Vol. 40 (Number 30) Year 2019. Page 14

MISHRA, Satyakama 1 & PRADHAN, Bibhuti Bhusan 2

Received: 29/05/2019 • Approved: 23/08/2019 • Published 09/09/2019

6. Data Analysis and Interpretation

ABSTRACT: This paper makes an attempt to explain the impact of liquidity management on the profitability of private sector banks in India. For this purpose, 10 private sector banks have been considered for the period from 2013 to 2017. Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) have been used as independent variables to denote the liquidity management of the banks, while Return on Assets (ROA) and Return on Equity (ROE) have been used as dependent variables for the profitability of the banks. It is found that there is a significant negative effect of CDR and IDR on ROA. However, in the case of ROE, it is found that there is no significant relationship between banks’ profitability and liquidity taking all the variables into consideration with respect to all the selected commercial banks in India. This leads to the conclusion that the commercial banks can focus on increasing their profitability without affecting their liquidity and vice versa. |

RESUMEN: Este documento intenta explicar el impacto de la gestión de la liquidez en la rentabilidad de los bancos del sector privado en la India. Para este propósito, se han considerado 10 bancos del sector privado para el período de 2013 a 2017. Se han utilizado la Tasa de Depósito en Efectivo (CDR), la Tasa de Crédito-Depósito (CRDR) y la Razón de Inversión-Depósito (IDR) como variables independientes para denotar la gestión de liquidez de los bancos, mientras que el Retorno sobre Activos (ROA) y el Retorno sobre Patrimonio (ROE) se han utilizado como variables dependientes para la rentabilidad de los bancos. Se ha encontrado que hay un efecto negativo significativo de CDR e IDR en ROA. Sin embargo, en el caso de ROE, se encuentra que no existe una relación significativa entre la rentabilidad de los bancos y la liquidez, teniendo en cuenta todas las variables con respecto a todos los bancos comerciales seleccionados en la India. Esto lleva a la conclusión de que los bancos comerciales pueden centrarse en aumentar su rentabilidad sin afectar su liquidez y viceversa. |

The trade-off between liquidity and profitability has been a burning issue in the field of banking sector. Theoretically, both liquidity and profitability are affected by the working capital decisions of any company. Excess of investment in working capital may result in low profitability and lower investment may result in poor liquidity. Therefore, the management needs to trade off between liquidity and profitability to maximize shareholders’ wealth. Every organization, whether profit-oriented or not, irrespective of size and nature of business, requires necessary amount of working capital. Working capital is the most crucial factor for maintaining liquidity, survival, solvency and profitability of business (Mukhopadhyay, 2004). It is observed that if a firm wants to take a bigger risk for mammoth profits, it minimizes the dimension of its working capital in relation to the revenues it generates. If it intends to improve its liquidity, that in turn raises the level of its working capital. Nonetheless, this technique might tend to reduce the sales volume and consequently, it would affect the profitability. Thus, a company needs to have a striking balance between liquidity and profitability. In order to maintain high profitability levels, companies might need to forfeit their solvency by maintaining relatively low levels of current assets. As soon as the companies start doing so, their profitability would improve as less amount of money is fastened up to the idle current assets and their solvency would be in danger. Therefore, excessive levels of current assets may have a negative effect on the firm’s profitability, whereas a low level of current assets may lead to lower level of liquidity and stock outs, resulting in difficulties in maintaining smooth operations. (Van and Wachowicz, 2004).

In today’s developing and competitive world, the banking sector has emerged as a key player that contributes to the growth of economy, development of financial sector and more importantly, creation of employment in the country. Banks are the fulcrum of financial system of any economy and they play an important role in contributing to a country’s economic development. The major role of banks is to collect money from the public in the form of deposits and then along with its own funds to serve the demands of the customers quickly, paying interest for the deposits and to meet out the expenses to carry out its activities. For this purpose, banks maintain adequate liquidity and earn profits from their activities. Profit is the main reason for the continued existence of every commercial organization and profitability depicts the relationship of the absolute amount of profit with various other factors. In any case, compared to other business concerns, banks in general have to pay much more attention for balancing profitability and liquidity. Liquidity is required to meet the prompt demands of customers and profitability is required to meet the expenses of banks. But both the terms are contradictory in nature. If banks maintain more liquidity, their profitability decreases, and if they increase their profitability, they will have to reduce their liquidity.

Liquidity of bank refers to reserves of cash, securities, bank’s ability to convert an asset into cash, and unused bank lines of credit. Liquidity must be adequate to meet all maturing unsecured debt obligations due within a one-year time horizon. Despite different approaches that can be used to analyze bank’s liquidity, the following are the key ratios that can be used to examine bank’s liquidity: Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) and whether they could be converted quickly to cover redemptions. On the other hand, profitability of the bank determines its ability to increase capital (through retained earnings), support the future growth of assets, absorb loan losses and provide return to investors. The key financial ratios that are used in assessing the profitability of a bank include: Return on Assets (ROA), Return on Equity (ROE), Net Interest Margin to Total Assets, and Operating Profit to Total Assets. Keeping this in mind, banks have to do a balancing act between liquidity and profitability. This paper tries to answer the following set of questions: (i) What is the relationship between liquidity and profitability of a commercial bank? and (ii) What is the impact of liquidity management on profitability of banks?

D’Souza (2002) discovered that the profitability of the public sector banks in the late 1990s improved relatively to that of private and foreign banks. In this context, Nayak (2001) and Mathur (2002) argued that private banks perform better than public banks only because the private sector banking has a legal support that makes them free from the adversaries of extraneous pressures as well as they are least involved in socioeconomic policies of the government. Vijayakumar (2002) discovered the declining trend of gross profit ratio of public sector banks in the pre-reform period, indicating that the funds were not used profitably. However, Bhide et al.(2002) and Ketkar and Ketkar (2008) experienced positive impact of the banking sector reforms on the profitability of the public sector banks, but RBI mandate of priority sector lending and inadequate risk management techniques, etc. continue to hurt both the efficiency and profitability. Chauduri (2002) suggested that the public sector banks in India are neither strong nor very weak, but they do not have any further capacity to bear the burden of government policies. Patnaik and Patnaik (2005) concluded that the profitability position of SBI is better than that of other public sector bank groups. In contrast to it, Kaur and Kapoor (2007) found that the relative efficiency of nationalized banks was higher than the relative efficiency of SBI and associates of SBI group. Guruswamy (2012) evaluated the profitability performance of SBI and found that among the associate banks, State Bank of Patiala, State Bank of Hyderabad, State Bank of Indore and State Bank of Bikaner proved to be the most dynamic in earning profit compared to SBI. Badola and Verma (2006) concluded that the explanatory power of spread, non-interest income, provisions and contingencies, and operating expenses is significant while credit deposit ratio, non-performing asset as percentage to net advances and business per employee are found with low explanatory power. Nimer et al. (2013), by using the financial reports of 15 Jordanian banks listed at Amman Stock Exchange (ASE) for the period from 2005-2011, concluded that liquidity has a significant negative influence on the profitability because of banks having excessive liquidity instead of investing the money to generate profit. On the same grounds, Munteanu (2013), using panel data of Eastern and Central European commercial banks over the period 2003- 2010, found a slight positive and negative impact of liquidity on both ROE and ROA, explaining a nonlinear relationship between the variables. Lastly, Ibe (2013) found that there is a significant relationship between cash and short term fund and bank profitability for Nigerian banks.

Liquidity was an instrumental factor during the recent financial crisis. As uncertainty led funding sources to evaporate, many banks quickly found themselves short on cash to cover their obligations as they became due. In extreme cases, banks in some countries failed or were forced into mergers. As a result, in the interests of broader financial stability, substantial amounts of liquidity were provided by authorities in many countries, including India and the US. Again, in the aftermath of the crisis, there is a general sense that banks had not fully valued the importance of liquidity risk management and the implications of such risk for the bank itself as well as the wider financial system. As such, experts and policy makers have suggested that banks should hold more liquid assets than in the past, to help self-insure against potential liquidity or funding difficulties. This has led to an international desire for common measures and standards for liquidity risk, culminating in the ongoing work by the Basel Committee on Banking Supervision (BCBS, 2010). Since liquid assets such as cash and government securities generally have a relatively low return, holding them imposes an opportunity cost on a bank. In the absence of regulation, it is reasonable to expect banks to hold liquid assets to the extent they help to maximize the company’s profitability. Beyond this, policy makers have the option of making larger holdings of liquid assets a requirement, for instance, if it is seen as a benefit to the stability of the overall financial system.

Based on the studied literature, the following are the objectives:

There are a total of 93 scheduled commercial banks on RBI website, which include all categories of public, private and foreign banks as on December 2016 (www.rbi.org.in). Out of these scheduled commercial banks, 10 private sector banks have been considered for this study. The sampling method adopted for this study is purposive. CDR (cash held by banks to their aggregate deposits), CRDR (CRDR is the ratio of outstanding credit to aggregate deposit levels of banks) and IDR (ratio of outstanding investments to aggregated deposits of banks) have been used as independent variables to denote the liquidity management of the banks, while ROA (Net Income/Total Assets) and ROE (Net Income/Total Equity) have been used as proxy variables for profitability of the banks.

The study used secondary data which has been collected from the RBI publications such as Annual Report on Trends and Progress of Banking in India, Annual Report of RBI, and various publications of RBI like RBI Bulletin, IBA Bulletin, websites and magazines. The period of the study is 2013 to 2017. The collected data from this source has been compiled and used with due care as per the requirement of the study.

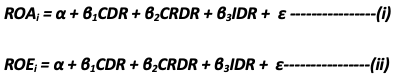

Correlation analysis is done to study the interrelationship between different sets of independent and dependent variables. Regression models have been used to measure the effect of liquidity management on the profitability of selected private sector banks.

Where Return on Assets (ROA) and Return on Equity (ROE) are the dependent variable for regression model while Cash-Deposit Ratio (CDR), Credit-Deposit Ratio (CRDR) and Investment-Deposit Ratio (IDR) are independent variable for regression models. The test of significance of overall multiple regression models were made through F-test. This test was conducted to verify the validity of each of the regression model. To carry out the F-test, the Analysis of Variance (ANOVA) was performed.

Further, multiple coefficient of determination (R2) and adjusted multiple coefficient of determination (adjusted R2) were also compiled to measure the explanatory power of multiple regression model used in the analysis. For establishing validity of the model, F-test was performed at 0.05 level of significance. SPSS Statistics 18 was used for analyzing the data.

The descriptive statistics of selected variables of liquidity management and profitability of private sector banks through their respective financial ratios during the selected period are presented in Table 1

Table 1

Descriptive Statistics of Measures of Liquidity

Management and Profitability of Private Sector Banks

Variable |

Range |

Max |

Min |

Mean |

CDR |

0.87 |

5.33 |

6.2 |

5.836 |

CRDR |

8.4 |

81.9 |

90.3 |

85.042 |

IDR |

10.39 |

34.45 |

44.84 |

40.25 |

ROA |

0.18 |

1.5 |

1.68 |

1.598 |

ROE |

2.65 |

13.81 |

16.46 |

15.496 |

Valid N |

10 |

The descriptive statistical analysis revealed that the criteria used for measuring profitability such as ROA and ROE averaged were found to be 1.598 and 15.496, respectively, for private sector banks. This indicates that the profitability measures in the case of private sector banks.

A further probe into the data revealed that the mean values of liquidity measures of private sector banks, such as CDR, CRDR and IDR were found to be 5.836, 85.042 and 40.250, respectively. The private sector banks have performed better with respect to profitability measures.

The correlation between different measures of liquidity management and profitability of private sector banks is presented in Tables 2

Table 2

Correlation Between Different Measures of Liquidity

Management and Profitability in Private Sector Banks

Measures/Variables |

CDR |

CRDR |

IDR |

ROA |

ROE |

|

CDR

|

Pearson Correlation |

1 |

–0.052 |

–0.097 |

0.324 |

0.165 |

Sig. (2-tailed) |

0.934 |

0.877 |

0.594 |

0.791 |

||

CRDR

|

Pearson Correlation |

–0.052 |

1 |

–0.962** |

–0.328 |

–0.787 |

Sig. (2-tailed) |

0.934 |

0.009 |

0.59 |

0.114 |

||

IDR

|

Pearson Correlation |

–0.097 |

–0.962** |

1 |

0.08 |

0.628 |

Sig. (2-tailed) |

0.877 |

0.009 |

0.898 |

0.257 |

||

ROA

|

Pearson Correlation |

0.324 |

–0.328 |

0.08 |

1 |

0.819 |

Sig. (2-tailed) |

0.594 |

0.59 |

0.898 |

0.09 |

||

ROE

|

Pearson Correlation |

0.165 |

–0.787 |

0.628 |

0.819 |

1 |

Sig. (2-tailed) |

0.791 |

0.114 |

0.257 |

0.09 |

||

Note: ** indicates that correlation is significant at 0.01 level (2-tailed).

A bird’s eye view of the data (see Table 2) revealed the inter-correlation values between selected variables of liquidity and profitability to be mixed (both positive and negative). The ‘r’ values were found to be positive but not significant between profitability variable as measured by ROA and liquidity variables as measured by CDR (0.324) and IDR (0.80), whereas the correlation between ROA and liquidity variable as measured by CRDR was found to be negative (–0.328) but not significant. Similarly, the correlation between profitability variable as measured by ROE and liquidity variables as measured by CDR (0.165) and IDR (0.628) was found to be positive but not significant, whereas the correlation between ROE and liquidity variable as measured by CRDR was found to be negative (–0.787) but not significant. It is apparent from the table that the correlation values were found to be statistically insignificant between all the independent and dependent variables individually used in the study.

The regression model summary to measure the effect of liquidity management on the profitability of private sector banks (dependent variable: ROA) is presented in Table 3.

Table 3

Model Summary and ANOVA Results

(Dependent Variable: ROA)

|

Coefficients |

|

|

||

Variables |

B |

Std. Error |

‘t’ Value |

Significance (p value) |

|

1

|

(Constant) |

9.333 |

1.796 |

5.196 |

0.035 |

CDR |

–0.307 |

–6.059 |

–6.059 |

0.014* |

|

CRDR |

–0.206 |

–0.524 |

–0.524 |

0.692 |

|

IDR |

–0.227 |

0.052 |

–4.363 |

0.049* |

|

R = 0.951, R2 = 0.904, Adj. R2 = 0.632, F-Value = 1.902 ( p-value = 0.049), *(p< 0.05) |

|||||

It is found that the coefficients of the regressors for all the independent variables were negative, showing that there is a negative relationship between ROA (profitability measure) and the explanatory variables (liquidity measures, i.e., CDR, CRDR and IDR) in the case of private sector banks. According to Table 3, as the calculated value of F is found to be significant, the overall fitness of the model got achieved.

The overall interpretation of these results is that there exists statistically significant relationship between banks’ profitability and banks’ liquidity as indicated by adjusted R2, i.e., 63.2% for private sector banks. Although the coefficients of the regressors are negative in private sector banks (suggesting a negative relationship between the regressors and the dependent variable), this relationship is statistically significant as suggested by the t-values, p-values, except CRDR.

Table 4

Model Summary and ANOVA Results

(Dependent Variable: ROE)

Variables |

Coefficients |

Significance |

|||

B |

Std. Error |

‘t’ value |

|||

1 |

(Constant) |

14.141 |

34.191 |

1.84 |

0.317 |

CDR |

–0.459 |

1.102 |

–0.407 |

0.754 |

|

CRDR |

–0.290 |

0.264 |

–0.433 |

0.74 |

|

IDR |

–1.420 |

0.252 |

–0.303 |

0.813 |

|

R = 0.415, R2 = 0.172, Adj. R2 = 0.082, F-Value = 0.104 at p-value = 0.910 |

|||||

The regression model summary to measure the effect of liquidity management on profitability of private sector banks (dependent variable: ROE) is presented in Table 4.

It is found that the coefficients of the regressors for all the independent variables were negative, showing that there is a negative relationship between ROE (profitability measure) and the explanatory variables (liquidity measures, i.e., CDR, CRDR and IDR) in private sector banks. In addition, the two-tail p-values for both explanatory variables are greater than 0.05, again suggesting that the explanatory variables do not have significant influence on the dependent variable. As per Table 4, the calculated value of F is also found to be less than the tabular value (0.104 at p-value = 0.910) which is more than 0.05 level of significance, which fails to prove that all the coefficients in the model are different than zero.

The combined effect of liquidity measures on ROE is 8.2% in private sector banks, as indicated by coefficient of determination. Although the coefficients of the regressors are negative in private sector banks (suggesting a negative relationship between the regressors and the dependent variable), this relationship is not statistically significant as suggested by the t-values, p-values and calculated F-value being less than the tabular value at 0.05 level of significance.

The trade-off between liquidity-profitability is one of the serious and burning issues discussed by practitioners, researchers and analysts because both liquidity and profitability are significant aspects of any business. It is more important in the case of banking sector. From the inferential statistical tests results, it can be concluded that liquidity has a significantly negative influence on the profitability as measured by Return on Assets (ROA) because of banks having excessive liquidity instead of investing the money to generate profit. However, there is no statistically significant relationship between Return on Equity (ROE) and liquidity measures taking all the variables into consideration, irrespective of the type or form of private sector commercial banks in India. This leads to the conclusion that the commercial banks can focus on increasing their profitability without affecting their liquidity and vice versa. However, this is not guaranteed because the situation might change, especially changes in the macroeconomic environment that are outside the control of the commercial banks.

Badola B S and Verma R (2006), “Determinants of Profitability of Banks in India: A Multivariate Analysis”, Delhi Business Review, Vol. 7, No. 2, pp. 79-88.

Basel Committee on Banking Supervision (BCBS, 2010). Retrieved from https:// www.bis.org/publ/bcbs189.pdf

Bhide M G, Prasad A and Ghosh Saibal (2002), “Banking Sector Reforms – A Critical Overview”, Economic and Political Weekly, Vol. 37, No. 5, pp. 399-408.

Chaudhuri S (2002), “Some Issues of Growth and Profitability in Indian Public Sector Banks”, Economic and Political Weekly, Vol. 37, No. 22, pp. 2155-2162.

D’Souza E (2002), “How Well Has Public Sector Banks Done? A Note”, Economic and Political Weekly, Vol. 37, No. 9, pp. 867-870.

Guruswamy D (2012), “Analysis of Profitability Performance of State Bank of India and its Associates”, ZENITH International Journal of Business Economics and Management Research, Vol. 2, No. 1, pp. 1-20.

Ibe, S.O (2013), The impact of liquidity management on the profitability of banks in Nigeria, Journal of Finance and Bank Management 1(1), 37-48.

Kaur, N. & Kapoor, R. (2007). Profitability Analysis of Public Sector Banks in India. Indian Management Studies Journal, 11, 167-180.

Ketkar K W and Ketkar S L (2008), “Performance and Profitability of Indian Banks in the Post Liberalization Period”, presented at the 2008 World Congress on National Accounts and Economic Performance Measure for Nations, May 13-17, Washington DC.

Mathur K B L (2002), “Public Sector Banks in India, Should They be Privatised?”, Economic andPolitical Weekly, Vol. 37, No. 23, pp. 2245-2256.

Mukhopadhyay D (2004), “Working Capital Management in Heavy Engineering Firms—A Case Study”, available at http://www.myicwai.com/knowledgebank/fm48

Munteanu, I (2013). Optimizing Bank Liquidity in Central and Eastern Europe, 6(1). 83-90.

Nayak D N (2001), “Liquidity, Productivity and Profitability of Foreign Banks and Domestic Banks in India: A Comparative Analysis”, Economic and Political Weekly, Vol. 36, No. 4, pp. 305-320.

Nimer, Warrad, Omari (2013), The impact of liquidity on Jordanian banks profitability through ROI, https://www.researchgate.net/publication/259786819_The_Impact_of_Liquidity_on_Jordanian_Banks_Profitability_through_Return_on_Assets

Patnaik, U.S. & Patnaik, M. (2005). Profitability in Public Sector Banks. New Delhi: Sonali Publications.

Van-Horne JC and JM Wachowicz (2004). Fundamentals of Financial Management (12th Edition). New York: Prentice Hall Publishers.

Vijaya kumar A (2002), “Profitability of Indian Public Sector Banks in Eighties”, in A Vijaya kumar (Ed.), Research Studies in Commerce and Management, pp. 81-85, Classical Publishing Company, New Delhi.

1. Research Scholar, Faculty of Management Sciences, Siksha O Anusandhan (Deemed to be University), Bhubaneswar, India. Email: satyakam066215@gmail.com

2. Registrar, Siksha O Anusandhan (Deemed to be University), Bhubaneswar, India.