Vol. 41 (Issue 08) Year 2020. Page 26

WISMANTORO, Yohan 1; SUSILOWATI, MG Westri Kekalih 2; SUBAGYO, Herry & UDIN, Udin 3

Received: 02/11/2019 • Approved: 28/02/2020 • Published 12/03/2020

ABSTRACT: Financial inclusion is one of the most important agendas in economic development and poverty alleviation. Financial inclusion internationally has been discussed in the Group of Twenty (G20) forum, Organization for Economic Cooperation and Development (OECD) countries, Alliance for Financial Inclusion (AFI), the Asia-Pacific Economic Cooperation (APEC), and Association of Southeast Asian Nations (ASEAN). Indonesia's government nationally has stated its commitment to developing financial inclusion. However, the study conducted by Bank Indonesia shows that 60 percent of Indonesia's population who live in rural areas have no access to formal financial services. The lack of this access, of course, restricts people's ability to increase their living standard. This study aimed to measure how far financial inclusion has been implemented on the low income of society. 320 samples of households that have expenditure up to 2 million rupiahs per month were used to analyze. By using a descriptive qualitative method, this study found that financial inclusion has been well implemented on the low income of society. |

RESUMEN: La inclusión financiera es una de las agendas más importantes en el desarrollo económico y el alivio de la pobreza. La inclusión financiera internacional se ha discutido en diversos foros, organizaciones e instituciones internacionales. El gobierno de Indonesia a nivel nacional ha declarado su compromiso de desarrollar la inclusión financiera. Sin embargo, el estudio realizado por el Banco de Indonesia muestra que el 60 por ciento de la población de Indonesia que vive en zonas rurales no tiene acceso a servicios financieros formales. La falta de este acceso, por supuesto, restringe la capacidad de las personas para aumentar su nivel de vida. Este estudio tuvo como objetivo medir hasta qué punto se ha implementado la inclusión financiera en los bajos ingresos de la sociedad. Para analizar se utilizaron 320 muestras de hogares con gastos de hasta 2 millones de rupias por mes. Mediante el uso de un método cualitativo descriptivo, este estudio encontró que la inclusión financiera se ha implementado bien en los bajos ingresos de la sociedad. |

Financial inclusion becomes one of the most important agendas in economic development context and poverty alleviation (Michael Chibba, 2009; Fadun, 2014; Worldbank.org, 2018). Financial inclusion internationally has been discussed in the Group of Twenty (G20) forum, Organization for Economic Cooperation and Development (OECD) countries, Alliance for Financial Inclusion (AFI), the Asia-Pacific Economic Cooperation (APEC), and Association of Southeast Asian Nations (ASEAN). Nationally, the commitment to develop financial inclusion has stated by Indonesia's government. Indonesia's government also already has a National Strategy to reach it, there are six pillars in the national strategy for financial inclusion: include financial education, public finance facilities, financial information mapping, policy/regulatory support, intermediation and distribution of facilities, and consumer protection (BI - Financial Inclusion Booklet, 2014).

The contribution of financial inclusion in economic development and poverty alleviation has been proven on some empirical studies. Through mobile banking, the poor people that are traditionally located in the informal sector and hardly enjoy banking services, they can now enjoy the financial services. Therefore, financial activity is increased in the rural areas and therefore economic growth is boosted (Mago, 2014), and financial inclusion constitutes an important tool for alleviating poverty and redistributing income in developing countries, particularly in Nigeria (Fadun, 2014). Deepika & Sigi (2014) state that although the chosen and conventional approaches to tackling poverty and other millennium development goals (MDGs) are useful, they are not sufficient to address the challenge. Financial Inclusion (FI) offers incremental and complementary solutions to tackle poverty, to promote inclusive development and to address the MDGs.

Ivatry & Pickens (2006) also confirm that Information and Communication Technologies (ICT), especially mobile phone development, contributes significantly to economic growth in African countries. The development of mobile phones consolidates the impact of financial inclusion on economic growth at the same time. It cannot be denied that social welfare is generally increased, there are still people cannot access development outcomes and formal financial services (Bank Indonesia, 2014). The study conducted by Bank Indonesia shows that 60 percent of 52 percent of Indonesia's population who live in rural areas have no access to formal financial services (Bank Indonesia, 2014). The lack of this access sometimes restricts a person's ability to increase their living standard. For example, an entrepreneur at home industry might be lost opportunity since he/she is not interlinked to financial services. He/she forced to reject the potential buyers that can only pay by transfer or non-cash payment. Financial inclusion enabling people, especially the low-income group interlinked with economic opportunity. The financial inclusion is an integral part of poverty alleviation.

Financial institution is an institution that provides financial services (financial management) for its customers. Financial institutions bring together the owners of funds to those who need such as, distributes of funds from investors to companies that need. This mean, financial institutions play a role as a financial intermediary in making the transfer of assets, liquidity, income allocations, and transactions. There are various financial institutions that can be classified into banks and nonbank (cooperatives, credit unions, venture capital, insurance, pension, and pawn shops). According to the Law of the Republic of Indonesia Number 10 of 1998 dated 10 November 1998, a bank is a business entity that raises funds from the public in the form of savings and channels it into the public in the form of credit or other forms in order to improve the standard of living. Indonesia’s banking structure consists of commercial banks and rural banks (BPR). BPR doesn’t create demand deposit, as well as a limited range of operational activities. Meanwhile, nonbank financial institution refers to all entities that carry out activities in the financial sector, which directly or indirectly raise funds notably by issuing commercial paper and distribute to people, especially to finance the company's investment.

Concerning with definition of financial inclusion, there is no standard definition, However, there are institutions tried to define it, as follows: (1) “Financial inclusion”refers to a state in which all working age adults have effective access to credit, savings, payments, and insurance from formal service providers. “Effective access” involves convenient and responsible service delivery, at a cost affordable to the customer and sustainable for the provider, with the result that financially excluded customers use formal financial services rather than existing informal options(Morawczynski & Pickens, 2009; GPFI, 2011), (2) “Financial inclusion involves providing access to an adequate range of safe, convenient and affordable financial services to disadvantaged and other vulnerable groups, including low income, rural and undocumented persons, who have been underserved or excluded from the formal financial sector”(The Financial Action Task Force, 2011), (3) Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way(www.worldbank.org) and (4) “process of ensuring access to appropriate financial products and services needed by all sections of the society in general and vulnerable groups such as weaker sections and low income groups in particular, at an affordable cost in a fair and transparent manner by regulated, mainstream institutional players” that consists four components of financial inclusion, namely: access (Ability to use formal financial services), quality (product attributes match the needs of the customer), usage (Actual usage of financial services) and welfare (effect on livelihoods of customers) (rbi.org.in).

Banking is business entities that cannot be spared from technological changes. Nowadays, some of the financial institutions have taken advantages of advances in information technology. As already known, information technology and electronic transaction promise some advantages over traditional services such as: ease and speed transaction, convenience, efficiency, and flexibility. For example, bank's services that are commonly known as e-banking. By using e-banking consumers can access bank services 24 hours a day through automated teller machine (ATM), the internet and mobile phones. Consumers are also able to avoid the long queues and the possibility of congestion. Electronic fund transfer (EFT) also enables the consumer to access their own account. EFT can be obtained by using an ATM or debit card and Personal Identification Numbers (PIN) by shortly scan cards or put his signature. Here are some examples of electronic services; (1) Automated Teller Machines (ATM) or 24-hour teller, ATM allows individuals to trade at any time, either for withdrawal, save, transfer the books of, or payment. Transactions carried out simply by inserting the ATM card and enter the PIN; (2) Phone banking, phone banking is a type of service that allows customers to make transactions such as carry out the payment order and the transfer by phone; (3) Internet banking, it is a service that uses the internet. The bank's services can be accessed anytime and anywhere as long as there is an Internet connection; and (4) Mobile banking, through which is possible to make transaction/account that can be accessed by mobile phones (cell phones).

The development of technology, especially information technology has changed the rules of life, including economic rules (Diniz, Birochi, & Pozzebon, 2012; Kpodar & Andrianaivo, 2011; Troyono, 2016). Today's economy has shifted from the old economics that tends to be analog and based on natural resources towards the new economy that based on science and technology or often referred to a digital economy (UNTAD, 2019). The technology especially information technology changes lead to a change in the patterns of production, consumption, and distribution. As mentioned previously, the technology especially information technology contribute significantly and consolidate the impact of financial inclusion on economic growth (Ivatry & Pickens, 2006; S. Mago, 2014; Kpodar & Andrianaivo, 2011). In term of financial services, internally the use of technology allows organizations to run more efficiently that will transform the organizational structure into a more streamlined and more efficient and effective working method (Koran Sindo, 2016). The development of the location of banking services is now almost impossible, adding new products will also not move away from innovations around mobile-banking and extensification of private banking services, which were originally directed to high-end customers only (Triyono, 2016). The financial planning services, which were initially very limited, are now more prevalent and made possible by the opening of opportunities to integrate insurance products, capital markets, and pension funds into banking services (OECD, 2011). The required technology is highly individualized and depends on the profile and needs of each customer. What is important is that current developments show that financial services are moving toward convergence between types of products. In such conditions, it is said that technology as an enabler of efficiency (Koran Sindo, 2016; Risto Linturi, 2015; Rajiv Bhandari, 2017). While the influence on external factors, technology will change the consumer itself. Technology can change the lifestyle or consumer mindset.

By technology, humans are very much helped to meet various needs and solve various problems encountered in everyday life. However, humans must also aware of the existence of various threats that can be caused by the technology, which will be able to harm the human. In the economy, the present distance and time are not a significant problem to economic growth today. Many applications are created to facilitate it. It can be seen that the higher the development of information technology, the higher the economic growth of the country even though the development of this information technology also has a negative impact such as a lot of misuse of technology in committing crimes. Related to financial inclusion as a part of poverty alleviation, the development of information technology enabling a financial intermediary to reach consumers that cannot be served by financial institution conventionally. As already known, transformation technology-based services offer several advantages over traditional services that require face-to-face services and other physical facilities. By using information technology some problems such as distance, time and queue can be eliminated. Therefore, the unbanked people who live in the rural area and away from conventional formal financial services will able to be served. The unbanked low-income who have a mobile phone are also can be served (Hm Treasury, 2004; Peter J. Morgan & Victor Pontines, 2014; Ndlovu & Ndlovu, 2013; Cepparulo, Cuestas, & Intartaglia, 2017; Chibba, 2009).

The object of this study is financial inclusion implementation in Semarang – Indonesia. Economically, the Gross Domestic Regional Product (GDRP) at the constant price of Semarang growths by 6.09 percent per year in 2011-2015 (semarangkota.bps.go.id, 2016). The growth of GDRP reflects that there are increasing in the number of goods and services produced. This performs the availability of goods and services for society become more to compensate for the rise of purchasing power of the people.

The population of this study is the low-income group who became the main target of financial inclusion. The unit sample is household. There are 16 subdistricts in Semarang and every sub-district is taken by 20 people or 320 respondents in total. The criterion for the selected respondent is a household that has expenditure up to 2 million rupiah per month. The sampling method used is convenience sampling. This study used primary and secondary data. The primary data are obtained by questionnaire whereas secondary data are obtained from various sources, especially statistics Indonesia and Bank Indonesia. For analizing data, this study uses descriptive qualitative analysis method.

There are four components of financial inclusion that includes: Access (ability to use formal financial services), Quality (product attributes match the needs of the customer), Usage (actual usage of financial services), and Welfare (effect on livelihoods of customers). However, this section will discuss the implementation of financial inclusion only by three elements i.e., Access (ability to use formal financial services), Quality (product attributes match the needs of the customer), and Usage (actual usage of financial services).

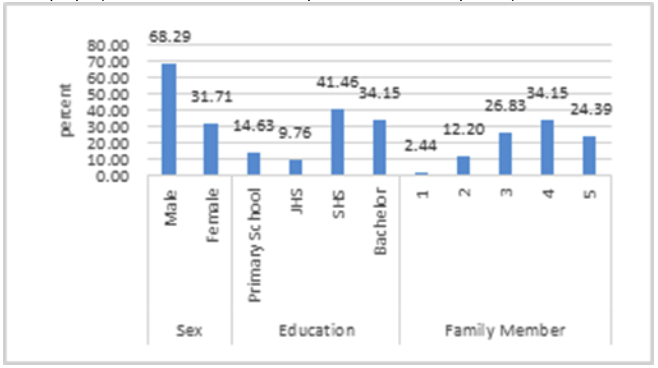

In more detail, Figure 1 shows the profile of respondents that classified by sex, education and family member. By sex, there are 68.29 percent male respondents and 31.71 percent female. Meanwhile, based on education, most (65,85%) of the respondents have a minimum of senior high school grade, and 34.15 percent of them are bachelor. Seen by the number of family members, most of them are living in a family with a membership of more than 4 people (number of member 4 is 34.15 percent and 5 is 24.39 percent).

Figure 1

Respondent Profile

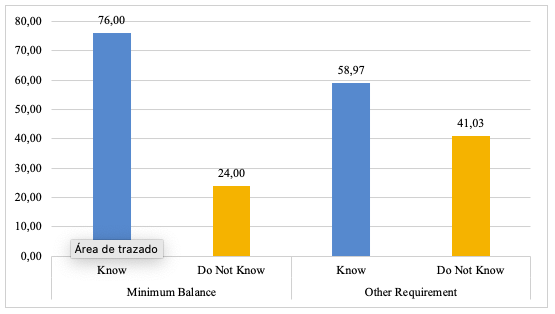

Some requirements often needed in an opening and keeping an account. Among others are the minimum amount of deposit at first (to open) and minimum balance to keep the account. Additionally, to keep the account remain active, the customer must be transactions at least once in a given period of time (usually six months) and if there are no transactions in the period, the account will automatically be classified as passive accounts or dormant accounts. The customer needs to activate the account in order to be able to use again. Associated with it, respondents tend to have a good knowledge of the minimum amount of deposit at first (to open) that required and minimum balance for the next. However, almost all (94.54%) respondents do not know that if there is no transaction within a certain period, the account will be automatically classified into passive or dormant accounts and in order to be able to use again, they have to activate it. Except for the personal data (usually demographic data), no other requirements are needed when opening an account. To open an account, it is enough for potential customers to go to the bank or collectively serve by the bank officer in a certain place that has been agreed. Thus it can be said that opening a bank account is easy and tended not incriminating.

Figure 2

Customer Knowledge of Account

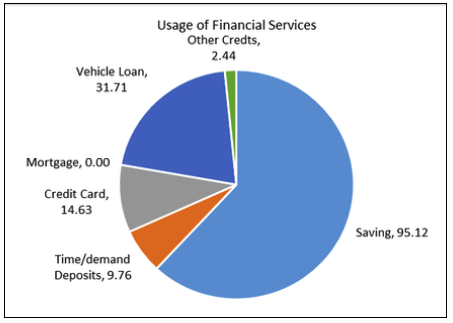

On the dimension of access, the poor and middle class of society had good access to financial services. This is reflected in the number of respondents who have a bank account. This study shows that respondents are familiar enough towards banking products. Most of them utilize those products. Almost all respondents have the deposit account, 93.41 percent of respondents have the saving account and 15.38 percent of respondents have a time-deposit account. More than half of the total respondents have debt, however, respondents who utilizing bank credit facilities is not as much as respondents who have a deposit account. There is 16.48 percent of respondents having a credit card. Vehicle ownership credit owned by 27.47 percent of respondents, mortgages owned by 5.49 percent of respondents and other credit by 2.20 percent of respondents. These conditions indicate that the funds channeled to the poor or low-income group are relatively small. The simple explanation for this finding is that the requirements to open deposit accounts tend to be easier than the credit accounts. For example, prudential banking requires character, capacity, capital, condition, Collateral or 5C for people to be able to utilize the credit facilities (Mulyati, 2018; Lindryani Sofyan, 2015; Andita Pritasari, 2017). The existence of these requirements can be alleged to as the cause of the difficulty of the poor and middle-low group to access credit facilities.

Figure 3

Ownership of Account

Though more than half of the total respondents have a debt, respondents who utilizing bank credit facilities is not as much as respondents having the deposit account. The debts they have, among others sourced from money lenders (4.55 percent), nonbank financial institutions, e.g. cooperatives (45.45 percent), as well as family/friends (50.00 percent). Of those who utilize bank credit reasoned that the banks provide lower interest, easier and more reliable. Meanwhile, of those who prefer non-bank loan reasoned that nonbanks loan have no minimum limit of amount, no need collateral, close to where they live, small installment in a weekly or bi-weekly period, and borrower-creditor recognize each other. There are some of the respondents who experienced rejection of credit applications in the last 3 years. However, they tended not to know rejection reason although it has been explained by creditors.

The most of the respondent doesn't have any other financial services such as insurance, debit card, payment facility for some billings (electricity, telephone and water). There is only 7.89 percent of respondents have insurance. Type of insurance owned is life and health insurance. None of them has a debit card and other facilities. Besides costly, they stated don't need those services. Because of the lack of financial consulting agency, they consult their financial matter to people nearby such as family, friends, and neighbors.

There is 4.88 percent of respondents don't have any bank account at all because they have no fund to save, and there is no bank branch office. This means that the existence of the branch office is important, it can be a trigger or stimulus for people to utilize the bank's financial services. That the existence of the branch office makes people who can be served will be wider and more. This also means that financial inclusiveness will be more implemented. There are 64 banks and 278 rural Banks in central Java, and 35.59 percent of which are in Semarang (Central Java Statistics, 2017). There is also more than 100 cooperation in Semarang (http://opendata.semarangkota.go.id, 2016). On average, every 1 km2 underserved by the formal financial institutions. However, how those financial institutions are easily accessible by group target are more important. This study found that respondents stated that it is very easy to reach out to the bank branch and also Automated Teller Machine (ATM).

There has been financial service offered by the bank and nonbank financial agency. However, these products cannot be easily accessed by the poor for various reasons, mainly because of poverty. Poor people tend to be less / no access to financial services, do not have the money to save on deposit accounts and cannot meet the requirements for a credit account. These conditions show that inclusive finance, namely financial services that involves providing access to an adequate range of safe, convenient and affordable financial services to disadvantaged and other vulnerable groups, including low income, rural and undocumented persons, who have been underserved or excluded from the formal financial sector yet implemented. The involvement of the poor and marginalized in financial services can be a medium for the government to implement the poverty alleviation programs. The poor and marginalized will also have greater access to the results of development. The following describes the attractiveness of some financial services as perceived by the poor.

Small Deposit.

There are six financial services that might be suitable for the poor and marginalized, those are small deposit, low of interest loans, working capital/investment, loans Management consultancy, the benefits of financial services consultancy, and Other financial services information. Data shows that those financial services are attractive, especially small deposit, low-interest loans, and financial services information.

Related to small deposit program, the government has launched a "Gerakan Menabung" (saving mobilization) since 2010 with "TabunganKu" (my saving) program (Bank Indonesia, 2014). TabunganKu is saving accounts that have easy requirements and no administrative costs. There are two types of TabunganKu includes: standard features (mandatory) and customized features (optional). Standard features of TabunganKu is a product that its features should be applied uniformly by all banks which launch TabunganKu. The standard features of TabunganKu are listed as following.

Table 1

Standard Features of TabunganKu

Standard Featured |

Conventional Bank |

Islamic banks |

Name of Product |

TabunganKu |

TabunganKu |

Administration Cost (Rp) |

0 |

0 |

Minimum initial deposit (account opening) (Rp) |

20,000 |

10,000 |

The minimum cash deposit (Rp) |

10,000 |

- |

Minimum balance (Rp) |

20,000 |

10,000 |

Penalty fees dormant balance V |

2,000/month |

1,000/month |

Minimum cash withdrawal at the counter (Rp) |

100,000 |

50,000 |

Account closure fee (Rp) |

20,000 |

5,000 |

Interest rate / bonus (Rp) |

0-500,000, no interest 500,000 – 1,000,000, 0.25%/annum >1,000,000 , 1% /annum |

Commercial Islamic banks, maximum bonus equivalent to 1% per Islamic BPR, 4 % per annum Islamic BPR profit sharing, incentive rate of about 4% |

The replacement cost of books |

0 |

0 |

Source: Bank Indonesia

Customized features (optional) is the product that its features can be selected to be applied by the bank. Banks can provide additional features such as more the product of savings such as saving a book, statement sheet, ATM cards or other banking services, as long as do not violate the collective agreement. Meanwhile, Low-Interest Loans, Working Capital/Investment, Loans Management consultancy, benefits of financial services consultancy, and other financial services information programs can be associated with the national Accelerated Poverty alleviation team, with their small loans called Kredit Usaha Rakyat (People’s Business Credit/KUR). KUR is a credit/financing for working capital and or investment for the Micro, Small and Medium Enterprises and Cooperatives (MSME) that productive and feasible but un-bankable. It is a program of credit/financing below 500 million rupiah that guaranteed by the Government for maximum 80% in agriculture, marine, and fisheries, forestry, and small businesses, and 70% in other sectors. There are three KUR scheme, namely; 1) Micro KUR, with a ceiling of up to 20 million rupiah which bears interest at a maximum of 22% per year, (2) Retail KUR, with a ceiling of 20 million to 500 million rupiah which bears interest at maximum of 13% per year, (3) Partnership KUR, with a ceiling of up to 2 billion rupiah. Partnership KUR usually uses other institutions, such as cooperatives, rural banks, and Non-bank Financial Institutions, to channel-KUR loan from implementer Bank to MSME. This study also found that small deposit, individual loan, financial and investment consultancy and financial education are attractive, important and beneficial to them.

The importance is one of the bases for decision making. In deciding to open or not a bank account, he/she would consider the importance of the account. Perceptions of the importance of banking products reflect benefits expected and also influence the usage. In the following exposure will be presented the respondents' perceptions of importance to some products that may be suitable for them. The aim, how they involved in opening the account, and underlying reasons to open or not a bank account is an important thing to note in the context of financial inclusion. It can be used as a reference to develop appropriate policies in order to improve financial services to the community, especially on those who are currently underserved or unbanked.

Figure 4

Usage of Financial Service

There are several options related to the aim of bank account opening such as receiving the transfer, receive remittances, savings, credit requirements, and others. Only two main reasons underlying in an opening of bank accounts by the poor. To save is the most widely chosen as a reason to open an account (88.57 percent of respondents stated). The rest (8.57 percent) stated that their main reason for having a bank account is to receive government's cash transfer (unconditionally cash transfer) or other assistance from the government and 2.86 percent of respondents stated to meet credit requirement. Unconditionally cash transfer is usually given as compensation for certain government policies to maintain the purchasing power of the poor or marginalized groups. An example is compensation for the increase in fuel prices as a result of the retraction/reduction in government subsidies. Unconditionally cash transfer is only given within a certain period.

Majority of respondents open account by themselves and those who open an account with the help of others, most of them helped by the bank officer. Most of the respondent who has bank account tend to save routinely for at least once a month (55.17 percent) and only if they have the money or when there was money (38.46 percent). There is 5.13 percent of respondents never save after issued.

Table 2

Importance of Financial Products

(% of Respondent Stated)

Products |

Very Unimportant |

Unimportant |

Neutral |

Important |

Very Important |

Have a Bank Account |

2.44 |

7.32 |

36.59 |

48.78 |

4.88 |

Individual Small Loans |

4.88 |

24.39 |

39.02 |

31.71 |

4.88 |

Credit Card |

4.88 |

29.27 |

34.15 |

19.51 |

7.32 |

Financial Consultancy |

7.32 |

21.95 |

31.71 |

36.59 |

2.44 |

Investment Consulting |

0.00 |

9.76 |

26.83 |

41.46 |

21.95 |

Financial Education*) |

0.00 |

0.00 |

20.00 |

20.00 |

0.00 |

Source: Primary data

Almost all (98.41percent) respondents have a deposit account and only 27.47 percent of them have a credit account. This means that the poor and middle class of society have had good access to financial services. Nevertheless, the contribution of fundraising as well as the banking credit distribution to the community towards GDRB is relatively low, the ratio of fundraising to GDRB is 0.44 (on average from 2010-2014), meanwhile, the working capital credit to GDRB ratio 0,19, to investment credit is 0.06 and to MSMEs Credit is 0,10 (Table 3). In more detail concern with ratio credit to GDRB, this studies found that credit to MSMEs also tend to be not growing, even the position of MSMEs credit in 2014 is lower than that of MSMEs credit in 2010. MSMEs credit to GDRB. This condition reflect that financial service facility in Semarang city still needs to be improved, especially the favor of banks to MSMESs. The low ratio of credit to GDRB reflects that the contribution of banking in encouraging economic growth is relatively low. As has been known that the amount of investment through increased working capital and new investment is also very instrumental in the provision of goods and services for the community. Likewise credit to the MSMEs, it must be recognized that MSMEs contribute toward the economy through employment, output and its resistant to the economic crisis. Since MSMESs is a strategic sector in the economy, the attention to MSMESs including the disbursement of credit in the sector needs to get attention.

Table 3

Ratio Fundraising, Working Capital Credit,

Investment Credit and MSMEs Credit to GDRP

Years |

Ratio GDRB |

|||

Fund Raising |

Working Capital Credit |

Investment Credit |

MSMEs Credit |

|

2010 |

0.42 |

0.16 |

0.04 |

0.19 |

2011 |

0.41 |

0.16 |

0.04 |

0.08 |

2012 |

0.44 |

0.20 |

0.06 |

0.08 |

2013 |

0.46 |

0.21 |

0.07 |

0.09 |

2014 |

0.45 |

0.21 |

0.07 |

0.08 |

Average 2010-2014 |

0.44 |

0.19 |

0.06 |

0,10 |

Source: Semarang District in Figure

The types of financial services furthermore provided by financial institutions will be more effective and give benefits if the services meet the needs. The financial institution should know whether the products are important or not from the consumer perspective. Table 2 shows the data of the respondent's opinion to some kind of financial services based on its importance. Generally, by comparing all of the financial services are important. However, in detail, it can be seen that financial service with a very high importance intensity is investment consulting (63.41 percent), and having an account (53.66 percent). Meanwhile, credit card tends to be considered unimportant by the low-income of society.

This study concluded that financial inclusion is well implemented on the low income of society in terms of account ownership or in the case of fundraising. However, it has not yet been well implemented in terms of lending/credit. The findings of this study reflected the condition of each component of financial inclusion as follows: (1) Access, it is found that basically formal financial services in term of availability such as cash offices, branch offices, and ATMs tend to be easily accessible; (2) Quality, the result shows that quality of financial inclusion on low income is relatively low; and (3) Usage, almost all respondents have a savings account in the bank with various goals.

Bank Indonesia, Booklet Financial Inclusion, 2014

Bhandari, Rajiv. Impact of Technology on Logistics and Supply Chain Management. IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 19-24 (www.iosrjournals.org)

Central Java Statistics. (2017)

Cepparulo, A., Cuestas, J. C., & Intartaglia, M. (2017). Financial development, institutions, and poverty alleviation: an empirical analysis. Applied Economics, 49(36), 3611–3622. https://doi.org/10.1080/00036846.2016.1265074

Chibba, M. (2009). Financial inclusion, poverty reduction, and the millennium development goals. European Journal of Development Research. https://doi.org/10.1057/ejdr.2008.17

Chibba, M. (2009b). Financial inclusion, poverty reduction, and the millennium development goals. European Journal of Development Research, 21(2), 213–230. https://doi.org/10.1057/ejdr.2008.17

Deepika, M. G., & SIGI, M. D. (2014). Financial inclusion and poverty alleviation: the alternative state-led microfinance model of Kudumbashree in Kerala, India. Enterprise Development & Microfinance, 25(4), 327–340. https://doi.org/10.3362/1755-1986.2014.030

Diniz, E., Birochi, R., & Pozzebon, M. (2012). Triggers and barriers to financial inclusion: The use of ICT-based branchless banking in an Amazon county. Electronic Commerce Research and Applications. https://doi.org/10.1016/j.elerap.2011.07.006

Fadun, S. O. (2014). Financial Inclusion, Tool for Poverty Alleviation and Income Redistribution in Developing Countries : Evidence from Nigeria. Academic Research International, 5(3), 137–146.

GPFI (2011), Global Standard-Setting Bodies and Financial Inclusion for the Poor: Toward Proportionate Standards and Guidance. A White Paper Prepared by CGAP on Behalf of the G-20’s Global Partnership for Financial Inclusion

hm Treasury. (2004). Promoting Financial Inclusion. Poverty, 114, 10–14.

https://www.bi.go.id/id/ssk/Peran-BI-SSK/keuanganinklusif/edukasi/Pages/Latar-Belakang-Keuangan-Inklusif.aspx, Leafleat tabungan ku. Bank Indonesia, 2014

http://opendata.semarangkota.go.id/dataset/dinkop-ukm-prov-jateng-lakip-dinkop-ukm-2016. No Title.

http://www.worldbank.org/en/topic/financialinclusion/overview. (2018). Financial Inclusion Financial inclusion is a key enabler to reducing poverty and boosting prosperity.

https://rbi.org.in/scripts/BS_Speeches, Retrieved May 15, 2018)

https://rbi.org.in/scripts/BS_Speeches.

Ivatry, G., & Pickens, M. (2006). Mobile Phone Banking and Low-Income Customers: Evidence from South Africa. Consultative Group to Assist the Poor Washington, 1–14.

Koran SINDO (2016) https://economy.okezone.com/read/2016/19/320/ 492672/teknologi-mengubah-layanan-keuangan. Jurnalis, Senin 19 September

Kpodar, K., & Andrianaivo, M. (2011). ICT, Financial Inclusion, and Growth Evidence from African Countries. IMF Working Papers, 11(73), 1. https://doi.org/10.5089/9781455227068.001

Linturi, Risto (2015). Technology as an enabler of sustainable well-being in the modern society Mulyati (2018). The Implementation of Prudential Banking to Prevent form Debtor with Bad Faith. Padjadjaran Journal of Law Volume 5 Number 1, Year 2018 (ISSN 2460-1543) (e-ISSN 2442 9325)

Mago, S. (2014). The Impact of Mobile Banking on Financial Inclusion In Zimbabwe: A Case for Masvingo Province. Mediterranean Journal of Social Sciences, 5(9), 221–230. https://doi.org/10.5901/mjss.2014.v5n9p221

Mago, S. C. S. (n.d.). The Impact of Mobile Banking on Financial Inclusion In Zimbabwe: A Case for Masvingo Province.

Morawczynski, O., & Pickens, M. (2009). Poor People Using Mobile Financial Services: Observations on Customer Usage and Impact from M-PESA. Cap, 4.

Ndlovu, I., & Ndlovu, M. (2013). Mobile Banking the Future to Rural Financial Inclusion: Case Study of Zimbabwe. IOSR Journal Of Humanities And Social Science (IOSR-JHSS), 9(4), 70–75.

OECD (2011). Chile. Review of the Financial System. OECD 2019

Peter J. Morgan & Victor Pontines. (2014). Financial Stability and Financial Inclusion. ADBI Working Paper, (No.488). https://doi.org/10.2139/ssrn.2464018

Pritasari, Andita (2017).Tinjauan Yuridis Penerapan Prinsip 5C, Jurnal Hukum dan Pembangunan. http://lib.ui.ac.id, Retrieved, February 7, 2019.

Sjofjan, Lindryani. (2015). PRINSIP KEHATI-HATIAN (PRUDENTIAL BANKING PRINCIPLE) DALAM PEMBIAYAAN SYARIAH SEBAGAI UPAYA MENJAGA TINGKAT KESEHATAN BANK SYARIAH. 1. 10.33751/.v1i2.927.

The Financial Action Task Force. (2011). FATF Guidance: Anti-money laundering and terrorist financing measures and Financial Inclusion. The Financial Action Task Force, 1–75.

Triyono. (2016). Technology Changes Financial Services.

UNTAD (2019). Digital Economy Report 2019. Value Creation and Capture: Implication for Developing Countries. United Nation, 2019.

1. Business and Economics Faculty, Universitas Dian Nuswantoro, Indonesia. Email: yohan.wismantoro@dsn.dinus.ac.id

2. Business and Economics Faculty, Unika Soegijapranata Semarang, Indonesia

3. Business and Economics Faculty, Universitas Dian Nuswantoro, Indonesia

4. Business and Economics Faculty, Universitas Muhammadiyah Yogyakarta, Indonesia. Corresponding author email: udin_labuan@yahoo.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License