Vol. 40 (Number 28) Year 2019. Page 12

PAVLOV, Pavel V. 1; MAKAROVA, Elena L. 2 & BAKALARCZYK, Sebastian M. 3

Received: 29/04/2019 • Approved: 15/08/2019 • Published 26/08/2019

ABSTRACT: The paper aims at defining the place of free economic zones in international trade, at identifying benefits from their use in the country and the conceptual justification of the need to apply their features into world practice with a view to achieve competitive advantages and to enable integration into the system of global economic ties. The author's hypothesis is that free economic zones are used in the regional and world practice as a pilot model for the introduction of new economic, financial, administrative tools and methods of management. In case of successful approbation of these models and tools, this experience can be transferred to the entire economy of the country, as well as regional economy. This article deals with the exploring of free economic zones in world practice operation, researching their Russian & Polish analogues – special economic zones; studying different types of special economic zones and evaluating their efficiency. |

RESUMEN: El artículo busca definir el lugar de las zonas de libre comercio en el ámbito internacional, identificar sus beneficios de en el país y la justificación conceptual de la necesidad para aplicar las características del régimen de zonas económicas libres en el mundo, con mira a lograr ventajas competitivas y permitir la integración de los países en el sistema de vínculos económicos mundiales. La hipótesis del autor es que las zonas de libre comercio se utilizan en la práctica regional y mundial como modelo piloto para la introducir nuevas herramientas económicas, financieras, administrativas y métodos de gestión. En caso de una aprobación exitosa de estos modelos y herramientas, esta experiencia se puede transferir no solo a toda economía del país, si no como a la economía regional. Este artículo trata sobre la exploración de zonas económicas libres en operaciones de práctica mundial, investigando sus análogos ruso y polaco - zonas económicas especiales; Estudiando diferentes tipos de zonas económicas especiales y evaluando su eficiencia. |

The development of international trade and international division of labor process is now becoming particularly relevant in view of the expansion of globalization processes in all spheres of economic activity. The apparent growth of international trade is characterized by the following milestones: at the beginning of the 19th century the world exports amounted 12% of the world's national product, in the 50's of 20th century it reached about 7% of the world production, and at the beginning of the 21st century, according to some estimates it is already 17%-20% (Held, 2004). At present, the application of preferential international trade modes, which are provided by the free economic zone (FEZ) concept, plays a special role in considering the expansion of foreign economic activity. In Russia, this term is also supplemented by its national interpretation – a special economic zone (SEZ) concept with special conditions of functioning. First of all, it is necessary to find out whether the concepts of the free economic zones used in the world economy and the special economic zones used in Russia are the same categories or we are talking about two different economic models, one of which is used in connection with the investment, and the other is referred to trade activities.

In accordance to International Convention (Bruxelles, 1999) for the simplification and harmonization of Customs Procedures free economic zone means a part of the state territory where the goods are placed and considered from the point of view of levying import customs duties and taxes as being outside the customs territory and not subject to normal customs control. Foreign practice of such economic zones development indicates that a unified approach to their designation has not been formed so far. From the variety of economic zones’ names occurring in foreign countries, we can, with a certain degree of conventionality, identify the following:

• free economic zones, the development of which is aimed primarily at attracting foreign investment for the socio-economic development of the region;

• special economic zones, the main purpose of which is to attract investments into the economy of the region in general, regardless of whether these investments are internal or external. Current paper aims to define the place of special economic zone in international trade, to identify the benefits from the use of the special economic zones’ mode in the country and the conceptual justification of the need to apply the features of the special economic zones’ mode into world practice with a view to achieving competitive advantages and enabling the integration of countries into the system of global economic ties.

The goals set by the states implementation with free economic zones are not homogeneous. Some states try to solve specific problems of regions, associated with unemployment elimination, low level of socioeconomic development, protection of interests for both producers and consumers. In others, free economic zones are used as a public interest, integral economic mechanism, effective sources of accumulating and disseminating for advanced foreign economic experience and management, increasing competitiveness of domestic production.

The investment capital considers the organization of domestic production in free economic zones as a crucial direction of its expansion, because the privileges granted in free economic zones allow it to receive higher profit. The average rate of profit in free economic zones is 25%-30%, and in Asian free economic zones it is more than 35%-40%. The payback period of capital investments in zones is 2-3 times shorter than in regular economic practice. It is considered normal when the invested funds pay off after 3-3.5 years. In many developing countries, 30% to 80% of all foreign investments enter their economy through free economic zones (Zimenkov, 2005).

Current world practice analysis of free economic zones application shows the obvious interest of foreign countries for creation and operation of free economic zones on their territories. According to the United Nations Industrial Development Organization (UNIDO), currently 120 countries around the world open about 3,000 free economic zones.Export products amount ranges in about 600 billion USD and up to 50 million people are employed. Thus, the calculation of the products export per worker in the zone is about 12,000 USD annually (Zdanov , 2011). The existence of thousands free economic zones of different types in the world with the established traditional system of general preferences (duty-free import of goods and services, exemption from taxes payment, indirect subsidies in the form of provision of infrastructured territory allocation for the participants of the zone, etc.), as well as the number of differentiated special privileges in the countries shows rather tough competition in the investment market for their attraction. The key factor of the race for expanding preferences or additional benefits introduction is the efficiency (recovery rate) of the host country's infrastructure investments and work places arrangement. Initial capital investments of free economic zones are 5,000 USD per workplace, standard-type zones employ about 10,000 workers, i.e: only at the initial stage of the free economic zone is required to invest 50 million USD totally (Danko & Okrut, 1998).

In the Russian Federation the importance for the understanding of the special economic zones and their role in the modern world belongs to the researchers of: «development of special economic zones» (Bublik & Gubareva, 2016), «functioning problems and development prospects of special economic zones» (Chepinoga and others, 2017), «failures, problems and prospects of special economic zones», (Inshakov & Kryukova, 2015), «analysis of the system of preferences and exemptions» (Redko, 2012), «analysis of the regional economic system of the type special economic zone» (Sukharev & Ilyina, 2012), «features of economic zones’ regulation» (Zhukovskaya, and others, 2016).

Starting from the beginning, the approach development of free economic zones and the evaluation of previously committed errors led to the decision to create on the territory of the Russian Federation, starting on July 22, 2005, the FEZ international institution variety, adapted to the domestic reality - special economic zones, which specifics include the provision of special territorial status and conditions for business activities established by the Russian legislation (Federal Law #116, 2005, July 22). In Russia, there are four different types of zones:

1) Industrial-production type zone;

2) Technological-innovative type zone;

3) Tourist-recreational type zone;

4) Port type zone.

The special economic zones classification is carried out in the first place, in accordance with activity types investors can perform in the zone.

Technological-innovative zones are designed for scientific activity products development and implementation to stimulate the innovation process with limited public funds involvement, effective use of all financial, material, scientific, natural, information, and other resources to strengthen scientific and technological potential of national economy and development of high-tech industries.

Industrial-production zones are designed to manufacture high-quality products in order to saturate the domestic consumer market and produce merchandise that can compete in the global market.

Tourist-recreational zones are created to enhance the competitiveness of tourism and other activities in the tourism sector, the development of health resorts and activities for the organizations of treatment and prevention of diseases, the development and use of natural medical resources.

The purpose of Port zones development is to attract investments for the construction and modernization of infrastructure facilities at the seaport, river port, and airport (Pavlov, 2006). The special economic zone is created for 49 years only, and this term is not subject to extension. For the opening and operation of the special economic zone, it is necessary to have certain development plans for each of the zones.

The special economic zone is created for 49 years only, and this term is not subject to extension. For the opening and operation of the special economic zone, it is necessary to have certain development plans for each of the zones.

In Russia there are 22 special economic zones: 9 industrial-production, 6 technological-innovative, 6 tourist-recreational and 1 port zone.

Each special economic zone is endowed with a special legal status, which gives special economic zone investors a number of tax privileges and customs preferences, as well as guarantees access to engineering, transportation, and business infrastructure. The costs of investors during project development in the special economic zone are on average 30% lower than in the Russian Federation. In special economic zones comfortable conditions for business development, implementation of investment projects, and the creation of new industrial and high-tech products are performed.

In Poland, special economic zones are considered as one of the important instruments for carrying out regional special economic zones policies. The main goal of their creation is the activation of economic life in depressed regions with a high level of unemployment Development of special economic zones was an experiment «to maintain employment structures outside the major cities» (Jensen, 2018), «to boost investment attractiveness in particular regions» (Ambroziak & Hartwell, 2018) and «stimulate economic growth in the region» (Pastusiak and others, 2018). However, at the time of the adoption of the Polish law on special economic zones (Legal Act October 20, 1994), it has largely become obsolete due to a change in the European Union's policy in this area, since the European Commission waged a large-scale struggle against individual and regional benefits that impede normal development competition. As a result of negotiations with the EU, Polish parliament was forced to reduce preferences for taxation of economic entities operating in special economic zones. A law was adopted (on November 16, 2000) amending the law on special economic zones, which was adopted on January 1, 2001.

A special economic zone is a specially designated zone with an established auxiliary infrastructure in which economic activity is conducted on preferential terms (exemption from payment of income tax).

To become a resident of a special economic zone, an investor must receive a special permit issued by the management of a special economic zone. With the permit for conducting business activity within the special economic zone, the investor must provide an overview of the investment, the expected level of employment, the business start date and for fulfilling deadlines, all of its obligations are listed in the permit, which usually operates until the end of the existence of a special economic zone.

At the end of the year 2017, there are 14 special economic zones in Poland, most of which have their own separate subzones. The total area of all zones today is about 12 thousand hectares, while the territory occupied by all special zones in the country cannot exceed 20 thousand hectares. If the entrepreneur has an interest in another localization of his investment project, outside the territory of the special economic zone, under certain conditions it is possible to include this place in its composition. As follows there is a list of zones’ names: Kamiennogorska, Katowicka, Krakow Technological Park, Kostrzynsko-Slubicka, Legnica, Lodz, Euro-park Mielec, Pomeranian, Slupska, Starachowicka, Suwalska, Tarnobrzeska, Warmia-Mazury, Walbrzych (Gossmi.ru, n.d.). Conditions for doing business within the special economic zone are:

• the volume of investments should exceed 100,000 EUR, while the share of the entrepreneur's own capital cannot be less than 25%;

• investments should be mastered for at least five years, counting from the project completion date (three years for small and medium-sized enterprises);

• workplaces at newly created facilities should be maintained for at least five years beginning from the date of employment (three years for small and medium-sized enterprises).

When we are talking about advantages offered in the special economic zones, first of all we pointed out the tax and customs privileges. However, these incentives of attractiveness for investors are only in the third or fourth place. The model of special economic zones consists of four major blocks.

The first block for potential investors is the development of an infrastructure at the expense of the state funds – roads, communications, energy supply, and buildings. In Russia, the special economic zones development is based on a public-private partnership consisting of joint investment of budget funds and private investment for the development of a particular territory. The state is responsible for the construction of infrastructure, and private business – for commercial facilities. In addition, near the special economic zones territory social infrastructure is being created: housing, kindergartens, schools – everything necessary for the life and work of resident specialists. Financing from the federal budget to create internal infrastructure is carried out through the authorized capital of JSC «Special Economic Zones», which was established in spring of year 2006 and 100% of shares of which belongs to the Russian Federation. JSC «SEZ» is the client and the developer of the zones’ objects. The construction of engineering infrastructure is also invested by the regions.

The second block of positive factors is related to the mode of friendly administration, that is, a real decrease of administrative barriers and the number of restrictive measures. The rights of a resident in the sphere of economic activity are always limited by the burden of fulfilling obligations due to his participation in the implementation of the special economic zone. The resident is obliged to provide the state control bodies with access to their real-estate objects, and provide them with the proper information, fulfill other requirements conditioned by the control. Specificity of the administrative mode operating on the special economic zones’ territory consists, first of all, of special procedure protocol for carrying out activities by state control bodies on the special economic zones territory. Measures for control, with the exception of tax and customs, are carried out by the state control (supervision) authorities in the form of planned comprehensive inspections, with the management agreement of special economic zones. In special economic zones, there is a clear support for project management, up to the fact that the administration must have a lawyer, a notary, representatives of pension and medical funds, tax service, insurance and all kinds of other specialists for «one-stop-shop» operations for all activities complex, connected with property rights, obtaining various building permits, settling migration issues, etc. The peculiarity of the legal mode for entrepreneurial activity on the special economic zones territory is manifested with special guarantees that the legislator grants to residents of the special economic zones. From the point of fiscal policy view, the state loses the amount of these benefits to the government budget. But on the other hand, the creation of joint ventures on the Russian Federation territory allows to attract investments into the domestic economy, provide employment to Russian citizens, and improve the political climate of the country and the quality of products.

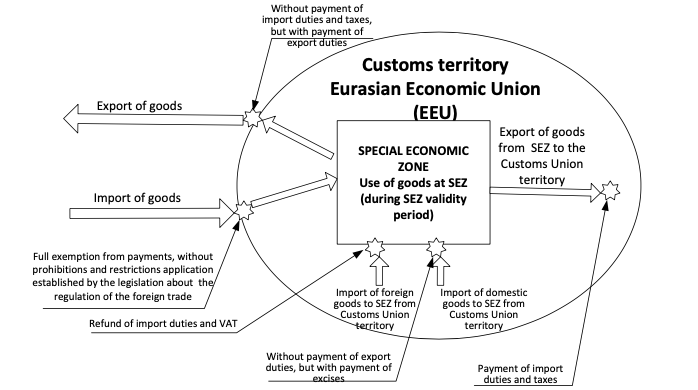

The third block is free custom zone mode (Figure 1), which is a good incentive for the high-tech equipment import. This mode assumes that all raw materials and technological components will be imported into the zone and exported beyond the territory of the Eurasian Economic Union of Russia, Belarus, Kazakhstan, Kyrgyzstan, and Armenia (hereinafter referred to as «Eurasian Economic Union») without paying VAT and customs duties. For import-dependent industries with a long production period this is a good investment opportunity (Pavlov, 2010).

Figure 1

The model of free custom zone mode, used in special economic zone*

* Authors’ own elaboration

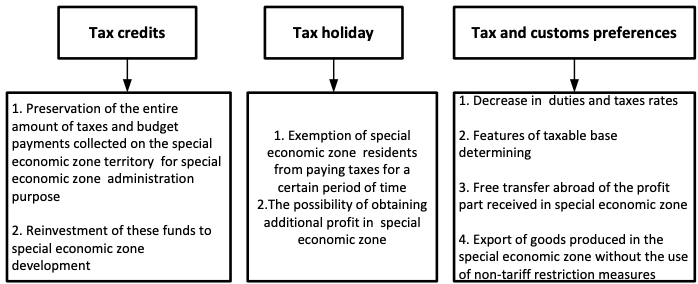

Finally, the fourth block is tax preferences granting in the world practice: exemption from land and property taxes, income tax benefits, are exercised by regional and local laws passed by regional and local legislative assemblies (Figure 2). All these factors give a unique synergy of entrepreneurial potential in special zones, «a direct link between the existence of tax benefits and other forms of the state support provided in a territory with a special tax mode, and the attraction of investors to the region» (Kashina, 2016).

Figure 2

Tax preferences in special economic zone*

* Authors’ own elaboration

In order to increase the effectiveness of the special economic zones for the last 2-3 years, a number of measures have been taken to approve:

Taking into account the established practice of special economic zone, a new mechanism for special economic zones setting up is also being applied, based on clear criteria approved by the Government of the country (Russian Federation), without conducting competitive procedures. In order to ensure the comprehensive development of special economic zone projects, the powers of the Russian Federation Government to unite special economic zones of one or several types into a cluster have been legislatively established.

The main benefits for investors of the Polish free economic zones are full exemption from payment of taxes for a period equal to half the period specified as the period of validity of the zone; tax allowance in 50% during the second period; simplified procedures for the sale of property and entry into the rights of heritage; exemption for 10 years from payment of property tax (AML Consulting, n.d.).

The guaranteed tax privilege in the form of exemption from income tax from legal entities (CIT) should be fully used by the investor before the end of the existence of this economic zone (currently until 2020), but it cannot exceed the established limit on the part of local authorities. Exemption from the payment of CIT is granted only in respect of profits derived from activities carried out within the framework of this zone (see Table 1).

Table 1

Comparative conditions for business organization in

special economic modes of individual countries*

Poland |

Russian Federation |

Exemption of legal entities from payment of corporate income tax until 2020 (the period of operation of the SEZ), the volume of tax preferences is 30-70% of the volume realized investments (depending on the territory and scale of the business) or, on a choice, reception of indemnification of two-year costs for the created workplace Exemption of individuals from paying income tax Preferences can be granted in a private area that can be included in the SEZ |

Reducing the tax rate on corporate income (profit) by 30-40% and more for industrial-industrial SEZ (exemption from the federal rate, reduction in regional rates) Reduction of tariffs for allocations to the pension fund, social and medical funds insurance in the period until 2017 by about 60%, in 2018 – by 40%, in 2019 – by 20% - Exemption from property taxes for up to ten years (may be extended by law subject of the Russian Federation) Exemption from payment of transport tax for a period of 5-10 years from the date of registration vehicle Exemption of SEZ residents from payment of land tax for a period of 5-10 years Exemption from customs duties and taxes, as well as the removal of non-tariff measures regulation |

*Authors own elaboration on the basis of Smirnov M.A. (2016).

Analysis of the Polish special economic zone Development: Implications for Russia. (Smirnov, 2016)

To fulfill all the requirements necessary to obtain a permit to conduct business in a special economic zone and the beginning of the activity itself, it will take from three to four months.

On January 1, 2012, amendments to the Law about special economic zones #116-FZ came into effect providing the conclusion of tripartite agreement about activities by the special economic zone resident, including the obligations of the special economic zone administration, management a company and special economic zone residents, including the development and launching objects of capital construction of engineering, transportation, innovation, social, and other infrastructure. The above agreements allow the infrastructure facilities development within the timeframe necessary for special economic zone residents and ensure the full availability of their capacities, and also allow optimizing federal budget expenditures during engineering infrastructure facilities construction of the special economic zone, taking into account the needs of investors.

A separate block of amendments to the special economic zone legislation is sent to ensure the involvement of private management companies, namely: their status has been determined, the procedures for attracting special economic zone infrastructure facilities have been established, the conditions for the management agreement for the special economic zone, which is concluded between the Ministry of Economic Development and the management company in relation to the special economic zone, or the cluster, have been detailed. In order to increase the attractiveness of the special economic zone for management companies, a privilege has been established for the payment of property tax: a rate of 0% for 10 years.

In addition, extra tax benefits are provided for special economic zone residents, the maximum area of special economic zone of the industrial-production type has been doubled, the life of all special economic zones has been extended for a period of up to forty-nine years, the concepts of technical-innovative, industrial and production activities and activities in port special economic zones due to the inclusion of additional permitted activities. These measures largely take into account the experience of existing special economic zones and the requests of their residents.

Despite all these benefits, the decisions to create new special economic zones require a critical approach, a lot of preparatory work and responsible decisions of federal, regional and local authorities. It is necessary to conduct a comprehensive analysis of the various components of the activities of the existing or major planned indicators of the newly created zones to compare the various benefits, the most important of which is the effectiveness of their operation.

Special economic zone effectiveness is proposed to understand as the complex property, covering different aspects of the special economic zone and its residents, taking into account the ratio of revenues from the special economic zone operation to the costs of its existence. It is possible to single out various components of efficiency, each of which has its own indicators, and not all of them are subject to quantitative evaluation:

- financial (commercial) efficiency, taking into account the consequences of the project for its immediate participants – residents of the zone;

- economic efficiency, showing the costs and results associated with the project, beyond the direct financial interests of its participants;

- budgetary efficiency, which is estimated by comparing the volume of investments from the budget of the host country and the entire aggregate of budget revenues, as well as the savings resulting from the implementation of the special economic zone project in budget expenditures;

- tax efficiency, taking into account the ratio of the budgetary effect to the volume of the benefits received by special economic zone residents for customs duties and other taxes;

- social effectiveness, which characterizes the social side of the project and its significance for the population of the region and the whole state (Pavlov, 2012).

Attempts to assess the effectiveness of the special economic zone have been undertaken by the Russian state since 2006. Thus, the indicators of financial efficiency were proposed to be carried out according to the methodology for calculating the indicators and applying the criteria for the effectiveness of investment projects that claim to receive state support from the funds of the Investment Fund of the Russian Federation (Executive order #139/82n, 2006, May 23). However, only in year 2012 and 2013 two resolutions of the Russian Federation Government «On the Approval of the Rules for Evaluating the Efficiency of the Special Economic Zones Functioning» were issued, with the second repealing the first (Governmental regulations #833, 2012, July15; #491, 2013 June 10).

The analysis of the special economic zone effectiveness activities carried out according to the new methodology of the Russian Federation Ministry of Economic Development and Trade was reflected in the «Report on the results of the operation of special economic zones for 2017 and for the period since the beginning of the operation of special economic zones» (MED of RF, n.d.). Consider the main conclusions from this report and perform their analysis.

The lowest performance indicators of special economic zone residents were obtained in the special economic zone tourist-recreational type (average 47.33% of planning effectiveness), which is caused by overestimated projected and planned values stipulated by the Development Plans, as well as special economic zone inadequate activity residents in 2017, including those related to the delay in the construction of special economic zone infrastructure facilities.

The analysis of the special economic zone effectiveness activities shows the successful application of the special economic zones Concept in Poland. For example, in 2016 Katowice special economic zone, according to the report of President Janusz Mihalec the companies celebrated the 20th anniversary and can confidently say that they have achieved significant success. During this time in special economic zone was attracted about 550 large-size company residents who invested more than 25 billion PLN (about 6 billion EUR) and created about 60,000 job positions. Since one workplace inside special economic zone contributes to the emergence of 3-5 vacancies for employment beyond its borders, we can say that, thanks to the activities of the special economic zone, about 250,000 jobs were created. Only for 2017 Katowice special economic zone attracted 18 investors with a total investment of 1.8 billion PLN (424.4 million EUR) and created 680 job positions.

65% of the residents of the special economic zone are from the automotive industry, including manufacturers of auto parts. A major success for us was the attraction of such a large investor as Opel. The factory of this company in Katowice is recognized as one of the best in the field of quality and productivity.

As for the national status of residents, 35.8% of investments are owned by American companies, 22.4% by Italian companies, 11.8 by Polish, 9.5 by German and 6.8% by Japanese residents.

Initially, the Katowice SEZ had at its disposal only 800 hectares of land. As a result of the expansion of investment and improvement of existing territories, the area of land included in the special economic zone has increased significantly and now amounts to more than 2.5 thousand hectares.

Special economic zone earns from several sources. One of them is the sale of land to investors. Also, the source of funding is the annual mandatory payment for services by residents. In addition, profit brings leasing office and storage space.

With regard to income distribution, all 4 subzones of the special economic zone – Gliwice, Jastrzкsbsko-Zorska, Sosnowicko-Dombrowska and Tyska – function as a single entity: they have overall management and a general budget, regardless of the income received by each sub-zone. The division of special economic zone into sub-zones is rather an organizational moment with the purpose of creating more convenient conditions for locating residents. At the same time, each subzone has its own representative in the form of a manager – Vice-president, with whom you can resolve any issues on the spot (Mikhalek & Jagello, 2017).

At present, the failure of the functioning of tourist-recreational and port special economic zones in several regions of Russian Federation, which has a number of both institutional and legal reasons, is obvious. The absence of special economic zone residents, the failure to adopt the special economic zone development plans for zones at the North Caucasus Federal District, for example, the unresolved issues of the amounts and sources of infrastructure facilities financing for the operation of the tourist-recreational special economic zone in Tver region, the inefficient functioning of the port zone in Ulyanovsk. The regions in Poland also require urgent measures, taking as an example strengths and weaknesses of Russian Federation experience.

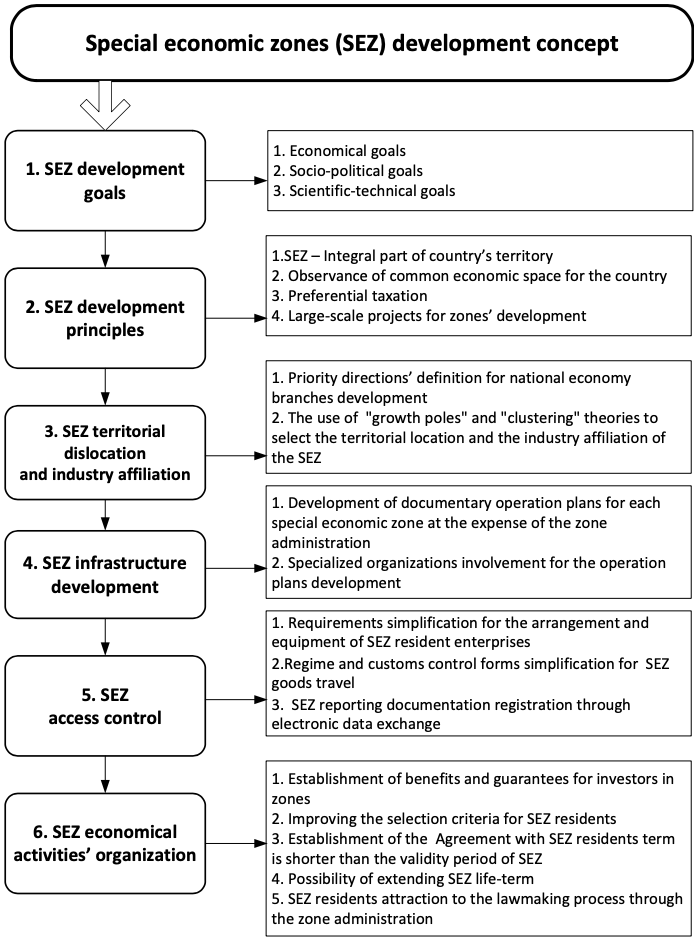

One of such primary measures is the adoption and implementation of the Development Concept of special economic zone in the country; the system of views to ensure the functioning of the state management modern mechanism in the sphere of foreign economic activity of the country. This Concept should include the issues of defining the principles for the development of the special economic zone in the region, the special economic zone territorial deployment, the special economic zone infrastructure development, and the special economic zone economic activities organization (Figure 3).

The implementation of development concept in regions of Russian Federation is possible in three stages:

The first stage implies the approval at the level of the country government Decree of the Development Concept for special economic zones. This will allow the approval of the development vector of legislation in the field of improving the special economic zone activities and lay the foundation for creating a legal platform for their full-fledged functioning.

The second stage includes the adoption of amendments to the Federal Laws «On Special Economic Zones in the Russian Federation», Part Two of the Tax Code of Russia and the publication of separate Government Decrees concerning the approval of rules for the differential granting of privileges for tax payments and changing the procedure for taxation at special economic zones; new procedure for determining the country of goods origin from at special economic zones; selection recommendations of enterprises-applicants for residency at special economic zones and their regions of location.

The implementation of the third stage will lead to an increase in the commercial interest of foreign investors at special economic zones operation, the growth of the well-being of the territories of their application, and the transfer of successful experience in applying these types of zones to the rest of the country.

Figure 3

Development concept of special economic zones*

* Authors’ own elaboration

Considering the concept of special economic zones development in Poland, the Ministry of Economy proposes to extend this time until 2026, transfers «Warsaw Business Journal», passing to the next stage of development.

In the opinion of the Polish government, it is very important for the country to keep the special economic zones attractive for investors, as they act as the main incentive for large investment projects in Poland. There is a fear that after the special economic zones loses their special status in 2020, investments in Poland may decrease. The Office of the Prime Minister states that «special economic zones will be the only major source of new investment in the next three years».

Currently, one of the key incentives offered by the special economic zones is tax incentives. According to the calculations of the Ministry of Economy, investors saved more than 4.9 billion PLN of taxes between 2007-2010 thanks to the SEZ. At the same time, during the same time, 3.3 billion PLN were paid to the Polish treasury from the profit tax and value added tax.

During this time, 188 new licenses were dispensed to companies operating in the special economic zones, bringing their total number to almost 1,500. According to EU legislation, the total area of the special economic zones should not exceed 20,000 hectares. In Poland, this area is now 60% of the permitted EU.

The amount allocated by the European Union to finance new investments for 2007-2013 has already been exhausted, and the funds to be allocated in 2014-2020 have not yet been determined, and probably will not be available until mid-2015. That's why Poland is so eager to keep the ECO open as long as possible (NewsBalt, 2012, June 8).

Finally, the special economic zones conditions can be used within the framework of the Poland-Russia cross-border cooperation program 2014-2020, which supports cross-border cooperation in the social, environmental, economic and institutional spheres.

Thus, we can draw a fundamental conclusion that the world experience of international economic relations development cannot be imagined without the functioning of FEZ. The special economic zone is a unique «workshop» for the development and operation of those economic relations that were initially absent in the country. In countries with different levels of economic development, different forms of special economic zones are used. For countries with developed economies (Western European countries, the United States, and Japan), duty-free zones of free trade at seaports, free airports, financial and banking centers, offshore, and technology-innovative zones are typical. In countries with a transitional (the former CMEA countries) and developing economies (North East Asia (Kostyunina, 2016)., Southern Asia, (Rahoof & Arul, 2016; Sahoo, 2015) and Latin America (Detlef, 2017; Kostyunina & Kozlova, 2018)), the export-production zones type has been developed greatly by increasing exports, they can solve the tasks facing them and obtain the freely convertible currency needed for the development of world economic relations and the solution of internal special economic, technical, technological, and other tasks. The Asian type of special economic zones is distinctly distinguished, its bright representative being the special economic regions and special coastal cities of China (Liu and others, 2018), Thailand (Kostyunina, 2017)., in which successful testing of the specific tactics of China's long-term economic policy – balancing between self-reliance and the greatest possible openness of the country's economy to the outside world.

The analysis of the evolution process of FEZs functioning showed that previous attempts to create and operate in Russia, which began in the 1990s, did not bring positive results. Further revision of the FEZ approach and the recording of previously committed errors led to the decision to create in 2005 a separate type of free economic zones - special economic zones - a «pilot project» for the implementation of the new innovative, investment, tax and customs policy.

The Polish Government approved plans to grant tax benefits to investors throughout the country, and not only in regions designated as special economic zones. The further functioning of the special economic zones should not raise doubts with the European Commission, provided that special economic zones still fit into the structure of the Regional Community Policy, as the special economic zones instructions are consistent with the rules of regional community assistance(Immigrant.Today, 2018 February 23).

Thereby, special economic zones in Russia and Poland still have limited application, because such complex mechanism of economic activity as special zones still requires certain methodological toolkit - Development Concept of Special economic zones.

Ambroziak A., Hartwell C. (2018). The impact of investments in special economic zones on regional development: the case of Poland. Regional Studies, Taylor & Francis Journals, vol. 52(10), 1322-1331. doi: 10.1080/00343404.2017.1395005

AML Consulting. (n.d.). Free economic zone in Poland. Retrieved from http://polandconsulting.ru/sez/ (date of access:02.01.2019)

Bruxelles. (1999). International Convention on the Simplification and Harmonization of Customs Procedures - Kyoto Convention. Special Annex D, Chapter 2 «Free zones».

Bublik V.A., Gubareva A.V. (2016). Topical Issues of the Creation and Development of Special Economic Zones. Perm University Herald. Juridical Sciences, 33, 286–297. doi:10.17072/1995-4190-2016-33-286-297

Chepinoga, O. A., Solodkov, M.V., Semenova, A.E. (2017). Problems of functioning and development prospects for special economic zones in Russia. Baikal Research Journal, vol. 8 (3). doi: 10.17150/2411-6262.2017.8(3).4.

Danko T.P., & Okrut Z.M. (1998). Free economic zones in International sector: Tutorial. M.: INFRA-M. 30.

Detlef, N. (2017). Trade: The Undervalued Driver for Regional Integration in Latin America. GIGA Focus, no.5, September. 63.

Executive order #139/82n. (2006, May 23). On design procedure metrics and performance criteria of investment projects. Ministry of Economic and Ministry of Finance Russian Federation.

Federal Law #116. (2005, July 22). On Special Economic Zones in Russian Federation

Gossmi.ru (n.d.). Innovation clusters in Poland. Retrieved from http://gossmi.ru/page/gos1_225.htm (date of access:11.12.2018)

Governmental regulation #491. (2013, June 10). On regulation of performance criteria of Special Economic Zones operation. Governmental regulation of Russian Federation.

Governmental regulation #833. (2012, July 15). On regulation of performance criteria of Special Economic Zones operation. Governmental regulation of Russian Federation.

Held D. (2004). Global Transformations: Politics, Economics, Culture. M.: Praxis, 198-201. doi:10.1057/9780333981689_2

Immigrant.Today (2018, February 23). In Poland, tax incentives for investors are approved. Retrieved from: https://immigrant.today/article/13116-v-polshe-utverdili-nalogovye-lgoty-dlja-investorov.htm (date of access:23.12.2018)

Inshakov, O.V. Kryukova, E.V., (2015). Special economic zones as a nanoindustry development institute: failures, problems and prospects Vestnik Volgogradskogo gosudarstvennogo universiteta. Seriya 3, Ekonomika. Ekologiya [Science Journal of Volgograd State University. Global Economic System] no. 1. 6-17. doi: http://dx.doi.org/10.15688/jvolsu3.2015.1.1

Jensen, C. (2018). The employment impact of Poland’s special economic zones policy. Regional Studies, Taylor & Francis Journals, vol. 52(7), 877-889. doi: 10.1080/00343404.2017.1360477

Kashina, N.V. (2016). Priority development areas: A new tool for attracting investment in the far east of Russia, Economy of region, Centre for Economic Security, Institute of Economics of Ural Branch of Russian Academy of Sciences, vol. 1(2), 569-585. doi:10.17059/2016–2–21

Kostyunina, G.M. (2016). Integration processes in North East Asia. Russian Foreign Economic Journal, no.7, 28-39.

Kostyunina, G.M. (2016). Integration processes in North East Asia. Russian Foreign Economic Journal, no.8, 31-37.

Kostyunina, G.M. (2017). The practice of free economic zones in Thailand.Russian Foreign Economic Journal, no.5, 38-53.

Kostyunina, G.M., Kozlova O.A. (2018). Integration in Latin America as a factor for foreign trade promotion. Russian Foreign Economic Journal, no.4, 51-67.

Liu, W., Shi, H.-B., Zhang, Z., Tsai, S.-B., Zhai, Y., Chen, Q., Wang, J. (2018). The development evaluation of economic zones in China. International Journal of Environmental Research and Public Health, 15 (1), art. no. 56. Retrieved from: http://www.mdpi.com/1660-4601/15/1/56/pdf (date of access:09.08.2018) doi: 10.3390/ijerph15010056

MED of RF (n.d.) Special economic zones. Ministry of economic development in Russian Federation. Retrieved from: http://economy.gov.ru/minec/about/structure/deposobeczone/2018290632 (date of access:12.12.2018).

Mikhalek J. & Jagello J. (2017). Special economic zones: the experience of Poland. Director No. 9. 34-37. Retrieved from: http://director.by/home/hot-news/5570-osobye-ekonomicheskie-zony-opyt-polshi (date of access:12.05.2018)

NewsBalt (2012, June 8) Poland is afraid of losing investments with the closure of its special economic zones in 2020. Retrieved from: http://newsbalt.ru/news/2012/06/08/polsha-boitsya-poteryat-investicii-s-z/(date of access:21.12.2018)

Pastusiak, R., Bolek, M., Jasiniak, M., Keller, J. (2018). Effectiveness of special economic zones of Poland [Uиinkovitost slobodnih ekonomskih zona Poljske]. Zbornik Radova Ekonomskog Fakultet au Rijeci vol. 36(1), 261-283. doi:10.18045/zbefri.2018.1.263

Pavlov P.V. (2006). Special economic zones as institutional tools of Russia integration in Global International economy. Rostov-on-Don: RSU Press, 145.

Pavlov P.V. (2010). Special tax and customs procedures. Taganrog: NOU VPO «TIUE» Press, 196.

Pavlov P.V. (2012). Special Law-administrative procedures of foreign trade activity. M.: Norma, 245-248.

Rahoof TK, A., Arul, P.G. (2016). An Evaluation of Special Economic Zones (SEZs) Performance Post SEZs Act 2005. Universal Journal of Industrial and Business Management 4(2): 44-52, doi:10.13189/ujibm.2016.040202

Redko, K.Y. (2012). Analysis of the system of preferences and exemptions introduced for the subjects within free economic zones and territories of priority development. Actual Problems of Economics. Vol.137 (11), 154-160

Sahoo, P. (2015). Time to review the special economic zones act. Economic and Political Weekly, Vol. 50(14). 23-26

Smirnov M.A. (2016). Analysis of the Polish Special Economic Zone Development: Implications for Russia. Financial journal, no. 5. 82-93.

Sukharev, O.S., Ilyina, O.B. (2012). The analysis of the regional economic system of the type special economic zone using the method of structural changes Economy of region, 3. 249-260.

Zdanov Y.N. (2011). Interview of Chief of Federal Agency of Special economic zones direction. Retrieved from: www. rosoez.ru (date of access:19.05.2018)

Zhukovskaya, I.V., Shinkevich, A.I., Yalunina, E.N., Lushchik, I.V., Zhukova, M.A., Mokhova, G.V., Ostanin, L.M. (2016). Features of economic zones’ regulation in terms of economic instability, International Journal of Environmental and Science Education Vol. 11(18), 12787-12801 [ijese.2016.951]

Zimenkov R.I. (2015). Free economic zones: Tutorial. M.: YUNITI-DANA. 223.

1. Professor, Southern Federal University, 344006, Russia, Rostov-on-Don, Bolshaya Sadovaya str., 105/42, E-mail: pavel.pavlov20@gmail.com

2. Associate Professor, Southern Federal University, 344006, Russia, Rostov-on-Don, Bolshaya Sadovaya str., 105/42, E-mail: elmakarova@sfedu.ru

3. Professor, Lodz University of Technology, 90-924 Poland, Lodz, Piotrkovska str., 266 E-mail: sebastian.bakalarczyk@p.lodz.pl