Vol. 41 (Issue 05) Year 2020. Page 4

MYKYTYUK, Petro P. 1; KOTYS, Nataliya V. 2 & MYKYTYUK, Yuliya I. 3

Received: 27/08/2019 • Approved: 01/02/2020 • Published 20/02/2020

ABSTRACT: Methodical approaches to the analysis of the efficiency of fixed assets use in building organizations on the basis of economic-mathematical models are offered. The sequence of calculations of analytical indicators of the main means of resources, which allows to obtain a reliable assessment of their effectiveness, is developed. The composition of factors and reserves for increasing the efficiency of the fixed assets use is revealed and specified, that will enable to raise the return on assets and profitability of building organizations fixed assets. |

RESUMEN: Han sido propuestos enfoques metódicos de análisis de eficacia de utilización del activo capital de las empresas constructoras sobre la base de los modelos económico-matemáticos. Ha sido elaborado el orden del cálculo de los indicadores analíticos del activo capital, que da la posibilidad de apreciar su eficacia de una manera cierta. Han sido revelados y precisados los componentes de los factores y de los recursos de mejora de eficacia de utilización del activo capital, que dará la posibilidad de mejorar el rendimiento de capital y rentabilidad del activo capital de las empresas constructoras. |

The concept of resource efficiency implies the need to improve the system of resource provision for the activities of organizations in order to increase resource use efficiency, as well as carrying out comprehensive analysis, which includes providing, identifying and mobilizing existing and potential reserves. The main objective of carrying out the analysis of the efficiency of contracting construction organizations productive resources use is the timeliness of studying of changes in economic processes that either threaten to withdraw the organization from a given direction or rate of development, or indicate the emergence of additional reserves, which will enable its quick conversion into an effective mode of operation (Mykytyuk, 2008). The value of the carried out analysis of production resources depends on the timely use of the analytical information and the way it affects the processes of production and sales of building products (Soroka, 2015).

The provision of organizations with essential facilities in the required quantity and range, the degree of their use are among the determinants of raising the efficiency of construction (Karabanyk & Mykytyuk, 2018).

Fixed assets are the material and technical base of production, the foundation for its improvement and development. This process takes place by both increasing the potential of fixed assets (extensively) and increasing the efficiency of their use (intensively). Significant increase in fixed assets leads to complications in the technical re-equipment of production, moral and physical aging of equipment, which reduces the efficiency of its use and the possibility of conversion. Therefore, it is more economically justifiable to increase the time of operation of the equipment, to load the available park to the full extent, to maintain its operation in the most qualified way, etc (Mykytyuk & Soroka, 2015).

The issues of analysis of the provision of organizations with the fixed assets have been paid attention in the works of such scholars as Z. V. Zadorozhnyi (Zadorozhnyi, 2013), N. O. Kovalchuk (Kovalchuk & Pobizhan, 2017), B. M. Lytvyn (Lytvyn, 2004), M. R. Luchko (Luchko, 2013), N. I. Pylypiv (Pylypiv & Matiieshyn, 2014), A. D. Sheremet (Sheremet & Sayfulin, 2003), Ch. Homburg (Homburg, 1992), A. Marion (Marion, 1999) and others.

The works of these scientists constitute the basis for formation and development of the conceptual principles for the analysis of use of enterprises resources. However, changes in market conditions, instability and a number of other characteristics of the national economy in general and of building construction organizations in particular, actualize the need for theoretical substantiation and development of methodological approaches to the analysis of the efficiency of building organizations fixed assets use, adaptable to present continuous, focused on modeling their development strategy taking into account changes in external and internal environment of their operating (Mykytyuk Y. , 2019).

The methodological basis of the research s includes a set of dialectical methods, latest views and scientific theses of the leading scientists at the analysis of the efficiency of use of construction organizations fixed assets.

To accomplish this task, the following cognition methods were used, namely: induction and deduction (at the stage of collection and systematization of the information for carrying out the research, in the process of theoretical comprehension and improvement of organizational and practical foundation for increasing the efficiency of use of fixed assets); comparison, abstraction, analysis and synthesis (to ensure systematic approach to solving certain problematic issues of analysis of fixed assets use); expert assessments and abstractions (aimed at substantiating the choice of significant factors and indicators of the efficiency of the fixed assets use); economic and mathematic methods and formalization (to develop a method for analyzing and modeling the efficiency of construction organizations fixed assets).

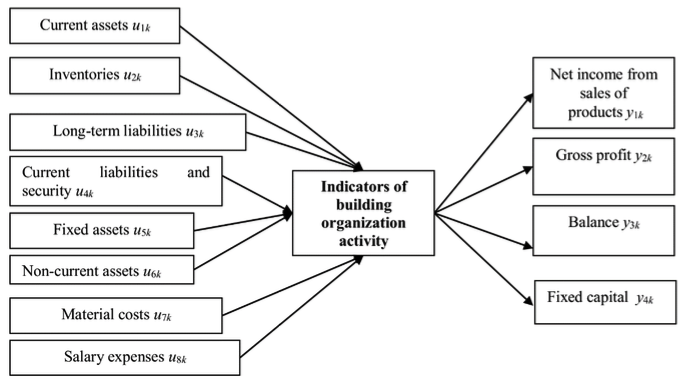

The research proposers the methodical approach to carrying out the analysis of interdependence of the indicators of: net income from sales of products y1k, gross profit y2k, balance (amount of current and non-current assets) y3k, fixed capital y4k, current assets u1k, non-current assets u6k, production stocks u2k, long-term liabilities u3k, current liabilities u4k, fixed assets u5k, material expenses u7k, labor costs u8k.

Further, on the basis of analysis of the fixed assets of the PrJSC PBO "Lvivmiskbud", a model was developed to show separately the dependence of gross profit, net income on sales of products and balance, fixed capital on the fixed assets, non-current assets, current assets, inventories, long-term liabilities, current liabilities, material expenses and labor costs.

Schematically, the model of financial indicators of the construction organization performance is shown in Figure 1.

Figure 1

Scheme of interdependence of indicators

of the building organization performance

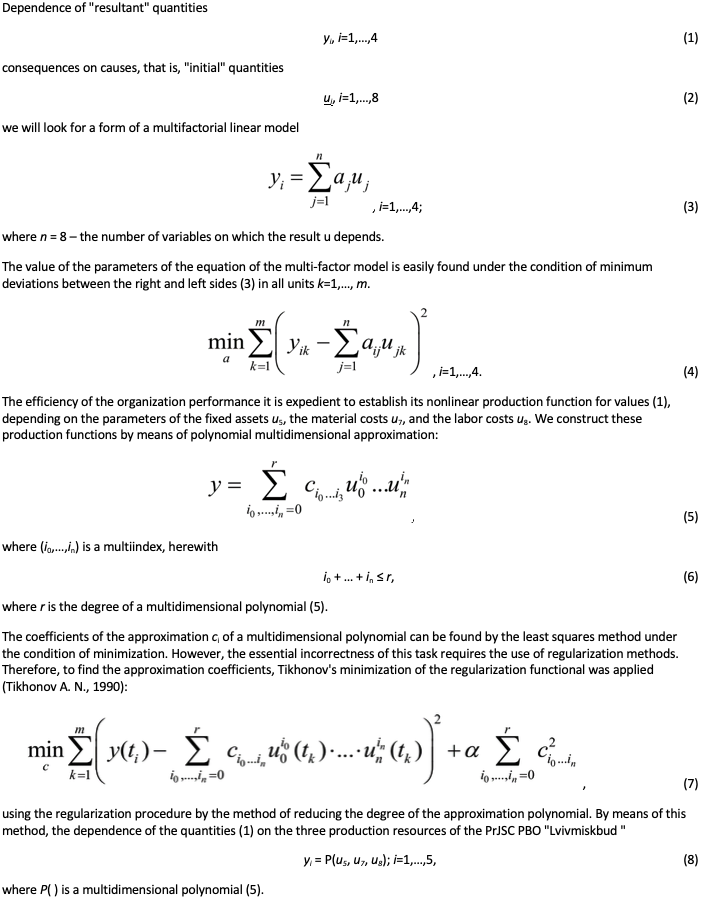

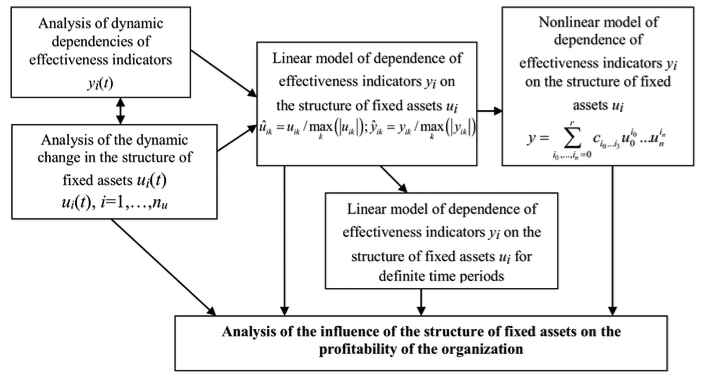

Methods of analysis of trends of constituent elements of fixed assets and indicators of results a contracting building organization performance based on the construction of a multi-factor linear model (3) are used.

The analysis of provision with the fixed assets, carried out on the example of the PrJSC PBO "Lvivmiskbud", covers the sequence of calculations and qualitative generalizations summarized in the following algorithm. (Krupka Ya.D., 2013)

Algorithm. Analysis of the availability and efficiency of the fixed assets.

1. To establish the values of productivity indicators yi(t), i=1,…,ny (1), where ny is the number of these indicators.

2. To establish the values of the components of the fixed assets ui(t), i=1,…,nu (1), where nu is the number of these components.

3. To carry out qualitative analysis of the dynamic dependencies yi(t), ui(t), identifying the behavior of the economic object, the impact of the fixed assets on its productivity.

4. To construct a linear model of productivity of the fixed assets (3).

5. Analyzing the values of the parameters of the linear model (p.4), to determine which components of the fixed assets cause significant direct and inverse effects on the financial indicators of the enterprise performance, to identify factors that have little effect on it.

6. To establish economic conclusions concerning the influence of the components of the fixed assets on the financial indicators of the enterprise performance and to develop proposals for the further effective management of the of fixed assets structure.

7. If during the investigated period of time the economic behavior of the enterprise substantially changed, to repeat pp. 3-6 for different fragments from the observation period.

8. Having selected the components of the fixed assets that significantly affect the financial indicators of the enterprise performance, to construct a nonlinear model in the form of the production function of profit indicators, recorded by means of using a multidimensional degree polynomial (7).

9. To carry out a qualitative analysis of the nonlinear model of dependence of profit on the structure of the fixed assets. To establish the regularity of the economic behavior of the enterprise, to reveal financial, technological and organizational-planning aspects of influence of the fixed assets structure on the financial indicators of the enterprise performance.

10. On the basis of the established rules of influence of the structure of fixed assets on the financial indicators of the enterprise performance to develop recommendations how to improve management of provision and use of the fixed assets, taking into account qualitative patterns and quantitative indicators regarding the optimal structure of the fixed assets.

The described algorithm defines the sequence of calculations and operations of qualitative and quantitative analyses concerning the availability and efficiency of the fixed assets use by a construction organization. Graphically, this algorithm is depicted in the diagram below (Figure 2).

Figure 2

Scheme of calculations and analysis in the research of the impact of the

fixed assets structure on the profitability of a construction organization

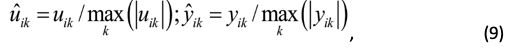

According to equations (3-4), a linear model of dependence of the PrJSC PBO "Lvivmiskbud" productivity (1) on the values (2) that affect it, is constructed. As a result of analysis of the parameters of this model, obtained over the entire observation interval k=1,…, 60, it was found out that the discovered model is inaccurate and its parameters do not have an economic interpretation. Further, model (3) was constructed for quantities (1-2), standardized for the units:

but that experiment did not lead to solutions that have an economic content.

Consequently, this negative result of the linear model (3) construction for the entire observation interval of the PrJSC PBO "Lvivmiskbud" shows that the parameters of the mentioned model must be identified separately for three different periods of the organization economic activity - decline (1-15 months), changing period (14 -25 months), sustainable development (24-60 months)

In order to identify the influence of certain factors (2) - the elements of the structure of capital on the efficiency (1), the separate linear models (3-4) for three periods of time from the whole observation period for the PrJSC PBO "Lvivmiskbud" were separately constructed.

T1=[1,…,15]; T2=[14,…26]; T3=[26, 60]. (10)

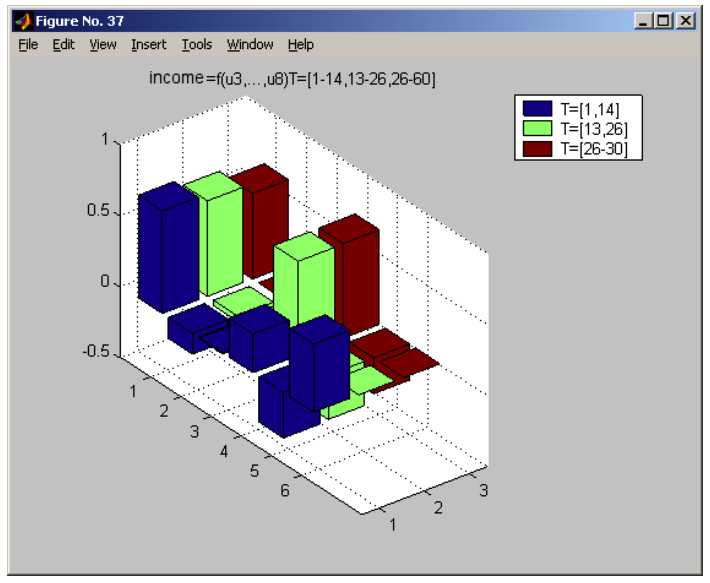

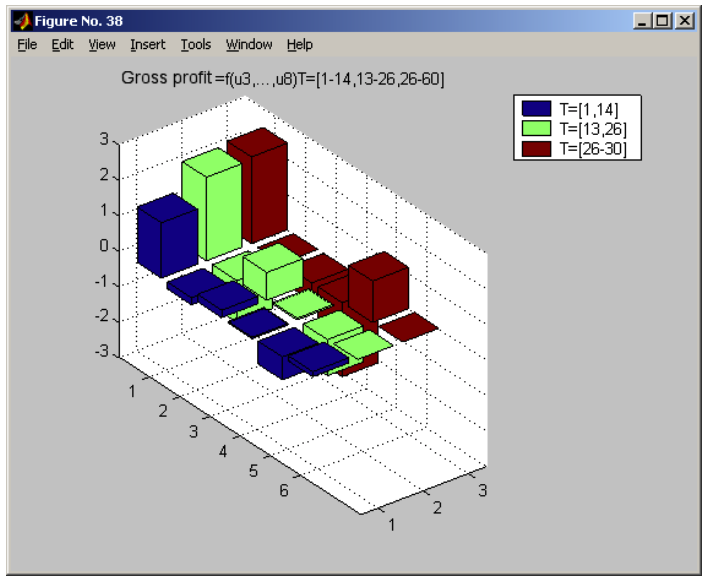

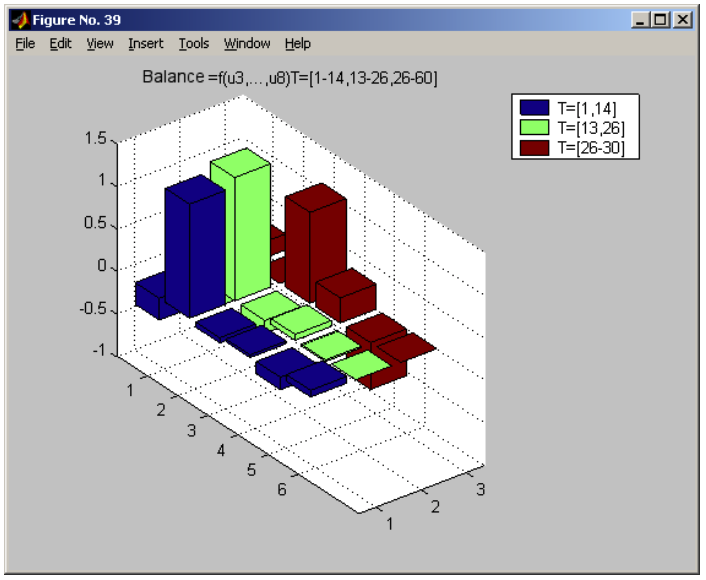

The attempt to construct a model (3) for the PrJSC PBO "Lvivmiskbud" for three periods of time (10) for all 8 parameters (2) also led to substantially inaccurate results, according to which the financial indicators of an organization performance depends only on current assets and inventories (Figure 3 (a)).

Figure 3 (a)

Chart of the coefficients magnitude of the linear multi-factor model of net income

from sales of products y1 for three periods of time (10) of the PrJSC PBO "Lvivmiskbud"

without taking into account the circulating capital. The parameters correspond to the

values u3,...,u8 in accordance with (2)

Therefore, taking into consideration the immutability of the conditions for provision with the circulating capital and production resources over three segments of time (10), model (3) was constructed for values (2) without current assets and inventories. The result - the values of the parameters a of the model (3) for the standardized values (9) are shown in the charts (Figure 3 (b-c)).

Figure 3 (b)

Chart of the coefficients magnitude of the model of the linear model of gross profit y2 for

the three time segments (10) of the PrJSC PBO "Lvivmiskbud" without taking into account t

he circulating capital

-----

Figure 3 (c)

Chart of the coefficients magnitude

of the linear model of balance

Analyzing the significance of these parameters, it is easy to note that, along side with improvement of the productivity of an organization, the impact of long-term liabilities, whose magnitude is directly proportional to net income from product sales on its income is diminished, as the whole, that is, the strategy of minimizing these liabilities is unacceptable - obviously, it is necessary to look for their optimal value. Other liabilities, in particular wage arrears, are inversely proportional to sales net revenue and, with improved productivity of an organization their impact on profitability is dwindling into nothing.

The impact of fixed assets on the productivity of the PrJSC PBO "Lvivmiskbud" remains unchanged and low during all the three identified periods of time. This indicates almost entirely non-renewal of fixed assets.

During the "collapse", the impact of non-current assets of the PrJSC PBO "Lvivmiskbud" was positive, but less than other factors. After intensifying the organization activity and in the course of its sustainable development, just non-current assets are the most influential on its income. If obligations to banks that have a similar effect with increasing productivity lose their significance, the role of non-current assets remains constant.

Material expenditures of the PrJSC PBO "Lvivmiskbud" have a negative impact on income and with improvement of the financial results of the organization their importance decreases. This is obvious, since they are part of the opposite account article.

During the recession, labor costs significantly influenced the profitability of the PrJSC PBO "Lvivmiskbud". Subsequently, during the intensification of the production and its steady development, their influence significantly decreased.

Thus, comparing the influence of the main elements in the structure of the capital of the PrJSC PBO "Lvivmiskbud" with the influence of the main types of resources - material, fixed assets and labor, we note that the current assets make a generally greater impact than the allocated resources. Of the latter, the financial indicators of the organization performance during its growth, are influenced most by the cost of material resources, and this impact is inversely proportional.

Little negative impact of the fixed assets on the income during the economic growth of the organization (the third period) shows that it did not ensure the full use of the fixed assets, and that use decreased in comparison with the second period - the period of "intensification".

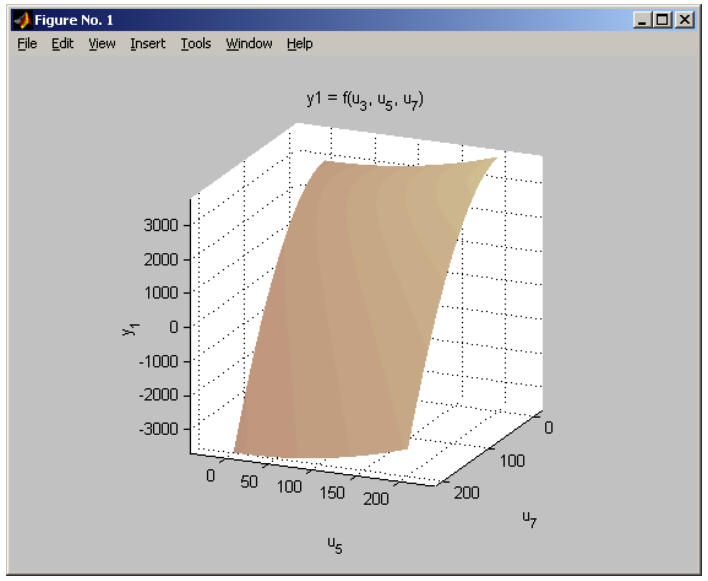

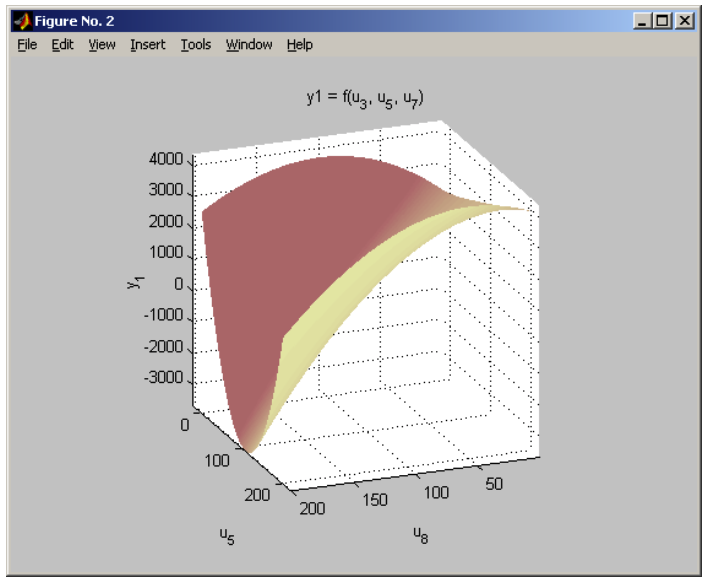

Charts of such production functions of the behavior that represent the three-dimensional dependence projection (8) are shown in Figure 4 (a-b).

Figure 4 (a)

Graph of dependence of the net income from sales of products y1 of the PrJSC

PBO "Lvivmiskbud" on improvement of the fixed assets u5 and material costs u7

-----

Figure 4 (b)

Graph of dependence of the net income from sales of products y1 of the PrJSC

PBO "Lvivmiskbud" on the volume of the fixed assets u5 and labor costs u8

Analyzing the graphs of dependence of the net income from sales of products on the main types of resources (Figure 4 (a)), we observe that the increase in material expenditures leads to some slowdown in the financial results, which, however, is faster than the growth of productivity as a result of improvement of the fixed assets. On the contrary, improvement of the fixed assets leads to a little but accelerated growth. Thus, the optimal management of distribution of the resources between the fixed assets and material expenditure corresponds to the line of the f rise on the plane in Figure 4 (a).

Carrying out the same analysis of dependence of the net income from sales of products, on the value of the fixed assets and on wages (Figure 4 (b)), we observe that raising wages leads to a rapid but slowing down productivity growth which reaches some maximum, after which a decline in productivity begins. It is important that the graph in Figure 4 (b) shows the real data, and on this plane some decline in production begins depending on the size of wages. That is, the wages fund at the PrJSC PBO "Lvivmiskbud" is close to optimal (although the analysis does not say anything about the optimality of its structure). From the graph in Figure 4 (b), which corresponds to the area of data defining (1), it is evident that the average value of the fixed assets falls to the bottom of the saddle basin, that is, in the organization unfortunately, there is a tendency to the worst possible use of the fixed assets.

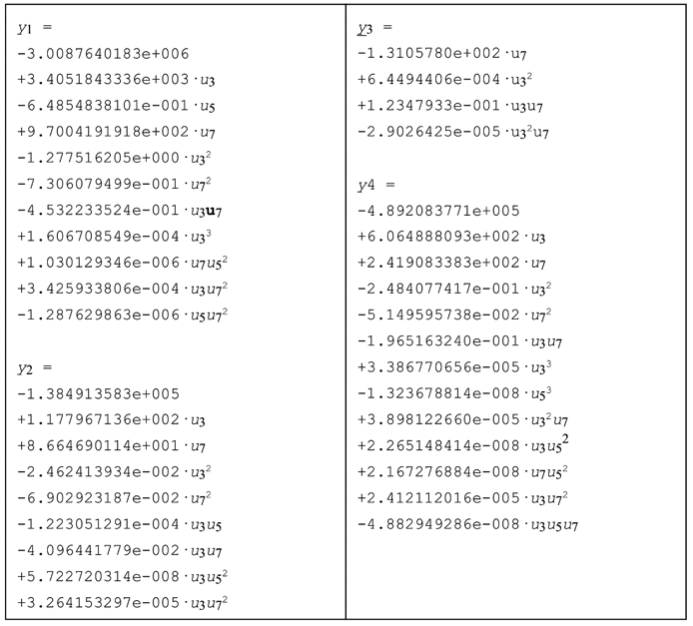

An explicit stock of production functions obtained for the indicators (2) of the PrJSC PBO "Lvivmiskbud", is shown in Figure 5.

Figure 5

Algebraic record of multidimensional production

functions of the PrJSC PBO "Lvivmiskbud"

The analysis of the production functions of the PrJSC PBO "Lvivmiskbud" shows that the organization is generally stable its development is close to optimal, especially as regards the size of the wage fund and the volume of material expenditures. However, the size of the fixed assets of this organization will remain far from the desired values.

Since the income and gross profit of an organization show the same qualitative behavior, while the balance and its fixed capital reflect its relatively stable state concerning the change in the values (1) that affect it, the gross profit y2. is taken for the further study of the impact of various resources on the PrJSC PBO "Lvivmiskbud" performance.

Based on analysis of the established production functions, linking the indexes of the organization profitability with the most important structural elements of the fixed assets, a number of essential regularities of the organization production activities, productivity of use, updating and replacement of the fixed assets are established.

Summarizing the problem, it can be stated that the method has been developed to study the structure of the fixed assets of the construction industry organizations, their dynamic change and their impact on the overall financial indicators of the organization performance. This method is the complex combination of a number of links of qualitative analysis of economic, technological and financial regularities and computational modeling of these regularities followed by their quantitative and qualitative analysis.

For the preliminary study of the influence of the fixed assets structure on the productive forces of the organization, methods of qualitative analysis of trends of the constituent elements of the fixed assets and indicators of the productivity of the organization are applied.

For the time periods of the uniform economic behavior of the organization of, the method of constructing a linear model that reflects the dependence of productivity indicators on the structural elements of the fixed assets, followed by analysis of the obtained model and economic interpretation of the qualitative and quantitative values of the model parameters, is used.

On the basis of the linear model of dependence of productivity indicators on the structural elements of the fixed assets, it was established which of them have the most positive and negative impact on the profitability of the organization.

For the elements of the fixed assets structure that have the most noticeable influence on the profitability of the organization, a number of nonlinear production functions, given by multidimensional degree polynomials, are constructed.

For the first time, for determination of the parameters of these behavioral functions, methods of regularized identification combining Tikhonov regularization method with reduction of the degree of approximating multidimensional polynomial, are used.

In particular, it has been proved that in modern conditions provision with the fixed assets is improved slowly, and this provision should correspond to the growth rate of the organization efficiency and to the extensive parameters of this process. Under the condition of too fast increase of volume of the fixed assets, in especially at the beginning of the implementation of a new project, their efficiency is reduced. Insufficient provision with the fixed assets slows down overcoming past negative tendencies, reduces the success of production projects. In particular, violation in the structure of fixed assets entails a general decline of the capital productivity.

On the basis of the research, which was carried out, a set of recommendations aimed at improving management of the fixed assets taking into account the economic trends of the market, the financial state of the organization, the organizational peculiarities of managing it, as well as the technological characteristics of exploitation of the fixed assets in contract building organizations was elaborated.

The developed method of research, substantiated on the basis of research and modeling of the PrJSC PBO "Lvivmiskbud", is generalized for the case of arbitrary enterprises of the construction industry and its application for another separate organization is tested.

The practical use of the developed method of dynamic and structural research of the fixed assets impact on the financial indicators of the organization activities confirms its high practical efficiency and shows that it is suitable as a tool for studying the economic state of an organization and as means to support decision-making in planning management of the fixed assets.

Homburg, C. (1992). Strategisches Controlling in der Praxis an Biespiel eines Maschinenbauunternehmens [Strategic controlling in practice at Biespiel an engineering company]. Der Controlling-Berater, Vol. 6, 133–154. (in German)

Karabanyk, S., & Mykytyuk, Y. (2018). Rol samofinansuvannia pry zabezpechenni innovatsiinoho rozvytku budivelnoi orhanizatsii [The role of self-financing in introducing innovative development in construction organizations]. Visnyk Ternopilskoho natsionalnoho ekonomichnoho universytetu, Vol. 1, 98-105. Retrieved from http://dspace.tneu.edu.ua/handle/316497/29178 (in Ukranian)

Kovalchuk, N. O., & Pobizhan, T. A. (2017). Analіz stanu osnovnyh zasobіv na pіdpryiemstvah Ukrainy [Analysis of the situation of the main properties on enterprises of Ukraine]. Molodyi vchenyi, No. 10 (50), 910-914. Retrieved from http://molodyvcheny.in.ua/files/journal/2017/10/206.pdf (in Ukranian)

Luchko, M. R. (2013). Skladni pytannia v obliku osnovnykh zasobiv [Complex issues in accounting for fixed assets]. Sotsialno-ekonomichni problemy i derzhava, Vol. 2(9), 188–194. Retrieved from http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR=20&S21STN=1&S21FMT= ASP_meta&C21COM=S&2_S21P03=FILA=&2_S21STR=Sepid_2013_2_21 (in Ukranian)

Lytvyn, B. M. (2004). Orhanizatsiino-ekonomichni metody upravlinnia parkom budivelnoi tekhniky [Organizational and economic methods of construction machinery fleet management]. Naukovo-praktychnyi posibnyk [Scientific and practical guide]. Ternopil: Ekon. dumka. (in Ukranian)

Marion, A. (1999). Le Diagnostic d’Entreprise [Business Diagnosis]. Paris: Ed. ECONOMICA. (in French)

Mykytyuk, P. P. (2008). Analiz stanu ta zabezpechenosti osnovnymy zasobamy budivelnykh orhanizatsii ta shliakhy pidvyshchennia rivnia mekhanizatsii [Analysis of the condition and availability of fixed assets of construction organizations and ways to increase the level of mechani. Proceedings of the Mizhnarodnyi biznes ta menedzhment: problemy ta perspektyvy v umovakh hlobalizatsii : materialy Mizhnar. nauk.-prakt. konf. (Ukraine, Ternopil, 22–24 of October 2008) (pp. 315–317). Ternopil: Ekon. dumka. (in Ukranian)

Mykytyuk, P. P., & Soroka, T. M. (2015). Analiz efektyvnosti vykorystannia materialno-tekhnichnykh resursiv v budivelnii orhanizatsii [Analysis efficiency of the use logistical of building organizations]. Visnyk Khmelnytskoho natsionalnoho universytetu, No. 2, Vol. 2, 23-26. Retrieved from http://dspace.tneu.edu.ua/handle/316497/19233 (in Ukranian)

Mykytyuk, Y. (2019). Upravlinnia portfelem innovatsiino-investytsiinykh proektiv u zhytlovomu budivnytstvi [Management of a portfolio of innovation and investment projects in housing construction]. Visnyk Ternopilskoho natsionalnoho ekonomichnoho universytetu, Vol. 1, 151-159. Retrieved from http://dspace.tneu.edu.ua/handle/316497/34045 (in Ukranian)

Pylypiv, N. I., & Matiieshyn, M. M. (2014). Metodychni aspekty oblikovoho zabezpechennia protsesu ekspluatatsii osnovnykh zasobiv budivelnykh pidpryiemstv [The methodical aspects of accounting ensuring the process of exploitation basic means of building enterprises]. Visnyk Natsionalnoho universytetu "Lvivska politekhnika". Menedzhment ta pidpryiemnytstvo v Ukraini: etapy stanovlennia i problemy rozvytku [Management and entrepreneurship in Ukraine: stages of development and development problems], No. 794, 212–220. Retrieved from http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR=20&S21STN=1&S21FMT= ASP_meta&C21COM=S&2_S21P03=FILA=&2_S21STR=VNULPM_2014_794_31 (in Ukranian)

Sheremet, A. D., & Sayfulin, R. S. (2003). Metodika finansovogo analiza [The method of financial analysis]. Moscow: INFRA-M. (in Russian)

Soroka, T. M. (2015). Analiz zabezpechenosti pidpryiemstva osnovnymy zasobamy [Analysis of maintenance of the enterprises of fixed assets]. Ekonomichnyi analiz, Vol. 2 (21), 213-219. Retrieved from https://www.econa.org.ua/index.php/econa/article/view/959 (in Ukranian)

Tikhonov A. N., G. A. (1990). Chislennye metody reshenii︠a︡ nekorrektnykh zadach [Numerous methods of solving incorrect tasks]. Moscow: Nauka. (in Russian)

Zadorozhnyi, Z. V. (2013). Oblik vytrat pidpryiemstva [Cost accounting of the enterprise]. In Y. D. Krupka, Z. V. Zadorozhnyi, N. Y. Mykytiuk, & N. V. Hudz, Finansovyi oblik: pidruchnyk [Financial accounting: a textbook] (pp. 385–406). Kyiv: Kondor. (in Ukranian)

1. Doctor of Science in Economics, professor of the Department of Management and Public Administration, Ternopil National Economic University, Ukraine, e-mail: pp.mykytiuk@gmail.com

2. PhD in Economics, associate professor of the Department of Management and Public Administration, Ternopil National Economic University, Ukraine, e-mail: natakotys@gmail.com

3. Post-graduate student of the Department of Management and Public Administration, Ternopil National Economic University, Ukraine, e-mail: mykytyuk.yu@gmail.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License