the frames of deals between related parties can have understatement, and in some cases (with regard to which low rates of customs duties are set) overstatement of real prices of imported goods occurs.

The Study was conducted in the framework of the research work, Financial University under the theme "Improvement of national regulations over transfer pricing".

Agreement on the application of article VII General agreement on tariffs and trade 1994. (n. d.). Date View September 17, 2017 https://www.wto.org/english/docs_e/legal_e/20-val.pdf

Artemyev A. A. and Baranowski, A. M., 2016. Terms of royalty inclusion into customs value of goods: theoretical and methodological aspects. Tax policy and practice 5: 64-69.

Customs Valuation and Transfer Pricing. (n. d.). Date View September 17, 2017 http://www.wcoomd.org/ru-ru/topics/valuation/activities-and-programmes/customs-valuation-and-transfer-pricing.aspx

General agreement on tariffs and trade 1994. (n. d.). Date View September 17, 2017 https://www.wto.org/english/docs_e/legal_e/06-gatt_e.htm

Law of the Russian Federation "On customs tariff" dated 21.05.1993 G. # 5003-1. Date View September 17, 2017 http://www.consultant.ru/document/cons_doc_LAW_1995/

Sidorova E.Y. 2015. Improvement the methods of tax regulation mechanism effectiveness assessment in the Russian Federation In Russian. The Economic Exchange-XXI, 11-12: 47-51

Sidorova E.Y. and Tixonova A.V. 2017. Assessment of the fiscal effect of the tax reform options until 2019. The Economic Exchange-XXI, 3-4: 45-49.

Solution 3.1 the inclusion in the customs value of imported goods interest payments. Date View September 17, 2017 https://www.wto.org/english/docs_e/legal_e/20-val_01_e.htm

The decision of Federal arbitration court of Volgo-Vyatsky district from may 28, 2014 case # A43-34050/2012. Date View September 17, 2017 http://base.garant.ru/39636353/

The decision of the Board Eurasian economic Commission of 22.09.2015 G. # 118 "About approval of Rules of accounting of interest payments in determining the customs value of goods". Date View September 17, 2017 https://www.alta.ru/tamdoc/15kr0118/

WCO guide to customs valuation and transfer pricing. (n. d.). Date View September 17, 2017 http://www.wcoomd.org/en/topics/key-issues/revenue-package/-/media/wco/public/global/pdf/topics/key-issues/revenue-package/15-_-wco-guide-to-customs-valuation-and-transfer-pricing-_-final_en.pdf

1. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49

2. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49, E-mail: ejsidorova@yandex.ru

3. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49

4. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49