Vol. 40 (Number 35) Year 2019. Page 13

SIDELNYKOVA, Larysa P. 1; NOVOSOLOVA, Olena S. 2 & DMYTRIV, Volodymyr I. 3

Received: 03/07/2019 • Approved: 07/10/2019 • Published 14/10/2019

ABSTRACT: The intensification of the financial instability processes in the economic systems of the countries is largely due to disparities in the amounts, terms and sources of involvement or allocation of financial resources, that are referred to as "financial imbalances" in the economic literature. In the paper, on the example of Ukraine, the approaches to the identification and evaluation of financial imbalances is presented. Specific actions and initiatives for implementation of the concept of adjustment of financial imbalances are proposed. |

RESUMEN: La intensificación de los procesos de inestabilidad financiera en los sistemas económicos de los países se debe en gran medida a las disparidades en los montos, términos y fuentes de participación o asignación de recursos financieros, que se conocen como "desequilibrios financieros" en la literatura económica. En el documento, sobre el ejemplo de Ucrania, se presentan los enfoques para la identificación y evaluación de los desequilibrios financieros. Se proponen acciones e iniciativas específicas para la implementación del concepto de ajuste de desequilibrios financieros. |

Aggravation of the problems of ensuring the financial stability of the economic system as a condition, which is the opposite of financial imbalances, necessitates a qualitatively new and systematic study of this issue. It is appropriate to associate financial stability with such a condition of an economic system, when all elements work with maximum or close to maximum efficiency. That is, a stable economic system has the ability to restrict and eliminate disparities by means of self-regulation mechanisms before they lead to a crisis. Finally, an economic system must be flexible, capable of adapting to potential challenges and counteracting endogenous and exogenous disturbance through clear legislative consolidation of preventive measures to overcome imbalances. The implementation of these tasks predetermines the need to solve the problem of identifying and overcoming financial imbalances, which will increase the sustainability of financial institutions, strengthen the competitive positions of the Ukrainian financial sector in the long run, and support business activity in the country in the context of European integration processes.

The emergence and spreading of certain manifestations of financial imbalances lead to the loss of flexibility an economic system's major elements; instability in domestic markets reduces incentives and opportunities for economic growth; permanent uncertainty destroys social capital and generates depressive mood in society. Consequently, the study of financial imbalances as causes of the instability of national economies, the identification of their immanent features, the development of their identification and evaluation techniques, and regulatory mechanisms will contribute to ensuring financial stability and prevent spreading of negative local fluctuations in the functioning of the global economy. At the same time, achieving a compromise between the processes of financial stabilization and supporting economic development in Ukraine is a priority task of introducing effective structural and institutional reforms that would reduce the existing and potential risks for the Ukrainian economy.

In world practice, to refer to the state of disequilibrium, the concept of "imbalance" is used, which is understood as «the state or condition of lacking balance, as inproportion or distribution or state of disequilibrium, discrepancy» (Shchetylova, 2012).

In the opinion of (Borio & Lowe, Securing Sustainable Price Stability: Should Credit Come Back from the Wilderness?, 2004), imbalanсе, or disequilibrium, is an inherent feature of a market economy that stems from its nature, and equilibrium is only its temporal state.

The (Regulation (EU) No.1176/2011 of the European Parliament and of the Council of 16 November 2011 on the Prevention and Correction of Macroeconomic Imbalances, 2011) “On the prevention and correction of macroeconomic imbalances” defines the term “imbalance” as “any trend giving rise to macroeconomic developments which are adversely affecting, or have the potential adversely to affect, the proper functioning of the economy of a Member State or of the economic and monetary union, or of the Union as a whole”. Such an interpretation clearly characterizes the imbalance as negative changes in the economy.

Extending the interpretation of this definition (Borio & Lowe, Securing Sustainable Price Stability: Should Credit Come Back from the Wilderness?, 2004) suggest considering financial imbalances as "overextension" in the balance sheets of economic agents, which arises during economic booms as a result of the interaction between asset prices and external financing, which in the future may lead to a reduction in the sustainability of economic growth and to aggravate the economic downturn. Thus, rapid credit expansion coupled with rising of asset prices increases the likelihood of financial instability.

(Kahn, 2010), the vice president of the Federal Reserve Bank of Kansas City, claims that financial imbalance is a steady deviation of the price of an asset or other financial variable from its long-term historical trend.

Likewise G. Kahn, Ukrainian scientist (Koziuk, 2007) emphasizes that financial imbalances are a significant deviation of the dynamics of financial aggregates (capitalization of the market of various financial instruments) from a historically known trajectory.

(Snizhko, 2008) emphasizes that financial imbalances embody the process of acquiring vulnerability by a financial system and manifest themselves in the form of overproduction or underproduction of financial products and services in particular market segments, overestimation of the financial system balances, cases of increased volatility in certain financial markets, etc.

(Luniakov, 2013) reasonably notes that "financial imbalances are, in a way, drivers of the financial system transition from the state of stability to that of instability, and which can be interpreted as due to exogenous (regulatory, technological, market, etc.) factors and / or endogenous (financial integration processes, financial convergence) factors of disproportion in terms of volumes, terms, sources of raising / allocation of funds, leading to a speculative rise in prices of financial assets and systemic financial risks".

In the 1990s and early 2000s, a number of scientists (Issing, Gertler, Goodfriend, & Spaventa, 1998), (McCallum, Robustness Properties of a Rule for Monetary Policy, 1988), (McCallum, Could a Monetary Base Rule Have Prevented the Great Depression, 1990), (McCallum, Should Monetary Policy Respond Strongly to Output Gaps?, 2001), (Meltzer, 1987), (Bernanke & Gertler, Monetary Policy and Asset Price Volatility, 1999), (Bernanke, Asset-price “Bubbles” and Monetary Policy, 2002) having analyzed episodes of price booms and recessions, revealed a significant impact of monetary policy on asset price fluctuations. The researchers drew attention to the high degree of connection between credit aggregates and "misalignments" in asset prices. Correlation of monetary aggregates with asset prices was smaller.

Subsequent studies in this area can be linked to the scientific work of (Borio & Lowe, Asset Prices, Financial and Monetary Stability: Exploring the Nexus, 2002). According to the authors, credit aggregates and asset prices, for the bodies of monetary regulation, may be some kind of "guiding lights" for the formation of financial imbalances and potential market conditions shocks, which manifest themselves as a result of asset prices collapse.

Summarizing the researches of foreign and Ukrainian scholars, it should be noted that financial imbalances are considered by them as the main reason for financial vulnerability, violations of financial security and sustainability, which is manifested in misestimation of the value of assets or imbalances in the financial flows of its individual entities. In addition, the formation and spread of financial imbalances are associated with so-called periods of "credit boom" in the private sector and price "bubbles".

Taking into account the foregoing, it is appropriate to define financial imbalances as a stable deviation of the dynamics of financial variables from long-term historical trajectories or economically justified values due to inherent deformations in the interaction of external financing and asset prices, which leads to violations in the functioning of the economic system as a whole, and in case of considerable accumulation and duration – to the emergence of financial instability, which, in the absence of effective measures, produces a financial crisis.

However, in Ukrainian practice, as well as in the practice of other countries with emerging markets, there are insufficient tools to detect and prevent financial imbalances. In this connection, there is an increase in urgency of the development and implementation of a methodology that would allow timely identification of financial imbalances, as catalysts of financial instability, and responding to them, in order to minimize their impact on the economy as a whole. Consequently, the determination of the directions for the development of a system for regulating financial imbalances in emerging markets is a vital necessity for modern financial science and practice.

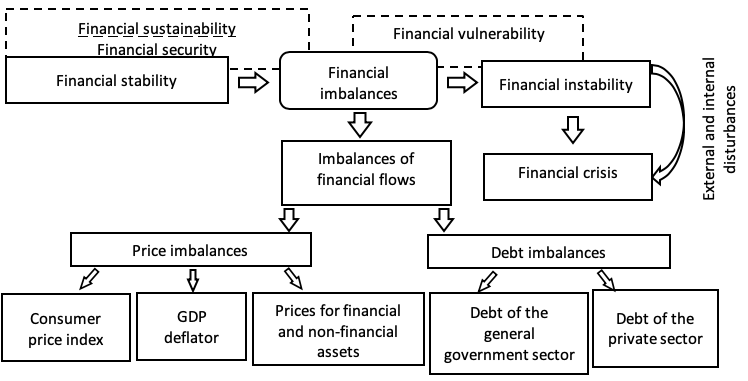

Financial imbalances, as the root cause of the emergence and spread of financial instability, are one of the types of economic imbalances that arise at a certain level of the economic system or at several levels simultaneously. Generating financial imbalances leads to greater vulnerability both to the economic system as a whole and to its financial component in particular; the violation of its sustainability and financial security, manifested in the inability to resist shocks in case of a change in market conditions. Under the influence of external shocks, an economic system appears in the state of instability and in the absence of effective anti-crisis measures it leads to a financial crisis. In the case where the amount of accumulated financial imbalances is critical in many areas of the economic system, a financial crisis occurs even without external shocks, bypassing the period of financial instability (Fig. 1).

Fig.1

Financial imbalances in economic system

Developed by the authors

By nature, there are different types of financial imbalances. Table 1 presents the authors’ vision of the classification of financial imbalances.

Тable 1

Classification of financial imbalances

Criterion of classification |

Types of imbalances |

The environment of occurrence

|

internal |

external |

|

Duration

|

short term |

long term |

|

Scale

|

global |

local |

|

Forms of manifestation |

imbalances of financial flows |

price |

|

debt |

Developed by the authors

Internal financial imbalances arise within economic system and depend on changes in its business environment. External financial imbalances are related to the capital flows across the state borders.

The formation and spread of financial imbalances can best be traced by identifying the types of their manifestation depending on the sequence of occurrence. Thus, according to the forms of manifestation, financial imbalances can be divided into imbalances of financial flows, price and debt imbalances.

Imbalances of financial flows cover a range of financial transactions the scale of which does not correspond to maintaining of balance between the real and financial sectors of the economy. Imbalances of financial flows arise under significant expansion of the financial sector and the potential existence of speculative benefits from financial market operations. However, the study of indicators characterizing financial flows, can only reveal the tendencies of changing the corresponding state for a certain period of time, and therefore do not fully reflect the financial system condition.

Price imbalances are significant deviations in prices of real and financial assets from their economically justified values. These imbalances manifest themselves in the form of "boom" of asset prices. As a rule, this situation takes place at the peak of the financial cycle. However, it should be noted that in the case of price "boom", the positive feature is the acquisition of additional benefits from the point of view of the owners of "overestimated" assets when they are sold at "overprices".

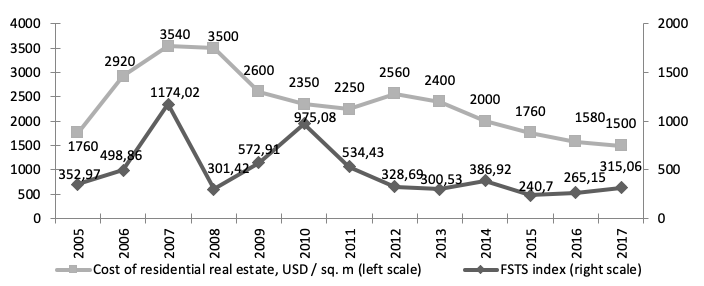

The main indicator of changes in the prices of financial assets is the change in the stock market indices, in particular, in Ukraine it is the Index of the First Stock Trading System (hereinafter - FSTS). An indicator for non-financial assets is the change in real estate prices.

The dynamics of the FSTS index, residential real estate prices in Ukraine is shown in Fig.2.

Figure 2

Dynamics of the stock market and real estate market indicators

in Ukraine in 2005-2017 (at the end of the period)

Calculated by the authors

The dynamics of the FSTS index (the percentage of the growth in the weighted average price of the "index basket" shares to the base period) is similar to the dynamics of prices for residential real estate. In addition to the unfavorable general economic situation, the importance of the FSTS index is influenced by the unattractiveness of the Ukrainian securities market due to their low profitability and a significant level of investor risk.

As a result of the analysis, the nature of the fluctuations of the FSTS index in 2005-2017 (Fig. 2) reveals the formation of a "price bubble" in the Ukrainian stock market. The maximum value of the FSTS index was observed in the middle of January 2008 and amounted to 1208 points (increase compared to the previous year was 120%). At the same time, the growth of asset value stimulated a corresponding expansion of lending.

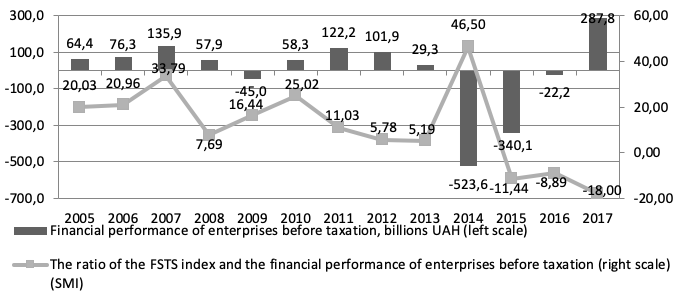

An alternative option for stock market valuation is the calculation of the Cyclically Adjusted Price-Earnings indicator or Schiller P/E ratio, which is the ratio of the current stock price or stock price index (P) and earnings (E) adjusted for inflation (Campbell & Shiller, 1998). The value of a similar indicator for the stock market of Ukraine - a stock market indicator (hereinafter - SMI) is shown in Fig. 3.

Figure 3

Dynamics of the FSTS Index and financial performance

before taxation of enterprises in Ukraine in 2005-2017

Calculated by the authors

Due to the lack of systematic statistical data on the real estate market in Ukraine, attempts to construct real estate price indices are non-informative. It is possible only to track the dynamics of absolute prices, and the established practice of expressing prices for real estate in US dollars makes the real estate market sensitive to the exchange rate fluctuations of the national currency.

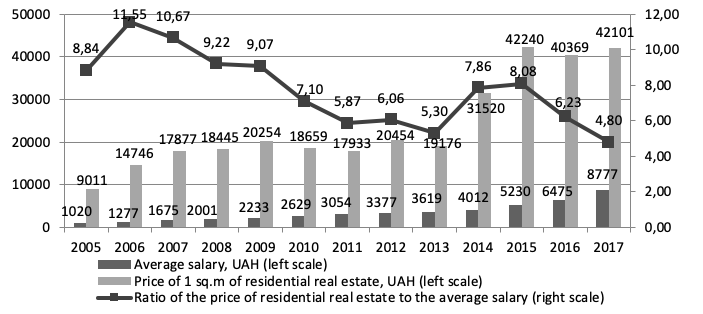

Given the existing restrictions on the possibilities of building price indices for the Ukrainian real estate market, let us determine the ratio of the price of residential real estate and average salary in Ukraine (Fig. 4).

As it can be seen from Fig. 4, the largest gap between the value of residential real estate and household income was observed in 2006, that is, the price imbalance in the real estate market reached its peak. In the period of 2007-2013, with the stable growth of the average salary, its ratio to the prices for residential real estate gradually decreased with slight fluctuations. Next year, with a nominal increase in salaries, the value of residential real estate in the national currency of Ukraine has increased rapidly, which also influenced the level of the indicator under study. At the same time, its growth in 2014 is due, first of all, to a rapid increase in real estate prices in the national currency. Similar trends remained in 2015. In 2016, the value of residential real estate decreased both in the national currency of Ukraine and in dollar equivalent.

Figure 4

Ratio of the price of 1 square meter of residential real estate and

average salary in Ukraine in 2005-2017 (at the end of the period)

Calculated by the authors

The main driver of the increase in the ratio of average salary and real estate price to the level of 11.55 in 2006 was the intensive growth of demand; instead, the reason for the decrease of this indicator in 2014-2015 (to the levels of 7.86 and 8.08 respectively) was a rapid depreciation of the national currency.

Debt imbalances are expressed in the significant accumulation of debt liabilities by economic actors, that ultimately leads to their insolvency and permanent debt crises. This situation is characterized by the "overload" of the balance sheets of economic entities with excessive liabilities, while the financial sector has a significant amount of distressed assets due to the deterioration in the quality of credit portfolio and non-payment crisis..

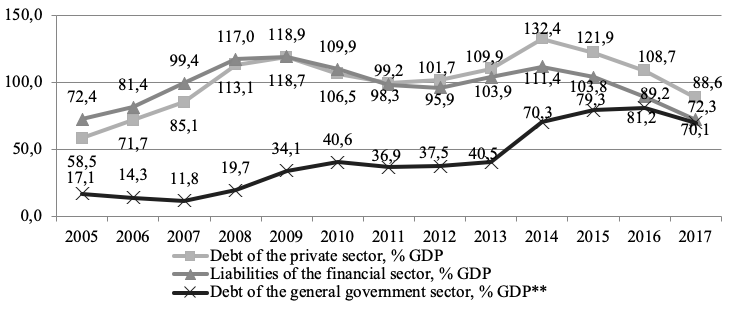

It is expedient to perform the study of debt imbalances in the context of the economic system sectors: the private sector, that of financial corporations (depository corporations and the National Bank of Ukraine), and the general government sector (Fig. 5).

Figure 5

Dynamics of debt liabilities of the sectors

of the economy of Ukraine in 2005-2017

*Calculated by the authors

**According to the IMF data

The rapid growth of the private sector debt of Ukrainian economy before 2009 was conditioned by the active involvement of credit funds on the domestic and foreign markets in pre-crisis period, and in 2008-2009, further devaluation factors were added, which eventually made the debts of the private sector quite significant. Household debt liabilities grew until 2008 inclusive; the population, despite the overestimated real estate market, actively attracted foreign currency mortgages. Rapid accumulation of private debt has made Ukrainian economy more vulnerable to the sudden stop of the capital flow to the country due to the global financial crisis. The period of 2011-2013 was marked by a gradual increase in the private sector's credit activity and an increase in its debt liabilities. The total debt of the private sector reached its maximum value in 2014, amounting to 132.4%, which even exceeded the value of 2009.

Considering debt liabilities of the financial sector of Ukraine, it should be noted that their dynamics is fully in line with trends in the private sector. At the same time, in world practice and in the scientific economic literature, there are no standards for an acceptable level of the liabilities of the financial corporations sector.

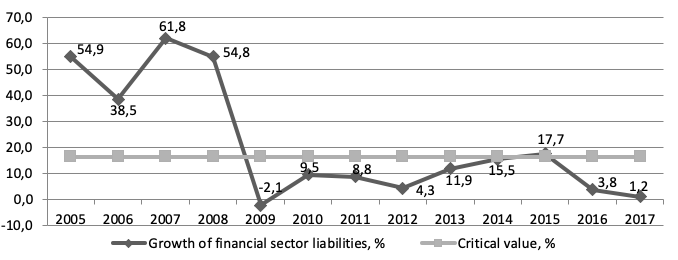

However, the diagnosis of the absolute and relative value of liabilities of the financial corporations sector only gives an idea of the debt scale. The European practice also monitors the annual growth of financial sector liabilities, the dynamics of which reveals trends in its functioning (Figure 6). The critical value of the indicator set by the European Macroeconomic Imbalance Procedure (hereinafter - MIP) equals 16.5%.

Figure 6

Dynamics of the growth rates of the financial

sector liabilities in Ukraine in 2005-2017, %

Calculated by the authors

Special attention in the context of our research is paid to the study of the debt liabilities of the public sector. As it has been already noted, the debt imbalances of the private and financial sectors of the economy ultimately negatively affect their financial performance. This causes declining tendencies in the formation of the state centralized monetary funds and forces public administration bodies to resort to borrowing, which results in the accumulation of public debt. Fig. 6 indicates that the debt value of the general government sector (hereinafter - GGS) during the analyzed period had a tendency for rapid growth. A significant accumulation of public debt in Ukraine is not only the result of not only debt policy discrepancies, but also the unceasing fiscal policy of the government, aimed at a significant expansion of budgetary expenditures without their adequate provision with income sources. And although this approach somewhat mitigates the socio-economic tension (supporting domestic demand, reducing tax burden), it ultimately leads to an increase in state debt liabilities. And in conditions of ineffective allocation of borrowed funds, the growth of public debt is uncontrolled, since the repayment of debts of previous periods requires new borrowings.

Another reason for the accumulation of significant amounts of public debt, in our opinion, is the actual passing of private debts to the state. Optimistic expectations in the context of rising asset prices will further increase the loan supply by the financial sector. When the incomes of the real sector of the economy and the population, for one reason or another, are insufficient for repaying current liabilities, a non-payment crisis arises, liquidity of credit institutions declines. The outflow of deposits from the banking system as a result of panic in the society does not allow on-lending of economic entities. Consequently, the accumulation of imbalances in terms of further credit expansion with a corresponding increase in asset prices leads to a decline in the stability of the state financial system. One of the manifestations of such a deterioration is the glut of financial institutions' balance sheets with "low-quality" or distressed assets, which ultimately affects the fiscal sector, since in order to support the financial sector and avoid social and economic instability, the state is forced to finance the repayment of debts of financial institutions and private borrowers.

The negative tendencies of the recent years in the Ukrainian economy indicate the need to find ways of restoring the balance in the financial sector, since the level of accumulated financial imbalances is critical, and the current global challenges require a high level of competitive advantages of the national economy, which is impossible without maintaining the financial stability of the economic system.

A key condition for achieving and ensuring financial stability is the construction of a system for regulating financial imbalances. It should combine elements of analysis and public policy measures to ensure financial stability and allow regulatory authorities to assess financial imbalances based on macroeconomic and monetary indicators, information on financial markets and the data obtained in the monitoring and regulation process.

Ukrainian economic science and practice does not have a clear, formalized approach to identifying and assessing the scale of financial imbalances. Therefore, the experience of the European Union member countries in introducing mechanisms for monitoring potential risks is important in the context of preventing the emergence of new financial imbalances. The first-priority steps in this direction should be: legislative provision of integrated and systematic monitoring of financial disproportions; harmonization of the rules of statistical accounting of financial assets and liabilities of institutional sectors according to the EU standards; delegation of powers to assess financial imbalances and elaborate measures for their regulation to the subdivision of the National Bank of Ukraine.

In our opinion, an assessment of the level of financial imbalance is required to determine the extent to which financial imbalances affect the economic system of the state as a whole and the development of its separate components. Despite the existence of a large number of approaches to the identification and monitoring of financial imbalances in the world financial practice, the application of those approaches is based mainly on the study of only certain aspects of their manifestation. Instead, it is the complex study of financial imbalances that is important because it allows formalizing their influence on various components of macroeconomic development. Various indicators are used directly for quantitative measurement of financial imbalances, on the basis of which conclusions are drawn on the presence or absence of "overbalancing".

As it is pertinently noted by (NASU Institute for Economics and Forecasting, 2015), the drawback of the study of financial imbalances in Ukraine according to the method developed for European countries is the lack of information for calculations or, in the presence of Ukrainian data, the inconsistency of the latter with the indicators for EU countries due to the difference in methods of the State Statistics Service of Ukraine and EUROSTAT. In Ukraine, for example, there is no data on changes in the housing price index, changes in the aggregate liabilities of the financial sector, as well as on the aggregate debt of the private sector, taking into account debt liabilities of the nonfinancial corporations sector, households and non-profit organizations providing services to households.

In our opinion, the procedure for assessing the level of financial imbalances in Ukraine should consist of a sequence of certain stages:

1. Determination of the list of indicators to be included in the methodology for assessing financial imbalances and setting their limit values.

2. Regular monitoring of the dynamics of financial imbalances indicators and tracking their deviation from optimal and threshold values. System analysis of potentially dangerous destabilizing factors.

3. Comparison of the results of the study of financial imbalances with the results of other empirical studies (indicators of financial stability, level of financial security, etc.).

4. Determination of exogenous and endogenous factors of the socio-economic sphere influencing the generation of financial imbalances.

5. Forecasting the risks of financial imbalances and developing measures to neutralize them.

6. In case of detecting significant imbalances, development of standardized algorithms for their adjustment and assessment of measures taken to achieve financial equilibrium.

The proposed list of non-duplicate indicators allows identifying various aspects of the manifestation of financial imbalances. However, in our opinion, in order to identify the initial stages of their formation, it is expedient to study the indicators of financial flow and price imbalances.

In particular, it is proposed to introduce the following indicators to this list:

- residential real estate price index (COMP_1);

- stock market index (COMP_2);

- change of the real effective exchange rate for the last 3 years,% (COMP_3);

- amount of lending to the private sector,% of GDP (COMP_4);

- change in the aggregate liabilities of the financial sector,% (COMP_5);

- the ratio of metallic reserve storing to short-term external debt (COMP_6) (Table 2).

Table 2

Input data for calculating the integral

index of financial imbalances

Year |

comp_1 |

comp_2 |

comp_3 |

comp_4 |

comp_5 |

comp_6 |

2006 |

11.55 |

20.96 |

12.9 |

5.2 |

38.5 |

0.83 |

2007 |

10.67 |

33.79 |

-4.1 |

7.6 |

61.8 |

0.85 |

2008 |

9.22 |

7.69 |

-18.1 |

10.2 |

54.8 |

0.68 |

2009 |

9.07 |

16.44 |

-13.9 |

-0.7 |

-2.1 |

0.67 |

2010 |

7.10 |

25.02 |

12.9 |

7.7 |

9.5 |

0.68 |

2011 |

5.87 |

11.03 |

11.0 |

12.3 |

8.8 |

0.53 |

2012 |

6.06 |

5.78 |

-4.3 |

9.1 |

4.3 |

0.37 |

2013 |

5.30 |

5.19 |

-8.6 |

10.7 |

11.9 |

0.34 |

2014 |

7.86 |

46.5 |

-22.9 |

5.0 |

15.5 |

0.13 |

2015 |

8.08 |

-11.44 |

-15.2 |

-14.5 |

17.7 |

0.26 |

2016 |

6.23 |

-8.89 |

7.7 |

-1.5 |

3.8 |

0.32 |

2017 |

4.80 |

-18.00 |

-2.5 |

1.0 |

1.2 |

0.41 |

Calculated by the authors

It should be noted that all six of the above indicators are relative. In calculating the selected indicators, quite scattered values were obtained, which requires their further normalization according to a scale from 0 to 1 and bringing to a comparable view.

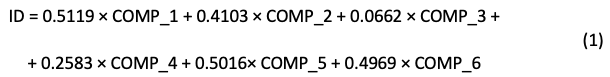

To sum up, it should be emphasized that in order to obtain an integral indicator of financial imbalances in the economic system of the state, it is expedient to consider the application of the principal component analysis. This method is intended to evaluate the parameters of a model with multicollinear variables. It allows determining the weight of the intercorrelating indicators of financial imbalances in the integral index of their assessment. The essence of the principal component analysis is to transform the set of selected variables of the integral index of financial imbalances into a new set of pairwise uncorrelated variables. These variables will form the integral index of financial imbalances. As a result, we obtain a situation in which the first variable of the new set corresponds to the maximum possible variance; the value of the second will be less, and so on. Therefore, the coefficients calculated for the first principal component can be used to form an integral index of financial imbalances in the economic system of the state in a particular year.

Using the eigenvalues of the first principal component, it is possible to present the general view of the integral index of financial imbalances (ID) for Ukraine in a given year i. To do this, it is necessary to sum up products of normalized values by separate indicators (variables) characterizing financial imbalances with coefficients according to the first principal component (formula 1):

Based on formula 1, it can be argued that almost all components of the developed integral index of financial imbalances in Ukraine, except of changing the real effective exchange rate and the amount of lending to the private sector, have roughly identical coefficients, which indicates an equal share of each indicator in the integral index.

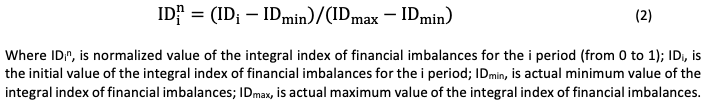

Using formula 1, we calculate the value of the integral index of financial imbalances for Ukraine in 2006-2017. Since the scattered values are obtained, it becomes necessary to convert them to a normalized scale from 0 to 1 using formula 2:

Where IDin, is normalized value of the integral index of financial imbalances for the i period (from 0 to 1); IDi, is the initial value of the integral index of financial imbalances for the i period; IDmin, is actual minimum value of the integral index of financial imbalances; IDmax, is actual maximum value of the integral index of financial imbalances.

Having obtained a normalized scale of the integral index of financial imbalances from 0 to 1, it is necessary to perform the gradation of this range to a few smaller ones to give the characteristics of the level of such imbalances. To do this, it is appropriate to use the concept of quartiles, according to which splitting off the scale from 0 to 1 will be carried out by four intervals. A quartile is used to describe indicators, the division of which differs from normal. The concept of quartiles involves ranking the variation series and dividing it into four parts:

- 0-0.25 – low level of imbalances;

- 0.26-0.50 – medium level of imbalances;

- 0.51-0.75 – high (significant) level of imbalances;

- 0.76-1 – critical level of imbalances.

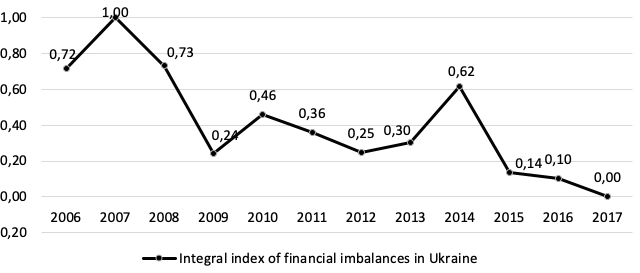

Fig. 7 presents the obtained values of the integral index of financial imbalances in Ukraine.

Figure 7

Dynamics of the integral index of financial

imbalances in Ukraine in 2006-2017

Calculated by the authors

Fig. 7 shows that the maximum values of the integral index of financial imbalances in Ukraine were observed in 2007-2008, and the minimum ones - in 2009 and 2017.

At the same time, it should be emphasized that the integral index of financial imbalances is an aggregate indicator of the equilibrium of the state's economic system. It allows detecting negative changes in the initial stages of their manifestation, but its ability to assess accumulated imbalances is somewhat limited, since excessive credit expansion and price imbalances affect the structure of the balance sheets of economic entities and lead to debt imbalances only after a certain period of time. Therefore, it is advisable to carry out elementwise monitoring of financial equilibrium by analyzing and evaluating each indicator of financial imbalances in dynamics, as a rapid deviation of one of them is a signal of the occurrence of a particular form of financial imbalances.

The main task of the state in the formation of a system for regulating financial imbalances is to create a consistent structure for analyzing aspects of financial stability with the aim of: 1) early detection of possible vulnerability factors, before they lead to downward correction in markets, the emergence of liquidity and solvency problems at financial and non-financial institutions or destruction of elements of financial infrastructure; 2) taking preventive and timely measures to avoid financial instability; 3) restoring stability of the system if the use of preventive measures in response will be unsuccessful (Schinasi, 2005).

Thus, we define the state regulation of financial imbalances in the economic system as a complex of measures and instruments of influence of the authorized state bodies aimed at preventing / minimizing negative consequences / overcoming negative consequences of financial imbalances. Taking into account the distinct forms of financial imbalances, it is expedient to carry out state regulation according to three directions: regulation of financial market imbalances, regulation of price imbalances, and regulation of debt imbalances.

The main purpose of state regulation of financial flows is to ensure the correspondence between the development of the financial and real sectors of the economy, as excessive activation of financial flows leads to financialization (Korneev, 2015), strengthening the role of the financial sector, and, accordingly, reducing the significance of the real sector .

The main directions of regulation of financial market imbalances in the economies with emerging markets are as follows:

Thus, on the example of Ukraine, we can state that the primary task of the governments of the states with emerging markets is to implement systemic reforms in order to stimulate economic growth and ensure financial stability. At the same time, the fundamental moment in modernizing these economies should be to maintain a clear balance between stimulating and regulatory measures. Thus, to revive economic processes, it is necessary to loosen monetary policy, which will deepen the gap between the real and financial sectors, and an increase in liquidity in circulation will contribute to speculative "overheating" of certain segments of the financial market and "price bubbles". The use of macro-prudential measures in accordance with the recommendations of the Third Basel Accord will allow ensuring financial stability in the long run by preventing systemic risks and overcoming imbalances at the micro and macro levels.

Balitska, V. V., & Korotkevich, O. V. (2016). Metodychni pidkhody do otsinky vplyvu chynnykiv finansovoi nestabilnosti na derzhavni finansy [Methodical approaches to estimating the impact of financial instability factors on public financesї. Investment: practic and experience, 17, 5-16.

Bernanke, B. (2002, October 15). Asset-price “Bubbles” and Monetary Policy. Speech delivered at the New York Chapter of the National Association for Business Economics. New York.

Bernanke, B., & Gertler, M. (1999). Monetary Policy and Asset Price Volatility. New Challenges for Monetary Policy (pp. 77–128). Kansas City: Federal Reserve Bank of Kansas City.

Bobeva, D. (2013). The New EU Macroeconomic Imbalances Procedure and its Relevance for the Candidate Countries. Journal of Central Banking Theory and Practice, 1, 69-88.

Borio, C., & Lowe, P. (2002). Asset Prices, Financial and Monetary Stability: Exploring the Nexus. BIS Working Paper, No 114.

Borio, C., & Lowe, P. (2004). Securing Sustainable Price Stability: Should Credit Come Back from the Wilderness? BIS Working Paper, No 157.

Campbell, J., & Shiller, R. (1998). Valuation Ratios and the Long-Run Stock Market Outlook. The Journal of Portfolio Management, 24(2), 11-26.

Issing, O., Gertler, M., Goodfriend, M., & Spaventa, L. (1998). Asset Prices and Monetary Policy: Four Views. London: Centre for Economic Policy Research (CEPR) and Bank for International Settlements (BIS) booklet, CEPR.

Kahn, G. (2010). Taylor Rule Deviations and Financial Imbalances. Federal Reserve Bank of Kansas City Economic Review, 2, 63-69.

Korneev, M. V. (2015). Dysbalansy rukhu finansovykh resursiv v ekonomitsi [Imbalances in the flow of financial resources in the economy]. Dnipropetrovsk: Aktsent.

Koziuk, V. (2007). Monetarni aspekty rozvytku pohliadiv na problemu zabezpechennia hlobalnoi finansovoi stabilnosti [Monetary Aspects of Developing Perspectives on the Problem of Global Financial Stability]. Bulletin of the National Bank of Ukraine, 4, 34-39.

Luniakov, O. (2013). Disbalansy v finansovom sektore ehkonomiki: sushchnost' i instrumenty regulirovaniya [Imbalances in the financial sector of the economy: the nature and adjustment instruments]. Sevastopol: Rybest.

McCallum, B. T. (1988). Robustness Properties of a Rule for Monetary Policy. Carnegie-Rochester Conference Series on Public Policy, 1(29), pp. 172-203.

McCallum, B. T. (1990). Could a Monetary Base Rule Have Prevented the Great Depression. Journal of Monetary Economics, 26, 3-26.

McCallum, B. T. (2001, May). Should Monetary Policy Respond Strongly to Output Gaps? American Economic Review, 91(2), 258-262.

Meltzer, A. H. (1987). Limits of Short-Run Stabilization Policy. Economic Inquiry, 25, 1-14.

NASU Institute for Economics and Forecasting. (2015). Identification Models of Macroeconomic Imbalances in Ukraine. In S. Shumska. Kyiv: DU "NASU Institute for Economics and Forecasting".

Order of the Ministry of Economic Development and Trade of Ukraine. (2013, October 29). Metodychni rekomendatsii shchodo rozrakhunku rivnia ekonomichnoi bezpeky Ukrainy [On Approval of Methodological Recommendations for Calculating the Level of Economic Security of Ukraine]. Retrieved from http://www.me.gov.ua/control/uk/publish/category/main?cat_id=38738&stind=1

Regulation (EU) No.1176/2011 of the European Parliament and of the Council of 16 November 2011 on the Prevention and Correction of Macroeconomic Imbalances. (2011). Retrieved from http://www.eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2011:306:0025:003

Schinasi, G. (2005). Safeguarding Financial Stability: Theory and Practice . Washington, D.C. : International Monetary Fund.

Shchetylova, T. V. (2012). Ocenka global'nyh disbalansov v ocenke makroehkonomicheskih sistem [Evaluating global imbalances in the assessment of macroeconomic systems]. Fundamentals of Economics, Management and Law, 6(6), 106-111.

Snizhko, O. (2008). Iierarkhiia finansovoi nestabilnosti [Hierarchy of financial instability]. Formation of market relations in Ukraine, 2, 29-33.

1. Doctor of Science, Head of the Department of Finance, Banking and Insurance, Kherson National Technical University, Kherson, Ukraine. E-mail: larisa1907s@gmail.com

2. PhD in Economics, Senior Lecturer of the Department of Finance, Banking and Insurance, Kherson National Technical University, Kherson, Ukraine. E-mail: novoselova27@gmail.com

3. PhD in Economics, Associate Professor of the Department of Taxes and Fiscal Policy, Ternopil National Economic University, Ternopil, Ukraine. E-mail: dmytriv88@ukr.net