Vol. 40 (Number 30) Year 2019. Page 13

HAMZAH, Zulfadli 1; PURWATI, Astri Ayu 2; SURYANI, Febdwi 3 & HAMZAH 4

Received: 29/05/2019 • Approved: 02/09/2019 • Published 09/09/2019

ABSTRACT: This study was designed to formulate a strategy to improve the quality of banking services using SERVQUAL and important models of Performance Analysis (IPA). The sample used was from 200 Islamic banking clients in Pekanbaru, Indonesia. Some findings of this study determine that activities that are generally related to the time and services provided by bank staff should be improved. These include that bank employees cannot have favoritisms to serve clients; they must respond correctly to all customer questions about banking products; diligently serve customers in order to reduce customer waiting time. |

RESUMEN: Este estudio fue diseñado para formular una estrategia a fin de mejorar la calidad de los servicios bancarios utilizando SERVQUAL e importantes modelos de Análisis de Desempeño (IPA). La muestra utilizada fue de 200 clientes de la banca islámica en Pekanbaru, Indonesia. Algunos hallazgos de este estudio determinan que deben mejorarse actividades que generalmente están relacionados con el tiempo y servicios prestados por el personal del servicio bancario. Estos incluyen a que los empleados del banco no pueden tener favoritismos para servir a clientes; deben responder correctamente a todas las preguntas de clientes sobre los productos bancarioso; atender con diligencia a los clientes a fin de recortar el tiempo de espera de los clientes. |

Islamic Banking is a banking system, which is administered based following the law and Islamic principles, referring to the Qur'an and the Sunnah. In practice, Islamic banking prohibits bank interest and investing in illegimate businesses. The Islamic Bank has operationally a National Islamic Board in that supervises Islamic banks through fatwa that must be complied with by all Islamic banks in Indonesia. The fatwa covers the types of activities, Islamic financial products and services, and oversees the application of the fatwa.

In recent years, Islamic banking in Indonesia has shown positive developments through the increase in the number of the Islamic banks. The data from bank Indonesia retrieved on December 2014 demonstrated that in 2013, there were 11 Islamic Commercial Banks (BUS), 23 Islamic Business Units (UUS), 399 Bank Sentral Republik Indonesia BPRS

(BPRS).

The rapid growth of Islamic banking in Indonesia is strongly supported by the large number of Indonesian Muslim communities. Through the Islamic banks, the Indonesian market potential is even substantial because of the values of morality and religion.

Two recent reports published by the World Bank and the IMF investigated the comparison of the effectiveness and efficiency of Islamic banking and conventional banking globally (Beck, 2013; Hasan & Dridi 2010). These studies specifically examined the financial performance, efficiency and stability of Islamic banks compared to conventional banks in the context of the global financial industry. In addition, a study conducted by Abdul-Majid et.al. examined the level of efficiency in Islamic and conventional banking in 10 countries. However, none of these studies evaluated the impact of service quality and image on customers’ satisfaction and loyalty in any comparative arrangement (Zameer et al., 2015).

To increase the market share, Islamic banking needs to analyze what factors influence the community to be willing to become customers in Islamic banks. The results of a research on Islamic banking in Tunisia revealed that service quality plays an important role in influencing people's decisions to prefer Islamic banking (Hoffman & Bateson 2002). Service quality refers to the customer's assessment of the core of the service they receive. People now tend to require prime service; they rather enjoy the convenience of service than a product quality.

Service quality is one of the important determinants of a bank success, but it is often difficult to measure service quality because of its distinctive characteristics (Hoffman and Bateson, 2002). The conceptual model of service quality was first introduced by Parasuraman et al. (1985). This model consisted of many dimensions, such as: reliability, responsiveness, competence, courtesy, credibility, security, access, communication, and understanding of customer service quality. Then, Parasuraman et al. (1988) revised the previous framework, service quality, that are conceptually considered as global assessments, or attitudes, is then related to service excellence, which is known as SERVQUAL. This measurement scale has been widely used as a general instrument for measuring service quality in Indonesia. Servqual consists of 5 dimensions including:

1. Physical evidence (tangibles). It is a physical attraction of a service that is usually observed through the attractiveness of physical facilities, equipments, materials used and the employees’ appearance. There are four attributes of physical evidence, they are:

• Modern equipments

• Facilities that have visual appeals

• Neat and professional employees

• Materials related to services that have visual appeals

2. Reliability. It is the company's ability to provide accurate services without making mistakes and the services are given in the right time. There are five attributes of this reliability, namely:

• Providing the services as promised.

• Reliable in handling service problems.

• Delivering the services properly since the first time.

• Delivering the services in accordance with the promised time.

• Saving notes or documents without errors.

3. Responsiveness. This means the employees’ willingness and ability to assist customers in providing service information and solving service problems. There are four attributes of the responsiveness, namely:

• Informing customers about the certainty of service delivery time.

• Immediate or fast service for customers.

• The willingness to assist the customers.

• The readiness to respond the customer requests.

4. Assurance. This implies that the employees’ behavior can foster customers’ trust towards the company so the company can create a sense of security for its customers. There are four attributes of assurance, which are:

• Employees who foster the trust in customers.

• Making the customers feel safe during the transactions.

• Employees who consistently behave politely.

• Employees who are able to answer customers’ questions.

5. Empathy. It means that the company understands the problems of its customers and acts in the customers’ interests, and gives personal attention to customers. It also has comfortable operating hours. There are five attributes of emphaty, they are:

• Giving individual attention to customers.

• Employees who treat customers attentively.

• Sincerely prioritizing the customers’ interests.

• Employees who understand customers’ needs.

• Comfortable operating time (office hours).

Some studies support the importance of service quality in marketing a product or service. Service quality is also widely regarded as a driver of corporate marketing and financial performance (Amin and Isa, 2008). Lee et al. (2000) make a substantial contribution to the service quality literature by using the SERVQUAL model and identify the determinants of perceived service quality. They sought to link determinants of service quality to the satisfaction for service-oriented companies. The authors found that perceived service quality was an antecedent of satisfaction. However, researchers such as Newman (2001) identify serious weaknesses in SERVQUAL values as a measure of service quality and as a diagnostic tool in the US banking sector.

Furthermore, Flavian et al. (2004) and Jayawardhena (2004) identify additional factors such as access to services, services offered, security, and reputation to measure the image of a company's service quality. In the meantime, other studies define and measure the dimensions of service quality as performance indicators (Vera and Trujillo, 2013). Joseph et al. (1999)applied service quality indicators in the banking sector and examined the impact of technology on service delivery. However, their study ignored the quality dimension to measure the role of technology in terms of achieving customer efficiency and satisfaction (Arbore and Busacca, 2009). Then, Jabnoun and Al-Tamimi (2003) modified the SERVQUAL model to evaluate perceived service quality from commercial banks in the United Arab Emirates. In this study, researchers analyzed the relative importance of each dimension of service quality; however, they did not relate these dimensions to service satisfaction. Moreover, Al-Tamimi and Al-Amiri (2003) and Amin and Isa (2008), assessed and analyzed the service quality of Islamic banks in Malaysia. Then, Dusuki and Abdullah (2007) revealed that these factors motivate customers to deal with Islamic banks in the dual banking system.

In addition, Jabnoun and Khalifa (2005) examined the quality-adjusted service size in conventional and Islamic banks in the United Arab Emirates while Kumar et.al. (2010) analyzed differences in service quality between conventional banks and Islamic banks in Malaysia and found interesting differences between the two banking systems in terms of tangibility and disparity in service quality. Unofrtunately, this finding has not been validated in a similar study.

The population in this study was all customers of the Islamic banks in Pekanbaru. This study applied the Roscoe sampling technique in which the number of samples was obtained as many as the number of variables (5) multiplied with a minimum sample number (30). Thus, a total of 150 respondents were obtained as the samples. The samples were added up to 200 respondents/ Islamic banks customers in order to maximize the results of the study. The sampling technique used was a probability sampling technique with a random system for all Islamic banking in Pekanbaru.

The results of respondents' evaluations towards the importance and performance variables of each Islamic banking service in Pekanbaru were calculated to obtain the suitability of the level of the customers’ interest to the level of service performance of Islamic banks. The level of conformity was the result of the comparison between performance scores and interest scores. From the level of suitability obtained, it was expected that it could be used as a reference to determine the priority of improving service quality attributes that affect students’ evaluation of the performance of services received.

The formula used is as follows (Supranto, 2011):

Tki= Xi/Yi x100%

Note:

Tki = The Level of Suitability of Respondents

Xi = Score of Performance Assessment

Yi = Score of Interest Assessment

The next step was to calculate the average score of STIE Pelita Indonesia's service quality by using the following formula:

Note:

X= Average score of the level of implementation/ performance

Y= Average score of the level of interests

n = Number of respondents X Y

In applying IPA technique, respondents were asked to assess the level of importance of the service attributes and the level of performance in each attribute of educational services. IPA analysis was accomplished by using SPSS 19 which provided scatter/dot graph analysis facilities in which the results were in the form of a Cartesian diagram. Cartesian diagram is a square construct divided into four parts which is limited by two lines intersecting perpendicular to the points (X and Y). X was the average of the performance rating level score while Y was the average of the importance level score. The purpose of IPA analysis was to identify the interest’s attributes of educational service in A, B, C, or D quadrant in the Cartesian diagram.

This review research was conducted by collecting international journal articles through journal databases such as: ERIC, Science direct, Google Scholar, IEEE, emeraldinsight, and others. There were 101 articles found to have keywords such as "Database, Database Course, Teaching and Learning Database, SQL, DBMS". After reviewing 101 journal articles related to teaching and learning database, 35 journal articles were selected due to their relevance to this study.

Table 1

Analysis of Demography

Demography |

Characteristics |

Frequency |

Percentage |

Gender |

Male |

78 |

39 % |

Female |

122 |

61 % |

|

Age |

Under 20 years old |

40 |

20 % |

20-30 years old |

88 |

44 % |

|

30-40 years old |

57 |

28.5 % |

|

above 40 years old |

15 |

7.5 % |

|

Income |

2-3 million |

21 |

10.5 % |

3-5 million |

119 |

59.5 % |

|

above 5 million |

60 |

30 % |

|

Duration of being customer |

under1 year |

47 |

23.5 % |

1-2 year (s) |

36 |

18 % |

|

above 2 years |

117 |

58.5 % |

Source: Processed Data (2018)

The results of the demographic analysis of the respondents above demonstrate that in terms of the characteristics of gender, the respondents were dominantly women (61%). In the other hand, in terms of age, the majority of respondents were at the age of 20-30 years with a percentage of 44%. Then, in terms of income, the majority respondents earned 3 to 5 million rupiah with a percentage of 59.5% and the average majority of the respondents, as much as 58.5%, have become customers for more than 2 years in the Islamic banks.

Validity test illustrated how valid and appropriate each attribute question of the service quality in this study was so that the questions were feasible to proceed to the next test. The results of the validity test show that the score of corrected item total correlation of all service quality attributes is > 0.5 in which according to the requirements for fulfilling the validity of the corrected item total correlation is > 0.3, so that the attribute is valid (Hair et al. 1988). The reliability test also shows the suitability of the question attributes on each service quality variable in which the cronbach alpha results showed a score > 0.6 which means that all variables in this study are reliable (Hair et al. 1988).

Table 2

Results of Gap Analysis

No |

Attributes |

Expectation |

Satisfaction |

Gap |

Rank |

Physical Evidence |

|||||

1 |

Islamic Bank employees are dressed politely and neatly in accordance with Syariat. |

4.63 |

4.02 |

-0.62 |

8 |

2 |

Islamic banks offer the convenience of ATMs to transact every where. |

4.53 |

3.51 |

-1.02 |

27 |

3 |

Islamic banks have a strategic and affordable location. |

4.32 |

3.50 |

-0.82 |

22 |

4 |

The cleanliness of the Islamic Bank offices is very well maintained. |

4.79 |

4.30 |

-0.50 |

5 |

5 |

The office equipments and facilities used to serve the customers are fully available. |

4.48 |

4.16 |

-0.32 |

1 |

6 |

Islamic banks have an online banking service system that is easy to use. |

4.49 |

3.82 |

-0.68 |

13 |

7 |

Islamic banks have large parking area. |

4.39 |

3.72 |

-0.68 |

12 |

Empathy |

|||||

8 |

Islamic banks employees always give good attention to all customers in service. |

4.70 |

3.84 |

-0.86 |

25 |

9 |

Islamic bank employees have never chosen to serve particular customers. |

4.63 |

4.11 |

-0.52 |

7 |

10 |

Islamic banks always provide services expected by customers. |

4.51 |

3.81 |

-0.70 |

17 |

11 |

Islamic banks employees are always friendly and polite in serving customers. |

4.61 |

4.12 |

-0.49 |

4 |

12 |

Islamic bank employees understand customers’ needs and are able to solve each customers’ problems and complaints. |

4.47 |

3.81 |

-0.67 |

11 |

Responsiveness |

|||||

13 |

Islamic bank employees offer immediate respond to answer customers’ questions about Islamic bank products. |

4.67 |

3.86 |

-0.81 |

21 |

14 |

Islamic bank employees offer immediate respond to solve the complaints and problems experienced by customers. |

4.50 |

3.85 |

-0.66 |

10 |

15 |

Islamic bank employees are always able to meet customers’ needs quickly. |

4.50 |

3.73 |

-0.78 |

20 |

16 |

Islamic bank employees always act precisely and make very few mistakes. |

4.40 |

3.97 |

-0.43 |

2 |

17 |

Islamic bank employees are able to provide accurate information to customers related to Islamic banking products. |

4.63 |

4.15 |

-0.48 |

3 |

Reliability |

|||||

18 |

Information provided in every promotion performed by Islamic banks through brochures and other media is always right and accurate. |

4.63 |

3.95 |

-0.68 |

14 |

19 |

Information provided by employees in serving the customers is also accurate and accountable. |

4.61 |

4.11 |

-0.50 |

5 |

20 |

The time required to handle customers’ problems is always fast and the problem is resolved as promised. |

4.58 |

3.88 |

-0.70 |

16 |

21 |

Islamic bank employees have extensive knowledge. |

4.69 |

3.96 |

-0.73 |

18 |

22 |

Employees are able to serve customers on time so as to shorten the waiting time of customers in waiting for the service. |

4.59 |

3.90 |

-0.69 |

15 |

Assurance |

|||||

23 |

Islamic bank employees have excellent communication skills. |

4.72 |

3.88 |

-0.84 |

23 |

24 |

Islamic bank employees always act professionally and their credibility is undoubted. |

4.59 |

3.75 |

-0.84 |

24 |

25 |

Trading and using Islamic banking services is a safe choice. |

4.71 |

3.94 |

-0.77 |

19 |

26 |

Islamic bank employees have good ethics when serving customers. |

4.62 |

3.98 |

-0.65 |

9 |

27 |

Competencies possessed by Islamic bank employees are very good. |

4.74 |

3.86 |

-0.88 |

26 |

Source: Processed Data (2018)

The following are the results of the calculation to obtain the respondents’ expectations and performance scores of all the assessment criteria and the gaps obtained between performance and expectations (gap score). Gap score or variance can occur when there is a difference between expectations and reality that customers receive. The gap value consists of two, namely a positive gap and a negative gap. Based on the data in the table above, the 27 evaluation criteria for the service quality in Islamic banking services attained a negative gap result for all criteria. This indicates dissatisfaction with the quality of services obtained. The most distant gap between expectations and reality received by customers was in the attribute of "Islamic banks offer convenience ATMs to transact every where" while for the attributes with the smallest gap/ variance was "Office equipments and facilities used to serve customers are fully available".

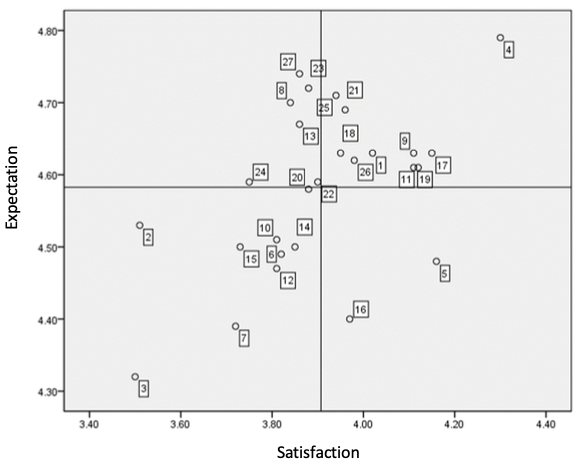

Figure 1

Importance Performance Analysis (IPA) matrix

The results of the Importance Performance Analysis (IPA) matrix divide the results of respondents' responses into 4 quadrants which consist of:

Quadrant I. maps service attributes that must be a priority of improvement because customers retained high expectation scores but their performance levels were considered not to be as expected by customers of Islamic banks. Several the attributes in this quadrant consist of empathy variables (Islamic bank employees never choose to serve particular customers), responsiveness variables (Islamic bank employees offer immediate respond to answer customers’ questions about Islamic bank products), Reliability variables (Employees are able to serve customers on time so as to shorten the waiting time of customers in waiting for services), Assurance variables (Islamic bank employees have excellent communication skills, Islamic bank employees always act professionally and their credibility is undoubted, Competencies possessed by Islamic bank employees are excellent). The variables of assurance dominated the attributes quality that must be improved by Islamic banking.

Quadrant II. illustrates the existence of service attributes that were also considered important by Islamic bank customers and their performance had been considered good. Therefore, Islamic banking must maintain the performance of these attributes in order to continue to perform better and continue to fulfill what is expected by customers. Attributes in this quadrant consist of physical evidence variables (Islamic Bank employees dress politely and neatly in accordance with Syariat, the cleanliness of Islamic Bank office is very well maintained), empathy variable (Islamic bank employees have never chosen to serve particular customers, Islamic bank employees are always friendly and polite in serving customers), responsiveness variable (Islamic bank employees are able to provide accurate information to customers about Islamic banking products), reliability variables (Information provided in every promotion carried out by Islamic banks through brochures or other media is always right and accurate, Information provided by employees in serving customers is also accurate and accountable, Islamic bank employees have extensive knowledge), and assurance variables (Transactions and using Islamic banking services are safe choices, Islamic bank employees have good ethics in serving customer).

Quadrant III. shows the service attributes in which Islamic bank customers did not have high expectations so that the level of importance did not get a high score and its performance was also considered mediocre, so it did not have to provide an improvement focus for the service attributes in this quadrant. The service attributes in this quadrant consist of physical proof variables (Islamic banks offer convenience ATMs to transact every where, Islamic banks have a strategic and affordable location, Islamic banks have an online banking service system that is easy to use, Islamic banks have large parking area), empathy variable (Islamic banks always provide services expected by customers, Islamic bank employees understand the customers’ needs and are able to solve each customer’s problem and complaint), responsiveness variables (Islamic bank employees offer immediate respond to solve complaints and problems experienced by customers, Islamic bank employees are always able to meet customers’ needs quickly) and reliability variables (The time needed to handle customers’ problems is always fast and problems are resolved according to the promised time).

Quadrant IV. shows the existence of service attributes that according to customers, their performance were good and even tended to exceed what customers wanted because actually customers did not have too much hope in these service attributes. Hence, there is no need to focus on attributes in this quadrant. There were 2 service attributes in this dimension, namely physical proof variables (the office equipments and facilities used to serve customers are fully available) and responsiveness variables (Islamic banks employees always act properly and make very few mistakes).

The results of this study provide an important contribution for Islamic banks to focus on improving their service quality in terms of achieving customer satisfaction. The quadrant I of IPA matrix becomes an important concern for Islamic banks to improve the attributes of this quadrant. One attribute in this quadrant is the empathy variable in which there is the attribute "Islamic bank employees never choose to serve perticular customers". In this case, customers need to feel that they are prioritized by the organizations that provide services. Empathy means caring, paying attention to the person, and providing services to customers(Pakurár et al., 2019). Therefore, the banking staff should serve whoever their customers are. Another attribute that should get important attention by Islamic banking is the responsiveness variable, like "Islamic bank employees grant immediate respond to answer customers’ questions about Islamic bank products". Responsiveness according to Parasuraman et al., (1991) underlines that the employees’ responsiveness consists of the ability to respond customers according to their requests. In this case Islamic banking staff must not only have the ability to respond well but the response times also must be fast. The speed of response time also plays a role in reducing customer waiting time in obtaining services. For this reason, the attributes in the reliability variable related to "Employees are able to serve customers on time so as to shorten the waiting time of customers in waiting for services" also becomes a matter that must be improved. Another thing that usually happens is that most customers don't mind waiting for a service if there are reasonable reasons, such as being serving another customer. However, if the employees make customers wait for no reason, like talking to each other or not caring about customers, it will probably influence the perceptions of service quality and the customers will feel dissatisfied (Alzaydi et al., 2018). Therefore, a supervision of service staff needs to be conducted by the company management in this case Islamic banking so that the service staff perform their tasks in accordance with the applicable procedures and rules. The last attribute that should be considered by Islamic banking is the assurance variable (Islamic bank employees have excellent communication skills, Islamic bank employees always act professionally and the credibility is undoubted, the competencies possessed by Islamic bank employees are excellent). Assurance variables dominate the attributes that quality must be improved by Islamic banking. To guarantee the service quality to customers, service staff must be able to communicate well and professionally in order to convince their customers. Communication is a form of guarding so that customers get information and the employees provide clear and understandable information. In addition to creating good communication, service staff must also have good competence in the services provided (Alzaydi et al., 2018). For this reason, some steps that can be taken by a bank to enhance its banking staff service capabilities are as follows (Novokreshchenova et al., 2016):

• Providing the training of quality service improvement for all banking service staff.

• The bank makes general rules for all employees about interacting with customers and subsequently at the end of each period the bank conducts a personnel / staff service competency audit which includes tests for knowledge of Islamic banking legislation, regulations and internal control issues, which reflect the specificity of each employee.

• Provide a customer complaint system and periodically follow up on customer complaints.

Importance Performance Analysis is an essential quality measurement tool to identify to what extent the service quality provided to customers achieves satisfaction. Some attribute findings that must be improved in this study are generally related to the time and services provided by Islamic banking service staff, including “Islamic bank employees may not choose to serve particular customers”; “Islamic bank employees must be responsive to answer customers’ questions about Islamic bank products”; “Employees must be able to serve customers on time so as to shorten the queue time of customers in waiting for services”; “Islamic bank employees must have excellent communication skills”; “Islamic bank employees should always act professionally and their credibility is undoubted”; and “Competencies possessed by Islamic bank employees are excellent”.

To be able to compete with conventional banks, the service quality of Islamic banks is a crucial aspect that should be improved. In this case, Islamic banking must formulate strategies to improve the ability of banking staff service, for examples by providing training, setting rules, monitoring and evaluating or auditing service performance. The results of this study found several weaknesses or dissatisfaction of the Islamic bank customers related to the staff’s response time and service time response. Thus, it is expected for next researchers to be able to design a service quality model that is suitable for Islamic banking that does not only focus on the service by staff but also fast service with technological assistance.

Many students who studied by using global or conventional techniques got difficulties in learning the basis or concept of database. They assert that dabatase learning is abstract and very difficult to understand. For this reason, many researches were conducted on the development and application of various methods to increase students' understanding in learning database courses. Most methods were developed by implementing computer technology, multimedia, mobile and web-based in order to provide interactivity, visualization, effectiveness and essence in getting teaching materials, tasks, database learning resources and student feedback. Those methods improved students’ performance and developed skills among students. Feedback and comments from students were positive and greatly encouraged students' interest in understanding database learning even deeper.

This research is funded by Directorate of Research and Community Service, Directorate General Research and Development, Ministry of Research, Technology and Higher Education (KEMENRISTEKDIKTI) and Riau Islamic Universities.

Alzaydi, Z. M., Al-Hajla, A., Nguyen, B., & Jayawardhena, C. (2018). A review of service quality and service delivery: Towards a customer co-production and customer-integration approach. Business Process Management Journal, 24(1), 295–328. https://doi.org/10.1108/BPMJ-09-2016-0185

Amin, M. and Isa, Z. (2008). An examination of the relationship between service quality perception and customer satisfaction: A SEM approach towards Malaysian Islamic banking. International Journal of Islamic and Middle Eastern Finance and Management, 1 (3), 191-209.

Beck, T., Demirgüç-Kunt, A. and Merrouche, O. (2013), Islamic vs. Conventional banking: Business model, efficiency and stability. Journal of Banking & Finance, 37(2), 433-447.

Dusuki, A.W. and Abdullah, N.I. (2007). Why do Malaysian customers patronise Islamic banks?, International Journal of Bank Marketing. 25(3),142-160.

Flavian, C., Torres, E. and Guinaliu, M. (2004). Corporate image measurement: A further problem for the tangibilization of internet banking services. International Journal of Bank Marketing, 22(5), 366-384.

Hair, J., Anderson, R., Tatham, R., & Black, W. (1988). Multivariate data analysis (5th ed.). New Jersey: Prentice Hall.

Hasan, M. and Dridi, J. (2010), The effects of the global crisis on Islamic and conventional banks: A comparative study: International Monetary Fund.

Hoffman, K.D. & Bateson, J.E. (2002), Fundamentals of marketing of services: Concepts, strategies and cases: Cengage Learning Editores.

Jabnoun, N. & Khalifa, A. (2005). A customized measure of service quality in the UAE. Managing Service Quality, 15 (4), 374-388.

Jabnoun, N. & Al-Tamimi, H.A.H. (2003). Measuring perceived service quality at UAE commercial banks. International Journal of Quality & Reliability Management, 20 (4), 458-472.

Jayawardhena, C. (2004). Measurement of service quality in internet banking: The development of an instrument. Journal of Marketing Management, 20(1-2), 185-207

Joseph, M., McClure, C. and Joseph, B. (1999). Service quality in the banking sector: The impact of technology on service delivery. International Journal of Bank Marketing, 17(4),182-193.

Kumar, M., Kee, F.T. & Charles, V. (2010). Comparative evaluation of critical factors in delivering service quality of banks: An application of dominance analysis in modified servqual model. International Journal of Quality & Reliability Management, 27(3), 351-377.

Lee, H., Lee, Y. and Yoo, D. (2000). The determinants of perceived service quality and its relationship with satisfaction. Journal of services marketing, 14 (3), 217-231

Newman, K. (2001). Interrogating servqual: A critical assessment of service quality measurement in a high street retail bank. International journal of bank marketing, 19 (3), 126-139.

Novokreshchenova, O. A., Novokreshchenova, N. A., & Terehin, S. E. (2016). Improving bank’s customer service on the basis of quality management tools. European Research Studies Journal, 19(3), 19–38.

Pakurár, M., Haddad, H., Nagy, J., Popp, J., & Oláh, J. (2019). The service quality dimensions that affect customer satisfaction in the Jordanian banking sector. Sustainability (Switzerland), 11(4), 1–24. https://doi.org/10.3390/su11041113

Parasuraman, A., Berry, L. L., & Zeithaml, V. A. (1991). Reassessment of Expectations as a Comparison Standard in Measuring Service Quaiity: implications for Furtiier Research. Journal of Retailing, 67(4), 420–450.

Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1985). A conceptual model of service quality and its implications for future research. Journal of marketing, 49 (4), 41-50.

Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1988). Servqual. Journal of retailing, 64 (1), 12-37.

Vera, J. and Trujillo, A. (2013). Service quality dimensions and superior customer perceived value in retail banks: An empirical study on Mexican consumers. Journal of Retailing and Consumer Services, 20 (6), 579-586.

Zameer, H., Tara, A., Kausar, U. and Mohsin, A. (2015), Impact of service quality, corporate image and customer satisfaction towards customers’ perceived value in the banking sector in Pakistan. International Journal of Bank Marketing, 33(4), 442-456.

1. Sharia Banking Department. Faculty of Islamic Studies. Universitas Islam Riau, Indonesia. zulfadlihamzah@fis.uir.ac.id

2. Management Department. Sekolah Tinggi Ilmu Ekonomi Pelita Indonesia, Indonesia. astri.ayu@lecturer.pelitaindonesia.ac.id

3. Accounting Department. Sekolah Tinggi Ilmu Ekonomi Pelita Indonesia, Indonesia. febdwi.suryani@lecturer.pelitaindonesia.ac.id

4. Faculty of Islamic Studies. Universitas Islam Riau, Indonesia. hamzah@fis.uir.ac.id