Vol. 41 (Issue 05) Year 2020. Page 22

KALOSHINA , Marina N. 1

Received: 28/10/2019 • Approved: 09/02/2020 • Published 20/02/2020

ABSTRACT: Business valuation is an important part of economic activity. The business valuation of industrial enterprises which shares are not traded on the free market is carried out on the basis of the company's financial statements. Financial indicators of industrial enterprises often do not provide an opportunity to adequately calculate a business valuation, indicate insolvency, dependence on external sources of financing, a high bankruptcy probability, loss-making, negative balance sheet value of equity and reserves, which indicates information uncertainty of estimates. The aim of the study is the formation of the business valuation of industrial enterprises specific principles in the conditions of information uncertainty of financial and economic performance indicators. The proposed methodology covers all three approaches (cost approach, income approach, market approach) that allows to evaluate the business using atypical quantitative indicators presented in the annual financial statements: Form No. 4 “Cash Flow Statement”, Form No. 5 Balance sheet appendix. The approach allows to get an adequate positive reliable business valuation in conditions when traditional methods give a formal, including negative, price of the assets of the industrial enterprise. |

RESUMEN: La valoración empresarial es una parte importante de la actividad económica. La aplicación de dicha valoración a las empresas industriales cuyas acciones no se negocian en el mercado libre se realiza sobre la base de los estados financieros de la empresa. Los indicadores financieros de esas corporaciones a menudo no brindan la oportunidad de calcular adecuadamente el valor de un negocio, su índice de insolvencia, su dependencia de fuentes externas de financiamiento, la probabilidad de bancarrota, las pérdidas o el valor negativo del balance de capital y reservas. Todo ello conduce a una situación de incertidumbre en la información disponible sobre el valor estimado de dichos parámetros. El objetivo del presente estudio es la formación de unos principios específicos de valoración de empresas industriales en las condiciones de incertidumbre de la información relativa a los indicadores de rendimiento económico y financiero. La metodología propuesta cubre tres enfoques (enfoque de costos, enfoque de ingresos y enfoque de mercado), lo cual permite evaluar un negocio utilizando indicadores cuantitativos atípicos presentados en los estados financieros anuales: Formulario N.° 4, "Estado de flujo de efectivo"; y Formulario N.° 5, apéndice del balance general. El enfoque dado en el documento permite obtener una valoración comercial confiable y adecuada en condiciones en que los métodos tradicionales dan un precio formal desfavorable, incluso negativo, de los activos de una empresa. |

Industrial enterprises are the object of research. The subject of the research is business valuation methods.

The relevance of the study topic depends on its demand in market relations, which is regulated by applicable law, as well as business interests. There is a need for business valuation when investing, insuring, calculating the tax base, establishing authorized capital, entering into transactions for the disposal of assets, and lending. The most complex cases from the methodological point of view of business valuation correspond to the conditions under which it is necessary to carry out calculations in the format of information uncertainty, in which the financial statements give the negative value of a developed business that determines the level of industrial country development.

Business valuation is carried out in accordance with the Federal Valuation Law of the Russian Federation, federal and international valuation standards.

The cost approach, which is presented by the net assets market valuation method, is based on the representative quarterly balance sheet information of the enterprise. In essence, valuation is the market value of the equity and reserves.

However, due to the significant accumulated value of the negative value of retained earnings, the value of a business may be less than zero. This happens when a financial analysis simultaneously indicates a high bankruptcy probability and an unsatisfactory balance sheet structure, which, as the study of company reporting shows, is a frequent occurrence for large industrial enterprises (Christauskas, Kazlauskiene, 2007).

A market approach, which is presented by the methods of correlation and regression of functional dependencies, allows us to identify functional relationships (linear, multiplicative, exponential type) between an industrial enterprise’s capitalization and income. If the financial statements show losses, then the business value is also negative (Bondarchuk, Burdina, Gracheva, Karpasova, 2018). At the same time, there is a sharp decrease in the correlation coefficient if profitable and unprofitable companies are presented in the sample at the same time. The situation can be improved by means of argument transposition, for example, by replacing income with revenue. However, for the distribution business (for example, for companies that manage budget funds for the state defense order implementation), such a recombination does not give a reliable result (Lin, Su, 2008). The income approach, which is represented by the method of net present value, estimates the cash flow generated by net profit and depreciation. With significant losses in the last reporting year, the forecast of future flows does not allow to unambiguously reliably estimate the business value.

All these dwells upon information uncertainty in calculating the business value. As signs of information uncertainty for a business valuation of industrial enterprises, it is worth highlighting: losses, the negative value of retained earnings, the negative value of the reported and market value of equity and reserves, the absence of reliable, including insider, officially positioned calculations of capitalization based on differentiated data on all assets, a high bankruptcy probability, as well as the absence of transactions on disposal, reorganization (mergers, acquisitions, etc.) and bidding with valuation object’s shares (Palepu, Healy, 2007).

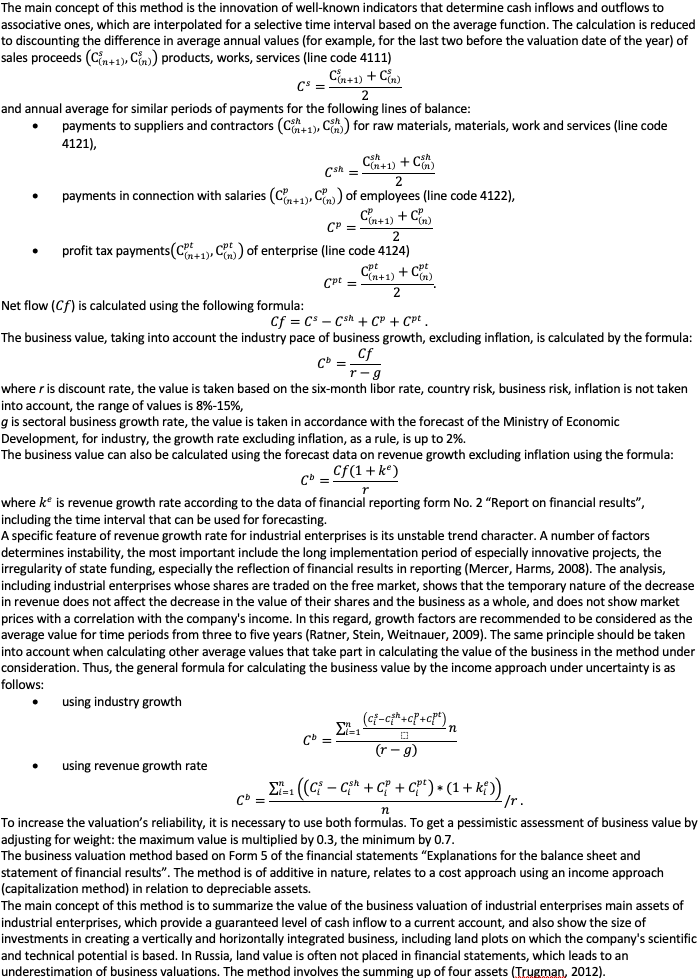

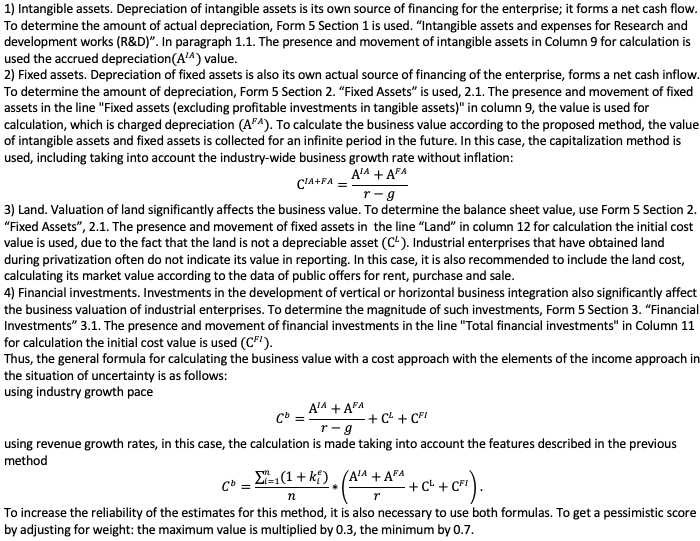

The method of business valuation based on form 4 of the financial statements “Cash Flow Statement” section of cash flows from current operations (Ministry of Finance of the Russian Federation, 2011). The method relates to the income approach, is a type of capitalization method.

Currently, the most frequently used method for assessing business value within the framework of the income approach is the net present value (NPV) method, which is based on forecast and post-forecast flows of income and expenses. Long-term forecasting is a probabilistic process, which allows to qualify the results of business value assessment as a calculation with a low degree of reliability. It is proposed to estimate the NPV method using actual a priori flows, which are averaged over several previous periods. The identified trend in the income and expense flows reflecting the achieved financial results of the evaluated industrial enterprise is most often extended for at least 6 months, due to the length of the production cycle of such business entities. Since business valuation is also legitimate for 6 months from the date of valuation in accordance with applicable law, the use of averaged a priori information for the NPV method increases the validity of the estimates obtained (Matschke, Brösel, Matschke, 2010). The justification of the discount rate for forecast flows is also based on the future information situation, which also reduces the effectiveness of the calculations. If the business value is determined for an industrial enterprise having unprofitable activities for more than one reporting period, the forecast of income and expenses is always oriented to future profit, which reduces the reliability of estimates. The proposed approach to the assessment allows to solve these problems.

It is also proposed to use the principles of a comparative approach to further increase the reliability and validity of calculating business value within the framework of uncertainty.

For analysis, it is necessary to choose three analogues, which are industrial enterprises with a similar profile of activity in relation to the valuation subject and calculate their business activity ratings. As analysis shows, such analogues can have a high degree of affiliation.

It is proposed to replace the standard set of indicators (asset turnover ratio, current assets turnover ratio, capital productivity, equity capital turnover, borrowed capital turnover, accounts receivable turnover, accounts payable turnover) with the following list – intangible asset utilization rate, intangible asset return on assets, the renewal intensity fixed assets coefficient, return on fixed assets (Astrachan, Jaskiewicz, 2008).

These indicators affect the net cash flow of the enterprise. The intensity of renewal of fixed assets shows a possible increase in the share of depreciation in the structure of cash inflows. The intensity of use and capital productivity determines the level of labor productivity and the prospects for increasing net profit of the organization.

These indicators are also considered according to the financial statements: Form 4, 5, which formed the basis of the proposed methods for business valuation. According to these indicators, it is necessary to calculate their average growth rate in relation to the previous period or in relation to the selected base (Agrawal, Agrawal, 2017). Each of the indicators should grow criterial; therefore, the maximum rating will be given to that industrial enterprise, which average value by the four indicators will be higher (Spiridonova, 2018).

As a result of business valuation calculations, several estimates can be obtained that are ranked in descending order. The choice is proposed in accordance with the ranking number. If the evaluated company has a rating of 2, then preference is given to the second in descending order of calculated business value (Aluko, Amidu, 2005). Application of the rating allows to consider the prospective financial inertia of the enterprise for 6 months. Also, the proposed approach allows to compare the value of the business at the same time for profitable and unprofitable analog enterprises in dynamics.

A posteriori analysis of the activities of industrial enterprises shows that traditional business valuation approaches give divergent results with respect to exchange expectations. Such a situation can be justified by actual losses and, as a result, a high probability of bankruptcy, which has no legal consequences for industrial enterprises. The disproportion of estimates obtained by instrumental and factographic methods can be qualified as information uncertainty, which is proposed to be compensated for by special valuation principles, which allow correcting the inaccuracy of the results of business valuation calculation.

The proposed methods allow eliminating the influence of all factors that qualify information uncertainty, which are of stochastic nature to the valuation results. Two business valuation finite algorithms are presented, which are related to cost and income approaches, which in practice give coherent results.

The proposed procedure for selecting a reasonable valuation result based on a relational rating, which is formed on the basis of special coefficients, for industrial enterprises belonging to the same field of activity, also allows to increase the calculations’ validity.

Agrawal, T., Agrawal, A. (2017). Vocational education and training in India: a labor market perspective. Journal of Vocational Education and Training, 69(2) 246–265.

Aluko, B.T., Amidu, A.R. (2005). Corporate business valuation for mergers and acquisitions. International Journal of Strategic Property Management, 9(3) 173-189.

Astrachan, J.H., Jaskiewicz, P. (2008). Emotional returns and emotional costs in privately held family businesses: advancing traditional business valuation. Family Business Review, 21(2) 139-149.

Bondarchuk, N.V., Burdina, A.A., Gracheva, M.E., Karpasova, Z.M. (2018). Financial and economic analysis for tax advice. Moscow: Vershina.

Christauskas, C., Kazlauskiene, V. (2007). Risk reflection in business valuation methodology Engineering Economics, 51(1) 7-15.

Lin C., Su, D. (2008). Industrial diversification, partial privatization and firm valuation: Evidence from publicly listed firms in China. Journal of Corporate Finance, 14(4) 405-417.

Matschke, M., Brösel, G., Matschke, X. (2010). Fundamentals of functional business valuation. Journal of Business Valuation and Economic Loss Analysis, 5(1): 7-7.

Mercer, Z.C., Harms, T.W. (2008). Business valuation: an integrated theory. New-York: Wiley.

Ministry of Finance of the Russian Federation (2011). Order of the Ministry of Finance of the Russian Federation of February 2, 2011 N 11n "On approval of the Accounting Regulations" Cash Flow Statement". Retrieved from https://base.garant.ru/12184342.

Palepu, K.G., Healy, P.M. (2007). Business analysis and valuation. London: Thomson.

Ratner, I., Stein, G.T., Weitnauer, J.C. (2009). Business valuation and bankruptcy. New-York: Wiley.

Spiridonova, E.A. (2018). Business valuation. Textbook for bachelors. Moscow: Urait.

Trugman, G.R. (2012). Understanding business valuation: A practical guide to valuing small to medium sized businesses. New-York: American Institute of Certifies Public Accountants, Inc.

1. PhD, Docent, Moscow Aviation Institute (MAI), 125993, Russia, Moscow, Volokolamskoe highway, 4. E-mail: kaf505@mai.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License