Vol. 40 (Issue 37) Year 2019. Page 11

IFADA, Luluk Muhimatul 1; FAISAL, Faisal 2; GHOZALI, Imam 3 & UDIN, Udin 4

Received: 04/07/2019 • Approved: 22/10/2019 • Published 28/10/2019

ABSTRACT: This study examines the effect of company attributes (i.e., dividend policy, capital structure, and ownership concentration) on firm values. The sample consists of fifty-six companies listed on Jakarta Islamic Index. SmartPLS program is used to analyze the data. The findings show that ownership concentration and profitability have a positive effect on firm value. In contrast, liquidity has a negative effect on capital structure. However, this study doesn’t find any relationship between profitability and capital structure. Finally, capital structure mediates the relationship between profitability, liquidity, and firm value. |

RESUMEN: Este estudio examina el efecto de los atributos de la empresa (es decir, la política de dividendos, la estructura de capital y la concentración de propiedad) en los valores de la empresa. La muestra consta de 56 empresas incluidas en el índice islámico de Yakarta. El programa SmartPLS se utiliza para analizar los datos. Los resultados muestran que la concentración de la propiedad y la rentabilidad tienen un efecto positivo en el valor de la empresa. En contraste, la liquidez tiene un efecto negativo en la estructura del capital. Sin embargo, este estudio no encuentra ninguna relación entre rentabilidad y estructura de capital. Finalmente, la estructura de capital media la relación entre rentabilidad, liquidez y valor de la empresa. |

The main purpose of the company is not only to earn a profit but also to maximize the firm value. Firm value can be achieved by increasing stock prices to enhance the prosperity of the owner. Saona & San Martín (2018); Crisóstomo et al. (2011) explained that there are several company attributes i.e., dividend policy, capital structure, and ownership concentration can affect firm value. Dividend policy and capital structure are complementary ways of controlling agency problems because they tend to influence manager incentives and impact on firm value (Saona & San Martín, 2018).

Saona & San Martín (2018) found that dividend policy has a positive effect on firm value. Highly dividend policy in the form of dividend payout can increase stock price and firm value of the companies. The finding of Anton (2016); Baker & Powell (2012); Hauser & Thornton ( 2017) is in line with the study of Saona & San Martín (2018). However, Dennis & Smith (2014) argued that the effect of dividend policy on firm value is negative. Creating an artificial dividend may decrease the firm value because it diverts funds from investment to the consumption of perquisites. Another study is conducted by Dennis & Smith (2014) which found that dividend policy has no effect on firm value.

Saona & San Martín (2018); Nababan (2016); La Rocca (2007) conduct a study related to capital structure revealed that capital structure has a positive effect on firm value. The increase in performance can be seen from the company's capital structure. Firm value can increase the high capital structure ratio. However, Vo & Ellis (2017) cannot support the effect of capital structure on firm value. Capital structure has a negative effect on firm value.

This study also considers the ownership structure as a factor that influences firm value. The previous study suggests that in developing countries such as Indonesia, the ownership structures are characterized by high concentrations. Saona & San Martín (2018); Crisóstomo et al. (2011) argued that the concentration of ownership is a significant driver of the firm value of the market. It reduces the intensity of financial constraints and therefore increases firm value. De Miguel, Pindado, and De La Torre (2004), Saona & Martin (2010); García-Meca & Sánchez-Ballesta (2011); Wang (2018) provided evidence that the concentration of ownership negatively affects firm value.

Saona & San Martín (2018) and Nababan (2016) showed that capital structure positively affects firm value. Capital structure is able to drive management to increase firm value. In contrast, Loncan (2014); Chen, Li-Ju, & Chen (2011) found that capital structure has a negative effect on firm value. Manurung et al. (2014) also proved that capital structure has no effect on firm value.

In terms of the relationship between profitability and firm value, Chen, Li-Ju, & Chen (2011); Crisóstomo, De Souza Freire, & De Vasconcellos (2011); Deswanto & Siregar (2018); Haryono & Iskandar (2015); Nuryaman (2015); Osazuwa & Che-Ahmad (2016); Purwanto & Agustin (2017) found that the higher profitability will increase the higher of firm value. However, Kodongo, Mokoaleli-Mokoteli, and Maina (2015) and Oktrima (2017) found that profitability has no effect on firm value.

Barclay et al. (2003) support the positive effect of the company's ability to fulfill short-term obligations to firm value. Firm value can increase with high liquidity ratio. However, Amihud & Mendelson (2008); Osazuwa & Che-Ahmad (2016) cannot support the effect of liquidity on firm value. The company's liquidity ratio is not considered by investors to invest because this ratio is considered only to cover the company's short-term liabilities with current assets.

This study adds an antecedent test of capital structure in the form of profitability and liquidity and sees its influence on firm value. It shows the capital structure mediates profitability and liquidity toward firm value. Profitability and liquidity have an influence on the capital structure with a negative direction as pecking order theory. The higher liquidity and profitability of the company indicates that there are an internal funding source and priority in the fulfillment of capital requirements rather than the use of debt.

This study extends the previous studies by developing the relationship between company attributes, capital structures and firm. This study also considers the profitability and liquidity variables in the model. As stated by Alfi & Safarzadeh (2016); Chen, Li-Ju, and Chen (2011), profitability and liquidity can affect firm value. Furthermore, they argued that capital structures can mediate the relationship between profitability and liquidity and firm value. Thus, the purpose of this study is to examine the effect of company attributes on firm value and to test profitability and liquidity as antecedents of capital structure on firm value.

Enterprise theory recognizes the existence of accountability from the company owners and stakeholders (Triyuwono, 2007). Enterprise theory is developed into sharia enterprise theory because of it more closely with the concept of sharia. Triyuwono (2007) revealed that the sharia enterprise theory includes God, human, and nature. This theory establishes God as the highest stakeholder. The definite consequence is the application of sunnatullah as the basis of sharia accounting construction. The second stakeholder is a human being that is divided into two groups, those who directly contribute to the company (direct stakeholders) and parties that do not contribute to the company (indirect stakeholders). The last stakeholder is nature. Nature is a party that contributes to the way the company like God and man. Companies can stand and exist physically because they stand on earth, producing raw materials available from nature, using energy, and so on. As revealed by Rahayu (2015) that registered companies in Jakarta Islamic Index (JII) have passed a series of processes and fulfill the same elements as other indexes, even paying attention to the illicit elements in the view of Majelis Ulama Indonesia.

Signaling theory states that company executives who have better information about their employer will be compelled to provide information open to prospective investors (Ross, 1977). In addition, this theory describes the company will always try to give a positive signal on the company's performance to external parties through the disclosure of information in the financial statements. This theory can be a reference to provide a positive signal that can be shown with the state of profitability, liquidity and dividend policy. The higher profitability, liquidity, and dividend policy are considered to be capable to provide a positive signal for investors to increase the company values.

Pecking order theory is the development of signaling theory. This theory is a funding structure that offers other alternatives to make funding decisions (Myers & Majluf, 1984). Pecking order theory explains that companies are advised to have policies to funding sources and to consider low cost and risk. This theory can be a reference to increase firm value because it assumes that the high profitability of the company will reduce the use of debt. Companies will use external funding if the internal is not sufficient (Brealey, Myers, & Allen, 2005.

Dividend policy is determined by agency costs arising from the separation of ownership and control (Jensen, 1986). Disbursements of cash to shareholders reduce the manager's ability to spend firm assets on perquisites and also increase the manager likelihood to face the discipline of capital markets. For measurements, it uses the payout ratio. The ratio is the proportion of dividend to each share with the profit earned. According to Saona & San Martín (2018), the use of this proxy is based on the payout ratio that provides an overview of how management shares profits to shareholders rather than keeping in retained earnings.

Miller & Modigliani (1963) identify the irrelevance of capital structure and invariance of the weighted average cost of capital to the proportion of debt and equity. In other words, internal and external financing are perfect substitutes (Bevan & Danbolt, 2002). Measurement of capital structure uses leverage (Hovakimian & Li, 2011). Chen and Zhao (2006) argue that leverage implies the cumulative use of held funds, debt, and equity, thereby disclosing the company's financial policies and potential impacts on firm value.

Owing to their significant equity holdings, major shareholders typically have stronger incentives and power to discipline management and remedy the free rider problem associated with dispersed ownership (Heugens, van Essen, & van Oosterhout, 2009). Nevertheless, significant equity positions can obviously tempt to large shareholders to expropriate from minority investors by assuming control of the firm and depriving the latter of the returns due on their investments (Li & Qian, 2013). Ownership concentration is measured by majority ownership or institutional share ownership. It is appropriately used as a proxy for the average company in Indonesia that is dominated by the family and there is no separation between ownership and control (Arora & Sharma, 2016; Iqbal, Nawaz, & Ehsan, 2018; Noorlailie, 2018).

Profitability is used as an indicator of the company’s fundamental performance which represents management performance. Rating of earnings is an assessment of the condition and the ability earnings to support operations and capital (Rusydiana & Parisis, 2016). Return on assets (ROA) indicators as used by Chen, Li-Ju, and Chen (2011) to measure profitability.

The liquidity measures a company’s ability to pay off its current liabilities (payable within one year) with its current assets such as cash, accounts receivable and inventories (Yeo, 2016). The higher ratio is better than the company's liquidity position. Relationship between liquidity and leverage can have two possible forms where more levered firms want to reduce the risk of financial distress (Loncan, 2014). Liquidity is measured with current ratio (Loncan, 2014; Yeo, 2016).

2.9. Firm Value

Firm value is the perception of the investor to the success of a company. It is reflected in the share price of the company. The increase of the share price shows the trust of the investors to the company. They are willing to pay more with aiming for a higher return. The firm value is the total assets owned. It consists of the market value of share and liabilities (Damodaran, 2002). The high stock price can provide a good signal to attract investors to determine investment decisions. The firm value in this study uses proxies of Crisóstomo et al. (2011); Saona & San Martín (2018) namely the ratio of market price to book value ratio.

Dividend payouts theoretically can be characterized as mechanisms capable for increasing firm value. Dividend policy serves as a disciplinary tool by means of high dividend payments to align managers' interests with investors and increase firm value (De Miguel et al. 2004). According to Crisóstomo et al. (2011), dividend payout policy can improve managerial oversight by entering creditors as supervisors. When the dividend payout is relatively low, the company is encouraged to get external funds from the debt, so the creditor takes the supervisory role with the loan funds by monitoring the manager's performance and increasing firm value. Saona & San Martín (2018); Anton (2016); Baker & Powell (2012); Hauser & Thornton (2017) gained the empirical support of the positive effect of dividend policy on firm value. Therefore,

H1: Dividend policy has a positive effect on firm value.

Capital structure becomes the emergence of company efficiency with the use of debt as a control mechanism by managers (Barclay et al., 2003). The occurrence of performance improvement can be seen in the company's capital structure. This is in accordance with the signaling theory where the capital structure can be a signal for investors to invest because the company is considered as a good performance to fund the capital structure. Saona & San Martín (2018) ; Nababan (2016); La Rocca (2007) show that there is a positive effect of capital structure on firm value. Thus,

H2: Capital structure has a positive effect on firm value.

Saona & San Martín (2018) stated that ownership concentration can be used as an internal mechanism to discipline management. Share ownership by the largest shareholders can be used as an incentive to supervise as well as influence decision making for management. This cannot be done by shareholders if the ownership of shares in the company is very small (Saona & San Martín (2018). Crisóstomo et al. (2011) show that share ownership has a positive effect on firm value. Thus,

H3: Ownership concentration has a positive effect on firm value.

The ability of the company to earn a high profit means that the company has sufficient funds in the operationalization. The high level of profit is used as a return earning to meet operational funds. This is in accordance with pecking order theory where the return earning becomes the main alternative followed by debt and as the last option to issue shares in the acquisition of capital resources. Chen, Li-Ju, and Chen (2011) obtained that profitability has a negative effect on capital structure. Thus,

H4: Profitability has a negative effect on capital structure.

The high profitability of the company shows the prospect of a good future. The high profitability performs the more profits that are distributed for shareholders. This is in accordance with signaling theory because of the high profitability can provide a signal for investors to invest. Nababan (2016); Crisóstomo et al. (2011); Deswanto & Siregar (2018); Haryono & Iskandar (2015); Nuryaman (2015); Osazuwa & Che-Ahmad (2016); Purwanto & Agustin (2017) empirically gain proof that profitability has a positive effect on firm value. Thus,

H5: Profitability has a positive effect on firm value.

A high level of liquidity is considered to meet the company's operational needs with internal funds without having to rely on external funds. This is in line with the pecking order theory because of the increased liquidity will have enough excess assets and it can be used to finance the company's operations and reduce debt. Owino (2011) in their research proved that liquidity has a negative effect on capital structure. Thus,

H6: Liquidity has a negative effect on capital structure.

The decision to determine the number of cash reserves has become one of the significant factors in the financial literature (Alfi & Safarzadeh, 2016). In accordance with signaling theory, the high liquidity of the company will provide a signal and a positive response from the market to increase firm value. Barclay et al (2003); Marsha & Murtaqi (2017) show that liquidity has a positive effect on firm value. Thus,

H7: Liquidity positively affects firm value.

The population of this study is listed companies manufacturing in the JII of the period 2014-2017. This study refers to both qualitative and quantitative. This shows that JII's performance has improved quite well. The high investor response to the listed companies' shares is also due to the fact that JII shares have healthy capital structure, liquid and most investors think that JII has a lower financial risk and higher return potential. This study uses purposive sampling with criteria (1) companies consistently existing in JII of the period 2014-2017; (2) companies submit the financial statements in the rupiah currency; (3) companies have the required data; (4) companies have a positive profit in the period of 2014-2017. Data, therefore, is analyzed using structural equation modeling (SEM) with partial least square (PLS) method.

Table 1

Sample of the Study

Explanation |

Total |

Total companies entering in JII of the period 2015 |

30 |

Companies that are not registered consistently in the Jakarta Islamic Index in the period 2014-2017 |

13 |

Companies that are not presented in rupiah-denominated financial statements for the period 2014-2017 |

3

|

Number of research samples per years of the study period |

14 |

Table 2 shows the descriptive statistics of the sample.

Table 2

Descriptive Statistics

Variable |

N |

Min |

Max |

Mean |

Std. Deviation |

Dividend Policy |

56 |

0.1002 |

0.7509 |

0.3608 |

0.1814 |

Capital Structure |

56 |

0.1364 |

0.6931 |

0.4077 |

0.1649 |

Ownership Concentration |

56 |

0.1788 |

0.8499 |

0.5834 |

0.1584 |

Profitability |

56 |

0.0248 |

0.4018 |

0.1318 |

0.0843 |

Liquidity |

56 |

0.4500 |

6.9133 |

2.2359 |

1.5972 |

Firm Value |

56 |

1.02 |

58.48 |

6.0868 |

11.5151 |

Based on Table 2, it can be seen that dividend policy shows the average value of 0.3608. It means the average dividend compared to earnings per share of 36.08 percent. Capital structure means that the average debt to asset ratio is 40.77 percent. The concentration of ownership shows the average institutional share ownership of 58.34 percent. Profitability average is 13.18 percent of total assets. The average liquidity of current assets is 2.2359 times to the current debt. The average value of the company is 6.0868. It means that the stock price compared to the book value of shares is 6.08 times.

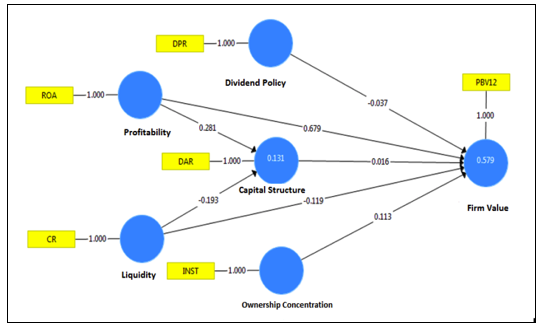

Figure 1

Full Model

From Figure 1, it can be seen that the outer loading shows each construct is quite high (greater than 0.5). It indicated ‘valid and reliable’. The VIF value shows that there is no collinearity because the value is less than 5.

Table 3

R-Square (R2)

|

R Square |

R Square Adjusted |

Firm Value |

0.579 |

0.537 |

Capital Structure |

0.131 |

0.098 |

From Table 3, it can be seen that firm value has R-Square better than capital structure (0.579 or to 57.9%). This means that firm value can be explained by the independent variables, i.e., dividend policy, capital structure, ownership concentration, profitability and liquidity of 57.9% while 42.1% is explained by other variables.

Table 4

Hypotheses Testing

Hypotheses |

Estimate |

T-Statistic |

ρ |

Result |

Dividend Policy à Firm Value |

-0.037 |

0.377 |

0.353 |

Rejected |

Capital Structure à Firm Value |

0.016 |

0.107 |

0.107 |

Rejected |

Ownership Concentration à Firm Value |

0.113 |

1.514 |

0.065 |

Accepted |

Profitability à Capital Structure |

0.281 |

1.917 |

0.028 |

Rejected |

Profitability à Firm Value |

0.684 |

6.641 |

0.000 |

Accepted |

Liquidity à Capital Structure |

-0.193 |

1.640 |

0.051 |

Accepted |

Liquidity à Firm Value |

-0.122 |

1.371 |

0.085 |

Rejected |

Notes: * ρ < 0.05.

Based on the results of the analysis in Table 4, it can be concluded that dividend policy has no effect on firm value. The dividend policy is deemed not to affect the welfare and prosperity of shareholders. Dividends distributed are considered not necessarily continuing to increase firm value. There may also be an external factor for investors who consider management to choose using retained earnings rather than dividend payments to make a profit. This result shows that the average company has a policy in dividend distribution which has a fixed value or not really increase every year, so the dividend policy does not give a significant effect on firm value. This finding is supported by Dennis & Smith (2014) that dividend policy has no effect on firm value.

The positive effect of concentration of ownership on firm value is proved. Company governance through a concentration of ownership policy may affect the firm value since majority ownership is proven to influence management's decision-making to take into account the interests of shareholders. Management actions can accommodate the interests of shareholders by making institutional investors to increase share ownership and firm value. The results support the findings of Chabachib, Fitriana, Hersugondo, Pamungkas, & Udin (2019); Crisóstomo et al. (2011); Heugens et al. (2009).

The result of the analysis shows that profitability affects capital structure. This result indicates if the higher profitability will increase capital structure. The result of this study is not consistent with pecking order theory because it assumes internal funding is preferred over funding from outside of the company. The result of this supports the finding of Andika, Prasetyo, & Fitria (2016).

This study proves that profitability has a positive effect on firm value. This indicates that higher profitability will increase firm value. The result of this study also supports the signaling theory where the company will always try to give a positive signal to external parties about the performance. This is indicated by the high profitability can increase investment on future good prospects. The high demand for investment to invest capital can make the stock price will increase. This result supports the study of Chen, Li-Ju and Chen (2011); Crisóstomo et al. (2011); Deswanto & Siregar (2018); Haryono & Iskandar (2015); Nuryaman (2015); Osazuwa & Che-Ahmad (2016); Purwanto & Agustin (2017).

This study reveals that there is a negative effect of liquidity on capital structure. The result of this study supports the pecking order theory where the company selects funding sources from within rather than external sources. The high liquidity causes the company reducing its debt because it has substantial funds and can be used to finance operations. This result supports the studies of Owino (2011).

Based on the results of the analysis, liquidity affects firm value with negative direction. High liquidity companies actually lower the firm value. This finding is not in line with the signaling theory where a company has high liquidity to give a positive signal and increase firm value. The finding supports the results of Hersugondo, Pertiwi, & Udin (2019); Hersugondo & Udin (2019); Purwanto & Agustin (2017).

Table 5 shows the total indirect effect of profitability on firm value through capital structure.

Table 5

Indirect Effect of Profitability on Corporate Value through Capital Structure

Explanation |

Indirect effect of profitability on firm value (A) |

Direct effect of profitability on capital structure (B) |

Indirect effect of capital structure on firm value (C) |

Indirect effect (D) = A+(BXC) |

Profitability à Capital Structure à Firm Value |

0.684 |

0.287 |

0.016 |

= 0.684+ (0.287x 0.016) = 0.684 + 0.0045 = 0.6885 |

The calculation in Table 5 proves that capital structure becomes the mediating variable of profitability and firm value. Indirect effect (0.6885) is greater than direct effect (0.684). It shows the high profitability of increasing firm value indirectly through capital structure. This result is supported by Chen, Li-Ju, and Chen (2011). This study provides direction of the importance of management to increase capital structure to mediate profitability and firm value.

Table 6 presents the total indirect effect of liquidity on firm value through the capital structure.

Table 6

Indirect of Liquidity on Firm Value through Capital Structure

Explanation |

Direct effect of liquidity on firm value (A) |

Direct effect of liquidity on capital structure (B) |

Direct effect of capital structure on firm value (C) |

Indirect effect (D) = A+(BXC) |

Liquidity à Capital Structure à Firm Value |

-0.122 |

-0.193 |

0.016 |

= -0.122 + (-0.193 x 0.016) = -0.122 - 0.003 = -0.125 |

Table 6 shows that capital structure becomes a mediating mediation in the relationship between liquidity and firm value. Comparison of direct effect (-0.122) is smaller than the indirect effect (-0.125). This result concludes that the high liquidity will increase the value of the company indirectly through capital structure. This indirect effect indicates that a liquid company will lower capital structure, which in turn will increase the investor's capital investment and firm value.

The results of the study conclude that concentration of ownership and profitability have a positive effect on firm value, and capital structure mediates the relationships between profitability and liquidity on firm value. This results approve the findings of Crisóstomo et al. (2011); Osazuwa & Che-Ahmad (2016); Owino (2011). This study has an implication on company attribute in the form of concentration of ownership which has a positive effect on firm value. Likewise, profitability also has a positive effect on firm value such as liquidity on capital structure. Management has a high commitment to the creation of profitability and liquidity to balance the optimum capital structure to increase firm value. In addition, management is also expected to maintain the proportion of ownership concentration in order to increase firm value.

This study has some limitations and suggestions for further research as follow:

The samples of this study only consist of fifty-six companies listed in JII 2015. It is more challenging for future research to expand the samples to generate the findings.

Firm value has a standard deviation of 11.5151 which higher than its mean value of 6.0868. This means that the indicator of firm value low of data accuracy. Future research should use other indicators such as Tobin's q. It is expected that Tobin's q as the proxy of firm value can provide a piece of good information and accuracy.

R-square value of capital structure is too small (0.098). This means that only 9.8% of the variable is described as an independent variable, 90.2% is described other variables that out the study. Future research should add company size as a moderating variable with the consideration of the negative effect of profitability on capital structure (Chen, Li-ju, and Chen, 2011).

Alfi, S., & Safarzadeh, M. H. (2016). Effect of Capital Structure and Liquidity on Firm Value. International Journal of Applied Business and Economic Research, 14(14), 817–827.

Amihud, Y., & Mendelson, H. (2008). Liquidity, the Value of the Firm, and Corporate Finance. Journal of Applied Corporate Finance, 20. https://doi.org/https://doi.org/10.1111/j.1745-6622.2008.00179.x

Andika, Prasetyo, A., & Fitria, A. (2016). Pengaruh Struktur Aktiva, Ukuran Perusahaan, Profitabilitas dan Risiko Bisnis Terhadap Struktur Modal. Jurnal Ilmu dan Riset Akuntansi, 5(9), 1-19.

Anton, S. G. (2016). the Impact of Dividend Policy on Firm Value. a Panel Data Analysis of Romanian Listed Firms. Journal of Public Administration, Finance and Law, (10), 107–113. https://doi.org/10.1515/rebs-2016-0039

Arora, A., & Sharma, C. (2016). Corporate governance and firm performance in developing countries : evidence from India. Corporate Governance, 16(2), 420–436. https://doi.org/10.1108/CG-01-2016-0018

Baker, H. K., & Powell, G. E. (2012). Dividend policy in Indonesia: Survey evidence from executives. Journal of Asia Business Studies, 6(1), 79–92. https://doi.org/10.1108/15587891211191399

Barclay, M. J., Marx, L. M., & Smith Jr, C. W. (2003). The joint determination of leverage and maturity. Journal of corporate finance, 9(2), 149-167.

Beik, I. S., & Fatmawati, S. W. (2014). Pengaruh Indeks Harga Saham Syariah Internasional Dan Variabel Makro Ekonomi Terhadap Jakarta Islamic Index. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah, 6(2), 155–178.

Bevan, A. A., & Danbolt, J. (2002). Capital structure and its determinants in the UK - A decompositional analysis. Applied Financial Economics, 12(3), 159–170. https://doi.org/10.1080/09603100110090073

Brealey, R., Myers, S. C., & Allen, F. (2005). Principle of Corporate Finance, Eighth Edition: McGraw–Hill.

C. Myers, S., & Majluf, N. S. (1984). Myers S.C., and N.S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have.pdf. Journal of Financial Economics, 13, 187–221. https://doi.org/10.1016/0304-405X(84)90023-0

Chabachib, M., Fitriana, T. U., Hersugondo, H., Pamungkas, I. D., & Udin, U. (2019). Firm Value Improvement Strategy, Corporate Social Responsibility, and Institutional Ownership. International Journal of Financial Research, 10(4), 152-163.

Chen, Li-Ju and Chen, S.-Y. (2011). The influence of profitability on firm value with capital structure as the mediator and firm size and industry as moderators: The influence of profitability on firm value with capital structure as the mediator and firm size and industry as moderators. Investment Management and Financial Innovations, 8(3), 121–129.

Crisóstomo, V. L., De Souza Freire, F., & De Vasconcellos, F. C. (2011). Corporate social responsibility, firm value and financial performance in Brazil. Social Responsibility Journal, 7(2), 295–309. https://doi.org/10.1108/17471111111141549

Damodaran, A. (2002). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. New Jersey: John Wiley & Sons, Inc.

De Miguel, A., Pindado, J., & De La Torre, C. (2004). Ownership structure and firm value: New evidence from Spain. Strategic Management Journal, 25(12), 1199-1207. doi: DOI: 10.1002/smj.430.

Dennis, S. A., & Smith, W. S. (2014). Dividend irrelevance and firm control. Research in Finance (Vol. 30). Emerald Group Publishing Limited. https://doi.org/10.1108/S0196-382120140000030010

Derun, I., & Mysaka, H. (2018). Stakeholder perception of financial performance in corporate reputation formation. Journal of International Studies, 11(3), 112–123. https://doi.org/10.14254/2071-8330.2018/11-3/10

Deswanto, R. B., & Siregar, S. V. (2018). The associations between environmental disclosures with financial performance, environmental performance, and firm value. Social Responsibility Journal, 14(1), 180–193. https://doi.org/10.1108/SRJ-01-2017-0005

García-Meca, E., & Sánchez-Ballesta, J. P. (2011). Firm value and ownership structure in the Spanish capital market. Corporate Governance, 11(1), 41–53. https://doi.org/10.1108/14720701111108835

Haryono, U., & Iskandar, R. (2015). Corporate Social Performance and Firm Value. International Journal of Business and Management Invention, 4(11), 69–75. https://doi.org/10.2134/agronj1995.00021962008700060006x

Hauser, R., & Thornton, J. H. (2017). Dividend policy and corporate valuation. Managerial Finance, 43(6), 663–678. https://doi.org/10.1108/MF-05-2015-0157

Hersugondo, Pertiwi, S. N. A., & Udin. (2019). Corporate Social Responsibility and Corporate Value: Evidence from an Emerging Economy, Indonesia. Quality - Access to Success, 20(172), 51-55.

Hersugondo, & Udin. (2019). Corporate governance and corporate value: The mediating role of investment effectiveness base on human capital. Quality - Access to Success, 20(171), 56-61.

Heugens, P. P. M. A. R., van Essen, M., & van Oosterhout, J. (2009). Meta-analyzing ownership concentration and firm performance in Asia: Towards a more fine-grained understanding. Asia Pacific Journal of Management, 26(3), 481–512. https://doi.org/10.1007/s10490-008-9109-0

Hovakimian, A., & Li, G. (2011). In search of conclusive evidence: How to test for adjustment to target capital structure. Journal of Corporate Finance, 17(1), 33-44.

Iqbal, S., Nawaz, A., & Ehsan, S. (2018). Financial performance and corporate governance in microfinance: Evidence from Asia. Journal of Asian Economics. https://doi.org/10.1016/j.asieco.2018.10.002

Jensen, M. C. (1986). Journal of Social and Personal. The American Economics Review, 15(6), 323–329. https://doi.org/10.1177/0265407598156003

Khajar, I., Hersugondo, H., & Udin, U. (2018). Antecedents and Outcomes of Corporate Governance: Evidence from Indonesia. European Research Studies Journal, 21(4), 480-492

Khajar, I., Hersugondo, H., & Udin, U. (2019). Comparative Study of Sharia and Conventional Stock Mutual Fund Performance: Evidence from Indonesia. Wseas transactions on business and economics, 16, 78-85

La Rocca, M. (2007). The influence of corporate governance on the relation between capital structure and value. Corporate Governance, 7(3), 312–325. https://doi.org/10.1108/14720700710756580

Li, J., & Qian, C. (2013). Research notes and commentaries principal-principal conflict under weak institutions : A Study of Corporate Takeovers in China. Strategic Management Journal. https://doi.org/10.1002/smj

Loncan, T. R. (2014). Capital Structure, Cash Holdings, and Firm Value : a Study of Brazilian Listed Firms. Business Management, 25(64), 46–59.

Kodongo, O., Mokoaleli-Mokoteli, T., & Maina, L. N. (2015). Capital structure, profitability and firm value: panel evidence of listed firms in Kenya. African Finance Journal, 17(1), 1-20.

Manurung, S. D., Suhadak, & Nuzula, N. F. (2014). The Influence of Capital Structure on Profitability and Firm Value (a Study on Food and Beverage Companies Listed in Indonesia Stock Exchange 2010-2012 Period). Jurnal Administrasi Bisnis, 7(2), 1-8.

Marsha, N., & Murtaqi, I. (2017). the Effect of Financial Ratios on Firm Value in the Food and Beverage Sector of the Idx, 6(2), 214–226.

Miller, M. H., & Modigliani, F. (1963). Corporate Income Taxes and the Cost of Capital: A Correction. The American Economic Review, 53(3), 433–443. https://doi.org/10.2307/1809167

Myšková, R., & Hájek, P. (2018). Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of International Studies, 10(4), 96–108. https://doi.org/10.14254/2071-8330.2017/10-4/7

Nababan, Y. (2016). Pengaruh Intellectual Capital Terhadap Return Saham (Perusahaan Real Estate dan Property Yang Terdaftar di Bursa Efek Indonesia Tahun 2011-2013). Doctoral dissertation, Universitas Bengkulu.

Noorlailie, S. (2018). The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as a mediating variable. Asian Journal of Accounting Research. https://doi.org/10.1108/AJAR-06-2018-0008

Nuryaman. (2015). The Influence of Intellectual Capital on The Firm's Value with The Financial Performance as an Intervening Variable. Procedia Social and Behavioral Sciences, 211(September), 292–298. https://doi.org/10.1016/j.sbspro.2015.11.037

Oktrima, B. (2017). Pengaruh Profitabilitas, Likuiditas, Dan Struktur Modal Terhadap Nilai Perusahaan (Studi Empiris: Pt. Mayora Indah, Tbk. Tahun 2011–2015). Jurnal Manajem Keuangan, 1(1), 98-107.

Osazuwa, N. P., & Che-Ahmad, A. (2016). The moderating effect of profitability and leverage on the relationship between eco-efficiency and firm value in publicly traded Malaysian firms. Social Responsibility Journal, 12(2), 295–306. https://doi.org/10.1108/SRJ-03-2015-0034

Owino, O. E. (2011). The relationship between liquidity and leverage of companies quoted at the NSE. Retrieved from http://erepository.uonbi.ac.ke/bitstream/handle/11295/13648/Oduol_The relationship between liquidity and leverage of companies quoted at the NSE.pdf?sequence=3

Purwanto, P., & Agustin, J. (2017). Financial Performance towards Value of Firms in Basic and Chemicals Industry. European Research Studies Journal, XX(2), 443–460.

Rahayu, Y. (2015). Analisis Portofolio Optimal Dan Penilaian Kinerja Saham-Saham Jakarta Islamic Index (JII). UIN Sunan Ampel Surabaya. Undergraduate thesis.

Ross, S. A. (1977). The determination of financial structure : the incentive-signaling approach. The Bell Journal of Economics, 8(1), 23–40.

Rusydiana, A. S., & Parisis, S. Al. (2016). The Measurement of Islamic Bank Performance : A Study Using Maqasid Index and Profitability. Global Review of Islamic Economics and Business, 4, 001–014.

Saona, P., & Martin, P. S. (2010). Firm- and Country-level Determinants of Firm Value in Emerging Markets: A Corporate Governance Approach. Emerg Mark Financ Trade 46:80–94. doi:10. 2753/ree1540-496x460306, 1–30.

Saona, P., & San Martín, P. (2018). Determinants of firm value in Latin America: an analysis of firm attributes and institutional factors. Review of Managerial Science, 12(1), 65–112. https://doi.org/10.1007/s11846-016-0213-0

Triyuwono, I. (2007). Perspektif, Metodologi, dan Teori Akuntansi Syariah: PT RajaGrafindo Persada.

Vo, X. V., & Ellis, C. (2017). An empirical investigation of capital structure and firm value in Vietnam. Finance Research Letters, 22, 90–94. https://doi.org/10.1016/j.frl.2016.10.014

Wahyudi, S., Silfani Permata Sari, Hersugondo, H., & Udin, U. (2019). Capital Adequacy Ratio, Profit-Sharing and Return On Asset: Case Study of Indonesian Sharia Banks. Wseas transactions on business and economics, 16, 138-144

Wang, B. (2018). Ownership, institutions and firm value: Cross-provincial evidence from China. Research in International Business and Finance, 44, 547–565. https://doi.org/10.1016/j.ribaf.2017.07.125

Yeo, H. (2016). Solvency and Liquidity in Shipping Companies. The Asian Journal of Shipping and Logistics. https://doi.org/10.1016/j.ajsl.2016.12.007

1. Accounting Department, Economics Faculty, Universitas Islam Sultan Agung, Ph.D Scholar of Business and Economics Faculty, Diponegoro University, Indonesia

2. Business and Economics Faculty, Diponegoro University, Indonesia

3. Business and Economics Faculty, Diponegoro University, Indonesia

4. Business and Economics Faculty, University of Muhammadiyah Yogyakarta, Indonesia. Corresponding author email: udin_labuan@yahoo.com