Vol. 41 (Issue 08) Year 2020. Page 12

OLESHKO, Anna A. 1; KASYCH, Alla O. 2; POKATAIEVA, Olga V. 3; TROKHYMETS, Olena I. 4; KANTSUR, Inna G. 5

Received: 03/09/2019 • Approved: 26/02/2020 • Published 12/03/2020

ABSTRACT: The purpose of the paper is to determine the ways of Government debt reduction in the EU countries and in Ukraine. The survey is based on the economic analysis of the indicators such as Aggregate Government debt, Government debt in GDP, Government investments. The tendencies of Government debt accumulation in EU and in Ukraine were defined. United targets of downward government debt in EU and in Ukraine are to reduce the Government debt in GDP to the optimal level. |

RESUMEN: El propósito del artículo es identificar formas de reducir la deuda pública en los paises de EU y en Ucrania. Los estudios se basan en un análisis económico de indicadores como la deuda pública total, la deuda pública en el PIB, inversion pública. Se identificaron tendencias en la acumulación de deuda pública en la UE y Ucrania. Se definieron objetivos comunes de deuda gubernamental a la baja en la UE y Ucrania. |

Security of economic development and macroeconomic stability are related to policies of Government debt management. An increase in the correlation of Government debt to Gross domestic product (GDP) leads to negative consequences for the financial system of the country and slows down economic growth rate, and in the worst case – provokes economic recession and financial crisis. Reinhart, C., Reinhart, V., and Rogoff (2015) proved the growth of Government debt leads to the business activity and Government investment decrease (reduction).

The necessity to address to the problem of Government debt reduction is a challenging issue and a priority both globally and at regional level. One concern is the surge in global debt, which reached the record peak of US$164 trillion in 2016. General Government Gross Debt of Euro Area is 86 % of GDP and has an upward trend. Ukraine’s share of General Government Debt of 63.9 % of GDP and Ukraine geographically belongs to Europe and is an associate member of European Union. Association Agreement between Ukraine and EU regulates that budget policy of Ukraine should be aimed at the development of the system of middle term budget projection (planning), improvement of program-oriented and goal-oriented approach and analysis of the effectiveness and efficiency of the implementation of budget programs, improvement of experience and information exchange on the planning issues and on the issues of budget implementation and stage of the Government debt.

In this context the optimum Government debt is determined in its comparison to the economic growth rate. There should be potential opportunities to the country in the redemption and Government debt service in a mid-term and long-term perspective.

Establishing and maintaining EU-Ukraine common standards on the Government debt value and rate is an important challenge to ensure the sustainable development of the European Region.

Theoretical approaches of famous scientists and practical experience of realization of the Government debt policy management are presented in the newest research Yared (2019). The author focuses on the necessity of the countries’ Government debt reduction, introduction of optimal Government debt policy and optimal level of Government debt and presents empirical facts in order to prove his statement.

Problems of determining the optimal value of Government debt and forming a debt policy to reduce within the conditions of financial security threats are studied and considered by scientists on different parameters. Barro (1999) conducted research on Government debt management. Barro (1998) for the first time ever empirically found the relationship between economic growth and the level of budget deficits and Government debt.

Dornbusch (1990) studied theoretical and historical aspects of management of Government debt. Afonso and Jalles (2013) found a negative effect of the debt-to-GDP to economic growth and that financial crisis is detrimental for growth, while fiscal consolidation promotes growth. Afonso and Furcery (2010) also analyzed influence of balanced-budget increase on the real GDP dynamics in the OECD countries and EU and revealed that volatility of budget expenditures has a destructive effect on GDP. According to the results of the empirical survey in 107 countries of the world by Engen and Skinner (1992), they revealed that with a balanced-budget increase at 10 percentage points, GDP growth rates slow down at 1.4 percentage points.

The results of study of optimal relation of internal debt to external debt are important. In particular, Panizza (2008) found that in case of excessive growth of the debt burden on the budget substitution of the external debt to internal is necessary.

Government debt-to-GDP correlation has a significant impact on economic growth. Correlation of the Government debt to GDP significantly influences economic growth. Teles and Mussolini (2014) state that the greater the share of Government debt in GDP is, the less positive influence of the productive expenses on the economic growth we observe. At the same time, if the Government loan has a targeted and the confirmed and agreed fiscal equilibrium of Government debt growth does not have negative influence on GDP dynamics.

Correlation between policy of Government debt management and fiscal (tax) policy was analyzed by Oleshko (2016). According to Kasych (2011) opinion investment activity of the State influences on the volume of the aggregate debt.

Debt burden of the financial system of Ukraine and countries of the Eurozone were the object of the research of Trusova, Karman, Tereshchenkoand Prus (2018). These scientists developed measures and activities of reducing the risks of regulatory budgetary (fiscal) policy.

However, there is no specific research aimed at elaboration of common goals of EU and Ukraine as an associate EU member on Government debt reduction policies.

The multidimensionality of studies of Government debt influence on economic growth and determining the ways of its optimization cause the necessity of further scientific research.

Methodological basis of the research are the methods of empirical and comparative analysis, statistical methods.

Theoretical generalization to determine general factors influencing Government debt growth are based on the methods of logical generalization, system approach and historical analysis.

Methodological approach was used to estimate debt burden on GDP while developing common areas of EU and Ukraine Government debt policy.

Analysis and forecast of the Government debt dynamics in the EU countries and in Ukraine is carried out using financial indicators based on the methodology 2008 SNA "System of National Accounts, 2008". The indicators of debt in this article consist of the following: non-financial corporations’ debt to equity ratio; private sector debt; general government debt, as a percentage of GDP.

Excessive increase of the Government debt in GDP in European countries causes deceleration of economic growth. It’s necessary to point out that according to EU standards, the share of Government debt at level 60% in GDP is considered as economically safe. However, in the vast majority of the EU countries this indicator exceeds optimal permissible value. And in such countries as Greece (188.7 %), Italy (152.4 %), Portugal (145.3), France (124.2 %), Belgium (122.3 %), Spain (114.6 %) Aggregate Government debt exceeds GDP (Table 1).

Table 1

Aggregate Government debt, as a percentage of GDP

Country |

2000 |

2005 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Austria |

71.07 |

76.25 |

90.54 |

91.47 |

97.34 |

94.36 |

101.87 |

100.80 |

101.34 |

94.91 |

91.49 |

Belgium |

120.54 |

108.30 |

107.98 |

110.60 |

120.47 |

118.48 |

131.11 |

127.82 |

128.94 |

122.33 |

120.08 |

Czech Republic |

24.39 |

32.39 |

45.58 |

48.35 |

57.88 |

57.96 |

55.25 |

52.01 |

47.69 |

43.82 |

40.28 |

Denmark |

60.46 |

45.12 |

53.44 |

60.11 |

60.62 |

56.73 |

59.14 |

53.43 |

51.41 |

48.87 |

47.38 |

Estonia |

6.80 |

8.16 |

11.93 |

9.54 |

13.15 |

13.62 |

13.85 |

12.75 |

12.73 |

12.55 |

12.87 |

Finland |

51.01 |

46.53 |

55.06 |

57.52 |

64.34 |

64.78 |

71.69 |

75.06 |

75.46 |

73.23 |

68.93 |

France |

72.43 |

82.14 |

101.00 |

103.81 |

111.94 |

112.47 |

120.16 |

120.83 |

125.46 |

124.25 |

122.36 |

Germany |

59.52 |

70.06 |

84.45 |

84.18 |

88.11 |

83.27 |

83.35 |

78.96 |

76.01 |

71.52 |

68.32 |

Greece |

111.70 |

115.82 |

128.97 |

110.91 |

164.11 |

179.69 |

180.82 |

182.94 |

185.79 |

188.73 |

.. |

Hungary |

61.01 |

67.22 |

85.80 |

94.79 |

98.12 |

96.54 |

100.11 |

99.39 |

99.44 |

94.08 |

87.84 |

Ireland |

38.72 |

31.33 |

83.50 |

111.46 |

129.36 |

131.73 |

121.20 |

88.52 |

84.14 |

77.24 |

.. |

Italy |

118.99 |

117.43 |

124.88 |

117.94 |

136.24 |

143.69 |

156.06 |

157.03 |

154.89 |

152.40 |

148.01 |

Latvia |

14.50 |

14.63 |

53.16 |

47.51 |

45.72 |

43.43 |

45.84 |

41.06 |

49.09 |

47.35 |

44.15 |

Lithuania |

34.44 |

24.90 |

45.47 |

45.73 |

51.26 |

48.00 |

52.58 |

53.95 |

51.61 |

47.82 |

41.21 |

Luxembourg |

17.10 |

17.69 |

28.26 |

27.36 |

29.81 |

30.31 |

30.61 |

30.71 |

28.74 |

30.52 |

28.79 |

Netherlands |

61.13 |

58.31 |

68.62 |

72.88 |

78.49 |

78.00 |

82.44 |

78.62 |

76.60 |

69.83 |

64.57 |

Poland |

45.02 |

54.69 |

60.93 |

61.21 |

64.39 |

65.00 |

70.54 |

69.87 |

72.50 |

68.12 |

66.09 |

Portugal |

62.02 |

79.98 |

104.07 |

107.85 |

137.10 |

141.43 |

151.40 |

149.15 |

145.32 |

145.30 |

140.62 |

Slovak Republic |

57.86 |

38.37 |

47.39 |

49.95 |

58.30 |

61.16 |

60.43 |

59.68 |

59.77 |

58.24 |

56.26 |

Slovenia |

37.08 |

35.24 |

47.84 |

51.41 |

61.69 |

78.84 |

99.31 |

102.29 |

97.33 |

88.82 |

82.72 |

Spain |

65.17 |

49.98 |

66.56 |

77.69 |

92.53 |

105.73 |

118.41 |

116.31 |

116.50 |

114.61 |

113.47 |

Sweden |

63.04 |

64.15 |

52.59 |

53.28 |

54.40 |

57.15 |

63.40 |

61.56 |

60.32 |

58.55 |

57.22 |

Ukraine |

45.30 |

17.70 |

39.90 |

36.30 |

35.30 |

38.40 |

69.40 |

79.10 |

80.90 |

71.90 |

61.40 |

Source: (Organization for Economic Co-operation and Development,2019).

Based on the results of the debt burden on GDP in EU countries and in Ukraine it is possible to predict and carry out a comparative analysis of the level of aggregate debt burden in the countries of the Eastern and Western Europe and Ukraine. In the future it will become an analytical basis for development of activates of government debt reduction in European Union and in Ukraine.

Excessive increase in Aggregate Government debt leads to increased costs of its repayment and servicing, debt security problems and escalation of financial crisis.

International experience does not give an absolute answer to the question of the optimal amount of budget deficit and Government debt in the phase of economic decline and prosperity phase, although a common and traditional is the standard of budget deficit of 3–4% of GDP. Therefore, each country should focus on realization of its own social and economic priorities which can cause greater or lesser amounts of budget deficit and, respectively, determining the optimal level of debt burden on the budget.

Based on the International Monetary Fund (2018) estimates debt-service capacity has improved in most advanced economies, and balance sheets appear strong enough to sustain a moderate economic slowdown or a gradual tightening of financial conditions. However, overall debt and financial risk taking have increased, and the creditworthiness of some borrowers has deteriorated.As a result, the stock of lower-rated investment-grade (BBB) bonds has quadrupled, and the stock of speculative-grade credits has almost doubled in the Euro Area since the crisis. Therefore, a significant economic downturn or sharp tightening of financial conditions could strain the debt-service capacity of indebted firms. If monetary and financial conditions remain easy, debt will likely rise further in the absence of policy action, raising the specter of a deeper downturn in the future.

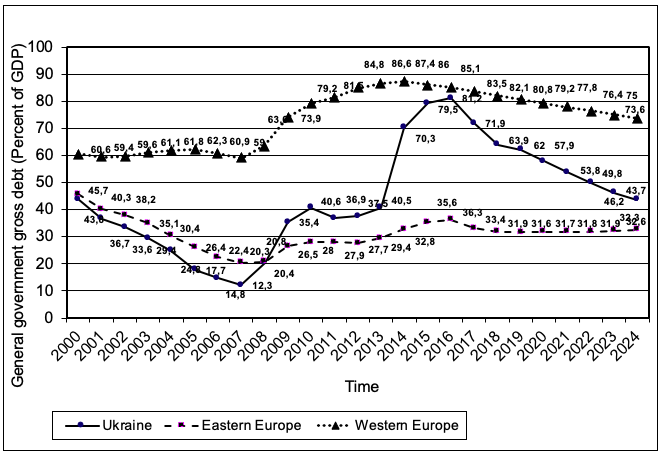

Debt burden on the economies of the Eastern Europe countries is smaller compared to the Western Europe countries. In Ukraine the dynamics of Government debt to GDP are quite volatile, while in Eastern and Western Europe countries there is no significant and sharp change in the debt burden on the economy. It has to deal with more advanced and sophisticated EU countries debt policy.

UndertheoptimisticscenariowithastrongandactiveGovernmentdebtreductionpolicyinGDPitisprojected its decrease by 2024 intheWesternEuropecountriesto 73.6%, Eastern Europe – to 32.6 %, Ukraine – to 43.7 % (Fig.1).

Figure 1

Aggregate Government debt (Percent of GDP) in European countries and in Ukraine

Source: Summarized by the authors according to the data (International Monetary Fund, 2019).

Debt policy provides for balancing of the revenues and expenditures of the Government budget. With the introduction of the concept of a socially oriented State, it is necessary to reconcile the goals of Government debt reduction and social expenditures financing, which satisfy social needs of the population.

The level of budget socialization is determined by the share of expenditures on social security in GDP and in total expenditures of the Government budget. According to ESSPROS methodology general expenditures on social security include expenditures on: 1) social security and social maintenance; 2) healthcare; 3) housebuilding and housing programs, which are financed at the expense of State and Local budgets; 4) Government extrabudgetary trust funds: mandatory Government social insurance, insurance on temporary disability, unemployment and workplace.

Among the European Union countries, the highest expenditures (cost) on social security in GDP have the following countries France (30.8 %), Denmark (29.7%), Sweden (29.4 %), the Netherlands (28.4 %), Belgium (28.3 %), Austria (28.2 %), Germany (27.8 %) and Switzerland (26.4 %). These countries spend two times more on social needs then four countries with the lowest level of expenditures: Latvia (12.6 %), Romania (14.3 %), Estonia (15.1 %) and Bulgaria (15.5 %). In Ukraine the total share of social expenditures in GDP reaches 27%. Social expenditures in Ukraine are one of the lowest in Europe. In terms of purchasing power parity, expenditures on social security per capita is an average EUR 1374, which is the lowest indicator among the EU countries, where it ranges from EUR 1661 in Bulgaria to EUR 14057 in.

An important expenditure item of a budget which influences long-term economic growth and can cause Government debt increase is Government investment. With deceleration of economic growth, it’s wise to finance Government investment at the expense of internal and external loan not exceeding 3 % of GDP. At the high rates of economic growth, increase in Government investment is wise to finance mainly at the expense of internal no-tax revenues, which neutralize the “effect of crowding-out of private investment by Government investment”. The possible limit of the Government investment for the EU countries should be at the level of 2% of GDP, and if this indicator is exceeded, the crowding-out of private investment takes place, which slows down the rate of capital accumulation. For post-socialist countries the most optimal is the amount of Government investment into the infrastructure at 4 % of GDP.

The growth of Government investments should relate to the amount of Government savings and should not exceed the correlation of the Government debt to GDP in a mid-term perspective (otherwise further expenditures on repayment and service of the debt could exceed the investment benefits). The efficiency of Government investment is influenced and affected by their multi-sectoral distribution, in terms of economic efficiency, and should consider the priority of financing of economic sectors, the scale of returns and payoff period of investments. As a rule, the investment into infrastructure give greater return in a mid-term; investments in social, innovation and technological, scientific project – in long-term period; investments in State-owned enterprises and financing State-owned sectoral, scientific and technical targeted integrated programs –both in mid- and long-term period. In highly profitable sectors of the economy should be accumulated such amount of Government investments, which allow to cover the losses from financing non-profit social projects.

Current account deficit of the balance of payments is the factor of growth of Government debt. There is a direct correlation between budget deficit and balance of current account of balance of payments: reducing the budget deficit by one percent of GDP improves the balance of current account of the balance of payments by more than a half percent (International Monetary Fund, 2011). In the short-term period the improvement of the balance of current account and, relatively, reduction of budget deficit on this basis is possible due to devaluation of the national currency. However, in the conditions of incompetence of budget and tax mechanisms, devaluation increases the cost of the external debt service in national currency and increases the burden on public finances.

In the context of debt policy formation, an optimal balance of internal and external debt must be provided. European Region countries, including Ukraine, are slowly increasing their external borrowings, which leads to increase in financial dependence on international organizations. The increase of external debt of the country has the following effects on parameters of the economic growth:

In the midterm perspective it is necessary to intensify Government debt policy instruments aimed at achieving target level of Government debt not higher than 60% of GDP and the level of the budget deficit not exceeding 3% of GDP.

With effective debt policy achievement of the optimal level of debt burden on GDP in the most countries of the Eastern Europe, including Ukraine, it is expected the reduction of the level of Government debt in GDP. In the Western Europe countries high level of debt burden is expected in Austria, Belgium, Italy, France.

Countries of European Union with elevated government debt are vulnerable to a Global financing conditions, which could jeopardize economic activity. The size and pace of deficits and debt need to be on a downward path toward their medium-term targets and calibrated to each country’s cyclical conditions and available fiscal space. Low-income countries need to mobilize revenues, rationalize spending, and improve spending efficiency. Emerging market countries of East Europe, as Ukraine, need to raise revenue to finance critical spending on physical and human capital and social spending.

United targets of downward government debt in European Union and in Ukraine there should be a reduction in the level of Government debt in GDP at the expense of balancing incomes and expenditures, achieving the optimal balance between internal and external Government debt, improving efficiency and flexibility of expenditures and optimization of public finances management.

Afonso, A., and Furcery, D. (2010). Government size, composition, volatility and economic grows. European Journal of Political Economy. 26 (4), 517 – 532.

Afonso, A., and Jalles J. (2013). Growth and productivity: The role of government debt. International Review of Economics & Finance. 25, 384–407.

Barro, R. J. (1998). Determinants of Economic Growth: A Cross-Country Empirical Study. MIT Press, 1 (0262522543). Retrieved from https://www.nber.org/papers/w5698.pdf

Barro, R. J. (1999). Notes on optimal debt management. Journal of Applied Economics. 2, 281 – 289.

Dornbusch, R. (1990). Public debt management: theory and history. Cambridge University Press.

Engen, E., and Skinner, J. (1992). Fiscal Policy and Economic Grows. NBER Working Paper. 4223.

International Monetary Fund. 2018. Fiscal Monitor: Capitalizing on Good Times. Washington, April.

International Monetary Fund. 2019. Global Financial Stability Report: Vulnerabilities in a Maturing Credit Cycle. Washington, DC, April.

International Monetary Fund. 2011. World economic outlook: Slowing Growth, Rising Risks. Washington, DC, September.

Kasych, A. O. (2011). Theoretical and methodical grounds for analysis of internal sources for financing of investment activity. Actual Problems of Economics. 3 (117), 243-250.

Oleshko, A. A. (2016). Stabilization imperatives of state taxation policy. Actual Problems of Economics. 4(178), 280 – 285.

Organization for Economic Co-operation and Development. 2019. Government at a Glance indicators. Retrieved from https://stats.oecd.org/Index.aspx?queryid=82342

Panizza, U. (2008). Domestic and External Public Debt in Developing Countries. UNCTAD Discussion Papers. 188. Retrieved from https://debt-and-finance.unctad.org/Documents/Discussion-papers/Domestic_and_External_Public_Debt_in_Developing_Countries_PANIZZA_2008.pdf

Yared, P. (2019). Rising Government Debt: Causes and Solutions for a Decades-Old Trend. Journal of Economic Perspectives. 33 (2), 115–140. doi: 10.1257/jep.33.2.115

Reinhart, C., Reinhart, V., and Rogoff, K. (2015). Dealing with Debt. Journal of International Economics. 96 (1), 43–55.

Teles, V., and Mussolini, C. (2014). Public debt and the limits of fiscal policy to increase economic grows. European Economic Review. 66, 1 – 15.

Trusova, N. V., Karman, S. V., Tereshchenko, M. A. & Prus, Y. O.Debt burden of the financial system of Ukraine and countries of the Eurozone: Policy of regulating of the risks. Revista Espacios, 39 (39). Retrieved from http://revistaespacios.com/a18v39n39/a18v39n39p30.pdf

1. Professor of Management Department, Kyiv National University of Technologies and Design, Ukraine, e-mail: anna_oleshko@ukr.net

2. Head of Management Department, Kyiv National University of Technologies and Design, Ukraine, e-mail: kasich.alla@gmail.com

3. Doctor of Economic Sciences, Classic Private University, Ukraine, e-mail: Pokataeva.Olga1978@gmail.com

4. Doctor of Economic Sciences, Classic Private University, Ukraine, e-mail: Yelena.Trohim@gmail.com

5. Associate Professor of Management Department, University of State Fiscal Service of Ukraine, Ukraine, e-mail: kig2017@ukr.net

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License