Vol. 39 (Number 32) Year 2018 • Page 14

Juliya Sergeevna TSERTSEIL 1

Received: 08/06/2018 • Approved: 30/06/2018

ABSTRACT: The main prerequisites for the development of corporate management institution were a significant expansion of production activities of large companies in developed countries, entry into new markets and increased competition, which marked the process of internationalization and globalization of the world economy. For such an expansion, companies need additional financial resources, which they try to obtain by issuing shares or investing in securities of other companies at the initial stage of their development. |

RESUMEN: Los principales requisitos previos para el desarrollo de la institución de gestión empresarial son una expansión significativa de las actividades de producción de las grandes empresas en los países desarrollados, la entrada en nuevos mercados y una mayor competencia, que marcó el proceso de internacionalización y globalización de la economía mundial. Para tal expansión, las compañías necesitan recursos financieros adicionales, que tratan de obtener emitiendo acciones o invirtiendo en valores de otras compañías en la etapa inicial de su desarrollo. Palabras clave: gestión corporativa, capitalización de empresas, pagos de dividendos, partes interesadas financieras clave. |

To present a more comprehensive analysis of corporate strategy, one should first study the development aspects of corporate management institution, within which corporate strategy is being formed.

Currently, the modern market economic space is characterized by the presence of a corporate form of business, owned by a wide range of individuals and legal entities. The main prerequisites for the development of this process was a significant expansion of production activities of large companies in developed countries, entry into new markets as well as increased competition, which marked the process of internationalization and globalization of the world economy. For such an expansion, companies need additional financial resources, which they try to obtain by issuing shares or investing in securities of other companies at the initial stage of their development. Thus, corporations enter the stock markets and interact with external investors.

One of the manifestations of the globalization process of economic life was the enlargement of investment processes, which facilitated the movement of huge financial resources accumulated in developed countries within the world market. This led to an increase in competition for obtaining capital by companies from different countries. They began to focus on the requirements of investors, the main of which is the quality of corporate management. World practice has shown that effective corporate management makes it easier for companies to access capital markets, increases investor confidence in them and improves their competitiveness.

The effectiveness of corporate management directly affects the flow of external investment in the country’s economy. That is why the problem of corporate management is of special importance in Russia.

In a strategic sense, this means enhancing Russia's competitiveness in the global financial markets. Initially, in January 2002, amendments were made to Federal Law No. 208-FZ of December 31, 1995 "On Joint-Stock Companies". The Federal Financial Markets Service has taken the initiative to develop and implement a program to improve corporate management. One of the main elements of this program is the introduction of advanced corporate management principles into practice.

Currently, the Corporate Governance Department of the Ministry of Economic Development of the Russian Federation has been formed, which is its structural subdivision that performs the following functions.

Table 1

Structure of Corporate Governance Department of the Ministry

of Economic Development of the Russian Federation

Control function |

Coordinating function |

Executive function |

Legislative function |

Management function |

Monitoring of activities of the Federal Agency for State Property Management as regards activities of the commission and collegial bodies |

Organization and selection of legal entities for the promotion of privatized federal property and (or) the implementation of the seller’s functions on behalf of the Russian Federation |

Methodical and analytical support of the process of strategic planning of companies with state participation |

Improvement of law enforcement activities in the management of joint-stock companies, whose shares are in federal ownership, including the introduction of positive corporate management experience and the development of the Institute of Professional Directors |

Preparation and submission of a report to the Government of the Russian Federation on the results of the privatization of state and municipal property and the implementation of the forecast plan (program) for the privatization of federal property |

Preparation of proposals and control of the involvement of federal property in economic circulation on investment terms |

Preparation and submission of a report on the management of shares of joint-stock companies, which are in federal ownership |

Preparation and submission of a report on the management of shares of joint-stock companies, which are in federal ownership |

Improvement and development of proposals for the introduction of new mechanisms for the management of federal property, including as regards the dividend policy for joint-stock companies, whose shares are in federal ownership |

Providing preparation of proposals for forecasting federal budget revenues from the use and sale of federal property, monitoring of the federal budget implementation |

|

Formation of the position of the Russian Federation as a shareholder in the preparation of draft directives of the Government of the Russian Federation for participation in general meetings of shareholders and sessions of the boards of directors of joint-stock companies included in a special list |

|

Development of draft normative legal acts regulating property relations |

Preparation and submission of draft decisions by the President of the Russian Federation and the Government of the Russian Federation to the Government of the Russian Federation on introducing changes to the list of strategic enterprises and strategic joint-stock companies and other special lists of joint-stock companies |

Note. Compiled by the author based on the information posted on the website

of the Ministry of Economic Development of the Russian Federation.

Retrieved from http://economy.gov.ru/minec/about/structure/depcorp/index.

The introduction of corporate management into the practice of Russian enterprises contributes to their investment attractiveness both in Russian and foreign stock markets, as well as to the successful initial placement of shares of a number of large and medium-sized Russian companies.

Karim and Taqi (2013) review and study the corporate management system and elements of its structure as well as the processes of creating an effective system of corporate management, which is reflected in Table 2.

Table 2

Corporate management accountability process

Stakeholders |

|||||

Expectations |

Accountability |

||||

Policy level management |

Review performance |

Review decisions and actions |

Review Justification and excuses |

Consequential Decisions and actions |

Policy level management |

Executive level management |

Control and feedback Audit reports Management reports |

Resource availability Opportunities/threats Industry performance |

Responsiveness Compliance Transparency |

Rewards Punishments Sanctions Withdrawal of support |

Executive level management |

Functional level management |

Functional level management |

||||

Note. Retrieved from http://www.qurtuba.edu.pk/jms/default_files/JMS/7_1/JMS_January_June2013_59-73.pdf

Scientific schools represented by research and scientific institutions form models reflecting the essence and content of the corporate management system.

Table 3

The Corporate Mondragon Vision

A competitive, profitable and entrepreneurial cooperative group |

||||||

Value added employment and sustainable development within the community |

||||||

Intercooperation |

Innovation Promotion Knowledge |

Globalization |

||||

Principles and Values through a Management Model as a competitive advantage |

||||||

The sense of cooperative experience |

Corporate management model |

Basic cooperative principles |

Values |

Mission |

||

Note. Retrieved from http://www.mondragon-corporation.com/wp-content/themes/mondragon/docs/Corporate-Management-Model.pdf

Thus, the leading element of the company's value management system is its corporate strategy. This strategy is formed to maximize the company’s value. As part of strategic planning, the strategy identifies the direction of business and determines the ways to strengthen corporate competitive advantages, in particular of the joint activities of business units, and to overcome the shortcomings identified in the process of implementing this corporate strategy. In this connection, there is a need to develop a classification of corporate strategies that increase the effectiveness and operability of the process of their formation.

An inalienable tool for implementing the company’s corporate management mechanism is its dividend policy. Many authors study the processes of balancing dividend payouts and accumulation rates, which is reflected in Table 4.

Table 4

Factors that are important in the choice between dividends and repurchases as a payout mechanism

Factor |

Dominating payout form |

Taxes |

Depends |

Conveying information |

Depends on time horizon |

Management bonding |

Dividends |

Shareholder right |

Depends on other factors |

Investor preferences |

Depends on preferences |

Attracting monitors |

Depends on other factors |

Managing EPS |

Repurchases |

Changing capital structure |

Depends on other factors |

Residual policy |

Depends on other factors |

Note. Retrieved from http://faculty.london.edu/hservaes/Corporate%20Dividend%20Policy%20-%20Full%20Paper.pdf

The authors of the Report of Deutsche Bank (2006) have formed the factor model for determining the amount of dividend payments at the macrolevel on a scale going from 0 (Not Important) to 5 (Very Important) and identified the following factors:

- avoid cutting the dividend per share;

- maintain stable dividend per share;

- increase dividend per share;

- maintain stable dividend payout ratio;

- set dividend in line with cashflows;

- increase dividend payout ratio;

- increase dividend yield;

- maintain stable dividend yield.

Corporate strategy justifies the company's activities in several market segments, methods and tools for creating value as a result of merging individual enterprises within a single corporate structure, as well as the nature of the competition of each of them. Corporate strategy connects different divisions of the corporation into a single whole to ensure the maximum increase in its value. In particular, corporate strategy explains the advantages of diversification of companies operating within the same corporation. Therefore, the process of studying and implementing corporate strategies is an effective value management tool at the general corporate level, based on a multivariate scenario analysis and an assessment of the synergetic effect of corporate activities. This is due to the following reasons: firstly, the growth of competition makes many of the corporate strategies unpromising; secondly, the innovation process at the present stage of economic development is most effective when combining approaches from essentially different areas of science.

When developing a corporate strategy, one should take into account the competitive advantages provided by this strategy which will allow the enterprise to create its new value. The strategy should be chosen on the basis of the analysis of competitors, the market situation in general, and the available tangible and intangible assets and professional resources. Corporate strategy should contain the following elements of the value management system:

• Presence of essential assumptions about the future development of the company’s external and internal environment;

•Accounting for constraints on production factors such as labor, land, capital, information, entrepreneurial ability, including those determined by corporate social responsibility, as well as opportunities to mitigate these constraints;

• Identification of key value factors, including institutional factors;

• Identification, accounting and management of transaction costs;

• Definition of key areas of the company’s competence;

• Construction of a model for forecasting the dynamics of key value factors under different assumptions;

• Assessment of business value when choosing each strategy with regard to alternative costs;

• Comparative analysis of alternative scenarios with regard to risk.

The management quality rating is an assessment of the risk of loss of the company's owners, related to the company's management quality and the observance of the owners’ rights. The Standard & Poor's methodology for assessing corporate management quality is presented in Table 5.

Table 5

Corporate criteria framework

Country risk |

CICRA |

Business risk profile |

ANCHOR |

MODIFIERS |

STAND-ALONE CREDIT PROFILE |

GROUP or GOVERNMENT INFLUENCE |

ISSUER CREDIT RATING |

Industry risk |

Diversification / portfolio effect |

||||||

Competitive position |

Capital structure |

||||||

Cash flow |

Financial risk profile |

Financial policy |

|||||

liquidity |

|||||||

Leverage |

Management governance |

||||||

Comparable ratings analysis |

|||||||

Note. Retrieved from https://www.spratings.com/scenario-builder-portlet/pdfs/CorporateMethodology.pdf

To study the first group of CICRA risks, a scale is introduced for assessing the values from 1 to 6 and a matrix of risk values is constructed.

Table 6

Cash Flow / Leverage analysis ratios – standard volatility

Interval |

Core ratios |

Supplementary coverage ratios |

Supplementary payback ratios |

||||

FFO/debt, % |

Debt/EBITDA, (x) |

FFO/cash interest (x) |

EBITDA/interest (x) |

CFO/debt (%) |

FOCE/debt (%) |

DCF/debt (%) |

|

minimal |

60+ |

Less than 1.5 |

More than 13 |

More than 15 |

More than 50 |

40+ |

25+ |

modest |

45-60 |

1.5-2 |

9-13 |

10-15 |

35-50 |

25-40 |

15-25 |

intermediate |

30-45 |

2-3 |

6-9 |

6-10 |

25-35 |

15-25 |

10-15 |

significant |

20-30 |

3-4 |

4-6 |

3-6 |

15-25 |

10-15 |

5-10 |

aggressive |

12-20 |

4-5 |

2-4 |

2-3 |

10-15 |

5-10 |

2-5 |

Highly leveraged |

Less than 12 |

Greater than 5 |

Less than 2 |

Less than 2 |

Less than 10 |

Less than 5 |

Less than 2 |

------

Table 7

Cash Flow / Leverage analysis ratios – medial volatility

Interval |

Core ratios |

Supplementary coverage ratios |

Supplementary payback ratios |

||||

FFO/debt, % |

Debt/EBITDA, (x) |

FFO/cash interest (x) |

EBITDA/interest (x) |

CFO/debt (%) |

FOCE/debt (%) |

DCF/debt (%) |

|

minimal |

50+ |

Less than 1.75 |

10.5+ |

14+ |

40+ |

30+ |

18+ |

modest |

35-50 |

1.75-2.5 |

7.5-10.5 |

9-14 |

27.5-40 |

17.5-30 |

11-18 |

intermediate |

23-35 |

2.5-3.5 |

5-7.5 |

5-9 |

18.5-27.5 |

9.5-17.5 |

6.5-11 |

significant |

13-23 |

3.5-4.5 |

3-5 |

2.75-5 |

10.5-18.5 |

5-9.5 |

2.5-6.5 |

aggressive |

9-13 |

4.5-5.5 |

1.75-3 |

1.75-2.75 |

7-10.5 |

0-5 |

(11)-2.5 |

Highly leveraged |

Less than 9 |

Greater than 5.5 |

Less than 1.75 |

Less than 1.75 |

Less than 7 |

Less than 0 |

Less than (11) |

------

Table 8

Cash Flow / Leverage analysis ratios – low volatility

Interval |

Core ratios |

Supplementary coverage ratios |

Supplementary payback ratios |

||||

FFO/debt, % |

Debt/EBITDA, (x) |

FFO/cash interest (x) |

EBITDA/interest (x) |

CFO/debt (%) |

FOCE/debt (%) |

DCF/debt (%) |

|

minimal |

35+ |

Less than 2 |

More than 8 |

More than 13 |

More than 30 |

20+ |

11+ |

modest |

25-35 |

2-3 |

5-8 |

7-13 |

20-30 |

10-20 |

7-11 |

intermediate |

13-23 |

3-4 |

3-5 |

4-7 |

12-20 |

4-10 |

3-7 |

significant |

9-13 |

4-5 |

2-3 |

2.5-4 |

8-12 |

0-4 |

0-3 |

aggressive |

6-9 |

5-6 |

1.5-2 |

1.5-2.5 |

5-8 |

(10)-0 |

(20)-0 |

Highly leveraged |

Less than 6 |

Greater than 6 |

Less than 1.5 |

Less than 1.5 |

Less than 5 |

Less than (10) |

Less than (20) |

Definitions:

EBITDA – earnings before interest and tax, D&A

FFO – funds from operations

CFO – cash from operations

FOCF – free operating cash flow

DCF – discretionary cash flow

As can be seen, when determining the corporate management rating, the relative financial indicators of the company's economic activities are used.

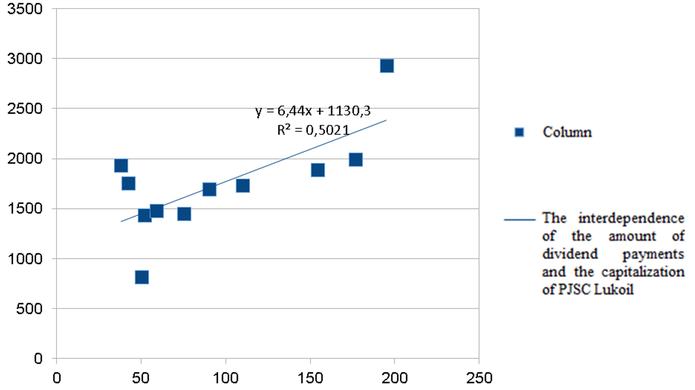

The author examines the relationship between dividend payments and the growth of the market value of the company's ordinary shares of PJSC Lukoil for a ten-year period (Table 7). Based on the data in Table 9, Figure 1 is constructed.

Table 9

The initial data on PJSC Lukoil for the period 2006-2016

Indicator |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

Amount of dividend payments per ordinary share, rubles |

38 |

42 |

50 |

52 |

59 |

75 |

90 |

110 |

154 |

177 |

195 |

Capitalization, billion rubles |

1941 |

1758 |

817 |

1440 |

1482 |

1448 |

1701 |

1735 |

1893 |

1995 |

2934 |

Period |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

-----

Figure 1

The relationship between the amount of dividend payments (x) and the market

capitalization of PJSC Lukoil (y) for the period 2006-2016. Note. Compiled by the author

based on the information posted on the official website of PJSC Lukoil

------

Table 10

General characteristics of the results of the financial

and economic activities of PJSC Lukoil for three periods

Indicator (by IFRS) |

3 Qtr 2017 |

2 Qtr 2017 |

1 Qtr 2017 |

4 Qtr 2016 |

3 Qtr 2016 |

2 Qtr 2016 |

1 Qtr 2016 |

4 Qtr 2015 |

3 Qtr 2015 |

2 Qtr 2015 |

1 Qtr 2015 |

Profit (million rubles) |

299263 |

201478 |

62684 |

207642 |

160767 |

105392 |

-11766 |

292745 |

153536.67 |

95112.61 |

40749.62 |

Revenue (million rubles) |

4274253 |

2790769 |

1431599 |

5227045 |

3826121 |

2516633 |

1177674 |

5749050 |

4948676.33 |

2848048.06 |

1355787.12 |

Profit (loss) |

351.84 |

236.88 |

73.7 |

244.12 |

189.01 |

123.91 |

-13.83 |

344.18 |

180.51 |

111.82 |

47.91 |

Price/earnings per share |

8.71 |

12.13 |

40.45 |

14.13 |

16.23 |

21.66 |

neg. |

6.82 |

12.43 |

22.09 |

56.46 |

Current liquidity ratio |

1.52 |

1.43 |

1.68 |

1.51 |

1.71 |

1.61 |

1.95 |

1.75 |

1.87 |

1.63 |

1.66 |

Financial leverage |

0.32 |

0.33 |

0.32 |

0.36 |

0.34 |

0.36 |

0.35 |

0.36 |

0.24 |

0.27 |

0.26 |

Return on equity (ROE),% |

8.68 |

6.02 |

1.92 |

6.43 |

4.92 |

3.28 |

- |

9.06 |

2.81 |

2.1 |

0.85 |

Return on assets (ROA), % |

5.95 |

4.06 |

1.3 |

4.14 |

3.23 |

2.09 |

- |

5.83 |

2.13 |

1.54 |

0.63 |

Price/earnings to growth (PEG) |

0.1 |

0.13 |

neg. |

neg. |

1.65 |

neg. |

1.52 |

neg. |

neg. |

neg. |

neg. |

Note. Retrieved from http://stocks.investfunds.ru

In the institutional economy, the key role in the management of corporate systems is played by institutions (Chapter 2, Organisational Stakeholders, Management, and Ethics). The implementation of the process of managing the company's value is a necessary condition for maximizing the well-being of shareholders, taking into account the limitations of corporate social responsibility. This condition is reflected in the company’s mission, which determines its strategic goal. Corporate strategy determines how the company can realize its strategic goal. At the same time, it is necessary to balance the interests of business owners, minority shareholders and hired managers, which is the cornerstone of corporate business strategy.

Unlike the traditional idea that corporate strategy should be based on the analysis of business unit strategies, the developed concept of value management in the post-industrial economy expands the possibilities of strategic corporate management. It should be noted that intellectual capital (intangible assets) is the central element of the value management system in the post-industrial economy, and its main component is human capital. This aspect of studying the process of value management brings to the forefront the knowledge and skills of the company’s employees and, most importantly, their ability to make effective managerial decisions.

The need for the use and the effectiveness of an institutional approach in the modern context stem from the growing influence of social factors on the economy, the central one being the human factor. In accordance with the theory of the firm developed by R. Coase, the firm should be viewed not as an indivisible subject, but at the level of its employees-individuals, i.e. at the level of making managerial decisions. At the same time, of particular relevance in corporate governance is the study and management of the development of the internal institutional environment. The success of many managerial decisions and initiatives depends on the preliminary preparation of the internal institutional environment, on the interaction of newly introduced institutions with existing ones, and on their subsequent "cultivation" within the framework of corporate culture. The development of intra-firm institutions is, therefore, the most important factor in value management.

Chapter 2. Organisational Stakeholders, Management, and Ethics. Available at: http://catalogue.pearsoned.ca/assets/hip/ca/hip_ca_pearsonhighered/samplechapter/0131245228.pdf

Information posted on the official website of the Ministry of Economic Development of the Russian Federation. Available at: http://economy.gov.ru/minec/about/structure/depcorp/index

Information posted on the website of the information resource Investfunds. Available at: http://investfunds.ru

Karim, N. & Taqi, S. M. (2013). The Importance of corporate management accountability. Journal of Managerial Sciences, 7(1): 59-73.

OECD (2014). Risk Management and Corporate Governance. OECD Publishing. Available at: http://www.oecd.org/daf/ca/risk-management-corporate-governance.pdf

RatingsDirect. Standard & Poor's Rating Services. Corporate Methodology. https://www.spratings.com/scenario-builder-portlet/pdfs/CorporateMethodology.pdf

Report of company. (2016). The annual report of PJSC Lukoil. Available at: http://www.lukoil.ru/FileSystem/PressCenter/121348.pdf

Report of Deutsche Bank. (2006). The Theory and Practice of Corporate Dividend and Share Repurchase Policy. Available at: http://faculty.london.edu/hservaes/Corporate%20Dividend%20Policy%20-%20Full%20Paper.pdf

Report of Mondragon. (2012). Corporate Management Model. Edited by Mondragon Corporation. 5th Edition. March, 2012. http://faculty.london.edu/hservaes/Corporate%20Dividend%20Policy%20-%20Full%20Paper.pdf http://www.mondragon-corporation.com/wp-content/themes/mondragon/docs/Corporate-Management-Model.pdf

1. Plekhanov Russian University of Economics, Moscow, Russia