Vol. 39 (Nº36) Year 2018. Page 10

Vol. 39 (Nº36) Year 2018. Page 10

N. V. AFANASIEVA 1; D.G. RODIONOV 2; Y.N. VASILEV 3

Received: 06/03/2018 • Approved: 11/04/2018

2. Problem Statement and Research Objectives

ABSTRACT: The article reveals the issues of improving assessment methods of coal enterprise competitiveness. Authors consider the definition of production and enterprise competitiveness in relation to mineral raw complex and in particular coal branch. We consider the fundamental factors of the price and non-price competition, conduct the analysis of terminology competition types. Seven criterias for coal enterprise competitiveness assessment were developed, including production, marketing, personnel, management, technology, ecology, sales efficiency. The proposed indicators of coal enterprise competitiveness assessment for complex estimation take into account various capacities of enterprise. The calculation method of the offered indicators system is described. The thoughtful discussion of proposed indicator system is performed. |

RESUMEN: El artículo revela los problemas de la mejora de los métodos de evaluación de la competitividad de la empresa del carbón. Los autores consideran la definición de producción y competitividad empresarial en relación con el complejo mineral en bruto y, en particular, con la rama del carbón. Consideramos que los factores fundamentales de la competencia de precio y no precio conducen el análisis de los tipos de competencia terminológica. Se desarrollaron siete criterios para la evaluación de la competitividad de la empresa del carbón, que incluyen producción, comercialización, personal, gestión, tecnología, ecología y eficiencia de ventas. Los indicadores propuestos de la evaluación de la competitividad de la empresa del carbón para la estimación compleja tienen en cuenta diversas capacidades de la empresa. Se describe el método de cálculo del sistema de indicadores ofrecidos. La discusión cuidadosa del sistema de indicadores propuesto se realiza. |

Currently the Russian Federation provides 10% of world production and 5% of world consumption of energy resources. Russia takes the third place in the world of producing primary energy resources. In spite of renewable energy sources development organic types of fuel form the basis of the national fuel balance. Among the organic types of fuel coal plays a significant role. The share of Russia in the international coal trade is about 11%. It is also on the third place in the world of its export volumes (Yanovskii, 2015).

The coal industry of the Russian Federation is one of the most important branches of fuel and energy complex which has been undergone radical changes for last 10 years. As a result of restructuring coal mining volume in Russia increased by more then 25% and it was 385,2 million t. in 2016 (Tarazanov, 2016). In the Russian Federation there are 22 coal basins and 129 separate coal fields.

According to the Long-term program of the national coal industry development for the period till 2030 approved by the order of the Government of the Russian Federation No. 1099-p of 21.06.2014 (further - the Program), one of the Program requirements for perspective development of the coal industry is transition from "simple" energy resource trade to hi-tech "power products" in the external and internal markets. It should provide (on the basis of deep coal processing) increasing efficiency of its final use and reduction of transport costs for consumers delivery.

For achieving the main objectives of the Program and eliminating threats of the national coal branch development the solution of the following major tasks is provided:

At the present moment there are some methods of competitiveness assessment. However this issue is not well studied in the coal industry. Currently there is no complex method of coal enterprise competitiveness assessment. The list of indicators recommended for measuring such assessment has not been developed yet.

The objective of the paper is to develop recommendations for forming a set of indicators on the basis of the analysis of the scientific works devoted to the problems of competitiveness assessment of the coal enterprise. Defining a set of indicators will allow to carry out more precise assessment.

The paper is primarily aimed at:

- to investigate theoretical and practical aspects of competition in Russian coal industry;

- to distinguish specific features of competitiveness in the coal industry;

- to analyze the indicators used for competitiveness assessment of coal enterprise;

- to propose a set of indicators for complex assessment of coal enterprise competitiveness.

2.1. Literature Review

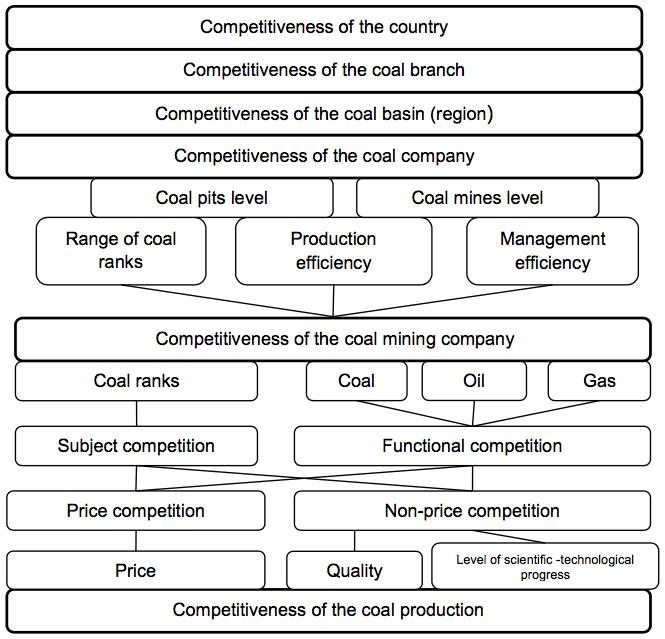

Fig. 1

Interconnection of competitiveness levels

However we can agree with T.V. Ponomarenko's opinion (Ponomarenko, 2011) that among subjects of the competition there is a new type which should be taken into account for distinguishing levels of competitiveness. It is a territorial industrial technological cluster.

As shows Fig. 1 the main problem is to define a competitiveness degree of coal-mining company. The solution of this task requires consideration of such issues as the price and quality of coal, level and characteristics of the competition in the market.

Within this research it is a good reason for considering the definition of production and enterprise competitiveness in relation to mineral raw complex and in particular coal branch. In the scientific literature devoted to competitiveness issues there is a great number of competitiveness definitions of these categories. Here are provided the best definitions from the point of view of the research object.

Competitiveness of goods is the ability of goods determined by set of its characteristics considered by a consumer to make a comparison with similar goods of other producers in the competitive market and be on sale in this regard at the prices not below average market (Ponomarenko, 2011).

Coal competitiveness is ability of coal production to be distiguished from other types of fuel and energy resources and coal competitors on the basis of qualitative and cost characteristics set (Mesyats, 2006).

Competitiveness of the company is the ability under certain external conditions to provide (support, increase) competitive advantages in comparison with other organizations operating in this market (Nevskaya et al., 2008).

Coal enterprise competitiveness is a producer's possibility of offering coal raw materials to meet such consumer's requirements as qualitative characteristics, quantity, the most favorable terms of delivery including the price and execution periods (Mesyats, 2006).

Besides the levels of competitiveness (Fig. 1) all types of assessment should be taken into consideration for forming methods of competitiveness (Tab. 1).

Table 1

The main distinctions between assessment of different

types of competitiveness potential (Ponomarenko, 2011)

Type of competitiveness potential |

Assessment time |

Assessment basis |

Information sources |

Cumulating potential |

Year |

Indicators of estimated company in the basis year |

accounting, financial and managerial information |

Dynamic competitiveness |

Period |

Company indicators of estimated brunch (sub-brunch) for the period of 3-5 years |

reference analysis, planning and forecasting, financial accounting data |

Strategic horizon of competitiveness |

Time horizon |

Company indicators of estimated brunch (sub-brunch) for the period of 5-15 years |

reference analysis, planning and forecasting, strategic accounting and reporting |

The assessment of the operating, dynamic potential depending on company abilities to use resources effectively and influence of external conditions and reaction of the company has to be provided for effective management of competitiveness.

The methodology of dynamic competitiveness assessment assumes a number of stages:

The balanced system of indicators (BSI) developed by R. Kaplan and D. Norton (Kaplan et al., 2006) is only possibly to use for strategic management of mining companies. According to this system control of strategic activity is carried out by the key performance indicators. Key Perfomance Indicators (KPI) are divided into four groups: finance; consumers; internal operational efficiency; training and development.

However, it is emphasized (Ponomarenko et. al., 2013) that such group division is not enough for the mineral resource companies. The traditional model should also contain such divisions as reproduction, interaction with environment and ecological.

Specialists of coal industry offer to use the following number of indicators for determination competitiveness level of coal mining company (Mesyats, 2006):

1. A share of the exported production in overall production output and sales revenue.

2. An export share of coal company in the total amount of export (production) of the region (country).

3. A range of coal production.

4. Quality production (conformity of qualitative characteristics to the contract parameters).

5. Price

6. Sales volumes.

7. Profit share of export.

In our opinion, it is necessary to expand the volume of these indicators significantly. For providing complex assessment of coal company competitiveness should be taken into consideration the indicators reflecting other aspects of enterprise activity.

The list of criteria, parameters and indicators of competitiveness assessment of mining companies was used to meet the target (Ponomarenko, 2011). There are 13 indicators divided into six groups (assessment criteria) in this list:

1. Production (indicators: a range of coal production; integrated quality indicator; output profitability).

2. Marketing (indicators: sales revenue; long-term contracts).

3. Personnel: (indicators: average professional qualification; rate of personnel turnover; labor capacity).

4. Management (indicator: production profitability).

5. Technology (indicators: depreciation coefficient; coefficient of renewal; retirement rate; a share of implemented research and development activities in total amount).

6. Sales efficiency (indicator: market share).

The traditional structure of the balanced indicators system has to be taken into consideration for defining a set of indicators and their group division. Although it requires to be modified. It has to be done due to the specific factors mentioned above influencing on mining companies activity.

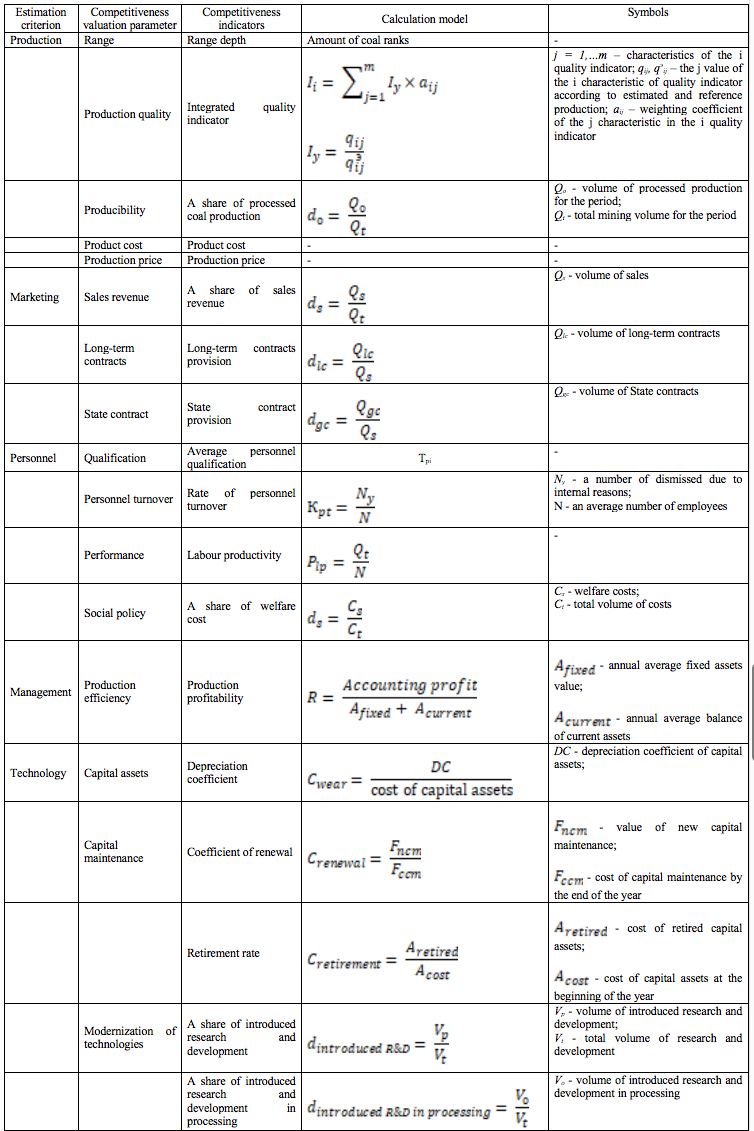

The following indicators divided into groups are proposed to use for coal enterprise competitiveness assessment.

3.1.1. Range. The indicators of quantity estimation are the following: width, depth, stability, range structure. The range indicators of coal enterprise are defined by extent of production processing, a variety of coal ranks, and also the ways of their use. Currently a product range of coal enterprise is firstly defined by mining and geological features of coal enterprise placement.

3.1.2. Production quality. This indicator is to be estimated by calculation of an integrated indicator of production quality. The calculation methods and application features of this indicator are considered before (Vasilev, 2015).

3.1.3. Producibility (a share of coal processing production of enterprise to total production). One of the main tasks within improving competitiveness of Russian coal branch is not only increasing volumes of coal mining. It also aims at coal conversion into product with high added value. Besides the traditional ways of coal quality improvement (reduction of ash content, humidity, sulfur content), currently various ways of non-fuel use of coal are being developed: fertilizer manufacturing, bitumen production, motor fuels, etc. (Romanov, 2010).

3.1.4. Product cost. The importance of this indicator for estimating enterprise production competitiveness is caused by importance of decreasing coal production cost. Sapozhnikova (2010) stresses a growth of coal mining product cost in the largest companies of Kuzbass during the period 2002-2011. It is explained by loss of controllability of the coal enterprises.

3.1.5. Production price in the market. In case for providing competitiveness assessment of the enterprise operating in several markets (segments), it has to be carried out by the indicator "the average price". Coal enterprise competitiveness depends on coal branch competitiveness which is mainly caused by existence of favorable price environment. Currently the main coal competitor is gas both in the internal and external markets. The functional competition as a factor of coal production competitiveness can be obvious only when the ratio of coal and gas prices reaches level 1:2 (Tonkikh, 2010; Yanovskii, 2015). Otherwise, coal fuel can not be competitive to gas. Besides, coal prices reduction is the reason for demand-side recession and coal mining decrease in Russia in 2013. Thus the indicator is also an indicator of coal branch competitiveness assessment in general.

3.2.1. A share of sales revenue in the total amount of production. This indicator is one of the main reflecting efficiency of enterprise sales and marketing activities.

3.2.2. Long-term contracts. Despite tendencies of developing spot and stock exchange transactions in coal trade (Molchanov, 2010, p. 1; Plakitkin et al., 2015; Pakhomova and Rikhter 2009), signing long-term contracts guarantees stable sales volumes for a long period of time. Transition to long-term contracts of coal supply for electric power, housing and communal services and metallurgy is one of the events promoting development of the internal and external coal markets.

3.2.3. State delivery contracts. The state contract is a kind of urgent contract signed for a year and longer period. Winning a tender of delivering large coal volumes for state and municipal needs actually means formation of a long-term sales production market. In many cases state contracting is one of the ways of coal-mining enterprise crisis recovery.

3.1. Qualification (Average personnel qualification).

3.2. Personnel turnover (rate of personnel turnover).

3.3. Performance (labor productivity).

3.4. Social policy (a share of welfare cost in total amount of personnel expenses). This indicator is a key one for meeting the targets of the Long-term program of Russian coal industry development.

4.1. Production efficiency (Production profitability).

3.5.1. Capital assets (depreciation coefficient).

3.5.2. Capital maintenance (coefficient of renewal and retirement rate).

3.5.3. Modernization of technologies (a ratio of volume of introduced research and development to the total amount of research and development). It is worthy of note that it refers to both coal mining methods and coal dressing. The problem of getting 60% share of dressed coal by the year of 2030 requires investments into modernization of coal processing plants (Linev et al., 2012).

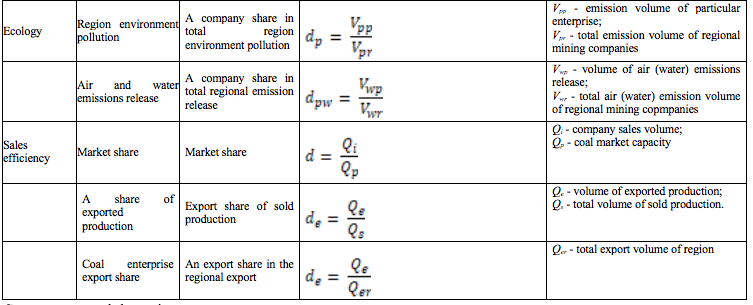

3.6.1. Region environment pollution. The indicator for this parameter is a company share in total region emission release.

3.6.2. Air and water emissions release (a company share in total region pollution).

3.7.1. Market share.

3.7.2. A share of the exported production in the total amount of sales.

3.7.3. The importance of this indicators analysis is determined by importance of foreign market for Russian coal-mining enterprises. Over the last 5 years the Russian coal export has been increased by 40%. Coal supply expansion in western and eastern directions is one of priorities for large Russian coal companies (Yanovskii, 2015).

The calculation ways of the given indicators are specified in tab. 2.

Table 2

Indicators of coal enterprise competitiveness assessment

Source: own elaboration

The main results of the investigation delivered in the reports at the following international conferences:

- II International Scientific seminar "Management, Economics, Ethics, Technics", 4th of March 2016, organized by Faculty of Organization and Management at the Silesian University of Technology, Zabrze, Poland;

- 16th International multidisciplinary scientific geoconference SGEM 2016. Ecology, economics, education and legislation. 30 June – 6 July, 2016. – Albena, Bulgaria.

The results presented in the article are applied as practical material for advanced training courses: "Technology optimization of coal rake open-pit mining" and "Progressive technologies and legal aspects of coal rake open-pit mining" in Saint-Petersburg Mining University.

Some proposed indicators can be not applicable in domestic market (in particular, indicators 7.2 and 7.3). The others can be not applied for competitiveness assessment in a foreign market (for example, financial results due to incomparability of accounting standard methods).

Thus methods of defining coal enterprise can be variable not only on different levels but it has many ways of assessment for each level.

For dynamic competitiveness assessment of coal enterprise it is necessary to calculate indicators by the offered formulas. It should be taken into account that indicators are recommended to be calculated in dynamics for the period of time 3-5 years. After the proposed indicators calculation the analysis is made in the following ways:

1. Comparison of the received indicator value with requirements of the industry standard or other documents.

2. Comparison of the received indicator value of the given enterprise with similar indicator value of the enterprise-competitor.

3. Dynamic row formation and its analysis. Thus the dynamic row analysis can be carried out in several ways. In particular, for obtaining dynamic competitiveness value the indicator value of estimated enterprise in report year should be divided by the indicator value of enterprise-competitor in reference year. Such analysis allows to review growth rates (decrease) of indicators in comparison with the corresponding indicators of the rival company.

Thus several years data of two leading branch enterprises should be considered for dynamic competitiveness assessment.

It should be noted that development of integrated indicator is impracticable. As a consequence, a special indicator which calculation requires special knowledge in the field of the higher mathematics and software application can be received. On the other hand, the received indicator will not give a chance to provide appropriate analysis. In general its value can be equal to planned (expected) value. However for having the best assessment it will be necessary to carry out the analysis of all indicators separately.

The analysis of methods of enterprise competitiveness assessment proves the necessity of making choice and justification of indicators for such assessment. Mining companies have some peculiarities defining specification of competitiveness indicators. Coal enterprise is distinguished from mining companies thus it causes to use a separate approach for its efficiency and competitiveness assessment.

Currently there are no complex indicators system of coal enterprise competitiveness assessment in the Russian Federation. The paper presents the system of indicators of coal enterprise competitiveness assessment of the Russian Federation and their calculation methods.

All up-to-date tendencies of developing Russian coal industry were considered for developing system of indicators. We recommend to apply marketing and environmental indicators as well as social policy ones. Currently particularly practical is to use the indicator called "share of introduced research and development in processing".

However it is worthy of note that this system is not universal for any coal enterprise. Competitiveness level and coal market segment should be taken into consideration for studying competitiveness of coal-mining enterprise. It requires to consider distinctions of competitiveness determination not only for the external and internal markets but also for various segments of domestic market. Coal production is to have various quality gradation for each segment. So enterprise has to develop various competitive advantages and competitive strategies.

This article was prepared with support from the Ministry of Science and Education of the Russian Federation (project No. 26.6446.2017/БЧ).

Aleshinsky R.E., 2007, New energetical companies on Russian coal markets. Мoscow: IC MEI

Davydov M.V., 2011, Reformed coal – stable and reliable resource of Russian electric power industry. Coal 9, 54-56

Embulaev V.N., Tonkih A.I., 2010, Coal enterprise management development to increase its competitiveness. Vladivostok: Dal'nauka

Glinina O., 2011, Energy efficiency and clean coal technologies. Coal 1, 33-39

Islamov S.R., 2012, Low-rank coal conversion into high-energy fuel. Coal 3, 64-66

Kaplan R.S., Norton D.P., 2014, The Balanced Scorecard: Translating Strategy into Action. Moscow: Olimp-Business

Krasnianskii G.L., Zaidenvarg V.E., Kovalchhuk A.B., Skryl A.I., 2010, Coal in Russian economy. Мoscow: Economika

Laktionov-Mandelstam E.A., 2012, Technical regulation system development of coal quality for increasing their competitiveness in the market. The MGGU Scientific Bulletin 9, 46-50

Linev B.I., Rubinshtein Y.B., Davydov M.V., Sazykin G.P., 2012, Rationalization of the coal preparation plant in Russia. Mining Journal 8, 8-14

Mesyats М.А., 2006, Enterprise foreign trade activity management (evidence from Kemerovo region coal industry). Kemerovo: Kuzbassvuzizdat

Molchanov O.Y., 2010, Current trends of the world coal market development. The Mining information and analytical bulletin 1, 36-43

Molchanov O.Y., 2010, Methodical aspects of the international competition in the coal market. The Mining information and analytical bulletin 2, 93-99

Nevskaya М.А., Ponomarenko T.V., Sultani А.N., 2008, Potash industry enterprises competitiveness potential assessment. Proceedings of the Mining Institute 179, 161-168

Pakhomova N.V., Rikhter К.К., 2009, Sectorial markets economy and state policy. Moscow: Economics

Plakitkin Y.А., Plakitkina L.S., Dyachenko К.I., 2015, Formation of the coal prices: the native and the world practice. Coal 1, 52-55.

Ponomarenko T.V., 2011, Strategic assessment methodology of mining companies competitiveness. Saint-Petersburg: The Polytechnical University publishing house

Ponomarenko T.V., Akinina I.A., Uvazhaev A.N., Battalova A.A., 2013, Key performance indicators of the balanced scorecard in strategic management of mining companies. Proceedings of the Mining Institute 201, 219-227

Romanov V.А., Tsvetkova S.N., Kretinina T.V., 2010, Postdepressed coal region: problems and perspectives of public-private partnership. Shakhty: GOU VPO «YRGUES»

Sapozhnikova L.Y., 2012, The crisis and the Kuzbass' coal competitiveness. The Mining information and analytical bulletin 10, 324-331

Tarazanov I., 2016, Results of coal industry work in 2015 year. Coal 3, 58-72

Tonkikh А.I., 2010, The role of state regulation in the Dalnii Vostok coal industry competitiveness rising. The Mining information and analytical bulletin 1, 360-364

Vasilev Y., 2015, Determination of coal production competitiveness of the Russian Federation. Economic, social and civilization challenges in the age of globalization 81, 13-23

Yanovskii А., 2015, About the problems, perspectives and tasks of coal industry. Coal 3, 9-11.

1. Laboratory of Complex Research of Regional Spatial Development Institute for Regional Studies of Russian Academy of Science, Russian Federation, Saint- Petersburg, Serpukchovskaya street 38, E-mail: afnv@bk.ru

2. Peter the Great Saint-Petersburg Polytechnic University, Russian Federation, Saint- Petersburg, Polytechnicheskaya, 29, E-mail: drodionov@spbstu.ru

3. Saint-Petersburg Mining University, Russian Federation, Saint-Petersburg, 21 line V.О., 2, E-mail: yur_vas@mail.ru